Cladding and Siding Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437545 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Cladding and Siding Market Size

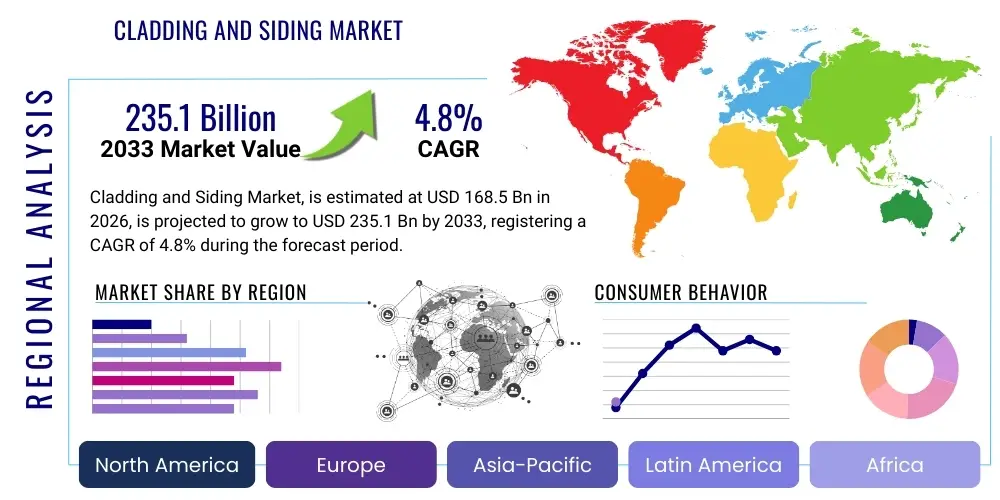

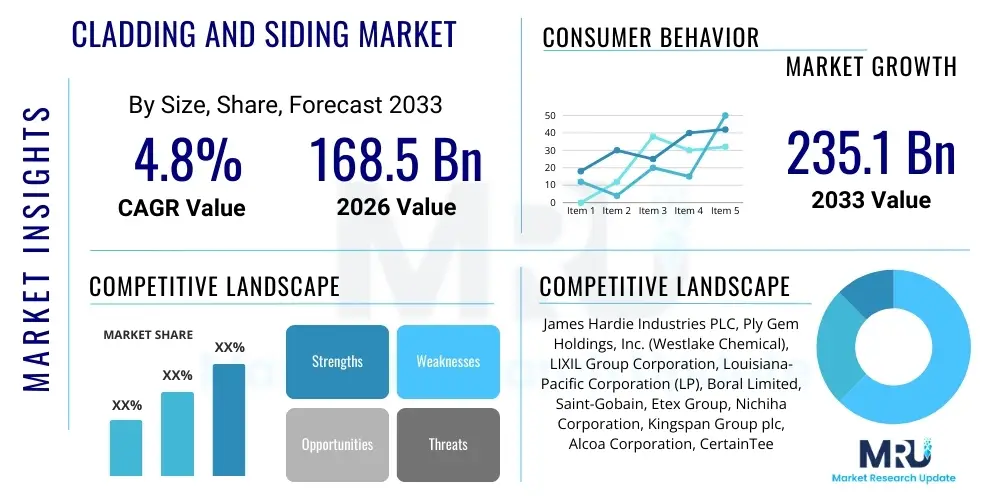

The Cladding and Siding Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $168.5 Billion in 2026 and is projected to reach $235.1 Billion by the end of the forecast period in 2033.

Cladding and Siding Market introduction

The Cladding and Siding Market encompasses the materials and systems utilized for protecting the exterior of commercial, residential, and industrial structures from weather elements, while simultaneously enhancing aesthetic appeal and improving energy efficiency. Cladding refers generally to the application of one material over another, whereas siding specifically denotes the exterior wall material used on houses and low-rise buildings. Key products include vinyl, fiber cement, wood, metal, stucco, and brick, each offering unique performance characteristics related to durability, thermal resistance, fire rating, and maintenance requirements. The selection of appropriate cladding or siding is a critical decision in construction, directly influencing the long-term structural integrity and operational costs of the building envelope.

Major applications for cladding and siding span across the entire construction ecosystem, driven primarily by new construction projects and extensive renovation activities. In the residential sector, siding materials like vinyl and fiber cement are prevalent due to their cost-effectiveness and low maintenance profile. Conversely, the commercial and institutional sectors frequently utilize high-performance materials such as metal panels, architectural glass, and specialized composite cladding systems to meet stringent fire codes, achieve complex architectural designs, and maximize thermal performance. The increasing global focus on sustainable building practices, particularly in developed economies, is further driving demand for materials that contribute to Leadership in Energy and Environmental Design (LEED) certification and zero-net energy goals.

The primary benefits driving market expansion include superior weather protection, structural insulation, noise reduction, and significant enhancement of a property's curb appeal and market value. Driving factors involve accelerated urbanization, particularly in Asia Pacific nations, leading to massive infrastructure and housing development projects. Furthermore, stringent regulatory mandates related to building energy performance, fire safety (post-Grenfell reforms), and the growing consumer preference for aesthetic versatility and low-maintenance solutions are major catalysts propelling the market forward. The continuous innovation in material science, leading to lighter, more durable, and environmentally friendly products, also plays a pivotal role in market growth.

Cladding and Siding Market Executive Summary

The Cladding and Siding Market demonstrates robust growth, fundamentally supported by global infrastructure spending and the persistent need for building envelope modernization to improve energy efficiency. Business trends indicate a strong shift towards prefabricated and modular cladding systems, which significantly reduce on-site installation time and labor costs, addressing skilled labor shortages prevalent across North America and Europe. Key manufacturers are focusing heavily on vertical integration and strategic mergers and acquisitions to secure raw material supplies and expand geographic reach, particularly into high-growth urban centers. Moreover, product diversification, emphasizing recycled and bio-based materials, is becoming a prerequisite for competitive differentiation, driven by corporate sustainability commitments and increasing investor scrutiny regarding Environmental, Social, and Governance (ESG) performance.

Regional trends highlight the Asia Pacific (APAC) region as the primary growth engine, fueled by rapid industrialization and governmental investments in affordable housing projects, especially in China, India, and Southeast Asian countries. While North America remains a mature and significant market, characterized by high adoption rates of premium fiber cement and engineered wood siding, the growth is primarily driven by repair and remodeling activities aimed at energy upgrades. Europe is witnessing accelerated adoption of ventilated façade systems, essential for compliance with the demanding European Union energy performance directives, necessitating materials with superior U-values and enhanced fire resistance, particularly mineral wool and advanced metal composites.

Segment trends reveal that the Fiber Cement segment is experiencing substantial expansion due to its superior durability, resistance to rot, fire, and insects, positioning it as a preferred substitute for traditional wood and high-cost brick. By application, the Residential segment dominates the market volume, largely utilizing cost-effective solutions like vinyl and conventional stucco. However, the Non-Residential segment, encompassing commercial and industrial buildings, drives revenue growth due to the higher utilization of expensive, high-performance, and custom-designed metal and composite panel systems. Material innovation focusing on lightweight, aesthetically customizable, and low volatile organic compound (VOC) emitting solutions is defining the trajectory of future segment dominance.

AI Impact Analysis on Cladding and Siding Market

User inquiries regarding Artificial Intelligence (AI) in the cladding and siding sector frequently revolve around how technology can enhance design accuracy, optimize material usage to minimize waste, and improve installation logistics. Common questions assess the feasibility of AI-driven generative design for complex façades, the role of machine learning in predicting material degradation and maintenance needs, and the integration of AI-powered robotics for safer, more precise on-site application. Users are keen to understand how AI can streamline the complex supply chain, matching material specifications with project timelines and budgetary constraints, ultimately reducing the overall cost and risk associated with large-scale building envelope construction. The consensus among professionals suggests that AI's primary value lies in its ability to manage complexity, optimize efficiency, and ensure quality control in an industry historically reliant on manual processes.

The introduction of AI is fundamentally transforming the pre-construction phase. Machine learning algorithms can analyze vast datasets of material performance, climate conditions, and structural requirements to recommend optimal cladding materials and assembly methods, significantly reducing design iteration cycles. Furthermore, AI tools are now capable of performing clash detection and generating highly accurate cutting patterns for custom panels, minimizing material scrap rates which is a substantial cost factor. This predictive capability allows manufacturers and contractors to implement just-in-time inventory management, alleviating storage issues and ensuring immediate availability of specialized components, thereby mitigating project delays inherent in traditional construction timelines.

In the operational sphere, AI integration extends to quality assurance and predictive maintenance. AI-powered image recognition and drone surveying are being deployed to inspect installed cladding for defects, thermal bridges, and structural weaknesses far more efficiently and accurately than traditional human inspection. This proactive monitoring shifts the maintenance paradigm from reactive repairs to predictive intervention, significantly extending the lifespan of the building envelope and enhancing occupant safety. The strategic implementation of AI in procurement, design, and site management establishes a foundation for smarter, more sustainable, and ultimately more resilient building exteriors, setting new benchmarks for industry performance.

- AI-driven generative design optimizes complex façade geometry and material specification.

- Predictive analytics forecasts maintenance schedules and potential material failures, reducing lifecycle costs.

- Machine learning algorithms enhance quality control through automated defect detection via visual inspection systems.

- Robotics integrated with AI facilitates precise, high-speed installation of panelized systems, improving site safety.

- Supply chain optimization using AI models matches fluctuating demand with optimal raw material procurement.

- Simulation tools powered by AI accurately model thermal performance and energy efficiency metrics of chosen cladding systems.

- Automated waste reduction by optimizing cutting layouts for custom material dimensions.

DRO & Impact Forces Of Cladding and Siding Market

The Cladding and Siding Market is heavily influenced by a dynamic interplay of factors categorized as Drivers, Restraints, and Opportunities (DRO). Key drivers include the global mandate for energy-efficient buildings, fueled by governmental regulations and green building standards like BREEAM and LEED, which necessitates the use of high-R-value insulating cladding materials. Coupled with this is rapid population growth and urbanization in emerging markets, leading to extensive construction activity in both residential and commercial sectors. The imperative to upgrade aging infrastructure in developed regions, ensuring compliance with updated fire safety and structural resilience codes, also provides significant sustained demand for new cladding systems. These forces collectively create a strong upward momentum, supporting volume and value growth across multiple product categories.

Conversely, several significant restraints impede faster market expansion. The most notable is the volatile pricing and supply chain unpredictability of key raw materials, including polymers, metals (aluminum), and wood pulp, which directly affects manufacturing costs and profitability. Additionally, the high upfront cost associated with premium, high-performance cladding systems, such as advanced composite panels or specialized ventilated facades, often deters widespread adoption, particularly in price-sensitive developing markets. Furthermore, the construction industry’s reliance on skilled labor for complex installations and the inherent challenges in ensuring consistent quality of workmanship across diverse projects act as persistent frictional restraints to market growth, requiring standardized installation procedures and innovative modular solutions.

Opportunities for market stakeholders primarily lie in the rapid innovation of sustainable materials and the integration of digital construction technologies. There is a substantial opportunity for manufacturers to commercialize bio-based, recycled content cladding options that appeal to environmentally conscious builders and regulatory bodies. The growing adoption of Building Information Modeling (BIM) and digital fabrication techniques allows for highly customized and precise production, streamlining the path from design to installation. Strategic geographic expansion into untapped markets in Africa and Latin America, coupled with specializing in retrofitting solutions for historical or energy-inefficient buildings, represents significant avenues for realizing long-term revenue growth and market diversification, transforming current challenges into future competitive advantages.

Segmentation Analysis

The Cladding and Siding Market is highly fragmented and segmented primarily by material type, application (residential vs. non-residential), and end-use, offering diverse product solutions tailored to specific performance requirements and aesthetic needs. Material segmentation provides clarity on cost structure, durability, and fire resistance, with categories ranging from traditional natural materials to modern high-performance composites. Application analysis distinguishes between large volume residential needs, often favoring cost-effective options, and the high-value, specification-driven non-residential sector. Understanding these segments is crucial for strategic market positioning and product development, allowing companies to target key demographic and infrastructural development trends globally.

- By Material:

- Vinyl Siding

- Fiber Cement

- Wood Siding (Natural Wood, Engineered Wood, Wood Composites)

- Metal Cladding (Aluminum, Steel, Zinc, Copper)

- Brick and Stone Veneer

- Stucco and EIFS (Exterior Insulation Finishing Systems)

- Composite Materials (High-Pressure Laminates, Fibre-Reinforced Plastic)

- Glass Cladding

- By Application:

- Residential (Single-Family, Multi-Family)

- Non-Residential (Commercial, Industrial, Institutional)

- By End-Use:

- New Construction

- Repair and Renovation (Retrofitting)

- By Installation Method:

- Conventional Non-Ventilated Systems

- Ventilated Façade Systems

Value Chain Analysis For Cladding and Siding Market

The value chain for the Cladding and Siding Market begins with upstream activities focused on raw material sourcing and processing, which is highly specialized depending on the end product—for example, extraction of minerals for cement, processing of wood pulp, or refining of aluminum/steel. Key upstream actors include petrochemical companies supplying polymers (for vinyl), mining companies, timber suppliers, and chemical manufacturers providing resins and additives. Efficiency in this stage is critical, as fluctuations in commodity prices directly impact the final product cost. Manufacturers must maintain robust supply contracts and often engage in hedging strategies to mitigate volatility and ensure a stable input supply, driving towards sustainable sourcing practices to meet modern regulatory standards.

The manufacturing and processing stage involves converting raw materials into finished cladding and siding products, including specialized processes like extrusion (for vinyl), autoclaving (for fiber cement), and roll forming or panel fabrication (for metal systems). Manufacturers invest heavily in research and development to improve product attributes such as fire rating, thermal performance, and color retention, seeking competitive advantages through proprietary technology. The products then enter the distribution channel, which is complex due to the varying sizes and specifications required for different projects. Distribution relies heavily on national and regional distributors, specialized building material wholesalers, and large retail home improvement chains, depending on whether the target is the professional builder (commercial) or the DIY segment (residential).

Downstream activities center on installation, encompassing general contractors, specialized façade installation companies, architects, and designers who specify the products, and the actual on-site labor. Direct distribution often occurs for large commercial projects where manufacturers deal directly with major contractors, providing customized solutions and technical support. Indirect channels dominate the residential and smaller renovation market, relying on dealers and retailers to interface with local builders and consumers. The trend towards prefabricated, easy-to-install systems is an attempt to shorten the downstream installation time and reduce dependency on highly skilled labor, creating opportunities for more standardized and reproducible outcomes, ensuring both product quality and project timeliness.

Cladding and Siding Market Potential Customers

The primary consumers of cladding and siding materials are segmented into distinct categories based on their purchasing volume, project type, and core requirements. Major potential customers include residential home builders, both large national firms and smaller regional custom builders, who prioritize cost-effectiveness, durability, aesthetic variety, and ease of installation to meet rapid housing demand. For this segment, products like vinyl, standard fiber cement, and engineered wood are highly attractive due to their balance of performance and affordability. The purchasing decision often revolves around supplier reliability, warranty provisions, and logistical support for large-scale procurement and delivery schedules across multiple housing sites.

A second crucial customer segment comprises commercial and industrial property developers, along with public sector bodies responsible for institutional buildings (hospitals, schools, government offices). These buyers prioritize regulatory compliance, particularly stringent fire ratings, high thermal insulation capabilities, and long-term, low-maintenance performance essential for large capital expenditure projects. They typically specify high-end materials such as advanced metal panels, specialized composite cladding, and architecturally demanding glass systems. The decision process for these customers is heavily influenced by architects, structural engineers, and façade consultants who ensure the selected material meets complex performance specifications and aesthetic vision, making technical support and testing certifications paramount.

Finally, the Repair and Remodeling (R&R) segment, encompassing property owners, homeowners, and renovation contractors, forms a substantial and growing customer base. These customers are driven by the need to restore or upgrade existing building envelopes, often seeking improved energy performance, better curb appeal, or compliance updates. While homeowners tend to focus on aesthetic return on investment and simplified maintenance (e.g., opting for vinyl over natural wood), R&R contractors look for readily available, easy-to-handle materials that minimize disruption and maximize installation speed. Manufacturers targeting this segment must focus on accessibility through retail channels and providing practical guides and technical support for installation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $168.5 Billion |

| Market Forecast in 2033 | $235.1 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | James Hardie Industries PLC, Ply Gem Holdings, Inc. (Westlake Chemical), LIXIL Group Corporation, Louisiana-Pacific Corporation (LP), Boral Limited, Saint-Gobain, Etex Group, Nichiha Corporation, Kingspan Group plc, Alcoa Corporation, CertainTeed (Saint-Gobain), Knauf Gips KG, Georgia-Pacific LLC, BMI Group, Cornerstone Building Brands, Inc., Cembrit Holding A/S, Rockwool International A/S, Tremco Incorporated, Döcke Extrusion, Tarkett S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cladding and Siding Market Key Technology Landscape

The technology landscape in the Cladding and Siding Market is rapidly evolving, driven by material science innovation focused on enhancing fire safety, durability, and thermal performance. A major technological advancement is the development of next-generation fiber cement and high-pressure laminates (HPL) that offer superior aesthetic quality mimicking natural wood or stone, but with significantly improved resistance to moisture, pests, and UV degradation. Furthermore, phase change materials (PCMs) and advanced insulation technologies are being integrated directly into EIFS and ventilated façade systems, substantially increasing the R-value of the building envelope without adding excessive thickness. This focus on performance through composite engineering is crucial for meeting increasingly demanding international building codes.

Digitalization and manufacturing precision represent another critical technological pillar. The widespread adoption of Building Information Modeling (BIM) allows architects and manufacturers to design and fabricate complex, bespoke cladding components with sub-millimeter accuracy, reducing installation tolerance errors and ensuring perfect fit on site. Manufacturers are implementing highly automated, precision-cutting, and robotic assembly lines, particularly for custom metal and composite panels, leading to faster production cycles and consistent product quality. This digital thread from design specification to fabrication is reducing waste, enhancing supply chain efficiency, and enabling the economic viability of highly complex architectural designs that were previously cost-prohibitive.

Installation technology is also undergoing a transformative shift toward modularization and rapid assembly systems. The shift from stick-built to panelized, pre-fabricated systems—often incorporating window and insulation layers—allows for faster envelope enclosure, critical for project timelines. New mechanical fastening systems and interlocking joints minimize the need for wet trades on site, improving speed and all-weather installation capability. Furthermore, advancements in specialized coatings and surface treatments, including self-cleaning (photocatalytic) technologies and highly durable, fade-resistant finishes, are reducing long-term maintenance costs and solidifying the market's trend toward low-lifecycle cost products, fundamentally redefining expectations for building exterior longevity and maintenance cycles.

Regional Highlights

- North America: This region is characterized by high demand for fiber cement and vinyl siding, driven primarily by the extensive single-family housing market and robust repair and remodeling activities in the US and Canada. Stringent requirements for extreme weather durability and energy conservation standards (especially in California and Northeastern states) are accelerating the adoption of premium, insulating cladding systems. Innovation centers around advanced engineered wood and sustainable polymer composites, ensuring market stability and driving incremental value growth.

- Europe: Europe is defined by stringent energy performance directives (EPBD) and a major focus on fire safety standards following regulatory updates. The market is dominated by high-performance insulation systems, particularly ventilated facades utilizing mineral wool, rockwool, and non-combustible composite panels. Germany, the UK, and France are leading adopters, prioritizing retrofitting existing, energy-inefficient building stock and driving innovation in highly functional, aesthetically integrated photovoltaic (BIPV) cladding solutions.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, fueled by rapid urbanization, massive infrastructure development, and substantial governmental investment in commercial and high-rise residential construction, particularly in China, India, and ASEAN nations. Demand is high for cost-effective materials like basic metal cladding and fiber cement, balancing budgetary constraints with the need for scalable and durable solutions. The adoption of Western safety standards is gradually driving the transition towards higher quality, fire-resistant materials in major metropolitan areas.

- Latin America (LATAM): The LATAM market, while smaller, is exhibiting consistent growth, particularly in major economies like Brazil and Mexico. Market penetration of advanced cladding systems is increasing, replacing traditional masonry and plaster finishes. Economic stability improvements are driving investments in high-quality materials that offer better protection against tropical climates and seismic activity, with EIFS and basic fiber cement systems gaining significant traction in new commercial developments.

- Middle East and Africa (MEA): This region presents a market split between large-scale, high-value commercial and architectural projects (driven by the GCC countries) demanding bespoke metal and glass façades, and lower-cost housing needs in African nations. Extreme heat resistance and aesthetic grandeur are key purchasing criteria in the Middle East, while rapid population growth in Africa is creating immense demand for scalable, affordable housing solutions, promoting the use of locally sourced materials and basic cladding panels.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cladding and Siding Market.- James Hardie Industries PLC

- Ply Gem Holdings, Inc. (Westlake Chemical)

- LIXIL Group Corporation

- Louisiana-Pacific Corporation (LP)

- Boral Limited

- Saint-Gobain

- Etex Group

- Nichiha Corporation

- Kingspan Group plc

- Alcoa Corporation

- CertainTeed (Saint-Gobain)

- Knauf Gips KG

- Georgia-Pacific LLC

- BMI Group

- Cornerstone Building Brands, Inc.

- Cembrit Holding A/S

- Rockwool International A/S

- Tremco Incorporated

- Döcke Extrusion

- Tarkett S.A.

Frequently Asked Questions

Analyze common user questions about the Cladding and Siding market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for high-performance cladding systems?

The primary driver is the global regulatory environment mandating increased energy efficiency in new and existing buildings. Governments are enforcing stricter thermal performance standards, requiring cladding systems with superior R-values, such as ventilated façades and advanced Exterior Insulation Finishing Systems (EIFS), to significantly reduce operational heating and cooling costs and meet climate targets.

Which cladding material segment is forecast to exhibit the highest growth rate?

The Fiber Cement segment is expected to show one of the highest growth rates due to its optimal balance of cost-effectiveness, exceptional durability, and resistance to fire, moisture, and pests. It serves as a superior, low-maintenance alternative to traditional wood and competes effectively with vinyl in terms of longevity and aesthetic appeal, particularly in high-volume residential and mid-tier commercial construction.

How do fire safety regulations impact material selection in the cladding market?

Fire safety regulations, particularly post-Grenfell Tower incident reforms, have fundamentally shifted material preferences towards non-combustible or limited-combustibility products. This legislative pressure drives increased demand for mineral wool insulated panels, metal composites with fire-retardant cores, and non-combustible fiber cement, often leading to the restriction or complete ban of traditional combustible polymer-based cladding systems in high-rise buildings.

What is the role of sustainable sourcing in the competitive landscape of the market?

Sustainable sourcing and manufacturing are becoming critical competitive differentiators. Customers, regulators, and investors increasingly favor suppliers who use recycled content, bio-based materials, and manufacturing processes that minimize carbon emissions. Companies offering Environmental Product Declarations (EPDs) and third-party certifications (e.g., FSC for wood) gain significant advantage, especially when bidding on green building projects adhering to LEED or BREEAM standards.

How is digital technology, such as BIM, changing the cladding design process?

Building Information Modeling (BIM) is revolutionizing the cladding design process by enabling comprehensive 3D modeling, precise material quantity takeoffs, and advanced clash detection prior to construction. BIM integration ensures that complex façade systems are fabricated exactly to specification, streamlining the supply chain, reducing on-site installation risk, and significantly improving overall project delivery efficiency and accuracy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager