Clear Aligner Therapy Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436292 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Clear Aligner Therapy Market Size

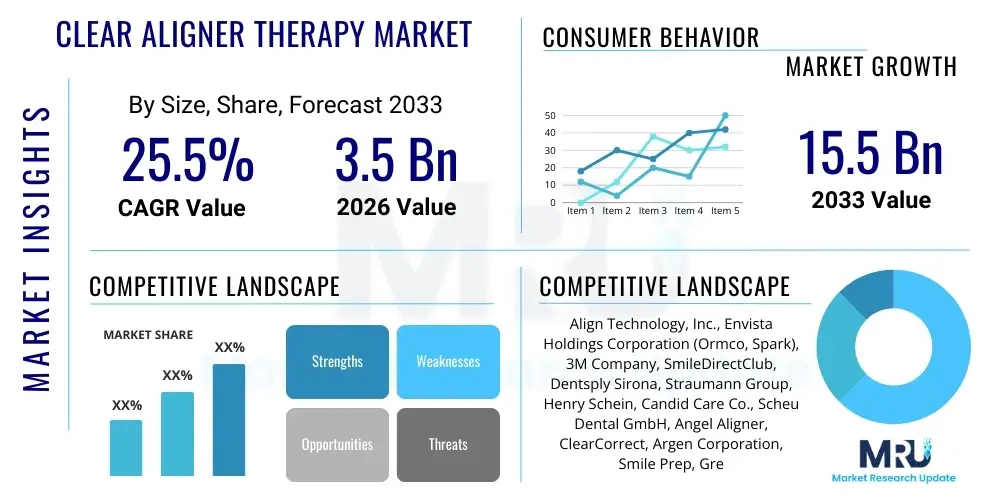

The Clear Aligner Therapy Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.5% between 2026 and 2033. This exponential expansion is underpinned by increasing aesthetic awareness globally and rapid technological integration in dental practices. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 15.5 Billion by the end of the forecast period in 2033. This substantial growth trajectory reflects the shift from traditional metal braces towards more discreet, convenient, and technologically advanced orthodontic solutions.

Clear Aligner Therapy Market introduction

The Clear Aligner Therapy Market involves the manufacturing and distribution of transparent, customized trays designed to gradually shift teeth into the desired position, offering a highly aesthetic and less invasive alternative to conventional orthodontic appliances. These aligners are predominantly fabricated using advanced thermoplastic materials, often utilizing state-of-the-art 3D printing technologies and sophisticated treatment planning software. Major applications span the correction of mild to moderate malocclusions, including crowding, spacing, and minor bite issues, catering primarily to the burgeoning adult orthodontic demographic seeking cosmetic improvements without the visual burden of fixed braces.

The primary benefits driving market adoption include enhanced patient comfort, superior aesthetics, ease of use (as they are removable for eating and cleaning), and predictable treatment outcomes facilitated by digital planning tools. These advantages significantly improve the patient experience compared to traditional methods, leading to higher compliance rates among users, especially young professionals and adults. Furthermore, the rising integration of teledentistry and Direct-to-Consumer (DTC) models has lowered the barrier to entry for patients, democratizing access to orthodontic care and fueling rapid market expansion, particularly in developed economies with high disposable income and significant focus on personal appearance.

Driving factors critical to market success include continuous innovation in polymer materials enhancing durability and clarity, the widespread adoption of intraoral scanners replacing traditional messy impressions, and aggressive marketing campaigns promoting aligner brands directly to end-consumers. Regulatory approvals for broader application scopes, allowing aligners to treat more complex cases, are also contributing significantly to market maturation. The confluence of digital workflow efficiency, material science advancements, and strong consumer demand for cosmetic dentistry solidifies the clear aligner therapy sector as one of the fastest-growing segments within the dental industry.

Clear Aligner Therapy Market Executive Summary

The Clear Aligner Therapy market is characterized by dynamic business trends centered on vertical integration, aggressive intellectual property defense, and intense competition between incumbent professional providers and disruptive Direct-to-Consumer (DTC) firms. Key business strategies involve expanding global manufacturing capabilities, investing heavily in AI-driven treatment software for optimized planning, and establishing strong partnerships with general practitioners (GPs) to widen the referral base beyond specialized orthodontists. The rising prevalence of hybrid models, where DTC companies partner with licensed dentists for oversight, indicates a strategic alignment aimed at balancing consumer convenience with clinical assurance, which is a critical trend influencing investor confidence and market structure.

Regionally, North America remains the dominant revenue generator due to early technology adoption, high patient awareness, and strong consumer spending power, supported by favorable reimbursement trends and established dental infrastructure. Asia Pacific (APAC) is emerging as the fastest-growing region, fueled by massive, untapped patient pools in countries like China and India, increasing urbanization, and the rapid establishment of modern dental clinics. Europe maintains a steady growth rate, driven by robust regulatory standards and a strong focus on high-quality, professional-grade aligners, often preferring provider-prescribed models over fully remote DTC options. These regional dynamics necessitate tailored marketing and distribution strategies for market participants.

In terms of segmentation trends, the adult segment consistently dominates the market, reflecting the unmet demand for aesthetic solutions among working professionals. However, the teenage segment is experiencing accelerated growth as providers successfully adapt aligners to handle more complex adolescent dentition requirements. Technological segmentation highlights the shift toward advanced multi-layer polymer aligners, which offer superior force control and comfort compared to conventional single-layer alternatives. Furthermore, the dominance of professional-led channel segmentation, despite the high profile of DTC models, underscores the continued importance of clinical diagnosis and oversight for achieving complex and reliable outcomes in orthodontic care.

AI Impact Analysis on Clear Aligner Therapy Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Clear Aligner Therapy Market primarily revolve around the accuracy and speed of treatment planning, the potential for personalized patient journeys, and the automation of clinical tasks. Common concerns include whether AI algorithms can reliably predict tooth movement in complex cases better than experienced orthodontists, how AI will influence the pricing structure of aligners, and the regulatory framework required for AI-assisted medical devices. Users also frequently ask about the role of machine learning in improving customer service diagnostics and reducing the need for multiple refinement stages, which often extend treatment duration and increase costs. The overarching expectation is that AI will drive efficiency and precision, but users demand evidence of clinical superiority and regulatory oversight.

The integration of AI is transforming clear aligner therapy from a manual, experience-based process into a precision-engineered digital workflow. AI tools are now integral in analyzing vast datasets of successful treatments to identify patterns, thereby generating highly accurate treatment plans that minimize the risk of failure and mid-course corrections. Furthermore, AI algorithms are being deployed to automate the segmentation of 3D intraoral scans, predict potential patient compliance issues based on demographic and historical data, and optimize the material thickness and cutting lines of the aligners for maximum biomechanical efficacy. This automation reduces laboratory time, cuts overhead costs, and enhances the scalability of manufacturing operations, which is crucial for major market players to maintain competitive pricing and high throughput.

This technological evolution means that AI is not merely a supplementary tool but a core component differentiating market leaders. Its influence extends to virtual monitoring solutions, where machine learning analyzes patient-submitted images to assess aligner fit and track progress remotely, significantly reducing in-office visits and improving patient convenience. This push towards remote, AI-guided monitoring aligns perfectly with the current shift towards digital healthcare delivery, ensuring that the clear aligner market remains at the forefront of medical technology adoption and patient-centric care models. The long-term impact is expected to standardize treatment quality globally, making expert-level planning accessible regardless of the location or experience level of the prescribing dentist.

- Enhanced 3D segmentation and diagnostic accuracy via machine learning models.

- Automated treatment planning algorithms reducing human error and planning time.

- Predictive analytics for optimizing tooth movement path and minimizing treatment length.

- Improved production efficiency through AI-guided 3D printing optimization.

- Remote monitoring systems analyzing patient photos for real-time compliance and progress tracking.

- Personalized force application profiles based on individual bone density and root morphology data.

DRO & Impact Forces Of Clear Aligner Therapy Market

The market dynamics of Clear Aligner Therapy are shaped by strong drivers focusing on consumer demand for aesthetics and technological sophistication, tempered by persistent restraints relating to complexity and cost, and propelled by significant opportunities in untapped global demographics and novel material science. The primary driving force is the confluence of increasing adult interest in cosmetic orthodontics, coupled with the proven efficacy and convenience offered by digital treatment workflows incorporating intraoral scanning and 3D printing. However, the market faces significant restraints, chiefly the relatively high initial capital expenditure for specialized dental equipment, the limitations in treating severe skeletal malocclusions compared to traditional fixed appliances, and the substantial litigation costs associated with protecting complex intellectual property portfolios.

Opportunities for exponential growth are concentrated in expanding market penetration across emerging economies, particularly in Asia Pacific and Latin America, where the middle-class population demanding aesthetic dental solutions is rapidly expanding. Further opportunities exist in developing advanced polymers that offer greater stiffness and force application capability while maintaining optical clarity, potentially enabling clear aligners to address a broader spectrum of orthodontic complexity. Additionally, strategic integration with general dental practices through comprehensive training and support programs represents a crucial avenue for market expansion, transforming GPs into key facilitators of aligner treatment alongside specialized orthodontists, thereby capturing a wider patient base.

The impact forces within the clear aligner ecosystem are characterized by high buyer bargaining power due to the proliferation of brands (both professional and DTC) providing similar clinical outcomes, leading to price sensitivity and demand for added value, such as virtual consultations or accelerated treatment options. Supplier bargaining power remains moderate, although specific advanced polymer material suppliers and proprietary 3D printing equipment manufacturers hold some leverage. Intense competitive rivalry, driven by significant R&D spending on patents and aggressive marketing strategies, mandates continuous innovation. Finally, the threat of substitutes is low to moderate; while traditional braces exist, their aesthetic inferiority minimizes their substitution risk, and the primary threat comes from new, cheaper entrants into the clear aligner space itself.

Segmentation Analysis

The Clear Aligner Therapy Market is segmented based on several critical parameters, including material type, end-user, age group, and distribution channel, providing a granular view of consumer preferences and market adoption patterns. Material segmentation, specifically between single-layer and multi-layer aligners, reflects ongoing technological advancements focused on optimizing force delivery and patient comfort, with multi-layer systems gaining significant traction due to superior performance characteristics and reduced requirement for attachments in certain cases. The analysis of these segments is vital for manufacturers in tailoring product development and competitive positioning within a rapidly evolving technological landscape.

The age group segmentation is bifurcated into adult and teenager categories, where the adult segment (aged 18 and above) holds the majority market share, driven by rising aesthetic consciousness among professionals and increased affordability. However, the teenage segment represents a significant growth area, spurred by product innovations designed for compliance monitoring and the ability of newer aligners to manage the complexities of mixed dentition. End-user segmentation is defined by the providers—orthodontists versus general dentists—with orthodontists traditionally dominating high-complexity cases, while general dentists are increasingly adopting aligners for simpler, esthetically driven treatments, particularly those involving hybrid DTC models.

The distribution channel analysis contrasts the professional-provided channel (PPC) and the direct-to-consumer (DTC) channel. The PPC segment maintains dominance, reflecting patient preference for clinical supervision, guaranteed outcomes, and the ability to address more severe malocclusions. The DTC channel, while facing greater regulatory scrutiny and often limited to mild cases, provides unmatched convenience and cost-effectiveness, driving its rapid growth among specific, price-sensitive consumer demographics. Understanding the distinct dynamics across these segments is essential for strategic market entry and sustained revenue growth.

- By Material Type:

- Single-Layer

- Multi-Layer

- Others (e.g., experimental biodegradable polymers)

- By Age Group:

- Teenagers (12 to 18)

- Adults (18 and above)

- By End-User:

- Orthodontists

- General Dentists (GPs)

- By Distribution Channel:

- Professional Provided Channel (PPC)

- Direct-to-Consumer (DTC) Channel

Value Chain Analysis For Clear Aligner Therapy Market

The value chain for Clear Aligner Therapy is highly integrated and dominated by technological processes, starting upstream with the supply of advanced raw materials, primarily medical-grade thermoplastic polymers (polyurethane resins, PET-G), and specialized 3D printing equipment (SLA, DLP, or binder jetting technologies). Upstream analysis focuses on securing reliable supplies of high-clarity, biocompatible materials that offer the necessary mechanical properties for consistent force application. Manufacturing involves the critical stages of digital planning (utilizing proprietary software for movement simulation), 3D printing of molds, thermoforming the aligner trays, and sophisticated post-processing for trimming and polishing. This stage is characterized by high capital investment in digital infrastructure and advanced manufacturing facilities, representing a significant barrier to entry.

Midstream activities involve the distribution channel, which is distinctly bifurcated into direct and indirect routes. Direct distribution is favored by major professional brands, involving direct sales teams engaging orthodontists and GPs, often supplemented by online portals for case submission and monitoring. Indirect channels, including traditional dental distributors or dental laboratory partnerships, are utilized by smaller or regional players. The DTC model represents a highly streamlined direct channel, bypassing the traditional dental practice consultation for initial steps, relying instead on mail-in impression kits or retail scanning centers, although regulatory shifts are pushing even DTC models toward mandated clinical oversight (hybrid models).

Downstream analysis focuses on the end-user interaction and post-treatment maintenance. The delivery of the aligners involves extensive patient education on usage and compliance, primarily facilitated through the prescribing dental professional in the PPC model. The efficacy of the treatment relies heavily on the quality of the initial digital diagnosis and the continuous monitoring of patient progress. The increasing adoption of digital communication tools for virtual check-ups streamlines the downstream process, enhancing customer satisfaction and reducing chair time. Success in the downstream market is defined by reliable clinical outcomes, patient comfort, and effective customer support, which reinforces brand loyalty and generates positive referrals.

Clear Aligner Therapy Market Potential Customers

Potential customers for Clear Aligner Therapy are broadly segmented into two primary categories: individuals seeking purely aesthetic corrections and those requiring orthodontic treatment for functional or minor bite issues. The dominant end-user demographic is adults (aged 25-45) who are financially stable, highly image-conscious, and prioritize discreet treatment solutions that minimize professional and social disruption. This group drives demand for professional-grade aligners and is often less price-sensitive than younger demographics, focusing instead on guaranteed outcome quality and minimized treatment duration. This core segment values the convenience of fewer office visits and the ability to maintain normal daily routines without the visibility of traditional metal braces.

The second major group includes adolescents and young adults (ages 12-24) whose parents are increasingly opting for clear aligners over traditional braces due to the perceived comfort and aesthetic benefits for their children, often influenced by peer pressure and social media visibility. While compliance is a greater challenge in this segment, technological solutions, such as embedded compliance indicators (dots), are successfully mitigating this risk. This market segment is increasingly served by specific product lines tailored for growing jaws and mixed dentition, broadening the addressable market beyond simple adult relapse cases. Potential customers also include general dentists seeking to expand their practice offerings and capture the significant latent demand for mild orthodontic correction that they historically referred out to specialists.

Furthermore, a third emerging customer group consists of individuals in lower-income demographics or remote geographic locations who prioritize cost-efficiency and accessibility, often utilizing the Direct-to-Consumer (DTC) models. While this segment typically requires only minor tooth movement, their sheer volume and global distribution make them a crucial growth driver for companies focusing on streamlined, lower-cost aligner solutions. Market participants must align their distribution strategies—whether highly clinical (PPC) or convenience-focused (DTC)—to effectively capture these distinct customer segments, adapting marketing messaging to address varied priorities concerning aesthetics, convenience, cost, and clinical risk tolerance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 15.5 Billion |

| Growth Rate | 25.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Align Technology, Inc., Envista Holdings Corporation (Ormco, Spark), 3M Company, SmileDirectClub, Dentsply Sirona, Straumann Group, Henry Schein, Candid Care Co., Scheu Dental GmbH, Angel Aligner, ClearCorrect, Argen Corporation, Smile Prep, Great Lakes Orthodontics, Danaher Corporation, K Line Europe, TP Orthodontics, Inc., ClearStep, DynaFlex, and Sun Dental Labs. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Clear Aligner Therapy Market Key Technology Landscape

The Clear Aligner Therapy market is fundamentally driven by sophisticated digital technologies that streamline the entire treatment process, ensuring high precision and patient predictability. The technological core relies heavily on Intraoral Scanning Technology, which replaces traditional plaster molds with high-resolution digital 3D models of the patient's dentition. These scanners (often employing confocal microscopy or structured light) capture minute details necessary for accurate diagnosis and precise treatment planning. The rapid adoption of these scanners has accelerated case submission times and significantly improved the quality of the data used for subsequent manufacturing steps, creating an efficient digital workflow backbone for the entire industry.

Crucially, Advanced 3D Printing and Additive Manufacturing technologies, primarily StereoLithography (SLA) and Digital Light Processing (DLP), are utilized to create highly accurate molds from the digital treatment plan. These molds are then used in the thermoforming process to create the actual aligner trays. Manufacturers are continually investing in faster, higher-resolution 3D printers and specialized photopolymer resins to improve mold fidelity and reduce manufacturing cycle times. Concurrently, advancements in Proprietary Biomechanical Software and Artificial Intelligence (AI) are essential for simulating complex tooth movements, predicting potential challenges (like root proximity or bone density limitations), and designing the sequential aligner stages with optimized force vectors. These software platforms are the key intellectual property differentiator among major market players, ensuring predictable clinical outcomes.

The evolution of Polymer Science and Materials Engineering is another vital technological area. Next-generation aligners utilize multi-layer thermoplastic materials (e.g., specialized blends of polyurethane and PET-G) which offer superior elasticity, durability, and sustained force delivery compared to older single-layer plastics. These advancements reduce the need for frequent aligner changes, minimize patient discomfort, and expand the range of malocclusions that clear aligners can effectively treat. Furthermore, the rise of Cloud Computing and Tele-dentistry Platforms facilitates remote patient monitoring and collaboration between dentists, labs, and patients, ensuring that the entire treatment journey is managed digitally, from initial diagnosis to retention phase, further solidifying the clear aligner market as a technology-first sector.

Regional Highlights

Regional dynamics play a significant role in market valuation and growth trajectory, reflecting variances in disposable income, aesthetic acceptance, regulatory environments, and dental infrastructure maturity. North America, encompassing the United States and Canada, currently holds the largest market share and remains the global leader in terms of technology adoption, high patient volume, and significant consumer awareness regarding cosmetic dentistry. The U.S. market, in particular, benefits from robust reimbursement structures, high expenditure on healthcare, and the aggressive marketing strategies of leading companies, fostering a highly competitive and innovative environment focused on both professional and hybrid DTC models. High incidence of malocclusion combined with a mature digital dental ecosystem ensures sustained market dominance in this region.

Europe represents a mature yet steadily growing market, driven primarily by major economies like Germany, the UK, and France. The European market generally favors Professional Provided Channels (PPC), with a stronger emphasis on stringent regulatory standards and clinical oversight, making it a critical region for high-quality, specialized aligners. Growth is fueled by increasing patient willingness to invest in aesthetic corrections and the rapid integration of intraoral scanners into general dental practices. Meanwhile, the Asia Pacific (APAC) region is projected to exhibit the highest CAGR during the forecast period. This surge is attributed to burgeoning middle-class populations in China and India, expanding access to modern dental facilities in urban centers, and increasing health and aesthetic awareness across younger generations. While price sensitivity is higher, the sheer scale of the patient pool makes APAC the most strategically important region for long-term global expansion.

Latin America (LATAM) and the Middle East & Africa (MEA) currently hold smaller market shares but present substantial untapped opportunities. Growth in LATAM is concentrated in urban areas of Brazil and Mexico, driven by improved economic conditions and rising interest in modern orthodontic solutions. The MEA region, particularly the GCC countries, shows promising growth potential due to increasing healthcare investments and a growing expatriate population with high disposable incomes demanding premium cosmetic services. Challenges in these regions include fragmented distribution networks, fluctuating economic stability, and varying levels of dental insurance coverage, necessitating focused, localized market entry strategies that often involve establishing regional training centers to build clinical competency and foster technology adoption.

- North America: Market leader; high patient volume, mature digital infrastructure, dominance of both PPC and DTC models, strong consumer spending power.

- Europe: Steady growth; focus on professional-led treatment (PPC), stringent regulatory environment, high quality standards, rapid integration of intraoral scanning.

- Asia Pacific (APAC): Fastest-growing region; immense untapped patient base (China, India), increasing urbanization, rising middle-class disposable income, strategic focus for global manufacturers.

- Latin America (LATAM): Emerging market; growth concentrated in Brazil and Mexico, improving economic conditions driving demand for aesthetic treatments.

- Middle East and Africa (MEA): High potential in GCC countries; increasing medical tourism and government investment in specialized healthcare facilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Clear Aligner Therapy Market, focusing on strategic developments, product portfolios, and market positioning.- Align Technology, Inc. (Invisalign)

- Envista Holdings Corporation (Ormco, Spark Aligners)

- Straumann Group (ClearCorrect)

- 3M Company

- Dentsply Sirona

- Henry Schein, Inc.

- Candid Care Co.

- SmileDirectClub (Under new operational structure)

- Scheu Dental GmbH

- Angel Aligner

- Argen Corporation

- Great Lakes Orthodontics

- K Line Europe GmbH

- TP Orthodontics, Inc.

- DynaFlex

- ClearStep

- Smile Prep

- Sun Dental Labs

- ProSmile

- Modern Orthodontics

Frequently Asked Questions

Analyze common user questions about the Clear Aligner Therapy market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Clear Aligner Therapy Market?

The Clear Aligner Therapy Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.5% between 2026 and 2033, driven primarily by technological advancements and increasing adult adoption of aesthetic orthodontic solutions globally.

How is Artificial Intelligence (AI) impacting clear aligner treatment planning?

AI significantly impacts clear aligner treatment planning by automating 3D segmentation, enhancing diagnostic accuracy, and utilizing predictive analytics to optimize tooth movement simulation, resulting in faster and more predictable clinical outcomes and reducing the need for lengthy refinement stages.

Which distribution channel dominates the Clear Aligner Therapy Market?

The Professional Provided Channel (PPC), where treatment is prescribed and monitored by orthodontists or general dentists, currently dominates the market share due to patient preference for clinical supervision and the complexity of cases requiring professional oversight, despite the rapid growth of the Direct-to-Consumer (DTC) models.

What are the primary restraints on the growth of the Clear Aligner Therapy Market?

Key restraints include the relatively high cost of treatment compared to traditional braces, the current technical limitations in successfully treating severe skeletal malocclusions with aligners alone, and the substantial initial capital investment required by dental practitioners for specialized digital equipment like intraoral scanners and advanced software.

Which region is expected to show the highest growth rate in the clear aligner market?

The Asia Pacific (APAC) region is anticipated to exhibit the highest CAGR during the forecast period. This accelerated growth is attributed to rising aesthetic awareness, rapidly expanding middle-class populations in emerging economies like China and India, and increasing investment in modern dental infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Clear Aligner Therapy Market Size Report By Type (Professional Treatment, Foundation Treatment), By Application (Teenagers, Adults), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Clear Aligner Therapy Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Clear Aligners, Therapy Services), By Application (Teenagers, Adults), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager