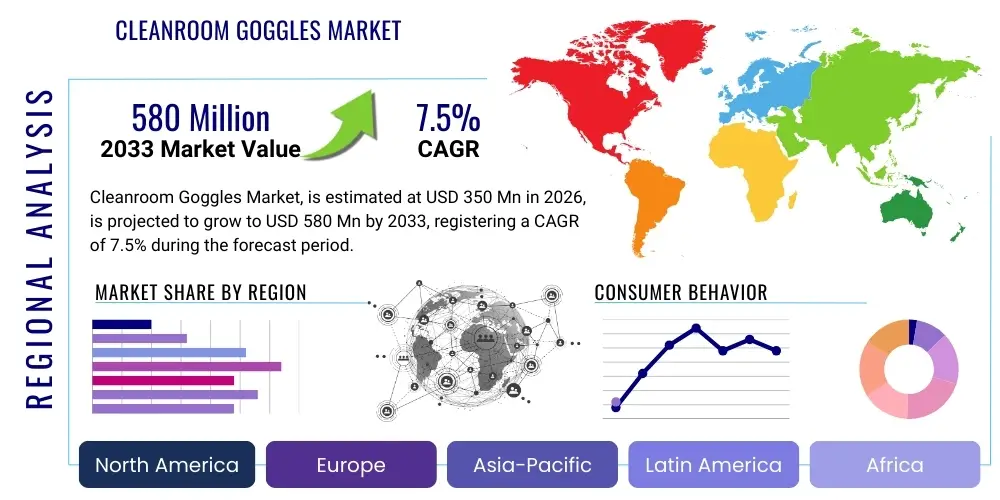

Cleanroom Goggles Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437607 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Cleanroom Goggles Market Size

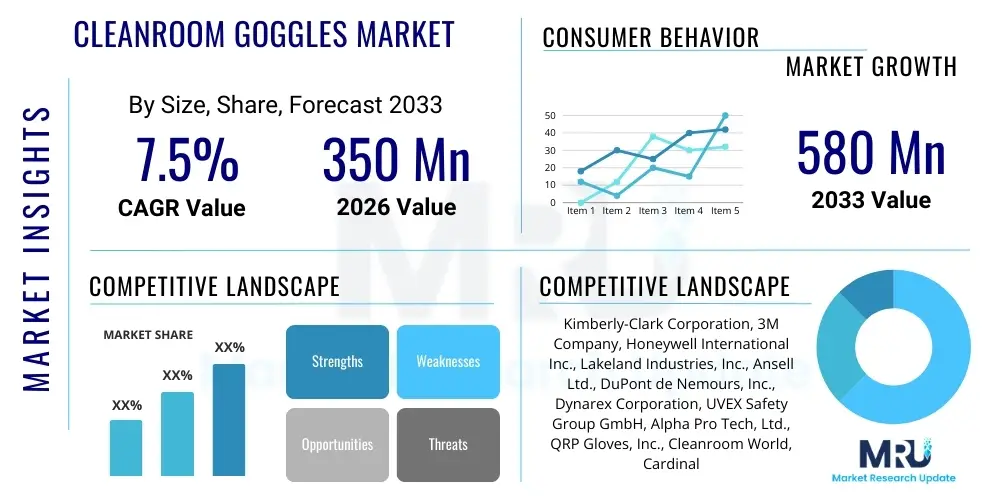

The Cleanroom Goggles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 580 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily underpinned by the stringent regulatory framework governing contamination control across pivotal high-technology and life sciences sectors globally, necessitating reliable personal protective equipment (PPE) designed specifically for controlled environments. The increasing establishment of manufacturing facilities that adhere to ISO 14644 and cGMP standards, particularly in emerging economies, further solidifies the long-term expansion prospects of this specialized safety market segment.

Cleanroom Goggles Market introduction

The Cleanroom Goggles Market encompasses specialized personal protective equipment engineered to safeguard personnel and, more critically, the sterile environment from particulate contamination and chemical exposure originating from the user. These goggles are differentiated from standard safety eyewear by their non-shedding materials, seamless design, ability to be sterilized (often via gamma irradiation or autoclaving), and compatibility with stringent cleanroom protocols, including gowning procedures and chemical resistance requirements. Products are typically manufactured from materials like high-grade polycarbonate, PVC, or silicone, ensuring low outgassing and high chemical tolerance, while also incorporating advanced anti-fog technologies crucial for sustained use.

Major applications for cleanroom goggles span critical industries such as semiconductor manufacturing, where even microscopic contamination can destroy complex circuitry; pharmaceutical and biotechnology production, involving sterile compounding and aseptic processing; and specialized medical device assembly. The fundamental benefit provided by these devices is twofold: protecting the wearer from splash hazards and airborne irritants, and preventing the shedding of skin flakes, hair, and microorganisms from the user into the controlled environment. Compliance with international standards, such as ISO classes (e.g., Class 10, Class 100), drives the adoption of specific goggle designs tailored to varying levels of environmental cleanliness.

Key driving factors accelerating the demand for cleanroom goggles include the global expansion of the biotechnology and biosimilar sectors, which rely heavily on aseptic environments for large-scale production. Furthermore, the miniaturization trends in the electronics industry require increasingly higher levels of particulate control, pushing manufacturers towards higher-specification, disposable, and often pre-sterilized goggle solutions. Regulatory enforcement, particularly by bodies like the FDA and EMA, requiring documented adherence to Good Manufacturing Practices (GMP), directly translates into mandatory investment in certified cleanroom PPE, sustaining robust market growth.

- Product Description: Non-shedding, anti-fog, chemically resistant eyewear designed for use in ISO-classified controlled environments to prevent cross-contamination.

- Major Applications: Pharmaceutical manufacturing, Biotechnology and biological research, Semiconductor and electronics fabrication, Aerospace and defense specialized assembly, Medical device manufacturing.

- Key Benefits: Particulate contamination prevention, chemical splash protection, enhanced regulatory compliance (c GMP/ISO), superior anti-fog performance for wearer comfort and visibility.

- Driving Factors: Increasing complexity of semiconductor devices, stringent global health and safety regulations, burgeoning global pharmaceutical manufacturing capacity, rise in R&D investment in biological sciences.

Cleanroom Goggles Market Executive Summary

The Cleanroom Goggles Market is currently characterized by a critical balance between cost-effectiveness and strict regulatory compliance, driving several core business and technological trends. The shift towards disposable goggle solutions, particularly in aseptic environments (e.g., ISO Class 5 and below), is a dominant trend, fueled by the rising costs and complex validation processes associated with sterilizing and reusing PPE. Geographically, the Asia Pacific (APAC) region is projected to maintain the fastest growth rate, propelled by massive foreign direct investment into electronics fabrication and pharmaceutical manufacturing hubs, especially in China, South Korea, and India. Companies are strategically focusing on developing high-performance, lightweight materials combined with integrated ventilation systems that maintain high air filtration efficiency without compromising visibility or comfort during long shifts.

From a segmentation perspective, the reusable segment, while growing slower than disposables, retains dominance in less critical cleanroom classes (e.g., ISO Class 7 and 8) due to lower long-term operational costs and improved sustainability profiles. However, advancements in low-particulate materials for disposable items continue to challenge this status quo. The electronics and semiconductor segment represents the highest demand for ultra-low particulate contamination control, requiring specialized, non-vented goggle designs that prevent air ingress. Conversely, the biotech segment drives demand for chemical and biological splash protection, necessitating high-resistance PVC or silicone frames.

Key industry movements include consolidation among specialized PPE providers and raw material suppliers seeking to control the specialized polymer supply chain. Manufacturers are increasingly leveraging digital tools for inventory management and traceability, crucial for cGMP environments where audit trails are mandatory. The increasing focus on ergonomic design features, such as adjustable head straps and compatibility with prescription eyewear and respirators, represents a crucial area of product development that directly influences user acceptance and compliance rates across all major end-user verticals. These interwoven business dynamics underscore a market maturing under the relentless pressure of quality control and zero-tolerance for contamination.

- Business Trends: Increased adoption of pre-sterilized disposable options, consolidation and specialization among key PPE suppliers, focus on sustainable materials for reusable variants, integration of advanced anti-fog and anti-scratch coatings.

- Regional Trends: APAC exhibits the highest growth due to booming semiconductor and biotech investment; North America and Europe remain dominant in revenue share due to strict regulatory enforcement and mature pharmaceutical industries.

- Segments Trends: Disposable goggles segment showing accelerated growth in critical environments (ISO 3-5); Polycarbonate material maintains leadership due to impact resistance and clarity; Biotechnology application segment is expanding rapidly driven by vaccine and cell therapy production.

AI Impact Analysis on Cleanroom Goggles Market

Common user questions regarding AI’s influence on the Cleanroom Goggles Market often revolve around how smart technologies can enhance manufacturing precision, improve compliance verification, and automate quality control processes to ensure zero defects in PPE. Users frequently inquire if AI-driven supply chain forecasting can prevent shortages of critical cleanroom supplies and whether machine vision systems are being deployed to detect microscopic defects on goggle surfaces that humans might miss. There is also significant curiosity about personalized ergonomics—using AI to analyze facial geometry to design more comfortable and compliant goggle fits for diverse workforces, thereby reducing compliance breaches caused by discomfort.

The core theme emerging from these inquiries is the expectation that AI and machine learning (ML) will elevate the quality assurance process far beyond current statistical sampling methods, moving towards a near-perfect quality standard essential for ISO Class 1 environments. AI is expected to revolutionize production line monitoring by utilizing high-resolution cameras to scan every finished product for micro-cracks, material non-uniformity, or particulate entrapment within the frame or lens itself, long before packaging. This immediate, high-fidelity defect detection dramatically reduces recall risks and enhances the reputation of manufacturers specializing in high-specification cleanroom PPE.

Beyond quality control, AI algorithms are playing an increasing role in optimizing cleanroom operations management. For goggle usage, this includes predictive maintenance for sterilization equipment, optimizing inventory levels based on real-time contamination risks observed in specific cleanroom zones, and enhancing training simulations for gowning procedures. While AI does not directly alter the chemical or physical properties of the goggles themselves, its impact on manufacturing efficiency, product reliability, and regulatory compliance validation is transformative, ensuring that the goggles reaching the end-user meet the absolute highest standards of cleanliness and structural integrity.

- AI-driven machine vision systems for 100% surface defect inspection of goggle lenses and frames, eliminating human error in quality control.

- Optimization of raw material usage and waste reduction through ML algorithms in injection molding processes for goggle components.

- Predictive modeling for cleanroom supply chain management, ensuring timely stocking and distribution of highly specialized, short-shelf-life sterilized goggles.

- Implementation of AI-enhanced training modules for staff on proper donning and doffing of goggles to maintain environmental integrity.

- Use of AI analytics to correlate goggle failure rates with specific manufacturing batch data for immediate root cause analysis and process adjustment.

DRO & Impact Forces Of Cleanroom Goggles Market

The market dynamics for cleanroom goggles are heavily influenced by a potent combination of stringent regulatory requirements (Drivers), operational challenges (Restraints), and continuous technological evolution (Opportunities), which collectively constitute the critical Impact Forces shaping investment and strategic decision-making. The primary driver is the non-negotiable nature of contamination control mandated by global standards bodies like the FDA, EMA, and ISO for life sciences and advanced manufacturing sectors. This external pressure forces immediate and sustained investment in certified PPE. Conversely, major restraints include the high recurrent costs associated with specialized, often single-use, sterilized items and the ongoing challenge of counterfeiting, where substandard goggles entering the supply chain pose severe operational and compliance risks to end-users.

The opportunities within the market are predominantly driven by materials science and integration capabilities. There is immense potential in developing next-generation anti-fog technologies that are durable yet compatible with rigorous sterilization cycles, particularly for reusable models. Furthermore, the integration of smart features, such as embedded RFID chips or QR codes for automated inventory tracking and compliance logging (essential for Industry 4.0 adoption in pharma), represents a significant growth pathway. The increasing complexity of advanced therapies, such as cell and gene therapies, which require extremely low particulate environments, fuels demand for specialized, high-barrier goggle designs that offer minimal outgassing and maximum filtration efficiency.

The immediate impact forces operating on the market involve escalating geopolitical trade tensions affecting the sourcing of specialized polymers, coupled with rising labor costs in manufacturing centers, pressuring profit margins for PPE producers. Furthermore, sustainability concerns are becoming a major force, pushing manufacturers to explore biodegradable or recyclable options for disposable products without compromising performance standards. These forces necessitate strategic agility, compelling market participants to invest heavily in resilient supply chains, regionalized manufacturing capabilities, and accelerated R&D focused on achieving both compliance and environmental responsibility, thereby ensuring long-term competitiveness in a highly regulated sector.

- Drivers: Intensified regulatory scrutiny on contamination control (c GMP, ISO 14644), rapid global expansion of the pharmaceutical and biotechnology industries, increasing complexity and particulate sensitivity in semiconductor fabrication, growing awareness of occupational safety standards in controlled environments.

- Restraints: High disposable costs and complex disposal protocols, challenges in material sourcing and price volatility of specialized polymers, prevalence of lower-quality counterfeit products disrupting established supply chains, user discomfort leading to non-compliance in extended shifts.

- Opportunities: Development of advanced, permanent anti-fog coatings, integration of smart tracking technologies (RFID/NFC) for inventory and audit trails, focus on sustainable, bio-degradable cleanroom compatible materials, market expansion into emerging healthcare and medical device assembly hubs.

- Impact Forces: Strict ISO and FDA guidelines demanding non-shedding, sterilizable materials exert constant pressure; high capital expenditure required for specialized manufacturing facilities acts as a barrier to entry; global events (e.g., pandemics) demonstrate inelastic, surge-dependent demand for certified PPE.

Segmentation Analysis

The Cleanroom Goggles Market is segmented based on several critical parameters, including the product's intended lifecycle (Disposable vs. Reusable), the material used in construction (Polycarbonate, PVC, etc.), the level of environmental cleanliness required (ISO Class), and the primary end-user application (Electronics, Pharma, etc.). This segmentation is essential as the performance requirements for goggles vary drastically; for instance, a goggle used in an ISO Class 8 general assembly area has vastly different technical specifications and cost parameters than one required for aseptic processing in an ISO Class 3 environment, which must be sterile and non-vented.

The Material segment is crucial, with Polycarbonate dominating due to its superior clarity, impact resistance, and durability, often used in reusable designs. However, PVC and silicone are preferred for disposable models where cost-effectiveness and excellent sealing properties are prioritized. The Application segmentation highlights the divergence in demand, where the Electronics sector typically demands ultra-low particulate standards, favoring non-vented designs, while the Biotech sector requires superior chemical splash resistance and steam/gamma sterilization compatibility. Understanding these nuanced needs allows manufacturers to tailor their product offerings and marketing strategies effectively across disparate high-tech industries.

The shift within the Product Type segment towards pre-sterilized disposables is the most defining trend. While reusable goggles offer economic benefits over time, the associated risk of improper cleaning, re-sterilization failure, and validation complexity often makes single-use, sterile options the default choice for critical, high-risk operations (e.g., compounding pharmacies and specialized R&D). This preference underscores the market's focus on minimizing risk and maintaining uncompromising regulatory compliance, even at a higher operational expenditure per unit.

- By Product Type:

- Disposable Goggles

- Reusable Goggles

- Pre-Sterilized Goggles (sub-segment of disposables)

- By Material:

- Polycarbonate

- Polyvinyl Chloride (PVC)

- Silicone and Elastomers

- Others (e.g., Polypropylene, TPE)

- By Cleanroom Classification:

- ISO Class 1–5 (Critical Environments)

- ISO Class 6–9 (General Controlled Environments)

- By Application/End-use:

- Pharmaceutical and Biotechnology

- Semiconductor and Electronics Manufacturing

- Medical Device Manufacturing

- Aerospace and Defense

- Academic Research and Specialty Laboratories

Value Chain Analysis For Cleanroom Goggles Market

The value chain for the Cleanroom Goggles Market begins with the Upstream Analysis, which focuses heavily on the procurement of highly specialized raw materials, primarily optical-grade polycarbonate, non-shedding PVC compounds, and medical-grade silicone elastomers. These raw materials must meet strict criteria regarding low extractables, low outgassing, and chemical inertness, often sourced from highly specialized chemical and polymer manufacturers. The quality and purity of these inputs directly determine the final cleanroom compatibility of the product. Manufacturers of goggles then focus on advanced injection molding and precision assembly in controlled environments (often ISO Class 7 or better) to ensure the product itself does not introduce contamination.

Midstream activities involve the primary manufacturing processes, including precision molding of lenses and frames, application of proprietary anti-fog coatings, and assembly of straps and ventilation systems. For sterilized products, this stage includes specialized packaging in cleanroom-compatible materials and external sterilization methods, predominantly gamma irradiation or E-beam processing, which must be validated and certified. The complexity of regulatory compliance and the need for validated sterilization processes create significant barriers to entry for new manufacturers, concentrating production capabilities among specialized players who can afford the necessary infrastructure and quality systems.

Downstream Analysis focuses on distribution channels, which are typically bifurcated into Direct and Indirect sales. Direct sales are often utilized for large pharmaceutical and semiconductor corporations requiring bespoke contracts and technical support, leveraging dedicated sales teams. Indirect channels utilize specialized cleanroom distributors, who possess deep knowledge of ISO classification requirements and handle logistics for smaller end-users and research labs. These distributors play a vital role in educating buyers on compliance and providing bundled cleanroom supply solutions (gowns, masks, etc.). The final consumption point is the end-user cleanroom, where strict procurement standards and long-term contracts based on validated performance heavily influence purchasing decisions.

- Upstream Analysis: Sourcing of high-purity polycarbonate resin, medical-grade PVC/silicone, specialized anti-fog chemical compounds, and non-latex/low-lint strap materials.

- Manufacturing & Processing: Precision injection molding in controlled environments, validated sterilization (Gamma/E-beam), application of durable coatings, and cleanroom packaging.

- Distribution Channel: Specialized Cleanroom and PPE distributors (indirect), direct sales to large corporate accounts (pharmaceutical majors, large fabs), e-commerce platforms for smaller labs and R&D centers.

- Downstream Analysis: Logistics and supply chain management focusing on maintaining product integrity (sterility and cleanliness) during transport to the end-user facility.

Cleanroom Goggles Market Potential Customers

The primary potential customers for cleanroom goggles are any organization operating a facility that must adhere to stringent environmental cleanliness standards, typically defined by ISO 14644 or equivalent regulatory standards like cGMP (Current Good Manufacturing Practice). These end-users are characterized by their zero-tolerance policy for particulate and microbial contamination, where failure to maintain cleanliness can result in catastrophic product loss, regulatory shutdowns, or significant financial penalties. Therefore, procurement is driven by verifiable technical specifications, certification adherence, and supplier reliability, rather than purely by unit cost.

The largest segments of end-users are concentrated within the life sciences and high-technology manufacturing sectors. Pharmaceutical companies involved in sterile drug compounding, vaccine production, and Quality Control (QC) laboratories represent a massive and continuously growing consumer base, demanding pre-sterilized, disposable options for high-grade cleanrooms (ISO Class 5 and below). Similarly, the biotechnology sector, including companies focused on cell and gene therapies and biosimilar production, requires robust chemical splash protection combined with anti-fog technology to ensure operator compliance and safety during complex biological processes.

The electronics and semiconductor industry forms another critical customer base, particularly manufacturers of microprocessors, memory chips, and specialized displays. These entities operate some of the cleanest environments globally (often ISO Class 1 to 3), necessitating non-vented, ultra-low particulate generating goggles. Procurement decisions in this sector often emphasize the material's outgassing properties and resistance to specific process chemicals used in lithography and etching. In summary, the ideal potential customer is an enterprise where contamination risk translates directly into a high probability of compliance failure and substantial economic loss, thereby justifying the investment in premium, certified cleanroom PPE.

- End-User/Buyers of the product:

- Pharmaceutical manufacturing facilities (Sterile compounding, Aseptic filling)

- Biotechnology companies (Cell and Gene therapy production, Vaccine manufacturing)

- Semiconductor fabrication plants (Fabs)

- Medical device assembly and sterilization companies

- Aerospace component manufacturing and assembly labs

- Specialized academic and industrial research laboratories (BSL-3/4 facilities)

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 580 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kimberly-Clark Corporation, 3M Company, Honeywell International Inc., Lakeland Industries, Inc., Ansell Ltd., DuPont de Nemours, Inc., Dynarex Corporation, UVEX Safety Group GmbH, Alpha Pro Tech, Ltd., QRP Gloves, Inc., Cleanroom World, Cardinal Health, Berkshire Corporation, Valutek, Micronclean, Tians International Co., Ltd., Sempermed (Semperit AG Holding), Superior Manufacturing Group, Saf-T-Gard International, Inc., Technicair & Filtration. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cleanroom Goggles Market Key Technology Landscape

The technology landscape of the Cleanroom Goggles Market is dominated by innovations in material science and specialized surface treatments aimed at enhancing visibility, ensuring sterility, and minimizing particulate generation. A paramount technological focus is on developing and implementing advanced, long-lasting anti-fog systems. Traditional anti-fog treatments often wear off quickly or are incompatible with chemical sterilization agents. Modern solutions involve permanent, hydrophilic coatings or complex dual-pane venting systems (for lower class cleanrooms) that actively manage temperature differentials to prevent condensation without compromising the barrier integrity required for high-class environments. The goal is to maximize operator compliance by ensuring clear, unobstructed vision throughout long operational periods.

Another crucial technological area is the validation and scalability of sterilization methods, particularly for disposable products. Gamma irradiation is the industry standard, requiring specialized polymeric materials that maintain structural integrity and optical clarity even after high-dose exposure. Manufacturers must meticulously control the sterilization process to ensure a Sterility Assurance Level (SAL) of 10-6, which is mandatory for sterile applications in life sciences. Furthermore, there is ongoing research into advanced packaging technologies—using low-shedding, multilayer barrier films—that ensure the goggles remain sterile until the point of use, and the packaging itself does not introduce contamination upon entry into the cleanroom (easy-tear cleanroom bags).

Ergonomics and integration technology also play a key role. Manufacturers are utilizing computational fluid dynamics (CFD) modeling to optimize goggle ventilation patterns for maximum airflow and heat dissipation while minimizing particulate ingress, a critical factor for compliance in non-vented designs. The rising adoption of Industry 4.0 principles necessitates the integration of traceable technologies like embedded Near Field Communication (NFC) or Ultra-High Frequency (UHF) RFID tags directly into reusable goggle frames. This allows for automated inventory management, tracking of cleaning and sterilization cycles, and seamless integration with facility management software, ensuring that only validated, compliant PPE is issued to personnel, significantly enhancing the overall quality system of the cleanroom operation.

- Anti-Fog Technology: Permanent hydrophilic and hydrophobic coatings applied during manufacturing for enduring clarity, reducing the need for temporary wipes or sprays.

- Sterilization Compatibility: Use of polymers resistant to degradation from Gamma and E-beam irradiation, ensuring lens clarity and structural integrity post-sterilization.

- Low Outgassing Materials: Utilizing specialized high-purity polycarbonate and silicone that minimize the release of volatile organic compounds (VOCs), critical for semiconductor cleanrooms (ISO Class 1-3).

- Ergonomic Design: Lightweight frames, adjustable head straps, and wide peripheral vision lenses designed for compatibility with respirators, hoods, and prescription glasses to maximize user comfort and compliance.

- Traceability Integration: Embedded RFID/NFC technology for automated asset tracking, cycle counting, and compliance auditing in cGMP environments.

Regional Highlights

- Asia Pacific (APAC): APAC is expected to demonstrate the highest Compound Annual Growth Rate (CAGR) throughout the forecast period, primarily driven by large-scale investments in semiconductor manufacturing (e.g., Taiwan, South Korea, China) and the rapid expansion of generic drug and biosimilar production in India and Southeast Asia. Governments in these regions are actively promoting the establishment of high-tech manufacturing hubs, necessitating vast quantities of certified cleanroom supplies. The sheer volume of new cleanroom construction here positions APAC as the dominant consumption center by the end of the forecast period.

- North America: North America holds a substantial revenue share, underpinned by its mature and highly regulated pharmaceutical, biotechnology, and aerospace industries. The United States, in particular, drives demand due to strict FDA enforcement of cGMP standards, especially concerning sterile drug manufacturing and advanced cell therapies. The market here is characterized by a high demand for premium, pre-sterilized, and traceable goggle solutions, reflecting a willingness to invest heavily in top-tier compliance and quality control infrastructure.

- Europe: Europe represents a mature market with robust growth, largely fueled by the European Medicines Agency (EMA) regulations and a strong presence of global pharmaceutical giants and high-precision electronics manufacturers in Germany, Switzerland, and Ireland. The European market shows a distinct preference for sustainable and recyclable options in the reusable goggle segment, driven by regional environmental mandates and corporate sustainability goals, pushing manufacturers towards advanced material science solutions.

- Latin America (LATAM): The LATAM market is characterized by emerging growth, particularly in Brazil and Mexico, due to increasing local pharmaceutical production capacity and the development of regional medical device assembly centers. While the market penetration of high-class cleanrooms is lower compared to NA or APAC, regulatory harmonization efforts and foreign investments are steadily increasing the demand for compliant cleanroom PPE, often through indirect distributor channels focusing on cost-effective, certified reusable options.

- Middle East and Africa (MEA): Growth in the MEA region is nascent but accelerating, particularly in the Gulf Cooperation Council (GCC) states (UAE, Saudi Arabia) which are strategically investing in domestic biotech and pharmaceutical manufacturing capabilities to diversify their economies. These ambitious "Vision" projects require the immediate importation of international standards and compliant supplies, offering specialized manufacturers a focused, high-value opportunity, albeit with complex logistics and regulatory adoption timelines.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cleanroom Goggles Market.- Kimberly-Clark Corporation

- 3M Company

- Honeywell International Inc.

- Lakeland Industries, Inc.

- Ansell Ltd.

- DuPont de Nemours, Inc.

- Dynarex Corporation

- UVEX Safety Group GmbH

- Alpha Pro Tech, Ltd.

- QRP Gloves, Inc.

- Cleanroom World

- Cardinal Health

- Berkshire Corporation

- Valutek

- Micronclean

- Tians International Co., Ltd.

- Sempermed (Semperit AG Holding)

- Superior Manufacturing Group

- Saf-T-Gard International, Inc.

- Technicair & Filtration

Frequently Asked Questions

Analyze common user questions about the Cleanroom Goggles market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between standard safety goggles and cleanroom goggles?

Cleanroom goggles are specifically engineered using non-shedding, low-particulate materials (low outgassing plastics and specialized coatings) and are manufactured, assembled, and packaged in an ISO-classified clean environment. Standard safety goggles are not suitable as they typically shed particulates, lack anti-fog treatments compatible with cleanroom chemistries, and are not sterilized, posing a severe contamination risk to sensitive processes.

Why are disposable cleanroom goggles growing faster than reusable options in critical environments?

Disposable, pre-sterilized goggles eliminate the complex, high-risk, and costly validation processes required for cleaning and re-sterilizing reusable PPE in ISO Class 5 and below environments. Regulatory compliance pressure (c GMP) favors the use of validated single-use items to minimize the chance of cross-contamination or cleaning residual failure, justifying the higher unit cost through maximized process integrity.

What role does material composition play in selecting cleanroom goggles for semiconductor manufacturing?

In semiconductor fabrication (Fabs), material composition is critical because of the need for ultra-low outgassing properties. Materials must not release volatile organic compounds (VOCs) that can deposit on wafers, interfering with lithography and etching processes. Therefore, non-vented, high-purity polycarbonate lenses and frames that meet strict chemical resistance standards are prioritized over standard PVC options.

How significant is the impact of anti-fog technology on market compliance and purchasing decisions?

Anti-fog technology is highly significant as fogging is a primary driver of non-compliance, where operators may improperly adjust or remove goggles due to obscured vision, leading to contamination breaches. Manufacturers actively seek goggles with permanent, superior anti-fog coatings that withstand repeated cleaning or sterilization cycles, ensuring high user acceptance and regulatory adherence throughout extended shifts.

Which geographic region dominates the demand for cleanroom goggles and why?

Asia Pacific (APAC) currently exhibits the highest growth and is expected to dominate consumption volume due to massive government and private sector investment in establishing new pharmaceutical manufacturing hubs (biosimilars, generics) and advanced semiconductor fabrication facilities (Fabs). The rapid scale-up of high-technology infrastructure across key nations like China, South Korea, and Taiwan drives unparalleled demand for all certified cleanroom PPE, including specialized goggles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager