Claritin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432047 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Claritin Market Size

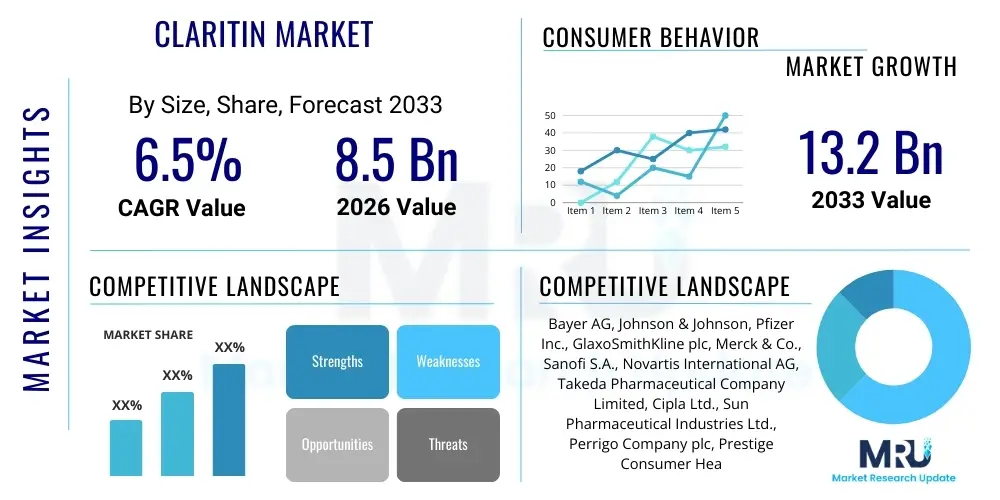

The Claritin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 13.2 Billion by the end of the forecast period in 2033.

Claritin Market introduction

The Claritin Market, defined by the sale of loratadine-based antihistamine products, represents a significant segment within the global over-the-counter (OTC) and prescription allergy relief pharmaceutical sector. Loratadine is a second-generation H1 receptor antagonist used primarily for the treatment of symptoms associated with seasonal allergic rhinitis (hay fever) and chronic spontaneous urticaria (hives). Claritin (loratadine) is widely recognized globally due to its non-drowsy formulation compared to older antihistamines, making it highly suitable for daily use without impairing cognitive or motor function, which has cemented its status as a preferred allergy management solution for millions of consumers worldwide seeking effective symptom control without the sedative effects.

Major applications of Claritin products encompass the alleviation of sneezing, runny nose, itchy or watery eyes, and itching of the throat or nose caused by allergic reactions to pollen, dust mites, pet dander, and mold. The market’s sustained growth is fundamentally driven by the escalating global prevalence of allergies, attributed largely to environmental factors, climate change, and increased urbanization leading to higher exposure to airborne allergens. Furthermore, the strategic shift of Claritin products from prescription status to OTC accessibility in key global markets has dramatically expanded the consumer base, enabling self-medication and immediate access to treatment.

Key driving factors include robust consumer awareness campaigns promoting allergy management, favorable regulatory environments supporting the switch to OTC status for proven safe medications, and continuous product innovation such as the development of combination products and novel delivery systems (e.g., orally disintegrating tablets and liquid gels). The inherent benefits of Claritin, such as rapid onset of action and 24-hour symptom relief, solidify its competitive position against both branded and generic rivals, underpinning the market's trajectory toward sustained expansion across developed and emerging economies alike. The persistent need for effective, convenient, and safe allergy relief remains the paramount catalyst for market advancement.

Claritin Market Executive Summary

The Claritin market is exhibiting robust growth, propelled primarily by enduring epidemiological trends showing increased allergy incidence globally and strategic expansion through enhanced distribution channels, particularly online platforms. Current business trends indicate a strong focus on differentiation beyond the core loratadine compound, with leading companies investing in line extensions such as Claritin-D (containing a decongestant) and pediatric formulations, addressing diverse consumer needs. Generic erosion remains a structural constraint; however, aggressive branding, consumer loyalty programs, and superior packaging innovations by the brand holder (Bayer AG) help maintain premium market positioning and revenue stability despite patent expiration.

Regionally, North America maintains the largest market share due to high allergy prevalence, established healthcare infrastructure, and high consumer spending power on OTC pharmaceuticals. However, the Asia Pacific (APAC) region is forecasted to display the highest growth rate, driven by rapidly improving access to healthcare, rising disposable incomes, and increasing urbanization contributing to higher sensitization rates among populations in countries like China and India. European markets, characterized by stringent regulatory environments, show steady growth, focusing on seasonal peaks and integrating pharmacy advisory services to drive informed sales.

Segment trends highlight the dominance of the Adult Age Group segment and the Tablet Product Type segment, reflecting the traditional usage patterns of antihistamines. Crucially, the Distribution Channel segment sees a dynamic shift toward Online Pharmacies and E-commerce platforms, offering convenience and often lower prices, compelling traditional Retail Pharmacies to enhance their in-store advisory services to retain competitive advantage. The sustained commercial viability of the Claritin brand relies on its ability to effectively navigate the dual pressures of generic competition and the need for perpetual product efficacy claims in a saturated pharmaceutical landscape.

AI Impact Analysis on Claritin Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Claritin market predominantly revolve around three critical areas: personalized allergy management, optimization of clinical trials for new formulations, and enhancing supply chain efficiency during peak allergy seasons. Users are highly concerned about how AI-driven predictive modeling of pollen counts and environmental triggers could lead to highly personalized dosing or preemptive advice, questioning whether current Claritin products can integrate seamlessly with such advanced digital health solutions. There is also significant interest in AI's role in accelerating the development process, specifically reducing the time and cost associated with drug reformulation and identifying new biomarkers related to treatment efficacy and side effects.

The key themes emerging from user concerns center on data privacy regarding health metrics used for personalized treatment recommendations and the accuracy of predictive algorithms in diverse climatic zones. Expectations are high that AI will revolutionize consumer interaction by providing dynamic, localized information about allergy risks, potentially integrating with smart home devices to manage indoor allergens. Furthermore, users anticipate that generative AI will significantly improve pharmacovigilance by rapidly analyzing vast amounts of post-market surveillance data, ensuring Claritin's continued safety profile and identifying rare adverse events faster than traditional methods, ultimately enhancing consumer trust in the established brand.

- AI-driven predictive analytics optimize Claritin inventory and distribution based on real-time local allergen maps.

- Generative AI accelerates new formulation research by simulating drug interactions and optimizing compound stability.

- Machine Learning algorithms enhance pharmacovigilance, monitoring millions of consumer reports for potential adverse reactions.

- AI-powered diagnostic tools improve the accurate identification of specific allergens, allowing for precise recommendations for Claritin usage.

- Personalized digital health assistants use AI to monitor user adherence and provide timely reminders for daily Claritin intake.

DRO & Impact Forces Of Claritin Market

The Claritin market dynamics are strongly shaped by a combination of inherent growth accelerators (Drivers), structural limitations (Restraints), strategic future possibilities (Opportunities), and external competitive and regulatory pressures (Impact Forces). The primary Driver is the alarming rise in allergic rhinitis prevalence globally, necessitating consistent and accessible antihistamine solutions. This trend is amplified by the continued regulatory approval allowing Claritin's broad Over-The-Counter (OTC) availability across major economies, significantly enhancing patient access without the need for a physician's prescription. Furthermore, Claritin's established non-sedating profile remains a crucial competitive advantage, aligning perfectly with consumer demand for medications that do not compromise productivity.

However, the market faces considerable structural Restraints, most notably intense competition from generic loratadine manufacturers who can offer products at significantly lower price points following patent expiry. This generic erosion pressures the profit margins of branded products. Another constraint involves potential consumer concerns regarding the long-term efficacy and side effect profile of antihistamines, prompting some patients to explore alternative, non-pharmacological therapies or seeking newer generation prescription options. Regulatory hurdles, particularly in obtaining approval for new combination products or label expansions, also represent ongoing, time-consuming restraints.

Opportunities for market expansion are substantial, especially through penetration into untapped emerging markets in APAC and Latin America, where growing middle classes are increasingly demanding branded, high-quality OTC healthcare products. Developing novel combination therapies, such as combining loratadine with mast cell stabilizers or nasal steroids, represents a strong product line extension strategy. Additionally, leveraging digital platforms for direct-to-consumer marketing, coupled with AI-driven predictive modeling for targeted marketing during peak allergy seasons, presents significant avenues for growth. The major Impact Force remains the rapid pace of competitive innovation, requiring continuous investment in brand awareness and clinical data generation to maintain market superiority against both existing generic rivals and emerging novel prescription drugs.

Segmentation Analysis

The Claritin market is systematically segmented based on Product Type, Age Group, and Distribution Channel, reflecting diverse consumer preferences and purchasing behaviors within the allergy relief landscape. Understanding these segments is crucial for manufacturers to tailor their marketing strategies, optimize product portfolios, and ensure efficient supply chain management, particularly in seasonal and geographically varied markets. The performance of these segments is interdependent; for instance, the increasing adoption of online distribution channels significantly impacts the volume sold through traditional retail pharmacies, while the Age Group segmentation dictates the required formulation types (e.g., syrups for pediatric use versus tablets for adults).

Analysis of Product Type reveals that oral tablets remain the bedrock of the market due to familiarity and ease of use, although the demand for specialized formats like chewable tablets and liquid gels is growing, catering to consumers seeking enhanced convenience or faster relief. The Age Group segmentation highlights the massive market size attributed to adults, who often manage chronic, self-diagnosed allergies, juxtaposed against the highly sensitive pediatric segment which requires specific, measured dosing and pleasant flavors. Furthermore, the Distribution Channel segmentation illustrates the industry's response to changing consumer convenience demands, balancing the critical role of professional advice offered by traditional pharmacies with the price sensitivity and accessibility offered by e-commerce platforms, necessitating omnichannel sales strategies for market leaders.

- Product Type

- Tablets (Standard and Orally Disintegrating)

- Syrups/Liquids

- Liquid Gels

- Injectables (Niche/Specific use)

- Age Group

- Adult (18 years and above)

- Pediatric (Under 18 years)

- Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies/E-commerce

Value Chain Analysis For Claritin Market

The Claritin market value chain commences with the upstream activities centered around the sourcing and synthesis of the active pharmaceutical ingredient (API), Loratadine. This stage involves complex chemical manufacturing processes, strict adherence to Good Manufacturing Practices (GMP), and sourcing of high-purity raw materials, typically dominated by specialized chemical and pharmaceutical intermediate suppliers in Asia. Upstream analysis focuses heavily on cost efficiency, quality control, and securing long-term supply contracts to mitigate risks associated with fluctuating material prices and regulatory compliance, particularly concerning impurity profiling and stability testing of the API before it moves into the formulation stage.

Midstream activities involve the formulation, manufacturing, packaging, and branding of the final Claritin product (e.g., tablets, syrups). This step is capital-intensive and requires advanced pharmaceutical manufacturing facilities capable of high-volume production under sterile conditions. Quality assurance is paramount here, ensuring dose accuracy, shelf-life stability, and compliance with diverse international packaging regulations (e.g., child-resistant closures, multi-language labeling). Strong branding and marketing investments are integrated into this midstream process to maintain the premium status of Claritin against generic alternatives, translating manufacturing quality into brand value.

The downstream distribution channel analysis reveals a complex network involving wholesale distributors, large retail chains, hospital group purchasing organizations, and increasingly, direct-to-consumer (DTC) sales through online pharmacies. Direct distribution is usually limited to strategic partnerships or specific regional models, while indirect distribution through wholesalers remains the dominant path, ensuring broad market penetration. The efficiency of this downstream segment is critical during peak seasonal allergy periods; logistics management, cold chain integrity (where applicable for liquid forms), and robust inventory systems are essential to prevent stockouts and capitalize fully on seasonal demand spikes. The shift towards online distribution requires integrating digital inventory management and sophisticated last-mile delivery solutions.

Claritin Market Potential Customers

The primary end-users and potential customers of Claritin products are individuals experiencing symptoms related to Type I hypersensitivity reactions, primarily allergic rhinitis (seasonal and perennial) and chronic idiopathic urticaria (hives). This customer base is highly diverse, spanning all age groups and demographics, but it is segmented by the frequency and severity of allergic symptoms. A significant portion of the market comprises self-medicating adults who require daily, non-drowsy relief to maintain productivity, valuing the 24-hour efficacy and ease of access provided by the OTC status of the product. These individuals are often repeat purchasers who exhibit strong brand loyalty due to established trust in the medication’s reliability and safety profile.

A crucial secondary customer segment includes pediatric patients and their caregivers. This group requires specialized formulations, such as liquid syrups or chewable tablets, necessitating clear, concise dosing instructions and palatable flavors, often requiring consultation with pediatricians or pharmacists before purchase. Furthermore, the market encompasses individuals who suffer from chronic, year-round allergies triggered by indoor irritants like dust mites and pet dander, requiring continuous or long-term medication management. These chronic users are particularly sensitive to price point and the ability to purchase in bulk, which drives them toward high-volume online distribution channels.

Finally, healthcare professionals, including general practitioners, allergists, and pharmacists, serve as key influencers and indirect customers. Their prescribing habits (where prescription status still applies) and recommendation patterns heavily influence consumer choices, particularly when distinguishing between Claritin and generic alternatives or newer generation prescription drugs. Pharmacists, in particular, play a vital role in OTC settings, providing the necessary guidance that reinforces the safety and effectiveness of the Claritin brand, thereby solidifying the purchasing decision for first-time users or those transitioning from competitor brands.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 13.2 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bayer AG, Johnson & Johnson, Pfizer Inc., GlaxoSmithKline plc, Merck & Co., Sanofi S.A., Novartis International AG, Takeda Pharmaceutical Company Limited, Cipla Ltd., Sun Pharmaceutical Industries Ltd., Perrigo Company plc, Prestige Consumer Healthcare Inc., Teva Pharmaceutical Industries Ltd., Alcon, Zydus Lifesciences Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Claritin Market Key Technology Landscape

The technology landscape supporting the Claritin market is primarily focused on advanced pharmaceutical formulation techniques and sophisticated digital platforms for consumer engagement and supply chain optimization. In formulation, advancements revolve around enhancing bioavailability and speed of onset. This includes the widespread adoption of Orally Disintegrating Tablets (ODTs), which use specialized excipients and manufacturing techniques to dissolve rapidly on the tongue without water, providing quicker relief and enhanced convenience, particularly for pediatric and elderly patients. Microencapsulation and nanotechnology are also being explored to potentially improve drug stability and controlled release profiles, although standard Claritin remains predominantly a conventional oral tablet formulation.

Furthermore, technology plays a pivotal role in manufacturing efficiency and quality control. Automated high-throughput manufacturing lines incorporating sensors and real-time monitoring systems ensure consistent dosing and product purity across billions of tablets produced annually. This adherence to Pharmaceutical Quality System (PQS) standards is technologically driven, using data analytics to predict and prevent potential batch failures. The continuous investment in robust packaging technology, ensuring tamper-evidence and extended shelf-life under various climate conditions, is essential for global distribution compliance.

On the consumer front, the technological ecosystem is increasingly digital. Key technologies include e-commerce integration for online pharmacy sales, enabling streamlined purchasing and subscription models. Crucially, leveraging Big Data and Artificial Intelligence (AI) to analyze allergy patterns (e.g., combining weather data, air quality reports, and localized pollen counts) allows manufacturers to execute highly targeted marketing campaigns and dynamically adjust inventory levels. Telemedicine platforms also facilitate virtual consultations, often leading to professional recommendations for trusted OTC brands like Claritin, integrating the product into the broader digital health continuum.

Regional Highlights

The global Claritin market exhibits significant regional variation in terms of market maturity, regulatory environment, and growth trajectory, necessitating tailored strategies for market penetration and maintenance across continents.

- North America (U.S. and Canada): This region is characterized by high market maturity, high per capita spending on healthcare, and the pervasive culture of self-medication facilitated by the established OTC status of Claritin. North America accounts for the largest revenue share globally, driven by exceptionally high rates of seasonal and perennial allergic rhinitis. The competitive landscape is highly intense due to strong generic presence, requiring continuous brand investment, innovation in combination therapies (e.g., Claritin-D), and reliance on extensive retail and online distribution networks to maintain market leadership.

- Europe (Germany, France, UK): European growth is steady, supported by high regulatory standards and strong consumer preference for clinically proven, established brands. The market structure varies significantly by country, with some regions maintaining stricter controls on OTC status. Demand peaks reliably during spring and summer allergy seasons. The strategic focus here is on partnerships with local pharmacy chains and ensuring robust clinical data communication to support pharmacist recommendations against generic competition.

- Asia Pacific (APAC) (China, India, Japan): APAC is the fastest-growing region, fueled by rapid urbanization, which correlates with increasing air pollution and higher allergy sensitization rates. Market expansion is driven by increasing disposable income, improving healthcare access, and the transition of populations from traditional remedies to Western pharmaceutical products. Challenges include navigating diverse regulatory frameworks and establishing robust cold chain logistics in developing economies.

- Latin America (LATAM): This region offers significant untapped potential. Growth is driven by economic stabilization and improving access to imported and branded pharmaceuticals. Pricing sensitivity is a major factor, requiring focused efforts on mid-tier pricing strategies and leveraging local distribution partners to reach diverse geographic areas.

- Middle East and Africa (MEA): The MEA market is developing, with growth concentrated in high-income Gulf Cooperation Council (GCC) countries. Market dynamics are heavily influenced by stringent government import controls and reliance on seasonal tourism demographics. Opportunities exist through government tenders and targeted marketing to expatriate populations seeking familiar international brands.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Claritin Market.- Bayer AG (Primary Claritin Brand Holder)

- Johnson & Johnson

- Pfizer Inc.

- GlaxoSmithKline plc

- Merck & Co.

- Sanofi S.A.

- Novartis International AG

- Takeda Pharmaceutical Company Limited

- Cipla Ltd.

- Sun Pharmaceutical Industries Ltd.

- Perrigo Company plc

- Prestige Consumer Healthcare Inc.

- Teva Pharmaceutical Industries Ltd.

- Alcon

- Zydus Lifesciences Ltd.

- Aurobindo Pharma Limited

- Dr. Reddy's Laboratories Ltd.

- Mylan N.V. (Viatris)

- Lannett Company, Inc.

- Glenmark Pharmaceuticals Limited

Frequently Asked Questions

Analyze common user questions about the Claritin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate of the Claritin Market?

The Claritin Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period spanning 2026 to 2033, driven by increasing global allergy prevalence and enhanced OTC accessibility.

How is generic competition impacting the branded Claritin segment?

Generic competition from manufacturers of loratadine is intense and exerts downward pressure on branded Claritin pricing and market share; however, the brand sustains its revenue through significant consumer loyalty, strategic product line extensions, and aggressive marketing differentiation.

Which distribution channel is experiencing the fastest growth for Claritin products?

Online Pharmacies and E-commerce platforms are recording the fastest growth rate in the Claritin distribution channel segment, capitalizing on consumer demand for convenience, 24/7 accessibility, and competitive pricing for bulk purchases of allergy medication.

What role does AI technology play in the future development of the Claritin Market?

AI is increasingly used to optimize the Claritin market through predictive modeling of seasonal allergy outbreaks for targeted marketing and supply chain optimization, and by enhancing pharmacovigilance to ensure ongoing safety monitoring of the product across diverse patient populations.

Which region holds the largest market share for Claritin and why?

North America holds the largest market share due to its established OTC culture, high prevalence of allergic rhinitis, high consumer purchasing power, and robust infrastructure supporting widespread distribution and advertising of allergy relief solutions.

What is the primary driver accelerating the demand for Claritin products globally?

The primary driver is the significant and sustained increase in the global prevalence of allergic rhinitis, compounded by environmental factors such as climate change and urbanization that extend allergy seasons and increase exposure to airborne allergens.

Are there specific product types driving market expansion within the Claritin portfolio?

While standard tablets remain dominant, specialized product types such as Orally Disintegrating Tablets (ODTs) and combination products (e.g., with decongestants) are key expansion drivers, addressing specific consumer needs for convenience and multifaceted symptom relief.

What are the main risks associated with the Claritin value chain?

Major risks include reliance on concentrated sourcing of the active pharmaceutical ingredient (API) from Asia, potential regulatory non-compliance in diverse international markets, and maintaining logistical efficiency during short, intense seasonal demand peaks.

How is the market addressing the needs of pediatric consumers?

The pediatric segment is addressed through specialized, palatable formulations like liquid syrups and chewable tablets, ensuring accurate dosing and ease of administration for children, supported by specific regulatory approvals and parental trust in the brand.

What future opportunities exist for key players in the Claritin market?

Key opportunities involve strategic expansion into high-growth emerging markets in Asia Pacific, the development of innovative combination drug therapies, and the establishment of robust direct-to-consumer digital engagement platforms.

Does the Claritin brand face competition from newer prescription antihistamines?

Yes, while Claritin dominates the OTC space, it faces indirect competition from newer, third-generation prescription antihistamines that claim enhanced efficacy or reduced off-target effects, compelling Claritin to continuously reaffirm its clinical profile and safety track record in promotional material.

What regulatory trends are impacting the availability of Claritin?

Favorable regulatory trends, particularly the continued global transition of loratadine from prescription status to Over-The-Counter (OTC) status, are expanding market access and simplifying the purchasing process for consumers, supporting overall market growth.

How is manufacturing technology evolving for Claritin products?

Manufacturing technology is evolving through the implementation of automated high-speed production lines, real-time quality assurance systems based on data analytics, and continuous efforts in microencapsulation techniques to potentially improve drug delivery characteristics.

What factors differentiate Claritin from generic loratadine products?

Differentiation relies on powerful brand recognition, perceived superior quality assurance, consistent supply chain reliability, specialized proprietary formulations (e.g., certain ODT variants), and extensive consumer-facing marketing support and educational initiatives.

What impact does climate change have on the Claritin market?

Climate change extends the length and intensity of pollen seasons across many regions, leading to a prolonged period of high allergy incidence and, consequently, increasing the duration of peak demand for products like Claritin beyond traditional seasonal windows.

Which Age Group segment contributes most significantly to market revenue?

The Adult Age Group segment contributes the most significant portion of market revenue, primarily because adults constitute the largest demographic for self-medication and chronic allergy management, often requiring long-term, non-sedating relief.

How important are pharmacists in the distribution process for Claritin?

Pharmacists remain critically important in the distribution process, particularly in OTC settings, acting as trusted advisors who provide professional recommendations, differentiate branded Claritin from generics, and offer essential guidance on appropriate usage and symptom management.

What is the forecast market size for Claritin by 2033?

The Claritin Market is projected to reach an estimated value of USD 13.2 Billion by the conclusion of the forecast period in 2033, reflecting stable annual growth based on allergy incidence and market penetration.

What considerations are important for marketing Claritin in emerging markets?

Marketing in emerging markets requires focusing on affordability, building foundational brand trust in less saturated environments, adapting to local distribution infrastructure challenges, and emphasizing the product’s safety and efficacy profile to a newly informed consumer base.

Does Claritin's efficacy align with modern consumer expectations for allergy relief?

Yes, Claritin's non-drowsy, 24-hour efficacy profile continues to align strongly with modern consumer expectations for effective allergy relief that supports daily productivity and minimizes impairment, maintaining its strong competitive advantage over older, sedating antihistamines.

How does the market address seasonal fluctuations in demand?

The market addresses seasonal fluctuations through rigorous supply chain planning, leveraging predictive analytics based on weather and pollen forecasts, and pre-positioning inventory in key distribution centers to ensure product availability during peak spring and summer allergy cycles.

What are the key concerns regarding the side effects of Claritin among consumers?

While Claritin is generally non-sedating, consumer concerns often relate to potential minor side effects like headache or dry mouth, and increasingly, concerns regarding long-term usage and potential loss of efficacy (tachyphylaxis), which necessitate continuous consumer education from the brand holder.

How has the COVID-19 pandemic structurally influenced the Claritin market?

The COVID-19 pandemic structurally accelerated the reliance on online pharmacies for purchasing OTC medications and increased consumer awareness regarding the differentiation between allergy symptoms and viral symptoms, temporarily influencing purchasing patterns and long-term channel preferences.

What makes the Pediatric segment particularly sensitive for market players?

The Pediatric segment is highly sensitive due to stricter dosing requirements, the need for appealing flavors, and heightened parental concern regarding drug safety and side effects, making clinical reassurance and professional recommendation crucial for market penetration.

What is the significance of the shift to OTC status for Claritin?

The shift to Over-The-Counter (OTC) status was pivotal, dramatically expanding the consumer base by removing the necessity for a physician's visit, thereby increasing market volume and establishing Claritin as a globally recognized self-care staple for allergy management.

How do technological advancements improve the end-user experience of Claritin?

Technological advancements improve the end-user experience through easier access via efficient e-commerce platforms, faster onset of action achieved by specialized formulations like ODTs, and enhanced consumer support via digital allergy monitoring tools.

What are the primary restraints on market expansion in developed economies?

The primary restraints in developed economies are market saturation, fierce price competition from generic alternatives, and the introduction of newer, highly effective prescription antihistamine and allergy treatment options, limiting significant incremental growth for the established brand.

How is intellectual property managed for the Claritin brand post-patent expiry?

Post-patent expiry, intellectual property protection focuses on trademark registration, brand loyalty, proprietary formulation improvements, unique packaging designs, and maintaining clinical data superiority to legally differentiate the branded product from commodity generic versions.

What is the role of combination therapies in the current Claritin product strategy?

Combination therapies, such as combining loratadine with a decongestant (like pseudoephedrine in Claritin-D), are critical for addressing multi-symptom relief and maintaining premium price points, catering to consumers requiring solutions beyond simple antihistamine action.

How do different global regions vary in terms of preferred Claritin product type?

North America and Europe widely prefer standard and ODT tablets due to convenience, while some Asian and Latin American markets show higher preferences for liquid syrups or chewable tablets, influenced by local prescribing practices and patient demographics.

What is the projected value chain element most likely to see cost reduction?

The upstream element, specifically the sourcing and synthesis of the API (Loratadine), is most likely to see continuous cost reduction due to intensified competition among global bulk drug suppliers and optimization of chemical synthesis processes.

Which company is the key brand holder for Claritin and its major variants?

Bayer AG is the key brand holder, responsible for the manufacturing, marketing, and distribution of the branded Claritin portfolio, including its various forms and combination products, across major global territories.

How does the segmentation by Age Group influence marketing efforts?

Age Group segmentation dictates highly specialized marketing efforts: adult campaigns focus on productivity and convenience, while pediatric campaigns target parents and emphasize safety, taste, and pharmacist recommendations.

What specific technological advancements support supply chain resilience during seasonal peaks?

Supply chain resilience is supported by real-time inventory tracking, AI-powered demand forecasting that integrates environmental data, and automated warehousing systems that expedite fulfillment during periods of sudden, massive seasonal demand spikes.

What is the primary difference in consumer behavior between chronic and seasonal Claritin users?

Seasonal users purchase intermittently, often impulsively at retail pharmacies during symptom onset, whereas chronic users seek continuous, long-term supply, prioritizing subscription models, bulk purchasing, and price sensitivity via online distribution channels.

How does the rise of personalized medicine affect the non-prescription Claritin segment?

The rise of personalized medicine creates both a challenge and an opportunity; it increases consumer demand for targeted therapies, pushing Claritin toward developing digital tools that offer personalized usage guidance while reinforcing the product's proven efficacy for broad allergy symptom relief.

What role do environmental factors, beyond pollen, play in market demand?

Environmental factors such as increasing levels of indoor allergens (dust mites, mold) driven by airtight modern housing, and higher levels of air pollution that exacerbate allergic airway inflammation, contribute significantly to the year-round, perennial demand for Claritin products.

How does the market ensure product stability and shelf-life for global distribution?

Product stability is ensured through rigorous quality control in formulation, use of advanced packaging materials that mitigate moisture and oxygen exposure, and extensive real-time stability testing programs compliant with International Conference on Harmonisation (ICH) guidelines for varying climatic zones.

What are the limitations of existing Claritin formulations in terms of speed of relief?

While Claritin is non-drowsy, its oral forms may take an hour or more for maximum effect. Limitations exist when comparing it to nasal sprays or immediate-release liquid solutions, driving ongoing research into faster-acting delivery systems like liquid gels.

How do governmental policies affect Claritin pricing strategies across regions?

Governmental policies significantly influence pricing. In regions where healthcare is highly regulated or subsidized (e.g., parts of Europe), pricing is constrained, whereas in free-market OTC environments like the U.S., pricing is determined more by brand value and competitive dynamics.

What consumer education initiatives are key for maintaining the Claritin brand image?

Key consumer education initiatives focus on clearly distinguishing Claritin's non-drowsy benefits from older antihistamines, educating on proper dosage during peak allergy seasons, and promoting the use of combination products for severe symptoms, thereby building informed brand loyalty.

What constitutes the 'Impact Forces' framework for the Claritin market?

Impact Forces primarily consist of intense competitive pressure from generic manufacturers, evolving regulatory scrutiny on drug safety, rapid technological advancements in digital health that influence consumer choices, and shifting public health crises (like pandemics) affecting purchasing behavior.

Why is the Asia Pacific region projected to be the fastest-growing market?

The APAC region is the fastest-growing due to its large, untapped consumer base, rapid economic development increasing affordability of branded OTC drugs, improving medical infrastructure, and severe urbanization leading to elevated allergen exposure and sensitization rates.

How do market leaders leverage digital marketing strategies during allergy season?

Market leaders leverage digital marketing by using geo-fencing and AI-driven targeting based on real-time local pollen counts and weather data, ensuring that advertisements for Claritin reach consumers precisely when their allergy symptoms are most likely to peak.

What is the significance of chronic spontaneous urticaria (hives) in the Claritin market?

Urticaria represents a critical niche market, as Claritin (loratadine) is a standard treatment option for chronic hives, providing sustained, non-sedating relief for long-term patients and ensuring a steady, non-seasonal demand segment for the product.

How does sustainability concern factor into Claritin product packaging and manufacturing?

Sustainability concerns are increasingly factored into packaging design, focusing on reducing plastic use, utilizing recycled materials, and optimizing package size for efficient transport, aligning with modern consumer preferences for environmentally conscious healthcare products.

What measures are taken to ensure the safety profile remains high in post-market surveillance?

Post-market surveillance involves continuous monitoring through pharmacovigilance systems, leveraging AI and machine learning to analyze global adverse event reports rapidly, and conducting real-world evidence (RWE) studies to ensure the long-term safety and tolerability of Claritin.

How important is intellectual property protection for pediatric formulations?

IP protection is essential for pediatric formulations (syrups, chewables) as these often involve secondary patents covering specific flavorings, dissolution characteristics, or unique combinations, which help the brand retain market exclusivity long after the API patent has expired.

What are the challenges for market entry in Latin America?

Challenges for market entry in Latin America include volatile economic conditions, currency fluctuations affecting import costs, complex and fragmented regulatory approval processes across different countries, and establishing robust logistical networks in diverse geographical territories.

How do competitive actions of other antihistamine brands influence Claritin's strategy?

Competitive actions, such as the launch of new generic versions or highly advertised newer-generation prescription brands, force Claritin to continuously invest heavily in advertising, clinical trials reaffirming efficacy, and defensive pricing strategies to protect its consumer base and retail shelf space.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager