Clampless Alignment Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436361 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Clampless Alignment Machine Market Size

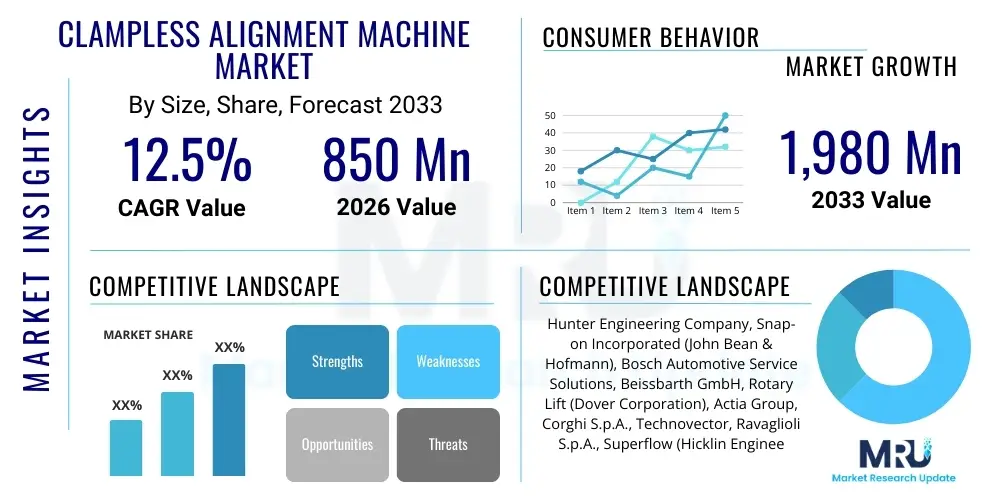

The Clampless Alignment Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,980 Million by the end of the forecast period in 2033.

Clampless Alignment Machine Market introduction

The Clampless Alignment Machine Market encompasses advanced diagnostic and servicing equipment designed primarily for automotive wheel alignment, utilizing non-contact or quick-attach mechanisms to measure and adjust vehicle geometry without requiring traditional rim clamps. This technological shift addresses key inefficiencies associated with older alignment systems, such as potential wheel damage, time-consuming setup procedures, and measurement inaccuracies stemming from human error or equipment wear. The evolution toward clampless technology is fundamentally driven by the rising complexity of modern vehicle suspensions, which are increasingly integrated with sophisticated driver-assistance systems (ADAS) that necessitate highly precise alignment parameters for optimal performance and safety.

These machines leverage cutting-edge technologies, including high-resolution 3D imaging, laser scanning, and inertial sensors, to provide real-time, highly accurate measurements of camber, caster, and toe angles. The primary applications span across general repair garages, authorized vehicle dealerships, specialized tire and alignment shops, and high-volume fleet maintenance centers. The core product description emphasizes rapid measurement acquisition, repeatability, and enhanced workflow efficiency, minimizing vehicle downtime and maximizing shop throughput. Furthermore, the ergonomic design and integrated software platforms often feature intuitive user interfaces, simplifying complex procedures for technicians across varying skill levels.

Key benefits driving market adoption include significantly improved measurement accuracy, elimination of potential rim scratching or damage—a crucial factor for premium and custom wheels—and substantial reduction in overall service time compared to conventional systems. The overarching market dynamic is fueled by the rapid global proliferation of highly sensitive vehicle platforms, including electric vehicles (EVs) and autonomous vehicles, which mandate frequent and extremely precise alignment checks to ensure tire longevity, fuel efficiency, and critical ADAS calibration integrity.

Clampless Alignment Machine Market Executive Summary

The Clampless Alignment Machine Market is characterized by significant technological advancements and strong demand stemming from the global automotive service sector’s transition towards precision maintenance, particularly catalyzed by the electric vehicle revolution. Current business trends indicate a strong push for integration capabilities, where alignment systems seamlessly interface with other diagnostic equipment and shop management software, driving higher operational efficiency. Leading market players are focusing heavily on developing software-as-a-service (SaaS) models for calibration updates and predictive maintenance features, moving the market structure beyond mere hardware provision toward integrated service solutions. Strategic partnerships between alignment equipment manufacturers and major automotive original equipment manufacturers (OEMs) are becoming critical to standardize protocols for complex ADAS-enabled alignments.

Regional trends reveal that North America and Europe currently dominate the market share, attributed to stringent safety regulations, a high concentration of technologically advanced service centers, and the early adoption of premium vehicle maintenance technologies. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by the massive expansion of the automotive aftermarket in China and India, increased vehicle parc size, and government initiatives promoting safer road transport infrastructure. In emerging economies, the adoption is driven by the necessity to upgrade traditional garages to handle modern, intricate vehicle designs, positioning these regions as crucial growth vectors for future market expansion.

Segment trends underscore the dominance of 3D imaging technology within the market, valued for its accuracy and speed, although sensor-based systems continue to hold relevance for portable and quick-check applications. The dealership segment remains the primary revenue driver, given their high volume of new vehicles requiring immediate post-sale checks and their adherence to OEM service standards. However, the independent garage segment is rapidly catching up, incentivized by competitive pressures to offer high-precision services. The integration of artificial intelligence (AI) is emerging as a significant segment disruptor, promising predictive diagnostics and automated calibration routines, further refining service quality and reducing labor dependency.

AI Impact Analysis on Clampless Alignment Machine Market

User inquiries concerning the impact of AI on the Clampless Alignment Machine Market primarily revolve around automation capabilities, predictive maintenance features, and the integration of ADAS calibration protocols. Users frequently ask if AI can automate the entire alignment process, how it enhances measurement accuracy beyond human capability, and what the return on investment (ROI) is for AI-enabled machines compared to standard models. Key expectations center on AI’s ability to analyze wear patterns, predict future component failures based on alignment history, and provide customized, prescriptive correction procedures tailored to specific vehicle models and driving conditions. Concerns often relate to data security, the required skill upgrade for technicians to interpret AI diagnostics, and the potential prohibitive cost of such advanced systems, summarizing a clear user desire for enhanced precision, streamlined operations, and integrated diagnostic intelligence.

The introduction of AI significantly transforms clampless alignment machines from simple measurement tools into intelligent diagnostic platforms. AI algorithms are employed to process vast amounts of sensor and camera data captured during the alignment process, identifying subtle geometrical variances that human observation or standard software might miss. This analysis allows for predictive diagnostics, where the system not only reports the current alignment status but also forecasts potential issues related to tire wear or suspension component fatigue based on real-time data comparison against massive cloud-based vehicle databases. Furthermore, AI facilitates automated decision-making regarding optimal shim placement or adjustment sequence, greatly reducing the skill dependency of the operator.

The core benefit of integrating AI lies in its capacity for real-time prescriptive analysis and enhanced operational efficiency. AI drives the seamless integration of alignment processes with complex ADAS recalibration tasks. For vehicles equipped with sophisticated driver-assistance systems, misalignment can critically compromise sensor performance. AI systems use vehicle-specific protocols to ensure that once mechanical alignment is corrected, the requisite electronic sensor calibration is performed automatically and accurately, conforming to OEM specifications. This capability minimizes rework, ensures vehicle safety compliance, and positions AI-enabled clampless machines as essential tools for high-end, future-proof automotive service centers.

- AI-driven automated diagnostic decision-making accelerates correction procedures.

- Predictive wear analysis extends component lifespan and optimizes tire management strategies.

- Seamless integration and automated execution of ADAS sensor recalibration.

- Enhanced data analysis capabilities identify nuanced alignment issues invisible to traditional methods.

- Optimization of energy consumption and operational efficiency through minimized setup time.

DRO & Impact Forces Of Clampless Alignment Machine Market

The dynamics of the Clampless Alignment Machine Market are shaped by a complex interplay of Drivers, Restraints, Opportunities, and broader Impact Forces. The primary drivers include the escalating demand for highly accurate vehicle servicing, fueled by the proliferation of sophisticated suspension systems in both internal combustion engine (ICE) vehicles and electric vehicles (EVs), alongside the critical necessity for precise ADAS sensor alignment. Restraints primarily involve the high initial capital investment required for these advanced systems, potentially excluding smaller, independent garages, and the ongoing challenge of requiring specialized technician training for operation and complex software maintenance. Opportunities arise from the global expansion of the automotive aftermarket in developing nations, coupled with the potential for integrating these systems into comprehensive Industry 4.0 shop management ecosystems, offering connectivity and remote diagnostics.

Impact forces currently shaping the competitive landscape are dominated by technological disruption and regulatory shifts. The rapid development of non-contact sensor technology and 3D machine vision is continually raising the standard for measurement precision, forcing existing market players to constantly innovate or face obsolescence. Furthermore, increasingly stringent vehicle safety regulations, particularly in developed regions regarding tire wear and ADAS functionality, compel service providers to adopt high-precision alignment tools. The economic impact force relates to the rising labor costs in many regions, making the time-saving efficiency of clampless machines a crucial factor in driving faster ROI for service businesses.

The shift towards electrification serves as a significant structural impact force. Electric vehicles often possess different weight distributions, higher torque outputs, and unique suspension geometries optimized for battery integration, demanding highly specialized and accurate alignment procedures. Clampless technology is particularly suited for EVs due to its non-damaging nature, protecting specialized wheels and sensitive electronic components. This technological convergence and regulatory environment collectively ensure that the market for clampless alignment machines remains on a steep growth trajectory, prioritizing precision and speed over cost considerations in high-value service environments.

Segmentation Analysis

The Clampless Alignment Machine Market is comprehensively segmented based on technology type, application, and primary end-user, allowing for a detailed understanding of market dynamics across diverse operational environments. Technology segmentation differentiates between high-resolution 3D imaging systems, which offer rapid, comprehensive measurements using multiple cameras and reflective targets, and highly accurate sensor-based systems, which often rely on advanced inertial measurement units (IMUs) or laser technology for highly repeatable, albeit sometimes slower, measurements. Understanding these technological nuances is crucial for manufacturers to tailor product offerings to specific performance requirements and cost sensitivities across different geographical regions.

Segmentation by application primarily distinguishes between passenger vehicles and commercial vehicles (including light and heavy trucks). Passenger vehicles represent the largest and most dynamic segment, driven by the massive global volume of personal automobiles and the increasing complexity of modern consumer vehicle suspension and safety systems. The commercial vehicle segment, while smaller in volume, demands extremely robust and highly durable alignment systems capable of handling large wheelbases and heavy loads, often prioritizing long-term reliability and minimal service downtime over ultimate speed. End-user categorization further refines the market view by grouping demand into automotive dealerships, independent repair shops (garages), and specialized tire service centers, each having unique procurement requirements and volume throughput needs.

- Technology Type:

- 3D Imaging Systems

- Sensor/Laser-based Systems

- Hybrid Systems

- Application:

- Passenger Vehicles

- Commercial Vehicles (Light Duty, Heavy Duty)

- End-User:

- Authorized Dealerships

- Independent Garages and Repair Shops

- Tire and Specialty Service Centers

- Fleet Maintenance Organizations

Value Chain Analysis For Clampless Alignment Machine Market

The value chain for the Clampless Alignment Machine Market begins with sophisticated upstream activities focused heavily on R&D and the sourcing of high-precision components. Key upstream suppliers include manufacturers of high-resolution industrial cameras, advanced laser sensors, complex inertial measurement units (IMUs), and specialized software developers providing proprietary algorithms for 3D modeling and data analysis. The cost structure at this stage is highly sensitive to fluctuations in the global semiconductor and optics markets. Manufacturers of the alignment machines concentrate on system integration, calibration accuracy, and proprietary software development, which constitutes the core intellectual property and competitive advantage.

The downstream segment of the value chain is focused on efficient distribution, installation, training, and robust after-sales support. Due to the high investment nature and technological complexity of clampless machines, specialized distribution channels are critical. Direct channels involve manufacturers selling directly to large dealership groups or major fleet operators, enabling personalized sales consultations, detailed integration planning, and high-level technical support. Indirect channels utilize specialized automotive equipment distributors and local dealers who provide sales reach to smaller, independent garages and manage local installation logistics and immediate technical assistance.

After-sales service—including software updates, remote diagnostics, and technician training—is crucial and represents a growing revenue stream, often delivered via digital platforms. The distribution channel selection significantly impacts the final customer relationship and profitability. Direct sales ensure higher margins and greater control over brand image, while indirect channels provide market penetration and localized support, particularly vital in geographically dispersed regions. The shift towards connected machines means that software maintenance and data subscription services are rapidly becoming indispensable components of the downstream value capture.

Clampless Alignment Machine Market Potential Customers

The potential customer base for Clampless Alignment Machines is concentrated within the automotive service and maintenance ecosystem, characterized by institutions requiring high throughput, unparalleled measurement precision, and a commitment to servicing late-model or specialized vehicles. Authorized dealerships of major automotive OEMs are prime buyers. These entities must adhere to strict manufacturer service protocols, particularly concerning new vehicle warranties and the complex calibration requirements of vehicles equipped with ADAS. Dealerships often prioritize technology that reduces labor time and ensures 100% adherence to specific OEM standards, making clampless, AI-integrated systems highly desirable.

Independent, large-scale repair facilities and high-volume tire service centers constitute the second major customer segment. As independent shops compete directly with dealerships, investing in advanced technology like clampless alignment systems is essential to attract premium repair work and maintain a competitive edge. These customers value the speed of setup and the reliability of measurement, which directly translate into maximized bay productivity and higher hourly revenue generation. The ability of clampless systems to handle a wide variety of wheel types without damage is a significant draw for specialty tire retailers.

Furthermore, large commercial fleet operators and governmental maintenance workshops represent a growing niche. These organizations require alignment machines capable of servicing a diverse fleet of vehicles—from passenger cars to heavy-duty trucks—rapidly and repeatedly. For fleets, slight misalignment translates directly into significantly higher fuel consumption and premature tire replacement costs. Therefore, the investment in high-precision clampless technology is justified by long-term operational savings and improved safety metrics, positioning fleet management as a crucial end-user segment focused on total cost of ownership (TCO) reduction.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,980 Million |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hunter Engineering Company, Snap-on Incorporated (John Bean & Hofmann), Bosch Automotive Service Solutions, Beissbarth GmbH, Rotary Lift (Dover Corporation), Actia Group, Corghi S.p.A., Technovector, Ravaglioli S.p.A., Superflow (Hicklin Engineering), CEMB S.p.A., Everest Equipment, Guangzhou GZ Industrial Co., LTD, ISTOBAL S.A., Launch Tech Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Clampless Alignment Machine Market Key Technology Landscape

The technological landscape of the Clampless Alignment Machine Market is dominated by sophisticated non-contact measurement methodologies, primarily revolving around 3D imaging and advanced sensor arrays. 3D imaging systems, often considered the market standard for high-throughput service centers, utilize multiple high-resolution industrial cameras positioned around the vehicle lift to capture images of proprietary target plates or reflective markers attached quickly to the wheel surface, without physical clamping onto the rim. Proprietary software then processes these images to create a highly accurate, three-dimensional model of the vehicle's suspension geometry, delivering results with sub-millimeter precision in a matter of seconds. This technology excels in speed, robustness against ambient light variations, and ease of use, minimizing reliance on mechanical calibration.

A secondary, yet rapidly evolving, technological component involves advanced sensor-based systems, including those utilizing laser scanners and Inertial Measurement Units (IMUs). Laser-based clampless systems project beams onto the wheel or tire sidewall and measure reflections to determine angle deviations, offering robust accuracy, particularly in environments where traditional target visibility might be compromised. IMU technology, borrowed heavily from aerospace and robotics, provides highly precise data on rotation and angular velocity, translating into reliable caster measurements and offering enhanced portability compared to camera-tower systems. These sensor technologies are particularly favored in applications requiring mobility or specialized measurements, providing viable alternatives to full 3D towers.

The integration of connectivity and software intelligence represents the most crucial technological convergence. Modern clampless machines are invariably Internet of Things (IoT) devices, utilizing cloud connectivity for automatic software updates, remote diagnostics, and standardized data storage. This connectivity is vital for accessing constantly updated OEM specifications necessary for ADAS calibration. Furthermore, machine learning algorithms are being embedded to manage the complexity of ADAS alignment, ensuring that the electronic calibration of sensors (such as radar and lidar) aligns perfectly with the newly corrected mechanical geometry. This technological trajectory confirms the market's movement toward fully automated diagnostic and correction systems.

Regional Highlights

- North America: North America holds a substantial market share, driven by a high vehicle parc concentration of luxury and technology-laden vehicles, which frequently require high-precision servicing. Stringent vehicle safety standards and high labor costs incentivize rapid adoption of efficient, automated clampless alignment technology. The presence of major automotive equipment manufacturers and extensive dealership networks also facilitates early market penetration of the latest technological iterations, particularly in the United States.

- Europe: Europe is a mature market characterized by early adoption of advanced automotive maintenance technology and a strong focus on environmental and safety regulations. Countries like Germany, the UK, and France show high demand, fueled by the accelerating transition to electric vehicles and hybrid models, which necessitate non-contact, high-accuracy alignment procedures. The regional market is highly competitive, emphasizing integration capabilities and compliance with Euro NCAP safety standards concerning ADAS.

- Asia Pacific (APAC): APAC is poised to be the fastest-growing regional market throughout the forecast period. This growth is underpinned by the massive expansion of the middle-class population, leading to explosive growth in vehicle ownership (especially in China, India, and Southeast Asia). While currently focused on capacity building, the increasing complexity of locally manufactured vehicles and the rise of advanced service centers in metropolitan areas are driving significant investment in modern clampless systems to upgrade existing infrastructure.

- Latin America: This region exhibits moderate but steady growth, largely concentrated in established economies like Brazil and Mexico. Market growth here is primarily driven by the need for enhanced durability and basic high-speed alignment solutions, often favoring cost-effective 3D imaging systems that provide a balance between precision and investment cost. Infrastructure development and rising standards in vehicle servicing are key indicators for future expansion.

- Middle East and Africa (MEA): The MEA market is an emerging segment, with demand concentrated in the GCC states (Saudi Arabia, UAE) due to high per capita income and a preference for premium vehicles. Investment is generally tied to luxury vehicle dealerships and large oil/gas fleet maintenance operations. The adoption rate is selective but high-value, focusing on premium equipment to serve the specialized needs of high-performance vehicles and large commercial fleets operating in harsh environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Clampless Alignment Machine Market.- Hunter Engineering Company

- Snap-on Incorporated (John Bean & Hofmann)

- Bosch Automotive Service Solutions

- Beissbarth GmbH

- Corghi S.p.A.

- Rotary Lift (Dover Corporation)

- Actia Group

- Technovector

- Ravaglioli S.p.A.

- CEMB S.p.A.

- Superflow (Hicklin Engineering)

- Launch Tech Co. Ltd.

- Guangzhou GZ Industrial Co., LTD

- Everest Equipment

- ISTOBAL S.A.

- Vamag Srl

- Stertil-Koni (Wabash)

- AVL List GmbH

Frequently Asked Questions

Analyze common user questions about the Clampless Alignment Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of clampless alignment systems over traditional clamped systems?

The primary technical advantage is the elimination of metal-to-metal contact with the wheel rim, thereby preventing wheel damage and improving measurement accuracy by bypassing the potential runout errors introduced by mechanical clamps. They use non-contact 3D imaging or sensors for faster, highly repeatable results.

How is the growth of Electric Vehicles (EVs) affecting the demand for clampless alignment machines?

EVs significantly boost demand because their specialized suspension systems and unique weight distribution require higher precision alignment. Furthermore, clampless systems prevent damage to the unique and often expensive wheels commonly found on EVs, making them essential service tools.

Are clampless alignment machines required for mandatory ADAS (Advanced Driver-Assistance Systems) calibration?

While the machine itself doesn't perform the final ADAS calibration, highly precise wheel alignment is a mandatory prerequisite for accurate electronic sensor calibration (e.g., radar and camera). Clampless systems offer the precision necessary to meet the strict geometrical standards required before ADAS software recalibration can commence effectively.

What is the typical ROI period for independent repair shops investing in clampless alignment technology?

The ROI period typically ranges between 18 to 36 months, highly dependent on shop volume and local labor rates. The rapid setup time (often reducing bay time by 10-15 minutes per vehicle) and the ability to charge a premium for high-precision, non-damaging service accelerate the return on investment compared to older, slower systems.

Which geographical region is expected to show the highest CAGR for this market through 2033?

The Asia Pacific (APAC) region, specifically driven by market expansion and automotive technological adoption in China and India, is projected to demonstrate the highest Compound Annual Growth Rate (CAGR) due to rapid infrastructure modernization and increasing vehicle parc size requiring modern service solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager