Clay Planter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436708 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Clay Planter Market Size

The Clay Planter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $750 Million in 2026 and is projected to reach $1,100 Million by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the accelerating trend of interior decoration focused on natural and sustainable materials, coupled with the increasing adoption of urban gardening practices across developed and emerging economies. The inherent aesthetic appeal and breathable nature of clay make it a preferred medium over plastic or composite alternatives, driving stable consumer demand.

Clay Planter Market introduction

The Clay Planter Market encompasses the production, distribution, and sale of containers manufactured primarily from terracotta, ceramic, or earthenware clay, designed specifically for cultivating plants. These planters are differentiated by their porosity, which allows for crucial aeration and moisture management essential for optimal plant health. The product spectrum ranges from traditional unglazed terracotta pots, highly favored for their natural moisture wicking properties, to intricately glazed ceramic planters used extensively for decorative purposes in both residential and commercial settings. Major applications include indoor ornamental gardening, outdoor landscaping in patios and gardens, and specialized horticultural uses such as bonsai cultivation.

Key benefits driving market adoption include the material's breathability, which mitigates the risk of root rot; its significant weight, offering stability for larger plants; and its universally appealing, earthy aesthetic that complements diverse interior design styles, particularly biophilic design. The market growth is fundamentally driven by increased consumer interest in home decor, the surging popularity of DIY gardening and self-sufficiency initiatives, and the sustained global shift toward natural and sustainable product choices, where clay offers a biodegradable and durable option compared to synthetic materials.

Clay Planter Market Executive Summary

The Clay Planter Market demonstrates resilient business trends characterized by a dual focus on traditional terracotta manufacturing efficiency and the expansion of high-end glazed ceramic decorative items. Key industry shifts include the automation of pottery production to meet scale demands while preserving artisan quality, and the increasing penetration of direct-to-consumer (DTC) sales models through e-commerce, allowing specialized manufacturers to bypass traditional retail channels. Furthermore, sustainability certification and traceable sourcing of clay materials are becoming competitive differentiators, influencing procurement decisions among major retailers and designers, necessitating greater transparency in the supply chain.

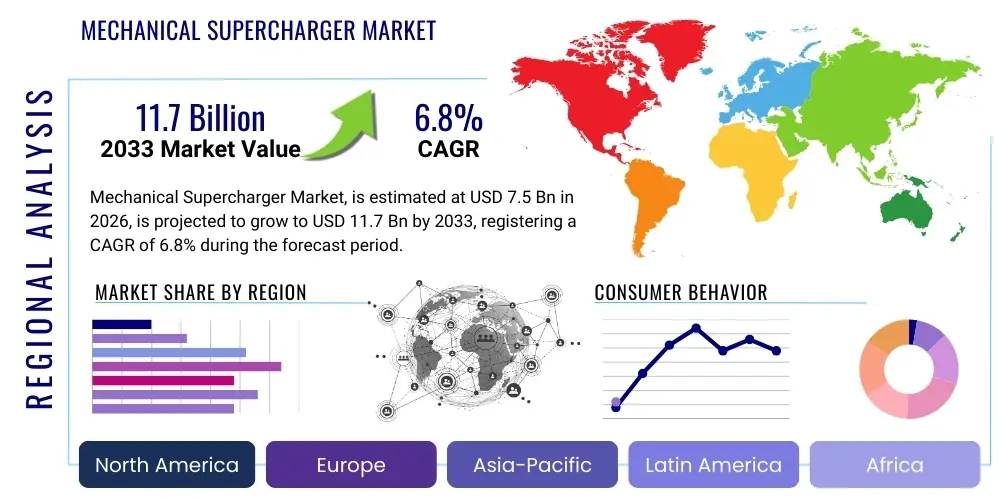

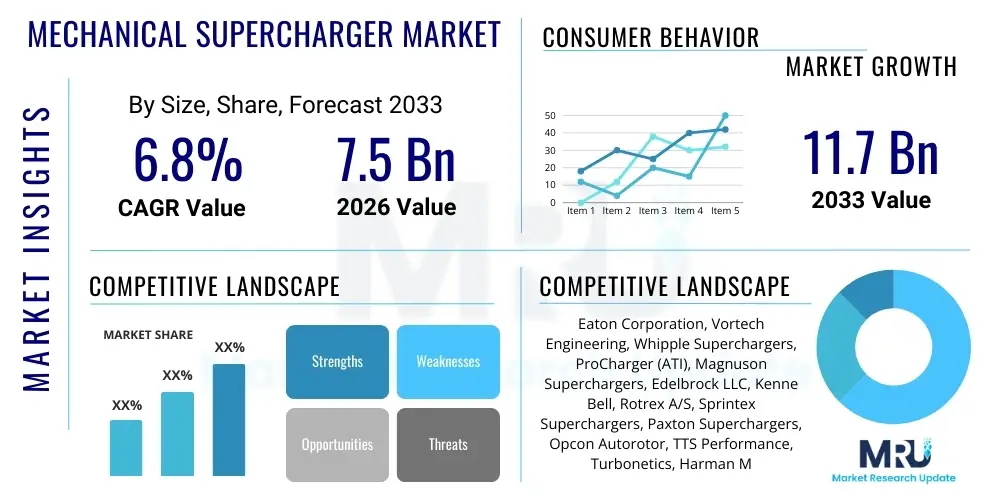

Regionally, the market is highly segmented, with Asia Pacific (APAC) dominating production capacity, particularly due to robust industrial ceramic infrastructure and lower operational costs. However, North America and Europe represent the highest value consumption markets, driven by substantial disposable income spent on premium home and garden aesthetics. European markets show a strong preference for artisanal, traditionally fired terracotta, while North America exhibits demand equally split between basic utilitarian pots and highly decorative glazed options, particularly for indoor foliage. Latin America and MEA are emerging markets, where demand is linked closely to residential construction booms and the expansion of retail infrastructure.

Segment trends highlight the premiumization within the Glazed Ceramic segment, which commands higher profit margins due to complex finishing and design variety. In terms of application, the Indoor Gardening segment is experiencing the fastest growth rate, propelled by urbanization and the trend toward decorating smaller living spaces with houseplants. Distribution channels are undergoing transformation, with online retail demonstrating superior growth performance, leveraging visual merchandising and efficient logistics solutions to handle the inherently fragile nature of clay products, thus maximizing market reach.

AI Impact Analysis on Clay Planter Market

Analysis of common user questions regarding the impact of AI on the Clay Planter Market reveals key themes centered on efficiency, design innovation, and supply chain optimization. Users are frequently querying how AI can assist in predicting material supply costs, optimizing kiln firing schedules for energy efficiency, and automating quality control checks for consistency in large-volume production runs. A major concern involves the role of AI in design—specifically, whether machine learning models can generate novel planter shapes and glaze patterns that resonate with contemporary consumer preferences, thereby accelerating product development cycles without eroding the artisanal heritage of clay work. Expectations are high that AI will significantly streamline complex logistics associated with shipping fragile, heavy goods, minimizing breakage and optimizing warehousing strategies.

The introduction of AI-driven robotics in the manufacturing process is expected to revolutionize basic forming and finishing tasks, addressing labor shortages while enhancing uniformity, especially in standard terracotta pot production. However, this raises questions about maintaining the perceived value of handmade goods. Furthermore, AI's application extends into advanced market analysis, where sophisticated algorithms process extensive consumer data, including social media trends and interior design forecasts, to accurately predict future demand for specific colors, textures, and sizes. This predictive capability significantly reduces overstocking and improves inventory management for wholesalers and retailers specializing in seasonal or trend-sensitive decorative planters.

Ultimately, the consensus among industry stakeholders and interested consumers is that AI will function primarily as an efficiency multiplier and predictive tool, rather than a replacement for core artisanal skills. Its influence will stabilize raw material costs, enhance product quality inspection (identifying micro-fissures undetectable by human inspection), and refine the complex global distribution networks required for the clay planter market, ensuring products arrive at their destination intact and on time. This technological integration aims to standardize the mass-produced segment while providing data-backed inspiration for high-end designers, ensuring a balanced market evolution.

- AI-driven optimization of kiln firing profiles to reduce energy consumption and improve material integrity.

- Predictive analytics for raw clay sourcing and inventory management, stabilizing input costs.

- Automated visual inspection systems (AI/ML) for quality control, identifying minor defects in glaze and form.

- Use of generative design models to suggest novel, trend-aligned planter geometries and surface textures.

- Optimization of complex logistics routes and packaging recommendations to minimize damage during transit of fragile products.

- Chatbots and AI assistants enhancing customer service for personalized design consultation and product selection.

DRO & Impact Forces Of Clay Planter Market

The Clay Planter Market is driven by the burgeoning popularity of home gardening and biophilic interior design, which necessitates durable, aesthetically pleasing containers. The increasing trend of urbanization globally fuels demand for indoor plants, directly impacting the market for smaller, high-design glazed ceramic planters suitable for apartment living. Furthermore, consumer preference for natural, eco-friendly, and sustainable materials strongly favors clay products over plastic alternatives, positioning the market favorably amidst growing environmental consciousness. These drivers collectively create a robust foundational demand across both functional and decorative applications, supporting steady volume and value growth.

Restraints primarily revolve around the inherent physical characteristics of the product. Clay planters are heavy, leading to high shipping and handling costs, which can significantly inflate final consumer prices, especially in comparison to lightweight plastic options. They are also exceptionally fragile, resulting in high rates of breakage during transportation and storage, imposing substantial losses on the supply chain. Moreover, traditional terracotta planters require frequent watering compared to non-porous materials, which can be perceived as an inconvenience by busy or inexperienced urban gardeners, potentially limiting widespread adoption in certain lifestyle demographics.

Opportunities for market growth lie in product innovation, particularly the development of treated or composite clay materials that retain the aesthetic appeal and breathability of traditional clay while offering reduced weight and increased durability (e.g., fiber-reinforced clay). The expansion of e-commerce platforms specializing in fragile goods handling, coupled with tailored sustainable packaging solutions, presents a chance to overcome logistic restraints. Impact forces include intense competition from cheaper composite and fiber-cement alternatives, which mimic the look of clay without the weight. Regulatory impacts concerning energy consumption in kiln firing (a major energy user) necessitate investment in greener manufacturing technologies, shaping the long-term cost structure and environmental footprint of the industry.

Segmentation Analysis

The Clay Planter Market is highly segmented based on material type, application, size, and distribution channel, reflecting the diverse needs of both functional gardeners and decorative consumers. Understanding these segments is crucial for manufacturers seeking to optimize product lines and marketing strategies, as performance and pricing vary significantly across categories. The primary differentiation exists between unglazed terracotta, valued for its utilitarian and breathable properties, and glazed ceramic, positioned as a premium decorative item commanding higher pricing due to complex finishing processes and aesthetic appeal. Application segmentation highlights the distinct requirements of indoor versus outdoor use, impacting factors such as drainage hole size, frost resistance, and aesthetic finish quality.

Further granularity is observed in the size segmentation, ranging from small pots (for succulents and seedlings) dominating the indoor segment, to large containers (for trees and substantial landscaping) driving the outdoor and commercial segments. The shift in consumer purchasing habits is most evident in the distribution channel analysis, where traditional garden centers and brick-and-mortar retailers maintain significant volumes, but online sales demonstrate the highest growth potential, catering to younger, design-conscious consumers seeking specialized or unique items not readily available locally. This detailed segmentation allows manufacturers to tailor production capacity and optimize inventory management for seasonal demands and shifting aesthetic trends in specific geographic regions.

- By Material Type:

- Terracotta (Unglazed Earthenware)

- Glazed Ceramic

- Stoneware and Porcelain

- Fired Clay Composites

- By Application:

- Indoor Gardening (Ornamental Plants, Herbs)

- Outdoor Landscaping (Patios, Balconies, Commercial Spaces)

- By Size:

- Small (Under 6 inches diameter)

- Medium (6 to 12 inches diameter)

- Large (Over 12 inches diameter)

- By Distribution Channel:

- Offline Retail (Specialty Garden Centers, Department Stores, Home Improvement Stores)

- Online Retail (E-commerce Platforms, Brand Websites)

Value Chain Analysis For Clay Planter Market

The value chain for the Clay Planter Market begins with upstream activities focused on the extraction and preparation of suitable raw materials, primarily various grades of natural clay (e.g., red clay, white clay). This stage includes critical processes such as sourcing, refining, cleaning, and blending clay with necessary additives (like grog or sand) to achieve desired plasticity and firing characteristics. Efficiency in the upstream segment is paramount, as variations in clay quality directly affect the structural integrity, porosity, and aesthetic finish of the final planter. Key upstream players include specialized mineral extractors and clay processing facilities, which supply homogenized clay bodies to manufacturers. Optimization at this stage involves minimizing waste and ensuring sustainable, responsible sourcing practices, particularly as demand for natural materials intensifies.

The core manufacturing stage involves forming (using techniques like throwing, molding, or automated pressing), drying, and high-temperature firing in kilns. Glazed ceramics introduce an additional layer of complexity, requiring specialized glazing chemicals, multiple firings, and skilled labor for intricate detailing, which significantly adds value. Downstream activities encompass warehousing, logistics (crucially handling fragile items), and distribution. Due to the weight and fragility of the products, logistics costs constitute a major proportion of the final price, driving the need for specialized packaging and regional distribution hubs to minimize shipping distances and breakage rates. Key distribution channels include direct sales to large commercial landscaping firms, wholesale supply to major retail chains, and direct-to-consumer sales via e-commerce, each requiring tailored logistical strategies.

The distribution network is segmented into direct and indirect channels. Direct distribution includes sales through manufacturer-owned stores or dedicated brand e-commerce sites, allowing for higher margin capture and closer control over customer experience, particularly for high-end or artisanal products. Indirect distribution relies heavily on partnerships with mass merchandisers (e.g., Walmart, Home Depot), specialty garden centers (e.g., local nurseries), and third-party online marketplaces (e.g., Amazon, Etsy). Specialty garden centers often play a critical advisory role, selling premium and application-specific products, whereas mass merchandisers focus on high-volume, standard terracotta and basic glazed options. The integration of robust inventory management systems across the distribution network is vital to manage the seasonal peaks associated with gardening and home decor refreshes.

Clay Planter Market Potential Customers

The Clay Planter Market serves a highly diversified customer base, spanning individual consumers, large commercial entities, and specialized institutional buyers. The largest demographic segment consists of individual residential consumers, who purchase planters for indoor houseplant display, balcony gardening, and residential landscaping. Within this group, two distinct profiles exist: the enthusiastic, experience-seeking Millennial and Gen Z urban dwellers, who drive demand for small, stylish, decorative glazed pots; and established homeowners and retirees who frequently purchase larger, durable terracotta containers for traditional outdoor gardening and permanent installations. Their purchasing decisions are highly influenced by aesthetic trends, sustainability concerns, and price points relative to durability.

Commercial entities represent a substantial value segment, encompassing landscape architecture firms, interior design specialists, and hospitality businesses (hotels, resorts, restaurants). These customers typically require large volumes of cohesive, durable, and often custom-sized planters for corporate offices, public spaces, and large-scale external installations. For these buyers, consistency in color, texture, and structural reliability is critical, leading them to favor high-quality stoneware or meticulously crafted glazed ceramics that withstand heavy traffic and varied environmental conditions. The growth in biophilic design mandates in commercial architecture is steadily boosting demand from this segment, often involving direct partnerships with manufacturers for bespoke solutions.

Additionally, institutional buyers, including botanical gardens, municipal parks departments, educational institutions, and healthcare facilities, constitute another important customer base. These entities prioritize functional characteristics such as long-term durability, frost resistance, and optimal drainage properties essential for maintaining large, diverse plant collections. While aesthetics are important, utility often dictates procurement, favoring robust, traditional terracotta pots or specially treated clay containers built to endure rigorous outdoor exposure. The need for bulk purchasing and reliable, timely supply chains are key requirements for these institutional end-users.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750.0 Million |

| Market Forecast in 2033 | $1,100.0 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Northcote Pottery, Kaddy's Planters, Earth Fired Pottery, Campania International, Longpi Pottery, Crescent Garden, Pottington, Deroma Spa, East Jordan Plastics, Scheurich GmbH, Pottery Barn, Teracrea, Capital Garden Products, Novelty Manufacturing, Studio Arhoj, Kenwingston Pottery, Elho B.V., D'Alesio & Son, Sichuan Tengyue Pottery, Haidong Pottery. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Clay Planter Market Key Technology Landscape

The technology landscape in the Clay Planter Market, while rooted in ancient craft, is increasingly embracing modern industrial processes to enhance efficiency, consistency, and material properties. The primary focus of technological advancement revolves around two areas: automated forming and advanced firing techniques. Automated machinery, including computer numerically controlled (CNC) roller-jiggering machines and hydraulic pressing equipment, is used to ensure high-volume, uniform production of standard terracotta and basic glazed forms, reducing labor costs and minimizing dimensional variation. This automation is crucial for manufacturers supplying large retailers where strict specifications and consistent quality are mandated. However, the application of technology is carefully balanced to ensure high-end, artisan-style planters retain the human element necessary for premium pricing and market appeal.

In terms of material processing, significant innovations include the refinement of clay body preparation, incorporating precise particle size distribution analysis and homogenization technologies. This ensures the clay is less prone to cracking during drying and firing, thereby reducing waste. Furthermore, the development of specialized clay composites, incorporating lightweight fillers such as recycled glass or fibrous materials, aims to address the critical industry challenge of weight and fragility. These composite clay technologies offer the breathable benefits and aesthetic characteristics of traditional clay while dramatically lowering logistics costs and improving product durability against impact and freeze-thaw cycles, making them ideal for commercial outdoor applications in varied climates.

Advanced kiln technology, particularly the shift toward continuous tunnel kilns and energy-efficient gas kilns, is reshaping the production stage. These modern kilns offer superior temperature control and atmosphere management compared to traditional batch kilns, leading to reduced energy consumption and more consistent glaze results, minimizing defects and re-firing needs. Furthermore, digital printing and decal technology are being utilized to apply complex, multi-color patterns and high-definition designs onto glazed surfaces that would be too costly or time-consuming to execute by hand. This digital transformation allows manufacturers to rapidly introduce new aesthetic collections responsive to fast-moving interior design trends, significantly compressing the time-to-market for decorative products and maintaining competitive relevance.

Regional Highlights

- Asia Pacific (APAC): APAC is the global manufacturing hub for clay planters, driven by low-cost labor, access to abundant raw clay resources, and sophisticated ceramic infrastructure, particularly in China, Vietnam, and India. While being a large exporter, domestic consumption is rapidly increasing due to rising urbanization, growing middle-class income, and the adoption of modern home decoration styles. The region is characterized by mass-market production alongside highly specialized traditional pottery centers (e.g., Yixing in China), catering to both functional and high-end niche markets.

- North America: This region is a major consumption market, characterized by high consumer spending on home improvement, gardening, and premium decorative items. Demand is heavily skewed towards large-sized planters for outdoor patios and high-design, small-to-medium glazed pots for indoor horticulture. The market is highly competitive, dominated by robust retail networks, large e-commerce penetration, and a strong preference for durable, frost-resistant products that can withstand harsh seasonal changes. Sustainability and ethically sourced products are increasingly important purchase criteria here.

- Europe: Europe represents a mature and discerning market with a strong historical tradition of terracotta and ceramic craftsmanship, particularly in countries like Italy, Spain, and Greece. The market prioritizes quality, traditional firing techniques, and regional heritage designs. Demand is driven by established gardening cultures and a strong focus on high-quality, long-lasting products. Germany and the UK are key markets for both basic utility pots and stylized designer planters. Stringent environmental regulations also push manufacturers toward adopting cleaner firing processes and sustainable packaging solutions.

- Latin America (LATAM): The LATAM market is experiencing significant growth, correlating with increased residential construction activity and the rise of middle-class consumerism. While local artisanal production is prevalent, there is increasing demand for imported, standardized, and high-quality glazed planters. Mexico and Brazil are primary growth engines, showing a gradual shift from purely functional uses towards decorative indoor applications, spurred by international interior design influences.

- Middle East and Africa (MEA): Growth in the MEA region is concentrated in urban centers, particularly the GCC countries, where massive landscaping projects in commercial and hospitality sectors drive demand for large, durable, and highly decorative planters capable of withstanding extreme heat and arid conditions. The residential market shows high elasticity towards luxury imported glazed products. In Africa, the market remains nascent, focused largely on basic, locally sourced terracotta for functional subsistence gardening, though modernization is occurring in major metropolitan areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Clay Planter Market.- Northcote Pottery

- Kaddy's Planters

- Earth Fired Pottery

- Campania International

- Longpi Pottery

- Crescent Garden

- Pottington

- Deroma Spa

- East Jordan Plastics (offers clay alternatives, influencing the market)

- Scheurich GmbH

- Pottery Barn (as a key retailer and brand influencer)

- Teracrea

- Capital Garden Products

- Novelty Manufacturing (offers clay alternatives, influencing the market)

- Studio Arhoj

- Kenwingston Pottery

- Elho B.V. (Offers diverse material planters)

- D'Alesio & Son

- Sichuan Tengyue Pottery

- Haidong Pottery

Frequently Asked Questions

Analyze common user questions about the Clay Planter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Clay Planter Market?

The Clay Planter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. This growth is driven by increasing consumer interest in home gardening, biophilic design trends, and a preference for sustainable, natural decorative materials over plastic alternatives, stabilizing market valuation.

What are the primary differences between terracotta and glazed ceramic planters?

Terracotta planters are porous, allowing air and water vapor to pass through the material, which helps prevent root rot but necessitates more frequent watering. Glazed ceramic planters are non-porous, offering excellent moisture retention and superior decorative value due to their vibrant colors and finishes, making them ideal for aesthetic indoor use.

How do high logistics costs impact the pricing of clay planters?

Due to the heavy weight and inherent fragility of clay planters, logistics and packaging costs are substantially higher compared to lightweight alternatives. These costs, coupled with high breakage rates during transit, contribute significantly to the final retail price, particularly for large, internationally shipped decorative pieces, posing a restraint to volume growth.

Which geographical region leads the demand for high-value decorative clay planters?

North America and Europe currently lead the demand for high-value decorative clay planters, driven by strong consumer purchasing power, established home decor and gardening markets, and a significant trend towards purchasing premium, artistically finished glazed ceramic products for both indoor and high-end outdoor installations.

What key role does AI play in modern clay planter manufacturing?

AI is primarily utilized to enhance operational efficiency by optimizing energy consumption in kilns, providing predictive analytics for raw material sourcing, and deploying automated visual inspection systems for quality control, thereby minimizing defects and streamlining complex, fragile-goods supply chain logistics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager