Clinical Diagnostics Automation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437055 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Clinical Diagnostics Automation Market Size

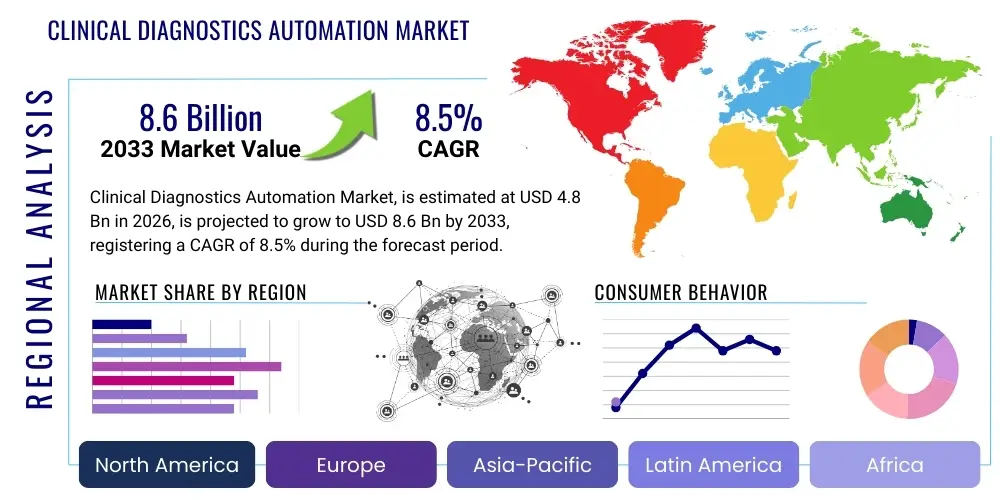

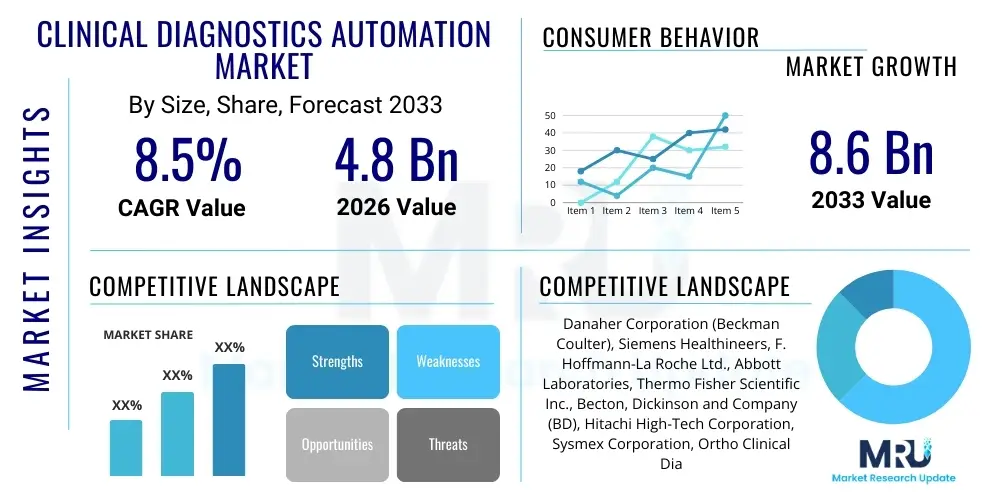

The Clinical Diagnostics Automation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 8.6 Billion by the end of the forecast period in 2033.

Clinical Diagnostics Automation Market introduction

The Clinical Diagnostics Automation Market encompasses the utilization of sophisticated robotic systems, integrated platforms, and high-throughput analytical instrumentation designed to streamline, accelerate, and standardize processes within clinical laboratories. This includes automation across various phases of testing: pre-analytical (sample preparation, sorting, centrifugation), analytical (immunoassay, clinical chemistry, molecular diagnostics), and post-analytical (storage, archiving, result validation). The primary objective of implementing automation is to enhance efficiency, minimize human error, improve turnaround time (TAT), and effectively manage the increasing volume of tests necessitated by aging global populations and rising incidence of chronic diseases.

Key products driving this market include total lab automation (TLA) systems, modular automation systems, automated immunoassay instruments, and advanced middleware software essential for integrating diverse instruments and optimizing workflow management. Major applications span hospital laboratories, private reference laboratories, and point-of-care settings where centralized high-volume testing is performed. The benefits are profound, including cost reduction through optimized labor utilization, standardization of results crucial for patient safety, and freeing up highly skilled technical staff to focus on complex analytical tasks rather than repetitive manual processes. Furthermore, automation is critical in managing biosafety risks by reducing direct handling of potentially infectious samples.

Driving factors for market expansion are multi-faceted, notably the imperative for operational cost reduction in healthcare systems globally, the persistent shortage of qualified clinical laboratory technicians, and technological advancements such as miniaturization, improved robotics, and the integration of artificial intelligence for workflow scheduling and quality control. The shift towards personalized medicine and high-volume specialty testing, such as molecular diagnostics for oncology and infectious disease surveillance, further necessitates highly reliable, scalable, and automated solutions to maintain accuracy and throughput across complex testing menus.

Clinical Diagnostics Automation Market Executive Summary

The Clinical Diagnostics Automation Market is witnessing robust growth, driven primarily by the escalating demand for high-throughput testing capabilities and the critical need to improve laboratory efficiency amidst constrained budgets and staffing shortages. Current business trends indicate a strong move toward Total Lab Automation (TLA) solutions, which offer end-to-end integration and significantly enhance operational coherence. Furthermore, strategic collaborations between diagnostic equipment manufacturers and middleware providers are becoming essential to offer seamless integration and data management capabilities, enabling laboratories to maximize the value of their installed automated systems and transition towards digitalization.

Regional trends highlight North America as the dominant market, characterized by high adoption rates due to advanced healthcare infrastructure, high healthcare expenditure, and the early implementation of regulatory standards promoting quality assurance in testing. Asia Pacific (APAC), however, is emerging as the fastest-growing region, fueled by rapid expansion of healthcare facilities, increasing awareness regarding preventive diagnostics, and substantial government investments in modernizing public health laboratory systems in countries like China and India. Europe maintains a steady growth trajectory, propelled by the replacement of legacy systems and the adoption of decentralized automation in specialized university hospitals and research centers.

Segmentation trends indicate that Automated Immunoassay Analyzers and Clinical Chemistry Analyzers dominate the product landscape due to their high volume of utilization in routine diagnostics. However, the Molecular Diagnostics Automation segment is projected to exhibit the highest CAGR, spurred by the accelerating need for automated nucleic acid extraction and PCR setup in response to global infectious disease monitoring and precision medicine initiatives. End-user segmentation shows that large Reference Laboratories remain the primary consumers of high-end TLA systems, though smaller Hospital Laboratories are increasingly adopting modular and scalable automation solutions to meet growing internal testing demands without major infrastructural overhauls.

AI Impact Analysis on Clinical Diagnostics Automation Market

Common user inquiries regarding the influence of Artificial Intelligence (AI) on the Clinical Diagnostics Automation Market frequently revolve around how AI can move beyond simple robotics control to enhance diagnostic accuracy, optimize complex workflows, and predict instrument failures. Users are highly concerned with AI’s ability to manage the vast datasets generated by high-throughput systems, asking specifically about AI-driven data interpretation, automated quality control (QC), and the potential for machine learning algorithms to identify subtle patterns in results that might indicate potential analytical errors or early disease states. Key expectations center on AI serving as the intelligent layer atop physical automation, transforming raw data into actionable clinical insights and ensuring predictive maintenance, thereby minimizing costly laboratory downtime and further reducing manual intervention.

The adoption of AI and Machine Learning (ML) is fundamentally changing the scope of laboratory automation, shifting the focus from purely physical sample movement to intelligent workflow optimization and decision support. AI algorithms are increasingly deployed in middleware to dynamically schedule tests based on priority, patient demographics, and resource availability, significantly improving throughput efficiency beyond what traditional software could achieve. Furthermore, AI is crucial in automating complex image analysis in digital pathology and hematology, accelerating the diagnostic process and ensuring consistent interpretation, which addresses the critical need for standardization across distributed testing sites. This integration transforms automation from a simple processing tool into an integrated diagnostic partner.

AI’s influence extends strongly into quality management and operational excellence. ML models are trained on historical performance data to predict potential component failures in automated systems, enabling proactive maintenance scheduling and preventing costly operational stoppages. In terms of quality control, AI systems can monitor reagent consumption, detect subtle shifts in QC results indicative of drift or contamination, and automatically flag questionable results for technologist review, thereby reinforcing the reliability of automated testing outputs. This shift towards smart automation ensures high uptime and maintains the integrity required for critical patient diagnostics, positioning AI as the ultimate catalyst for operational efficiency and diagnostic fidelity within the automated laboratory environment.

- AI-driven Predictive Maintenance: Minimizing instrument downtime by forecasting hardware failures.

- Intelligent Workflow Scheduling: Dynamic routing of samples based on urgency and available resources.

- Automated Image and Data Interpretation: Accelerating pathology and hematology analysis using deep learning.

- Enhanced Quality Control (QC): Real-time monitoring and anomaly detection in assay performance.

- Advanced Clinical Decision Support: Integrating test results with patient history to provide preliminary diagnostic insights.

- Optimization of Pre-analytical Phase: AI guiding robotic sorting and aliquoting based on test requirements.

DRO & Impact Forces Of Clinical Diagnostics Automation Market

The Clinical Diagnostics Automation Market is propelled by substantial Drivers (D), constrained by significant Restraints (R), presenting various lucrative Opportunities (O), and subjected to powerful Impact Forces. Key drivers include the overwhelming increase in the volume of diagnostic tests performed globally, driven by population growth and chronic disease prevalence, necessitating scalable solutions. The critical shortage of skilled laboratory personnel worldwide mandates the adoption of automation to sustain operations and quality. However, the high initial capital investment required for Total Lab Automation (TLA) systems and the complexity associated with integrating heterogeneous instrumentation from various vendors act as major restraints. Opportunities lie in the expansion into emerging markets, the integration of automation in molecular diagnostics, and the development of more flexible, modular systems suitable for mid-sized laboratories. The primary impact forces shaping the market are technological innovation, specifically the convergence of robotics, AI, and IT, and the tightening regulatory landscape emphasizing standardized, reproducible test results.

Drivers strongly influencing market expansion include the demonstrable economic benefits realized through reduced labor costs and improved operational efficiency that automation provides, particularly in high-volume reference labs. Furthermore, the inherent advantage of automation in reducing variability and minimizing transcription errors ensures higher patient safety and reliability, addressing a core need in modern healthcare. The increasing complexity of diagnostic procedures, particularly in areas like next-generation sequencing sample preparation and esoteric testing, simply cannot be handled manually at scale, creating an organic demand for automated workflows. Global initiatives focused on combating infectious diseases also necessitate rapid, high-throughput testing capabilities, which only advanced automation systems can reliably provide.

Despite these drivers, significant restraints inhibit faster adoption. Beyond the formidable upfront cost, the need for extensive physical space and infrastructure adjustments often proves challenging, especially in older hospital buildings. Furthermore, the resistance to change among existing laboratory staff, coupled with the steep learning curve required for operating and troubleshooting highly integrated systems, poses an adoption barrier. Market opportunities center around developing automation solutions specifically tailored for lower-resource settings or smaller clinical facilities through tiered, pay-as-you-grow modular systems. Additionally, the shift towards decentralized testing offers an opportunity for manufacturers to innovate smaller, fully contained automated instruments that can be deployed closer to the patient, blurring the lines between traditional lab space and clinical settings.

The impact forces are fundamentally altering market dynamics. Technological force, particularly the advances in robotic arms that are smaller, faster, and more precise, is continually improving the throughput and reliability of automated systems. The force of regulatory policy, such as efforts to standardize laboratory practices internationally, compels facilities to adopt validated, automated processes that guarantee consistency and traceability. Finally, competitive forces drive manufacturers to not only offer hardware but also comprehensive service contracts, middleware solutions, and AI support packages, transforming the market into a solution-based rather than product-based economy. These interwoven forces dictate investment decisions and strategic partnerships across the entire diagnostic ecosystem.

Segmentation Analysis

The Clinical Diagnostics Automation Market is segmented based on product type, end user, and application, allowing for a granular analysis of market dynamics and adoption patterns across different laboratory settings and diagnostic needs. Segmentation by product type reveals the core components essential for lab operations, ranging from robotic platforms and integrated systems to the crucial software layer that orchestrates them. This segmentation highlights the varying degrees of investment required and the specific technological capabilities laboratories prioritize, such as high-volume chemistry processing versus specialty molecular testing automation.

The end-user segmentation is critical for understanding consumption patterns, with large reference laboratories typically demanding high-end, centralized Total Lab Automation (TLA) systems due to massive testing volumes, while hospital laboratories often prefer modular or stand-alone automation units that integrate seamlessly into existing infrastructure. Furthermore, public health and academic research laboratories represent specialized niche segments requiring dedicated automation for large-scale epidemiological studies and complex research protocols, often focusing on advanced molecular and genomic analysis.

Application segmentation illustrates where automation delivers the most significant value, with clinical chemistry and immunodiagnostics historically leading due to the routine nature and high volume of these tests. However, emerging applications, particularly blood bank screening and infectious disease molecular diagnostics, are rapidly growing, driven by the need for speed, accuracy, and regulatory compliance. Analyzing these segments provides market participants with clear guidance on where technological investment and market penetration strategies will yield the highest returns, focusing on both established high-volume segments and high-growth specialty segments.

- Product Type:

- Total Lab Automation (TLA) Systems

- Modular Automation Systems

- Automated Pre-analytical Systems (Sorting, Capping/Decapping, Aliquoting)

- Automated Analytical Systems

- Automated Immunoassay Analyzers

- Automated Clinical Chemistry Analyzers

- Automated Molecular Diagnostics Systems (PCR, Extraction)

- Automated Microbiology Systems

- Automated Post-analytical Systems (Archiving, Storage)

- Laboratory Automation Software/Middleware

- End User:

- Reference Laboratories

- Hospital Laboratories

- Research and Academic Institutes

- Blood Banks and Transfusion Centers

- Application:

- Clinical Chemistry

- Immunoassays

- Microbiology

- Hematology

- Molecular Diagnostics

- Genetic Testing

Value Chain Analysis For Clinical Diagnostics Automation Market

The value chain for the Clinical Diagnostics Automation Market begins with upstream activities focused on the procurement of specialized components, including precision robotics, high-grade sensors, custom fluidics systems, and advanced microprocessors necessary for complex instrument manufacture. Key upstream players include specialized component suppliers and software developers focused on robotic control and middleware algorithms. Successful manufacturers maintain strong relationships with these suppliers to ensure reliability and cost-effectiveness of critical components, as component quality directly impacts the uptime and analytical performance of the final automation systems, which are subject to rigorous regulatory standards.

The core midstream phase involves the design, manufacturing, assembly, and rigorous testing of the automation platforms, followed by the development of proprietary software solutions that interface the hardware with Laboratory Information Systems (LIS). This phase is capital-intensive and requires substantial R&D investment to ensure compliance with global standards like CLIA, CAP, and ISO. Distribution channels form a critical link to the downstream market, encompassing direct sales teams for large TLA systems and partnerships with specialized distributors for modular units and reagents. Direct distribution allows manufacturers to offer integrated installation, training, and maintenance services, which are non-negotiable for highly complex automation solutions.

Downstream activities center on the end users—reference laboratories and hospitals—who implement, operate, and maintain these systems. Post-sale support, including service contracts, consumable supply (reagents, plastics), and middleware updates, represents a continuous revenue stream and a significant value differentiator for manufacturers. The indirect channel often involves third-party laboratory consultants or integration specialists who advise labs on selecting, installing, and optimizing complex automation workflows. The effectiveness of the value chain is ultimately measured by the system’s ability to minimize turnaround time and maximize analytical accuracy for the end-user clinical diagnostic services.

Clinical Diagnostics Automation Market Potential Customers

The primary potential customers and buyers of clinical diagnostics automation solutions are institutions that handle large volumes of patient samples and require consistent, rapid, and error-free testing. Reference Laboratories, which serve thousands of physicians and multiple hospitals, stand out as the largest purchasers, seeking high-throughput Total Lab Automation (TLA) systems that consolidate diverse testing platforms onto a single track, maximizing operational efficiency and handling peak demands seamlessly. Their need is driven by economies of scale and the necessity for centralized, high-quality testing services delivered across a broad geographic area. These organizations prioritize system reliability, vendor interoperability, and sophisticated middleware capabilities that enable cross-platform data management.

Hospital Laboratories, particularly those in large academic and regional medical centers, represent another crucial customer segment. These labs require modular automation solutions that can integrate into existing physical spaces and scale according to patient census fluctuations. Unlike reference labs, hospital labs prioritize rapid turnaround time for critical care samples (STAT testing), driving demand for specialized robotic pre-analytical modules and STAT priority routing capabilities within the automation track. They often seek vendors who can provide bundled solutions covering chemistry, immunoassay, and hematology to simplify procurement and maintenance across their primary testing divisions.

Beyond traditional clinical settings, specialized entities such as Blood Banks and Transfusion Centers are increasingly adopting automation for high-volume blood typing, infectious disease screening, and component preparation, driven by strict regulatory requirements for safety and traceability. Furthermore, large Academic Research Institutes and Pharmaceutical Companies utilize automation for high-throughput screening, biobanking management, and molecular profiling in clinical trials, requiring flexible, customized automation robotics and software capable of handling complex research protocols and integrating emerging genomic technologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 8.6 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Danaher Corporation (Beckman Coulter), Siemens Healthineers, F. Hoffmann-La Roche Ltd., Abbott Laboratories, Thermo Fisher Scientific Inc., Becton, Dickinson and Company (BD), Hitachi High-Tech Corporation, Sysmex Corporation, Ortho Clinical Diagnostics, QIAGEN N.V., Bio-Rad Laboratories, Inc., Mindray Medical International Limited, bioMérieux SA, Tecan Group, Hamilton Company, Cerner Corporation, Data Innovations LLC, Copan Diagnostics, Inc., S&I Robotics, Inc., Hudson Robotics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Clinical Diagnostics Automation Market Key Technology Landscape

The technological landscape of clinical diagnostics automation is dominated by advancements in robotics, sophisticated middleware, and the increasing integration of sensor technology for enhanced tracking and quality assurance. High-precision articulated robotic arms and linear track systems form the physical backbone of Total Lab Automation (TLA), enabling continuous, high-speed movement of samples between instruments. Modern systems are increasingly utilizing magnetic levitation or advanced conveyer technology to reduce vibration, increase speed, and ensure sample integrity during transport. Furthermore, the development of smaller, more flexible robotic units, often referred to as 'cobots' (collaborative robots), is enabling automation to move beyond massive centralized tracks and into smaller, modular environments, democratizing access to automation for mid-sized laboratories.

Middleware software is arguably the most critical technological element, serving as the command center that links various instruments, the LIS, and the automated track. Current middleware solutions leverage sophisticated algorithms, including AI and machine learning, to optimize sample routing, manage quality control protocols, and handle complex reflex testing scenarios without manual intervention. The trend is moving towards open-architecture middleware, allowing laboratories to integrate instrumentation from multiple vendors rather than being restricted to proprietary single-vendor solutions. This technological shift maximizes flexibility and capital utilization, directly addressing one of the primary restraints of the market—vendor lock-in and integration complexity.

Emerging technologies significantly impacting the market include the automation of molecular diagnostics workflows, specifically automated nucleic acid extraction and PCR setup, which are essential for infectious disease testing and genomics. Furthermore, digitalization in pathology, supported by automated slide handling and high-throughput scanning, coupled with AI-powered image analysis, is integrating previously manual, non-automated areas into the automated ecosystem. Future advancements will focus on integrating point-of-care (POC) testing devices into central automation platforms via digital connectivity, creating a truly unified diagnostics network that spans the entire patient care continuum and utilizes cloud infrastructure for massive data processing and analysis.

Regional Highlights

The regional analysis of the Clinical Diagnostics Automation Market reveals significant disparities in adoption rates, technological maturity, and growth trajectories, heavily influenced by local healthcare funding, regulatory frameworks, and infrastructural readiness. North America, comprising the United States and Canada, currently holds the largest market share, predominantly due to high healthcare expenditure, the presence of major global market players, and widespread adoption of sophisticated TLA systems in large reference laboratories. The region benefits from stringent regulatory standards enforced by bodies like the FDA, which incentivize laboratories to implement automated, standardized workflows to ensure compliance and quality assurance. The continuous push for cost-efficiency and the acute shortage of laboratory professionals drive sustained investment in automation technologies.

Europe represents a mature but steady growth market, characterized by government-led healthcare system upgrades and the replacement of older generation laboratory equipment. Western European countries, particularly Germany, France, and the UK, exhibit high adoption rates, driven by efforts to centralize testing and achieve economies of scale within national health services. However, the market growth is often constrained by slower procurement processes compared to the private sector-dominated North American market. The European landscape shows a strong trend toward modular automation tailored for specialized labs and university hospitals, alongside significant investment in automating microbiology and molecular diagnostics to combat antimicrobial resistance and manage regional disease outbreaks efficiently. The presence of major European automation manufacturers also ensures robust technological competition and local customization of solutions.

Asia Pacific (APAC) is projected to be the fastest-growing region throughout the forecast period. This rapid expansion is primarily attributable to massive infrastructure development in emerging economies like China, India, and South Korea, coupled with significant increases in public and private investment in healthcare modernization. The rising prevalence of chronic and lifestyle diseases and the expanding elderly population necessitate scalable diagnostic capacities, which automation provides. While high-end TLA adoption is prominent in large metropolitan reference labs in developed APAC nations, the emerging markets show a strong demand for cost-effective, durable, and modular systems that can handle large volumes in varied infrastructural settings. Government initiatives aimed at improving diagnostic accessibility and quality further cement APAC’s crucial role in future market expansion.

Latin America (LATAM) presents a dynamic, yet often fragmented, market. Automation adoption is concentrated in major economies such as Brazil and Mexico, driven by private-sector reference laboratories seeking global accreditation and enhanced operational efficiency. Challenges related to economic instability, varying regulatory oversight, and inconsistent healthcare spending across the region can restrain widespread adoption. However, increasing awareness of the benefits of standardization and the expansion of private diagnostic networks are fostering gradual market penetration. The demand often focuses on automated immunoassay and chemistry platforms suitable for medium-volume labs seeking efficiency improvements without committing to full-scale TLA infrastructure. Partnerships between global vendors and local distributors are essential for navigating the complex logistics and regulatory requirements in this region.

The Middle East and Africa (MEA) region shows localized pockets of high investment, particularly in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia, Qatar). These nations benefit from substantial oil wealth-backed governmental investments aimed at establishing world-class healthcare facilities, leading to the rapid adoption of the latest TLA and modular systems. These countries often skip intermediate technology generations, adopting advanced solutions immediately. In contrast, the African continent experiences slower overall growth, largely due to infrastructure limitations and funding constraints. However, there is a specialized demand for robust, semi-automated systems for infectious disease testing, often supported by international aid organizations focused on public health initiatives. The long-term growth in MEA relies heavily on sustained government investment in both infrastructure and specialized medical training to manage highly automated systems effectively.

- North America: Dominant market share due to mature healthcare infrastructure, high per capita healthcare spending, and established reference laboratory networks heavily invested in TLA solutions. Driven by labor shortages and regulatory mandates for quality.

- Europe: Steady growth fueled by system replacement cycles, government initiatives to centralize testing, and strong R&D focused on advanced analytical automation, particularly in molecular and microbiology applications.

- Asia Pacific (APAC): Fastest growing region, propelled by rapid healthcare infrastructure development, rising chronic disease burden, and increasing government investment in diagnostic capacity building, especially in China and India. Focus on modular and scalable solutions.

- Latin America (LATAM): Market growth concentrated in Brazil and Mexico, driven by private sector adoption of automation to achieve international quality standards and improve cost-efficiency in large private diagnostic chains.

- Middle East and Africa (MEA): High-value market segment in the GCC states due to significant state investment in state-of-the-art medical technology. Slower adoption in Africa, primarily focused on infectious disease automation supported by public health programs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Clinical Diagnostics Automation Market.- Danaher Corporation (Beckman Coulter)

- Siemens Healthineers

- F. Hoffmann-La Roche Ltd.

- Abbott Laboratories

- Thermo Fisher Scientific Inc.

- Becton, Dickinson and Company (BD)

- Hitachi High-Tech Corporation

- Sysmex Corporation

- Ortho Clinical Diagnostics

- QIAGEN N.V.

- Bio-Rad Laboratories, Inc.

- Mindray Medical International Limited

- bioMérieux SA

- Tecan Group

- Hamilton Company

- Cerner Corporation

- Data Innovations LLC

- Copan Diagnostics, Inc.

- S&I Robotics, Inc.

- Hudson Robotics

Frequently Asked Questions

Analyze common user questions about the Clinical Diagnostics Automation market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Total Lab Automation (TLA) and how does it benefit clinical laboratories?

Total Lab Automation (TLA) refers to fully integrated systems that automate the entire testing process, spanning pre-analytical, analytical, and post-analytical phases, using sophisticated robotics and centralized tracks. TLA benefits include significantly reducing human errors, dramatically improving sample turnaround time, lowering labor costs per test, and providing standardized, high-quality results essential for patient care.

What are the primary factors restraining the growth and adoption of clinical diagnostics automation?

The primary restraints are the high initial capital investment required for purchasing and installing complex automated systems, the necessity for substantial laboratory infrastructure renovation or space allocation, and the technical complexity involved in integrating new automation hardware with existing Laboratory Information Systems (LIS) and instruments from diverse vendors.

Which segment is expected to show the highest growth rate in the clinical diagnostics automation market?

The Molecular Diagnostics Automation segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by the increasing global demand for automated solutions in infectious disease testing, genomics, oncology diagnostics, and personalized medicine, which require high-throughput and precise robotic handling of complex nucleic acid samples.

How is Artificial Intelligence (AI) transforming the utility of laboratory automation systems?

AI is transforming automation by moving beyond basic robotic handling to introduce intelligent functionalities. AI-powered middleware facilitates dynamic, predictive workflow scheduling, optimizes quality control (QC) processes through real-time anomaly detection, and enables predictive maintenance to maximize system uptime and operational efficiency, integrating data intelligence with physical automation.

Which geographical region dominates the clinical diagnostics automation market, and why?

North America currently dominates the market, primarily due to the region's robust and highly digitized healthcare infrastructure, significant per capita healthcare expenditure, the presence of major global market players, and the urgent industry pressure stemming from persistent skilled laboratory personnel shortages, necessitating high levels of automation investment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager