Circulator Pumps Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432960 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Circulator Pumps Market Size

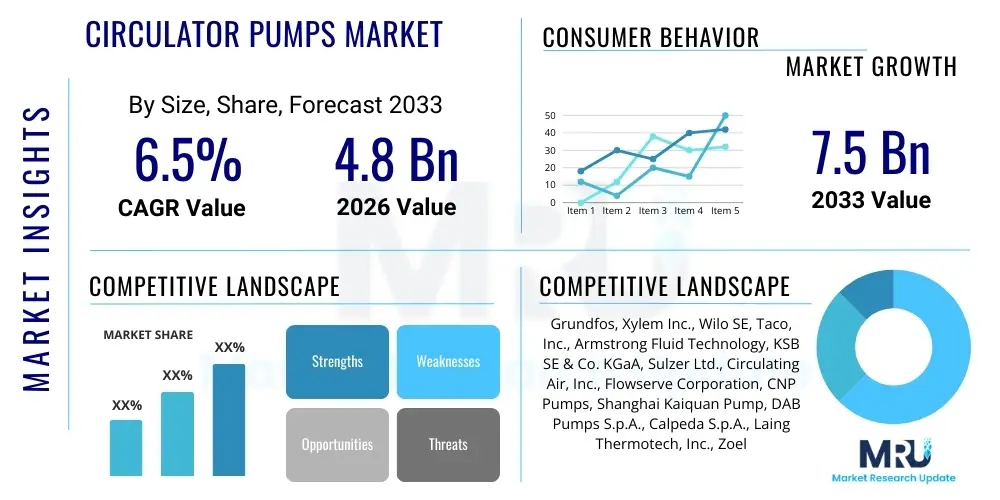

The Circulator Pumps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033. This consistent growth trajectory is fundamentally driven by the escalating global focus on energy efficiency in residential, commercial, and industrial Heating, Ventilation, and Air Conditioning (HVAC) systems. The adoption of stringent regulatory standards, particularly in developed economies, necessitates the replacement of older, less efficient pump technologies with modern, highly optimized circulating systems, thereby guaranteeing sustained demand across diverse geographic areas.

Circulator Pumps Market introduction

The Circulator Pumps Market encompasses devices specifically engineered to facilitate the mandatory movement of liquids, typically water or heat-transfer fluids, within closed hydronic systems used for heating (e.g., boiler systems, radiators) and cooling (e.g., chillers, district cooling). These pumps are critical components in maintaining thermal comfort and ensuring the functional integrity of complex plumbing and HVAC infrastructure across the built environment. Product innovation has heavily centered on integrating Electronically Commutated Motor (ECM) technology, which allows for variable speed operation and significantly reduced energy consumption compared to traditional fixed-speed induction motors, aligning with the global sustainability agenda and resulting in long-term operational cost savings for end-users.

Major applications of these high-efficiency pumps span across residential buildings, where they are integral to domestic hot water recirculation and radiant floor heating systems; commercial complexes, including hospitals, office towers, and academic institutions, where they manage large-scale zone heating and cooling loops; and specialized industrial processes requiring precise temperature management. The inherent benefits of modern circulator pumps, such as enhanced reliability, minimized noise levels, sophisticated flow control capabilities, and seamless integration with Building Management Systems (BMS), solidify their indispensable role in modern infrastructure. Furthermore, the decreasing Total Cost of Ownership (TCO) associated with premium, high-efficiency models, despite higher initial purchasing costs, is rapidly accelerating their market penetration across replacement and new installation cycles globally.

Circulator Pumps Market Executive Summary

The Circulator Pumps Market is characterized by robust technological advancement and shifting geographical demand patterns. Key business trends indicate a strong emphasis on smart connectivity and IoT integration, transforming pumps from simple mechanical devices into networked components that provide real-time performance data and enable predictive maintenance capabilities. Manufacturers are increasingly focusing on modular designs and standardization to streamline installation processes and reduce inventory complexity for distributors and installers. This strategic shift towards digitalization and data-driven operation is enhancing product differentiation and creating new value propositions centered around system optimization and energy management services, thereby elevating the competitive landscape.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by rapid urbanization, massive infrastructure investment in residential housing and commercial real estate development, particularly in emerging economies like China and India, and the rising standard of living demanding modern thermal comfort solutions. Concurrently, established markets in Europe and North America continue to drive demand through stringent energy conservation mandates and high rates of replacement activity for aging pump fleets, favoring advanced variable speed and smart pump technologies. Segment-wise, the residential application segment retains the largest volume share, but the commercial segment, driven by large-scale institutional and public building projects, demonstrates superior growth in terms of value, largely due to the mandatory specification of premium, high-pressure, and highly intelligent pumps essential for managing complex, multi-story hydronic networks.

AI Impact Analysis on Circulator Pumps Market

Common user questions regarding AI's impact on the Circulator Pumps Market typically revolve around how artificial intelligence can optimize pump operation in real-time, predict impending failures before they occur, and ultimately maximize the energy savings promised by ECM technology. Users are keen to understand if AI can dynamically adjust pump speed and flow based on fluctuating building occupancy, external weather conditions, and actual heating/cooling load requirements, moving beyond simple programmed setpoints. Furthermore, there is significant interest in how AI-driven analysis of vibrational, current, and temperature data transmitted via IoT sensors can revolutionize maintenance schedules, shifting from time-based preventative actions to condition-based, truly predictive interventions, significantly reducing downtime and operational expenditure across large installed bases.

- AI algorithms analyze real-time operational data (flow, pressure, temperature, energy consumption) to dynamically optimize pump performance, minimizing unnecessary energy waste.

- Predictive maintenance platforms utilizing machine learning can forecast component failure with high accuracy based on deviation from normal operating patterns (anomaly detection).

- AI-powered Building Management Systems (BMS) integrate circulator pump control with broader HVAC and environmental parameters, ensuring holistic system efficiency.

- Enhanced system diagnostics and automated troubleshooting facilitated by AI reduce the reliance on manual inspection and decrease mean time to repair (MTTR).

- AI assists in optimizing inventory and spare parts management by accurately predicting wear and tear across vast networks of installed pumps.

DRO & Impact Forces Of Circulator Pumps Market

The circulator pumps market dynamics are influenced by a complex interplay of regulatory pushes, technological advancements, and macroeconomic stability. A significant driver is the increasing global emphasis on decarbonization and energy efficiency, catalyzed by governmental mandates such as the European Union’s Eco-design Directive and similar energy performance standards implemented across North America and key Asian economies. These mandates effectively phase out older, inefficient pump models, forcing market adoption of sophisticated, variable speed ECM pumps. This regulatory environment creates a consistent replacement cycle and mandates higher performance standards for new construction projects, ensuring sustained volume growth. Additionally, the rapid expansion of district heating and cooling infrastructure, particularly in densely populated urban areas, serves as a crucial infrastructural driver, requiring robust and high-capacity circulating equipment.

However, the market faces restraints, primarily stemming from the significant initial capital investment required for high-efficiency ECM and smart pumps compared to conventional models. Although the TCO is lower, initial budget constraints, especially in developing regions or smaller residential projects, can delay adoption. Furthermore, the market is exposed to volatility in raw material pricing, particularly steel, copper, and specialized plastics used in pump construction, which can impact manufacturing costs and ultimately compress profit margins for mid-tier players. The successful integration of complex smart pump systems into existing, often outdated, building automation frameworks also presents technical and cybersecurity challenges that can act as a temporary barrier to swift deployment.

Opportunities abound in leveraging digitalization and addressing specialized application niches. The integration of IoT capabilities and cloud-based monitoring services allows manufacturers to transition towards service-oriented business models, generating recurring revenue through maintenance contracts and performance optimization subscriptions. Geographically, untapped potential exists in secondary and tertiary cities across APAC and Latin America, where infrastructural development is accelerating, creating virgin markets for initial installations. The specialized sector of high-temperature circulating pumps required for concentrated solar power (CSP) and geothermal systems also presents a high-value niche opportunity for technologically advanced market participants seeking premium price points and specialized engineering challenges. These forces collectively propel the market forward, despite periodic economic headwinds, fundamentally favoring innovations that deliver tangible energy savings and operational reliability.

Segmentation Analysis

The Circulator Pumps Market is comprehensively segmented based on technology, material composition, application area, and operational capacity, allowing for granular market analysis and targeted strategic planning. The technological segmentation, differentiating between traditional standard circulators and modern high-efficiency variable speed pumps, is the most crucial determinant of market value and future growth prospects. Furthermore, the segmentation by application—residential, commercial, and industrial—provides insight into specific performance requirements, such as pressure head and flow rate, which vary significantly across these end-user categories. The analysis of these segments reveals a market undergoing a rapid transition, moving away from commodity products toward specialized, interconnected, and energy-optimized solutions that command higher margins.

- By Type:

- Standard Circulators (Fixed Speed)

- High-Efficiency Circulators (Variable Speed/ECM)

- By Application:

- Residential (Domestic Hot Water, Heating Systems, Cooling)

- Commercial (Office Buildings, Hospitals, Educational Institutions, Hotels)

- Industrial (Process Cooling, Heat Transfer Systems, Specialized HVAC)

- By End-Use Product:

- Wet Rotor Pumps

- Dry Rotor Pumps

- By Material:

- Cast Iron

- Stainless Steel

- Bronze

- By Rated Power:

- Up to 25W

- 25W to 50W

- Above 50W

Value Chain Analysis For Circulator Pumps Market

The value chain for the Circulator Pumps Market initiates with the procurement of essential raw materials, including specialized metals (cast iron, stainless steel, aluminum for motor casings), copper wire for windings, and advanced composite materials for impellers and seals. Upstream analysis highlights the critical importance of secure, quality-controlled sourcing, as the performance and longevity of the pump are highly dependent on the resilience and corrosion resistance of the materials used. Suppliers of Electronically Commutated Motors (ECM) and associated microprocessors and sensors also occupy a strategic position upstream, significantly influencing the technological competitiveness and cost structure of the final product. Strong relationships with reliable component suppliers are essential for maintaining manufacturing efficiency and ensuring adherence to increasingly complex international quality and environmental standards.

The manufacturing and assembly phase involves precision machining, motor integration, testing, and quality assurance. High-efficiency pump production requires substantial capital expenditure in automated assembly lines and advanced testing facilities to calibrate variable speed drives and ensure optimal hydraulic performance. Downstream activities involve comprehensive distribution networks that bridge the gap between manufacturers and diverse end-users. Distribution channels are typically fragmented, encompassing large wholesale distributors focused on HVAC contractors, specialized plumbing supply houses catering to smaller installers, and direct sales teams handling large commercial or municipal infrastructure projects. The choice of channel significantly impacts market reach, pricing strategy, and the level of technical support provided post-sale.

The increasing complexity of smart circulator pumps has necessitated robust training and technical support throughout the distribution phase. Direct channels are often preferred for highly customized or large-scale industrial pumps where intricate system integration is required, demanding direct manufacturer expertise. Conversely, indirect channels (wholesalers and retailers) dominate the high-volume residential market, where ease of access and inventory availability are paramount. Effective value chain management, particularly optimizing logistics and enhancing responsiveness to seasonal construction cycles, is a key determinant of competitive advantage, enabling companies to minimize inventory holding costs while maximizing market responsiveness and customer satisfaction through reliable product delivery and post-installation service support.

Circulator Pumps Market Potential Customers

The potential customer base for circulator pumps is exceptionally broad, spanning three primary segments: residential, commercial, and industrial, each defined by distinct procurement behaviors and technical requirements. Residential customers, primarily composed of homeowners and small-scale housing developers, prioritize cost-effectiveness, compact size, low noise output, and integration with domestic heating systems such as radiant floors and high-efficiency boilers. The purchasing decision in this segment is often influenced by plumbing contractors or HVAC installers who recommend products based on ease of installation and proven reliability, making relationships with these intermediaries crucial for market penetration.

The commercial sector, which includes institutional buyers such as hospital administrators, property management firms, and corporate facility managers, represents a high-value customer group. These buyers focus intensely on energy efficiency metrics, compliance with stringent building codes, longevity, and seamless integration with complex Building Management Systems (BMS). Purchasing decisions here are typically based on rigorous specifications provided by consulting engineers, favoring leading brands known for advanced variable speed control, data logging capabilities, and comprehensive warranty support necessary for minimizing operational disruption in critical environments like data centers and healthcare facilities.

Industrial end-users, encompassing diverse sectors such as chemical processing, power generation, and specialized manufacturing, require highly customized, robust circulator pumps capable of handling extreme temperatures, high pressures, and potentially aggressive fluids. Their purchasing criteria are centered on reliability under severe operating conditions, material compatibility, and adherence to specific process requirements, often requiring direct consultation and bespoke engineering solutions from the pump manufacturers. The consistent need for replacement, maintenance, and system upgrades across all three segments ensures a perpetually active and financially stable demand structure for both new and aftermarket sales across the global marketplace.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Grundfos, Xylem Inc., Wilo SE, Taco, Inc., Armstrong Fluid Technology, KSB SE & Co. KGaA, Sulzer Ltd., Circulating Air, Inc., Flowserve Corporation, CNP Pumps, Shanghai Kaiquan Pump, DAB Pumps S.p.A., Calpeda S.p.A., Laing Thermotech, Inc., Zoeller Company, EBARA Corporation, Torishima Pump Mfg. Co., Ltd., Pentair, Inc., Franklin Electric Co., Inc., Bell & Gossett (Xylem brand) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Circulator Pumps Market Key Technology Landscape

The technological evolution of the Circulator Pumps Market is overwhelmingly focused on maximizing energy savings and enhancing operational intelligence, fundamentally driven by the adoption of Electronically Commutated Motor (ECM) technology. ECM motors utilize permanent magnets and sophisticated electronic controls rather than traditional brushes and mechanical commutators, allowing for precise, variable speed operation proportional to the actual system demands (such as required head and flow rate). This variable speed capability is the single most important technological breakthrough, enabling significant energy savings—often exceeding 50% compared to fixed-speed pumps—by eliminating operation at unnecessary maximum capacity. Manufacturers are continually refining motor designs, improving magnet materials, and miniaturizing control electronics to enhance efficiency and compactness, making these pumps suitable for smaller domestic applications as well as large commercial systems.

A second crucial technological vector involves the integration of Internet of Things (IoT) sensors and connectivity modules directly into the pump housing and control systems. These integrated sensors monitor vital operational parameters, including power consumption, vibration, fluid temperature, and differential pressure, transmitting this data wirelessly to cloud platforms. This connectivity facilitates real-time monitoring, remote diagnostics, and condition-based monitoring, which are paramount for sophisticated asset management in large commercial and municipal systems. The deployment of robust cybersecurity protocols around these connected devices is increasingly important to protect operational infrastructure from digital threats, representing a key area of R&D investment for market leaders.

Furthermore, advancements in hydraulic design and materials science continue to contribute to overall efficiency and longevity. The utilization of computational fluid dynamics (CFD) simulation tools allows engineers to optimize impeller and volute geometry, reducing internal friction and maximizing hydraulic output for minimal power input. Simultaneously, the increased use of corrosion-resistant materials such as specialized stainless steels and advanced polymer composites for pump casings and wet parts extends the operational life, especially when handling aggressive or highly mineralized fluids. The culmination of these technological advancements—ECM motors for power savings, IoT for intelligence, and refined hydraulics for mechanical efficiency—defines the competitive edge in the modern Circulator Pumps Market, heavily penalizing companies relying solely on legacy fixed-speed technologies.

Regional Highlights

The Circulator Pumps Market exhibits significant geographical variance in maturity, growth rate, and technological adoption, reflecting differences in building standards, climate requirements, and regulatory enforcement across continents. Europe currently holds a leading position in terms of installed base value and technological sophistication, primarily due to the stringent implementation of the Eco-design Directive which mandates the use of high-efficiency ECM circulators. Replacement demand in Western European countries remains consistently high, driven by sustainability goals and the need to upgrade aging infrastructure, ensuring a steady, profitable market for premium products and supporting substantial aftermarket service revenue streams.

North America is another mature market, characterized by strong demand originating from both commercial construction and residential retrofits. Regulatory frameworks, such as the Department of Energy (DOE) standards in the US, push towards higher efficiency, paralleling European trends. The market here is highly competitive, focusing on durability, ease of installation, and compatibility with proprietary HVAC control systems. Specific growth is observed in geothermal and solar thermal heating applications, which require specialized, robust circulating solutions capable of managing complex fluid dynamics and temperature variations. Manufacturers often tailor product lines to meet the specific requirements and certification processes (e.g., ETL, UL) prevalent in this region.

Asia Pacific (APAC) represents the fastest-growing market segment globally, powered by expansive urban development and increasing energy consumption across China, India, and Southeast Asia. While cost sensitivity remains a factor in certain sub-regions, the rapid adoption of modern building codes, often mirroring Western standards in new luxury and commercial developments, is fueling demand for high-efficiency pumps. Government incentives to improve air quality and reduce overall energy loads also contribute significantly to the growth. This region is a strategic battleground for major international manufacturers seeking high-volume sales, requiring a dual strategy of offering both high-end smart pumps for premium projects and reliable, cost-effective standard units for the burgeoning mass market construction sector.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets experiencing substantial, albeit localized, growth. In the MEA region, particularly the Gulf Cooperation Council (GCC) countries, demand is heavily skewed towards pumps used in district cooling systems and large-scale commercial real estate, driven by extreme climatic conditions necessitating robust cooling infrastructure. Latin American growth is more heterogeneous, linked closely to national infrastructure spending and economic stability, with increasing focus on energy-saving technologies in response to rising electricity costs.

- Europe: High market maturity; growth driven primarily by replacement cycles and mandatory compliance with rigorous energy efficiency directives (Eco-design), favoring variable speed ECM pumps.

- North America (NA): Steady commercial and institutional demand; strong regulatory push from DOE standards; high uptake in specialized hydronic systems including geothermal heat pumps.

- Asia Pacific (APAC): Highest volume growth due to accelerated urbanization and infrastructure development; large new construction projects; increasing adoption of energy-saving technology in tier 1 cities.

- Middle East & Africa (MEA): Growth concentrated in district cooling networks and large commercial/hospitality sectors due to extreme climate conditions; emphasis on reliability and cooling efficiency.

- Latin America (LATAM): Developing market; demand sensitive to macroeconomic conditions; gradual shift towards efficient pumping solutions stimulated by high local energy prices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Circulator Pumps Market.- Grundfos

- Xylem Inc.

- Wilo SE

- Taco, Inc.

- Armstrong Fluid Technology

- KSB SE & Co. KGaA

- Sulzer Ltd.

- Flowserve Corporation

- DAB Pumps S.p.A.

- Calpeda S.p.A.

- Laing Thermotech, Inc.

- Zoeller Company

- EBARA Corporation

- Torishima Pump Mfg. Co., Ltd.

- Pentair, Inc.

- CNP Pumps

- Shanghai Kaiquan Pump (Group) Co., Ltd.

- Circulating Air, Inc.

- Franklin Electric Co., Inc.

- Bell & Gossett (a brand of Xylem)

Frequently Asked Questions

Analyze common user questions about the Circulator Pumps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What technological factors are driving the major shift in the Circulator Pumps Market?

The primary technological driver is the widespread adoption of Electronically Commutated Motor (ECM) technology, which enables variable speed operation and significantly reduces energy consumption compared to older fixed-speed induction motors, aligning with global energy efficiency regulations and reducing long-term operational costs for end-users.

How does the implementation of IoT connectivity benefit circulator pump users?

IoT integration allows pumps to be monitored remotely in real-time, providing crucial data on performance, flow, and energy usage. This connectivity facilitates predictive maintenance schedules, automated troubleshooting, and optimized system control through integration with Building Management Systems (BMS).

Which geographical region holds the highest potential for market expansion during the forecast period?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by rapid urbanization, substantial investment in new commercial and residential construction, and increasing governmental focus on implementing modern, energy-efficient HVAC infrastructure across developing economies.

What is the primary difference between wet rotor and dry rotor circulator pumps?

Wet rotor pumps operate with the motor and pump impeller fully enclosed and submerged in the pumped fluid, which lubricates the internal components and cools the motor, leading to quieter operation. Dry rotor pumps separate the motor from the pumped fluid using a shaft and mechanical seal, allowing them to handle higher flow rates and pressures, typically favored in large commercial and industrial applications.

How significant is the influence of energy efficiency mandates on market adoption?

Energy efficiency mandates, such as the European Eco-design Directive, are critically significant as they legally enforce the phasing out of inefficient models and compel the market towards high-efficiency, variable speed pumps, thereby acting as a powerful and non-negotiable driver for market innovation and replacement sales globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager