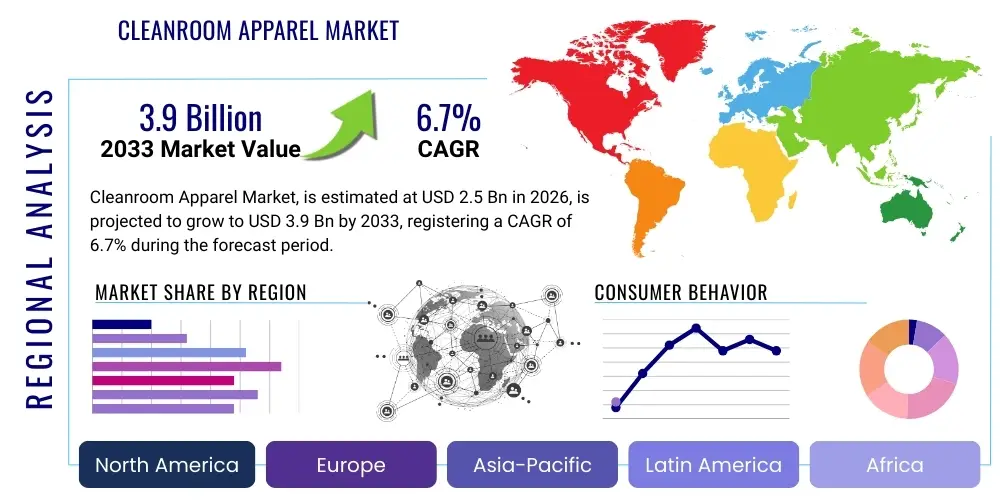

Cleanroom Apparel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436174 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Cleanroom Apparel Market Size

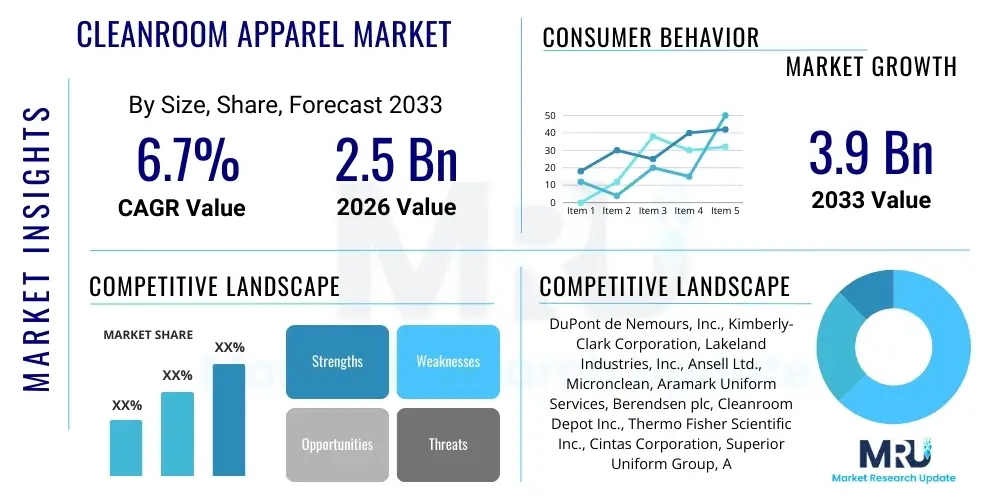

The Cleanroom Apparel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 3.9 Billion by the end of the forecast period in 2033. This growth is fundamentally driven by the stringent regulatory environment governing critical manufacturing sectors, particularly pharmaceuticals, biotechnology, and microelectronics, which necessitate rigorous contamination control protocols.

Cleanroom Apparel Market introduction

The Cleanroom Apparel Market encompasses specialized garments and accessories designed to minimize particle generation and prevent the transfer of contaminants into controlled environments, classified primarily by ISO 14644 standards. These essential products, including coveralls, frocks, hoods, boots, and face masks, serve as the primary barrier between the wearer and the critical manufacturing process, ensuring product integrity and operational safety. Demand is strongly linked to advancements in sensitive manufacturing fields, where even microscopic contamination can lead to catastrophic product failure or regulatory non-compliance. The market is defined by a shift toward high-performance materials offering enhanced particle filtration efficiency, electrostatic discharge (ESD) protection, and increased wearer comfort.

Major applications of cleanroom apparel span across the semiconductor industry, which requires ultra-high cleanliness levels (ISO Class 1-5), and the life sciences sector, including sterile compounding and vaccine manufacturing, which adhere to strict Good Manufacturing Practice (GMP) guidelines. The inherent benefits of utilizing validated cleanroom apparel include reduced defect rates, enhanced worker safety through barrier protection, and simplified compliance with international quality standards such as FDA and EMA regulations. These protective garments are crucial for maintaining the required air cleanliness levels necessary for delicate operations, thereby safeguarding billions of dollars in specialized equipment and high-value product batches.

The market’s driving factors are multifaceted, primarily fueled by the accelerating global expansion of pharmaceutical manufacturing, particularly in emerging economies, coupled with significant investments in next-generation fabrication facilities (fabs) for microelectronics. Additionally, the increasing complexity of biological drugs and advanced therapies (like cell and gene therapies) demands superior aseptic processing environments, boosting the consumption of disposable, sterile apparel. Regulatory mandates enforcing stringent particle control in industries like aerospace and medical device assembly further solidify the continuous growth trajectory of this specialized market segment.

Cleanroom Apparel Market Executive Summary

The Cleanroom Apparel Market is experiencing robust expansion, characterized by a fundamental shift toward disposable garments due to increasing sterility requirements and reduced cleaning costs, particularly in North American and European life science clusters. Business trends highlight strategic alliances and vertical integration among key players, focusing on supply chain resilience and the development of sustainable cleanroom textiles that meet high-level contamination standards while minimizing environmental impact. Technological innovation centers on improving garment breathability, anti-static properties, and advanced sterilization techniques (e.g., gamma irradiation, E-beam) to cater to the exacting needs of ISO Class 3 and Class 4 environments.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by massive governmental and private investments in semiconductor manufacturing (driven by countries like China, Taiwan, and South Korea) and the burgeoning biotechnology sector in India and Japan. While North America and Europe remain mature markets characterized by high penetration rates and strong regulatory frameworks, their growth is primarily sustained by the continuous renewal of existing pharmaceutical infrastructure and the stringent demands of advanced therapy manufacturing. Regulatory harmonization efforts globally are prompting manufacturers to adopt universally accepted standards, accelerating product differentiation based on material science and validated cleanliness levels.

Segmentation trends indicate that the Disposable segment dominates the market in terms of revenue and volume, offering convenience, verifiable sterility, and minimizing cross-contamination risks crucial for sterile pharmaceutical production. Among product types, coveralls and frocks maintain the largest share, as they provide the most comprehensive body coverage required for high-grade cleanrooms. The Pharmaceuticals & Biotechnology end-use segment is the primary revenue generator, owing to the high frequency of gowning procedures, strict GMP compliance, and the high criticality of the products being manufactured. This segment’s demand is inelastic, driven by essential healthcare needs and continuous drug development pipelines.

AI Impact Analysis on Cleanroom Apparel Market

User inquiries regarding AI's influence on the Cleanroom Apparel Market primarily revolve around how artificial intelligence can enhance quality control (QC), optimize supply chain logistics, and potentially automate the gowning process or apparel inspection. Users are concerned about maintaining validation accuracy as systems become automated and seek clarification on whether predictive maintenance enabled by AI can reduce unexpected equipment failures leading to cleanroom breaches. Key expectations center on using AI for predictive contamination modeling—analyzing environmental data (particle counts, HVAC parameters) to anticipate when garment failure or contamination breaches might occur, thereby ensuring proactive apparel replacement and improved risk mitigation strategies for manufacturers.

While AI does not directly alter the physical properties or materials of cleanroom garments, its transformative impact lies in the operational efficiency and quality assurance framework surrounding apparel management. AI-driven vision systems are increasingly being deployed for automated inspection of washed and sterilized reusable garments, detecting minute tears, pinholes, or improper folding that human inspectors might miss, significantly enhancing the reliability of the reusable apparel lifecycle. Furthermore, predictive inventory management uses machine learning algorithms to forecast apparel consumption rates based on production schedules, staff rotation, and projected regulatory audits, thereby optimizing stock levels, minimizing waste, and ensuring just-in-time delivery of specialized garments.

The integration of AI with smart cleanroom systems, including computerized gowning logging and personnel tracking, allows for sophisticated analysis of human movement patterns within controlled environments. This data helps facilities managers identify high-risk behaviors or traffic routes that may necessitate stricter gowning protocols or adjustments to apparel specifications. This data-driven approach moves cleanroom management from reactive particle counting to proactive contamination source control, ensuring that the apparel—the primary contaminant barrier—is utilized and maintained in the most effective manner possible across all classification levels.

- AI-enabled vision inspection for automated quality control of reusable garment integrity.

- Predictive contamination modeling optimizing replacement cycles for disposable and reusable apparel.

- Machine learning algorithms optimizing inventory levels and forecasting demand based on production variables.

- Integration of smart tags (RFID/NFC) with AI analytics for real-time tracking of garment sterilization cycles and usage history.

- Optimization of cleanroom workflows by analyzing personnel movement to inform apparel policy and design suitability.

- Automated compliance monitoring, cross-referencing apparel usage records with regulatory requirements (e.g., GMP Annex 1).

DRO & Impact Forces Of Cleanroom Apparel Market

The Cleanroom Apparel Market is powerfully driven by stringent regulatory frameworks, particularly those mandated by the FDA, EMA, and ISO standards (e.g., ISO 14644), which necessitate the use of specialized protective garments in controlled environments. Simultaneously, continuous technological advancements in sectors requiring high precision, such as semiconductors and nanotechnology, create an ongoing need for apparel with superior particle filtration efficiency and sophisticated anti-static properties. However, the market faces significant restraints, primarily the high initial cost associated with specialized, validated, and often disposable apparel, alongside challenges related to supply chain volatility for raw materials and the complex logistics of maintaining sterile inventory across global manufacturing sites. These restraints increase the operational expenditure for end-users, compelling them to constantly weigh cost efficiency against mandatory compliance.

Opportunities for market growth are abundant, particularly through the development of environmentally sustainable cleanroom apparel, addressing the widespread environmental concerns associated with disposable plastics. Furthermore, the expansion of advanced therapy medicinal products (ATMPs) and specialized compounding pharmacies presents a high-value niche demanding ultra-sterile, customized apparel solutions. The market is also benefiting from the digitalization of quality assurance processes, incorporating IoT and smart tags into apparel for enhanced tracking and validation, offering manufacturers a premium pathway for differentiation.

The major impact forces shaping this industry are regulatory stringency (driving demand and specifications), technological evolution (demanding higher performance materials), and increasing awareness regarding cross-contamination risks (favoring disposable and single-use options). These forces collectively accelerate the adoption curve for high-grade, certified apparel. The primary impact is the continuous upward pressure on quality and material science innovation, ensuring that apparel effectively serves as the critical line of defense against product contamination in sensitive manufacturing processes globally, thus linking market performance directly to success in high-tech and healthcare industries.

Segmentation Analysis

The Cleanroom Apparel Market segmentation provides a detailed view of the diverse product offerings and application landscapes driving market dynamics. The market is broadly categorized by Type (Disposable and Reusable), Product (Coveralls, Frocks, Hoods, Boots, Accessories), and End-Use Industry (Pharmaceuticals & Biotechnology, Electronics & Semiconductor, Medical Devices, and Others). Understanding these segments is crucial as regulatory demands and operational budgets dictate distinct preferences, with high-criticality sectors heavily favoring validated, disposable items, while certain large-scale industrial operations may prioritize the long-term cost-effectiveness of reusable garments.

The disposable segment, favored for its guaranteed sterility and convenience, currently holds the largest market share and is expected to exhibit the fastest growth, largely due to escalating demands in the life sciences sector driven by aseptic processing requirements. Conversely, reusable apparel remains popular in ISO Class 7 and Class 8 environments (less critical zones) and environments where large volumes are processed and stringent in-house laundering and sterilization capabilities are maintained. Geographic segmentation reflects the concentration of high-tech manufacturing, with APAC dominating supply chain activity and end-use consumption related to electronics, while North America and Europe lead in consumption for the highly regulated pharmaceutical sector.

- Type

- Disposable

- Reusable

- Product

- Coveralls

- Frocks

- Hoods

- Booties/Overshoes

- Face Masks

- Accessories (Goggles, Wipes, Gloves)

- Material Type

- Polypropylene

- Polyester

- Tyvek

- Others (Gore-Tex, SMMMS, etc.)

- End-Use Industry

- Pharmaceuticals & Biotechnology

- Electronics & Semiconductor

- Aerospace & Defense

- Medical Devices

- Research Laboratories

Value Chain Analysis For Cleanroom Apparel Market

The value chain for cleanroom apparel begins with the upstream segment involving raw material sourcing, predominantly centered on non-woven fabrics (polypropylene, polyethylene, polyester) and specialized barrier materials (e.g., DuPont Tyvek). This stage requires rigorous quality control as the base material’s particle retention and barrier properties directly determine the final product’s classification suitability. Key activities include polymerization, spinning, and fabric finishing (e.g., antistatic treatment, low-lint processing). Manufacturers often rely on a concentrated base of specialized textile producers capable of meeting ISO clean manufacturing requirements for the raw fabric itself, creating significant interdependencies within the supply chain.

The midstream phase, involving manufacturing and processing, includes garment cutting, stitching (often required to be bound or sealed to prevent particle shedding), gamma irradiation or E-beam sterilization (for disposable items), and packaging in double or triple layers specific to cleanroom transfer protocols. Direct distribution channels are often favored for large-volume pharmaceutical clients and high-tech manufacturers, where precise inventory management and validation documentation are critical. Indirect distribution utilizes specialized industrial safety and cleanroom supply distributors who manage smaller accounts and provide localized logistical support, ensuring broad market access.

The downstream segment focuses on end-user consumption, including the complex logistics of warehousing, cleanroom gowning procedure training, and subsequent disposal or professional laundering/re-sterilization (for reusable garments). Key challenges downstream involve maintaining the integrity of sterile packaging during transit and ensuring proper disposal according to hazardous waste regulations. The value chain is significantly influenced by regulatory bodies and third-party testing labs that validate and certify the apparel to required ISO/GMP standards before final acceptance by the end-user, emphasizing quality and traceability over simple cost metrics throughout the process.

Cleanroom Apparel Market Potential Customers

Potential customers for cleanroom apparel are highly diversified yet concentrated within regulated and specialized high-precision manufacturing sectors where airborne contamination mitigation is non-negotiable. The largest and most demanding customer segment comprises pharmaceutical and biotechnology companies, including manufacturers of biologics, sterile injectables, and advanced therapies, which require ISO Class 5 and GMP Grade A/B environments. These organizations prioritize certified sterility, validated barrier protection, and extensive documentation, often procuring large volumes of disposable coveralls and accessories.

The second major cohort includes electronics and semiconductor fabrication plants (fabs). These facilities, driven by the shrinking size of microchips, demand extremely low particle counts (ISO Class 1-4) and require apparel with advanced anti-static (ESD) properties and ultra-low-lint materials. Their procurement decisions are heavily influenced by the apparel's ability to prevent electrostatic discharge damage to sensitive components, alongside particle control efficiency. This segment often opts for specialized reusable garments or specific high-tech disposable options.

Other significant buyers include medical device manufacturers (especially those producing sterile implants or surgical tools), aerospace and defense contractors involved in satellite or precision instrument assembly, and accredited research laboratories that handle sensitive biological materials or nanotechnologies. Across all these segments, the purchasing decision is centralized around compliance, quality assurance, supplier reliability, and the total cost of contamination risk avoidance, making certification and validation key requirements for supplier selection.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 3.9 Billion |

| Growth Rate | 6.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DuPont de Nemours, Inc., Kimberly-Clark Corporation, Lakeland Industries, Inc., Ansell Ltd., Micronclean, Aramark Uniform Services, Berendsen plc, Cleanroom Depot Inc., Thermo Fisher Scientific Inc., Cintas Corporation, Superior Uniform Group, Alsco Inc., Valutek, Gamma Labs, Elis SA, Texwipe, Nitritex Ltd., Sempermed, Bemis Company, Inc., Steris PLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cleanroom Apparel Market Key Technology Landscape

The technology landscape of the Cleanroom Apparel Market is primarily focused on material science innovation and advanced sterilization techniques to meet increasingly challenging contamination control specifications. Key advancements involve the development of composite materials, such as multi-layered fabrics (e.g., SMMMS structures), that offer a superior balance between particle barrier protection, liquid repellency, and wearer comfort (breathability). Furthermore, antistatic and electrostatic dissipative (ESD) fabric treatments are crucial, especially for the electronics segment, where new technologies ensure permanent ESD properties without degrading through washing or sterilization cycles, maintaining critical protection integrity.

Sterilization technology is another pivotal area, particularly for disposable apparel destined for aseptic environments (e.g., Grade A/B pharmaceuticals). Gamma irradiation remains the industry standard, offering high sterility assurance levels (SAL); however, electron-beam (E-beam) sterilization is gaining traction due to its faster processing time and potential for less material degradation, which is essential for maintaining the physical properties of complex protective fabrics. Suppliers are also investing heavily in advanced cleanroom laundry technologies that employ stringent particle counting methods and validated washing cycles to ensure that reusable garments maintain their cleanliness classification over their designated service life.

Finally, digitalization and traceability technologies, such as RFID and NFC tags embedded within garments, are transforming inventory management and compliance tracking. These smart features allow end-users to accurately track the usage history, laundering cycles, and sterilization dates of each item, facilitating automated logging and ensuring adherence to strict internal and external audit requirements. This technological integration enhances operational security and provides verifiable data proving the continuous cleanliness status of the apparel throughout its entire lifecycle, moving the industry toward a more data-driven approach to contamination control.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate due to massive government and private sector investments in the semiconductor industry (especially in Taiwan, South Korea, and Mainland China) and the rapid expansion of generic and specialty pharmaceutical manufacturing hubs in India and Southeast Asia. The region is becoming a global manufacturing powerhouse, driving exponential demand for all classes of cleanroom consumables, particularly high-volume disposable apparel.

- North America: North America holds the largest revenue share, primarily driven by the stringent regulatory environment of the U.S. FDA and the large presence of established biotechnology and cell/gene therapy companies. Demand is characterized by a strong preference for high-quality, validated, and often domestically sourced sterile disposable garments required for critical aseptic processing in mature, high-value markets.

- Europe: Europe represents a mature market with stable growth, strongly supported by robust pharmaceutical manufacturing adhering to EU GMP Annex 1 guidelines. The region is a leader in adopting reusable apparel solutions coupled with certified industrial laundering services, driven partly by strong environmental mandates and a well-established network of specialized textile management providers.

- Latin America (LATAM): Growth in LATAM is steady but slower, influenced by the increasing regulation of the local pharmaceutical and medical device manufacturing sectors, particularly in Brazil and Mexico. The market often balances cost-efficiency with basic contamination control needs, leading to mixed adoption rates of disposable versus reusable items.

- Middle East and Africa (MEA): The MEA region is emerging, with demand concentrated in healthcare expansion projects, localized pharmaceutical production, and nascent semiconductor investments, notably in the UAE and Saudi Arabia. Market growth is dependent on infrastructure development and technology transfer, favoring international suppliers who can provide certified products meeting global standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cleanroom Apparel Market.- DuPont de Nemours, Inc.

- Kimberly-Clark Corporation

- Lakeland Industries, Inc.

- Ansell Ltd.

- Micronclean

- Aramark Uniform Services

- Berendsen plc

- Cleanroom Depot Inc.

- Thermo Fisher Scientific Inc.

- Cintas Corporation

- Superior Uniform Group

- Alsco Inc.

- Valutek

- Gamma Labs

- Elis SA

- Texwipe

- Nitritex Ltd.

- Sempermed

- Bemis Company, Inc.

- Steris PLC

Frequently Asked Questions

Analyze common user questions about the Cleanroom Apparel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between disposable and reusable cleanroom apparel?

Disposable apparel is single-use, pre-sterilized (often via gamma irradiation), and guarantees zero risk of cross-contamination, making it ideal for Grade A/B aseptic processes. Reusable apparel is made of durable fabrics, requires validated industrial laundering and sterilization processes after each use, and is typically employed in lower-grade cleanrooms (ISO Class 7/8).

Which end-use industry drives the highest demand for cleanroom apparel globally?

The Pharmaceuticals and Biotechnology sector is the dominant driver due to the extremely high regulatory demands, the critical need for aseptic processing in drug manufacturing, and the large volume usage of specialized, sterile disposable garments required to maintain GMP compliance and product integrity.

How do ISO standards influence the selection of cleanroom apparel?

ISO 14644-1 dictates the maximum permissible concentration of airborne particles, which directly determines the level of barrier protection required from the apparel. Apparel used in ISO Class 1 or Class 3 cleanrooms (e.g., semiconductor manufacturing) must have superior filtration efficiency, anti-static properties, and minimal particle generation compared to apparel used in ISO Class 7 or 8 environments.

What technological innovations are currently trending in cleanroom garment materials?

Current trends focus on advanced material composites offering enhanced breathability combined with superior barrier properties, permanent anti-static fabrics (ESD), and the integration of RFID or NFC technology for automated tracking and lifecycle management to improve compliance verification.

Is the Cleanroom Apparel Market moving towards sustainability?

Yes, sustainability is a growing focus, driven by environmental concerns over disposable plastics. Manufacturers are investing in recyclable materials, bio-based polymers for single-use garments, and optimizing reusable apparel laundry processes to reduce water and energy consumption, offering greener alternatives without compromising contamination control standards.

The detailed analysis of the Cleanroom Apparel Market reveals a landscape characterized by mandatory regulatory compliance and continuous material innovation. The demand elasticity in critical sectors, such as pharmaceutical manufacturing and high-precision electronics, ensures sustained growth, even amid economic fluctuations. The transition toward advanced therapies and smaller node semiconductor fabrication necessitates increasingly high-performance, validated apparel solutions. Geographically, while North America maintains high market value through specialized biotechnology demand, Asia Pacific is poised for explosive volumetric growth, driven by extensive industrialization. Key market strategies involve securing reliable supply chains, emphasizing product validation (sterility, particulate control), and developing sustainable disposable options to address environmental pressures. The integration of smart technologies, such as RFID tracking, further solidifies the market's trajectory toward enhanced operational efficiency and verifiable contamination control protocols, reinforcing the apparel's role as a critical component of controlled environments globally. Future market success hinges on the ability of manufacturers to deliver verifiable cleanliness, comfort, and compliance in increasingly stringent regulatory landscapes across all major end-use sectors.

A deeper dive into the technological requirements for the semiconductor industry reveals the necessity of apparel that actively mitigates electrostatic discharge (ESD). Modern microchip fabrication often occurs in environments demanding ISO Class 3 or better, where static buildup can instantly destroy sensitive circuitry. Apparel manufacturers respond by integrating carbon filaments or specialty conductive fibers into garment weaves. These advanced fabrics ensure surface resistivity within specified ranges, effectively channeling static charge away from sensitive components. The challenge is balancing high barrier efficiency (low particle shedding) with consistent ESD protection, a material science hurdle that differentiates premium suppliers. Furthermore, packaging technology for this sector is equally critical; garments must be double or triple-bagged in a manner that allows safe transfer into the cleanroom without introducing external contaminants, often requiring specialized folding techniques (like the "California fold") to facilitate sterile donning.

Conversely, the pharmaceutical sector, particularly sterile compounding and aseptic filling operations, prioritizes the sterility assurance level (SAL). The dominant concern here is the ingress of microbial contaminants. This segment heavily utilizes garments made from highly effective non-woven barriers, frequently sterilized by validated methods like gamma irradiation. The design features are tailored to prevent gaps in coverage—incorporating integrated hoods, finger loops, and sealed seams. The European Union’s Annex 1 update has heightened the requirements for sterile garments, pushing manufacturers to provide extensive documentation on particulate generation during movement (Helmke Drum testing) and validated sterilization cycles. This regulatory pressure reinforces the dominance of disposable, certified sterile apparel in this end-use segment, further driving revenue growth and necessitating rigorous quality control throughout the supply chain.

In terms of competitive dynamics, the market is moderately consolidated, with large, established players like DuPont and Kimberly-Clark leveraging their brand recognition, global distribution networks, and superior material science expertise. However, regional and specialized providers often thrive by offering tailored solutions for specific ISO classes or proprietary sterilization services (e.g., specialized garment rental and processing). The competition is increasingly centered on service offerings, particularly in the reusable segment, where total garment management (laundering, repair, revalidation, inventory) provides significant value to end-users. Pricing pressure remains a constant factor, especially for generic disposable components, compelling manufacturers to pursue cost efficiencies through automated production and optimization of non-woven material sourcing while simultaneously investing in premium features for high-criticality applications.

Looking ahead, the convergence of nanotechnology and advanced material science is expected to introduce "smart" cleanroom garments capable of dynamic monitoring. Imagine apparel that can subtly monitor environmental conditions immediately surrounding the worker, potentially signaling temperature, humidity, or even detecting localized particle excursions before a breach occurs. While currently nascent, this trend promises to transform contamination control from a static barrier requirement into an active safety system. This technological evolution will necessitate specialized data infrastructure within manufacturing facilities to process and react to the real-time input provided by the apparel. Such innovations will not only improve product yield but also fundamentally change the workflow of cleanroom operators and quality assurance personnel, representing a long-term opportunity for key market players.

Finally, the supply chain resilience post-2020 has become a major strategic consideration. Reliance on specific global regions for non-woven fabric precursors and sterilization services created vulnerabilities. As a response, major market participants are diversifying their sourcing strategies, increasing manufacturing capacity closer to primary consumption markets (nearshoring/reshoring), and implementing rigorous risk assessment protocols to ensure continuity of supply. For the highly critical pharmaceutical market, guaranteed supply of sterile disposables is paramount, driving long-term contracts and increased scrutiny of supplier contingency plans. This emphasis on resilient logistics and diversified manufacturing footprints ensures the market can sustain the growth demanded by the expanding global high-tech and healthcare infrastructure.

The economic landscape strongly favors products offering a verifiable return on investment (ROI) through contamination risk mitigation. For instance, in semiconductor fabrication, the cost of a single contaminated batch of wafers can run into millions of dollars; thus, investing in premium, validated cleanroom apparel, even if significantly more expensive than standard industrial garments, is a necessary insurance policy. This economic reality underpins the market's preference for quality and certification over basic cost savings in high-stakes environments. Apparel manufacturers must demonstrate clear lineage and certification against industry benchmarks (such as ISO 14644, IEST-RP-CC003, and specific GMP guidelines) to capture and maintain market share among top-tier end-users. The regulatory burden acts as a barrier to entry for non-certified suppliers, cementing the position of established, quality-focused vendors.

The Accessories segment, encompassing items like face masks, hoods, gloves, and specialized boots, contributes significantly to market revenue due to high consumption rates. These items often require frequent changes throughout a shift, particularly in pharmaceutical Grade C and D zones, and are crucial for covering all exposed human skin surfaces—the single largest source of particulate generation. Technological refinement in this area includes improved ergonomic designs for masks and gloves that maintain high filtration efficiency without compromising worker dexterity or comfort over long operational periods. Furthermore, the selection of materials for these accessories often focuses on compatibility with chemical disinfectants and ease of sterile removal to prevent contamination when exiting the controlled area, highlighting the comprehensive nature of contamination control planning.

The geographical analysis further emphasizes the difference between mature and emerging markets. While North America and Europe focus on replacing and upgrading existing cleanrooms and catering to R&D-intensive biopharma, APAC’s sheer volume growth stems from establishing entirely new manufacturing capacity. This means APAC represents a major opportunity for both disposable and reusable suppliers capable of scaling production quickly. Suppliers entering the APAC market must navigate diverse regional standards and sometimes localized procurement preferences, necessitating strategic partnerships or local manufacturing footprints. The Middle East, though smaller, is showing promise due to major governmental efforts to diversify economies away from oil and into high-tech manufacturing and advanced healthcare services, creating steady long-term demand for specialized cleanroom inputs, including apparel.

Finally, the growing trend of outsourcing industrial laundering and garment management services is influencing the dynamics of the Reusable segment. Companies are increasingly recognizing that maintaining in-house validated cleanroom laundry facilities is costly and complex. This trend benefits service providers like Aramark and Berendsen, who offer full-service, certified cleanroom apparel programs, allowing end-users to focus on their core manufacturing operations while ensuring continuous compliance with garment cleanliness standards. This service-oriented approach adds significant value and complexity to the reusable apparel market, pushing competition beyond just material cost to encompass reliability, validation, and logistical efficiency.

The market faces inherent challenges related to the shelf life and storage of sterilized disposable items. Gamma-irradiated products have defined expiration dates, and improper storage (e.g., exposure to heat or humidity) can compromise the sterile integrity of the packaging. Manufacturers must provide robust training and guidance on handling and inventory rotation (FIFO – First In, First Out) to minimize waste and ensure only validly sterilized apparel is used in critical zones. This logistical requirement demands close collaboration between the apparel supplier and the end-user's quality assurance team, adding a layer of service complexity that distinguishes specialized suppliers from commodity providers.

Overall, the trajectory of the Cleanroom Apparel Market is inextricably linked to global investments in health and technology infrastructure. As the world continues to demand faster, smaller, and more precise electronic components and increasingly complex, life-saving biological drugs, the demand for certified contamination control solutions will only intensify. The market is transitioning from simply providing barrier clothing to offering integrated, technologically advanced, and verifiable contamination management tools.

The regulatory framework is not static; ongoing updates, such as the EU GMP Annex 1 revisions, continually elevate the cleanliness requirements for personnel in critical processing areas. These updates directly mandate higher barrier efficiency for apparel, stricter requirements for gowning procedures, and comprehensive documentation of garment usage and sterilization history. This constant upward pressure on standards forces manufacturers to continuously innovate material compositions and garment designs to achieve superior particle control and microbial inhibition. Manufacturers that can anticipate and proactively meet these evolving regulatory benchmarks hold a significant competitive edge in securing high-value contracts within the most regulated industries.

The rising prevalence of contract manufacturing organizations (CMOs) and contract development and manufacturing organizations (CDMOs) further influences the market. These third-party service providers manage production for multiple clients, often requiring flexible and scalable cleanroom operations. This necessitates efficient apparel management, favoring suppliers who can provide rapid deployment, validated garment rental services, or large-scale disposable inventories tailored to various client specifications and changing batch sizes. The focus here is on efficiency and verifiable compliance documentation that can satisfy the audit requirements of multiple pharmaceutical clients simultaneously.

Technological advancement in the Electronics & Semiconductor sector is driving demand for ultra-clean materials that are not only low-linting but also chemically inert. As fabrication techniques move toward atomic-level precision, even minute residues from garment materials or processing chemicals can cause yield loss. Consequently, specialized cleanroom apparel for this sector often undergoes rigorous leaching tests and particulate generation audits far exceeding the requirements for the pharmaceutical industry. Suppliers who invest in proprietary cleaning and packaging processes for their materials, ensuring ultra-low non-volatile residue (NVR) levels, are positioning themselves as preferred partners for advanced semiconductor fabs.

Finally, workforce training and ergonomics are subtle but essential components of the market. Even the most technologically advanced apparel is ineffective if not donned and doffed correctly, or if it causes operator fatigue. Therefore, leading suppliers often provide integrated training modules and design garments (e.g., lightweight, breathable coveralls) that maximize wearer comfort while minimizing the risk of contamination caused by poor gowning compliance or uncomfortable movement within the cleanroom. This human factor consideration is increasingly important for retaining skilled labor in these highly specialized manufacturing environments.

The development of sustainable options for cleanroom apparel represents one of the most significant long-term growth opportunities, driven by both corporate social responsibility initiatives and increasing consumer pressure. While disposability currently dominates critical sterile processes, manufacturers are actively exploring closed-loop recycling programs for materials like polypropylene or researching biodegradable polymers that break down safely after use. Overcoming the technical challenge of combining high barrier protection with biodegradability remains a key focus for R&D investment, promising a major competitive differentiator for companies that successfully launch certified eco-friendly cleanroom solutions compliant with ISO standards without sacrificing safety or performance requirements in the years to come.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager