Clad Plate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436602 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Clad Plate Market Size

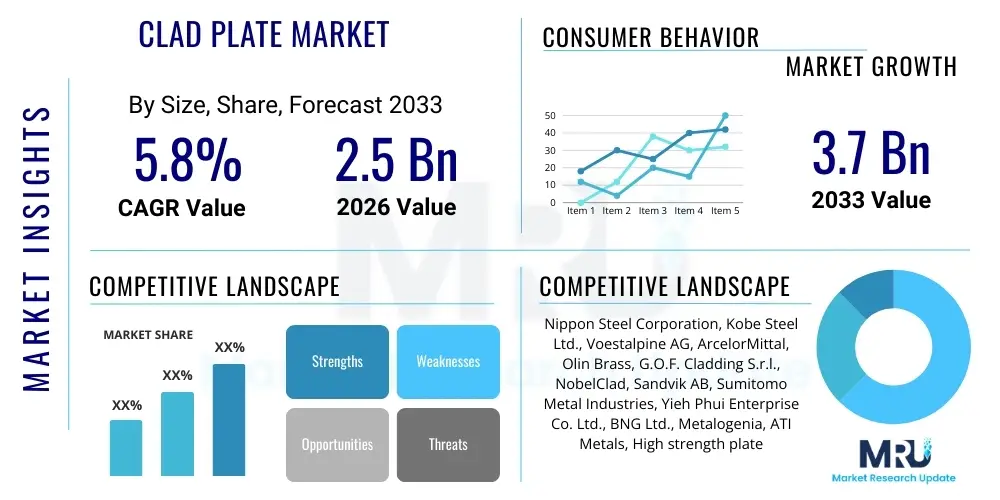

The Clad Plate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $3.7 Billion by the end of the forecast period in 2033.

Clad Plate Market introduction

Clad plates are sophisticated composite materials engineered by metallurgically bonding two or more layers of dissimilar metals, typically combining a cost-effective structural base metal (like carbon steel) with a thin layer of highly corrosion-resistant alloy (like stainless steel, titanium, or nickel alloys). This fusion is achieved through processes such as explosive bonding, roll bonding, or weld overlay, resulting in a product that inherits the strength and structural integrity of the base material while offering the superior corrosion, wear, and temperature resistance of the cladding layer. The primary purpose is to deliver high performance in severe operating environments without the prohibitive cost of using solid specialty alloys.

The core applications of clad plates are predominantly found in demanding industrial sectors where material failure due to corrosion or extreme pressure can lead to catastrophic downtime and safety hazards. These materials are vital in manufacturing pressure vessels, heat exchangers, reactors, storage tanks, and various components used in oil and gas refineries, petrochemical plants, chemical processing, and desalination facilities. The growing complexity of industrial processes, particularly in the production of specialized chemicals and in deep-sea oil exploration, continually elevates the demand for materials that offer exceptional reliability and longevity under harsh operational stresses.

Key driving factors influencing market expansion include the significant capital expenditure in the global chemical and petrochemical industries, especially across emerging economies in Asia Pacific and the Middle East. Furthermore, stringent regulatory standards concerning environmental protection and operational safety mandate the use of durable, highly resistant materials, favoring clad plates over traditional, less robust alternatives. The benefits derived from using clad plates—primarily reduced lifetime maintenance costs, extended equipment operational lifecycles, and optimal material utilization—cement their status as essential materials in heavy engineering and critical infrastructure projects worldwide, ensuring sustained market growth.

Clad Plate Market Executive Summary

The Clad Plate Market is experiencing robust expansion driven by global energy infrastructure investments, a critical shift toward corrosion-resistant solutions, and technological advancements in bonding techniques that improve manufacturing efficiency and material versatility. Current business trends indicate a strong focus on high-nickel alloy cladding for applications in severe acidic environments, particularly within the acetic acid and urea production sectors. Furthermore, manufacturers are increasingly adopting advanced inspection technologies and automated processes to ensure metallurgical integrity and meet stringent quality requirements imposed by regulatory bodies such as ASME and PED. This trend towards high-integrity manufacturing is crucial for establishing long-term customer confidence and securing major project contracts, particularly in the lucrative LNG and petrochemical refining segments.

Geographically, the Asia Pacific (APAC) region dominates market consumption and production, spearheaded by intensive industrial development in China, India, and South Korea, which are major hubs for chemical manufacturing, shipbuilding, and infrastructure development. North America and Europe, while representing mature markets, maintain high demand for clad plates in capacity expansion projects, particularly within the renewable energy sector, including components for concentrated solar power and advanced nuclear facilities. Regional trends also highlight a shift in manufacturing capabilities, with emerging economies rapidly scaling up production capacities, leveraging lower operational costs and increasingly sophisticated domestic technological expertise to compete with established global players. This competitive dynamic is driving overall efficiency and reducing lead times globally.

Segment trends underscore the dominance of the explosive bonding method due to its capability to handle large plate sizes and produce high shear strength bonds, making it ideal for large-scale pressure vessels and heat exchangers. However, the roll bonding method is gaining traction for its cost efficiency and applicability in thinner plates. Application-wise, the chemical processing industry remains the largest consumer, but the market share of the energy sector is growing rapidly, driven by global investments in natural gas processing, oil refining upgrades, and burgeoning demand for specialized materials in the nascent hydrogen infrastructure. Manufacturers are focusing R&D efforts on developing novel metal combinations, such as titanium-steel cladding, tailored specifically for extreme temperature and pressure applications, thereby diversifying the market landscape and opening new revenue streams.

AI Impact Analysis on Clad Plate Market

Common user questions regarding the influence of Artificial Intelligence (AI) on the Clad Plate Market often revolve around predictive material failure, optimizing complex bonding processes, and enhancing quality assurance without human intervention. Users are primarily concerned with how AI can minimize defects inherent in multi-metal bonding, such as delamination or insufficient shear strength, which are costly failures in critical infrastructure. The general expectation is that AI and Machine Learning (ML) models will be utilized to analyze vast datasets collected during manufacturing (temperature curves, pressure fluctuations, material composition logs) to predict optimal process parameters for different metal combinations, thus improving yield rates and product consistency, especially for difficult-to-bond materials like titanium to steel. Furthermore, there is significant user interest in how AI-driven non-destructive testing (NDT) can automate and accelerate the inspection of large-scale clad plates, ensuring rapid compliance with stringent industry standards.

- AI-driven optimization of explosive bonding parameters to ensure consistent metallurgical weld integrity across large surface areas.

- Machine Learning algorithms deployed for real-time monitoring and anomaly detection during the roll bonding process, minimizing material defects like warping or insufficient bond strength.

- Predictive maintenance (PdM) of heavy machinery, including rolling mills and high-pressure forming equipment, reducing unexpected downtime and operational costs in the cladding facility.

- Enhanced Non-Destructive Testing (NDT) using computer vision and ML for automated analysis of ultrasonic, radiographic, and shear strength tests, accelerating quality control and certification.

- Supply chain optimization through AI forecasting, improving inventory management of specialty raw materials (nickel, molybdenum, titanium) and optimizing logistics for heavy, oversized clad plate components.

- Simulation and digital twinning of new clad material combinations, allowing engineers to predict long-term performance and corrosion behavior under specific industrial conditions before physical prototyping.

DRO & Impact Forces Of Clad Plate Market

The market dynamics for clad plates are dictated by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and strategic direction of industry participants. Primary drivers include the global necessity for materials capable of resisting extreme corrosion and high temperatures in critical infrastructure, fueled by ongoing investments in the oil and gas sector (especially sour service applications), chemical processing, and power generation. Concurrently, increasing governmental regulations focused on extending the lifespan and ensuring the safety of industrial plants push end-users towards durable, high-integrity materials like clad plates, which offer superior performance-to-cost ratios compared to solid exotic alloys. The expansion of Liquefied Natural Gas (LNG) terminals and large-scale desalination projects globally represents a significant and persistent demand driver for stainless steel and duplex steel clad materials.

However, the market faces significant restraints, primarily stemming from the inherent complexities and high capital costs associated with the advanced manufacturing processes required for producing clad plates. Techniques like explosive bonding require specialized facilities, rigorous safety protocols, and highly skilled labor, contributing substantially to the final product cost, often making them economically viable only for critical, high-value applications. Furthermore, the limited availability and price volatility of key specialty alloying elements, such as nickel, titanium, and chromium, introduce supply chain risks and impact pricing stability. Technical challenges related to testing the bond integrity of thick plates and ensuring uniform cladding thickness across very large plates remain critical constraints that manufacturers must continually address through technological innovation.

Opportunities for growth are substantial, particularly driven by emerging technological shifts in global energy production. The nascent hydrogen economy, requiring specialized pressure vessels and piping capable of handling hydrogen embrittlement and high pressures, presents a vast new application area for clad materials. Similarly, the global resurgence of interest in Small Modular Reactors (SMRs) and advanced nuclear power facilities creates high demand for specialized nuclear-grade clad plates that must adhere to exceptionally stringent safety and material integrity standards. Furthermore, strategic opportunities lie in the continuous development of novel and more efficient bonding techniques, such as laser welding integration or hybrid bonding methods, aimed at reducing manufacturing costs and expanding the range of compatible dissimilar metal combinations, thus broadening the market's accessibility across mid-tier industrial applications.

Segmentation Analysis

The Clad Plate Market segmentation is crucial for understanding specific growth vectors and demand drivers across various manufacturing methods, material types, and end-use applications. The market is primarily segmented based on the bonding technology employed, which dictates the plates' size, thickness, and inherent metallurgical properties. Material segmentation reflects the performance requirements of the end-user environment, distinguishing between common alloys like stainless steel and high-performance materials such as titanium and zirconium. Application segmentation reveals the concentrated demand from capital-intensive sectors, with chemical processing and oil and gas dominating consumption due to their severe operating conditions and reliance on highly corrosion-resistant equipment.

- By Bonding Type:

- Explosive Bonding

- Roll Bonding (Hot/Cold)

- Weld Overlay Cladding

- Brazing and Diffusion Bonding

- By Base Metal Type:

- Carbon Steel

- Low Alloy Steel

- High Strength Low Alloy (HSLA) Steel

- By Cladding Material Type:

- Stainless Steel (300 series, Duplex, Super Duplex)

- Nickel and Nickel Alloys (Inconel, Hastelloy, Monel)

- Titanium and Titanium Alloys

- Copper and Copper Alloys

- Zirconium and other Refractory Metals

- By Application:

- Chemical Processing Industry (CPI)

- Oil and Gas (Petrochemical Refining, Offshore Platforms, LNG)

- Power Generation (Nuclear, Thermal, Desalination)

- Shipbuilding and Marine Applications

- Aerospace and Defense

- Metallurgical and Heavy Machinery

Value Chain Analysis For Clad Plate Market

The value chain for the Clad Plate Market begins with the upstream procurement and processing of specialty raw materials. This segment involves major global suppliers of high-grade carbon steel (base metal) and exotic alloys (cladding material), such as nickel, titanium, and specialized stainless steels. Upstream activities are characterized by high capital intensity and strict quality controls, as the purity and properties of these raw materials directly dictate the final clad plate performance. Critical processes include specialized melting and casting of high-performance alloys and rolling of base plates to stringent dimensional tolerances. Ensuring a stable and quality-controlled supply of these often-volatile raw materials is paramount to the operational efficiency of clad plate manufacturers.

The midstream constitutes the core manufacturing phase, where the metallurgical bonding processes take place, encompassing explosive bonding, roll bonding, or weld overlay. This stage is highly specialized and knowledge-intensive, requiring advanced engineering expertise, proprietary techniques, and certification to standards like ISO and ASME. Manufacturers transform separate metal sheets into composite clad plates, performing necessary post-bonding treatments such as flattening, heat treatment, and extensive Non-Destructive Testing (NDT) to verify bond integrity and mechanical properties. Efficiency improvements in this segment, such as larger explosion chambers or optimized rolling schedules, directly influence market competitiveness and production capacity.

The downstream activities involve further processing, distribution, and end-user application. Distributors and fabricators receive the raw clad plates and perform tasks such as cutting, machining, forming, and welding to create final components like pressure vessel shells, heat exchanger tube sheets, or large-scale tank walls. Given the size and weight of these materials, distribution channels often rely on specialized heavy haul logistics. The direct distribution channel (manufacturer to major EPC contractors or end-users) is dominant for large, customized projects, while indirect channels (involving specialized material distributors and fabrication houses) serve smaller, more standardized requirements, ensuring accessibility and timely delivery across global project sites.

Clad Plate Market Potential Customers

Potential customers for clad plates are predominantly large-scale engineering, procurement, and construction (EPC) firms, fabricators, and equipment manufacturers who serve the energy and chemical sectors. These customers require materials with certified performance profiles for high-pressure, high-temperature, and corrosive service. Key buyers include global oil and gas majors investing in refinery upgrades (especially hydrocracking units), petrochemical companies expanding production of intermediate chemicals (e.g., PTA, urea, acetic acid), and specialized equipment builders focusing on critical components such as shell-and-tube heat exchangers and reactor vessels. These buyers prioritize product quality, supplier certification, traceable material provenance, and the ability to handle oversized plates required for mega-projects.

The secondary customer segment includes utilities and governmental entities involved in strategic infrastructure development, notably in the nuclear power sector (for reactor vessels and storage tanks), large-scale municipal desalination plants (requiring duplex steel clad for brine resistance), and marine engineering firms involved in shipbuilding and offshore platform construction. For these customers, the long-term reliability and low maintenance profile of clad plates translate directly into operational cost savings and enhanced safety compliance. The purchasing decision is heavily influenced by adherence to national and international standards (e.g., NACE, API, ASME Boiler and Pressure Vessel Codes), making vendor pre-qualification and extensive technical documentation essential prerequisites for securing contracts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $3.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nippon Steel Corporation, Kobe Steel Ltd., Voestalpine AG, ArcelorMittal, Olin Brass, G.O.F. Cladding S.r.l., NobelClad, Sandvik AB, Sumitomo Metal Industries, Yieh Phui Enterprise Co. Ltd., BNG Ltd., Metalogenia, ATI Metals, High strength plate limited, VDM Metals, Dalian Clading Materials, Zibo Hitech Material Co., Ltd., Shandong Jinyida Plate Co. Ltd., Zhangjiagang Hongye Pressure Vessel Equipment Co. Ltd., Shanghai Rongsheng Metal Composite Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Clad Plate Market Key Technology Landscape

The technological landscape of the Clad Plate Market is dominated by three primary bonding methodologies, each suited for different material combinations, plate dimensions, and performance requirements. Explosive bonding, which utilizes controlled detonation to create a metallurgical bond through high-velocity impact, remains critical for large, thick plates and achieving high bond strength with challenging material pairings, such as titanium to steel. Recent technological advancements in this field focus on refining the explosion parameters through advanced simulations and precise charge placement to minimize the heat-affected zone and reduce residual stresses, thereby improving the overall quality and uniformity of the interface for ultra-thick pressure vessel applications.

Roll bonding, encompassing both hot and cold processes, relies on extreme pressure and often elevated temperature to create the metallic bond. Hot roll bonding is a more cost-effective method primarily used for producing thinner clad plates and is highly efficient for high-volume production, typically leveraging standard mill equipment. Technological innovation here is centered on optimizing pre-treatment surface preparation—such as vacuum rolling or protective atmosphere heating—to prevent oxidation and contamination at the interface, which can compromise bond integrity. Furthermore, advancements in specialized rolling mills allow for the production of wider and longer plates with excellent surface finish and tighter dimensional tolerances, meeting the demands of high-specification industries.

Weld overlay cladding, while technically distinct, is also a crucial technological component, particularly used for complex shapes, internal surfaces of vessels, and for repair applications. This method uses specialized high-deposition welding techniques (like submerged arc welding or narrow gap welding) to deposit a layer of corrosion-resistant alloy onto the base metal. The ongoing technological frontier involves integrating robotic and automated systems with real-time feedback mechanisms to ensure consistent bead geometry, minimal dilution of the cladding material with the base metal, and precise control over the heat input, which is vital for maintaining the desired metallurgical microstructure and corrosion performance, especially in highly critical components like reactor headers and large pipe flanges.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market due to massive infrastructure projects, robust expansion in the chemical and petrochemical sectors, particularly in China, India, and South Korea, and increasing investments in refinery capacity upgrades. The region benefits from lower manufacturing costs and significant demand from the shipbuilding industry, driving the need for large-scale clad plates.

- North America: This region represents a mature market characterized by high regulatory standards and strong demand from the oil and gas industry for sour service applications (high sulfur content). Growth is sustained by modernization projects in existing refineries and increasing investment in renewable energy and carbon capture technologies requiring specialized corrosion-resistant materials.

- Europe: Demand in Europe is primarily driven by the implementation of stringent environmental regulations and high-value, niche applications in the nuclear, pharmaceutical, and high-end chemical industries. Germany and Italy are key manufacturing and consumption hubs, focusing on high-quality, technically demanding clad plate solutions and advanced materials such as Hastelloy-clad steel for extreme chemical resistance.

- Middle East and Africa (MEA): This region is a major consumer due to significant investments in oil and gas upstream and downstream sectors, coupled with large-scale desalination projects. The extreme corrosive environments (high salt and sulfur content) necessitate the widespread use of duplex and high-nickel alloy clad plates in reactors, storage tanks, and pipelines, making MEA a critical growth area.

- Latin America: The market here is driven largely by the commodity cycles affecting the mining, oil, and gas industries, particularly in Brazil and Mexico. Demand focuses on basic clad materials for new refinery construction and maintenance of existing infrastructure, although economic volatility can influence the timing and scale of large capital projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Clad Plate Market.- Nippon Steel Corporation

- Kobe Steel Ltd.

- Voestalpine AG

- ArcelorMittal

- Olin Brass

- G.O.F. Cladding S.r.l.

- NobelClad (Explosive Fabricators, Inc.)

- Sandvik AB

- Sumitomo Metal Industries (now part of Nippon Steel)

- Yieh Phui Enterprise Co. Ltd.

- BNG Ltd.

- Metalogenia S.A.

- ATI Metals

- High strength plate limited

- VDM Metals GmbH

- Dalian Clading Materials Co., Ltd.

- Zibo Hitech Material Co., Ltd.

- Shandong Jinyida Plate Co. Ltd.

- Zhangjiagang Hongye Pressure Vessel Equipment Co. Ltd.

- Shanghai Rongsheng Metal Composite Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Clad Plate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using clad plates over solid corrosion-resistant alloys?

Clad plates offer a superior combination of structural integrity from the low-cost base metal (usually carbon steel) and exceptional corrosion/wear resistance from the thin cladding layer (e.g., titanium or nickel alloy). This significantly reduces material costs compared to using solid exotic alloys while maintaining the requisite performance in harsh industrial environments.

Which bonding method dominates the production of large-scale pressure vessels?

Explosive bonding is the dominant method for large-scale pressure vessels and heat exchangers. This technique provides a high-strength metallurgical bond, allows for the cladding of very thick base plates, and is effective for diverse, difficult-to-bond metal combinations required in critical high-pressure applications in the oil and gas and chemical processing industries.

How does the volatile pricing of nickel impact the Clad Plate Market?

Nickel is a primary component in many high-performance cladding materials, such as stainless steel 316L and various superalloys (Inconel, Hastelloy). High volatility in nickel pricing directly impacts the input costs for manufacturers, influencing the final selling price of nickel-clad plates and affecting project budgets, especially for long-term petrochemical projects.

What role does the hydrogen economy play in future demand for clad plates?

The hydrogen economy is a crucial emerging opportunity. Clad plates are essential for building robust hydrogen storage vessels, transport pipelines, and fueling station components. They are needed to mitigate material degradation risks, such as hydrogen embrittlement, at high pressures and cryogenic temperatures, driving demand for specialized material combinations like austenitic stainless steel cladding on steel.

What key quality metrics must clad plate manufacturers adhere to?

Manufacturers must adhere to strict international standards such as ASME, PED, and specific industry codes (e.g., NACE for sour service). Key quality metrics include certified bond strength (shear and tensile strength testing), low percentage of unbonded area, precise cladding thickness uniformity, and rigorous Non-Destructive Testing (NDT) using ultrasonic and radiographic inspection to ensure long-term operational safety.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager