Clean Coal Technologies Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433080 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Clean Coal Technologies Market Size

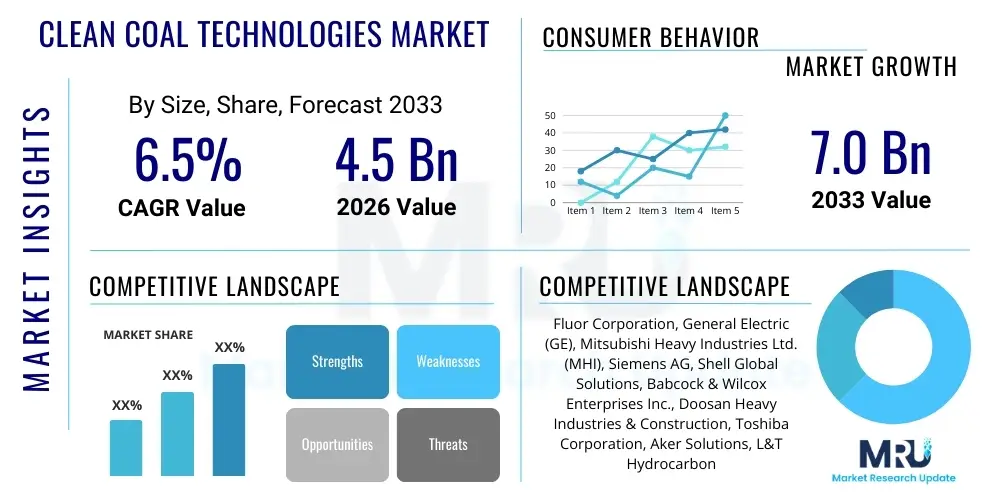

The Clean Coal Technologies Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.0 Billion by the end of the forecast period in 2033.

Clean Coal Technologies Market introduction

The Clean Coal Technologies (CCT) Market encompasses a diverse portfolio of advanced systems and processes designed to mitigate the environmental impact of coal utilization, specifically targeting reductions in greenhouse gas emissions, particularly carbon dioxide (CO2), alongside traditional pollutants like sulfur dioxide (SO2) and nitrogen oxides (NOx). This market serves as a critical bridge for economies heavily reliant on coal for base-load power generation, offering pathways to comply with increasingly stringent international climate regulations without immediately abandoning existing energy infrastructure. CCT solutions span the entire coal energy value chain, from preparation and combustion efficiency improvements to advanced post-combustion capture and storage. The fundamental objective is to maintain energy security while simultaneously striving toward decarbonization goals mandated by global climate accords.

Key technological products within this domain include Carbon Capture and Storage (CCS), Integrated Gasification Combined Cycle (IGCC), Supercritical (SC) and Ultra-Supercritical (USC) pulverized coal combustion systems, and advanced coal preparation techniques. Major applications of these technologies are primarily concentrated in the power generation sector, particularly large-scale thermal power plants, but also extend to industrial processes such as cement production and steel manufacturing where coal remains a primary fuel or reducing agent. The deployment of CCT delivers substantial benefits, including enhanced energy efficiency, reduced criteria air pollutant emissions, and, crucially, the potential for near-zero CO2 emissions through effective CCS implementation. These benefits are driving market momentum, particularly in developing economies where energy demand growth is coupled with abundant coal reserves.

Driving factors for the adoption of CCT include governmental incentives and subsidies for low-carbon energy infrastructure, advancements in carbon capture solvent technology that lower operational costs, and the persistent global need for stable, affordable base-load electricity. Furthermore, the longevity and reliability of coal reserves provide a geopolitical advantage in energy security, ensuring that nations view CCT as a necessary investment to balance economic growth with environmental stewardship. The increasing public and regulatory pressure to meet Net Zero targets, combined with ongoing technological breakthroughs that improve the cost-effectiveness and scalability of CCS projects, solidifies the market's trajectory towards sustained growth throughout the forecast period.

- Market Intro: Technologies mitigating environmental impact of coal use, focusing on CO2, SO2, and NOx reduction.

- Product Description: Includes CCS (pre, post, oxy-fuel capture), IGCC, Ultra-Supercritical (USC) boilers, and enhanced coal preparation methods.

- Major Applications: Large-scale thermal power generation, industrial sectors (cement, steel, chemicals).

- Benefits: Enhanced thermal efficiency, significant reduction in air pollutants, potential for decarbonization via CCS, improved energy security.

- Driving factors: Stringent environmental regulations, government investment in low-carbon infrastructure, necessity for stable base-load power, and technological maturity of capture systems.

Clean Coal Technologies Market Executive Summary

The Clean Coal Technologies (CCT) market is witnessing significant structural shifts driven by a dual necessity: maintaining energy stability while addressing climate change imperatives. Current business trends indicate a strong focus on scaling up commercial deployment of Carbon Capture, Utilization, and Storage (CCUS) projects, moving beyond pilot and demonstration phases. Investment is increasingly directed towards modular and integrated solutions that reduce the footprint and capital intensity of capture facilities. Furthermore, market competition is shifting towards optimization of existing assets, with a pronounced emphasis on retrofitting older coal plants with supercritical and ultra-supercritical combustion technologies before applying capture solutions. This strategic approach minimizes immediate stranded asset risk while capitalizing on incremental efficiency gains. Key stakeholders, including major engineering firms and utility operators, are forming complex public-private partnerships to navigate the high upfront investment costs associated with large-scale CCT deployment.

Regionally, the market exhibits divergent growth patterns. Asia Pacific, led by China and India, remains the dominant region due to massive existing coal fleets and soaring energy demands, prioritizing the immediate deployment of USC and SC technologies for efficiency gains. Conversely, North America and Europe are focusing heavily on the advanced stages of decarbonization, making significant financial commitments to pure CCS projects and large-scale CO2 transportation pipeline infrastructure, driven by high carbon pricing mechanisms and generous tax credits (like the U.S. 45Q). Segment trends reveal that the Carbon Capture and Storage (CCS) segment, particularly post-combustion capture, is anticipated to experience the highest growth rate, reflecting the global mandate to achieve deep emission cuts. This is followed closely by the demand for highly efficient combustion technologies (USC/SC), which offer immediate and cost-effective reductions in CO2 emissions per kilowatt-hour generated.

AI Impact Analysis on Clean Coal Technologies Market

Common user questions regarding AI's impact on Clean Coal Technologies revolve around optimizing the complex operational parameters of capture facilities, reducing the energy penalty associated with CO2 separation, and enhancing predictive maintenance for high-pressure, high-temperature combustion systems. Users are keenly interested in how Artificial Intelligence can minimize the overall cost of carbon capture and storage (CCUS), specifically asking about the feasibility of using machine learning algorithms to fine-tune solvent regeneration cycles or predict reservoir storage capacities with greater precision. The key themes emerging from this analysis center on operational efficiency improvements, risk mitigation, and advanced material science applications. Users expect AI to transform CCT from an economically marginal solution into a viable, mainstream technology by streamlining complex chemical and mechanical processes, thereby accelerating deployment timelines and ensuring reliable long-term performance.

- Operational Optimization: AI algorithms are used to optimize the solvent loading and regeneration processes in post-combustion capture units, reducing the parasitic energy load required for separation and significantly lowering operational expenditure (OPEX).

- Predictive Maintenance (PdM): Machine learning models predict equipment failure in critical components such as high-pressure steam turbines, gasifiers (in IGCC), and CO2 compression units, maximizing uptime and safety while minimizing unscheduled outages.

- Enhanced Reservoir Modeling: AI improves the accuracy of geological modeling for CO2 storage reservoirs, predicting long-term plume migration, capacity estimation, and potential leakage risks, which is vital for regulatory approval and secure permanent storage.

- Combustion Control Efficiency: Real-time data processing and AI feedback loops optimize the air-fuel ratio, steam temperature, and pressure within Ultra-Supercritical boilers, maximizing thermal efficiency and reducing emissions intensity instantaneously.

- Process Automation: Advanced robotics and AI-driven automation manage complex material handling and routine monitoring tasks in hazardous environments, improving safety and reducing labor costs in coal preparation and ash handling.

- Material Science Acceleration: AI accelerates the discovery and testing of next-generation capture solvents or membranes with lower degradation rates and higher selectivity, crucial for reducing the capital cost of capture equipment.

DRO & Impact Forces Of Clean Coal Technologies Market

The dynamics of the Clean Coal Technologies market are governed by a complex interplay of Drivers, Restraints, and Opportunities, collectively manifesting as significant Impact Forces. A primary driver is the necessity for energy security in rapidly industrializing nations, where coal provides the most reliable and affordable source of base-load power, requiring technological solutions to align its use with climate mandates. Coupled with this is the escalating pressure from international agreements, such as the Paris Agreement, which forces governments to either phase out coal or mandate the adoption of capture and control technologies. Technological advances, particularly in reducing the energy penalty of CO2 capture and improving the efficiency of high-temperature combustion, serve as fundamental drivers that make CCT increasingly economically viable. These drivers create a compelling demand signal for integrated energy solutions that can sustain existing infrastructure while addressing environmental costs.

However, significant restraints impede faster adoption. Foremost among these is the exceptionally high capital expenditure (CAPEX) required for large-scale CCS facilities and IGCC plants, making them difficult to finance, especially in volatile market conditions. Furthermore, the inherent risk of regulatory uncertainty—specifically the inconsistent and evolving nature of carbon pricing and liability frameworks for long-term CO2 storage—deter long-term private sector investment. Public perception and strong environmental activism, advocating for a complete phase-out of coal rather than abatement, also pose a considerable restraint, influencing policy decisions. Conversely, opportunities abound, particularly in the realm of Carbon Capture, Utilization, and Storage (CCUS), where captured CO2 is utilized for enhanced oil recovery (EOR), cement curing, or synthetic fuel production, thus converting a liability into a revenue stream. Developing modular, smaller-scale capture units suitable for retrofitting diverse industrial sites and scaling up CO2 transportation infrastructure present critical avenues for future market expansion.

- Drivers: Global commitment to net-zero emissions; mandatory air quality standards; growing energy demand, especially in Asia; reliability of coal as a base-load power source; government subsidies (e.g., 45Q tax credit in the U.S.).

- Restraints: High capital costs and long construction lead times for CCS projects; lack of comprehensive, stable regulatory framework for CO2 storage liability; significant parasitic energy load of capture systems; strong competition from renewables and natural gas.

- Opportunities: Expansion of Carbon Capture, Utilization, and Storage (CCUS) value streams (EOR, synthetic fuels, concrete); development of modular capture technology; advancements in solid sorbents and membrane separation to reduce energy penalty; establishment of regional CO2 transportation hubs and industrial clusters.

- Impact Forces: Policy mandates concerning decarbonization are the most significant positive impact force, accelerating technology adoption. Conversely, the high CAPEX hurdle remains the dominant negative impact force, limiting the speed of global deployment.

Segmentation Analysis

The Clean Coal Technologies Market is segmented based on the specific technology deployed, the application in which it is used, and the type of pollutant addressed. This segmentation provides a granular view of market dynamics, illustrating where investment is most active and where technological breakthroughs are gaining commercial traction. The technology segment is crucial, distinguishing between efficiency improvements (such as USC/SC boilers) which offer immediate benefits, and deep decarbonization solutions (such as CCS) which carry higher costs but promise near-zero emissions. Understanding these sub-segments helps stakeholders allocate resources effectively, prioritizing short-term cost-effectiveness or long-term climate compliance.

Furthermore, segmentation by application highlights the shift beyond traditional power generation. While utilities remain the largest consumer, industrial applications, particularly those with hard-to-abate emissions like cement and iron/steel production, are becoming increasingly important growth drivers for specialized CCT solutions. The market structure emphasizes the integration potential of these technologies, where efficient combustion is often a prerequisite for cost-effective capture. Analyzing these segments reveals a trend towards bespoke solutions tailored to the specific flue gas composition and operational profiles of different industrial processes, moving away from standardized power plant solutions.

- By Technology Type:

- Carbon Capture and Storage (CCS)

- Integrated Gasification Combined Cycle (IGCC)

- Supercritical (SC) and Ultra-Supercritical (USC) Combustion

- Flue Gas Desulfurization (FGD) and Selective Catalytic Reduction (SCR)

- By Capture Technology (Sub-Segment of CCS):

- Pre-Combustion Capture

- Post-Combustion Capture

- Oxy-Fuel Combustion Capture

- By Application:

- Power Generation (Thermal Power Plants)

- Industrial (Cement, Steel, Refineries, Chemicals)

- By Pollutant Targeted:

- CO2

- SOx

- NOx

- Particulate Matter (PM)

Value Chain Analysis For Clean Coal Technologies Market

The value chain for Clean Coal Technologies is complex and highly capital-intensive, starting with upstream activities involving coal preparation and technology licensing, moving through midstream construction and installation, and culminating in downstream operation, maintenance, and storage/utilization. Upstream analysis focuses on coal mining and preparation, where technologies like coal washing and blending enhance fuel quality, improving combustion efficiency and reducing sulfur content before the coal enters the boiler. This stage also involves the initial research and development of novel capture solvents, membranes, and high-efficiency boiler designs, where Intellectual Property (IP) licensing is a crucial component defining market competitiveness and technological standards.

The midstream phase involves the engineering, procurement, and construction (EPC) of the power plant or industrial facility, including the integration of CCT components such as gasifiers, supercritical boilers, and large-scale CO2 absorbers and compressors. Downstream analysis is dominated by the operation of the power plant, efficient pollutant control, and, most significantly, the management of the captured CO2 stream. Distribution channels for CCT predominantly involve direct sales and long-term service contracts between specialized EPC firms, technology licensors (e.g., Mitsubishi Heavy Industries, GE), and utility operators or industrial end-users. Indirect distribution is less common but occurs through government-led consortia or joint ventures established specifically for regional CO2 transport and storage infrastructure, such as pipeline networks and dedicated geological storage sites. The utilization of CO2, such as for Enhanced Oil Recovery (EOR) or industrial feedstock, represents a critical downstream revenue opportunity influencing investment decisions.

Clean Coal Technologies Market Potential Customers

The primary potential customers and end-users of Clean Coal Technologies are large-scale energy producers and industrial conglomerates operating facilities with significant, concentrated CO2 emissions. In the power sector, national and regional utility companies, especially those managing aging coal fleets that represent critical base-load capacity, are the key buyers. These utilities seek CCT solutions to comply with tightening regulatory limits on emissions while maximizing the lifespan of their substantial assets. Their decisions are heavily influenced by government mandates, carbon taxes, and incentives for low-carbon generation.

Beyond the utilities, the industrial sector constitutes a rapidly expanding customer base. Industries such as cement manufacturing, steel production, and chemical processing inherently generate large volumes of process-related CO2 that cannot be easily eliminated through fuel switching alone. These heavy industries require bespoke capture solutions (e.g., solvent-based or membrane separation tailored to specific flue gas compositions) to meet decarbonization goals. Furthermore, pipeline operators and consortiums specializing in carbon transport and storage infrastructure act as indirect customers, requiring the technology and expertise to manage and safely sequester the massive volumes of CO2 captured from multiple generating and industrial sites.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fluor Corporation, General Electric (GE), Mitsubishi Heavy Industries Ltd. (MHI), Siemens AG, Shell Global Solutions, Babcock & Wilcox Enterprises Inc., Doosan Heavy Industries & Construction, Toshiba Corporation, Aker Solutions, L&T Hydrocarbon Engineering, Sasol Limited, Hitachi, Ltd., Equinor ASA, NRG Energy Inc., ADNOC, Linde plc, ExxonMobil, Halliburton, China Huaneng Group, Korea Electric Power Corporation (KEPCO) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Clean Coal Technologies Market Key Technology Landscape

The technological landscape of the Clean Coal Technologies market is dominated by advancements aimed at maximizing thermal efficiency and achieving deep decarbonization through Carbon Capture and Storage (CCS). In terms of combustion efficiency, Ultra-Supercritical (USC) and Advanced Ultra-Supercritical (AUSC) pulverized coal technologies are standard bearers, operating at extremely high temperatures and pressures (above 600°C and 270 bar). This severe operating environment allows these boilers to achieve thermal efficiencies exceeding 45%, significantly reducing the coal burned and subsequently the CO2 emitted per unit of electricity generated compared to conventional subcritical plants. Research efforts are intensely focused on developing new materials, such as nickel-based superalloys, that can withstand even higher temperatures required for AUSC plants (up to 700°C), promising efficiencies nearing 50% and further lowering emissions intensity.

The most transformative technology in the landscape is Carbon Capture and Storage. Within CCS, the Post-Combustion Capture method, typically utilizing chemical absorption with amines (such as MEA), currently holds the largest market share due to its suitability for retrofitting existing plants. However, the high energy penalty associated with solvent regeneration drives innovation towards second and third-generation capture systems. This includes the development of advanced solvents, solid sorbents (like metal-organic frameworks or MOFs), and membrane separation technologies, all designed to require significantly less energy for CO2 separation. Furthermore, Integrated Gasification Combined Cycle (IGCC) technology, which converts coal into synthesis gas (syngas) before combustion, remains a niche but vital segment, particularly advantageous for pre-combustion capture as the CO2 concentration is higher and capture pressures are more favorable, leading to lower capture costs relative to post-combustion methods.

The successful integration of these diverse technologies requires sophisticated process control and digitalization. The rise of digital twins and advanced analytical platforms is enabling operators to model, simulate, and optimize the performance of CCT plants in real-time. This digital integration is crucial for managing the parasitic load imposed by capture systems, ensuring the reliable integration of power generation and CO2 handling infrastructure. The technological trajectory suggests a move away from single-source solutions towards modular, hybridized systems that incorporate the best features of high-efficiency combustion, next-generation solid sorbents, and sophisticated operational AI to achieve ambitious climate targets at a commercially sustainable cost.

Regional Highlights

- Asia Pacific (APAC): Dominance in Capacity and Efficiency

The Asia Pacific region, particularly China, India, and Southeast Asian nations, dominates the Clean Coal Technologies market in terms of installed capacity and ongoing project development. This dominance stems directly from the region's immense reliance on coal for base-load power, necessary to support rapid industrialization and population growth. China, being the world's largest coal consumer and producer, is heavily investing in Ultra-Supercritical (USC) technology, which represents the primary form of CCT adoption here, aiming to improve fleet efficiency and reduce local air pollution. While deep decarbonization through CCS has lagged behind efficiency improvements, government mandates and pilot projects are now accelerating, driven by international pressure and domestic environmental crises. The regional market growth is largely dictated by the balance between ensuring energy security and complying with national emissions reduction targets.

In India, the focus remains strongly on phasing out inefficient subcritical plants and mandatory adoption of highly efficient SC/USC technology for new capacity additions. The scale of required infrastructure investment in APAC means that large, established EPC contractors and multinational technology providers are indispensable. Furthermore, the region is beginning to develop regional CCUS hubs, often tied to industrial clusters, demonstrating a nascent but strong commitment to the long-term sequestration of CO2, although the utilization component (CCU) is often favored initially due to its economic return potential.

- North America: Policy-Driven CCS Leadership

North America is characterized by robust policy support specifically targeting Carbon Capture and Storage (CCS). The U.S. market is significantly driven by federal incentives, most notably the 45Q tax credit, which provides substantial financial rewards for captured and securely stored CO2. This policy framework has shifted the market focus away from incremental efficiency improvements and towards deep decarbonization. As a result, North America leads the world in the planning and development of commercial-scale CCS projects across both power generation and industrial sectors (e.g., ethanol, cement, and ammonia plants).

The region benefits from extensive geological capacity suitable for secure, permanent CO2 storage, particularly in the Gulf Coast and Midwest, facilitating the development of major CO2 pipeline infrastructure. The primary market activity involves retrofitting existing power and industrial facilities with post-combustion capture technology. Canada also maintains a strong commitment, hosting some of the world’s longest-running operational CCS projects (like Boundary Dam and Quest), which provides crucial operational experience and technological blueprints for future global deployments. This emphasis on policy-backed, commercial deployment makes North America a leader in the operational maturity of CCS technology.

- Europe: Stringent Environmental Standards and IGCC Focus

The European CCT market is defined by the continent's highly stringent climate targets, carbon pricing mechanisms (EU ETS), and a preference for phased decarbonization solutions. While overall coal dependence is decreasing, CCT remains relevant for specific industrial clusters and regions relying on solid fuels. Historically, Europe has been a pioneer in Integrated Gasification Combined Cycle (IGCC) technology, leveraging its potential for higher efficiency and easier CO2 capture, although high investment costs have limited widespread deployment.

Current growth is fueled by strategic investments in shared CO2 transport infrastructure, often involving cross-border cooperation (e.g., the Northern Lights project in Norway). European initiatives focus heavily on R&D to reduce the costs of capture solvents and advance membrane technology. The market here is highly specialized, targeting large industrial emitters in regions like the Netherlands, the UK, and Germany, where CCUS is viewed as essential for abating emissions that renewables cannot address. The regulatory environment acts as a strong, non-negotiable driver, compelling large emitters to explore every viable option, including CCT, to remain operational within the EU framework.

- Latin America & MEA: Emerging Markets for Efficiency

In Latin America, the CCT market is nascent, with focus primarily on improving the efficiency of existing, albeit smaller, coal fleets, generally utilizing Supercritical technology. Investment is often tied to foreign aid or multinational financing, and regulatory drivers are generally less strict compared to developed economies. Similarly, the Middle East and Africa (MEA) region exhibits growing interest, driven by the need for energy stability and industrial growth (especially steel and petrochemicals). Key oil and gas producers, such as Saudi Arabia and the UAE, are actively exploring CCUS, not necessarily for power generation abatement, but for Enhanced Oil Recovery (EOR) operations, where the utilization component provides a strong economic rationale for investment in capture infrastructure.

- China and India dominate market scale due to heavy coal usage and vast USC/SC deployment.

- North America leads in commercial CCS deployment, driven by the 45Q tax credit and large geological storage capacity.

- Europe focuses on R&D for next-generation capture and cross-border CO2 transport infrastructure, backed by the EU ETS.

- Latin America prioritizes operational efficiency improvements (SC technology).

- MEA utilizes CCUS primarily for Enhanced Oil Recovery (EOR) and industrial decarbonization, leveraging oil & gas sector expertise.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Clean Coal Technologies Market.- Fluor Corporation

- General Electric (GE)

- Mitsubishi Heavy Industries Ltd. (MHI)

- Siemens AG

- Shell Global Solutions

- Babcock & Wilcox Enterprises Inc.

- Doosan Heavy Industries & Construction

- Toshiba Corporation

- Aker Solutions

- Linde plc

- Hitachi, Ltd.

- Sasol Limited

- Equinor ASA

- NRG Energy Inc.

- ADNOC

- ExxonMobil

- Halliburton

- China Huaneng Group

- Korea Electric Power Corporation (KEPCO)

- JGC Corporation

Frequently Asked Questions

Analyze common user questions about the Clean Coal Technologies market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary economic challenge for commercializing Clean Coal Technologies?

The primary economic challenge is the high capital cost (CAPEX) associated with deploying Carbon Capture and Storage (CCS) infrastructure, which significantly increases the Levelized Cost of Electricity (LCOE) for coal-fired power plants. This is compounded by the high parasitic energy load of current capture processes, which reduces net power output and profitability.

How does Ultra-Supercritical (USC) technology contribute to 'clean coal' objectives?

USC technology contributes by dramatically increasing the thermal efficiency of the power plant (often above 45%), requiring less coal fuel per megawatt-hour generated. This intrinsic efficiency improvement directly translates to a significant reduction in CO2 emissions and other pollutants compared to traditional subcritical or supercritical plants.

What role does the 45Q tax credit play in the North American CCT market?

The U.S. 45Q tax credit is a critical policy driver that provides a substantial financial incentive (tax equity) per metric ton of captured and geologically stored CO2. This incentive fundamentally improves the business case and financing viability of large-scale CCS projects across the power and industrial sectors, accelerating commercial deployment in North America.

What are the key differences between pre-combustion and post-combustion carbon capture?

Post-combustion capture separates CO2 from the flue gas after combustion and is suitable for retrofitting existing plants, but it handles dilute CO2 streams. Pre-combustion capture (used typically with IGCC) separates CO2 from concentrated synthesis gas before combustion, offering easier separation and lower costs for new builds, but requires full plant redesign.

Are solid sorbents or membranes expected to replace traditional amine scrubbing in CCS?

Solid sorbents and membranes are next-generation technologies expected to partially displace or complement amine scrubbing. They are being developed to reduce the high energy penalty associated with solvent regeneration, offering the potential for lower operational costs, smaller equipment footprints, and improved environmental performance over traditional chemical absorption methods.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager