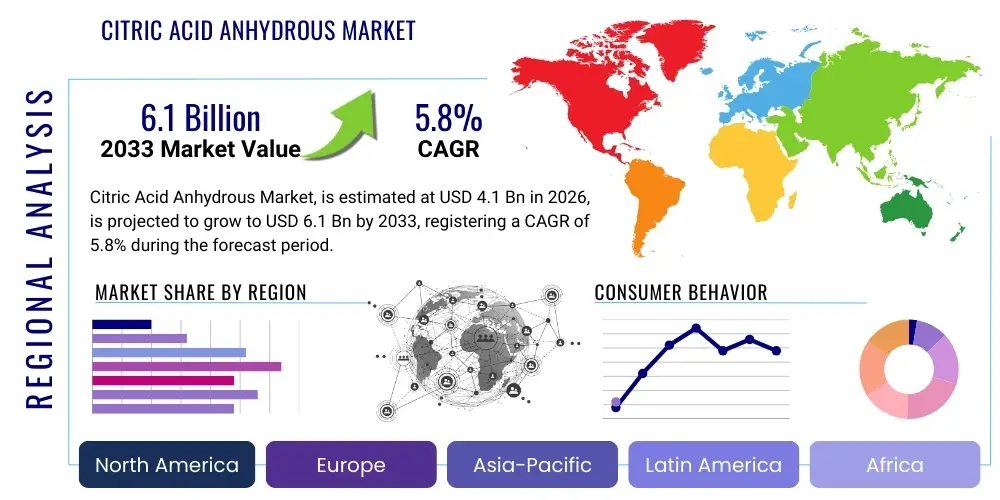

Citric Acid Anhydrous Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438209 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Citric Acid Anhydrous Market Size

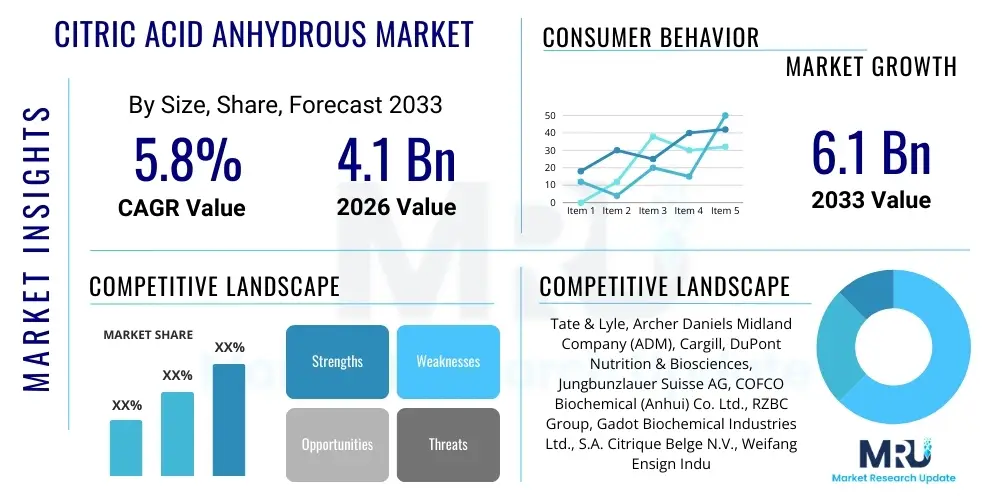

The Citric Acid Anhydrous Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033.

Citric Acid Anhydrous Market introduction

Citric acid anhydrous, a highly pure, white, crystalline powder derived primarily through the fermentation of carbohydrate substrates like molasses or corn starch using the fungus Aspergillus niger, represents the non-hydrated form of citric acid. This organic acid is globally recognized for its powerful chelating, buffering, and preserving properties, making it an indispensable additive across numerous industries. Its primary function often revolves around acting as an acidulant, imparting a tart, acidic flavor, particularly crucial in the expansive food and beverage sector where consumer preference leans towards naturally sourced ingredients and enhanced shelf stability. The purity and stability offered by the anhydrous form compared to its monohydrate counterpart make it highly desirable for specific pharmaceutical and industrial applications requiring minimal moisture content.

The market for citric acid anhydrous is fundamentally driven by the escalating global demand for processed and convenience foods, which heavily rely on acidulants and preservatives to maintain quality and extend product lifespan. Furthermore, the rising awareness regarding health and wellness has amplified its use in functional beverages and dietary supplements. In the pharmaceutical industry, it serves as an excipient, aiding in drug formulation, stability, and taste masking, especially in effervescent preparations. Its nontoxic nature and widespread acceptance by regulatory bodies across North America, Europe, and Asia Pacific reinforce its market dominance over synthetic alternatives. Consequently, continuous advancements in fermentation technology focusing on yield optimization and cost reduction are pivotal to supporting the market's trajectory.

Major applications span diverse sectors, including food and beverage processing, pharmaceuticals, personal care products, detergents, and industrial cleaning agents. In the food sector, it is vital for jams, jellies, soft drinks, and confectioneries. Its application in the detergent industry is significant, utilizing its chelating properties to soften water and enhance the effectiveness of cleaning formulations, aligning with the global push towards eco-friendly and phosphate-free cleaning products. The versatility and necessity of citric acid anhydrous across such critical end-use industries cement its position as a high-growth commodity in the global chemical landscape.

Citric Acid Anhydrous Market Executive Summary

The global Citric Acid Anhydrous Market is characterized by robust growth, primarily fueled by the accelerating consumption of packaged and functional foods, alongside increasing applications in the pharmaceutical and personal care sectors. Key business trends indicate a strong focus on backward integration among major manufacturers to secure raw material supplies (primarily molasses and corn starch) and achieve cost efficiencies in production, often involving large-scale fermentation units situated in cost-competitive regions. The market structure remains moderately consolidated, with a few large Asian players dominating production capacity, leading to intense pricing competition, particularly for bulk industrial grades. Sustainability is emerging as a critical competitive factor, with companies investing in bio-fermentation processes that minimize environmental footprint and maximize yield, attracting partnerships with environmentally conscious multinational corporations.

Regionally, the Asia Pacific (APAC) market, spearheaded by China and India, commands the largest share due to massive domestic production capabilities and surging demand from rapidly expanding food and beverage, and textile industries. APAC is also the epicenter of global exports, influencing global supply chain dynamics and pricing benchmarks. North America and Europe, while being mature markets, exhibit steady demand, driven primarily by stringent regulatory standards favoring safe, non-toxic additives in food and personal care. These regions are focused on high-purity, specialized grades of citric acid anhydrous, often used in complex drug formulations and premium beverage lines. Furthermore, Latin America and the Middle East & Africa (MEA) represent high-potential emerging markets, witnessing increased urbanization and subsequent growth in packaged goods consumption, necessitating greater imports of acidulants.

In terms of segment trends, the Food and Beverage application segment retains the largest market share, driven by its dual function as a preservative and flavor enhancer. However, the Pharmaceutical and Personal Care segments are projected to register the highest Compound Annual Growth Rate (CAGR) over the forecast period. This accelerated growth is attributed to the increasing use of anhydrous citric acid in oral care products, cosmetics, and the formulation of effervescent pharmaceutical preparations, capitalizing on its superior stability characteristics. The demand for industrial grade citric acid is also seeing moderate growth, bolstered by the shift towards safer, bio-based alternatives in industrial cleaning and metal finishing applications, supporting an overall balanced segmental expansion across the industry.

AI Impact Analysis on Citric Acid Anhydrous Market

User queries regarding the impact of Artificial Intelligence (AI) on the Citric Acid Anhydrous Market frequently revolve around optimizing fermentation yields, enhancing quality control consistency, and streamlining complex supply chain logistics. Consumers and industry stakeholders are keen to understand how AI-driven predictive modeling can minimize batch variability inherent in biological processes, leading to higher output and reduced waste. Key concerns include the initial capital expenditure required for integrating advanced sensors and AI platforms into existing fermentation tanks and downstream purification processes. Expectations are high that AI will facilitate truly continuous optimization of nutrient feeds, temperature, and pH levels, thereby lowering production costs and enabling manufacturers to respond rapidly to shifting raw material prices and global demand fluctuations, ultimately stabilizing the highly competitive global market pricing structure.

The application of AI in fermentation optimization represents the most significant area of transformation. Traditional fermentation processes rely on empirical data and historical averages, often resulting in suboptimal yields or extended batch times. AI systems, leveraging machine learning algorithms, can analyze thousands of variables—from substrate quality and microbial population genetics to external environmental factors—in real time. This capability allows for immediate, precise adjustments to operational parameters, predicting potential deviations before they impact the final yield. Such predictive maintenance and optimization capabilities are crucial for a low-margin commodity like citric acid, where even marginal improvements in yield translate directly into substantial profitability gains.

Beyond the manufacturing floor, AI is revolutionizing market analysis and demand forecasting specific to citric acid anhydrous. Given its widespread use across global supply chains (from soft drinks in Asia to pharmaceuticals in Europe), accurate forecasting is vital for inventory management and risk mitigation. AI platforms can ingest vast amounts of external data—including consumer trends, seasonal demands, regulatory changes, and competitive pricing strategies—to generate highly accurate demand forecasts, reducing the risk of overstocking or stockouts. This technological integration is transforming the operational efficiency of the citric acid anhydrous industry from a historically linear process into an agile, data-driven supply chain.

- AI-driven Predictive Analytics: Optimizing fermentation kinetics, substrate utilization, and process control parameters to maximize citric acid yield and purity.

- Automated Quality Assurance: Employing computer vision and machine learning for real-time analysis of crystalline structure and moisture content, reducing human error in grading.

- Supply Chain Optimization: Utilizing algorithms for dynamic routing, warehousing efficiency, and predicting supply disruptions based on global geopolitical or agricultural factors.

- Demand Forecasting: Enhancing the accuracy of market predictions by analyzing consumer data, regional economic indicators, and seasonal beverage consumption patterns.

- Energy Efficiency Management: Implementing AI to monitor and optimize energy consumption in resource-intensive steps like sterilization, filtration, and drying.

DRO & Impact Forces Of Citric Acid Anhydrous Market

The Citric Acid Anhydrous Market is influenced by a dynamic interplay of factors encompassing strong demand drivers, complex logistical restraints, and expansive opportunities, all magnified by critical internal and external impact forces. The dominant driver is the non-discretionary necessity of citric acid as a multifunctional ingredient across essential end-use industries, particularly the rapidly expanding global Food & Beverage sector, driven by increasing disposable incomes and preference for convenience food and beverages, especially in emerging economies. However, this growth trajectory is consistently challenged by the high volatility in the prices of key raw materials, primarily corn and molasses, which are susceptible to climatic variations and global agricultural policies, directly impacting manufacturer profitability and creating pricing instability for end-users. Opportunities arise from the transition to bio-based and sustainable formulations in non-food applications, such as biodegradable plastics and specialized medical cleaning agents, offering premium market niches.

Impact forces on the market are multifaceted, characterized by high supplier power and moderate buyer power. Supplier power is high due to the specialized nature of the fermentation process and the large scale required for economic production, limiting the number of global players capable of supplying large volumes consistently. This concentration provides significant leverage to key manufacturers in China and Europe. Conversely, buyer power remains moderate; while large multinational food and beverage corporations purchase huge quantities, they often rely on long-term contracts and dual-sourcing strategies to mitigate dependence on a single supplier. The threat of substitutes is relatively low, as few alternatives (like malic acid or ascorbic acid) offer the same cost-efficiency, functional versatility, and regulatory acceptance as citric acid across all its applications, though specialized markets may see targeted substitution.

Key restraining forces center on environmental regulatory pressures related to industrial effluent disposal and the energy-intensive nature of crystallization and drying processes, necessitating significant capital investment in wastewater treatment and efficiency upgrades. Geopolitical trade tensions and anti-dumping duties imposed on major exporting nations further disrupt established trade routes, forcing a shift in sourcing strategies and adding complexity to global logistics. Despite these challenges, the market's long-term outlook remains positive, underpinned by continuous population growth, persistent demand for stable food supply chains, and the increasing global emphasis on natural preservation methods over synthetic alternatives.

Segmentation Analysis

The Citric Acid Anhydrous Market is broadly segmented based on its application, grade, and the form it takes, with the 'anhydrous' form being distinct from 'monohydrate' primarily due to its moisture content and stability profile, influencing its suitability for various industrial requirements. Analyzing the market through these segmentations provides deep insights into consumer behavior, industrial procurement patterns, and regional specialization. The application segmentation, which includes Food & Beverages, Pharmaceuticals, Personal Care, and Industrial uses, dictates both volume demand and the requisite purity levels. For instance, pharmaceutical applications demand extremely high purity and stringent compliance, justifying premium pricing, while industrial cleaning applications primarily focus on bulk availability and cost-efficiency.

Further granularity is achieved through the segmentation by grade—Food Grade, Industrial Grade, and Pharmaceutical Grade—which reflects the varying regulatory requirements and quality standards imposed by respective end-use sectors. The Food Grade segment commands the largest volume share globally, essential for the preservation, flavoring, and pH stabilization of a vast array of consumer products. Meanwhile, the Pharmaceutical Grade, despite lower volume, generates higher revenue due to the rigorous purification processes and certifications required (such as USP, BP, EP), ensuring compliance for critical drug formulations, especially intravenous and oral liquid preparations where stability is paramount.

The segmentation structure is fundamental for manufacturers to optimize production schedules and marketing efforts. As the pharmaceutical and personal care industries continue their exponential growth, demand is shifting toward specialized, low-moisture anhydrous grades suitable for dry powder formulations and high-stability cosmetic ingredients. This trend encourages innovation in crystallization and drying technologies, creating opportunities for suppliers who can consistently meet these elevated purity and stability specifications, thereby driving value addition within traditionally high-volume, low-margin segments of the market.

- By Application:

- Food & Beverages (F&B)

- Pharmaceuticals

- Personal Care & Cosmetics

- Industrial & Household Detergents

- Chemical & Technical Applications

- By Grade:

- Food Grade

- Pharmaceutical Grade

- Industrial Grade

- By Form:

- Powder

- Granular

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Citric Acid Anhydrous Market

The value chain for the Citric Acid Anhydrous Market begins with upstream activities focused on securing raw materials, primarily agricultural commodities such as corn starch, molasses, or tapioca starch, which serve as the carbohydrate substrates for fermentation. Due to the high volume required, suppliers of these substrates, especially major agricultural producers, wield significant bargaining power. Efficient logistics in the procurement and storage of these bulk materials are critical, as transportation costs and spoilage risks directly impact the cost of goods manufactured. The upstream segment is characterized by strong regional concentration, often located near large farming areas or sugar processing plants to minimize inbound freight costs and ensure freshness, establishing a strong link between agricultural output and chemical production stability.

The middle segment involves the core manufacturing process: industrial fermentation using Aspergillus niger, followed by complex downstream processing, including filtration, purification, crystallization, and the final critical drying process to achieve the anhydrous form (less than 0.5% moisture). This stage is capital-intensive and requires high technical expertise and energy consumption. Major producers invest heavily in proprietary fermentation strains and energy recovery systems to maintain competitive pricing. Distribution channels typically involve a multi-layered approach, including direct sales to major multinational food and pharmaceutical corporations (often managed through long-term contracts) and indirect distribution through chemical distributors and local agents to reach smaller industrial and regional clients. Direct channels are preferred for specialized grades requiring technical support, while indirect channels provide wider geographical coverage.

The downstream segment includes the end-user industries: Food & Beverage manufacturers, Pharmaceutical companies, and Personal Care product formulators. Demand from these sectors drives innovation and quality requirements. Customer requirements often necessitate tailored packaging, specific certifications (e.g., Kosher, Halal, USP), and just-in-time delivery schedules. The proximity of manufacturing facilities to major consumption hubs, particularly in densely populated regions like Southeast Asia and Western Europe, reduces final transportation costs and strengthens supplier-customer relationships. Success in the downstream market is determined by reliability, product consistency, and the ability to navigate complex regulatory landscapes specific to food additives and pharmaceutical excipients.

Citric Acid Anhydrous Market Potential Customers

The primary customers for Citric Acid Anhydrous span a wide spectrum of industrial entities that rely on its acidifying, chelating, and preservative qualities, making the market highly diversified but concentrated around the Food & Beverage and Pharmaceutical manufacturing sectors. Large multinational corporations within the beverage industry, including producers of carbonated soft drinks, bottled waters, and functional juices, represent the largest volume consumers, utilizing the product extensively for flavor enhancement and pH stabilization to prevent bacterial growth. Similarly, processed food manufacturers—involved in producing confectionery, dairy derivatives, and canned goods—are essential long-term clients due to their consistent need for food-safe preservatives and acidulants, emphasizing bulk purchasing and supply chain reliability.

Beyond bulk consumption, the pharmaceutical industry represents the highest value customer segment. Potential buyers here include drug formulation companies specializing in oral solid dosages, effervescent tablets, and pediatric syrups. These customers demand the highest purity Pharmaceutical Grade (USP/BP/EP) anhydrous citric acid, where the risk tolerance for contaminants is zero. Their purchasing decisions are driven by stringent regulatory compliance and the ability of the supplier to provide detailed audit trails and technical documentation, rather than mere price competition. This segment often entails long qualification periods but results in stable, high-margin contractual relationships, making them a premium focus area for key manufacturers seeking diversification away from commodity markets.

Further potential customers exist in the growing Personal Care and Household Cleaning sectors. Cosmetic formulators use anhydrous citric acid for pH adjustment in creams, lotions, and shampoos, while industrial users, particularly detergent and cleaning agent manufacturers, rely on its chelating properties to sequester metal ions and enhance the cleaning efficacy of formulations, especially in hard water areas. The shift towards biodegradable and natural cleaning ingredients accelerates demand from these segments, particularly those seeking phosphate-free, green-certified product inputs. These diversified end-uses provide resilience to the overall market, buffering against slowdowns in any single industry.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tate & Lyle, Archer Daniels Midland Company (ADM), Cargill, DuPont Nutrition & Biosciences, Jungbunzlauer Suisse AG, COFCO Biochemical (Anhui) Co. Ltd., RZBC Group, Gadot Biochemical Industries Ltd., S.A. Citrique Belge N.V., Weifang Ensign Industry Co., Ltd., Delek Group, TTCA Co. Ltd., Natural Citric Acid LLC, Citribel S.A., Huangshi Xinghua Biochemical Co. Ltd., Kenko Corporation, V.V.F. Corporation, Fuyang Biotech, Zhejiang Guangyu, Yixing Union Biochemical |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Citric Acid Anhydrous Market Key Technology Landscape

The production of citric acid anhydrous relies fundamentally on microbial fermentation technology, predominantly utilizing strains of Aspergillus niger. The technological landscape is currently defined by continuous optimization efforts focused on enhancing yield, reducing production cycle time, and ensuring the high purity required for specialized grades. Key innovations center around submerged fermentation (SmF), which is the standard industrial method due to its efficiency and scalability. Advances in bioreactor design, including improved aeration systems and automated process control loops, are essential for maintaining optimal fermentation conditions, minimizing batch variations, and conserving energy, which is a major operating cost component.

Crucially, the move towards genetic engineering and strain optimization represents a pivotal technological shift. Researchers are leveraging CRISPR/Cas9 and other molecular biology tools to modify Aspergillus niger strains, enhancing their ability to convert low-cost agricultural substrates into citric acid more efficiently while reducing the formation of unwanted byproducts. Furthermore, the downstream processing—particularly the crystallization and drying stages necessary to produce the stable anhydrous form—is witnessing significant upgrades. Manufacturers are adopting advanced multi-stage evaporators and spray drying techniques designed to minimize thermal degradation and ensure precise control over crystal size and moisture content, critical factors for pharmaceutical grade applications.

Integration of Industry 4.0 technologies, including the use of high-throughput screening, sensor technology, and advanced data analytics, is streamlining manufacturing processes. These tools allow for real-time monitoring of metabolic activity within the bioreactors and automatic adjustments, leading to unprecedented consistency and operational efficiency. The technological advancements are particularly aimed at achieving superior energy efficiency in purification steps—such as ion exchange and activated carbon filtration—to meet sustainability goals while reducing overall cost of production, maintaining competitive advantage in the global commodity market.

Regional Highlights

The Citric Acid Anhydrous Market displays significant regional disparities in both production capacity and consumption patterns, reflecting varying industrial maturity, consumer demographics, and regulatory environments. Asia Pacific (APAC) holds the dominant market share globally, driven primarily by China, which acts as the world's largest producer and exporter. The massive industrial base in China and India supports vast manufacturing outputs not only for domestic consumption, fueled by rapidly growing middle-class demand for processed foods and beverages, but also for global supply chains. Investment in advanced manufacturing technologies and capacity expansion remains high in APAC, ensuring its continued leadership in terms of volume and competitive pricing.

North America and Europe represent mature markets characterized by steady, high-value demand, often focused on pharmaceutical and premium food applications. Regulatory frameworks like the FDA in the US and EFSA in Europe impose strict quality and safety standards, driving demand for certified, high-purity anhydrous grades. European consumption is strong due to its significant market presence in functional beverages, confectionery, and household detergents, coupled with a strong emphasis on sustainability, favoring European-sourced citric acid which often adheres to more stringent environmental standards. These regions are less focused on bulk industrial production and more on customized solutions and specialized grades.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging as high-growth potential regions. LATAM demand is bolstered by increasing urbanization, which fosters demand for ready-to-eat meals and packaged goods, particularly in countries like Brazil and Mexico. The MEA region, while starting from a smaller base, is witnessing robust growth in the food processing industry and infrastructural development, leading to increased demand for industrial cleaning and water treatment applications. However, both regions largely depend on imports from Asia Pacific or Europe, making their market dynamics sensitive to global logistics costs and international trade policies. Expanding local manufacturing or strategic partnerships are key to stabilizing supply chains in these emerging territories.

- Asia Pacific (APAC): Dominates production and consumption, led by China and India; characterized by high volume manufacturing and robust demand from the F&B and textile industries.

- North America: Mature market focused on high-purity pharmaceutical and nutraceutical applications; driven by strict regulatory adherence and consumer preference for natural ingredients.

- Europe: Strong demand for acidulants in detergents and functional beverages; emphasis on sustainable production practices and localized supply chains.

- Latin America (LATAM): High growth potential driven by rising urbanization and demand for packaged food and beverages; heavily reliant on imports.

- Middle East & Africa (MEA): Emerging market with increasing use in regional food processing and industrial water treatment; characterized by high import dependency and developing local manufacturing capacity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Citric Acid Anhydrous Market.- Tate & Lyle

- Archer Daniels Midland Company (ADM)

- Cargill

- DuPont Nutrition & Biosciences

- Jungbunzlauer Suisse AG

- COFCO Biochemical (Anhui) Co. Ltd.

- RZBC Group

- Gadot Biochemical Industries Ltd.

- S.A. Citrique Belge N.V.

- Weifang Ensign Industry Co., Ltd.

- Delek Group

- TTCA Co. Ltd.

- Natural Citric Acid LLC

- Citribel S.A.

- Huangshi Xinghua Biochemical Co. Ltd.

- Kenko Corporation

- V.V.F. Corporation

- Fuyang Biotech

- Zhejiang Guangyu

- Yixing Union Biochemical

Frequently Asked Questions

Analyze common user questions about the Citric Acid Anhydrous market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the growth of the Citric Acid Anhydrous Market?

The primary driver is the accelerating global demand from the Food and Beverage industry, where anhydrous citric acid is essential for preservation, flavoring, and enhancing the shelf life of convenience foods, soft drinks, and confectioneries due to its superior acidulant properties.

How does Citric Acid Anhydrous differ from Citric Acid Monohydrate, and which applications favor the anhydrous form?

Citric Acid Anhydrous contains less than 0.5% moisture, making it highly stable. It is preferred over the Monohydrate form for moisture-sensitive applications, particularly dry pharmaceutical formulations (like effervescent tablets) and certain powder-based food mixes where water content must be strictly controlled.

Which geographical region dominates the global supply and production of Citric Acid Anhydrous?

Asia Pacific (APAC), specifically China, dominates the global supply and production of citric acid anhydrous, benefiting from large-scale fermentation facilities, cost-effective raw material procurement, and vast export capabilities, making it the primary sourcing hub globally.

What raw materials are typically used in the industrial production of citric acid anhydrous?

The industrial production relies mainly on the submerged fermentation process utilizing carbohydrate substrates. The most common raw materials include corn starch, molasses (a byproduct of sugar refining), and less frequently, tapioca or other starchy materials, which are fed to the Aspergillus niger fungus.

What key challenge limits profitability for manufacturers in the Citric Acid Anhydrous Market?

The primary challenge is the high volatility and fluctuation in the cost of key agricultural raw materials (corn and molasses), which are highly susceptible to weather conditions, crop yields, and global commodity market speculation, directly impacting production costs and manufacturer margins.

Is the manufacturing process environmentally sustainable?

The manufacturing process, which involves fermentation, is generally considered more sustainable than traditional chemical synthesis. However, challenges exist regarding high energy consumption in crystallization and drying, and the need for rigorous wastewater treatment to manage fermentation effluents, pushing manufacturers toward adopting greener technologies and circular economy practices to improve environmental profiles.

What role does Citric Acid Anhydrous play in the growing personal care industry?

In the personal care industry, it functions as a primary pH adjuster, helping stabilize formulations in cosmetics, creams, and shampoos. Its mild acidulant and chelating properties also make it effective in sequestering metal ions found in water, enhancing product efficacy and shelf stability without causing skin irritation.

Are there significant technological advancements expected in the fermentation stage?

Yes, significant advancements are centered around genetic engineering (e.g., using CRISPR) to optimize Aspergillus niger strains for higher yield and improved substrate efficiency. Furthermore, the integration of AI and machine learning for real-time process control in bioreactors is crucial for consistent batch quality and lowering operational costs, defining the next wave of technological growth.

Which application segment is expected to show the fastest CAGR during the forecast period?

The Pharmaceutical segment is projected to exhibit the fastest Compound Annual Growth Rate (CAGR). This is due to the increasing global focus on non-toxic excipients, the rise in effervescent drug formulations, and the strict requirement for the highly stable anhydrous grade in medication where moisture control is vital for therapeutic stability.

How do trade policies and anti-dumping duties affect the global Citric Acid Anhydrous supply chain?

Trade policies, particularly anti-dumping duties imposed by Western nations on Chinese imports, significantly disrupt the traditional supply chain flow, leading to increased sourcing costs, mandatory diversification of supplier bases for large buyers, and price volatility in regional markets that rely heavily on imports.

What competitive strategies are major players utilizing to maintain market share?

Major players are focusing on backward integration to secure raw material supply, implementing advanced automation and AI for yield optimization, and strategically positioning manufacturing facilities closer to key consumer markets to reduce logistics costs. Emphasis is also placed on developing premium, high-purity grades for specialized pharmaceutical and personal care markets.

Is Citric Acid Anhydrous used in the production of biodegradable materials?

Yes, it is increasingly being explored and used as an important component or catalyst in the production of certain biodegradable polymers and bioplastics. Its non-toxic nature aligns perfectly with the shift towards environmentally friendly packaging solutions, opening up new industrial applications beyond traditional uses.

What is the current regulatory landscape for citric acid anhydrous in food applications?

The regulatory landscape is highly stable and favorable. Citric acid anhydrous is generally recognized as safe (GRAS) by the FDA in the United States and is approved as a food additive (E330) across the European Union and many Asian countries. Strict adherence to food safety standards remains paramount, but its established history ensures consistent market acceptance.

How does the chelating ability of citric acid contribute to its industrial applications?

Its strong chelating ability allows it to bind and sequester metal ions, particularly calcium and magnesium, which is highly beneficial in industrial cleaning and detergent formulations. This process softens water, prevents scale buildup, and enhances the effectiveness of cleaning agents, driving its demand as a non-toxic alternative to phosphate builders.

What impact does raw material volatility have on end-user pricing?

Raw material volatility, particularly concerning corn and molasses prices, directly translates into fluctuating production costs. While large manufacturers try to absorb short-term shocks, sustained increases in substrate costs often necessitate price adjustments for bulk commodity grades, affecting procurement budgets for high-volume end-users like beverage companies.

Why is the anhydrous form crucial for effervescent pharmaceutical preparations?

The anhydrous form is crucial because effervescent tablets require an extremely low moisture content to prevent premature reaction between the acid (citric acid) and the base (bicarbonate). Using the monohydrate form would introduce sufficient moisture to initiate the reaction prematurely, compromising the product's stability and shelf life.

What growth drivers are emerging in the Latin American market?

Growth in the Latin American market is fueled by rising per capita consumption of packaged and processed foods, increasing disposable incomes, and the expansion of local food and beverage manufacturing facilities. Demand for natural preservatives that meet consumer health trends further supports market expansion in countries like Brazil, Mexico, and Argentina.

How is digital transformation affecting the value chain beyond manufacturing?

Digital transformation is heavily impacting the downstream value chain through advanced logistics platforms and e-commerce solutions, enabling quicker transactions and improved supply chain visibility. Manufacturers are utilizing digital tools for precise inventory management and streamlined order processing, enhancing customer service and reducing operational lead times globally.

What is the market expectation regarding substitutes like malic acid or fumaric acid?

While substitutes like malic and fumaric acid are utilized in niche flavoring applications, they are not expected to significantly displace citric acid anhydrous. Citric acid maintains a strong competitive advantage due to its versatility, superior cost-to-performance ratio, and universally accepted regulatory status across diverse application segments.

What factors determine the high revenue generation of the Pharmaceutical Grade segment?

The high revenue generation in the Pharmaceutical Grade segment is driven by the stringent quality control requirements, necessity for specialized certifications (USP, EP), lower batch sizes, and the subsequent premium pricing structure applied to offset the extensive purification and testing protocols needed to ensure absolute safety and efficacy for drug formulation.

How do manufacturers ensure the sustainability of the supply chain?

Manufacturers are ensuring sustainability by focusing on responsible sourcing of raw materials (often using agricultural byproducts), optimizing energy usage in drying processes, implementing closed-loop water systems in purification, and investing in advanced wastewater treatment facilities to minimize environmental discharge, aligning with global corporate sustainability goals.

What is the primary function of Citric Acid Anhydrous in the Industrial & Household Detergents sector?

In the detergents sector, its primary function is as a builder or water softener. By chelating metal ions responsible for water hardness, it significantly improves the efficiency of surfactants, allowing the cleaning agents to perform optimally, especially crucial for phosphate-free and environmentally friendly formulations.

Why are specialized packaging and handling protocols necessary for anhydrous citric acid?

Specialized packaging, often involving multilayer bags or containers with moisture barriers, is necessary for anhydrous citric acid because its inherent low moisture content makes it highly hygroscopic. If exposed to atmospheric moisture, it absorbs water, converting to the less stable monohydrate form, compromising its quality and intended functionality.

What are the key differences between Food Grade and Industrial Grade citric acid?

The key difference lies in the purity and concentration of impurities. Food Grade citric acid must meet stringent regulatory standards (e.g., FCC), ensuring it is safe for human consumption with minimal heavy metal contamination. Industrial Grade, while still highly effective, is produced to less demanding purity specifications, acceptable for non-ingestible applications like cleaning or technical chemical processes.

How is the current geopolitical environment influencing market dynamics?

The current geopolitical environment, marked by trade conflicts and pandemic-related logistics disruptions, introduces significant uncertainty. This leads to increased efforts by buyers to diversify their supply bases away from single high-risk regions, favoring suppliers who can demonstrate resilience, geographical diversity, and transparent sourcing practices.

What is the average shelf life of Citric Acid Anhydrous?

When stored correctly in a cool, dry environment and its original, sealed packaging, Citric Acid Anhydrous typically maintains a high-quality standard and can have a shelf life of up to two to three years. The anhydrous nature significantly contributes to this extended stability compared to products with higher moisture content.

How critical is the choice of microbial strain in the fermentation process?

The choice and optimization of the Aspergillus niger microbial strain are extremely critical. Strain selection directly determines the fermentation yield, efficiency of substrate conversion, resistance to contamination, and the concentration of citric acid produced, fundamentally impacting the entire cost structure and feasibility of the industrial operation.

What investment trends are observed among leading market manufacturers?

Leading manufacturers are increasingly investing in capital-intensive projects such as capacity expansions in APAC, technological upgrades to enhance energy efficiency in European facilities, and digitalization of quality control and supply chain management systems to improve operational agility and maintain a strong competitive edge in the commodity chemical space.

How does the market address fluctuations in consumer preference towards natural ingredients?

The market benefits significantly from this trend, as citric acid is naturally derived (bio-fermented) and generally perceived as a natural ingredient, making it a preferred choice over synthetic acidulants. Manufacturers highlight the natural source and non-GMO certification of their products to align with clean label consumer movements.

What challenges exist in scaling up production to meet global demand?

Scaling up requires substantial capital investment in bioreactor and purification infrastructure, securing massive, stable supplies of agricultural substrates, and navigating increasingly strict environmental regulations regarding industrial effluents and emissions, which collectively represent significant hurdles for new market entrants.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager