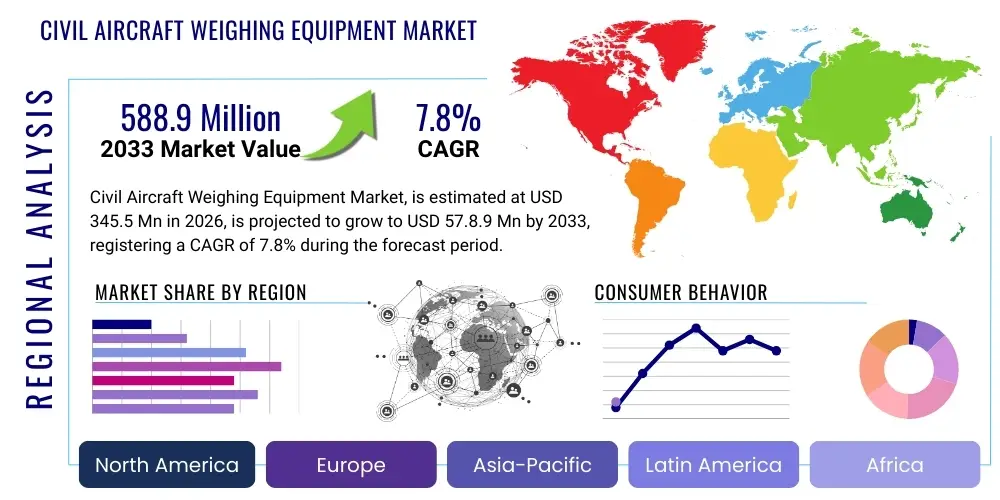

Civil Aircraft Weighing Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438698 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Civil Aircraft Weighing Equipment Market Size

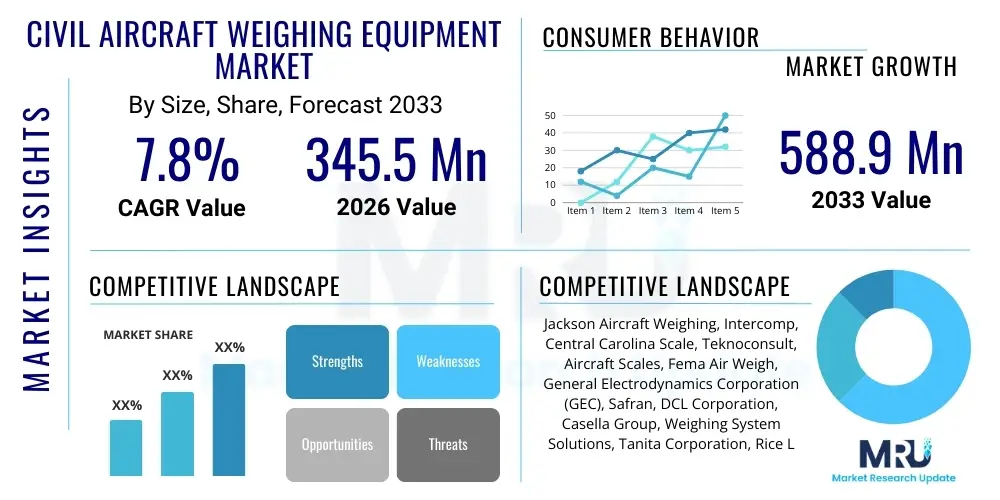

The Civil Aircraft Weighing Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 345.5 Million in 2026 and is projected to reach USD 588.9 Million by the end of the forecast period in 2033.

Civil Aircraft Weighing Equipment Market introduction

The Civil Aircraft Weighing Equipment Market encompasses specialized instrumentation and systems designed for accurately measuring the weight and center of gravity (CG) of commercial airliners, general aviation aircraft, and rotorcraft. These sophisticated systems are crucial for ensuring flight safety, optimizing fuel efficiency, and maintaining compliance with stringent regulatory requirements imposed by aviation bodies such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA). The equipment ranges from portable, high-accuracy scale systems utilized in maintenance hangars to integrated on-board weight and balance systems used during flight operations. Accurate weight measurement is fundamental for calculating critical performance metrics, including takeoff and landing distances, payload capacity, and stability parameters.

The primary products within this domain include floor scales (pad systems), platform systems, and tension links, catering to various aircraft sizes and operational needs. Major applications span across Maintenance, Repair, and Overhaul (MRO) facilities, airline operations, and aircraft manufacturing plants (OEMs). Benefits derived from utilizing precise weighing equipment include enhanced operational safety by preventing overloading or incorrect center of gravity placement, significant cost savings through optimized load distribution, and reduced risk of structural damage. The market growth is predominantly driven by the continuous expansion of global commercial aircraft fleets, the increasing focus on preventive maintenance protocols, and the mandatory regulatory cycles requiring periodic aircraft weighing.

Furthermore, technological advancements are reshaping the market landscape. The transition towards wireless and interconnected weighing systems that offer real-time data integration into airline maintenance systems (MRO software) is a key trend. These modern systems minimize setup time, reduce potential human error, and provide traceable data logs required for compliance audits. As the volume of air traffic increases globally, particularly in emerging economies of the Asia Pacific region, the demand for reliable, high-precision weighing solutions essential for maintaining rigorous airworthiness standards continues to accelerate, thereby propelling market expansion.

Civil Aircraft Weighing Equipment Market Executive Summary

The Civil Aircraft Weighing Equipment Market exhibits robust growth, primarily fueled by stringent global aviation safety regulations mandating precise aircraft mass and balance verification, alongside the continuous growth and modernization of commercial airline fleets worldwide. Key business trends include the shift towards sophisticated digital weighing solutions, particularly wireless and Bluetooth-enabled systems, which enhance efficiency and data management for MRO providers. Consolidation among smaller specialized manufacturers and strategic partnerships between weighing equipment providers and major aircraft maintenance software vendors are also defining the competitive landscape, aiming to offer integrated lifecycle management solutions to airline operators.

Regionally, North America and Europe currently dominate the market due to the high concentration of major MRO hubs, strict compliance frameworks, and the presence of leading weighing equipment manufacturers. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, driven by massive investments in new airport infrastructure, the rapid expansion of low-cost carriers (LCCs), and substantial fleet procurement activities in countries like China and India. This regional dynamic is compelling global vendors to localize their supply chains and enhance service network capabilities in high-growth Asian markets.

Segment-wise, the market sees robust demand for platform systems, favored by large MRO centers handling wide-body aircraft, while floor scales remain popular for portability and use in smaller general aviation segments. The end-user segment is dominated by MRO facilities, which require routine calibration and weighing services as part of heavy maintenance checks. A notable segment trend is the increasing expenditure on calibration and maintenance services, ensuring the continuous accuracy and regulatory compliance of existing equipment, providing stable recurring revenue streams for service providers throughout the forecast period.

AI Impact Analysis on Civil Aircraft Weighing Equipment Market

User queries regarding AI's influence in the Civil Aircraft Weighing Equipment Market frequently revolve around how artificial intelligence can move beyond simple measurement to predictive maintenance, real-time load management, and enhanced safety analytics. Users are keen to understand if AI can predict component wear in weighing systems, thereby minimizing downtime for calibration, and how machine learning algorithms can integrate weight data with flight planning software to achieve dynamic, optimized center-of-gravity calculations instantaneously before takeoff. Concerns also center on the reliability of AI interpretation of complex load shifts and the regulatory approval process for automated, AI-driven weight verification systems, requiring validation that these systems meet the same stringent accuracy standards as traditional, human-verified methods.

The introduction of AI is shifting the equipment’s role from a static measuring tool to a dynamic analytical asset. AI algorithms can analyze historical weighing data, ambient environmental conditions, and maintenance logs to predict potential calibration drifts or component failures within the weighing scales themselves, enabling just-in-time servicing rather than fixed-schedule checks. Furthermore, integrating AI with onboard systems allows for continuous, real-time mass and balance monitoring during flight, offering potential safety improvements by detecting subtle, uncommanded load shifts that might affect handling characteristics. This integration elevates the value proposition of weighing systems far beyond their traditional use in maintenance hangars.

However, the immediate impact of AI is focused primarily on the data analysis and predictive maintenance layers rather than replacing the fundamental physical measurement components (load cells, sensors). AI-powered diagnostic tools are being developed by key players to accelerate the troubleshooting process for complex wireless network issues and ensure data integrity during transmission from the scale to the central database. This technological evolution demands higher data processing capabilities within the equipment and greater standardization in data formats to allow seamless cross-platform integration, ensuring that civil aircraft operators can leverage sophisticated analytics for improved operational efficiency and safety compliance.

- AI-driven Predictive Maintenance: Optimizing calibration schedules and reducing unexpected equipment failures in weighing scales.

- Real-Time Center of Gravity Optimization: Utilizing machine learning to integrate load cell data with flight management systems for dynamic balancing adjustments.

- Automated Data Validation: Employing AI to cross-reference measured weight against calculated maximum payload and historical norms to flag anomalies immediately.

- Enhanced Data Integrity: Using cryptographic and AI verification techniques to ensure the accuracy and tamper-proofing of critical weight records for regulatory audits.

- Simulation and Training: AI-enhanced simulators using precise weight data to model aircraft behavior under various load conditions for pilot training.

- Remote Diagnostics: AI algorithms enabling manufacturers to remotely diagnose equipment faults and suggest targeted maintenance interventions.

DRO & Impact Forces Of Civil Aircraft Weighing Equipment Market

The Civil Aircraft Weighing Equipment Market is fundamentally influenced by robust drivers, constrained by high operational costs and complex regulatory barriers, yet possesses substantial growth opportunities stemming from technological modernization. The primary drivers include the mandatory periodic weighing requirements imposed by global aviation regulatory bodies (FAA, EASA), the relentless focus of airlines on improving fuel efficiency—which necessitates highly accurate weight and balance calculations—and the continuous expansion of the global commercial aircraft fleet, driving demand for initial equipment procurement and subsequent calibration services. Impact forces are derived from the interplay of these factors, resulting in a sustained demand curve highly inelastic to economic cycles but sensitive to changes in aviation safety mandates.

Restraints largely involve the high initial capital investment required for purchasing certified, high-precision weighing systems, particularly large platform scales. Furthermore, the necessity for frequent, costly, and certified recalibration services, often requiring specialized technicians and adherence to NIST (National Institute of Standards and Technology) or equivalent global standards, adds significant operational expenditure for end-users. The opportunity landscape is significantly boosted by the ongoing technological transition towards wireless, portable, and highly integrated weighing solutions. This includes systems that can communicate directly with enterprise resource planning (ERP) systems and Maintenance Information Systems (MIS), offering streamlined workflows and reduced manual handling of critical data, appealing particularly to efficiency-conscious MRO providers globally.

The market also faces an increasing impact force from sustainability pressures. As airlines strive to reduce carbon emissions, optimizing aircraft weight and load distribution becomes paramount, driving investment in more precise and frequently used weighing technologies. Opportunities also exist in developing next-generation weighing solutions for emerging aircraft platforms, such as Electric Vertical Takeoff and Landing (eVTOL) vehicles and large-scale cargo drones, which will require specialized, lightweight, and high-precision weighing apparatus not currently standard in conventional civil aviation, thus opening up new niche markets for specialized manufacturers.

Segmentation Analysis

The Civil Aircraft Weighing Equipment Market is meticulously segmented based on product type, technology, application, and end-user, reflecting the diverse requirements across the aviation maintenance and operation lifecycle. Understanding these segments is crucial for manufacturers to tailor their offerings, ranging from highly portable pad-based systems used by general aviation to massive, integrated platform systems required for wide-body aircraft maintenance checks. The segmentation highlights the strong reliance of the market on regulatory compliance activities conducted by MRO facilities and the increasing adoption of digital, wireless technologies across all operational segments to enhance data accuracy and efficiency.

- By Product Type:

- Floor Scales (Pads)

- Platform Scales (Integrated Systems)

- Load Cell Systems (Tension/Compression Links)

- By Technology:

- Wired Weighing Systems

- Wireless Weighing Systems (Radio Frequency, Bluetooth)

- Hydraulic and Mechanical Systems (Traditional)

- By Application:

- Weight and Balance Determination

- Load Monitoring

- Calibration and Verification

- By Aircraft Type:

- Commercial Aircraft (Narrow-body, Wide-body, Regional Jets)

- General Aviation (GA) Aircraft

- Rotorcraft (Helicopters)

- By End-User:

- Maintenance, Repair, and Overhaul (MRO) Facilities

- Airlines and Operators

- Aircraft Manufacturers (OEMs)

- Military and Government Agencies (Civil Applications)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Civil Aircraft Weighing Equipment Market

The value chain for the Civil Aircraft Weighing Equipment Market begins with the upstream suppliers responsible for providing highly specialized raw materials and electronic components, particularly high-precision strain gauges, durable load cells, specialized alloys for scale structures, and sophisticated communication modules (e.g., wireless transmitters). The quality and certification of these upstream components are paramount, as they directly dictate the accuracy and regulatory compliance of the final weighing system. Manufacturers often engage in rigorous qualification processes for suppliers to ensure material traceability and reliability under extreme operational environments, a critical step given the safety-critical nature of the end product.

The middle segment of the chain involves the Original Equipment Manufacturers (OEMs) who design, assemble, calibrate, and certify the final weighing equipment systems (floor scales, platforms). This stage is capital-intensive and requires substantial investment in R&D, focusing on precision engineering, software integration, and obtaining necessary certifications (e.g., ISO, OIML, and aviation-specific approvals). Distribution channels are primarily direct, especially for large, integrated platform scales sold to major MRO facilities and OEMs, necessitating specialized technical sales teams. For smaller, portable pad systems, distribution often involves specialized aviation parts distributors or authorized service centers, acting as indirect channels.

Downstream activities are dominated by end-users (MROs and airlines) utilizing the equipment and, crucially, the extensive ecosystem of calibration and maintenance service providers. Since accurate weighing is mandated periodically, the aftermarket services—including recalibration, repair, and software updates—constitute a vital and high-margin segment of the value chain, ensuring long-term customer engagement. Direct channels facilitate deep technical support and custom solutions for complex MRO requirements, while indirect channels through local agents and regional distributors improve market penetration and provide essential localized calibration services, maintaining the operational integrity and regulatory adherence of the equipment throughout its lifecycle.

Civil Aircraft Weighing Equipment Market Potential Customers

The primary consumers and end-users of Civil Aircraft Weighing Equipment are entities directly responsible for the safe operation, maintenance, and manufacture of civil aircraft. Maintenance, Repair, and Overhaul (MRO) facilities represent the largest and most frequent buyers, driven by the mandate to perform precise weight and balance checks during heavy maintenance visits (C-checks and D-checks). These facilities require a mix of equipment, from fixed, high-capacity platform systems for wide-body aircraft to portable systems for smaller jobs. The continuous stream of maintenance cycles ensures sustained demand for both new equipment and, crucially, certified calibration and service contracts, making MROs reliable, long-term revenue sources.

Airlines and individual aircraft operators constitute another significant customer base. While many airlines outsource heavy checks, they often require their own portable weighing equipment for quick checks, troubleshooting, or remote field operations. Furthermore, major aircraft manufacturers (OEMs) such as Boeing, Airbus, and specialized regional jet builders are critical potential customers, needing highly accurate, certified systems during the assembly and certification phases of new aircraft models to establish initial operational weights and center of gravity envelopes. Government and military aviation sectors, particularly those operating large transport or presidential fleets under civil aviation rules, also require compliant weighing solutions, often prioritizing ruggedness and portability alongside high accuracy standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 345.5 Million |

| Market Forecast in 2033 | USD 588.9 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Jackson Aircraft Weighing, Intercomp, Central Carolina Scale, Teknoconsult, Aircraft Scales, Fema Air Weigh, General Electrodynamics Corporation (GEC), Safran, DCL Corporation, Casella Group, Weighing System Solutions, Tanita Corporation, Rice Lake Weighing Systems, Precia Molen, Mettler Toledo, Vishay Precision Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Civil Aircraft Weighing Equipment Market Key Technology Landscape

The technological landscape of civil aircraft weighing equipment is rapidly transitioning from traditional hydraulic and mechanical systems to highly sophisticated, digital electronic load cell technologies. Modern systems predominantly rely on high-precision electronic strain gauge load cells that offer superior accuracy (often exceeding 0.1% full scale) and reliability over mechanical counterparts. The core technological innovation driving market growth is the widespread adoption of wireless communication protocols, primarily utilizing secure Radio Frequency (RF) and industrial Bluetooth technologies. Wireless systems significantly simplify setup by eliminating cumbersome cables, reducing trip hazards in hangars, and accelerating the overall weighing process. These wireless capabilities are often paired with ruggedized tablets or dedicated controllers running specialized software for data acquisition, enabling real-time monitoring and reporting.

Furthermore, digital signal processing and advanced sensor fusion techniques are enhancing the overall robustness and reliability of the weighing data. Many contemporary systems incorporate intelligent compensation features that automatically account for environmental factors such as temperature fluctuations or subtle floor irregularities, ensuring consistent measurement accuracy across different MRO environments. The development of self-calibrating or smart calibration warning systems is also gaining traction, reducing the reliance on manual, annual recalibration processes by providing continuous health monitoring of the load cells. This focus on long-term data stability and minimizing downtime is a critical technological selling point for major airline customers focused on maximizing aircraft utilization rates.

Integration capabilities are perhaps the most critical technological differentiator. Leading manufacturers are focusing heavily on developing software APIs and standardized data outputs that allow seamless integration of weight and balance measurements directly into major airline maintenance management software (e.g., AMOS, TRAX) and Enterprise Resource Planning (ERP) systems. This integration minimizes manual data entry, eliminates transcription errors, and ensures regulatory documentation is generated automatically and archived securely. Future advancements are concentrating on using non-contact measurement techniques, such as advanced laser systems paired with load cells for dynamic measurement, although these are currently nascent, demonstrating the industry's drive toward faster, more autonomous weighing solutions.

Regional Highlights

The Civil Aircraft Weighing Equipment Market exhibits diverse growth patterns influenced by regional fleet sizes, regulatory maturity, and investment in MRO infrastructure. North America holds a dominant market share due to the immense scale of commercial and general aviation operations, the presence of major aircraft OEMs, and the rigorous enforcement of FAA maintenance mandates, driving consistent demand for certified equipment and calibration services. Europe follows closely, characterized by a highly mature aviation sector, substantial MRO activity, and strict adherence to EASA regulations, with key hubs in Germany, the UK, and France fostering strong technological innovation.

Asia Pacific (APAC) is projected to be the fastest-growing region throughout the forecast period. This acceleration is attributed to unprecedented fleet expansion by major regional carriers, massive infrastructure development including new MRO centers in China, India, and Southeast Asia, and a growing emphasis on adopting international safety standards. The MEA region, particularly the Gulf states, demonstrates specialized demand driven by their large, modern, long-haul fleets, necessitating investment in high-capacity platform weighing systems capable of handling the largest commercial aircraft efficiently. Latin America shows steady growth, driven by regional fleet replacement cycles and the increasing professionalization of local MRO operations.

- North America: Market leader, driven by mature aviation infrastructure, high defense spending on civil applications, and early adoption of wireless weighing technologies.

- Europe: Strong demand supported by EASA mandates, a high concentration of sophisticated MRO providers, and active technological development in sensor accuracy.

- Asia Pacific (APAC): Highest CAGR fueled by new aircraft deliveries, expansion of low-cost carriers, and government investments aimed at building world-class MRO capabilities.

- Middle East & Africa (MEA): Growth centered on massive hub airports (e.g., UAE, Qatar) requiring high-capacity systems for wide-body fleet maintenance and stringent safety standards.

- Latin America: Steady demand based on ongoing fleet modernization, particularly in Brazil and Mexico, and rising internal demand for certified maintenance services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Civil Aircraft Weighing Equipment Market.- Intercomp Company

- Jackson Aircraft Weighing Systems Inc.

- Central Carolina Scale, Inc.

- General Electrodynamics Corporation (GEC)

- Fema Air Weigh Inc.

- Aircraft Scales Inc.

- Teknoconsult

- Safran S.A. (through specialized subsidiaries or related segments)

- Mettler Toledo

- Rice Lake Weighing Systems

- Precia Molen

- Vishay Precision Group (VPG)

- Tanita Corporation

- DCL Corporation

- Avery Weigh-Tronix

- MinebeaMitsumi Inc. (Load Cell components)

- Casella Group

- Weighing System Solutions, LLC

- Testometric Group

- Sterling Scale Co., Inc.

Frequently Asked Questions

Analyze common user questions about the Civil Aircraft Weighing Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of civil aircraft weighing equipment and why is it mandatory?

The primary function is to accurately determine the aircraft's empty weight and, critically, its precise center of gravity (CG). This measurement is mandatory under international aviation regulations (FAA/EASA) because proper weight and CG placement are fundamental to flight stability, control effectiveness, and adherence to structural load limits, directly impacting operational safety and fuel efficiency. Regulatory bodies require periodic checks, typically every few years or following major structural repairs, to ensure compliance.

What are the key differences between floor scales (pad systems) and platform scales for aircraft weighing?

Floor scales, or pad systems, are portable, modular, and typically used for smaller aircraft, field operations, or situations where rapid setup is necessary, accommodating low-to-medium capacity requirements. Platform scales are large, integrated, and often permanently installed within MRO hangars; they handle the highest capacities and are essential for weighing wide-body and heavy commercial aircraft, providing the highest level of stability and repeatable accuracy for complex maintenance checks.

How is technology, specifically wireless capability, impacting the Civil Aircraft Weighing Equipment Market?

Wireless technology is significantly improving efficiency by eliminating cable management, reducing setup time, and enhancing safety in hangar environments. Modern wireless systems (using Bluetooth or RF) ensure secure, real-time data transmission directly to management software, minimizing human transcription errors and providing immediate, traceable digital records essential for regulatory reporting, thereby accelerating the MRO workflow and improving data integrity.

Which geographical region is expected to show the fastest growth in demand for aircraft weighing equipment?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth. This rapid expansion is driven by the region's aggressive commercial fleet modernization and expansion programs, particularly in major economies like China and India, coupled with massive government and private investment in developing local, certified MRO capabilities, which necessitates substantial procurement of new weighing and calibration systems.

What are the main challenges facing the manufacturers and users of civil aircraft weighing equipment?

Manufacturers face challenges related to meeting extremely high standards for accuracy and obtaining rigorous aviation certifications (e.g., NIST, traceable calibration requirements), coupled with the need for continuous technological integration with complex airline maintenance software systems. Users face the challenge of high initial capital expenditure for certified equipment and the ongoing, mandatory requirement for frequent, costly, and specialized recalibration services performed by certified technicians to maintain regulatory compliance and operational accuracy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Civil Aircraft Weighing Equipment Market Statistics 2025 Analysis By Application (Commercial Jetliners, Business jet, Regional aircraft, Others), By Type (Platform System, Jack Weigh System), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Civil Aircraft Weighing Equipment Market Statistics 2025 Analysis By Application (Commercial Jetliners, Business jet, Regional aircraft), By Type (Platform System, Jack Weigh System), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager