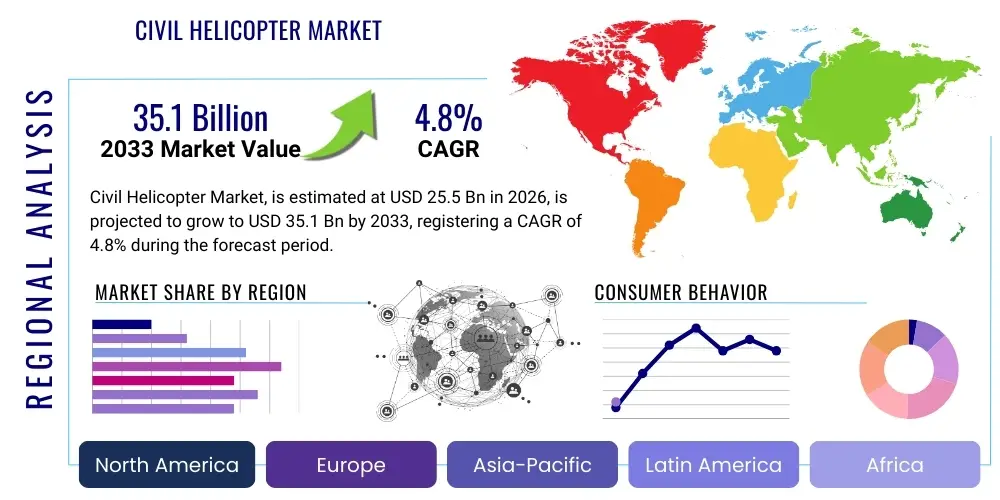

Civil Helicopter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437408 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Civil Helicopter Market Size

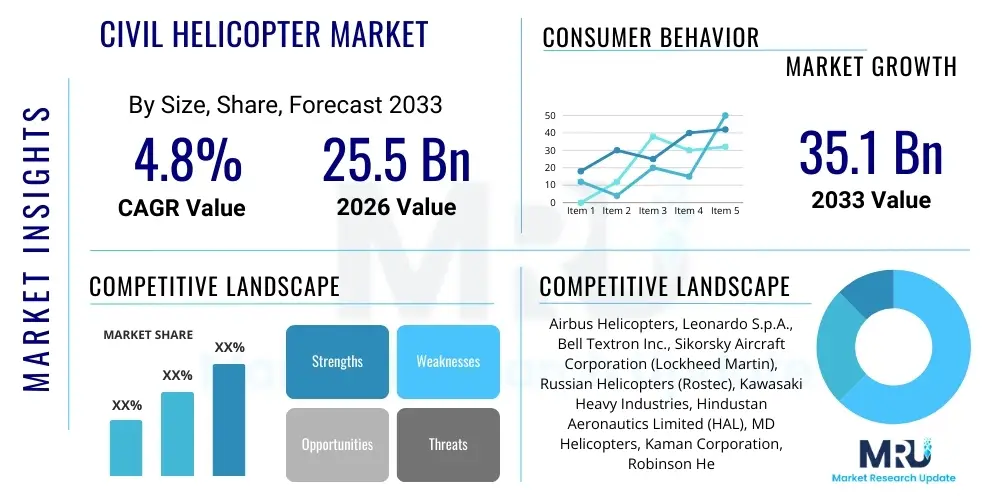

The Civil Helicopter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 35.1 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by increasing global demand for emergency medical services (EMS), expansion of offshore oil and gas exploration activities requiring robust transport solutions, and the modernization of aging civil fleets across developed economies. The valuation reflects both new helicopter deliveries and the highly profitable aftermarket services segment, including maintenance, repair, and overhaul (MRO).

Civil Helicopter Market introduction

The Civil Helicopter Market encompasses the design, manufacturing, sale, and servicing of rotorcraft utilized for non-military applications worldwide. This sector serves a crucial function in specialized aerial operations where vertical take-off and landing (VTOL) capabilities are essential. Products range from light single-engine helicopters used for flight training and utility work to heavy multi-engine platforms optimized for offshore oil rig support and search and rescue (SAR) missions. Major applications include corporate and VIP transport, emergency medical services (EMS), law enforcement surveillance, disaster relief, and specialized utility tasks such as powerline inspection and logging.

The primary benefit of civil helicopters lies in their operational flexibility, allowing access to remote or congested areas inaccessible by fixed-wing aircraft. They offer rapid response times crucial for life-saving operations (EMS/SAR) and provide cost-effective solutions for resource transportation in challenging environments like deep-sea platforms or mountainous terrain. Driving factors include tightening safety regulations necessitating fleet upgrades, rising urbanization increasing the need for urban air mobility (UAM) infrastructure and EMS, and continuous technological advancements in composite materials, avionics, and quieter engine technologies, enhancing performance and reducing environmental impact.

Furthermore, global economic recovery post-pandemic has stimulated corporate travel demand, boosting the VIP transport segment. Simultaneously, the sustained requirement for sophisticated law enforcement and governmental utility platforms for border patrol and firefighting activities maintains stable demand. Original Equipment Manufacturers (OEMs) are increasingly focused on developing hybrid-electric and fully electric vertical takeoff and landing (eVTOL) aircraft, although traditional turbine helicopters remain the backbone of heavy-duty civil operations for the forecast period.

Civil Helicopter Market Executive Summary

The Civil Helicopter Market is characterized by moderate but steady expansion, underpinned by essential service demands rather than cyclical economic spikes. Business trends indicate a strong shift towards optimizing aftermarket services, which often generate higher profit margins than new unit sales. OEMs are expanding their global service networks and leveraging digital tools like predictive maintenance to enhance fleet reliability and reduce downtime for operators. Geographically, North America and Europe currently dominate due to mature infrastructures and high demand for EMS and corporate transport, but the Asia Pacific region is emerging as the fastest-growing market, driven by increasing government investments in disaster management, rising wealth fueling corporate aviation, and infrastructural development projects requiring aerial support.

Segment trends highlight the light and medium helicopter categories as the primary engines of volume growth, especially within the utility and training sectors. The demand for heavy-lift helicopters remains tied closely to the fluctuating dynamics of the offshore oil and gas industry. There is a perceptible trend toward enhanced safety features, including advanced autopilot systems and collision avoidance technology, influencing purchasing decisions. Furthermore, the integration of advanced digitalization across cockpit systems, mission planning, and maintenance schedules is a critical differentiator among competitors. The market structure remains moderately consolidated, with key players investing heavily in R&D to introduce fuel-efficient and multi-mission capable platforms to cater to diverse operator needs across regions.

The adoption rate of new technologies, particularly those related to reducing noise pollution and enhancing operational efficiency, will define competitive advantages in urban environments. While regulatory hurdles pose a restraint, particularly concerning flight paths and licensing for new generation aircraft, the inherent need for vertical lift capabilities in critical national infrastructure (healthcare, security, energy) ensures robust market resilience. Operators are increasingly favoring leasing and fractional ownership models to manage capital expenditure, a trend that OEM financing arms are keenly supporting to stimulate sales velocity and maintain consistent delivery schedules over the forecast horizon, securing long-term service contracts simultaneously.

AI Impact Analysis on Civil Helicopter Market

User inquiries regarding AI's influence in the Civil Helicopter Market frequently revolve around three core themes: safety enhancement through autonomous systems, optimization of maintenance schedules, and the role of AI in training and simulation. Users express significant interest in how AI can mitigate human error, particularly in high-stress environments like SAR or EMS missions. A major concern is the regulatory framework required for partial or full autonomy (often viewed as a precursor to Urban Air Mobility integration), and the reliability of AI-driven diagnostic tools. Key expectations include personalized training curricula, real-time flight path optimization for fuel efficiency, and substantial cost reduction stemming from minimized unscheduled maintenance events.

AI is set to revolutionize operational efficiency and safety in the civil rotorcraft sector. Through advanced machine learning algorithms processing vast amounts of flight data, AI systems can accurately predict component failures long before they occur, shifting MRO practices from fixed intervals to true condition-based maintenance. This predictive capability significantly reduces aircraft downtime, improves fleet availability, and lowers overall operational costs for civil operators, especially those managing large fleets for critical infrastructure support or offshore transportation. Furthermore, AI contributes to enhanced situational awareness in the cockpit by synthesizing complex sensor data, presenting pilots with clear, actionable insights in challenging weather or visibility conditions, thereby increasing mission success rates and safety margins, a paramount concern for all civil operations.

Beyond maintenance and immediate operational support, AI is central to the development of next-generation training platforms and synthetic environments. By analyzing pilot performance metrics and identifying specific weaknesses, AI-powered simulators can generate dynamic, challenging, and hyper-realistic scenarios tailored to individual training needs, accelerating proficiency development and reducing overall training hours. The long-term impact involves AI assisting in certification processes by simulating edge cases and analyzing flight envelopes, paving the way for eventual regulatory acceptance of higher levels of automation in civil helicopters, particularly for tasks deemed dull, dirty, or dangerous (the 3Ds).

- AI-Driven Predictive Maintenance (PDM) optimizes MRO schedules, increasing asset utilization.

- Enhanced Sensor Fusion and Situational Awareness reduces pilot workload and mitigates human error risk.

- Advanced Flight Control Algorithms improve stability, fuel efficiency, and flight performance in challenging conditions.

- AI-Powered Flight Training Simulators offer personalized, high-fidelity scenario generation for accelerated crew competence.

- Autonomous Navigation and Obstacle Avoidance systems lay the groundwork for future uncrewed civil utility operations.

- Data Analytics and Machine Learning improve supply chain forecasting for spare parts and critical components.

DRO & Impact Forces Of Civil Helicopter Market

The Civil Helicopter Market is shaped by a robust interplay of Drivers (D), Restraints (R), and Opportunities (O), subjected to several long-term impact forces. Key drivers include the escalating global demand for specialized emergency medical services (EMS), governmental investment in disaster response capabilities, and continued necessity for aerial surveillance and critical infrastructure inspection (power lines, pipelines). These inherent needs provide a stable foundation for demand, particularly in light and medium multi-mission segments. However, the market faces significant restraints, notably the high upfront acquisition costs, substantial operational expenses (fuel, complex MRO), and stringent, often slow-moving global aviation regulatory processes for new technologies. Furthermore, public perception regarding noise pollution in urban environments poses a challenge, particularly as operators attempt to expand services like corporate transport closer to metropolitan centers.

Opportunities are emerging rapidly through technological innovation, specifically the development of quieter, more efficient turbine engines and the gradual integration of hybrid-electric propulsion systems, which promise reduced operating costs and environmental footprints, thereby addressing major restraints. The burgeoning Urban Air Mobility (UAM) concept, while currently focused on eVTOLs, is pushing infrastructure and regulatory advancements that traditional civil helicopters can leverage, especially for specialized high-speed city-to-city transport or executive shuttles. Furthermore, the expansion of global connectivity and sophisticated sensor technology presents opportunities for enhanced data collection services (geophysical surveys, advanced aerial mapping), expanding the helicopter's role beyond simple transportation.

The major impact forces include geopolitical instability affecting defense budgets that often overlap with civil SAR and utility procurement; volatile fuel prices directly impacting operational profitability; and the competitive threat posed by future advanced eVTOL architectures, which may capture the low-end corporate and air taxi segments currently served by light helicopters. Additionally, the increasing stringency of environmental mandates, particularly in Europe, forces OEMs to accelerate investments in sustainable aviation fuels (SAF) compatibility and noise reduction technologies. Ultimately, regulatory harmonization across major regions regarding safety standards and automation integration will significantly determine the pace of market expansion and technological adoption in the next decade.

Segmentation Analysis

The Civil Helicopter Market is extensively segmented based on key operational parameters, ensuring that manufacturing output aligns precisely with specialized end-user requirements across different mission profiles. Segmentation by weight class (Light, Medium, Heavy) dictates primary usage, ranging from training and private use (Light) to complex SAR and offshore transport (Medium and Heavy). Segmentation by application is crucial, dividing the market into high-growth sectors like EMS and stable markets such as corporate transport and utility operations. Furthermore, the segmentation between new deliveries and the aftermarket segment, including MRO, modifications, and component services, highlights the industry's reliance on supporting its established global fleet to maintain operational viability and maximize long-term profitability for OEMs and third-party service providers globally.

- By Type (Weight Class):

- Light Helicopters (Under 3,175 kg/7,000 lbs): Used primarily for training, private ownership, and light utility/surveillance.

- Medium Helicopters (3,175 kg to 9,072 kg/20,000 lbs): Dominant segment for EMS, law enforcement, corporate transport, and many offshore missions.

- Heavy Helicopters (Over 9,072 kg/20,000 lbs): Exclusively for heavy offshore transport, massive utility lifts, and complex SAR operations.

- By Application:

- Offshore Transportation (Oil & Gas): High-performance, twin-engine aircraft supporting personnel and cargo transfer to offshore rigs.

- Air Ambulance/Emergency Medical Services (EMS): Rapid-response rotorcraft equipped with medical facilities for critical patient transport.

- Corporate/VIP Transport: High-end executive helicopters featuring luxury interiors and advanced avionics for business travel.

- Law Enforcement & Public Safety: Helicopters utilized for surveillance, border patrol, and tactical operations.

- Utility & Aerial Work: Platforms for logging, firefighting, construction, powerline inspection, and agricultural dusting.

- Training & Flight Instruction: Basic rotorcraft used for pilot certification and recurring proficiency training.

- By Manufacturing & Delivery:

- New Deliveries: Factory-new aircraft sales.

- Aftermarket Services (MRO & Components): Maintenance, repair, overhaul, upgrades, and spare parts provision, representing a critical high-margin revenue stream.

Value Chain Analysis For Civil Helicopter Market

The value chain of the Civil Helicopter Market is complex, involving several high-specialization tiers, starting from raw material sourcing and culminating in long-term maintenance contracts. Upstream analysis focuses on Tier 2 and Tier 3 suppliers providing highly specialized components: advanced composite materials (carbon fiber, Kevlar), sophisticated avionics systems (flight control computers, navigation aids), and engine components (turboshafts). These suppliers, often concentrated in North America and Europe, hold significant leverage due to intellectual property and regulatory compliance barriers. OEMs (Original Equipment Manufacturers) like Airbus Helicopters and Leonardo form the core of the chain, engaging in design, integration, final assembly, and initial airworthiness certification, absorbing components from thousands of suppliers.

Downstream analysis involves the direct relationship between OEMs and the end-user operators (e.g., EMS providers, offshore transport companies, private corporate entities). The distribution channel is predominantly direct, especially for medium and heavy helicopters, involving long-term sales contracts, comprehensive pilot training, and initial support packages provided directly by the OEM or their certified global sales branches. For light helicopters, independent regional distributors and brokers often play a greater role. The crucial downstream component is the high-value aftermarket segment (MRO), which represents significant recurring revenue, often outsourced partially to third-party MRO firms but increasingly retained by OEMs seeking to control quality and customer retention through proprietary digital tools and original spare parts.

The complexity of the asset and the long operational life of civil helicopters (often 30+ years) necessitate a tightly controlled distribution and service structure. Direct engagement ensures that safety standards and proprietary modifications are implemented correctly. Indirect channels, primarily third-party MROs and parts distributors, fill geographical gaps and specialize in certain legacy fleet maintenance. Financing and leasing companies also act as crucial intermediaries, facilitating sales by lowering the immediate capital burden on operators, thereby smoothing delivery cycles and maintaining market liquidity, which is vital for high-cost assets like rotorcraft.

Civil Helicopter Market Potential Customers

Potential customers for the Civil Helicopter Market are highly diversified, ranging from public sector entities focused on security and infrastructure to private companies requiring specialized heavy-lift capabilities and high-net-worth individuals demanding bespoke transport solutions. End-users fall broadly into governmental, commercial, and private categories, each demanding specific performance characteristics and certification levels. Governmental buyers, including police forces, coast guards, and firefighting agencies, seek multi-mission platforms capable of enduring harsh operational environments and integrating sophisticated surveillance technology. These buyers prioritize reliability, operational range, and low maintenance requirements, often requiring long-term support contracts.

Commercial operators form the largest customer base. This group includes oil and gas exploration companies demanding heavy-lift, IFR-certified, twin-engine aircraft for rigorous offshore personnel transport; air medical service providers prioritizing speed, medical equipment integration, and reliable single- and twin-engine platforms; and utility companies needing specialized equipment for external load operations and line patrol. For these customers, the total cost of ownership (TCO) and fleet availability are the paramount concerns, leading them to favor OEMs with strong, widespread global service networks and robust support infrastructure.

The third group includes private individuals and corporate flight departments requiring comfortable, fast, and secure VIP transport, primarily utilizing medium-light twin-engine helicopters. These buyers emphasize luxury customization, low cabin noise, and the latest safety avionics. The emerging demand for Urban Air Mobility (UAM) services also positions new fractional ownership and air taxi service operators as increasingly significant potential customers, especially as they look to bridge service gaps between existing fixed-wing air travel and last-mile connectivity using conventional rotorcraft until full eVTOL scalability is achieved, potentially serving as an important transition phase clientele.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 35.1 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Airbus Helicopters, Leonardo S.p.A., Bell Textron Inc., Sikorsky Aircraft Corporation (Lockheed Martin), Russian Helicopters (Rostec), Kawasaki Heavy Industries, Hindustan Aeronautics Limited (HAL), MD Helicopters, Kaman Corporation, Robinson Helicopter Company, China Aviation Industry Corporation (AVIC), Enstrom Helicopter Corporation, Rotorcraft Leasing Co., PHI Group Inc., Erickson Incorporated, Bristow Group, StandardAero, Safran Helicopter Engines, Rolls-Royce. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Civil Helicopter Market Key Technology Landscape

The Civil Helicopter Market is continuously being redefined by advancements focused on safety, efficiency, and environmental compliance. A central technological focus is the evolution of advanced avionics systems, particularly the integration of highly sophisticated glass cockpits featuring Synthetic Vision Systems (SVS) and Enhanced Vision Systems (EVS). These systems drastically improve pilot situational awareness, especially during IFR (Instrument Flight Rules) and low-visibility operations, a critical requirement for EMS and SAR missions. Furthermore, the development and integration of advanced autopilot and fly-by-wire (FBW) systems are simplifying the control inputs, reducing pilot fatigue, and enabling higher levels of stability augmentation, which are essential for precision utility work and hovering capabilities.

Another pivotal area is material science and component innovation. OEMs are increasingly adopting lightweight, high-strength composite materials for airframes, rotor blades, and even dynamic components. These composites reduce the overall weight of the aircraft, which directly translates into better fuel efficiency, increased payload capacity, and improved performance envelopes. Simultaneously, noise abatement technology is crucial for gaining acceptance in urban areas. This includes designing quieter rotor systems (e.g., five-blade configurations, advanced tip shapes) and utilizing engine noise suppression techniques, ensuring compliance with strict environmental regulations imposed by metropolitan authorities and expanding access for corporate operators.

Finally, the propulsion technology landscape is undergoing a revolutionary shift. While turboshaft engines remain the current standard, continuous improvements focus on enhanced power-to-weight ratios and reduced specific fuel consumption (SFC). More disruptively, significant R&D is directed toward hybridization and electric propulsion systems, laying the groundwork for future generations of civil rotorcraft that promise lower operating costs and zero-emission capabilities for short-haul missions. Connectivity technology, including satellite communication links and sophisticated health and usage monitoring systems (HUMS), also ensures real-time data transmission for predictive maintenance and mission coordination, enhancing overall operational continuity and safety.

Regional Highlights

- North America (Dominant Market Share): North America, particularly the United States, holds the largest market share in terms of fleet size and operational maturity. This dominance is driven by high investment in emergency medical services (EMS), robust general aviation infrastructure, and a substantial requirement for law enforcement and utility operations. The region benefits from a high number of private and corporate operators. Technological adoption, especially in advanced avionics and data-driven maintenance (HUMS), is rapid due to favorable regulatory environments (e.g., FAA). The continued need to replace aging fleets of older Bell and Sikorsky models provides a stable flow of new orders, while the offshore market remains active, centered primarily in the Gulf of Mexico.

- Europe (Stringent Regulatory Environment): Europe represents a mature market characterized by extremely stringent environmental and noise regulations, especially concerning operations near urban centers. The demand is strong across the continent for advanced EMS and SAR missions, often state-funded or subsidized. European manufacturers like Airbus and Leonardo benefit from local presence and historical supply relationships. The focus here is heavily skewed toward multi-mission twin-engine helicopters that can meet demanding safety requirements (e.g., EASA standards). The gradual retirement of legacy platforms like the Puma and Super Puma variants in several utility and transport roles is driving moderate demand for next-generation platforms.

- Asia Pacific (Fastest Growth Trajectory): The Asia Pacific region is projected to register the highest Compound Annual Growth Rate (CAGR) over the forecast period. This growth is fueled by massive infrastructure development projects requiring aerial support, rapid urbanization increasing the necessity for air taxis and effective EMS coverage across developing economies, and significant government procurement for public safety and disaster relief capabilities, particularly in China, India, and Southeast Asia. Regulatory harmonization and the development of adequate MRO infrastructure remain regional challenges, but high capital expenditure from governments modernizing their public fleets and a surge in high-net-worth individuals purchasing corporate rotorcraft are strong tailwinds.

- Latin America (Resource Extraction Focus): The market in Latin America is heavily reliant on resource extraction, primarily supporting mining and oil and gas operations, particularly in Brazil and Mexico. Demand is concentrated in medium and heavy-lift helicopters capable of operating in challenging, high-altitude, or remote jungle environments. The corporate and VIP segment is also significant in major urban centers. Economic volatility and currency fluctuations can impact fleet purchasing decisions, often leading operators to favor leasing models and maximizing the operational life of existing fleets through aggressive MRO programs rather than immediate replacement.

- Middle East & Africa (Strategic Importance): The Middle East is a key market for high-end corporate transport and specialized platforms for security and surveillance applications, supported by strong government spending and high oil wealth. The demand for advanced multi-mission helicopters capable of operating reliably in high-heat environments is paramount. The African market is primarily driven by humanitarian aid logistics, resource exploration support (often involving specialized heavy-lift needs in remote areas), and governmental public safety initiatives, though these markets face challenges related to logistical complexity and reliance on foreign financing for fleet acquisition.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Civil Helicopter Market.- Airbus Helicopters

- Leonardo S.p.A.

- Bell Textron Inc.

- Sikorsky Aircraft Corporation (Lockheed Martin)

- Russian Helicopters (Rostec)

- Kawasaki Heavy Industries

- Hindustan Aeronautics Limited (HAL)

- MD Helicopters

- Kaman Corporation

- Robinson Helicopter Company

- China Aviation Industry Corporation (AVIC)

- Enstrom Helicopter Corporation

- Rotorcraft Leasing Co.

- PHI Group Inc.

- Erickson Incorporated

- Bristow Group

- StandardAero

- Safran Helicopter Engines

- Rolls-Royce

- Honeywell International Inc.

Frequently Asked Questions

Analyze common user questions about the Civil Helicopter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth in the Civil Helicopter Market?

Market growth is primarily driven by the increasing global requirement for Emergency Medical Services (EMS), expanding utility operations for infrastructure maintenance, and government investments in Search and Rescue (SAR) and public safety capabilities worldwide, particularly in rapidly developing regions like Asia Pacific.

How significant is the role of aftermarket services in the civil rotorcraft sector?

Aftermarket services, including Maintenance, Repair, and Overhaul (MRO), are crucial. They constitute a high-margin, stable revenue stream for Original Equipment Manufacturers (OEMs), essential for maintaining the operational reliability and safety of the existing global fleet, often outweighing the profitability of new unit sales.

What technological trends are most impacting the development of new civil helicopters?

The most impactful technological trends include the integration of advanced digital avionics (glass cockpits, SVS/EVS), the increased use of lightweight composite materials for airframe construction, and significant research into hybridization and noise-reduction technologies to comply with environmental mandates and facilitate Urban Air Mobility (UAM) integration.

Which geographical region holds the largest market share for civil helicopters?

North America currently holds the largest market share, driven by a large existing fleet, advanced operational infrastructure, high demand from EMS, corporate transport sectors, and a robust regulatory environment supporting continuous fleet modernization and technological adoption.

What are the primary restraints challenging the expansion of the Civil Helicopter Market?

Major restraints include the extremely high initial acquisition and operational costs (fuel, specialized maintenance), complex and lengthy airworthiness certification processes for new designs, and increasing public resistance and regulation regarding noise pollution, especially in high-density urban operating environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Civil Helicopter MRO Market Statistics 2025 Analysis By Application (Commercial, Private, The commercial holds an important share in terms of applications, and accounts for 70% of the market share.), By Type (Airframe Heavy Maintenance, Engine Maintenance, Component Maintenance), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Civil Helicopter Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Small helicopter (maximum takeoff weight 2 MT), Light Helicopter (maximum takeoff weight between 2MT to 4 MT), Medium Helicopter (maximum takeoff weight between 4MT to 10 MT)), By Application (Exploration, Agriculture, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager