Climate Risk Analytics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432290 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Climate Risk Analytics Market Size

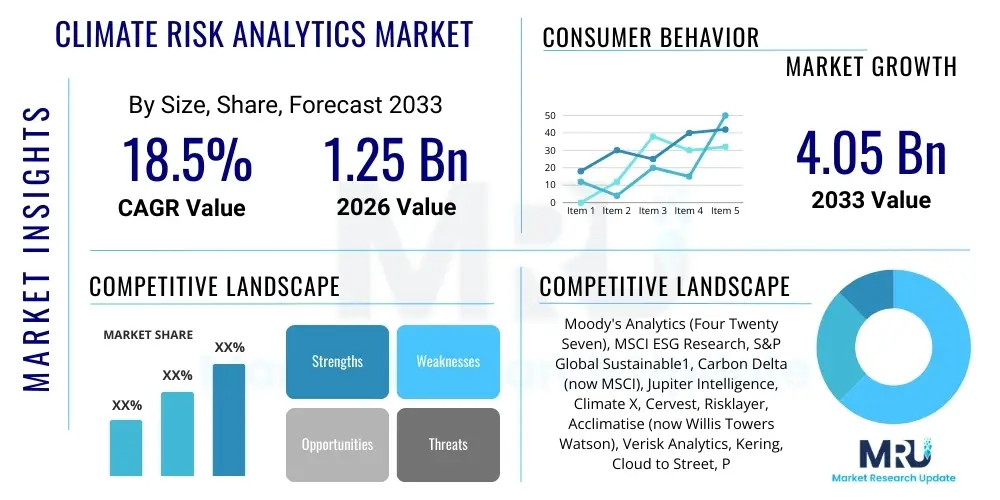

The Climate Risk Analytics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 4.05 Billion by the end of the forecast period in 2033.

Climate Risk Analytics Market introduction

The Climate Risk Analytics Market encompasses specialized software, data services, and consulting solutions designed to quantify, model, and manage the financial impacts of climate-related hazards and policy changes on businesses and governmental entities. This domain integrates advanced climate science models, geospatial data, economic analysis, and financial metrics to provide comprehensive risk assessments. The core product offering includes proprietary analytical platforms capable of performing scenario analysis, stress testing, and vulnerability mapping, primarily distinguishing between physical risks (e.g., floods, heatwaves, drought) and transition risks (e.g., policy changes, technological shifts, market demand fluctuations related to the shift to a low-carbon economy). Major applications span across banking, insurance, energy, real estate, and public sector organizations, enabling them to comply with emerging disclosure mandates, optimize investment decisions, and enhance corporate resilience strategies.

The primary benefits derived from adopting robust climate risk analytics platforms include improved capital allocation, reduction in potential liability exposure, and enhanced transparency for stakeholders, especially investors prioritizing Environmental, Social, and Governance (ESG) criteria. These tools allow institutions to move beyond simple qualitative assessments towards quantitative financial modeling, ensuring that climate risks are integrated into core financial planning and enterprise risk management frameworks. Furthermore, detailed regional and asset-level vulnerability assessments enable targeted mitigation and adaptation measures, supporting long-term business continuity planning in the face of escalating climate volatility.

Driving factors for the significant growth of this market include the global implementation of mandatory climate disclosure frameworks, such as those recommended by the Task Force on Climate-related Financial Disclosures (TCFD) and forthcoming requirements under the European Union's Corporate Sustainability Reporting Directive (CSRD). Simultaneously, the increasing frequency and severity of extreme weather events worldwide necessitate proactive risk quantification by the insurance and reinsurance sectors, pushing demand for high-resolution physical risk models. Finally, growing pressure from institutional investors and central banks demanding climate-stress testing across financial portfolios is accelerating the deployment of advanced analytical solutions across the financial services sector globally.

Climate Risk Analytics Market Executive Summary

The Climate Risk Analytics Market is experiencing accelerated expansion, driven primarily by stringent global regulatory mandates and the undeniable escalation of climate-related physical hazards impacting global supply chains and asset valuation. Key business trends show a significant pivot among financial institutions towards integrating transition risk modeling into credit assessment processes, particularly focusing on sector-specific carbon intensity and policy misalignment. The market is increasingly characterized by strategic partnerships between traditional financial data providers and specialized climate science modeling firms, aiming to offer integrated, end-to-end solutions. Furthermore, the adoption of cloud-based deployment models is dominating, offering scalability and accessibility necessary for processing vast datasets associated with multi-scenario climate projections. Investor activism and the demand for standardized, reliable climate data are forcing corporations across all major industrial sectors—from energy and utilities to manufacturing and real estate—to procure advanced analytical capabilities to manage reporting obligations and safeguard future profitability.

Regionally, Europe stands as the dominant force in terms of market maturity and regulatory push, spearheaded by comprehensive initiatives like the EU Green Deal and associated financial supervision frameworks, demanding detailed climate-related stress tests from banks and insurers. North America, particularly the United States, is demonstrating rapid growth, fueled by state-level mandates and mounting pressure from the Securities and Exchange Commission (SEC) regarding climate disclosure, leading to high investment in sophisticated analytics within the BFSI and energy sectors. The Asia Pacific region is emerging as a critical growth engine, driven by the susceptibility of its highly populated coastal areas to physical climate risks and the massive capital flows into infrastructure and renewable energy, necessitating detailed physical risk mapping for long-term project viability. Latin America and the Middle East & Africa are showing nascent but accelerating growth, largely focused on managing resource scarcity risks (water, agriculture) and ensuring infrastructure resilience.

Segment trends highlight the dominance of the Physical Risk segment due to the immediate, measurable financial damage caused by extreme weather, requiring immediate mitigation strategies. However, the Transition Risk segment is forecast to exhibit the fastest growth, propelled by the urgent global focus on decarbonization pathways and the associated policy, legal, and technological risks. From a deployment perspective, the Software-as-a-Service (SaaS) model is overwhelmingly preferred for its lower initial cost, ease of integration with existing enterprise resource planning (ERP) systems, and continuous model updating capabilities, essential for incorporating the latest climate projection data. The BFSI industry remains the largest end-user segment, utilizing analytics for portfolio risk screening, credit scoring adjustments, and catastrophic modeling, while the government and public administration segment shows substantial potential driven by infrastructure planning and urban resilience initiatives.

AI Impact Analysis on Climate Risk Analytics Market

Common user inquiries regarding the influence of Artificial Intelligence (AI) on the Climate Risk Analytics market revolve around how machine learning can improve the granularity and predictive accuracy of climate models, particularly concerning localized physical risk projections. Users are keen to understand if AI can effectively process the petabytes of disparate data—including satellite imagery, historical claims data, and climate model outputs—faster and more reliably than traditional statistical methods, thereby reducing model uncertainty and operational costs. Key themes also include the application of Natural Language Processing (NLP) for analyzing corporate disclosure documents to identify latent transition risks and opportunities, and the use of deep learning for automating scenario generation and stress-testing processes across massive, diversified investment portfolios. Furthermore, there is significant interest in how explainable AI (XAI) can address the "black box" concern, ensuring regulatory acceptance and user trust in the outputs used for crucial financial decisions, and how generative models might accelerate the development of synthetic, stress-tested climate scenarios.

- AI/ML enhances the processing and integration of vast, high-resolution geophysical datasets (e.g., Copernicus, NOAA data), leading to more precise localized physical risk assessments (e.g., flood probability, heat stress).

- Machine learning algorithms significantly improve predictive modeling capabilities for chronic climate risks such as sea-level rise and long-term changes in agricultural productivity.

- AI facilitates advanced scenario analysis and climate stress testing, enabling organizations to run thousands of complex climate pathways (e.g., IPCC SSP scenarios) simultaneously for comprehensive portfolio evaluation.

- Natural Language Processing (NLP) is increasingly utilized to analyze regulatory texts, corporate reports, and news sentiment, accurately flagging potential transition risks and reputational hazards.

- Deep learning models optimize financial modeling by linking climate hazards directly to specific financial metrics (e.g., loan default rates, asset devaluation), improving risk quantification for lending and investment portfolios.

- AI drives the development of proprietary risk scoring models, moving beyond generalized global climate models to create highly customized, sector-specific risk indices tailored to unique operational environments.

- Automation through AI reduces the manual effort required for data preparation and standardization, addressing a major industry challenge related to heterogeneous climate and financial datasets.

- Generative AI techniques are beginning to be explored for creating synthetic, realistic extreme weather event sequences for sophisticated disaster preparedness and insurance loss modeling.

- Explainable AI (XAI) tools are crucial for ensuring transparency and auditability of model outputs, which is vital for meeting stringent financial regulatory compliance requirements (e.g., central bank stress testing).

- AI aids in dynamic monitoring of supply chain vulnerabilities by correlating geopolitical, economic, and climate-related data streams in real-time to predict disruptions.

DRO & Impact Forces Of Climate Risk Analytics Market

The Climate Risk Analytics Market is shaped by a confluence of powerful regulatory mandates and undeniable physical realities, categorized under Drivers, Restraints, and Opportunities (DRO). The primary driving force remains the increasing globalization of climate disclosure requirements, such as those propagated by the TCFD, forcing listed companies and financial entities to standardize and quantify their climate exposure. Simultaneously, the growing awareness among corporate boards and investors regarding the fiduciary duty to manage climate risk is fueling demand. Conversely, the market faces significant restraints, chiefly stemming from the inherent complexity and uncertainty within long-term climate models, leading to skepticism about the accuracy of projected financial impacts. The high initial capital expenditure required for deploying sophisticated analytical platforms, coupled with the shortage of skilled professionals capable of bridging climate science, data engineering, and financial modeling, also impede broader market adoption. Nevertheless, substantial opportunities exist, particularly in the fusion of climate data with core business intelligence platforms, the customization of localized risk models for SME resilience, and the expansion of these services into rapidly developing economies requiring significant climate-resilient infrastructure investment.

The impact forces within this market operate at multiple levels, creating significant momentum. Regulatory pressure acts as a foundational force, mandating adoption and standardizing market practices globally. Physical climate changes, evidenced by rising insured losses and disruption of critical infrastructure, function as a tangible force, pushing organizations to seek immediate, high-resolution risk data. Technological forces, specifically advancements in satellite remote sensing, big data processing, and AI, provide the foundational tools necessary for effective analysis, consistently lowering the barriers to entry for specialized solution providers. Moreover, investor and stakeholder forces, driven by ESG mandates and the pursuit of sustainable finance, exert continuous influence on corporate governance, ensuring that climate risk analysis remains a top-tier management priority, thereby sustaining long-term market growth and innovation.

Addressing the restraints is critical for market maturation. Data heterogeneity—the challenge of merging disparate climate projections (often coarse resolution) with highly specific financial data (e.g., asset location, valuation, insurance coverage)—requires greater standardization and collaborative data sharing frameworks. Furthermore, overcoming the talent deficit requires significant investment in interdisciplinary education and training programs focused on climate finance and computational science. Successfully navigating these challenges, particularly by leveraging scalable cloud infrastructure and modular, API-driven solutions, will transform climate risk analytics from a compliance exercise into a core strategic competitive advantage, unlocking substantial latent demand across previously underserved sectors and geographies.

- Drivers:

- Global proliferation of mandatory climate-related financial disclosure frameworks (e.g., TCFD, CSRD).

- Increasing frequency and severity of extreme weather events necessitating robust physical risk quantification for business continuity.

- Growing investor focus on ESG criteria and the demand for quantifiable portfolio climate risk metrics.

- Regulatory pressure from central banks requiring climate stress testing for financial stability assessment.

- Expansion of catastrophic loss models and underwriting necessity within the insurance and reinsurance industries.

- Advancements in high-resolution geospatial data availability and processing power for localized risk assessment.

- Restraints:

- High initial implementation costs and complexity of integrating climate models into legacy enterprise risk management systems.

- Lack of standardized methodologies and data frameworks for linking climate metrics to financial valuation.

- Inherent scientific uncertainty and wide variance in output associated with long-term climate projections and scenario analysis.

- Shortage of interdisciplinary talent skilled in climate science, financial modeling, and data analytics.

- Challenges associated with access to granular, proprietary asset-level data required for accurate physical risk assessment.

- Perceived low urgency or skepticism regarding the immediate financial impact of chronic climate risks in some corporate sectors.

- Opportunities:

- Integration of climate risk analysis with broader enterprise risk management (ERM) and treasury functions.

- Customization and verticalization of analytical solutions tailored for specific high-risk sectors (e.g., agriculture, mining, infrastructure).

- Expansion into emerging markets requiring climate resilience planning for massive public and private infrastructure projects.

- Development of standardized, automated reporting tools compliant with multiple global regulatory bodies.

- Leveraging blockchain and decentralized data sharing platforms for verifiable and transparent climate risk data exchange.

- Providing specialized consultancy services focused on developing corporate climate adaptation and mitigation strategies based on analytical findings.

Segmentation Analysis

The Climate Risk Analytics Market is comprehensively segmented based on the type of risk analyzed, the component of the solution, the deployment model utilized, and the specific industry vertical served. This granular segmentation reflects the diverse needs of end-users, ranging from financial institutions focused on systemic portfolio risk to energy companies concerned with site-specific operational resilience. The segmentation by risk type—Physical versus Transition—is fundamental, addressing both the immediate, tangible impacts of climate hazards and the long-term, systemic impacts of decarbonization policies. Furthermore, the component segmentation (Software vs. Services) highlights the complementary nature of this market, where sophisticated proprietary models require significant accompanying consulting and integration support to be effectively adopted and utilized within complex corporate structures. Deployment models increasingly favor cloud-based solutions, reflecting the need for scalability, remote access to updated data feeds, and computational power necessary for running complex, large-scale climate simulations.

The primary axis for segment growth is driven by the industry vertical. The Banking, Financial Services, and Insurance (BFSI) sector represents the dominant revenue segment, characterized by stringent regulatory oversight (e.g., Solvency II, Basel III/IV implications) and the necessity to manage exposure across vast credit and underwriting portfolios. However, rapid acceleration is observed in the Government and Public Sector segment, where climate risk analytics are crucial for urban planning, infrastructure resilience, and public policy formulation concerning resource management and disaster preparedness. Similarly, the Energy and Utilities sector is a high-growth area, driven by the dual challenge of managing physical risks to generation assets (e.g., solar farm flooding, nuclear plant heat stress) while navigating aggressive global transition policies impacting fossil fuel assets and requiring detailed carbon trajectory modeling.

The ongoing trend of solution modularity allows clients to adopt specialized components, such as data feed services for high-resolution climate projections or focused modeling APIs, rather than requiring full-suite platform deployment. This flexibility caters particularly well to mid-sized organizations with limited internal analytical resources. As the market matures, the integration of analytics specifically focused on climate liability risks—addressing potential litigation against companies failing to disclose or mitigate known climate exposures—is emerging as a distinct, high-value subsegment, particularly relevant for legal and compliance departments seeking proactive defense strategies against shareholder lawsuits and regulatory actions.

- By Risk Type:

- Physical Risk Analytics (Acute risks: cyclones, floods, wildfires; Chronic risks: sea-level rise, temperature change, resource scarcity).

- Transition Risk Analytics (Policy and legal risks, Market risks, Technology risks, Reputational risks).

- Liability Risk Analytics (Litigation exposure analysis and regulatory non-compliance mapping).

- By Component:

- Software (Proprietary modeling platforms, API integration tools, Geospatial mapping software).

- Services (Consulting and Advisory Services, Integration and Implementation Services, Training and Support Services, Data Feed and Custom Modeling Services).

- By Deployment Model:

- Cloud-Based (SaaS, Private Cloud, Hybrid Cloud) – Preferred for computational intensity and scalability.

- On-Premise – Used primarily by organizations with high data security concerns or regulatory mandates requiring local data storage.

- By Industry Vertical:

- Banking, Financial Services, and Insurance (BFSI) – Core user for credit, underwriting, and portfolio risk management.

- Government and Public Sector – Used for infrastructure planning, disaster response, and regional climate adaptation strategies.

- Energy and Utilities – Focus on asset resilience, regulatory compliance, and carbon footprint transition pathway analysis.

- Real Estate and Construction – Essential for property valuation, development siting, and insurance qualification.

- Manufacturing and Supply Chain – Analysis of component sourcing, operational continuity, and transport route resilience.

- Agriculture, Food, and Forestry – Modeling impact on crop yields, water stress, and land-use changes.

- Mining and Natural Resources – Assessing regulatory transition risks and physical risks to extraction sites and infrastructure.

Value Chain Analysis For Climate Risk Analytics Market

The value chain for the Climate Risk Analytics market begins with the foundational data providers (Upstream), progresses through sophisticated modeling and software development (Core Processing), and culminates in delivery and advisory services to the end-users (Downstream). The upstream segment is dominated by governmental and academic institutions (e.g., IPCC, NASA, meteorological services) providing core climate science, historical hazard data, and future climate projection models (CMIP data). This stage also includes specialized geospatial data firms and satellite providers offering high-resolution imagery and topographical data essential for physical risk modeling. The critical challenge upstream is standardizing this diverse data into formats suitable for commercial application, a task often undertaken by specialized data aggregators and pre-processors who prepare the data feeds for the core analytics platforms.

The core processing layer involves the Climate Risk Analytics vendors themselves, where the proprietary value is added. This includes developing complex hydrological, atmospheric, and financial modeling software, often incorporating advanced AI/ML algorithms to perform scenario analysis, stress testing, and vulnerability mapping. Key activities at this stage are the rigorous validation of models against historical data, the linkage of scientific outputs to specific financial metrics (e.g., EBITDA exposure, insurance premium hikes), and the creation of user interfaces and APIs for enterprise integration. Distribution channels are varied, involving direct sales teams for large financial institutions, partnerships with traditional financial data vendors (e.g., Bloomberg, Refinitiv), and increasingly, cloud marketplaces for SaaS deployment, ensuring broad accessibility and seamless updating.

Downstream, the market is defined by the end-users and the consultancy ecosystem that supports implementation. Direct channels involve in-house deployment teams within major banks or multinational corporations. However, indirect channels, encompassing management consulting firms, specialized ESG advisory services, and system integrators, play a vital role. These partners translate complex analytical findings into actionable business strategy, assist with regulatory disclosure reporting, and provide the bespoke training required to integrate climate risk insights into capital expenditure decisions and treasury functions. The value chain is highly integrated, requiring strong collaboration between climate scientists, software engineers, and financial risk experts to ensure the analytical output is both scientifically robust and financially relevant for the ultimate buyers.

Climate Risk Analytics Market Potential Customers

The potential customer base for Climate Risk Analytics solutions is highly diverse yet unified by the need to quantify climate exposure to protect assets and ensure regulatory compliance. The primary customers are large financial institutions, including central banks, commercial banks, asset managers, and insurance companies. Commercial banks leverage these tools for assessing credit risk associated with carbon-intensive loan portfolios and for real estate lending, ensuring compliance with future physical and transition risks. Asset managers use the analytics to screen investments based on climate resilience (both physical and transition) and to fulfill increasing fiduciary responsibilities related to ESG investing, thereby attracting climate-conscious capital and mitigating stranding risk in portfolios.

Beyond the financial sector, large non-financial corporations constitute a significant segment of end-users. This includes companies in the Energy and Utilities sector (oil & gas, renewable power providers) who require detailed analysis of asset vulnerability to extreme weather and modeling of transition pathways mandated by net-zero targets. Real estate developers, infrastructure operators (ports, railways, utilities), and global manufacturers utilize these tools for capital planning, site selection, and optimizing supply chain resilience. For these customers, the purchase decision is driven less by regulatory mandates (though compliance is essential) and more by operational necessity, aiming to reduce costs associated with climate damage, manage business interruptions, and ensure long-term operational viability.

Furthermore, governmental bodies, multilateral organizations, and public sector agencies represent a rapidly growing customer segment. National and sub-national governments use climate risk analytics for developing national adaptation plans, performing infrastructure stress testing, and allocating funds for climate-resilient development projects, particularly in high-risk coastal and agricultural zones. International organizations and development banks rely on these assessments to de-risk investments in developing economies. The overarching goal for all potential customers is to transform climate uncertainty into quantifiable risk metrics, thereby enabling informed strategic decisions that enhance resilience and long-term financial stability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 4.05 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Moody's Analytics (Four Twenty Seven), MSCI ESG Research, S&P Global Sustainable1, Carbon Delta (now MSCI), Jupiter Intelligence, Climate X, Cervest, Risklayer, Acclimatise (now Willis Towers Watson), Verisk Analytics, Kering, Cloud to Street, Planet Labs PBC, SAS Institute, IBM (Environmental Intelligence Suite), GeoClimate, The Climate Service (acquired by Morningstar), Climacell (now Tomorrow.io), Arabesque S-Ray, Trucost (part of S&P Global). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Climate Risk Analytics Market Key Technology Landscape

The technological backbone of the Climate Risk Analytics Market is a sophisticated blend of data science, geospatial capabilities, and high-performance computing. At its core, the technology relies heavily on advanced Climate Modeling, utilizing outputs from global circulation models (GCMs) and regional climate models (RCMs) derived from international scientific collaborations (e.g., CMIP6). These models are downscaled and integrated with proprietary hazard models (e.g., flood probability models, storm surge models) to generate granular, location-specific physical risk projections. Crucially, Big Data Analytics and Cloud Computing platforms (e.g., AWS, Azure, Google Cloud) are essential, enabling the storage, processing, and instantaneous analysis of petabytes of historical weather data, climate forecasts, and asset-specific spatial information. This capability ensures that models can run complex multi-scenario analyses rapidly and cost-effectively, which is a foundational requirement for financial stress testing mandates.

Artificial Intelligence and Machine Learning (AI/ML) techniques represent the cutting edge of technological advancement in this sector. AI is used extensively for pattern recognition in large datasets, enhancing the accuracy of predictive models for both acute and chronic risks, and optimizing the computational efficiency of scenario generation. For instance, ML algorithms are deployed to identify complex non-linear relationships between climate variables and financial impacts, often surpassing the limitations of traditional linear regression methods used in standard financial models. Furthermore, the integration of cutting-edge Geospatial Technologies, including high-resolution satellite remote sensing data (Synthetic Aperture Radar, multispectral imagery) and GIS systems, allows for precise mapping of physical assets and their vulnerabilities to hazards like land subsidence, wildfire, or inundation, providing essential real-world context for financial models.

Finally, the market heavily utilizes Application Programming Interfaces (APIs) and modular Software-as-a-Service (SaaS) architectures to ensure seamless integration of climate data and risk scores into existing enterprise resource planning (ERP) systems, financial modeling tools, and risk dashboards. This API-driven approach facilitates the democratization of climate intelligence, moving it beyond specialist departments into core business functions like lending, procurement, and asset management. The increasing use of visualization tools, coupled with interactive dashboards, is also a critical technological component, ensuring that the highly technical outputs of the climate models are translated into intuitive, decision-relevant insights for non-scientific executive users. Future technological innovation is expected to center on developing standardized data ontologies and leveraging decentralized ledger technology (Blockchain) for creating immutable, auditable records of climate disclosures and asset resilience metrics.

Regional Highlights

- Europe: Market Leader and Regulatory Vanguard

Europe currently holds the largest market share in the Climate Risk Analytics sector, largely driven by its proactive regulatory environment. Initiatives such as the EU Green Deal, the Sustainable Finance Disclosure Regulation (SFDR), and the implementation of the Corporate Sustainability Reporting Directive (CSRD) mandate comprehensive disclosure and integration of climate risks across the financial sector and large corporations. The European Central Bank (ECB) and the Bank of England (BoE) have been pioneers in climate stress testing, driving demand for high-fidelity transition and physical risk modeling software. The market here is highly mature, characterized by strong partnerships between financial service providers and specialized climate tech firms, focusing intensely on data quality, methodological standardization, and alignment with taxonomy requirements. Demand is particularly high in the insurance sector (Solvency II compliance) and among asset managers seeking to demonstrate portfolio resilience to institutional investors.

- North America: Rapid Growth and Investor Pressure

North America, particularly the United States, is the fastest-growing market, propelled by evolving regulatory clarity and powerful investor pressure. While federal regulation has historically lagged behind Europe, the SEC's proposed rules on climate-related disclosures, alongside state-level mandates in California and New York, are significantly accelerating corporate adoption. The market demand is bifurcated: financial services primarily focus on transition risk modeling (e.g., calculating stranded asset potential in energy portfolios), while insurance and real estate segments prioritize physical risk analytics due to mounting losses from severe weather events (hurricanes, wildfires). The region is a hub for innovation, with numerous venture-backed climate tech startups leveraging advanced AI and remote sensing technologies to deliver granular, asset-level risk scores, competing intensely with established financial data giants.

- Asia Pacific (APAC): Vulnerability and Infrastructure Focus

The APAC region presents immense potential, driven by high physical vulnerability—particularly in coastal and densely populated areas—and massive infrastructure investment, requiring long-term resilience planning. Countries like Japan, Singapore, and Australia are leading the adoption curve, with regulators taking steps toward TCFD alignment. China and India, facing rapid industrialization and significant climate impacts on agriculture and water resources, represent substantial opportunities for scaling risk analytics, primarily focused on national and regional governmental planning and assessing risks to supply chains traversing the continent. The complexity of the region lies in its diverse regulatory landscape and the varying availability of standardized financial and climate data, requiring solutions to be highly adaptable to local meteorological and economic contexts.

- Latin America (LATAM) and Middle East & Africa (MEA): Emerging Applications

These regions are emerging markets for climate risk analytics, with growth primarily concentrated in specific sectors. In LATAM, applications center on agricultural risk management, water resource scarcity modeling, and assessing physical risks to energy infrastructure. In the MEA region, the market is driven by sovereign wealth funds focused on diversification and the need to manage extreme heat stress and water scarcity, particularly impacting the energy and construction sectors. Adoption is often linked to international finance requirements (e.g., World Bank, development banks) for large-scale infrastructure projects, mandating climate risk assessment as a prerequisite for funding and ensuring resilience standards are met.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Climate Risk Analytics Market.- Moody's Analytics (Four Twenty Seven)

- MSCI ESG Research

- S&P Global Sustainable1 (Trucost)

- Jupiter Intelligence

- Climate X

- Cervest

- Verisk Analytics (AIR Worldwide)

- BlackRock (Aladdin Climate)

- SAS Institute

- IBM (Environmental Intelligence Suite)

- GeoClimate

- The Climate Service (Morningstar Sustainalytics)

- Climacell (Tomorrow.io)

- Kering

- Risklayer

- Accenture

- Willis Towers Watson (Acclimatise)

- Planet Labs PBC

- Arabesque S-Ray

- Baringa Partners

Frequently Asked Questions

Analyze common user questions about the Climate Risk Analytics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between physical risk and transition risk analytics?

Physical risk analytics quantify the financial impact of specific climate hazards—acute events like floods or chronic changes like rising sea levels—on tangible assets and operations. Transition risk analytics assess financial consequences stemming from the shift to a low-carbon economy, covering policy changes, technology disruption, market shifts (e.g., carbon pricing), and reputational factors impacting asset valuation and profitability.

Which regulatory frameworks are driving the adoption of Climate Risk Analytics?

The primary global drivers include the recommendations set by the Task Force on Climate-related Financial Disclosures (TCFD), which promotes standardized reporting. Regionally, the European Union's Corporate Sustainability Reporting Directive (CSRD) and Sustainable Finance Disclosure Regulation (SFDR), along with climate stress testing mandates by central banks (e.g., ECB, BoE, Federal Reserve), are compelling institutions to implement robust analytical solutions for compliance and risk quantification.

How does Artificial Intelligence improve the accuracy of climate risk models?

AI, particularly machine learning, enhances model accuracy by processing vast datasets (satellite imagery, climate model outputs) at high speed and resolution. It improves downscaling techniques to provide localized, granular risk projections and identifies complex, non-linear correlations between climate indicators and specific financial metrics, reducing uncertainty in long-term risk forecasts and stress-testing scenarios.

Which industry vertical is the largest consumer of Climate Risk Analytics solutions?

The Banking, Financial Services, and Insurance (BFSI) sector is the largest consumer. Financial institutions require these analytics for mandatory regulatory compliance, managing portfolio exposure to climate risks, adjusting credit ratings, and enhancing catastrophic modeling capabilities necessary for underwriting and reinsurance pricing strategies across global asset classes.

What are the main challenges faced during the implementation of Climate Risk Analytics platforms?

Key challenges include the heterogeneity of available data, making standardization difficult; the inherent uncertainty associated with long-term climate projections, which complicates financial decision-making; and the high costs involved in integrating complex, proprietary climate models into existing legacy enterprise risk management systems, compounded by a shortage of specialized interdisciplinary talent.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager