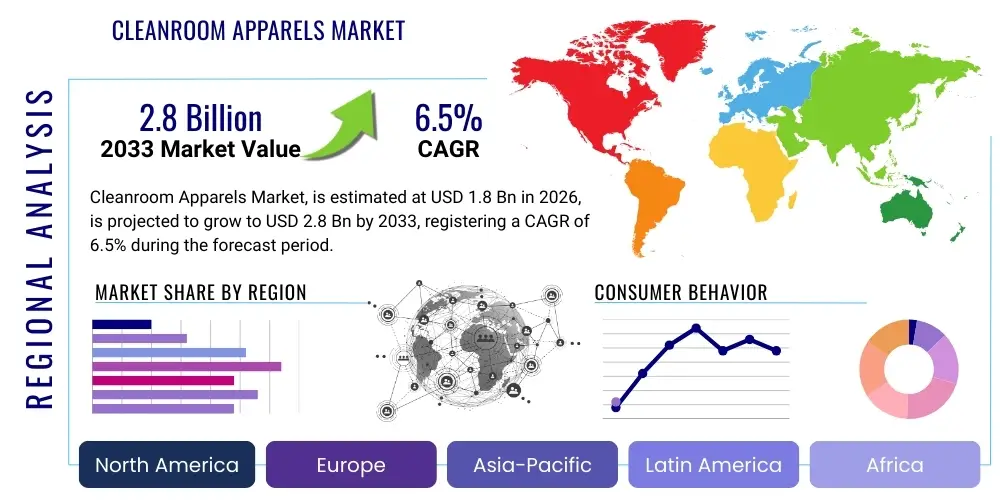

Cleanroom Apparels Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438360 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Cleanroom Apparels Market Size

The Cleanroom Apparels Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033.

Cleanroom Apparels Market introduction

The Cleanroom Apparels Market encompasses specialized garments and accessories designed to minimize particle generation and prevent the contamination of sensitive manufacturing environments, such as those found in biotechnology, semiconductor manufacturing, aerospace, and pharmaceutical industries. These products, ranging from coveralls, frocks, gowns, boot covers, hoods, and shoe covers, are essential protective layers that shield the controlled environment from human-generated particulates, fibers, and microorganisms. The design and material composition of these apparels—which often include synthetic materials like polyester, polypropylene, and specialized laminates—are strictly regulated to meet stringent international standards (e.g., ISO 14644, USP 797) concerning particle shedding, static dissipation, and resistance to chemical infiltration. The increasing complexity and miniaturization in electronics manufacturing and the accelerating pace of biological drug development are primary factors driving the sustained demand for high-performance, validated cleanroom garments globally.

The fundamental product description centers on high-integrity barrier systems that must maintain cleanliness classifications, typically achieved through non-linting fabrics and highly durable construction capable of enduring multiple cycles of industrial washing and sterilization. Major applications span across aseptic processing in pharmaceuticals, where cross-contamination is critical; microelectronics fabrication, requiring sub-micron particle control; and medical device manufacturing, demanding sterile environments. The inherent benefits derived from utilizing these apparels include enhanced product yield, compliance with rigorous governmental and international safety regulations, and the long-term protection of sensitive, high-value equipment and processes. The effectiveness of cleanroom apparel is intrinsically linked to the material’s filtration efficiency, breathability, and ergonomic design, ensuring user compliance and comfort without compromising the contamination control protocols established within the facility.

Driving factors for this market expansion are multifaceted, anchored by the rapid expansion of the semiconductor industry, particularly in Asia Pacific, where advanced fabrication plants (fabs) necessitate ultra-clean environments (ISO Class 1-3). Furthermore, the global proliferation of pharmaceutical and biotechnology manufacturing facilities, spurred by the continuous introduction of novel biological therapies, mandates the use of disposable or highly controlled reusable cleanroom garments. Regulatory enforcement globally, emphasizing strict cGMP (current Good Manufacturing Practice) standards for sterile product manufacturing, compels end-users to invest in certified and reliable cleanroom apparel. The shift towards disposable apparel, driven by concerns over reprocessing validation and biological contamination risk, further fuels market growth, particularly in highly sensitive, critical application areas where zero risk tolerance is mandated by regulatory bodies and internal quality assurance protocols.

Cleanroom Apparels Market Executive Summary

The Cleanroom Apparels Market is experiencing robust growth driven by escalating investments in high-technology sectors and increasingly stringent regulatory mandates governing contamination control. Key business trends include a significant shift towards sustainable and recyclable cleanroom apparel, responding to global environmental pressures without compromising barrier integrity. There is also marked innovation in material science, focusing on enhanced comfort, improved particle filtration efficiency, and advanced antistatic properties, crucial for handling static-sensitive components in the electronics industry. Furthermore, major manufacturers are focusing on expanding their vertically integrated supply chains to mitigate risks associated with global sourcing disruptions, a lesson learned profoundly from recent global logistical challenges, leading to increased regional manufacturing capacity for critical supplies.

Regional trends highlight the Asia Pacific (APAC) region as the dominant and fastest-growing market segment, primarily propelled by massive government and private sector investments in semiconductor foundries (especially in Taiwan, South Korea, and China) and the burgeoning biomedical research and manufacturing ecosystem in countries like India and Singapore. North America and Europe maintain stable, mature market positions, characterized by high adoption rates of premium and specialized apparel, especially within the established biopharmaceutical sector and high-end aerospace industries, prioritizing reusable garments due to developed laundering infrastructure. The Middle East and Africa (MEA) and Latin America are emerging markets, displaying accelerated growth fueled by new infrastructure projects in healthcare and localized attempts to establish independent pharmaceutical manufacturing capabilities, thereby increasing the demand for basic and mid-range contamination control garments.

Segment trends show the disposable apparel category consistently outpacing reusable garments in growth rate, driven by end-users seeking convenience and guaranteed barrier integrity without the complexities of validation and reprocessing. Among product types, coveralls and gowns maintain the largest market share due to their comprehensive coverage requirements in ISO Class 5 and below environments. By application, the semiconductor and electronics segment dominates revenue due to the extreme criticality of particle control in wafer fabrication, while the pharmaceutical and biotechnology segment exhibits the highest growth velocity, supported by continuous R&D expenditure and the necessity for sterile, non-shedding protective wear. The integration of RFID tracking into apparel management systems is also emerging as a key trend, optimizing inventory control and ensuring compliance tracking for laundered reusable garments.

AI Impact Analysis on Cleanroom Apparels Market

User queries regarding the impact of Artificial Intelligence (AI) on the Cleanroom Apparels Market commonly revolve around themes of automation, quality control enhancement, and supply chain efficiency. Specific concerns include how AI algorithms can predict contamination risk based on garment usage patterns, optimize the laundering and sterilization processes for reusable apparel, and manage inventory to reduce waste and obsolescence. Users are particularly interested in the potential for AI-driven vision systems to detect minute defects in apparel before deployment, which is critical for maintaining ISO standards, and how predictive analytics can improve material sourcing and manufacturing throughput, ultimately reducing the cost and lead time for specialized garments. The key expectation is that AI will move the industry from reactive contamination control to proactive, predictive maintenance of apparel systems.

AI's primary influence will be realized through optimizing the complex logistics inherent in supplying and managing cleanroom garments. AI-powered demand forecasting systems will utilize historical usage data, seasonal trends, production schedules of end-users, and even real-time facility occupancy data to predict apparel requirements with higher accuracy. This capability directly reduces unnecessary inventory costs for both manufacturers and end-users and minimizes the risk of supply shortages for critical items. Furthermore, in the realm of reusable apparel, AI-driven sorting and inspection systems integrated with automated laundry facilities can significantly improve quality assurance. These systems use machine learning models trained on millions of images to rapidly identify subtle fabric degradation, pinholes, or seam failures invisible to the human eye, ensuring that only certified, high-integrity garments are returned to sensitive cleanroom environments.

Beyond logistics and quality control, AI is poised to enhance the design phase and material performance monitoring. Computational material science, leveraged by AI, can accelerate the development of new textiles with superior filtration capabilities, reduced shedding, and enhanced chemical resistance, tailored precisely to specific contamination risks (e.g., handling cytotoxic drugs vs. silicon wafers). For manufacturers, AI-integrated manufacturing execution systems (MES) can optimize production line balancing and machine utilization, reducing manufacturing inconsistencies and waste, leading to higher sustainability scores for the final product. While AI will not directly replace the garment itself, its application across the apparel lifecycle—from material innovation to compliance monitoring and automated inventory—will fundamentally elevate the safety, reliability, and cost-efficiency of contamination control practices globally, integrating apparel management seamlessly into smart facility operations.

- AI-Enhanced Quality Control: Utilizing computer vision systems for automated, high-speed defect detection in both disposable and reusable apparel production lines.

- Predictive Demand Forecasting: Machine learning algorithms optimizing inventory levels for end-users based on real-time operational metrics and historical consumption patterns, minimizing stockouts and waste.

- Optimized Laundry Logistics: AI-driven scheduling and tracking systems for reusable garments, ensuring optimal cleaning cycles, reducing wear-and-tear, and guaranteeing compliance documentation.

- Material Innovation Acceleration: Applying AI/ML in computational chemistry to speed up the discovery and testing of next-generation low-shedding, high-barrier fabrics.

- Compliance Monitoring Automation: Using integrated sensor data and AI to verify proper donning and doffing procedures and track the usage history of individual garments for audit purposes.

DRO & Impact Forces Of Cleanroom Apparels Market

The dynamics of the Cleanroom Apparels Market are dictated by a powerful interplay of demand-side drivers originating from high-tech manufacturing expansion, stringent regulatory restraints centered on quality and compliance, and pervasive opportunities presented by material science innovation and emerging geographical markets. The market is fundamentally driven by the non-negotiable need for contamination control across sensitive sectors, where product failure due to particulate matter results in catastrophic financial losses and regulatory penalties. This intrinsic requirement ensures continuous investment regardless of short-term economic fluctuations. Restraints often manifest as high initial procurement costs for specialized, high-performance apparel, complex validation requirements for reusable items, and challenges related to the disposal of large volumes of single-use plastics, creating friction between environmental goals and contamination control necessities.

Key drivers include the global push towards advanced semiconductor technology, characterized by decreasing feature sizes and increasing wafer sensitivity, necessitating higher ISO class environments (Class 1-3) which rely heavily on ultra-clean garments. Simultaneously, the biotechnology and pharmaceutical sector’s aggressive growth, particularly in sterile injectable manufacturing and cell and gene therapies, mandates the use of specialized, high-grade sterile apparel to meet globally harmonized cGMP standards. Opportunities lie in developing sustainable cleanroom apparel solutions, utilizing biodegradable or more easily recyclable materials without compromising particle barrier efficiency, thereby addressing the growing environmental restraint. Furthermore, developing nations are rapidly building pharmaceutical infrastructure, opening vast untapped markets for both disposable and foundational reusable cleanroom wear. Strategic expansion into localized manufacturing within these emerging regions represents a significant opportunity for market penetration and risk diversification.

The impact forces influencing the market are high, primarily stemming from regulatory authority actions and technological shifts in end-user industries. Regulatory changes, such as revised ISO standards or stricter FDA/EMA guidelines on aseptic processing, immediately force manufacturers and users to adopt new, compliant apparel, exerting a strong positive pressure on market premiumization and innovation. The shift towards automated manufacturing environments, while potentially reducing the number of personnel, simultaneously increases the requirement for specialized apparel tailored for robotics and automated systems to prevent cross-contamination from robotic components or machinery lubricants. The high capital expenditure required for sophisticated laundries for reusable garments acts as a key barrier to entry for smaller reusable providers, consolidating the market power among a few large, specialized service providers. Ultimately, market evolution is consistently dictated by the non-negotiable principle that contamination control remains the paramount objective in all critical manufacturing settings, ensuring continuous demand for superior apparel.

Segmentation Analysis

The Cleanroom Apparels Market is highly segmented across several critical dimensions, including product type, material, usage mode (disposable vs. reusable), and end-user application. This detailed segmentation allows manufacturers to target specific compliance requirements and performance needs of diverse sectors, from the stringent particulate control demanded by microelectronics to the bioburden minimization required in aseptic pharmaceutical manufacturing. The fundamental objective of all segments remains particle and microbial control, but the specific attributes—such as antistatic properties, chemical resistance, and sterilization compatibility—vary significantly, influencing material selection (e.g., Tyvek, polypropylene, Gore-Tex) and design complexity. The structure of the market reflects the tiered necessity for cleanliness, ranging from basic accessories for lower-class environments to fully integrated coverall systems for ultra-clean spaces.

Analysis of the segments reveals that the material segment is rapidly evolving, driven by the demand for fabrics that offer a better balance between barrier protection, wearer comfort (breathability), and sustainability. The distinction between disposable and reusable segments is crucial; disposable apparel often dominates high-risk areas due to guaranteed sterility and ease of compliance, while reusable apparel, prominent in established, stable manufacturing environments (particularly in Europe and North America), offers a cost-effective solution validated through rigorous industrial laundering processes. The application segment clearly illustrates the market's reliance on high-tech industries, with the pharmaceutical/biotechnology sector and the electronics/semiconductor sector consistently contributing the vast majority of revenue, defining the innovation trajectory for new product development.

Geographical segmentation underscores regional specialization, where APAC leads primarily due to semiconductor fabrication investment, driving demand for specialized antistatic garments. Meanwhile, Europe and North America focus heavily on high-end biopharma manufacturing, prioritizing sterile, traceable gowns and coveralls. Understanding these segmented demands is essential for market penetration, requiring companies to tailor not just their products but also their distribution and compliance documentation to meet localized regulatory standards, particularly concerning product validation and sterilization certification. The continuous refinement of standards necessitates that segment leaders maintain continuous R&D investment to ensure their product portfolio remains relevant and compliant across all critical end-user applications globally.

- By Product Type:

- Coveralls

- Gowns/Frocks

- Shoe Covers/Boot Covers

- Hoods/Caps

- Face Masks

- Other Accessories (Wipers, Gloves, Sleeves)

- By Usage Mode:

- Disposable

- Reusable

- By Material Type:

- Polyester

- Polypropylene

- Polyethylene (PE)

- Poly-coated Materials

- Other Specialty Fabrics (e.g., Gore-Tex, non-woven laminates)

- By End-use Application:

- Semiconductor & Electronics

- Pharmaceutical & Biotechnology

- Medical Devices

- Aerospace & Defense

- Academic & Research Labs

- Food Processing

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Argentina)

- Middle East & Africa (MEA)

Value Chain Analysis For Cleanroom Apparels Market

The value chain for the Cleanroom Apparels Market begins with the upstream procurement and processing of specialized raw materials, primarily high-density polyethylene, polyester filaments, and various non-woven polymers, which must meet low-linting and antistatic specifications. Raw material suppliers (chemical companies and specialized textile manufacturers) are critical as the quality and purity of the base fabric directly determine the final product's contamination control capability. This upstream segment is highly specialized, requiring robust R&D to develop materials that balance filtration efficiency with user comfort and environmental requirements. Competition at this stage often centers on proprietary fiber treatments, anti-static coatings, and the development of sustainable, low-shedding substrates, requiring high capital investment in specialized manufacturing facilities.

The midstream involves the core manufacturing, cutting, sewing, and assembly of the apparel, followed by critical processing steps such as washing, particle testing, and sterilization (often using Gamma irradiation or Ethylene Oxide for disposable products). This phase requires strict adherence to ISO 9001 and specific cleanroom manufacturing environments (typically Class 7 or 8 for assembly) to prevent initial contamination of the product itself. For reusable garments, this stage also includes the provision of specialized industrial laundering and reprocessing services, which act as a continuous feedback loop and crucial value-added service. Distribution channels form the link to the downstream market, utilizing both direct sales teams for large pharmaceutical and semiconductor clients, and indirect routes through specialized cleanroom supply distributors who manage inventory and logistical complexities for smaller labs and mid-sized manufacturing plants.

Downstream analysis focuses on the end-users—semiconductor fabs, biopharmaceutical companies, and hospitals—who are the final consumers and where the apparel's performance is ultimately validated. Direct sales channels are frequently employed when end-users require highly customized products, long-term supply contracts, or specialized technical support for compliance and regulatory audits. Indirect channels are crucial for market reach and efficiency, especially for standard disposable items or general-purpose garments, where distributors offer localized stock, rapid delivery, and aggregated purchasing power. The complexity of regulatory compliance and the need for just-in-time inventory management in high-value manufacturing environments dictate the preferred channel, making robust, traceable distribution networks essential for maintaining market share and minimizing supply chain risk for contamination-sensitive clients.

Cleanroom Apparels Market Potential Customers

Potential customers for Cleanroom Apparels are concentrated within industries where stringent environmental control is mandatory to prevent product failure, maintain quality, and ensure regulatory compliance. The primary end-users are high-technology manufacturers who operate controlled environments classified from ISO Class 9 down to the ultra-critical ISO Class 1. Specifically, this includes major multinational pharmaceutical corporations engaged in sterile filling, API manufacturing, and formulation of biologics, where particle control is essential to prevent microbial ingress and ensure patient safety. Biotechnology firms developing cell therapies, gene therapies, and specialized vaccines represent a high-growth customer segment due to the extremely sensitive nature of their products and processes, demanding the highest quality, often sterile, disposable apparel solutions.

Beyond the life sciences sector, the semiconductor industry constitutes the largest consuming segment by volume and value, driven by the ceaseless miniaturization of microchips. Semiconductor fabrication plants (fabs) require antistatic, non-shedding coveralls, boots, and hoods to protect silicon wafers from human-generated particulate contamination, which can cause circuit defects at the nanoscale. These customers frequently utilize both specialized reusable garments, managed through sophisticated laundry loops, and disposable products for specific, high-risk operations. Other significant buyers include manufacturers of precision medical devices (e.g., implantable instruments, diagnostics), aerospace companies assembling satellites or sensitive electronic components, and various academic and government research laboratories conducting high-purity material science or biological experiments under controlled conditions.

The purchasing decision among these potential customers is heavily influenced by three factors: demonstrated regulatory compliance (proof of sterility and filtration efficiency), material performance (static dissipation and comfort), and long-term cost of ownership (balancing disposable convenience against reusable longevity). Procurement departments prioritize suppliers who can provide comprehensive validation documentation, consistent quality across global manufacturing sites, and reliable supply chain security, viewing cleanroom apparel not merely as a consumable, but as an integral, non-negotiable component of their contamination control strategy. Market penetration strategies must therefore address quality assurance mandates and supply continuity guarantees to secure major contracts with these high-value, quality-driven end-users.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DuPont de Nemours Inc., Kimberly-Clark Corporation, Lakeland Industries Inc., Cardinal Health, 3M Company, Ansell Limited, Micronclean, Cleanroom Depot Inc., Berner International GmbH, QRP Inc., Veltek Associates Inc., Texwipe, Nitritex (part of Ansell), Shield Medicare, Contec Inc., Bio-Clean, Gamma Cleanroom, Prudential Overall Supply, Elis Cleanroom, VWR International (part of Avantor) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cleanroom Apparels Market Key Technology Landscape

The technological landscape of the Cleanroom Apparels Market is constantly evolving, driven primarily by material science innovations focused on achieving lower particle shedding rates, improved electrostatic discharge (ESD) properties, and greater wearer comfort without compromising barrier protection. Key advancements center around the development of high-density woven fabrics (primarily polyester) for reusable apparel, which utilize complex filament structures and tightly controlled weaving patterns to minimize fiber release and particulate entrapment. For disposable garments, the focus is on advanced non-woven materials, such as flashspun high-density polyethylene fibers (e.g., Tyvek), which offer excellent barrier properties against both liquids and dry particulates. Recent innovations also include multi-layer composite laminates that combine mechanical strength with fluid impermeability and breathability, crucial for long operational shifts in high-temperature environments.

A significant technological focus is placed on enhancing the intrinsic properties required by end-user applications. For the electronics segment, the integration of carbon fibers or specialized conductive threads within the apparel fabric is a mandatory technology to ensure effective electrostatic dissipation, preventing damage to sensitive microelectronic components. In the pharmaceutical sector, the core technology involves sterilization compatibility and validation; apparel must withstand harsh sterilization methods, primarily gamma irradiation for disposable products or high-temperature autoclaving and chemical cleaning processes for reusable items, without degradation of barrier performance. Manufacturing technologies, specifically advanced seam construction—such as bound seams, taped seams, or ultrasonic welding—are critical to preventing particle escape through stitch holes and maintaining the apparel's integrity as a complete barrier system.

The ongoing digitization of cleanroom operations also introduces advanced tracking and compliance technology into the apparel landscape. The implementation of Radio Frequency Identification (RFID) tags embedded directly into reusable garments is becoming standard practice, enabling automated inventory management, tracking of individual usage cycles, monitoring the number of laundry washes, and ensuring proper rotation and retirement of garments based on performance metrics. This smart apparel technology supports rigorous AEO compliance by providing an immutable audit trail for every piece of clothing entering the controlled environment. Future technological trends point towards sensor-integrated apparel capable of monitoring internal conditions, such as humidity or temperature, and potentially detecting micro-leakages or failures in the barrier function in real-time, thereby pushing the envelope of contamination control from passive protection to active monitoring within the controlled environment.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing region in the cleanroom apparels market, primarily propelled by monumental governmental and private investments in the semiconductor and electronics manufacturing sectors, particularly in nations like China, Taiwan, South Korea, and Japan. The region houses the majority of the world's semiconductor fabrication plants, driving an immense demand for ultra-clean, ESD-safe disposable apparel (ISO Class 1 to 3). Additionally, the rapid expansion of generic drug manufacturing and the localization of biotech R&D in countries like India and Singapore are fueling the need for specialized sterile garments. Local manufacturers are increasingly improving their product quality to compete with global suppliers, often benefiting from lower operational costs but needing robust compliance documentation to service multinational clients.

- North America: North America holds a substantial market share, characterized by its mature and highly regulated biopharmaceutical industry, particularly the U.S. market, which demands premium, validated cleanroom solutions. The focus here is less on volume growth and more on high-value, specialized sterile disposable gowns and validated reusable services for critical aseptic processing facilities (ISO Class 5 and below). Strong domestic presence of major aerospace and medical device manufacturers further drives demand. Regulatory stringency imposed by the FDA ensures a high barrier to entry and mandates continuous quality improvement, leading to high adoption of advanced, traceable apparel systems.

- Europe: Europe maintains a robust and highly standardized market, heavily influenced by EU GMP guidelines and ISO standards. Germany, France, and the UK are key contributors, driven by established pharmaceutical R&D, advanced medical technology production, and specialized manufacturing (e.g., automotive clean zones). The European market exhibits a higher preference for sustainable and highly durable reusable cleanroom garment services, supported by sophisticated and centrally controlled industrial laundry networks that prioritize long garment lifecycles and stringent environmental standards. Emphasis on sustainability is a stronger market force here than in other regions.

- Latin America (LATAM): The LATAM market is emerging, driven mainly by localized pharmaceutical production expansion, particularly in Brazil and Mexico, aimed at reducing reliance on imported drugs. The demand profile is mixed, seeing adoption of both foundational reusable apparel and standard disposable items, often balancing cost-efficiency with nascent regulatory compliance requirements. Market growth is dependent on economic stability and governmental investment in local healthcare and manufacturing infrastructure, presenting significant opportunities for basic and mid-range apparel suppliers.

- Middle East & Africa (MEA): MEA is the smallest yet exhibiting stable growth, primarily fueled by significant investments in healthcare modernization, especially in the Gulf Cooperation Council (GCC) countries establishing pharmaceutical and biotechnology manufacturing hubs. The region relies heavily on imported cleanroom supplies, and demand is concentrated in sterile hospital environments, oil and gas specialty maintenance (where high purity is required), and new R&D facilities. Supply chain reliability and technical support for specialized apparel are crucial purchasing criteria in this geographically complex market.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cleanroom Apparels Market.- DuPont de Nemours Inc.

- Kimberly-Clark Corporation

- Lakeland Industries Inc.

- Cardinal Health

- 3M Company

- Ansell Limited

- Micronclean

- Cleanroom Depot Inc.

- Berner International GmbH

- QRP Inc.

- Veltek Associates Inc.

- Texwipe

- Nitritex (part of Ansell)

- Shield Medicare

- Contec Inc.

- Bio-Clean

- Gamma Cleanroom

- Prudential Overall Supply

- Elis Cleanroom

- VWR International (part of Avantor)

Frequently Asked Questions

Analyze common user questions about the Cleanroom Apparels market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for disposable cleanroom apparel?

The demand for disposable cleanroom apparel is primarily driven by the stringent regulatory requirement for guaranteed sterility and the elimination of complex validation processes associated with reprocessing reusable garments. Disposable items offer a consistent, certified level of contamination control, reducing the risk of cross-contamination in critical aseptic environments, particularly within the pharmaceutical and biotechnology sectors.

How does the Cleanroom Apparels Market address sustainability concerns?

The market addresses sustainability concerns through two main avenues: the development of advanced reusable garments designed for extended lifecycles and high-efficiency industrial laundering, and the innovation of single-use apparel made from bio-based or highly recyclable materials. Manufacturers are focusing R&D on non-woven fabrics with reduced environmental footprints that maintain ISO classification compliance.

Which end-user segment accounts for the highest revenue share in the Cleanroom Apparels Market?

The Semiconductor and Electronics segment typically accounts for the highest revenue share, driven by the massive scale of microchip fabrication globally, requiring continuous use of specialized antistatic, non-shedding apparel to protect highly sensitive wafers from sub-micron particulate contamination and electrostatic discharge.

What is the role of ISO 14644 standards in shaping cleanroom apparel requirements?

ISO 14644 standards define the cleanliness levels (Class 1 to Class 9) required for controlled environments. These standards directly dictate the type, material composition, particle retention efficiency, and donning procedures for cleanroom apparel. Apparel must be certified to meet the specified particulate control requirements of the class in which it is utilized, serving as the essential compliance benchmark for all manufacturers and end-users.

What are the critical considerations when selecting reusable versus disposable cleanroom garments?

Critical considerations include the required cleanliness class, the cost of ownership, and regulatory mandates. Disposable apparel guarantees sterility and eliminates validation risk, favored in high-risk areas. Reusable apparel is cost-effective over time in stable, mid-to-low-class environments, but requires significant capital investment in validated industrial laundering and rigorous internal compliance tracking systems to maintain barrier integrity and certification.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager