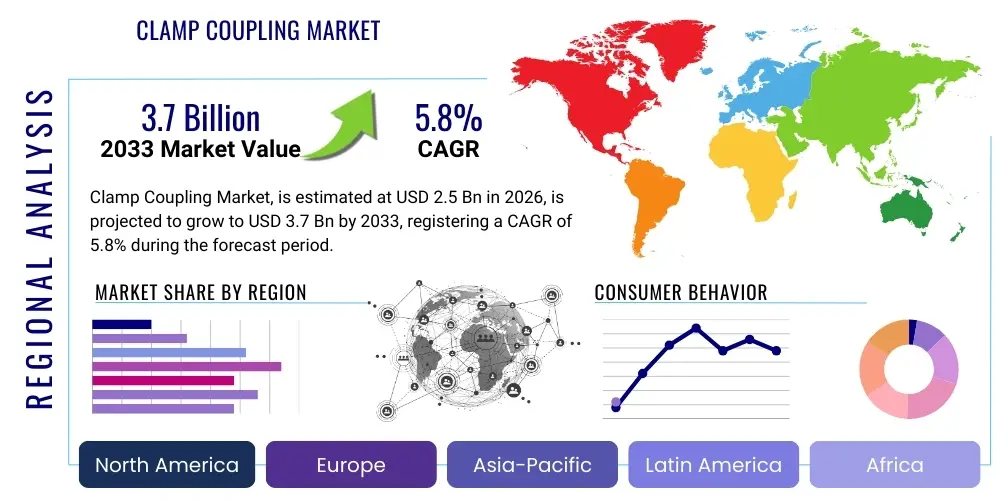

Clamp Coupling Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436962 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Clamp Coupling Market Size

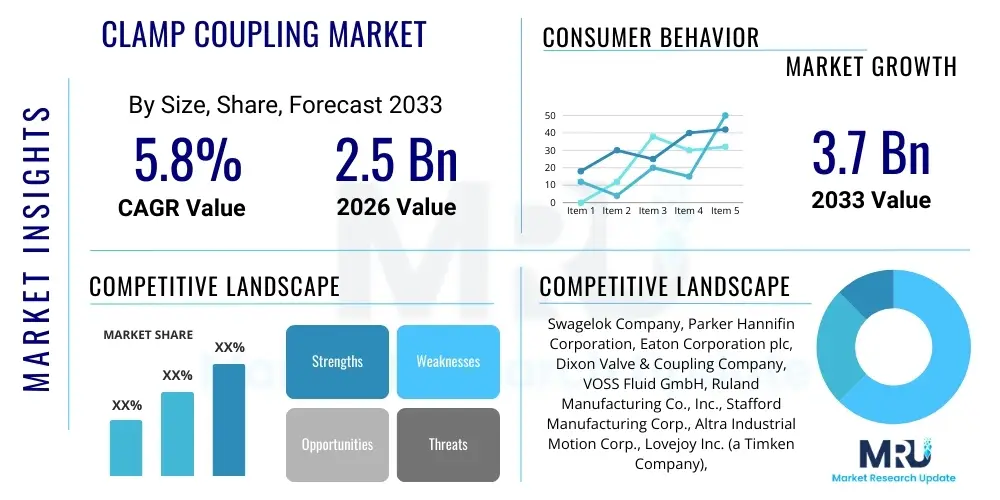

The Clamp Coupling Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 3.7 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by escalating demand from critical process industries, including oil and gas, chemical processing, and pharmaceuticals, where reliable, quick-disconnect, and leak-proof connections are non-negotiable for operational safety and efficiency.

The valuation reflects increasing industrial automation across emerging economies, necessitating standardized and easily maintainable piping and fluid transfer systems. Furthermore, regulatory mandates concerning emission control and operational safety, particularly in high-pressure and high-temperature environments, favor the adoption of high-integrity clamp couplings over traditional connection methods. The market size expansion is also supported by continuous innovation in materials science, leading to specialized couplings made from advanced stainless steel alloys and high-performance engineered plastics designed for corrosive media handling.

Clamp Coupling Market introduction

The Clamp Coupling Market encompasses the production, distribution, and utilization of mechanical components designed to join two shafts, pipes, or conduits securely without requiring permanent alteration (such as welding) or complex installation procedures. Clamp couplings, characterized by their non-marring, radial-clamping force, offer precise shaft alignment and superior torque transmission, making them indispensable in rotating machinery and fluid transfer systems. The primary product types include rigid couplings, which prioritize high stiffness and precise alignment, and flexible couplings, which compensate for minor misalignment, vibration, and thermal expansion. Key applications span across heavy machinery, material handling systems, wastewater treatment, and sensitive cleanroom environments, driven by the need for quick assembly, disassembly, and maintenance.

The fundamental benefits driving the widespread adoption of clamp couplings include ease of installation, high repeatability, reduced downtime, and the ability to distribute clamping force evenly, which minimizes shaft deformation compared to set-screw counterparts. Their design ensures effective sealing and structural integrity, especially crucial in vacuum or high-pressure fluid lines. The market is significantly propelled by the increasing complexity of industrial machinery requiring modular designs and frequent servicing. Driving factors include the globalization of manufacturing supply chains, which necessitates standardized components; stringent industrial safety standards promoting leak-proof connections; and the rising adoption of hygienic coupling systems in the food, beverage, and pharmaceutical sectors.

The versatility of clamp couplings allows them to accommodate different material requirements—from robust stainless steel for corrosive chemical environments to lightweight aluminum for aerospace and specialized engineered plastics for non-metallic piping. The continuous push toward Industry 4.0 and smart manufacturing environments further boosts demand, as clamp couplings facilitate the quick modification and integration of sensor and monitoring equipment into existing systems. This adaptability ensures that industrial processes remain nimble and responsive to changing production demands while upholding strict performance benchmarks for torque and pressure resistance.

Clamp Coupling Market Executive Summary

The Clamp Coupling Market is entering a dynamic phase defined by shifting business trends towards customized and modular coupling solutions, especially in the growing field of renewable energy and electric vehicle manufacturing. Business trends show a strong emphasis on additive manufacturing technologies for prototyping complex coupling geometries and optimizing material usage, thereby reducing component weight and production lead times. Companies are increasingly integrating IoT-enabled sensors into coupling systems to monitor vibration, temperature, and torque in real-time, moving the industry towards predictive maintenance models. Strategic mergers and acquisitions are common as major players seek to consolidate regional market presence and acquire niche technology expertise, particularly in specialized fluid dynamics applications.

Regional trends indicate that Asia Pacific (APAC) remains the fastest-growing market, propelled by massive infrastructure development, rapid industrialization in China and India, and expanding capital expenditure in chemical and semiconductor fabrication plants. North America and Europe, while mature, are characterized by high-value sales driven by stringent regulatory compliance (e.g., ATEX requirements for explosive atmospheres) and demand for premium, high-performance materials in aerospace and advanced manufacturing. Segment trends highlight stainless steel as the dominant material segment due to its unparalleled corrosion resistance. Furthermore, the two-piece clamp coupling segment is experiencing accelerated growth, favored by maintenance teams for its superior ease of installation and ability to be fitted or removed without disturbing adjacent components in highly integrated systems.

AI Impact Analysis on Clamp Coupling Market

Common user inquiries regarding AI's influence on the Clamp Coupling Market often center on how digital tools can enhance design precision, optimize manufacturing processes, and improve predictive maintenance capabilities. Users frequently ask if AI can simulate coupling performance under extreme conditions more accurately than traditional FEA methods, and whether machine learning algorithms can detect minor defects during quality control, thereby minimizing failure rates in high-stakes environments like deep-sea oil rigs or pharmaceutical manufacturing lines. The consensus expectation is that AI will not fundamentally change the mechanical principle of clamping but will revolutionize the lifecycle management of these components. Key themes include the implementation of AI-driven optimization loops for material selection based on specific operational envelopes and using cognitive computing to manage complex inventory systems for thousands of varied coupling types across multiple geographic locations.

The core concerns revolve around data security when integrating operational data into AI platforms and the required investment in training specialized personnel to manage these advanced systems. However, the perceived benefits, such as reduced waste in manufacturing, optimization of clamping torque requirements based on real-time feedback, and significantly lowering unplanned downtime through predictive failure analysis, overwhelmingly drive interest. AI’s ability to correlate vibration signatures from rotating equipment with specific coupling wear patterns is particularly appealing to heavy industries seeking to extend asset life and improve safety margins. Ultimately, AI adoption is expected to shift the focus from reactive replacement to proactive, data-informed maintenance, fundamentally changing the service and support landscape surrounding clamp coupling utilization.

- AI-driven topology optimization reduces material usage while maintaining or improving structural integrity of coupling designs.

- Machine learning algorithms enhance quality control by analyzing visual inspection data and identifying micro-cracks or surface imperfections invisible to human inspectors.

- Predictive maintenance schedules are optimized using AI to analyze real-time operational data (vibration, pressure, temperature), predicting the remaining useful life of the coupling.

- Automated inventory management systems use AI forecasting to predict demand fluctuations for specific coupling sizes and materials, improving supply chain resilience.

- Simulation models, enhanced by AI, allow for rapid iteration and testing of new material compositions under simulated stress conditions, accelerating product development.

DRO & Impact Forces Of Clamp Coupling Market

The Clamp Coupling Market is significantly shaped by a confluence of driving factors, restrictive constraints, and emerging opportunities, all interacting to form powerful market impact forces. Key drivers include stringent regulatory compliance regarding leakage prevention, especially in the chemical and wastewater sectors, which favors high-integrity clamping mechanisms. The accelerating trend of industrial automation and the need for modular, easy-to-assemble machinery further bolster demand. Conversely, the market faces restraints such as the high initial cost of specialized, high-tolerance clamp couplings compared to traditional set-screw or bolted flange connections, coupled with performance limitations in extremely high-temperature or continuous high-vibration applications where flexible couplings may experience premature failure. These limitations necessitate continuous R&D investment to expand the operational envelope of clamp technology.

Opportunities for growth are primarily concentrated in the adoption of specialized coupling solutions for nascent but rapidly expanding industries, notably hydrogen transportation and storage infrastructure, where ultra-high integrity seals are paramount. Furthermore, the shift towards sustainable manufacturing practices creates demand for lightweight, energy-efficient couplings made from advanced composite materials. The collective influence of these dynamics—the impact forces—dictates pricing power, competitive intensity, and the direction of innovation. The inherent reliability of clamp couplings acts as a strong pull factor (driver), while material price volatility (restraint) acts as a persistent push force, compelling manufacturers to optimize supply chain resilience and explore alternative material substitutes, ensuring market dynamism remains high.

A major impact force is the intellectual property landscape; companies holding patents for proprietary quick-connect or sealing technologies maintain a significant competitive edge, influencing market penetration. The balance between offering standardized, off-the-shelf solutions and customized, application-specific designs remains a critical strategic decision. The market’s responsiveness to changing industry standards (e.g., ASME, API) directly affects adoption rates, positioning regulatory compliance as a dominant external impact force that mandates continuous product updates and certifications. This interplay of technology, regulation, and economics determines long-term profitability and market concentration.

Segmentation Analysis

The Clamp Coupling Market is segmented based on critical performance characteristics, material composition, design complexity, and end-user application, allowing for a detailed understanding of demand patterns across diverse industrial landscapes. Analyzing these segments provides strategic insights into which product types are driving volume growth and which specialized materials command premium pricing. Key segmentations include Type (rigid vs. flexible, one-piece vs. two-piece), Material (stainless steel, aluminum, engineered plastics), and End-User Industry (Oil & Gas, Food & Beverage, Automotive, etc.). This granular approach highlights the critical role coupling design plays in environments ranging from cleanrooms requiring sanitary connections to heavy industry demanding high torque capacity.

The two-piece clamp coupling segment dominates revenue generation due to its inherent advantage in maintenance and installation, particularly in retrofit scenarios where components cannot be easily accessed or dismantled. Material segmentation shows a growing preference for specialty stainless steel grades (e.g., 316L) in hygienic and corrosive applications, contrasting with aluminum’s steady adoption in aerospace and automotive due to its high strength-to-weight ratio. Geographic segmentation clearly demonstrates the nexus of industrial activity and coupling demand, with manufacturing hubs leading consumption. Understanding these divisions is crucial for manufacturers tailoring their product portfolios to specific regional regulatory requirements and industrial development phases.

- By Type:

- One-Piece Clamp Coupling

- Two-Piece Clamp Coupling

- Rigid Clamp Coupling

- Flexible Clamp Coupling

- Quick Disconnect Coupling

- By Material:

- Stainless Steel (304, 316L)

- Aluminum

- Carbon Steel

- Engineered Plastics (e.g., Acetal, Nylon)

- Specialty Alloys (e.g., Titanium)

- By End-User Industry:

- Oil and Gas

- Chemical and Petrochemical

- Food and Beverage (Sanitary Applications)

- Pharmaceutical and Biotechnology

- Automotive and Aerospace

- Pulp and Paper

- Water and Wastewater Treatment

- Power Generation

Value Chain Analysis For Clamp Coupling Market

The value chain for the Clamp Coupling Market begins with upstream activities focused on securing high-quality raw materials, primarily specialized metal alloys such as 316L stainless steel, high-tensile aluminum, and specific engineering plastics, procured from primary metal producers and chemical suppliers. Given the precision engineering required for these components, raw material quality assurance and stable pricing are critical determinants of manufacturing cost and final product performance. Specialized processes like forging, casting, and precision machining are employed, where efficiency and tolerance control significantly influence the value added. Research and development focused on material science and anti-corrosion treatments represent a crucial upstream investment, leading to differentiation in high-performance segments.

The downstream segment involves distribution, sales, and post-sales support, directly engaging with diverse end-user industries. Distribution channels are highly fragmented, ranging from direct sales models for highly customized or large-volume contracts (common in the Oil & Gas sector) to extensive indirect networks utilizing industrial distributors, master wholesalers, and specialized parts suppliers (prevalent for standard components in MRO—Maintenance, Repair, and Operations). The selection of the distribution channel is often dictated by the complexity of the product; proprietary or technically complex couplings typically require highly trained direct sales teams, whereas standardized clamp couplings move through established, catalog-based distribution networks.

Direct sales provide manufacturers with greater control over customer relationships and technical support, offering a high-touch, consultative selling approach essential for bespoke solutions or critical infrastructure projects. Conversely, indirect channels leverage the distributor's existing logistical infrastructure and regional market access, ensuring faster, wider market penetration and reduced inventory holding costs for the manufacturer. The aftermarket services, including technical training, rapid replacement part provisioning, and on-site troubleshooting, constitute a significant portion of the downstream value proposition. Companies that excel in reliable, timely post-sales support build strong brand loyalty, which is particularly vital in maintenance-intensive industries where coupling failure results in costly downtime.

Clamp Coupling Market Potential Customers

Potential customers for clamp couplings span the entire spectrum of process and manufacturing industries where the reliable transmission of torque or the secure containment and transfer of fluids is necessary. End-users are broadly categorized based on their functional needs: those requiring high-precision mechanical linkages (e.g., robotics, test equipment, motion control) and those requiring leak-proof fluid/pneumatic connections (e.g., chemical plants, food processing). In the fluid handling sector, major buyers include petrochemical refineries and upstream oil and gas operators who demand specialized, heavy-duty clamps capable of withstanding extreme pressures and temperatures and resisting aggressive chemical media, often adhering to API specifications.

The Food & Beverage and Pharmaceutical sectors represent a rapidly growing customer base, driven by the need for sanitary, clean-in-place (CIP) compliant couplings. These customers prioritize components made from 316L stainless steel with smooth internal surfaces, ensuring zero product entrapment and preventing microbial growth. Buyers here are often Procurement Managers and Engineers focused on compliance with FDA and other international hygienic standards. In contrast, customers in the general manufacturing and automotive industries are often focused on standardized components offering speed, cost-effectiveness, and ease of maintenance in high-volume production lines, utilizing aluminum and carbon steel couplings for shaft-to-shaft connections in conveyor systems and assembly equipment.

Emerging potential customers include operators building green energy infrastructure, such as hydrogen fuel cell production facilities and carbon capture installations. These applications require completely new classes of specialized couplings designed to manage the unique challenges posed by highly volatile or reactive media at cryogenic temperatures or extreme pressures. Additionally, large engineering, procurement, and construction (EPC) firms act as major buyers, specifying and purchasing couplings in bulk for massive greenfield industrial projects worldwide, prioritizing suppliers who can guarantee scale, standardization, and global logistical support.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 3.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Swagelok Company, Parker Hannifin Corporation, Eaton Corporation plc, Dixon Valve & Coupling Company, VOSS Fluid GmbH, Ruland Manufacturing Co., Inc., Stafford Manufacturing Corp., Altra Industrial Motion Corp., Lovejoy Inc. (a Timken Company), ABB Ltd., Bimba Manufacturing Company, Rexnord Corporation, Regal Rexnord Corporation, Helical Products Company, Ringfeder Power Transmission GmbH, SICK AG, Trelleborg AB, Freudenberg Sealing Technologies, Saint-Gobain S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Clamp Coupling Market Key Technology Landscape

The technological landscape of the Clamp Coupling Market is characterized by continuous advancements in material science, precision manufacturing, and integration of smart features. A pivotal technology involves the development of advanced sealing mechanisms, such as proprietary elastomer compounds and metal-to-metal seals, designed to maintain integrity under extreme thermal cycling and high-pressure differentials encountered in aerospace and deep-sea applications. Precision machining technologies, particularly CNC multi-axis turning and milling, are crucial for achieving the extremely tight dimensional tolerances necessary for effective radial clamping and shaft alignment, ensuring minimal runout and maximum torque transmission efficiency. Furthermore, surface treatment technologies, including passivation, anodizing, and specialized coatings, are increasingly utilized to enhance corrosion resistance and extend component life in highly aggressive chemical environments, adding a layer of technological sophistication to otherwise mechanical components.

Additive manufacturing, or 3D printing, is gaining traction, primarily in the prototyping and production of low-volume, highly complex coupling geometries, particularly those utilizing high-performance polymers or specialized metal powders. This technology enables rapid customization and weight optimization that traditional subtractive manufacturing struggles to match. Another significant area of technological focus is the integration of Industry 4.0 elements. This involves embedding miniature sensors (micro-electromechanical systems, or MEMS) within the coupling structure. These sensors monitor key operational parameters, such as excessive vibration, rotational speed variances, and temperature anomalies, transmitting data wirelessly for condition monitoring and predictive maintenance protocols. This shift transforms the coupling from a passive component into an active, data-generating asset.

The push for quick-disconnect technology is also driving significant innovation, focusing on user-friendly, tool-free designs that maintain high security and robust sealing capabilities. Specialized locking mechanisms, incorporating features like safety interlocks and visual indicators for secure engagement, are key technological differentiators, particularly in applications where frequent connection and disconnection are required, such as in modular laboratory equipment and high-purity gas delivery systems. Regulatory alignment also dictates technology, with manufacturers constantly developing and certifying products to meet new global standards for pressure vessel safety and environmental protection, making compliance technology a core competitive advantage.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of growth for the Clamp Coupling Market, attributed to massive industrial expansion, particularly in manufacturing, infrastructure, and chemical processing across countries like China, India, and Southeast Asian nations. The region benefits from lower manufacturing costs, making it both a major consumer and a primary global supplier. Demand is particularly high in the construction of new petrochemical complexes and the burgeoning semiconductor fabrication industry, which requires ultra-high purity and leak-free components.

- North America: This region is characterized by high demand for premium, technologically advanced couplings, driven by stringent safety regulations in the Oil and Gas sector (especially fracking and pipeline infrastructure) and the aerospace industry. The US market emphasizes durable, high-integrity materials and advanced certifications (e.g., ASME, API), supporting a market focused on replacement and upgrade cycles in mature industrial facilities, alongside significant investment in robotics and automation requiring precision rigid couplings.

- Europe: Europe maintains a strong focus on environmental and safety standards (e.g., REACH, ATEX directives), driving the adoption of high-specification, specialized clamp couplings in the pharmaceutical, chemical, and precision engineering sectors. Germany, known for its automotive and machine tool industries, leads regional demand for high-torque flexible couplings. The region is also at the forefront of adopting standardized, modular systems that utilize two-piece couplings for ease of maintenance and faster assembly times.

- Latin America (LATAM): Market growth in LATAM is heavily dependent on investment cycles in the extractive industries (mining) and oil and gas (Brazil, Mexico). The demand often targets rugged, durable couplings capable of handling challenging operational environments, often requiring components resistant to high wear and corrosion. Market maturity is varied, leading to a strong presence of both standardized, cost-effective solutions and high-specification imports.

- Middle East and Africa (MEA): Dominated by major infrastructure projects related to energy (oil, gas, and renewable power generation) and water management (desalination plants), MEA requires extremely reliable couplings that can withstand harsh desert climates, high salinity, and high thermal loads. Government spending on diversifying economies away from raw oil extraction is boosting demand in new sectors like construction and chemical manufacturing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Clamp Coupling Market.- Swagelok Company

- Parker Hannifin Corporation

- Eaton Corporation plc

- Dixon Valve & Coupling Company

- VOSS Fluid GmbH

- Ruland Manufacturing Co., Inc.

- Stafford Manufacturing Corp.

- Altra Industrial Motion Corp.

- Lovejoy Inc. (a Timken Company)

- ABB Ltd.

- Bimba Manufacturing Company

- Rexnord Corporation

- Regal Rexnord Corporation

- Helical Products Company

- Ringfeder Power Transmission GmbH

- SICK AG

- Trelleborg AB

- Freudenberg Sealing Technologies

- Saint-Gobain S.A.

Frequently Asked Questions

Analyze common user questions about the Clamp Coupling market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary factors are driving the growth of the Clamp Coupling Market?

The market growth is fundamentally driven by the escalating demand for highly reliable, leak-proof fluid transfer systems across critical process industries (e.g., chemical, pharma) and the increasing global trend toward industrial automation and modular machinery design, which necessitates components offering quick installation and maintenance capabilities.

Which material segment holds the largest share in the Clamp Coupling Market?

Stainless steel, particularly 316L grade, currently dominates the material segment. This dominance stems from its superior resistance to corrosion, high chemical compatibility, and ability to meet stringent hygienic standards required by the pharmaceutical, food and beverage, and specialized chemical processing industries globally.

How is AI impacting the manufacturing and performance of clamp couplings?

AI is transforming the sector primarily through predictive maintenance, where machine learning analyzes operational data (vibration, temperature) to anticipate coupling failure before it occurs, significantly reducing unplanned downtime. AI is also used upstream in optimizing coupling design for weight reduction and material selection.

What is the main difference between one-piece and two-piece clamp couplings?

One-piece couplings are installed by sliding them over the end of a shaft, requiring shaft removal for installation or repair. Two-piece couplings split in half, allowing them to be installed or removed radially around a shaft without dismantling the adjacent machinery, offering a significant advantage in repair and maintenance scenarios.

Which geographical region exhibits the fastest growth rate for clamp coupling adoption?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is fueled by massive capital investment in infrastructure, rapidly expanding manufacturing bases, and growing demand from large-scale chemical and oil and gas projects across China, India, and Southeast Asia.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager