Circulating Tumor Cells and Cancer Stem Cells Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433616 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Circulating Tumor Cells and Cancer Stem Cells Market Size

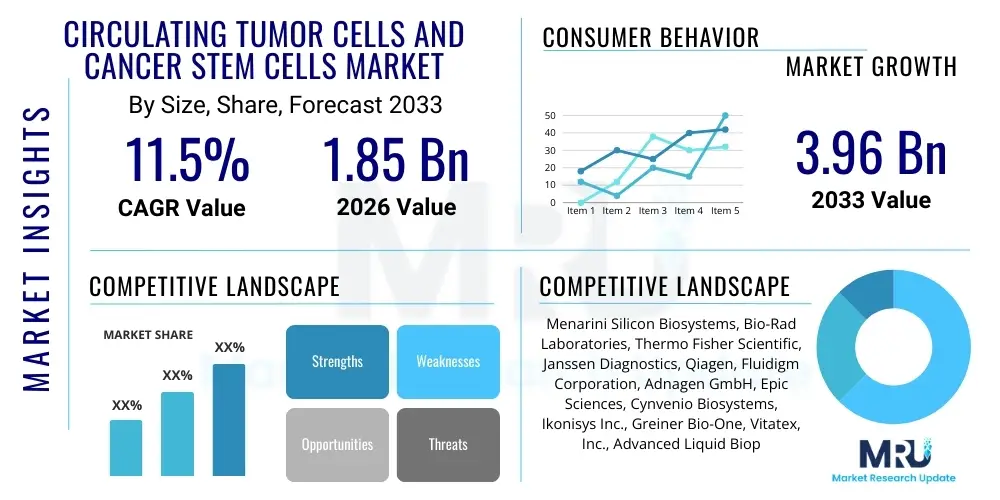

The Circulating Tumor Cells and Cancer Stem Cells Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $3.96 Billion by the end of the forecast period in 2033.

Circulating Tumor Cells and Cancer Stem Cells Market introduction

The Circulating Tumor Cells (CTCs) and Cancer Stem Cells (CSCs) Market encompasses advanced technologies designed for the isolation, identification, and molecular characterization of rare cancer cells present in the peripheral blood of cancer patients. These markers are pivotal components of the liquid biopsy paradigm, offering non-invasive alternatives for monitoring disease progression, evaluating treatment efficacy, and understanding mechanisms of metastasis. The clinical utility of CTCs and CSCs lies in their ability to provide real-time snapshots of tumor heterogeneity and evolution, enabling oncologists to make dynamic, informed therapeutic decisions, moving beyond the limitations associated with traditional tissue biopsies.

Products driving this market primarily include dedicated isolation and enumeration platforms, specialized assay kits, and advanced analytical software. Key technologies utilize physical properties (size, density) or molecular characteristics (surface markers, such as EpCAM) to separate these rare cells from complex hematological backgrounds. Major applications span cancer prognostication, early detection of recurrence, assessment of drug resistance evolution, and serving as surrogates for personalized therapy selection. The benefits are substantial, offering a less painful, repeatable sampling method crucial for longitudinal monitoring of metastatic disease and clinical trials.

The primary driving forces stimulating market expansion include the global increase in cancer prevalence, requiring more efficient and less invasive diagnostic tools. Furthermore, significant technological leaps in microfluidics, immunomagnetic separation, and single-cell sequencing are drastically improving capture efficiency and analysis depth. The surging demand for personalized medicine, where treatment selection is tailored based on specific molecular targets found on CTCs or CSCs, cements the foundational role of these technologies in the future oncology landscape. Regulatory support and substantial investments in liquid biopsy research also contribute significantly to the accelerating adoption rates across established healthcare systems.

Circulating Tumor Cells and Cancer Stem Cells Market Executive Summary

The Circulating Tumor Cells and Cancer Stem Cells Market is poised for robust expansion, fundamentally driven by the shift towards non-invasive diagnostics and the escalating need for real-time therapeutic monitoring in oncology. Current business trends indicate a strong focus on integration, where standalone CTC capture systems are being combined with sophisticated downstream molecular analysis techniques, such as next-generation sequencing (NGS), to provide comprehensive genomic and transcriptomic profiles. Furthermore, collaborations between technology developers and pharmaceutical companies are intensifying, as CTC platforms prove indispensable for companion diagnostics development and clinical trials evaluating novel targeted therapies.

From a regional perspective, North America maintains market leadership, attributed to substantial research funding, early adoption of high-cost advanced diagnostic equipment, and the presence of numerous key market players and pioneering academic institutions. Europe follows closely, driven by favorable reimbursement policies for molecular diagnostics and a strong emphasis on precision medicine initiatives. The Asia Pacific region, while emerging, represents the fastest-growing market, propelled by rapidly improving healthcare infrastructure, increasing awareness of personalized cancer care, and a large patient pool, particularly in densely populated countries like China and India.

Segmentation analysis highlights the technology segment, particularly microfluidics and standardized automated platforms, as experiencing the highest growth trajectory due to their superior efficiency, lower sample input requirements, and reproducibility compared to older enrichment methods. In terms of application, clinical prognostication and therapeutic efficacy monitoring constitute the largest share, reflecting the immediate clinical utility of CTC counts and characterization in guiding treatment plans for metastatic breast, prostate, and lung cancers. The End-User segment remains dominated by academic and research institutions, although the adoption rate in clinical laboratories and hospitals is rapidly increasing as technologies become more robust and commercially viable.

AI Impact Analysis on Circulating Tumor Cells and Cancer Stem Cells Market

User inquiries regarding Artificial Intelligence (AI) in the CTC and CSC market predominantly center on how machine learning algorithms can overcome the historical challenges of low throughput, high variability, and difficulty in standardizing cell identification and enumeration. Users specifically seek information on AI's capability to enhance the sensitivity and specificity of CTC detection in incredibly dilute samples, particularly differentiating true CTCs from surrounding leukocytes and artifacts with high fidelity. A significant area of interest is the deployment of deep learning models for automating image analysis, which traditionally demands intensive human expertise, thereby streamlining the workflow from raw sample processing to clinically relevant insight generation.

The integration of AI also addresses major translational concerns, particularly leveraging high-dimensional molecular data derived from single CTCs or CSCs. Users are highly interested in how AI can process complex genomic, proteomic, and morphological features extracted from these cells to predict therapeutic response, forecast disease recurrence, and identify actionable drug resistance mutations that might not be apparent through conventional statistical analysis. This analytical prowess allows researchers and clinicians to move beyond simple cell counts toward personalized prognostic indicators, optimizing treatment pathways and drug selection based on complex patterns identified only through advanced computational approaches.

Therefore, the prevailing expectation is that AI will significantly accelerate the clinical utility and commercial viability of CTC and CSC technologies. Key themes revolve around improving diagnostic speed, lowering inter-operator variability, and creating predictive models that correlate molecular signatures with patient outcomes—transforming these tools from niche research instruments into mainstream clinical diagnostic platforms capable of handling massive datasets generated by single-cell multi-omics analyses. The market anticipates a rapid rollout of AI-powered analysis modules integrated directly into commercial CTC platforms, standardizing data interpretation globally.

- AI enhances CTC image recognition accuracy and reduces false positives/negatives in enumeration.

- Machine learning algorithms optimize the identification of rare CSC phenotypes and molecular signatures.

- Deep learning models correlate complex CTC genomic profiles with patient clinical outcomes and drug response predictions.

- AI standardizes data interpretation across diverse laboratory settings, mitigating inter-variability issues.

- Computational tools facilitate rapid screening of molecular alterations (mutations, fusions) relevant to targeted therapy selection.

DRO & Impact Forces Of Circulating Tumor Cells and Cancer Stem Cells Market

The dynamics of the Circulating Tumor Cells and Cancer Stem Cells market are shaped by a complex interplay of driving forces (D), critical restrictions (R), burgeoning opportunities (O), and overarching impact forces. The primary engine of growth is the global paradigm shift in oncology towards precision medicine, which necessitates non-invasive, repeatable methods for molecular characterization of tumors. Technological maturation, particularly in microfluidics and highly sensitive immunocapture techniques, significantly boosts capture purity and efficiency, making these platforms more appealing for clinical adoption. Coupled with the rising global incidence of various cancers and increasing R&D investments by both pharmaceutical and biotech firms seeking biomarkers for drug development, these elements create a robust market acceleration.

However, significant restraints temper this expansion. The inherent rarity and heterogeneity of CTCs necessitate highly complex and expensive separation instrumentation and specialized reagents, posing a considerable barrier to entry, especially for smaller clinical laboratories. Furthermore, a lack of universal standardization across different capture and enumeration platforms hinders the direct comparison of results between studies and institutions, complicating clinical validation and regulatory approval processes. The challenge of maintaining CTC viability and integrity for downstream functional assays also presents a technical hurdle that restricts the immediate clinical translation of certain advanced analyses, requiring continuous research into optimal preservation and handling protocols.

Despite these limitations, immense opportunities exist, primarily through the integration of CTC/CSC analysis with emerging therapeutic fields, notably immunotherapy. Monitoring treatment response to immunotherapies and predicting potential immune escape mechanisms via CSC analysis offers a high-value application space. The untapped potential within emerging economies, coupled with increased public awareness and investment in liquid biopsy technology, presents major expansion avenues. Furthermore, the development of integrated, fully automated systems that reduce operator dependence and increase throughput will dramatically enhance clinical adoption, moving these sophisticated tools beyond specialized research centers and into routine clinical oncology practice.

Impact Forces Summary: Technological innovation in microfluidics and single-cell analysis acts as a powerful accelerating force, while regulatory uncertainty and the requirement for robust clinical validation in diverse cancer types serve as moderating constraints. The market is ultimately propelled by the clinical need for predictive biomarkers that personalize cancer treatment and improve patient stratification.

Segmentation Analysis

The Circulating Tumor Cells and Cancer Stem Cells Market is comprehensively segmented based on technology, application, and end-user, reflecting the diverse approaches and clinical uses of these diagnostic tools. The technological segmentation is crucial, differentiating between platforms based on physical properties (e.g., size exclusion) and those utilizing biological recognition (e.g., immunomagnetic separation), each offering unique advantages in terms of throughput, purity, and downstream compatibility. Application segmentation highlights the primary clinical and research uses, ranging from early diagnosis and prognosis to complex drug development processes. End-user categorization distinguishes between research-focused environments and patient-care settings, crucial for understanding adoption patterns and commercial strategies within the healthcare ecosystem.

The Technology segment is witnessing rapid evolution, particularly driven by the development of microfluidic devices, which allow for highly efficient, automated separation and single-cell handling, addressing the limitations of older systems like the CellSearch platform. The Application segment is largely dominated by applications in therapeutic monitoring and prognosis, where quantifiable changes in CTC counts or molecular profiles directly influence patient management decisions. Research applications, while smaller in market share, are vital for new biomarker discovery and validation, acting as the pipeline for future clinical tests. Growth is also pronounced in segments targeting the detection of CSCs, which are highly implicated in drug resistance and metastasis, offering predictive power beyond basic CTC enumeration.

Geographically, market penetration varies significantly based on healthcare expenditure and regulatory environments. Established markets like North America and Europe possess high technology adoption rates and favorable reimbursement scenarios for advanced diagnostics. Conversely, segments within the Asia Pacific region are characterized by high investment in local manufacturing capabilities and the establishment of high-throughput central diagnostic laboratories, focused on catering to large, underserved patient populations and transitioning into personalized medicine approaches.

- By Technology

- CTCs Enrichment and Isolation (Immunomagnetic Separation, Microfluidics, Density-based Separation, Size-based Separation)

- CTCs Detection and Analysis (PCR, FISH, IHC, NGS, Flow Cytometry)

- By Application

- Prognosis and Therapeutic Monitoring

- Drug Development and Clinical Trials

- Diagnosis and Screening

- Personalized Medicine

- By Cancer Type

- Breast Cancer

- Prostate Cancer

- Colorectal Cancer

- Lung Cancer

- Other Cancers (Pancreatic, Ovarian, Melanoma)

- By End User

- Academic and Research Centers

- Hospitals and Clinical Laboratories

- Pharmaceutical and Biotechnology Companies

Value Chain Analysis For Circulating Tumor Cells and Cancer Stem Cells Market

The value chain for the CTC and CSC market begins intensely in the upstream segment with fundamental research and development (R&D), primarily conducted by academic institutions and specialized biotech firms focusing on novel separation mechanisms (e.g., advanced microfluidics) and high-specificity antibodies or reagents. This stage involves significant intellectual property generation and refinement of core technological platforms necessary for highly efficient cell capture from complex matrices. Manufacturing focuses on producing precision instrumentation, microfluidic chips, specialized buffers, and validated assay kits under strict quality control measures, demanding high capital investment due to the sophistication of the hardware involved.

Midstream activities involve sophisticated distribution channels. Due to the requirement for specific handling, cold chain logistics, and high technical support, indirect distribution via specialized life science distributors is common, particularly for reaching distant research centers and clinical sites. Direct sales models are often employed by major players for large, complex instrument sales to high-volume end-users, ensuring rigorous training and service agreements. Specialized reference laboratories often function as a crucial intermediary, processing samples from community hospitals and offering centralized CTC/CSC testing services.

Downstream deployment is centered at the end-user facilities—hospitals, centralized clinical laboratories, and pharmaceutical R&D centers—where the actual sample processing, analysis, and clinical interpretation occur. The successful translation of raw data into actionable clinical insights relies heavily on standardized operating procedures and the integration of sophisticated bioinformatics and AI tools. Reimbursement policies and clinical guideline incorporation are critical downstream factors that determine the ultimate commercial success and broad adoption of these advanced diagnostic technologies, completing the value chain by delivering prognostic or predictive information to the prescribing oncologist.

Circulating Tumor Cells and Cancer Stem Cells Market Potential Customers

The primary consumers of Circulating Tumor Cells and Cancer Stem Cells technologies are diverse but predominantly centered around entities engaged in advanced oncology research, diagnostics, and therapeutic development. Academic research institutions and large cancer centers constitute a major customer base, purchasing instruments and consumables for basic science investigations into metastasis, tumor evolution, and drug resistance mechanisms, often utilizing federal or private grants to fund initial acquisitions. These entities drive the demand for highly flexible and sophisticated single-cell analysis platforms.

Clinical laboratories and large hospital networks represent the fastest-growing customer segment. As CTC analysis moves into routine clinical practice, these customers seek standardized, high-throughput, and regulatory-approved (e.g., FDA-cleared) automated systems for routine prognostic tests and monitoring therapeutic efficacy in common metastatic cancers (e.g., breast, prostate, lung). Their purchasing decisions are critically influenced by assay reproducibility, cost-effectiveness, and the ease of integration with existing lab infrastructure and data management systems, often favoring centralized testing models.

Pharmaceutical and biotechnology companies form a crucial, high-value customer group. They utilize CTC and CSC platforms extensively throughout their drug development pipelines, particularly during preclinical validation and Phase I/II clinical trials, where CTCs serve as dynamic biomarkers to assess pharmacodynamics, determine optimal dosing, and select patients for targeted therapies (companion diagnostics). These corporate customers demand instruments capable of generating reliable, longitudinal patient data required for regulatory submission and the subsequent commercialization of novel oncology drugs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $3.96 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Menarini Silicon Biosystems, Bio-Rad Laboratories, Thermo Fisher Scientific, Janssen Diagnostics, Qiagen, Fluidigm Corporation, Adnagen GmbH, Epic Sciences, Cynvenio Biosystems, Ikonisys Inc., Greiner Bio-One, Vitatex, Inc., Advanced Liquid Biopsy, F. Hoffmann-La Roche Ltd., Miltenyi Biotec, Clearbridge BioPhotonics, Nitta Corporation, Creatv MicroTech, Inc., Biocartis NV, Celsee, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Circulating Tumor Cells and Cancer Stem Cells Market Key Technology Landscape

The technological landscape of the CTC and CSC market is highly dynamic, characterized by continuous innovation aimed at solving the dual challenges of high sensitivity (capturing ultra-rare cells) and high purity (eliminating background contamination). Core technologies broadly fall into two categories: marker-dependent (based on specific surface protein expression, typically EpCAM or specific CSC markers) and marker-independent (relying on physical differences such as size, deformability, or electrical properties). Immunomagnetic separation, utilizing magnetic beads conjugated to antibodies (e.g., the established CellSearch system), remains the benchmark for standardized enumeration, providing clinical validation for basic CTC counts in metastatic disease.

However, newer generation technologies, particularly those leveraging microfluidics, are gaining significant traction. Microfluidic chips offer precise control over fluid dynamics, allowing for highly efficient, size-based filtration (e.g., using specific filters or micro-pillars) or immunocapture in a highly confined environment, which significantly reduces sample volume and processing time. These chips are instrumental for single-cell analysis because they maintain cell viability and minimize shear stress, making the captured cells suitable for sophisticated downstream molecular assays, including single-cell RNA sequencing and exome sequencing, which provides unparalleled depth of molecular characterization for personalized treatment planning.

Furthermore, technology development is heavily focused on automated platforms that combine enrichment, staining, and analysis functions into a single, user-friendly instrument. Tools such as Dielectrophoresis (DEP)-based separation systems and technologies from companies like Epic Sciences (which uses image analysis for marker-independent detection) represent the leading edge, offering highly flexible workflows adaptable to diverse cancer types, including those exhibiting low EpCAM expression. The ability to isolate and analyze viable CSCs—often characterized by specific markers (e.g., CD44, CD133) and functional traits—is crucial, driving specific technological advancements in fluorescence-activated cell sorting (FACS) and specialized culture systems that allow for functional testing of drug resistance, moving the field toward predictive oncology.

Regional Highlights

North America: North America, particularly the United States, holds the largest market share and is expected to maintain its dominance throughout the forecast period. This leadership is attributed to several critical factors: exceptionally high healthcare expenditure, significant public and private investment in cancer research, and the early adoption of advanced liquid biopsy and personalized medicine technologies. The region benefits from a well-established infrastructure of specialized oncology centers, favorable regulatory pathways (e.g., FDA clearances of CTC platforms), and the strong presence of major market innovators and key opinion leaders. Furthermore, the robust ecosystem linking pharmaceutical companies, diagnostic developers, and academic research institutions ensures a continuous pipeline of innovation and rapid clinical translation of research findings into standard practice, particularly in metastatic breast, prostate, and lung cancer management.

Europe: Europe represents the second-largest market, characterized by strong governmental support for precision medicine initiatives and a sophisticated academic research environment. Countries such as Germany, the UK, and France are actively integrating CTC analysis into their clinical trial frameworks and national cancer screening programs. The market growth is fueled by increasing awareness among oncologists regarding the prognostic value of CTCs and favorable reimbursement policies established in several Western European nations. While standardization remains a challenge across the diverse regulatory environments of the EU, collaborative research networks are actively working to harmonize procedures, driving stable, measured adoption across the continent.

Asia Pacific (APAC): The APAC region is projected to exhibit the highest CAGR during the forecast period. This accelerated growth is primarily driven by rapidly improving healthcare infrastructure, a dramatic increase in cancer incidence due to demographic shifts and lifestyle factors, and rising patient disposable income enabling access to advanced diagnostic modalities. Countries like China, Japan, and South Korea are heavily investing in establishing centralized diagnostic laboratories and fostering domestic biotech capabilities in liquid biopsy. Although currently characterized by lower overall adoption rates compared to Western nations, the massive patient population and the strategic shift towards molecular diagnostics make APAC a highly lucrative and critical expansion zone for global CTC/CSC technology providers, requiring localized market strategies.

- North America (U.S., Canada): Market leader due to high R&D funding, early clinical adoption, and established regulatory framework for advanced diagnostics. Focus on integrated NGS platforms.

- Europe (Germany, UK, France): Strong growth driven by national precision medicine initiatives, robust academic research, and favorable reimbursement structures for molecular diagnostics.

- Asia Pacific (China, Japan, India, South Korea): Fastest-growing region, propelled by rising cancer prevalence, improving healthcare access, and significant government investment in centralized testing facilities and localized manufacturing.

- Latin America (Brazil, Mexico): Emerging market characterized by increasing health awareness and gradual infrastructural improvements, focusing on adoption in private sector oncology centers.

- Middle East and Africa (MEA): Niche market growth primarily concentrated in affluent Gulf Cooperation Council (GCC) countries, driven by high-quality private healthcare services and international collaborations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Circulating Tumor Cells and Cancer Stem Cells Market.- Menarini Silicon Biosystems (A part of the Menarini Group)

- Bio-Rad Laboratories, Inc.

- Janssen Diagnostics (A Johnson & Johnson Company)

- Thermo Fisher Scientific Inc.

- Qiagen N.V.

- Fluidigm Corporation

- Epic Sciences, Inc.

- Adnagen GmbH

- Ikonisys Inc.

- Cynvenio Biosystems, Inc.

- Greiner Bio-One International GmbH

- Vitatex, Inc.

- F. Hoffmann-La Roche Ltd. (Roche Diagnostics)

- Miltenyi Biotec B.V. & Co. KG

- Clearbridge BioPhotonics Pte Ltd.

- Nitta Corporation (Through Angle Technology)

- Creatv MicroTech, Inc.

- Biocartis NV

- Celsee, Inc. (A part of Bio-Rad Laboratories)

- Advanced Liquid Biopsy S.L.

Frequently Asked Questions

Analyze common user questions about the Circulating Tumor Cells and Cancer Stem Cells market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between CTCs and traditional tissue biopsy in cancer diagnostics?

CTCs (Circulating Tumor Cells) analysis is a non-invasive liquid biopsy method providing real-time, dynamic molecular snapshots of a tumor, enabling longitudinal monitoring of disease progression and treatment response. Traditional tissue biopsy is invasive, often static, and primarily used for initial diagnosis and staging, but cannot easily track tumor evolution over time.

How do technological advancements, such as microfluidics, drive market growth?

Microfluidics technology significantly enhances CTC capture efficiency and purity by offering precise control over small fluid volumes, leading to improved sensitivity and reduced sample processing time. This automation and higher performance make CTC analysis more reliable and suitable for large-scale clinical application, thus accelerating market adoption.

What role do Circulating Tumor Cells play in personalized medicine and therapeutic monitoring?

CTCs are crucial for personalized medicine as they allow for the identification of specific drug resistance mutations and actionable molecular targets in real-time. By monitoring changes in CTC counts and molecular profiles during therapy, clinicians can quickly assess treatment effectiveness and adjust regimens to overcome resistance, optimizing patient outcomes.

Which regions are leading the adoption of CTC and CSC technologies?

North America currently leads the global market in terms of revenue and technology adoption, driven by strong regulatory support and significant investments in research and development. The Asia Pacific region is forecast to experience the fastest growth due to rapidly improving healthcare infrastructure and rising cancer prevalence.

What are the main challenges hindering the broad clinical standardization of CTC platforms?

The primary challenges include the lack of standardized protocols across diverse capture technologies (e.g., immunomagnetic vs. size-based separation), which leads to variability in reported results. High instrumentation costs and the need for greater clinical validation across all cancer types also limit widespread implementation outside of specialized research centers.

How are Cancer Stem Cells (CSCs) particularly relevant to metastasis research?

CSCs represent a highly aggressive, small subpopulation within the tumor responsible for initiating metastasis and conferring resistance to chemotherapy and radiation. Analyzing CSCs isolated from the circulation provides critical insights into the biological mechanisms of disease recurrence and allows for the development of highly targeted drugs aimed at eliminating these resistant cells.

Is the market leaning towards marker-dependent or marker-independent CTC isolation?

While marker-dependent systems like CellSearch (EpCAM-based) hold historical clinical validation, the market is increasingly favoring marker-independent and highly flexible platforms, especially those based on microfluidics or physical properties (size/deformability). This shift is driven by the need to capture CTCs from diverse cancer types, including those that undergo Epithelial-Mesenchymal Transition (EMT) and lose EpCAM expression.

What is the significance of integrating AI and machine learning into CTC analysis workflows?

AI integration is vital for automating the complex process of image analysis, significantly improving the accuracy and speed of CTC enumeration and identification, particularly when differentiating rare CTCs from blood background cells. AI also aids in interpreting complex single-cell molecular data, linking genetic profiles to therapeutic predictions and prognostic indicators.

How do pharmaceutical companies utilize CTC technology in drug development?

Pharmaceutical companies use CTC platforms extensively as dynamic biomarkers in clinical trials. They assess the biological activity of novel oncology drugs, monitor the emergence of drug resistance mechanisms in real-time, and utilize CTC molecular profiles to develop companion diagnostics for patient stratification and treatment selection.

Beyond simple enumeration, what advanced analyses are performed on captured CTCs?

Advanced analyses include single-cell Next-Generation Sequencing (NGS) to profile genomic mutations and copy number variations, RNA sequencing to assess gene expression and splicing, and Fluorescence In Situ Hybridization (FISH) to detect chromosomal abnormalities. These molecular assays provide the detailed information required for precision oncology decision-making.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager