Cleanroom Doors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433555 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Cleanroom Doors Market Size

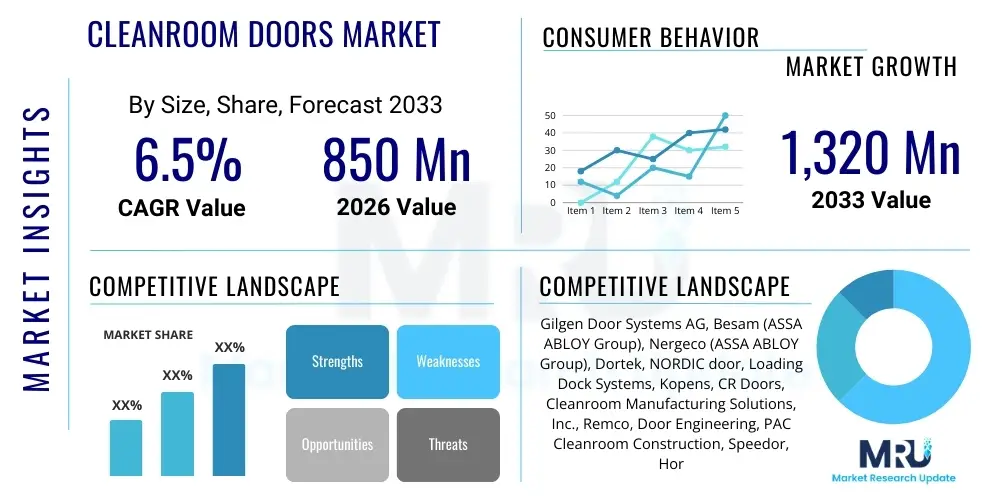

The Cleanroom Doors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $850 Million in 2026 and is projected to reach $1,320 Million by the end of the forecast period in 2033.

Cleanroom Doors Market introduction

The Cleanroom Doors Market encompasses specialized entryway solutions designed to maintain stringent environmental control within controlled environments, primarily characterized by extremely low levels of particulates, microorganisms, and chemical vapors. These doors are integral components in industries such as pharmaceuticals, biotechnology, semiconductor manufacturing, and healthcare, where contamination control is paramount to product quality and process integrity. The products range from manual hinged doors to highly automated, interlocking sliding doors, often featuring specialized sealing mechanisms, non-shedding materials, and resistance to harsh cleaning agents. The essential function of a cleanroom door is to minimize air exchange between controlled and uncontrolled areas, thus preserving the required ISO classification of the space.

The market growth is fundamentally driven by the escalating demand for high-quality manufactured goods and the stringent regulatory standards imposed on sensitive industries globally. Cleanroom doors must comply with international standards such as ISO 14644, ensuring operational efficiency and compliance. Major applications include sterile filling suites, microelectronics fabrication areas, advanced material research labs, and hospital isolation rooms. These doors provide significant benefits, including enhanced operational hygiene, reduced risk of cross-contamination, improved energy efficiency through better sealing, and compliance with Good Manufacturing Practices (GMP) and other regulatory frameworks. The technological evolution toward automation and integration with Building Management Systems (BMS) further amplifies their value proposition.

Key driving factors accelerating market expansion include rapid advancements in the biopharmaceutical sector, particularly vaccine and cell therapy production, which require large, high-grade cleanroom facilities. Furthermore, the relentless miniaturization in semiconductor technology necessitates increasingly controlled manufacturing environments, boosting demand for high-speed, airtight door systems. The growing healthcare infrastructure in developing economies and the modernization of existing industrial facilities to meet higher cleanliness standards also contribute significantly to the positive market trajectory. Investment in sustainable and energy-efficient cleanroom designs necessitates the integration of high-performance door systems that minimize air leakage and operational footprint.

Cleanroom Doors Market Executive Summary

The global Cleanroom Doors Market exhibits robust growth, underpinned by significant technological advancements and intensified regulatory scrutiny across key end-use industries. Business trends highlight a strong shift toward automation, with high-speed rolling doors and integrated interlocking systems gaining prominence due to their efficiency in minimizing particle ingress and maximizing throughput. Manufacturers are increasingly focusing on modular designs and materials that offer superior chemical resistance and ease of sanitation, particularly responding to the needs of aseptic processing. Furthermore, sustainability is becoming a key differentiator, pushing companies to develop lighter, more energy-efficient door systems that integrate seamlessly with existing HVAC and contamination monitoring infrastructure, driving higher average selling prices for advanced models.

Regional trends indicate that the Asia Pacific (APAC) region is poised for the most rapid expansion, largely fueled by massive investments in domestic pharmaceutical manufacturing, biotechnology research hubs, and large-scale semiconductor fabrication plants in countries like China, India, South Korea, and Taiwan. North America and Europe, representing mature markets, maintain dominance in terms of overall market value, characterized by demand for premium, customized, and highly compliant solutions, driven primarily by established biopharma giants and cutting-edge R&D centers. Latin America and the Middle East & Africa (MEA) show nascent but accelerating demand, spurred by improved healthcare infrastructure spending and localized efforts to establish pharmaceutical self-sufficiency.

Segmentation trends reveal that the Pharmaceutical & Biotechnology segment maintains the largest market share due to the non-negotiable requirement for sterile environments in drug production. Based on product type, automated doors, including sliding and high-speed roll-up doors, are experiencing the fastest growth, replacing traditional manual hinged doors in high-traffic or highly critical zones. Material analysis indicates that stainless steel and composite materials are favored over traditional aluminum due to superior durability, microbial resistance, and compatibility with rigorous cleaning protocols. The integration of advanced features such as hermetic sealing, touchless operation, and access control mechanisms defines the trajectory of product innovation across all segments, ensuring alignment with Industry 4.0 standards.

AI Impact Analysis on Cleanroom Doors Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Cleanroom Doors Market primarily revolve around predictive maintenance, automation efficiency, and integration with wider smart facility management systems. Users are concerned with how AI algorithms can anticipate mechanical failures in high-speed door mechanisms, optimizing uptime and preventing breaches in controlled environments. Another key area of interest is utilizing AI-driven image processing and sensor data to monitor personnel flow and automatically adjust door operation speeds or interlocking sequences to minimize particle generation and air disturbance. The expectation is that AI integration will shift cleanroom door functionality from a reactive component to a proactive, predictive element within the contamination control ecosystem, ultimately enhancing overall compliance and operational cost-effectiveness.

- AI-powered Predictive Maintenance: Algorithms analyze motor cycles, usage frequency, and seal integrity data to forecast necessary maintenance, drastically reducing unexpected downtime and contamination risks.

- Optimized Interlocking Systems: AI dynamically manages complex interlocking sequences based on real-time operational flow and differential pressure readings, ensuring minimal breach time and maximum air tightness.

- Enhanced Access Control: Facial recognition and biometric systems integrated with AI algorithms enable rapid, touchless verification and log tracking, streamlining sterile gowning procedures.

- Energy Consumption Optimization: AI analyzes facility occupancy and external environmental factors to adjust door speed and sealing force, minimizing conditioned air loss and reducing HVAC load.

- Compliance Reporting Automation: AI systems automatically generate detailed logs of door operations, cycles, and pressure differentials, simplifying audit trails and ensuring regulatory adherence.

- Integration with Smart HVAC/BMS: Doors become intelligent components within the Building Management System (BMS), communicating status and potential air leakage points for immediate system compensation.

DRO & Impact Forces Of Cleanroom Doors Market

The dynamics of the Cleanroom Doors Market are governed by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and associated Impact Forces. The primary drivers include escalating investments in the global pharmaceutical sector, especially in biologics and personalized medicine manufacturing, alongside increasingly stringent regulatory guidelines (e.g., EU GMP Annex 1 revisions) requiring superior contamination control technologies. However, these factors are balanced by restraints such as the high initial capital expenditure associated with installing highly automated, hermetically sealed door systems, particularly challenging for smaller pharmaceutical or electronics fabrication facilities. Furthermore, the specialized materials and customization required often lead to extended lead times and complex maintenance requirements, acting as a frictional force against rapid adoption.

Opportunities for market expansion are substantial, primarily driven by the ongoing trend of facility modernization and expansion in emerging economies, coupled with the rising demand for modular cleanroom solutions that necessitate highly specialized integrated door systems. The development of advanced, composite materials that offer lighter weight, better chemical resistance, and non-shedding properties presents a compelling avenue for product differentiation. Furthermore, the trend towards incorporating Internet of Things (IoT) sensors and AI capabilities for real-time monitoring and predictive maintenance represents a major value-added opportunity for manufacturers, moving beyond mere physical barriers to integrated smart control points within the cleanroom environment. These opportunities are enabling manufacturers to capture higher margins in the premium segment.

The resulting impact forces compel market participants to prioritize innovation in sealing technology and automation speed. The regulatory environment acts as a strong, non-cyclical force, ensuring consistent demand for high-compliance products, making product certification a critical competitive factor. Economic volatility, particularly in capital-intensive industries like semiconductors, can slow down large-scale facility construction, temporarily dampening demand, but the underlying push towards miniaturization and higher purity levels ensures long-term resilience. The synergistic relationship between cleanroom door technology and advancements in HVAC and filtration systems creates a powerful positive feedback loop, driving overall quality standards upward throughout the forecast period.

Segmentation Analysis

The Cleanroom Doors Market segmentation provides a detailed structural breakdown based on criteria such as product type, operating mechanism, material, and end-user industry, enabling a precise understanding of market dynamics and targeted strategic investment. The core segments reflect the varying levels of sterility and operational demands inherent in different controlled environments. Segmentation by product type helps differentiate between standard barriers and advanced automated systems crucial for high-traffic zones, while segmentation by material highlights the preferences based on chemical exposure and cleaning protocols required by specific end-users. The fastest-growing segments typically involve highly integrated, automated solutions that offer superior sealing capabilities and minimal particle generation, aligning with the stringent requirements of ISO Class 5 and higher.

Analyzing the end-user segmentation is critical, as the requirements of the Pharmaceutical & Biotechnology industry (focusing on aseptic processing and durability) differ significantly from those of the Semiconductor & Electronics industry (focusing on high-speed operation and non-particulate generation). The diverse needs across these sectors drive specialization in door design, ranging from pressure-resistant hermetic sealing doors for laboratories to high-speed roll-up doors designed for rapid material transfer between zones. Regional segmentation further refines this view, highlighting where major demand centers are located and tailoring market approaches to local regulatory mandates and economic conditions. This multi-dimensional segmentation approach is essential for accurate market forecasting and strategic positioning in the competitive landscape.

- By Product Type:

- Hinged Doors (Single and Double Leaf)

- Sliding Doors (Manual and Automated)

- High-Speed Roll-Up Doors (Fabric and PVC)

- Overhead Doors

- Specialty Doors (Interlocking, Hermetically Sealed)

- By Operating Mechanism:

- Manual

- Semi-Automatic

- Fully Automatic (Sensor-Activated, Access Control Integrated)

- By Material:

- Stainless Steel

- Aluminum

- PVC/GRP (Glass Reinforced Plastic)

- Composite Materials

- By End-User Industry:

- Pharmaceutical & Biotechnology

- Semiconductor & Electronics

- Medical Devices

- Hospitals & Healthcare

- Aerospace & Defense

- Food & Beverage Processing

- By Cleanroom Class (ISO Standard):

- ISO Class 1 to 5 (High Purity)

- ISO Class 6 to 9 (Lower Purity)

Value Chain Analysis For Cleanroom Doors Market

The value chain for the Cleanroom Doors Market begins with the upstream suppliers responsible for providing highly specialized raw materials, including pharmaceutical-grade stainless steel (304/316), advanced non-shedding polymers (PVC, composites), sophisticated motor drives, and electronic components for automation and interlocking systems. The competitive advantage at this stage hinges on material quality, traceability, and the ability to meet stringent non-shedding and anti-corrosion specifications. Manufacturers invest heavily in R&D to optimize door profiles, sealing mechanisms, and integration capabilities. Effective sourcing ensures cost control and compliance with international material safety standards, which are critical given the door's constant exposure to cleaning agents.

The core manufacturing and assembly phase involves precision engineering to achieve the required hermetic sealing and operational reliability. This midstream segment is characterized by customization and system integration, as doors are often designed specifically for the dimensions and pressure requirements of individual cleanroom facilities. Distribution channels are typically complex, involving a mix of direct sales to large, integrated contractors responsible for facility construction (direct channel) and indirect sales through specialized cleanroom equipment distributors and system integrators. These distributors provide localized installation, maintenance, and compliance verification services, which are critical value-adds, especially in geographically dispersed markets.

The downstream segment involves the installation, operational use, and long-term maintenance required by the end-users. Due to the high precision and critical nature of cleanroom operations, after-sales service, including periodic seal replacement and calibration of automation sensors, is a significant revenue stream. Direct sales channels are preferred for highly customized, large-scale projects (e.g., new semiconductor fabs), ensuring seamless integration and quality control from design to handover. Indirect channels are frequently used for smaller projects, replacement parts, or standard installations in markets where local expertise is necessary. The efficiency of the distribution network and the technical proficiency of installers directly impact the operational integrity of the cleanroom environment, making robust installer certification programs essential for market leaders.

Cleanroom Doors Market Potential Customers

The Cleanroom Doors Market serves a diverse yet highly regulated clientele, primarily composed of organizations that rely on controlled environments to ensure product quality, safety, and regulatory compliance. The dominant end-users are concentrated within the Pharmaceutical and Biotechnology sectors. These buyers, including global drug manufacturers, contract manufacturing organizations (CMOs), and advanced therapy (cell and gene) developers, require doors that offer superior hermetic sealing, chemical resistance, and robust interlocking systems to maintain aseptic conditions during critical processes like filling, packaging, and fermentation. Their purchasing decisions are heavily influenced by GMP standards and validation requirements, prioritizing durability and ease of cleaning over initial cost.

Another major customer segment is the Semiconductor and Electronics industry, encompassing wafer fabrication plants (fabs), microchip manufacturers, and hard drive assembly facilities. These buyers demand ultra-high-speed, non-shedding doors that can operate rapidly and reliably within extremely low-particulate environments (ISO Class 1-4). Their focus is on minimizing particle generation during operation and maximizing throughput efficiency. Additionally, hospitals and healthcare facilities, particularly those with dedicated compounding pharmacies, sterile processing departments (CSSDs), and infectious disease isolation wards, are increasingly adopting specialized cleanroom doors to meet USP <797> and <800> compliance standards for compounding sterile preparations.

Emerging customers include aerospace and defense contractors involved in precision component manufacturing and satellite assembly, which require controlled environments to prevent dust and debris from affecting sensitive equipment. Furthermore, high-end food processing facilities, particularly those dealing with dairy, prepared meals, or sensitive ingredients, are upgrading their infrastructure to use certified cleanroom doors to prevent microbial contamination and meet stringent HACCP regulations. The common thread among all potential customers is the critical need for a reliable, quantifiable barrier solution that supports their specific environmental integrity protocols and demonstrates measurable compliance during regulatory audits.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Million |

| Market Forecast in 2033 | $1,320 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Gilgen Door Systems AG, Besam (ASSA ABLOY Group), Nergeco (ASSA ABLOY Group), Dortek, NORDIC door, Loading Dock Systems, Kopens, CR Doors, Cleanroom Manufacturing Solutions, Inc., Remco, Door Engineering, PAC Cleanroom Construction, Speedor, Hormann, Chase Doors, STERI-DOORS, A&B Architectural, AES Clean Technology, Allied Modular Building Systems, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cleanroom Doors Market Key Technology Landscape

The technological landscape of the Cleanroom Doors Market is rapidly evolving, driven by the need for superior airtightness, speed, and integration capabilities. A significant development is the widespread adoption of hermetic sealing technology, particularly in sliding door systems, which employ specialized track mechanisms and inflatable or compression seals to create a complete barrier against air leakage and microbial transfer. These systems are crucial for achieving ISO Class 5 and 6 environments in high-risk zones, such as pharmaceutical compounding and surgical suites. Furthermore, the integration of magnetic levitation (Maglev) technology is emerging for high-speed automatic doors, offering smoother, quieter operation with fewer moving parts susceptible to wear and particle generation, thereby improving longevity and compliance.

Automation and touchless operation define the current standard for advanced cleanroom door solutions. This involves sophisticated sensor technologies, including radar, infrared, and inductive loops, combined with sophisticated programmable logic controllers (PLCs) that manage door speed, sequencing, and interlocking functions. The interlocking mechanism is a core technology, ensuring that only one door in an airlock or pass-through chamber is open at any time, maintaining differential pressure stability. Modern systems incorporate highly reliable redundant safety features and continuous self-diagnostic capabilities, immediately alerting operators to any compromise in the sealing integrity or operational function, crucial for maintaining audit trails.

Material science and surface treatment technologies are also pivotal. Manufacturers are increasingly utilizing specialized powder coatings and antimicrobial stainless steel alloys that resist pitting, corrosion from aggressive cleaning agents (e.g., hydrogen peroxide vapor), and microbial growth. Another key technology involves the integration of advanced access control technologies, such as biometric readers and RFID/NFC systems, directly into the door frame. This integration facilitates rapid, documented access while ensuring that only authorized and appropriately gowned personnel enter critical areas, minimizing human-induced contamination risk. The future focus remains on developing door systems that are not just barriers but intelligent, interconnected components of a holistic contamination control network.

Regional Highlights

The global Cleanroom Doors Market demonstrates distinct regional characteristics and growth trajectories, heavily influenced by localized regulatory frameworks, industrial concentration, and investment levels in advanced manufacturing infrastructure.

- North America (NA): Dominates the market value due to the strong presence of major pharmaceutical and biotechnology companies, extensive investment in cutting-edge R&D, and the established semiconductor industry. Demand is concentrated in premium, highly automated, and customized hermetically sealed doors, driven by rigorous FDA and GMP compliance requirements. The US is the primary market, focusing heavily on technology integration and lifecycle cost efficiency.

- Europe: Characterized by stringent regulatory oversight (e.g., EMA, EU GMP Annex 1) and a robust medical device and pharmaceutical manufacturing base, particularly in Germany, France, and the UK. The region shows high adoption of modular cleanroom concepts, driving demand for seamlessly integrated, high-quality stainless steel and composite door systems, prioritizing energy efficiency and long-term durability.

- Asia Pacific (APAC): Expected to register the highest CAGR during the forecast period. This rapid growth is attributable to massive government initiatives supporting domestic pharmaceutical production (e.g., 'Make in India'), burgeoning electronics manufacturing in China and Taiwan, and significant expansion of healthcare infrastructure. The demand here is two-tiered: high-volume, cost-effective standard doors for new facilities, and advanced automated solutions for flagship fabs and bio-pharma hubs.

- Latin America (LATAM): Exhibits steady growth, primarily driven by expanding pharmaceutical packaging and food processing sectors in Brazil and Mexico. The market is moderately fragmented, with increasing preference for reliable, easy-to-maintain doors, though budget constraints often favor semi-automatic or manual solutions over fully automated ones in non-critical zones.

- Middle East & Africa (MEA): Represents an emerging market focused on localizing pharmaceutical production (especially in Saudi Arabia and UAE) and modernizing existing hospital facilities. Growth is tied directly to large-scale infrastructure projects and governmental efforts to diversify economies away from oil, leading to targeted investment in specialized cleanroom components, including high-specification doors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cleanroom Doors Market.- Gilgen Door Systems AG

- Besam (ASSA ABLOY Group)

- Dortek

- Nergeco (ASSA ABLOY Group)

- NORDIC door

- Loading Dock Systems

- Kopens

- CR Doors

- Cleanroom Manufacturing Solutions, Inc.

- Remco

- Door Engineering

- PAC Cleanroom Construction

- Speedor

- Hormann

- Chase Doors

- STERI-DOORS

- A&B Architectural

- AES Clean Technology

- Allied Modular Building Systems, Inc.

- M. H. EBY, Inc.

Frequently Asked Questions

Analyze common user questions about the Cleanroom Doors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a hermetically sealed cleanroom door?

The primary function is to provide an absolute air seal when closed, preventing cross-contamination and maintaining critical differential air pressure between adjacent controlled zones. Hermetic sealing is essential for critical areas like BSL-3 labs and aseptic pharmaceutical filling lines.

Which end-user industry accounts for the largest market share in cleanroom doors?

The Pharmaceutical and Biotechnology industry holds the largest market share. This dominance is due to the non-negotiable regulatory requirement for sterile environments necessary for drug discovery, manufacturing, and packaging, driving demand for specialized, highly compliant door solutions.

How does automation benefit cleanroom door operations?

Automation increases operational efficiency by enabling rapid, touchless entry/exit, minimizing human interaction and associated particle generation. It also ensures precise interlocking sequences and reduces air leakage time, contributing significantly to contamination control and compliance.

What materials are preferred for high-purity cleanroom doors and why?

Stainless steel (Grade 304 or 316) and specialized non-shedding composite materials are preferred. These materials offer superior chemical resistance to harsh cleaning agents, high durability, non-porous surfaces that prevent microbial harboring, and structural integrity under frequent use.

How is AI expected to influence the future maintenance of cleanroom door systems?

AI will be leveraged for predictive maintenance, analyzing operational sensor data (e.g., motor strain, cycle count) to anticipate component failures before they occur. This proactive approach ensures maximum uptime, minimizes emergency repairs, and maintains continuous environmental integrity.

The ongoing expansion of the global semiconductor industry, driven by the proliferation of 5G technology, IoT devices, and advanced computing, necessitates continuous investment in new fabrication facilities, all of which require sophisticated cleanroom door infrastructure. The doors in these environments must facilitate extremely fast material handling while adhering to the most stringent ISO Class requirements (Class 1 to 4). High-speed roll-up doors made from non-particulating materials and integrated with automated guided vehicle (AGV) systems are becoming standard components. This technological convergence ensures that material transfer efficiency does not compromise the ultra-clean environment, directly contributing to higher yields in microchip manufacturing. The demand for flawless production environments in electronics serves as a powerful, non-cyclical driver for specialized door solutions.

Furthermore, the shift towards modular cleanroom systems is profoundly impacting door design and installation. Modular facilities offer flexibility and scalability, crucial for rapidly responding to market demands, such as vaccine production capacity expansion. Cleanroom door manufacturers are responding by developing modular-compatible door frames and systems that can be rapidly integrated, dismantled, and reassembled without compromising airtightness or structural integrity. This standardization effort, focused on plug-and-play components and flexible sizing, reduces construction time and overall project complexity. This trend is particularly evident in emerging biotech hubs where speed-to-market for new facilities is a key competitive differentiator, favoring manufacturers who can supply complete, validated, modular-ready packages.

Regulatory mandates remain the most influential external force shaping the market. The introduction and strict enforcement of international standards, particularly the revised EU GMP Annex 1 concerning sterile medicinal product manufacturing, emphasize risk management and contamination control in minute detail. This revision places increased emphasis on the integrity of physical barriers, forcing pharmaceutical manufacturers to upgrade existing door systems to meet stricter validation protocols, including proof of hermetic sealing capabilities and detailed audit logs. This regulatory pressure guarantees sustained expenditure on high-specification, certified cleanroom doors across established markets in North America and Europe, preventing commoditization of the premium segment and ensuring continuous technology refresh cycles.

The market faces technical restraints related to power failure contingency and system complexity. Automated cleanroom doors must function flawlessly even during power outages to maintain the integrity of the controlled environment. This necessitates the integration of robust battery backup systems and manual override mechanisms that are both secure and easy to operate. Managing the complexity of interlocking systems, especially across multiple zones with varying pressure regimes, requires highly skilled installation and frequent software updates, adding to the total cost of ownership. Overcoming these technical challenges requires manufacturers to invest in simplified user interfaces and standardized diagnostic tools, enhancing the reliability and ease of maintenance for critical end-users.

Investment patterns in the cleanroom sector show a clear pivot towards minimizing human intervention, positioning touchless access control and integrated robotic operation as future standards. Modern cleanroom doors are increasingly designed to communicate bidirectional data regarding their status (e.g., cycle count, pressure delta impact, seal degradation) directly to the central Building Management System (BMS). This connectivity enables automated responses—such as HVAC system adjustments to compensate for minor air breaches—and provides comprehensive data required for continuous quality monitoring (CQM). The successful adoption of Industry 4.0 principles in cleanroom environments mandates that doors are viewed as intelligent sensors and actuators, not merely physical barriers, opening new avenues for specialized software and data services attached to the hardware.

The segmentation by material continues to be shaped by evolving sanitization methods. While stainless steel remains the benchmark for durability and chemical resistance, advanced composite materials incorporating properties such as inherent anti-static or antimicrobial coatings are gaining traction, especially in the medical device manufacturing and food processing sectors. These composites offer weight advantages, superior thermal insulation, and often lower maintenance profiles, challenging the traditional dominance of metallic solutions. Manufacturers must balance material selection with the cost of fabrication and the required compliance level, as some high-grade pharmaceutical facilities maintain an unwavering preference for certified 316L stainless steel for all contact surfaces due to its validation history and extreme resistance to VHP (Vaporized Hydrogen Peroxide) decontamination cycles.

In terms of operational mechanism, the segment of specialty doors, particularly those featuring interlocking systems and rapid roll-up features, is seeing disproportionate growth. Interlocking doors are essential for airlocks and gowning areas, ensuring strict control over material and personnel transfer. High-speed roll-up doors, capable of opening and closing within seconds, minimize the duration of air exchange, thus reducing the risk of particle ingress during high-frequency transfer operations, a common occurrence in warehouse interfaces with production areas. The performance metric of door cycle speed and sealing efficacy is becoming a critical competitive benchmark, driving innovation in motor technology and flexible material science.

The competitive landscape is characterized by established global players offering comprehensive cleanroom infrastructure solutions alongside highly specialized niche manufacturers focusing solely on advanced door and airlock systems. Mergers and acquisitions are common, as large conglomerates seek to integrate specialized sealing and automation technologies into their broader construction and facility management portfolios. Strategic alliances focused on developing standardized interfaces between door control units and proprietary BMS platforms are crucial for penetrating large-scale integrated facility projects. Key companies are investing in local manufacturing and servicing capabilities, particularly in APAC, to efficiently manage logistics and provide rapid, localized technical support, which is mandatory for maintaining mission-critical cleanroom operations.

The environmental sustainability factor is starting to influence purchasing decisions, particularly in Europe. Customers are seeking cleanroom doors manufactured using recyclable materials and systems designed for minimal power consumption. Door systems that offer superior insulation and sealing contribute directly to reducing the energy load on the massive HVAC systems required in cleanrooms, providing a significant long-term operational cost saving and reducing the facility’s carbon footprint. Manufacturers highlighting these sustainability features alongside contamination control capabilities are positioning themselves favorably for procurement contracts driven by corporate environmental, social, and governance (ESG) targets.

Future growth opportunities also lie in retrofitting existing older facilities. Many established pharmaceutical and electronics plants need to upgrade their decades-old infrastructure to meet modern ISO/GMP standards. This massive requirement for modernization provides a robust, non-construction-dependent revenue stream for specialized door manufacturers. Retrofit projects often require highly customized door sizes and seamless integration with existing wall panels and differential pressure controls, demanding high technical expertise from the supplier. The ability to provide comprehensive validation documentation and rapid installation with minimal operational disruption is essential for securing these high-value retrofit contracts.

In conclusion, the Cleanroom Doors Market is shifting from a standard construction component to a critical piece of intelligent contamination control technology. The growth trajectory is stable, backed by structural demands in healthcare and technology, and accelerated by regulatory intensification and the integration of smart automation and AI-driven maintenance protocols. Manufacturers succeeding in this environment will be those that prioritize hermetic sealing performance, system integration, material science innovation, and robust after-sales support globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager