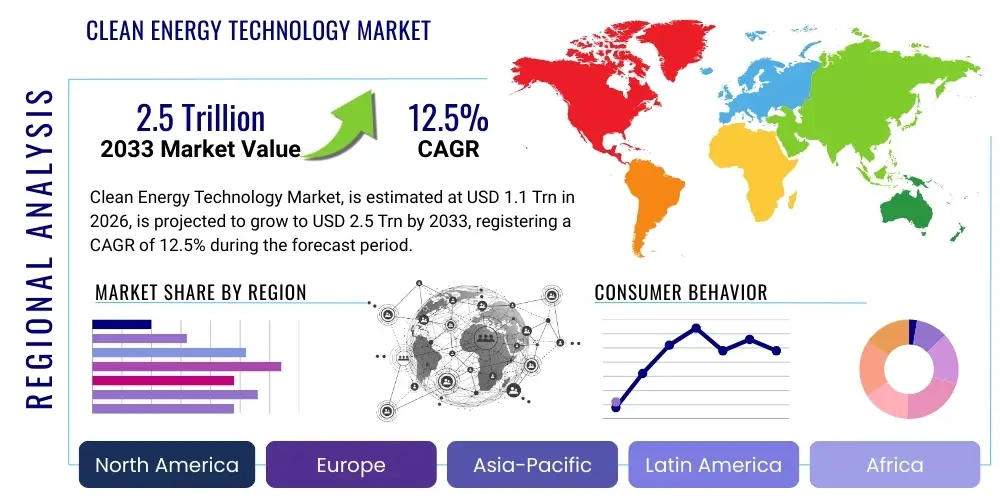

Clean Energy Technology Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437377 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Clean Energy Technology Market Size

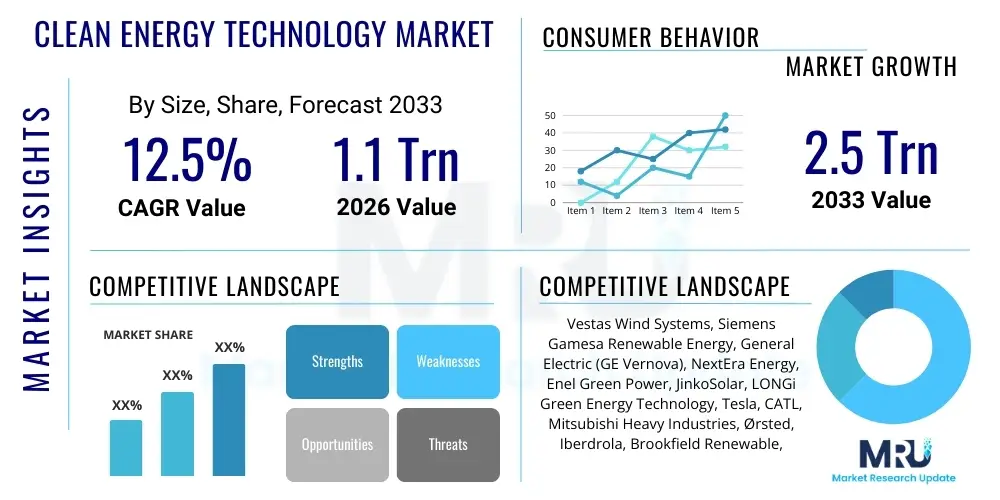

The Clean Energy Technology Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 1.1 Trillion in 2026 and is projected to reach USD 2.5 Trillion by the end of the forecast period in 2033. This robust expansion is fueled by stringent global decarbonization targets, accelerating technological maturity across solar photovoltaics and wind power, and massive infrastructure investments aimed at enhancing grid resilience and energy storage capacity worldwide.

Clean Energy Technology Market introduction

The Clean Energy Technology Market encompasses the entire ecosystem of technologies and services designed to generate power from renewable or non-polluting sources, drastically reducing reliance on fossil fuels. Key components include solar photovoltaic systems, onshore and offshore wind farms, hydroelectric power generation, geothermal energy extraction, advanced battery storage solutions, and green hydrogen production infrastructure. These technologies are crucial for meeting global climate objectives, ensuring energy security, and driving economic growth through innovation.

Major applications of these technologies span electric power generation for utility-scale grids, decentralized power solutions for remote communities, integration into transportation sectors (electric vehicles and sustainable fuels), and powering industrial processes through electrification and clean hydrogen use. The primary benefit derived from this transition is the substantial reduction in greenhouse gas emissions and air pollution, alongside providing long-term stable energy prices less susceptible to geopolitical volatility. Furthermore, the development and deployment of clean energy solutions foster significant job creation in manufacturing, installation, and operation sectors.

Driving factors for the market's current momentum include supportive governmental policies such as tax credits, renewable portfolio standards (RPS), and carbon pricing mechanisms, which significantly improve the economic viability of clean energy projects. Simultaneously, the drastic reduction in the Levelized Cost of Electricity (LCOE) for solar and wind generation has made them cost-competitive, and often cheaper, than conventional power sources in many regions. Growing corporate commitment to environmental, social, and governance (ESG) criteria and the resultant demand for clean Power Purchase Agreements (PPAs) further accelerate market adoption and investment across all major economies.

Clean Energy Technology Market Executive Summary

The Clean Energy Technology Market is experiencing unprecedented growth driven by mandatory decarbonization mandates and massive private-sector investment, shifting from being subsidized niche solutions to mainstream, cost-effective power generation sources. Business trends highlight a strong focus on digital transformation, utilizing technologies like IoT and AI to enhance asset performance and grid reliability. Mergers and acquisitions are frequent, consolidating expertise across generation, storage, and software solutions, especially as major oil and gas companies aggressively pivot towards renewable portfolios to meet internal sustainability targets and investor pressure.

Regionally, Asia Pacific (APAC), particularly China and India, maintains market dominance due to aggressive national renewable energy targets, high demand for electricity driven by rapid industrialization, and favorable manufacturing conditions for solar and battery components. Europe continues to lead in policy innovation, especially concerning green hydrogen development and offshore wind capacity, supported by the EU’s Green Deal initiatives. North America is experiencing a significant investment surge, largely stimulated by legislative actions such as the Inflation Reduction Act (IRA) in the United States, which provides substantial long-term certainty for domestic manufacturing and project development across the energy transition value chain.

Segment trends reveal that Energy Storage is the fastest-growing segment, critical for resolving the intermittency challenges inherent in solar and wind power, thereby stabilizing modern grids. Utility-scale solar photovoltaics (PV) and offshore wind are attracting the largest capital expenditure, reflecting their proven scalability and efficiency. Furthermore, there is an escalating trend towards hybridization, where solar and wind projects are paired with battery storage (co-located systems), maximizing asset utilization and enhancing overall grid integration capabilities. Green hydrogen is emerging from the pilot stage into commercial viability, focusing initially on decarbonizing hard-to-abate industrial sectors like steel, ammonia, and heavy transportation.

AI Impact Analysis on Clean Energy Technology Market

User queries regarding the impact of Artificial Intelligence (AI) on clean energy generally center on how AI can solve the fundamental challenge of renewable energy intermittency and optimize complex decentralized grid systems. Key themes include the role of predictive analytics in resource forecasting (wind speed, solar irradiance), optimizing battery charging and discharging cycles, improving the efficiency and lifespan of physical assets through preventative maintenance, and managing the dynamic supply and demand balance in smart grids. Users are concerned about the necessity of robust data infrastructure and cybersecurity required to deploy these AI solutions effectively across critical national energy infrastructure, while expecting AI to be the primary enabler of a fully decentralized, resilient, and net-zero power system.

- AI enables highly accurate forecasting of renewable energy output (solar and wind), crucial for grid operators to manage supply fluctuations and reduce reliance on fossil fuel backups.

- Machine learning algorithms optimize the dispatch and performance of Battery Energy Storage Systems (BESS), predicting peak demand windows and maximizing arbitrage opportunities.

- AI-driven predictive maintenance analyzes real-time sensor data from wind turbines and solar farms to detect anomalies early, significantly reducing downtime and O&M costs.

- Generative AI models assist in optimizing the physical layout and design of new clean energy projects, maximizing power generation efficiency based on site-specific topographical and meteorological data.

- Smart grid management utilizes AI to balance decentralized energy resources (DERs) in real-time, facilitating bidirectional power flow and enhancing overall grid stability and resilience against disturbances.

- Natural Language Processing (NLP) and computer vision are employed in monitoring construction sites and operational assets, ensuring safety compliance and efficient quality control.

DRO & Impact Forces Of Clean Energy Technology Market

The Clean Energy Technology Market is fundamentally shaped by powerful drivers, systemic restraints, significant strategic opportunities, and complex external impact forces. The primary drivers include aggressive national renewable energy targets, policy certainty provided by major governmental acts (like the EU's Fit for 55 and the US IRA), and the economic driver of decreasing technology costs, which have made clean energy the most affordable new power source in numerous jurisdictions globally. This cost parity, coupled with escalating consumer and corporate demand for sustainable practices, fuels continuous market expansion and technological adoption.

Restraints primarily revolve around the challenges inherent in high penetration of variable renewables, namely grid infrastructure limitations and the intermittency of generation, which necessitate vast investments in transmission upgrades and storage solutions. Supply chain bottlenecks, particularly the reliance on critical minerals (lithium, cobalt, rare earth elements) and geopolitical concentration of manufacturing capacity (especially for solar components), pose significant logistical and strategic risks. Furthermore, lengthy and complex permitting processes for new large-scale projects often delay deployment, hindering the speed required for an effective energy transition.

Opportunities for market players are substantial, particularly in the emerging fields of green hydrogen production and utilization for industrial decarbonization, and in the development of long-duration energy storage (LDES) technologies required for multi-day grid balancing. The ongoing modernization of legacy grid infrastructure into fully digital smart grids presents massive investment potential in digital solutions and cybersecurity. Impact forces, including rapid technological advancements (e.g., higher efficiency solar cells, new battery chemistries), geopolitical stability affecting energy trade routes, and evolving carbon market mechanisms, collectively determine the speed and direction of the market's transition, creating both urgency and instability for investors and developers.

Segmentation Analysis

The Clean Energy Technology Market is analyzed across various critical segments, including technology type, end-user application, and regional deployment, providing a granular view of investment flow and technological maturity. The market structure reflects a transition from monolithic centralized generation to a more diverse and distributed energy landscape. While solar and wind remain the largest generating segments, the exponential growth of energy storage solutions underscores the market’s focus on achieving reliability and dispatchability. Understanding these segment dynamics is crucial for investors prioritizing areas of high return and rapid scaling, particularly where policy support and technological readiness align.

- Technology Type

- Solar Power (PV, CSP)

- Wind Power (Onshore, Offshore, Floating)

- Hydropower (Large Hydro, Small Hydro, Pumped Storage)

- Bioenergy (Biomass, Biogas, Biofuels)

- Geothermal Energy

- Ocean Energy (Tidal, Wave)

- Green Hydrogen

- End-User

- Residential

- Commercial

- Industrial

- Utility

- Transportation

- Application

- Power Generation

- Heating and Cooling

- Decentralized Power (Off-Grid)

- Electrification of Transportation

- Component/System

- Energy Storage Systems (Lithium-ion, Flow, Compressed Air)

- Power Electronics (Inverters, Converters)

- Turbines and Generators

- Panels and Modules

- Grid Infrastructure and Software

Value Chain Analysis For Clean Energy Technology Market

The value chain for clean energy technology is highly complex and multi-layered, beginning with upstream activities focused on research, development, and the extraction of critical raw materials. Upstream analysis highlights significant challenges related to the sustainable sourcing of essential minerals such as lithium, nickel, cobalt, and polysilicon, coupled with the need for enhanced ethical and environmental standards in mining and processing. R&D activities are crucial for developing next-generation technologies like solid-state batteries and perovskite solar cells, aiming for higher efficiency and reduced material dependency, thereby creating competitive advantages for early movers in technology licensing and intellectual property.

Midstream activities encompass the manufacturing, assembly, and deployment phases. This involves the highly globalized production of components (e.g., solar modules, wind blades, battery cells), which is currently concentrated primarily in Asia Pacific. Supply chain resilience is a growing focus, driving strategies for regionalization and diversification of manufacturing bases, particularly in North America and Europe, supported by localization incentives. This phase also includes the financial structuring and project development of utility-scale assets, requiring specialized expertise in project finance, risk assessment, and regulatory navigation, transitioning the technology from manufactured goods into operational power infrastructure.

Downstream analysis covers the operation, maintenance, distribution, and consumption of clean energy. Distribution channels are varied, including direct sales to utilities for large-scale projects, indirect sales through engineering, procurement, and construction (EPC) contractors, and residential/commercial distribution through authorized installers and retailers. The proliferation of distributed generation necessitates advanced grid integration and sophisticated energy management software. Post-deployment, the focus shifts to asset optimization, predictive maintenance (often through digital twins and AI), and eventual decommissioning and circular economy practices, including the recycling of panels and batteries, which is emerging as a critical component of long-term sustainability and resource security in the sector.

Clean Energy Technology Market Potential Customers

The potential customer base for Clean Energy Technology is highly diverse, encompassing traditional energy consumers, infrastructure operators, and entities driven by specific decarbonization mandates. Major purchasers are large public and private utilities globally, which are mandated or incentivized to integrate vast amounts of renewable capacity to meet energy demand and regulatory standards. These utility buyers are primarily focused on large-scale, reliable, and cost-effective generation and storage solutions, investing heavily in centralized wind and solar farms, as well as high-capacity battery storage systems for frequency regulation and grid stability.

The industrial and commercial sectors represent another rapidly expanding segment of end-users, motivated by corporate sustainability goals (Scope 1, 2, and 3 emissions reduction), securing stable energy supply, and mitigating energy price volatility. Industrial buyers, particularly those in heavy manufacturing, chemicals, and data centers, are increasingly signing corporate Power Purchase Agreements (CPPAs) or investing directly in behind-the-meter generation and microgrids. They are also the primary early adopters of green hydrogen for process heat and feedstock substitution, particularly in sectors where electrification is technically challenging or economically prohibitive.

Residential customers, often termed prosumers, constitute a crucial segment driven by the desire for energy independence, reduced utility bills, and environmental consciousness. This segment primarily purchases rooftop solar PV systems, residential battery storage, and smart home energy management systems. Furthermore, government entities and municipal infrastructure projects are significant buyers, deploying clean technologies for public transport electrification (e.g., electric bus fleets), street lighting, and achieving resilience targets for critical public infrastructure, ensuring a broad and diversified demand profile across the global market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.1 Trillion |

| Market Forecast in 2033 | USD 2.5 Trillion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vestas Wind Systems, Siemens Gamesa Renewable Energy, General Electric (GE Vernova), NextEra Energy, Enel Green Power, JinkoSolar, LONGi Green Energy Technology, Tesla, CATL, Mitsubishi Heavy Industries, Ørsted, Iberdrola, Brookfield Renewable, Schneider Electric, SMA Solar Technology, First Solar, TotalEnergies, RWE, AES Corporation, Boralex |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Clean Energy Technology Market Key Technology Landscape

The technological landscape of the clean energy market is characterized by rapid innovation across generation, storage, and grid management. In solar technology, the focus is shifting beyond conventional silicon modules towards next-generation materials like perovskites, which promise higher efficiencies and lower manufacturing costs due to reduced material usage and simpler processing. Tandem solar cells, combining silicon with perovskite layers, are nearing commercial viability and could significantly boost the energy yield per panel, addressing limitations in land use and material scarcity. This pursuit of higher power density is critical for urban and high-demand applications.

In the storage sector, lithium-ion remains dominant, but intense R&D is dedicated to improving safety, energy density, and cycle life, alongside developing alternative chemistries. Long-Duration Energy Storage (LDES) is gaining traction, necessary for stabilizing the grid over periods ranging from 8 hours to multiple days. Technologies such as flow batteries, compressed air energy storage (CAES), and green hydrogen storage systems (P2X – Power-to-X) are receiving massive investment. Green hydrogen, produced via electrolysis powered by renewables, is emerging as a crucial decarbonization tool for heavy industry and long-haul transport, supported by advancements in high-efficiency, cost-effective electrolyzers.

Furthermore, digital technologies form the backbone of modern clean energy systems. Advanced smart grids utilize sophisticated sensors, high-speed communication networks, and artificial intelligence to manage decentralized generation and optimize energy flow in real-time, ensuring resilience and efficiency. Offshore wind technology continues to evolve rapidly, particularly with the commercialization of floating offshore wind platforms, which unlock access to deeper waters with stronger, more consistent wind resources, significantly expanding the addressable market beyond traditional fixed-bottom installations. These innovations collectively drive down operational costs, enhance performance, and accelerate the transition to fully integrated, resilient clean energy systems.

Regional Highlights

- Asia Pacific (APAC): APAC is the global leader in both deployment and manufacturing capacity for clean energy technologies, driven primarily by China, which dominates the global supply chain for solar PV, wind turbines, and battery components. Rapid industrialization and urbanization across countries like India, Vietnam, and South Korea necessitate enormous energy capacity additions, largely fulfilled by renewables. The region is seeing massive investment in utility-scale solar parks and offshore wind projects to meet increasingly stringent national targets.

- Europe: Europe maintains its leadership in policy innovation, notably through the European Green Deal and REPowerEU initiatives, aiming for deep decarbonization and energy independence from fossil fuels. Key regional focus areas include the rapid expansion of offshore wind in the North Sea, extensive R&D and pilot deployment of green hydrogen infrastructure, and regulatory frameworks promoting cross-border energy sharing and grid modernization across the EU member states.

- North America: The market in North America, spearheaded by the United States, is undergoing a transformative period following the passage of the Inflation Reduction Act (IRA). This legislation provides unprecedented long-term fiscal incentives for domestic manufacturing, particularly in solar, battery storage, and clean hydrogen production, catalyzing massive private sector investment and supply chain localization efforts. Canada is also expanding its hydro and wind resources while focusing on critical mineral sourcing.

- Latin America: This region presents high potential due to abundant natural resources, particularly solar irradiance in Chile’s Atacama desert and extensive wind resources in Brazil and Mexico. The market is primarily driven by competitive energy auctions and increasing commercial demand, attracting foreign investment into large-scale utility projects, although political and regulatory stability remains a variable factor.

- Middle East and Africa (MEA): The Middle East, historically reliant on oil and gas revenues, is now a major investor in gigawatt-scale solar PV and green hydrogen projects, driven by diversification strategies (e.g., Saudi Arabia’s Vision 2030 and UAE’s Net Zero targets). Africa, while facing infrastructure challenges, shows immense potential for decentralized clean energy solutions, including mini-grids and off-grid solar, crucial for energy access and rural electrification.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Clean Energy Technology Market.- Vestas Wind Systems

- Siemens Gamesa Renewable Energy

- General Electric (GE Vernova)

- NextEra Energy

- Enel Green Power

- JinkoSolar

- LONGi Green Energy Technology

- Tesla

- CATL

- Mitsubishi Heavy Industries

- Ørsted

- Iberdrola

- Brookfield Renewable

- Schneider Electric

- SMA Solar Technology

- First Solar

- TotalEnergies

- RWE

- AES Corporation

- Boralex

Frequently Asked Questions

Analyze common user questions about the Clean Energy Technology market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of growth in the Clean Energy Technology Market?

The primary driver is the confluence of stringent global government decarbonization policies, such as the US Inflation Reduction Act and the EU Green Deal, coupled with the rapid decline in the Levelized Cost of Electricity (LCOE) for solar and wind, making them economically superior to conventional power generation in most regions.

How is energy storage addressing the issue of renewable energy intermittency?

Energy storage systems, primarily lithium-ion batteries and emerging long-duration storage solutions, capture excess renewable generation during peak production times and discharge power during periods of low generation or high demand, thereby stabilizing the grid and ensuring reliable power dispatchability.

Which region currently leads the global Clean Energy Technology manufacturing sector?

Asia Pacific, specifically China, dominates the global clean energy manufacturing sector, holding majority market share in the production of solar PV modules, wind turbine components, and lithium-ion battery cells, driving global supply chain dynamics and technological scale.

What role does Green Hydrogen play in the energy transition?

Green Hydrogen is crucial for decarbonizing hard-to-abate sectors like heavy industry (steel, cement) and long-haul transportation, which cannot be easily electrified. It acts as a clean energy carrier, produced via electrolysis using renewable electricity, offering a pathway to achieve net-zero industrial emissions.

What are the key technological advancements expected to shape the market by 2033?

Key technological advancements include the commercialization of high-efficiency perovskite and tandem solar cells, the deployment of cost-effective long-duration energy storage (LDES), the scaling of floating offshore wind platforms, and the deep integration of AI for smart grid management and asset optimization.

Detailed Regional Market Analysis

A deeper dive into regional dynamics reveals specialized investment strategies and unique regulatory environments that influence technology adoption rates and market maturity. North America's market expansion, largely centralized in the United States, is undergoing a profound transformation. The Inflation Reduction Act (IRA) acts as a powerful catalyst, stimulating vast domestic investment not only in deployment but critically, in establishing a resilient domestic supply chain for key components, including solar cell manufacturing, battery Gigafactories, and electrolyzers. This governmental certainty is redirecting global capital flows and reducing dependence on foreign supply chains, prioritizing energy security alongside decarbonization goals. Furthermore, the focus on transmission infrastructure upgrades is critical in this region to accommodate the geographically dispersed nature of large-scale renewable resources, such as solar in the Southwest and wind in the central plains.

In Europe, the emphasis is heavily placed on achieving deep energy system integration and developing cutting-edge technologies. The North Sea is transforming into a major energy hub, linking massive offshore wind farms with various European grids, often facilitated by international cooperation and policy alignment. European nations are pioneering in the Power-to-X (P2X) economy, leveraging excess renewable power to produce synthetic fuels and green hydrogen, thus utilizing renewable energy to decarbonize sectors beyond electricity. Regulatory initiatives are stringent, requiring high standards for sustainability, waste management, and product lifecycles, pushing manufacturers towards circular economy models and traceable supply chains for raw materials.

The Asia Pacific region continues to be the engine of global growth, characterized by scale and speed. While China’s unparalleled manufacturing capacity sets the pace, emerging economies like India and Indonesia are rapidly increasing their renewable energy targets to manage booming energy demand while combating severe air quality issues. India’s ambitious targets for solar and storage deployment, often utilizing competitive reverse auctions, drive costs down globally. However, the region also faces considerable challenges related to local grid stability and the complexity of financing large-scale cross-border projects, necessitating innovative solutions in decentralized power generation and microgrid deployment, especially in island nations and remote areas.

Detailed Analysis of Energy Storage Segment

The Energy Storage segment is indispensable to the future stability of the Clean Energy Technology market, transitioning from a supplementary service to a foundational component of modern electricity grids. Lithium-ion technology, specifically tailored for grid-scale battery energy storage systems (BESS), dominates the current market due to its high energy density, efficiency, and decreasing cost curve, driven by massive production scale-up in the electric vehicle industry. These systems are essential for critical grid services, including frequency regulation, peak shaving, and providing firming capacity for intermittent renewables, thereby maximizing the usable output of solar and wind assets.

However, the increasing demand for grid flexibility necessitates the rapid development and commercialization of Long-Duration Energy Storage (LDES). LDES solutions, such as flow batteries, green hydrogen storage, and gravity-based systems, are designed to store energy economically for durations exceeding eight hours, or even seasonally. This is vital for regions aiming for 80% to 100% renewable energy penetration, where occasional multi-day periods of low solar or wind output must be managed without fossil fuel intervention. Investment in LDES technologies is accelerating, backed by government R&D grants and utility pilot programs focused on reliability and resilience under extreme weather conditions.

The integration of storage is also driving distributed energy resources (DERs) market expansion. Residential and commercial battery systems increase local energy self-sufficiency and resilience, allowing prosumers to participate actively in demand response programs. This decentralization requires advanced software and IoT platforms to aggregate and manage thousands of individual storage units, creating virtual power plants (VPPs) that provide flexible capacity to the grid operator. The interplay between decreasing storage costs, smart grid technologies, and favorable regulatory frameworks is cementing energy storage as the highest growth segment within the clean energy ecosystem.

Detailed Analysis of Solar Technology Segment

Solar Photovoltaics (PV) remains the largest deployed clean energy technology globally, characterized by unparalleled cost reductions achieved over the last decade and rapid manufacturing scale. Utility-scale solar farms, often deployed in large, arid regions, represent the bulk of the market, driven by competitive power purchase agreements (PPAs) that offer long-term, low-cost electricity. Technological advancements focus on increasing module efficiency and durability, including the transition to larger wafer sizes (M10, G12) and the adoption of n-type cell architectures, such as TOPCon and Heterojunction (HJT), which improve energy yield over the module lifecycle.

The distributed generation segment (rooftop solar for commercial, industrial, and residential applications) is also expanding significantly, supported by favorable net metering policies and declining installation costs. Distributed solar is critical for load reduction during peak demand hours and enhances localized energy security. The integration of Building Integrated Photovoltaics (BIPV), where solar cells are seamlessly incorporated into building materials like facades and roof tiles, is emerging as a niche market, prioritizing aesthetics alongside power generation in urban environments.

Supply chain management is a critical factor in the solar segment, given the high concentration of manufacturing in Asia. Efforts in North America and Europe to localize the polysilicon, wafer, and cell production stages are aimed at mitigating geopolitical risks and ensuring supply resilience. Furthermore, environmental concerns regarding the manufacturing process (energy consumption for polysilicon) and end-of-life panel recycling are prompting innovation in manufacturing sustainability and circular economy practices, ensuring the long-term environmental integrity of the solar value chain.

Detailed Analysis of Wind Technology Segment

The wind energy segment, comprising onshore and offshore installations, continues to be a cornerstone of the clean energy transition, valued for its proven scale and ability to contribute significantly to national grid capacity. Onshore wind, while facing constraints related to land use and community opposition in densely populated areas, remains a highly cost-effective option, with ongoing advancements focused on developing higher hub heights and larger rotor diameters to maximize energy capture in lower wind speed sites.

Offshore wind, however, is the segment experiencing the most dramatic technological and geographical expansion. The move towards gigawatt-scale projects, utilizing massive turbines (15 MW and above), leverages better and more consistent wind resources far from shore. Critically, the commercial deployment of Floating Offshore Wind (FOW) technology is unlocking vast untapped potential in regions with deep coastal waters, such as the US West Coast, Japan, and the Mediterranean, where traditional fixed-bottom structures are unfeasible. FOW requires specialized infrastructure and robust supply chains, presenting significant opportunities for shipyards and port upgrades.

Operational efficiency in the wind segment is increasingly driven by digitization. Predictive maintenance strategies, powered by AI and digital twins, monitor structural integrity, gearbox health, and blade aerodynamics in real-time, reducing unexpected failures and lowering O&M costs, particularly for complex offshore installations. Furthermore, advancements in specialized high-voltage direct current (HVDC) transmission cables are vital for efficiently bringing large quantities of power generated far offshore back to the main grid, integrating these immense renewable resources effectively into existing utility networks.

Impact of Geopolitical Factors on Market Growth

Geopolitical factors exert a significant and often volatile impact on the Clean Energy Technology Market, influencing everything from raw material access to deployment targets. Energy security concerns, heightened by recent global conflicts and political tensions, have become a primary driver, accelerating the demand for localized renewable energy infrastructure to minimize reliance on imported fossil fuels. This urgency is directly translating into increased government support for domestic manufacturing incentives, particularly in North America and Europe, aimed at building sovereign capacity across the solar and battery value chains.

The market faces inherent vulnerabilities due to the highly concentrated supply chain for critical components and materials. The dominance of a few geographical regions in processing rare earth elements, polysilicon, and battery precursors creates single points of failure, exposing projects to political risks, trade tariffs, and unforeseen supply disruptions. Strategic responses include the formation of mineral sourcing alliances among allied nations and significant investment in recycling technologies to create a closed-loop system, reducing reliance on primary raw material extraction.

Furthermore, international cooperation on climate policy, such as the commitments made under the Paris Agreement and subsequent COPs, drives global demand and sets aspirational targets. However, the varying speeds of regulatory implementation across different nations, coupled with fluctuating political commitment, create uneven market landscapes. Geopolitical stability is crucial for long-term, capital-intensive investments like utility-scale offshore wind and green hydrogen pipelines, making risk assessment related to political regime changes and international trade agreements paramount for project developers and financiers.

Financial and Investment Landscape Analysis

The financial landscape of the Clean Energy Technology Market is robust, characterized by a massive influx of capital from diverse sources, including institutional investors, sovereign wealth funds, development banks, and private equity. Investment momentum is strongly linked to the growing importance of Environmental, Social, and Governance (ESG) criteria, making clean energy assets increasingly attractive as stable, long-term infrastructure investments that align with sustainability mandates.

Key financial trends include the increasing sophistication of financing mechanisms. Project finance, previously dominated by traditional bank debt, now utilizes complex structures involving green bonds, sustainability-linked loans, and securitization of Power Purchase Agreements (PPAs). The standardization of PPA contracts has reduced risk perception, enabling financing for projects in emerging markets. Additionally, Venture Capital and Growth Equity funds are actively targeting early-stage companies focused on breakthrough technologies such, as long-duration storage chemistry and advanced grid optimization software.

Despite the positive trajectory, the sector faces financing challenges, particularly for risky, first-of-a-kind projects like large-scale green hydrogen facilities or floating offshore wind. De-risking these investments often requires blended finance approaches, utilizing government guarantees, concessional funding, or public-private partnerships to bridge the initial viability gap. The availability of capital remains high, but execution risks associated with inflation, rising interest rates, and commodity price volatility necessitate careful financial planning and risk management across all phases of the project lifecycle.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager