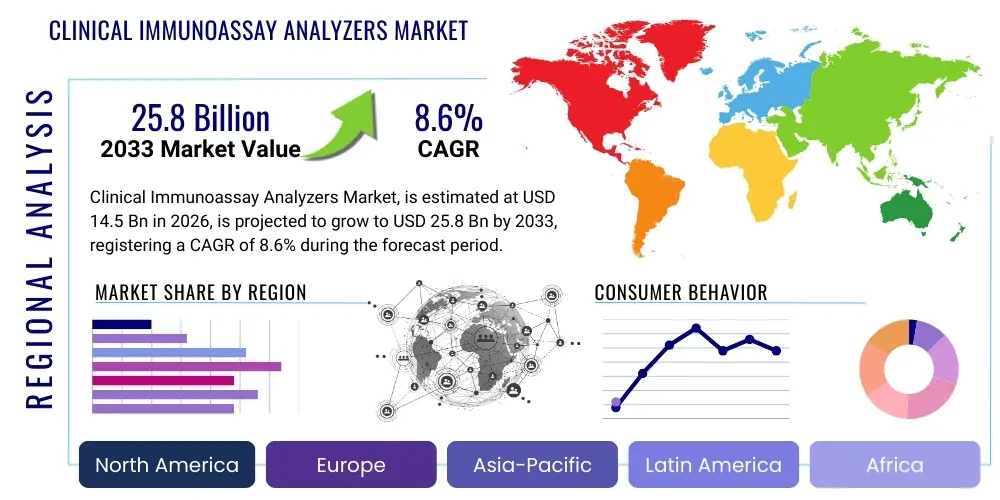

Clinical Immunoassay Analyzers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437939 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Clinical Immunoassay Analyzers Market Size

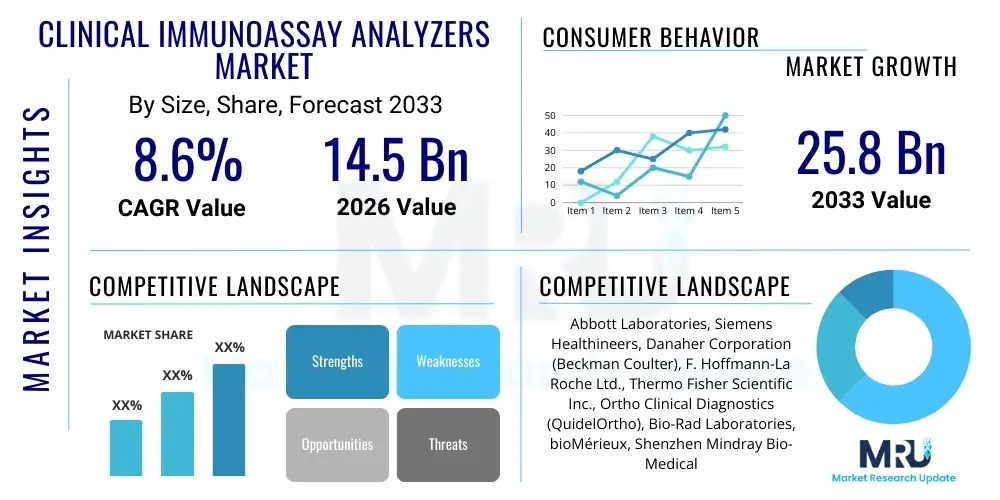

The Clinical Immunoassay Analyzers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.6% between 2026 and 2033. The market is estimated at $14.5 Billion in 2026 and is projected to reach $25.8 Billion by the end of the forecast period in 2033.

Clinical Immunoassay Analyzers Market introduction

Clinical Immunoassay Analyzers are sophisticated diagnostic instruments essential for measuring the concentration of specific biological substances, such as proteins, hormones, drugs, and infectious disease markers, using antigen-antibody reactions. These analyzers are critical tools across modern healthcare settings, enabling rapid and accurate quantitative and qualitative detection of analytes in biological fluids like blood, urine, and saliva. The systems range from small, benchtop devices suitable for point-of-care testing (POCT) to high-throughput, fully automated laboratory instruments capable of handling thousands of tests per hour, catering to diverse clinical needs, including emergency diagnostics, chronic disease management, and public health screening programs.

The core functionality of these analyzers relies heavily on advanced detection technologies, predominantly Chemiluminescence Immunoassay (CLIA), Enzyme Immunoassay (EIA), and Fluorescence Immunoassay (FIA). CLIA, in particular, dominates the current landscape due to its superior sensitivity, wide dynamic range, and high throughput capabilities, making it the preferred method for routine and specialized testing in centralized labs. The increasing prevalence of infectious diseases, chronic lifestyle disorders such as cardiovascular ailments and cancer, and the global aging population are primary drivers augmenting the demand for efficient and highly sensitive diagnostic platforms capable of early and reliable disease detection and monitoring.

The primary applications of clinical immunoassay analyzers span major therapeutic areas including oncology, endocrinology (thyroid and diabetes management), cardiology (troponin and BNP testing), and infectious disease screening (HIV, Hepatitis). The undeniable benefits of these systems—such as automation, minimized manual errors, enhanced reproducibility, and expedited result turnaround times—position them as indispensable components of the in vitro diagnostics (IVD) ecosystem. Furthermore, continuous innovation focused on integrating microfluidics, developing multiplexing capabilities, and miniaturization of devices to facilitate decentralized testing environments are key factors fueling continuous market expansion and adoption across emerging economies.

Clinical Immunoassay Analyzers Market Executive Summary

The Clinical Immunoassay Analyzers Market is characterized by robust growth driven by the escalating demand for automated diagnostic solutions, coupled with significant advancements in chemiluminescence technology offering improved analytical performance. A major business trend involves strategic consolidation, where key multinational players are acquiring niche technology providers to broaden their test menus and geographic footprint, focusing heavily on developing integrated laboratory systems (Total Laboratory Automation - TLA). Additionally, there is a strong shift towards open system architecture and specialized high-throughput platforms catering to complex diagnostics, necessitating substantial investments in reagent R&D to support diverse test panels and maintain proprietary control over test availability.

Geographically, North America currently holds the largest market share, attributable to well-established healthcare infrastructure, high awareness regarding preventive medicine, and favorable reimbursement policies supporting advanced diagnostic testing. However, the Asia Pacific (APAC) region is projected to exhibit the highest CAGR during the forecast period, fueled by massive government investments in expanding healthcare access, a rapidly growing patient pool, and increasing adoption of automated diagnostic solutions in countries like China, India, and Japan. Regional trends also show a rising adoption of decentralized testing models in Europe and North America to alleviate the burden on central laboratories and improve patient access, particularly for chronic condition monitoring.

From a segment perspective, the Reagents & Kits segment dominates the market by revenue, primarily due to their recurring purchase nature essential for system operation and the constant expansion of specialized biomarker testing panels. Among technologies, Chemiluminescence Immunoassay (CLIA) remains the gold standard, favored for its sensitivity and throughput, although Fluorescence Immunoassay (FIA) is gaining traction, especially in POCT and near-patient settings due to its stability and reduced assay time. The application segment growth is largely propelled by oncology and infectious disease testing, reflecting global health priorities and the ongoing need for precise screening tools. Hospitals and specialized clinical laboratories remain the primary end-users, increasingly seeking scalable, modular systems that can adapt to fluctuating testing volumes and streamline workflow efficiency.

AI Impact Analysis on Clinical Immunoassay Analyzers Market

Common user questions regarding AI's impact on Clinical Immunoassay Analyzers center on themes such as improving diagnostic accuracy, optimizing laboratory workflow efficiency, and enabling predictive maintenance of sophisticated instruments. Users frequently inquire about AI's role in interpreting complex multiplexed assay data, standardizing results across different analyzer platforms, and minimizing intra-laboratory variability, especially concerning rare or complex biomarkers. The primary expectations revolve around utilizing machine learning algorithms to enhance quality control procedures, accelerate the development of novel diagnostic algorithms for early disease detection (e.g., subtle patterns in cardiac markers or cancer panels), and automate decision support systems for clinicians, transforming raw immunoassay data into actionable insights rather than merely raw quantitative values, thereby facilitating precision medicine approaches.

- AI algorithms enhance data interpretation by analyzing complex assay patterns, improving the detection of subtle biomarker changes.

- Machine learning optimizes laboratory workflows through automated scheduling, sample prioritization, and resource management, reducing turnaround time (TAT).

- Predictive maintenance models utilize AI to monitor analyzer performance metrics, forecasting potential hardware failures before they occur, minimizing instrument downtime.

- Deep learning enables the standardization of results across diverse instrument models and reagent lots, improving inter-laboratory result consistency.

- AI assists in the accelerated development and validation of novel multiplexing immunoassays by rapidly identifying optimal reagent combinations and incubation protocols.

- Integration of AI-driven decision support tools provides clinicians with contextualized diagnostic guidance based on immunoassay results combined with patient clinical history.

- AI significantly improves quality control (QC) by detecting anomalies and outliers in calibration curves and control samples with greater precision than traditional statistical methods.

DRO & Impact Forces Of Clinical Immunoassay Analyzers Market

The Clinical Immunoassay Analyzers Market expansion is fundamentally propelled by the rising global incidence of chronic diseases, including autoimmune disorders, cardiovascular diseases, and various cancers, which necessitate frequent and accurate biomarker monitoring for diagnosis and treatment efficacy assessment. This pervasive demand is significantly amplified by continuous technological advancements, particularly the refinement of CLIA and introduction of microfluidics-based systems, offering superior sensitivity and decreased sample volume requirements. Conversely, market growth faces considerable restraints, predominantly stemming from the extremely high capital investment required for acquiring and installing fully automated, high-throughput analyzers, coupled with the stringent and complex regulatory approval pathways for novel diagnostic platforms and associated proprietary reagents, especially in established markets like the US and Europe. The scarcity of highly skilled laboratory personnel trained to operate and maintain these increasingly sophisticated instruments, particularly in developing regions, further impedes broader adoption.

Significant opportunities for market participants lie in penetrating the rapidly expanding Point-of-Care Testing (POCT) segment, driven by the shift toward decentralized healthcare and the need for rapid diagnostics in emergency settings. Furthermore, developing nations represent a lucrative area for expansion, where increasing healthcare spending and the modernization of clinical laboratory infrastructure provide substantial avenues for deploying mid-to-high capacity analyzers. Manufacturers are strategically focusing on creating integrated diagnostic platforms that combine immunoassay testing with clinical chemistry and molecular diagnostics (multiplexing), streamlining laboratory operations and enhancing diagnostic utility. The growing focus on companion diagnostics and personalized medicine also mandates the development of highly specific and standardized immunoassay tests for therapeutic drug monitoring and complex biomarker detection, offering substantial revenue streams for innovative companies.

The market impact forces are strongly characterized by the technological momentum favoring automation and connectivity, pushing laboratories to invest in integrated systems that support seamless data transfer and centralized management. Competitive rivalry is fierce, driven by the proprietary nature of reagents, creating high switching costs for established customers, thereby making the battle for new instrument placements a critical factor. Furthermore, regulatory hurdles act as a constraining force, ensuring high standards of quality and performance but simultaneously lengthening the product development cycle. The influence of large group purchasing organizations (GPOs) and health system consolidations also exerts downward pressure on analyzer pricing, shifting the focus of competition toward superior service contracts, enhanced reliability, and comprehensive test menu offerings rather than capital cost alone.

Segmentation Analysis

The Clinical Immunoassay Analyzers Market segmentation provides a granular view of diverse product offerings, applications, and end-user needs, essential for targeted market penetration strategies. This market is broadly segmented based on technology, product type, application, and end-user, with technology being the most decisive factor influencing analytical performance and market dominance. The continuous evolution within these segments reflects the industry's commitment to enhancing diagnostic throughput, precision, and accessibility, catering to both centralized high-volume testing facilities and decentralized, rapid testing environments. Detailed analysis across these categories reveals significant shifts in preference, such as the overwhelming adoption of high-sensitivity methods like CLIA over traditional EIA, driven by clinical requirements for earlier and more definitive diagnoses across critical disease states.

The product segmentation, split between instruments (analyzers) and consumables (reagents and kits), clearly demonstrates that consumables generate the bulk of recurring revenue, establishing them as the financially stable core of the market due to constant utilization. Meanwhile, the application segmentation highlights the increasing clinical significance of immunoassays beyond traditional screening, moving into specialized areas like oncology biomarker monitoring and therapeutic drug level measurement, areas characterized by high growth potential. The market structure is thus defined by the strategic interplay between capital equipment sales (analyzers, representing high entry barrier investments) and the ongoing sales of proprietary reagents (ensuring long-term revenue streams and customer lock-in). This dynamic necessitates manufacturers to continually innovate on both fronts—improving instrument speed and reliability while simultaneously expanding the menu of available high-quality diagnostic tests.

- By Technology:

- Chemiluminescence Immunoassay (CLIA)

- Enzyme Immunoassay (EIA)

- Radioimmunoassay (RIA)

- Fluorescence Immunoassay (FIA)

- Others (e.g., Immunoblotting, Western Blotting)

- By Product:

- Analyzers (Automated, Semi-Automated, POCT Devices)

- Reagents & Kits (Antibodies, Calibrators, Controls, Buffers)

- By Application:

- Infectious Diseases

- Cardiology

- Oncology

- Endocrinology

- Therapeutic Drug Monitoring (TDM)

- Autoimmunity

- Others (Fertility, Drug Abuse Testing)

- By End-user:

- Hospitals

- Clinical Laboratories (Reference and Private)

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

Value Chain Analysis For Clinical Immunoassay Analyzers Market

The value chain for Clinical Immunoassay Analyzers begins with upstream activities focused on sophisticated research and development, encompassing the creation and refinement of highly specific antibodies and antigens, optimization of detection chemistries (like luminophores or fluorophores), and engineering high-precision microfluidic components and optics. Key upstream suppliers include specialty chemical producers, biotechnology firms specializing in monoclonal antibody generation, and high-tech component manufacturers providing pumps, sensors, and detection modules. This phase is characterized by intense intellectual property protection and high R&D expenditures necessary to maintain analytical superiority and regulatory compliance. Efficiency in this stage directly dictates the sensitivity, specificity, and cost-effectiveness of the final diagnostic system.

The midstream phase involves the manufacturing and assembly of the immunoassay analyzers and the bulk production of companion reagents and kits. Major manufacturers (OEMs) focus on streamlining complex assembly processes, ensuring stringent quality control measures, and integrating software for automation and data management. Production facilities are often highly automated to meet global demand while minimizing variability in instrument calibration and reagent quality. A critical aspect here is inventory management for temperature-sensitive reagents and timely distribution to prevent degradation, especially considering the global regulatory standards that must be met before commercialization in various regions.

Downstream activities involve the distribution channel, which is crucial for market access. Distribution is typically handled through a hybrid model: direct sales forces for large hospital networks and centralized clinical laboratories, providing installation, training, and ongoing service contracts, and indirect channels utilizing third-party distributors for smaller clinics, regional labs, and international markets where direct presence is cost-prohibitive. Post-sale support, including technical assistance and consumable replenishment, is a continuous driver of customer loyalty and recurring revenue. The effectiveness of the service network is a key competitive differentiator, ensuring maximum instrument uptime and continuous delivery of proprietary reagents, thereby closing the value loop from research bench to patient diagnosis.

Clinical Immunoassay Analyzers Market Potential Customers

The primary consumers, or end-users, of clinical immunoassay analyzers are centralized clinical laboratories and large hospital systems, which require high-throughput, fully automated instruments capable of running hundreds of tests simultaneously to manage vast patient populations and diverse testing menus. These entities prioritize instruments offering scalability, seamless integration with existing laboratory information systems (LIS), and robust technical support to ensure minimal operational downtime. Their purchasing decisions are often influenced by total cost of ownership (TCO), including the recurring cost and stability of reagents, rather than initial capital investment alone. For major hospitals, the ability to consolidate multiple testing platforms onto a single, automated track system is a significant factor in vendor selection.

A rapidly expanding segment of potential customers includes specialized testing facilities such as oncology centers, cardiac clinics, and endocrinology labs, which require specialized, medium-throughput analyzers focusing on niche biomarker panels like cancer antigens or therapeutic drug monitoring (TDM). Furthermore, the burgeoning demand for Point-of-Care Testing (POCT) devices has created a new customer base, encompassing emergency rooms, primary care physician offices, and retail clinics, which need compact, rapid, and easy-to-use immunoassay systems for quick diagnostic decisions in non-laboratory environments. These customers value speed and portability over extreme throughput, and ease of use is paramount given the typically non-specialist nature of the operating staff.

Finally, academic research institutes and biotechnology/pharmaceutical companies represent crucial, albeit smaller, segments. Research institutes utilize advanced immunoassay platforms for biomarker discovery, clinical trial support, and basic science investigations, often demanding instruments with high flexibility and specialized assay development capabilities. Pharmaceutical companies rely on these analyzers for preclinical testing, quality control of drug production, and monitoring drug efficacy and toxicity during clinical trials. These customers often seek instruments that offer high sensitivity and compatibility with complex sample matrices, favoring customizable open systems alongside standard proprietary platforms for routine assays.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $14.5 Billion |

| Market Forecast in 2033 | $25.8 Billion |

| Growth Rate | 8.6% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Abbott Laboratories, Siemens Healthineers, Danaher Corporation (Beckman Coulter), F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc., Ortho Clinical Diagnostics (QuidelOrtho), Bio-Rad Laboratories, bioMérieux, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Sysmex Corporation, DiaSorin S.p.A., Fujirebio, Tosoh Corporation, PerkinElmer, Inc., Becton, Dickinson and Company (BD), Hitachi High-Technologies Corporation, Stago, Nova Biomedical, DRG International, Luminex Corporation (A part of DiaSorin). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Clinical Immunoassay Analyzers Market Key Technology Landscape

The technology landscape of the Clinical Immunoassay Analyzers market is dominated by automation and enhanced detection methodologies, primarily revolving around Chemiluminescence Immunoassay (CLIA). CLIA utilizes light emission (chemiluminescence) triggered by an enzyme-substrate reaction, offering exceptionally high sensitivity, superior throughput, and a wide dynamic range, making it the preferred platform for high-volume centralized laboratories globally. Manufacturers are continually advancing CLIA systems by increasing testing speeds (up to 1,000 tests/hour in flagship models), improving integration capabilities with Total Laboratory Automation (TLA) systems, and enhancing the stability of reagents to extend shelf life and reduce waste. The shift toward magnetic particle separation within CLIA assays further contributes to better washing steps and reduced background noise, thereby boosting analytical precision across diverse sample matrices.

Beyond CLIA, the market is witnessing significant innovation in Fluorescence Immunoassay (FIA) and microfluidics-based systems, especially targeted at the Point-of-Care Testing (POCT) sector. FIA offers speed and simplicity, relying on stable fluorescent labels for detection, and is particularly suitable for rapid, cartridge-based assays utilized in emergency departments and decentralized settings. Concurrent developments in multiplexing technology, such as bead-based assays (e.g., Luminex technology), allow for the simultaneous quantification of multiple analytes from a single, small sample volume. This capability is crucial for complex diagnostics like comprehensive allergy panels, cytokine profiling, and infectious disease differentiation, driving efficiency in both clinical and research environments by reducing the need for multiple discrete tests.

Furthermore, significant technological focus is placed on connectivity and digital integration. Modern immunoassay analyzers are being designed with robust connectivity features, enabling real-time remote monitoring, automatic software updates, and seamless communication with laboratory information management systems (LIMS) and hospital electronic health records (EHR). This digitalization not only streamlines laboratory workflow and reduces transcription errors but also facilitates the implementation of advanced quality control mechanisms and remote technical diagnostics. The incorporation of advanced robotics and artificial intelligence is beginning to optimize sample handling, minimize operator intervention, and provide sophisticated data analysis capabilities, positioning the market for the next generation of smart diagnostic platforms characterized by predictive analytics and enhanced operational autonomy.

Regional Highlights

The global Clinical Immunoassay Analyzers Market demonstrates varied growth patterns across key geographic regions, reflecting differences in healthcare expenditure, technological adoption rates, and regulatory environments. North America, specifically the United States, represents the dominant market, primarily driven by a high concentration of leading market players, aggressive adoption of advanced automated systems, and substantial governmental and private investment in healthcare R&D. Favorable reimbursement structures for complex diagnostic tests, combined with a high prevalence of chronic diseases demanding precise screening and monitoring, solidify the region's leading position. Furthermore, the stringent quality standards enforced by regulatory bodies necessitate the continuous upgrade of laboratory infrastructure, favoring high-end, high-throughput analyzers.

Europe constitutes the second largest market, characterized by mature healthcare systems and high awareness of diagnostic technologies. Key growth drivers in countries like Germany, France, and the UK include the implementation of standardized screening programs and the strong presence of academic research centers focusing on biomarker discovery. However, economic pressures and centralized procurement processes often lead to more cost-conscious purchasing decisions compared to North America. Western European countries are actively integrating laboratory automation and embracing decentralized testing models, particularly for infectious disease management and cancer screening, supporting the robust demand for both centralized and POCT immunoassay systems.

Asia Pacific (APAC) is projected to be the fastest-growing region, presenting substantial untapped potential. This exponential growth is attributable to rapid improvements in healthcare infrastructure, increasing disposable incomes, and the modernization of clinical laboratories in emerging economies such as China and India. Government initiatives aimed at widening access to diagnostics, coupled with the rising geriatric population and high burden of infectious diseases, are fueling demand. Manufacturers are focusing on developing cost-effective, durable, and mid-capacity analyzers specifically tailored to the infrastructure challenges and budgetary constraints prevalent in many APAC countries. Latin America and the Middle East & Africa (MEA) are also exhibiting moderate growth, driven by increasing foreign direct investment in private healthcare and the rising adoption of sophisticated diagnostic tools in response to global health crises and rising chronic disease rates, although growth is often constrained by volatile economic conditions and fragmented distribution channels.

- North America: Dominates the market share due to advanced healthcare IT integration, high reimbursement rates, and the strong presence of global market leaders like Abbott and Danaher. Focus on fully automated, integrated laboratory systems.

- Europe: Mature market characterized by stringent regulatory standards and centralized healthcare procurement. Strong emphasis on decentralized testing and specialized diagnostics for oncology and autoimmunity.

- Asia Pacific (APAC): Expected to register the highest CAGR, driven by massive investments in public health infrastructure in China and India, increasing accessibility to automated diagnostic platforms, and rising disease prevalence.

- Latin America: Growth stimulated by expanding private healthcare sector and increasing urbanization. Demand focused on robust, scalable systems that balance capacity and affordability.

- Middle East & Africa (MEA): Emerging market where growth is concentrated in the Gulf Cooperation Council (GCC) countries due to high per capita healthcare spending and modernizing hospital infrastructure. Focus is on establishing core diagnostic capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Clinical Immunoassay Analyzers Market.- Abbott Laboratories

- Siemens Healthineers

- Danaher Corporation (Beckman Coulter)

- F. Hoffmann-La Roche Ltd.

- Thermo Fisher Scientific Inc.

- Ortho Clinical Diagnostics (QuidelOrtho)

- Bio-Rad Laboratories

- bioMérieux

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Sysmex Corporation

- DiaSorin S.p.A.

- Fujirebio

- Tosoh Corporation

- PerkinElmer, Inc.

- Becton, Dickinson and Company (BD)

- Hitachi High-Technologies Corporation

- Stago

- Nova Biomedical

- DRG International

- Luminex Corporation (A part of DiaSorin)

Frequently Asked Questions

Analyze common user questions about the Clinical Immunoassay Analyzers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technology driving growth in the Clinical Immunoassay Analyzers Market?

The primary growth driver is Chemiluminescence Immunoassay (CLIA) technology, which offers superior analytical sensitivity, high throughput, and increased precision compared to older methods like ELISA. CLIA enables high-volume testing and is foundational for fully automated laboratory systems.

Which segment contributes the most revenue to the overall Immunoassay Analyzers market?

The Reagents & Kits segment consistently contributes the most substantial revenue. This is due to the proprietary nature and necessity of these consumables, which are purchased repeatedly throughout the lifecycle of the installed analyzers, ensuring reliable, recurring income for manufacturers.

How is Point-of-Care Testing (POCT) influencing the immunoassay analyzer market?

POCT is significantly expanding the market by creating demand for compact, rapid, and easy-to-use immunoassay analyzers, particularly those utilizing cartridge-based Fluorescence Immunoassay (FIA). This shift moves diagnostics closer to the patient, improving turnaround time for critical emergency or decentralized testing.

What are the key challenges facing manufacturers of high-throughput immunoassay analyzers?

Key challenges include managing the high capital cost of advanced systems, navigating complex global regulatory approval processes for novel assays, and mitigating the high switching costs associated with proprietary reagents, which intensifies competitive pressure during new instrument placements.

Which geographical region is anticipated to show the fastest market expansion?

The Asia Pacific (APAC) region, led by China and India, is anticipated to record the highest compound annual growth rate (CAGR). This acceleration is driven by significant governmental investments in healthcare infrastructure modernization and a rapidly expanding patient base requiring advanced diagnostic services.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager