Clinical Diagnosis Automation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435059 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Clinical Diagnosis Automation Market Size

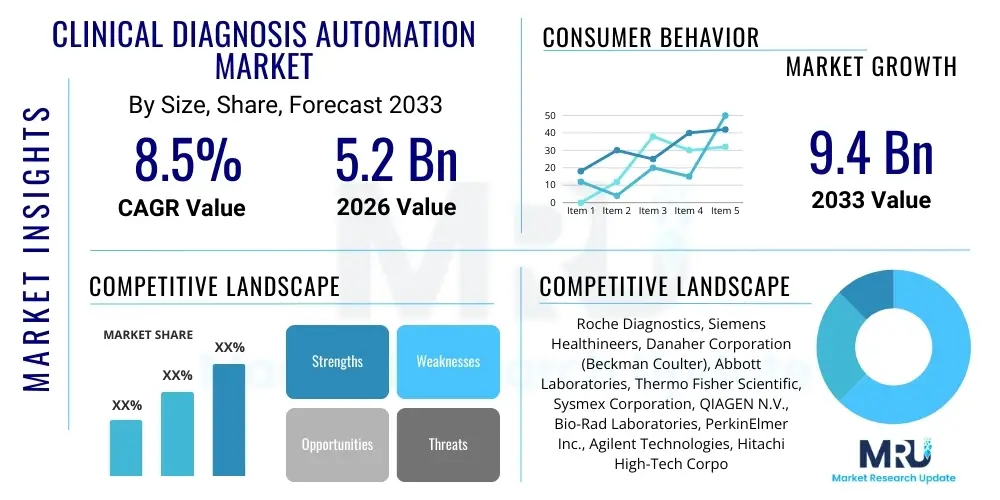

The Clinical Diagnosis Automation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 9.4 Billion by the end of the forecast period in 2033.

Clinical Diagnosis Automation Market introduction

The Clinical Diagnosis Automation Market encompasses the utilization of advanced robotics, sophisticated instruments, integrated software solutions, and streamlined workflows designed to minimize manual intervention in laboratory testing. This automation spans the entire diagnostic cycle, including sample handling, processing, analysis, and data interpretation, significantly enhancing operational efficiency and diagnostic accuracy. Products within this market range from automated liquid handlers and total lab automation (TLA) systems to specialized modular systems used in high-volume testing environments.

Major applications driving market adoption include clinical chemistry, hematology, immunoassay, microbiology, and molecular diagnostics. The inherent benefits of automation, such as reduced turnaround time (TAT), minimization of human error, improved safety standards for laboratory personnel, and standardized testing protocols, are primary accelerators. These systems are indispensable in large reference laboratories and academic medical centers striving to manage increasing test volumes while adhering to stringent quality control requirements.

Key driving factors for market expansion include the rising prevalence of chronic and infectious diseases requiring frequent diagnostic monitoring, the persistent shortage of skilled laboratory technicians globally, and sustained technological advancements focused on integrating high-throughput screening capabilities with predictive analytics. Furthermore, governmental and regulatory pressure to reduce healthcare costs and enhance diagnostic reliability promotes the investment in centralized, automated laboratory infrastructure.

Clinical Diagnosis Automation Market Executive Summary

The global Clinical Diagnosis Automation Market is characterized by robust growth, propelled by the urgent need for operational streamlining in healthcare systems worldwide. Current business trends indicate a strong shift towards Total Lab Automation (TLA) solutions, which provide seamless integration across multiple testing disciplines, moving beyond isolated instrumentation. Strategic mergers and acquisitions among established instrumentation providers and software firms are common, aiming to offer end-to-end solutions that incorporate advanced features like artificial intelligence for predictive maintenance and enhanced quality control. Customization and modularity are key competitive differentiators, allowing laboratories of various sizes to adopt automation incrementally.

Regionally, North America maintains market dominance due to high healthcare expenditure, established regulatory frameworks encouraging diagnostic innovation, and the early adoption of advanced laboratory technologies. However, the Asia Pacific region is forecast to exhibit the highest growth rate, fueled by expanding healthcare access, increasing investment in public and private diagnostic infrastructure, and a rising awareness regarding early disease diagnosis in countries like China, India, and Japan. European growth remains steady, driven by centralized health services focused on efficiency improvements and addressing aging populations.

Segment trends highlight the strong performance of immunochemistry and molecular diagnostics applications, particularly following global health crises that emphasized the need for rapid, high-throughput testing capabilities. By product type, automated instruments and robotics continue to hold the largest market share, though the informatics segment, particularly Laboratory Information Systems (LIS) and Laboratory Information Management Systems (LIMS), is experiencing accelerated growth as data integration and management become critical bottlenecks that automation seeks to resolve. End-users, led by hospital laboratories and large reference laboratories, are prioritizing scalable, interoperable systems that can handle both routine and complex specialized testing.

AI Impact Analysis on Clinical Diagnosis Automation Market

Common user questions regarding AI's influence in the Clinical Diagnosis Automation Market center on predictive maintenance, diagnostic reliability enhancement, workflow optimization, and the potential displacement of human labor. Users frequently inquire about the feasibility of AI-driven systems interpreting complex image-based diagnostics (like digital pathology and advanced microscopy) with greater speed and consistency than human experts. They are also highly concerned with data security, regulatory compliance for AI-validated diagnostic algorithms, and the integration complexity of machine learning models into existing legacy laboratory infrastructure. The overarching theme is the expectation that AI should transition automation from merely accelerating physical tasks to significantly improving cognitive diagnostic processes.

AI’s integration is fundamentally transforming clinical automation by enabling predictive capabilities across the entire workflow. Machine learning algorithms are increasingly utilized for proactive quality control, identifying potential instrument failures before they occur, thereby maximizing uptime and sample integrity. Furthermore, AI is crucial in optimizing complex scheduling and routing of samples within Total Lab Automation (TLA) tracks, minimizing bottlenecks and ensuring that urgent samples receive prioritized handling. This level of intelligent operational management ensures resource allocation is optimized, moving clinical labs toward true operational excellence and maximizing the return on investment in high-cost automation infrastructure.

Beyond operational efficiency, AI is deeply impacting the diagnostic phase itself. In fields such as clinical microbiology and digital pathology, deep learning models are assisting in the rapid identification of microbial pathogens, classification of cells, and quantification of biomarkers with superior objectivity and scalability. This cognitive automation elevates the role of the laboratory specialist, allowing them to focus on complex, non-routine cases while routine diagnostic interpretation is handled with high accuracy by the automated systems. The long-term implication is a shift toward personalized medicine, where AI-powered automation integrates diagnostic results with clinical data to generate highly tailored treatment recommendations, establishing a new standard for precision diagnostics.

- AI enhances predictive maintenance protocols, reducing system downtime.

- Machine learning optimizes sample routing and scheduling in high-throughput environments.

- AI algorithms improve diagnostic accuracy and consistency in image analysis (e.g., digital pathology).

- Facilitates advanced data integration and interpretation for personalized medicine initiatives.

- Enables sophisticated anomaly detection and quality control checks on testing results.

DRO & Impact Forces Of Clinical Diagnosis Automation Market

The Clinical Diagnosis Automation Market is shaped by a confluence of strong market drivers (D) and significant operational restraints (R), creating numerous opportunities (O) for innovation, all modulated by potent internal and external impact forces. The primary driver is the accelerating volume of diagnostic tests globally, fueled by demographic shifts such as aging populations and the rising incidence of non-communicable diseases. This volume necessitates scalable solutions that manual processes simply cannot accommodate. Conversely, the high initial capital expenditure required for purchasing and installing fully automated systems, coupled with the complexity of integrating these solutions into diverse existing healthcare IT environments, represents a major restraint, particularly for smaller hospitals and laboratories in developing regions.

Opportunities are abundant in the areas of decentralized and point-of-care (POC) automation, allowing advanced testing capabilities to move closer to the patient, thereby improving accessibility and speed. Furthermore, the convergence of automation with molecular diagnostics and genomics testing offers specialized niches for market growth. The ongoing development of cloud-based LIMS and data management solutions presents a critical opportunity to overcome legacy IT integration challenges and improve interoperability across different healthcare providers. Addressing cybersecurity risks associated with highly integrated diagnostic data networks also opens avenues for specialized service providers.

The impact forces exerted on this market include intense regulatory scrutiny (e.g., FDA and CE markings), which dictates the pace of innovation and market entry, ensuring systems maintain high standards of accuracy and reliability. Competitive rivalry is fierce, driven by a few large global players vying for market share through continuous technological advancement and strategic geographical expansion. The supplier power remains relatively high due to the specialized nature of complex robotic and analytical instrumentation. Furthermore, technological substitution risk is moderate, as fully integrated automation remains superior to semi-automated processes, though the potential for highly miniaturized, disruptive POC technologies exists. Economically, the pressure to reduce hospital operating costs globally serves as a powerful force pushing adoption, justifying the high upfront investment through long-term efficiency gains.

Segmentation Analysis

The Clinical Diagnosis Automation Market is segmented across multiple dimensions, primarily by Product, Application, End-user, and Region. Understanding these segments is crucial for strategic market entry and forecasting growth trajectories. The Product segment is broad, encompassing hardware components like automated liquid handlers, clinical analyzers, and robotic systems, alongside crucial software components such as Laboratory Information Systems (LIS) and middleware. The Application segment highlights the specific areas of clinical practice where automation is deployed, ranging from routine clinical chemistry to highly complex molecular diagnostics.

Segmentation by End-user delineates the primary consumers of these sophisticated systems, typically dominated by large hospital laboratories and private reference laboratories that possess the necessary volume and capital to justify TLA investment. However, specialized clinics and research institutions also form growing sub-segments, particularly those focused on genetic testing or high-throughput drug screening. The heterogeneity within these segments underscores the need for vendors to offer modular and scalable solutions that cater to varying throughput demands and financial constraints across the healthcare landscape.

The continuous innovation within automation is driving segment shifts, particularly the growth in molecular diagnostics automation, which has become essential for managing specialized testing volumes related to oncology, infectious diseases, and hereditary disorders. The integration capabilities offered by sophisticated middleware are transforming the software segment, making interoperability a primary purchasing criterion, often overshadowing hardware specifications in complex laboratory environments. This focus on seamless data flow and integration across disparate instruments dictates how clinical laboratories structure their future automation investments.

- By Product:

- Automated Systems and Analyzers (e.g., Clinical Chemistry, Immunoassay, Hematology)

- Robotic Systems and Modules (e.g., Liquid Handlers, Sample Transportation)

- Software and Informatics (e.g., LIS, LIMS, Middleware)

- By Application:

- Clinical Chemistry

- Immunology/Immunoassay

- Molecular Diagnostics

- Hematology

- Microbiology

- By End-user:

- Hospital Laboratories

- Reference and Independent Laboratories

- Academic and Research Institutes

Value Chain Analysis For Clinical Diagnosis Automation Market

The value chain for clinical diagnosis automation is complex, involving multiple specialized stages starting from highly technical upstream suppliers. Upstream analysis focuses on the manufacturers of critical components, including precision robotics, specialized sensors, optical systems, and highly reliable control software modules. These suppliers must adhere to stringent quality standards, as the reliability of the entire automated system hinges on the integrity of these components. Key activities at this stage involve raw material sourcing, proprietary software development, and the meticulous assembly of sophisticated electromechanical subsystems, requiring significant investment in research and development.

Midstream activities involve the primary market players—the original equipment manufacturers (OEMs) who design, integrate, assemble, and market the comprehensive automation platforms. This stage focuses on complex system integration, ensuring that robotic handling systems interface flawlessly with analytical instruments and laboratory informatics systems (LIS/LIMS). Distribution channels are critical, often involving a mix of direct sales teams for large, custom TLA installations, and specialized third-party distributors for standardized benchtop systems. Direct channels are preferred for high-value sales, allowing manufacturers to maintain tight control over installation, training, and maintenance contracts.

Downstream analysis centers on the end-users (hospital labs, reference labs) and the post-sale service ecosystem. The utilization and maintenance phase are crucial, as automated systems require continuous technical support, calibration, and reagent supply management. Service contracts are a significant revenue stream for manufacturers. The indirect impact involves diagnostic test providers and managed care organizations that benefit from the improved efficiency and reduced costs enabled by automation. The efficiency achieved at the downstream stage—reduced turnaround time and high throughput—is the ultimate measure of the value chain's success.

Clinical Diagnosis Automation Market Potential Customers

The primary consumers, or potential customers, in the Clinical Diagnosis Automation Market are entities that manage high volumes of clinical specimens and require standardized, reliable diagnostic results. Hospital laboratories, particularly those associated with large regional medical centers or integrated delivery networks (IDNs), represent a major customer segment. These institutions handle an immense variety of tests and are under constant pressure to improve efficiency, reduce operational costs, and manage staff shortages. Their purchasing decisions are heavily influenced by the system's ability to integrate with their existing hospital information systems (HIS) and meet institutional quality metrics.

Independent and reference laboratories constitute another critical customer base. These commercial entities, such as Quest Diagnostics or LabCorp, specialize in processing massive volumes of tests for regional or national coverage. For them, throughput maximization, scalability, and the lowest cost per test are paramount. They prioritize Total Lab Automation (TLA) solutions and modular systems that can run continuously with minimal intervention, thereby justifying significant capital investment based on economic scale and operational longevity.

Emerging potential customers include specialized research institutes, pharmaceutical companies conducting clinical trials, and specialized clinics focusing on molecular or genetic testing. These customers often require highly flexible and specialized automation platforms that can handle small batch sizes of complex assays with extreme precision, such as Next-Generation Sequencing (NGS) preparation or complex biobanking tasks. Their purchasing criteria often focus less on generalized throughput and more on specialized functionality, high precision, and compliance with stringent research protocols.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 9.4 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Roche Diagnostics, Siemens Healthineers, Danaher Corporation (Beckman Coulter), Abbott Laboratories, Thermo Fisher Scientific, Sysmex Corporation, QIAGEN N.V., Bio-Rad Laboratories, PerkinElmer Inc., Agilent Technologies, Hitachi High-Tech Corporation, Becton, Dickinson and Company (BD), bioMérieux, Tecan Group, Hamilton Company, Ortho Clinical Diagnostics, General Electric Healthcare, Mindray Medical International, Seegene Inc., Biomerica, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Clinical Diagnosis Automation Market Key Technology Landscape

The technological landscape of clinical diagnosis automation is characterized by the convergence of advanced robotics, sophisticated analytical instrumentation, and powerful information technology infrastructure. Core to this landscape are flexible modular automation systems (MAS) and Total Lab Automation (TLA) tracks, which utilize highly precise, high-speed robotic arms and linear transport systems to move samples efficiently between various analytical modules. These systems rely heavily on sensors, machine vision, and barcode reading technologies to ensure accurate sample identification and tracking throughout the entire pre-analytical, analytical, and post-analytical phases, minimizing sample mix-ups and identification errors which are critical for patient safety.

A crucial technological element is the development and standardization of middleware—software designed to sit between the laboratory instruments and the Laboratory Information System (LIS). Middleware acts as an intelligent data manager, standardizing the data format from disparate instruments, enforcing testing rules, managing reflex testing protocols, and facilitating communication with the hospital’s electronic health records (EHR). The latest generation of middleware often incorporates machine learning algorithms to optimize workflow queues and flag questionable results based on historical trends or predetermined quality control parameters, further enhancing diagnostic reliability and reducing the need for constant human supervision.

Furthermore, innovations in specialized analytical techniques are being rapidly integrated into automated platforms. This includes fully automated nucleic acid extraction and amplification systems vital for molecular diagnostics, high-throughput flow cytometry systems, and digital microscopy integrated with deep learning for automated slide scanning and analysis. The trend is moving towards miniaturization and greater integration of multi-functional modules, allowing laboratories to consolidate multiple test types onto fewer instruments, thus reducing physical footprint and optimizing resource utilization while maintaining high throughput capability essential for modern clinical demands.

Regional Highlights

Regional dynamics play a crucial role in shaping the Clinical Diagnosis Automation Market, reflecting differences in healthcare infrastructure maturity, reimbursement policies, and economic capacity for capital investment.

- North America is the dominant region, primarily driven by the presence of major market players, high adoption rates of advanced diagnostics, established reimbursement policies, and significant operational pressure on large commercial reference laboratories to optimize cost-efficiency through automation. The U.S. leads in adopting sophisticated Total Lab Automation (TLA) systems across major hospital networks and independent labs.

- Europe represents a mature market with steady growth, supported by centralized healthcare systems (especially in the UK, Germany, and France) that prioritize efficiency and standardization. The focus here is often on replacing older instrumentation and integrating IT solutions that link diagnostics across regional hospital groups, driven by strong regulatory requirements for quality management.

- Asia Pacific (APAC) is projected to be the fastest-growing region. This surge is attributed to rapidly expanding healthcare infrastructure in emerging economies (China, India), increasing government expenditure on modernization of diagnostic facilities, and a growing patient pool demanding advanced testing services. Japan and South Korea already possess highly automated laboratories and serve as technological innovation hubs within the region.

- Latin America (LATAM) shows increasing adoption, particularly in private healthcare sectors of countries like Brazil and Mexico. Market growth is constrained somewhat by varied reimbursement schemes and fluctuating economic conditions but presents strong opportunities as hospitals seek cost-effective ways to manage rising infectious disease burdens and chronic conditions.

- The Middle East and Africa (MEA) region is characterized by targeted automation investments, largely concentrated in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia) which possess modern, well-funded healthcare facilities. Investment often targets specialized diagnostics automation, such as molecular testing, but overall adoption remains lower compared to developed markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Clinical Diagnosis Automation Market.- Roche Diagnostics

- Siemens Healthineers

- Danaher Corporation (Beckman Coulter)

- Abbott Laboratories

- Thermo Fisher Scientific

- Sysmex Corporation

- QIAGEN N.V.

- Bio-Rad Laboratories

- PerkinElmer Inc.

- Agilent Technologies

- Hitachi High-Tech Corporation

- Becton, Dickinson and Company (BD)

- bioMérieux

- Tecan Group

- Hamilton Company

- Ortho Clinical Diagnostics

- General Electric Healthcare

- Mindray Medical International

- Seegene Inc.

- Biomerica, Inc.

Frequently Asked Questions

Analyze common user questions about the Clinical Diagnosis Automation market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Total Lab Automation (TLA) and why is it essential for modern labs?

Total Lab Automation (TLA) is an integrated system utilizing robotics and software to manage all pre-analytical, analytical, and post-analytical phases of testing. It is essential for maximizing sample throughput, minimizing human error, standardizing results, and managing the increasing volume and complexity of diagnostic tests efficiently.

What are the primary drivers accelerating the adoption of clinical diagnosis automation?

The primary drivers include the escalating global demand for diagnostic testing, the critical shortage of skilled laboratory technicians, the imperative to reduce healthcare operational costs, and continuous technological advancements in robotics and high-throughput analytical instrumentation.

How does the high initial cost of automation systems impact market growth?

The substantial initial capital expenditure required for purchasing and installing complex automation systems acts as a major restraint, particularly for smaller hospitals and laboratories in developing regions, delaying adoption despite the clear long-term efficiency benefits.

Which segments of the automation market are seeing the fastest technological innovation?

The fastest technological innovation is observed in the Molecular Diagnostics and Informatics segments. Molecular diagnostics requires specialized automation for precise nucleic acid handling, while informatics (middleware and LIS) is rapidly integrating AI and cloud computing to manage complex data flow and interpretation.

How is Artificial Intelligence (AI) specifically enhancing clinical diagnosis automation?

AI enhances automation by enabling predictive maintenance for instruments, optimizing complex sample routing logistics, improving the accuracy of image-based diagnostics (e.g., digital pathology), and facilitating advanced quality control checks on analytical results, transitioning automation beyond physical tasks to cognitive processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager