Clinical Mass Spectrometry Sales Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434838 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Clinical Mass Spectrometry Sales Market Size

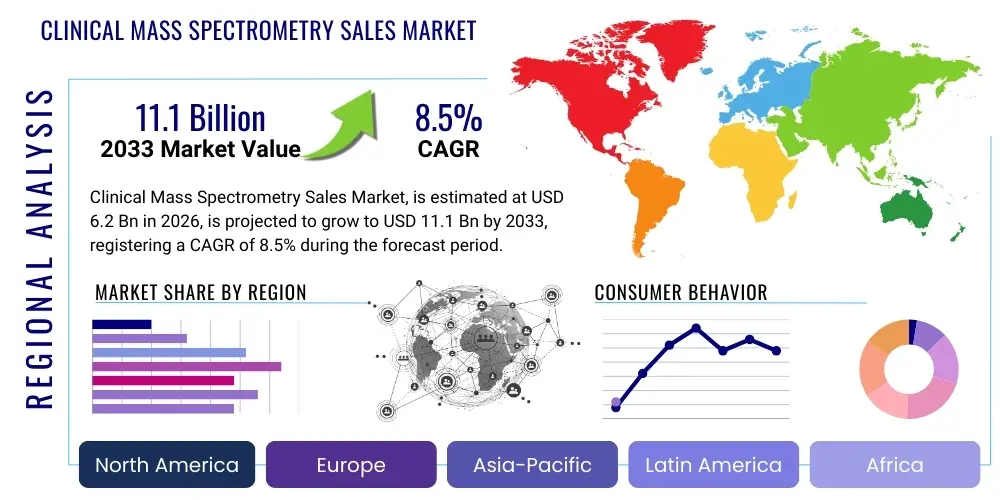

The Clinical Mass Spectrometry Sales Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 6.2 Billion in 2026 and is projected to reach USD 11.1 Billion by the end of the forecast period in 2033.

Clinical Mass Spectrometry Sales Market introduction

The Clinical Mass Spectrometry (CMS) Sales Market encompasses the sales of highly sophisticated analytical instruments used primarily in clinical laboratories for diagnostics, toxicology screening, therapeutic drug monitoring (TDM), endocrinology, and newborn screening. These systems leverage the principle of separating ions based on their mass-to-charge ratio, offering unparalleled sensitivity, specificity, and throughput compared to traditional immunoassays. The core product category includes tandem mass spectrometers (LC-MS/MS), Gas Chromatography-Mass Spectrometry (GC-MS), and matrix-assisted laser desorption/ionization time-of-flight (MALDI-TOF) systems. Clinical applications are rapidly expanding beyond routine testing into complex personalized medicine areas, including proteomics, metabolomics, and sophisticated biomarker quantification, driven by the need for definitive and rapid diagnostic results that minimize false positives and negatives, thereby improving patient outcomes and streamlining clinical workflows.

Major applications driving the demand for CMS systems include chronic disease management, infectious disease testing, genetic disorder screening, and forensic toxicology. Benefits associated with mass spectrometry adoption in clinical settings involve enhanced measurement accuracy, reduced assay interference from matrix effects or cross-reactivity, and the capability to simultaneously analyze multiple analytes in a single sample run, a concept known as multiplexing. This high level of specificity is critical when monitoring small molecule drugs or quantifying endogenous compounds present at very low concentrations. Furthermore, CMS instruments offer substantial flexibility for developing laboratory-developed tests (LDTs), allowing clinical labs to rapidly adapt to emerging diagnostic needs, particularly in areas where commercial kits are limited or nonexistent, positioning the technology as foundational for future clinical diagnostics.

Driving factors stimulating market expansion include the increasing prevalence of chronic diseases requiring precise quantification of drug levels and biomarkers, heightened demand for newborn screening panels, and growing regulatory scrutiny demanding higher sensitivity and accuracy in diagnostic tests. Technological advancements, such as miniaturization, improved ionization sources, and user-friendly software interfaces, are lowering the operational complexity and cost associated with CMS, making it accessible to a wider range of clinical laboratories globally. The shift away from conventional immunoassays, which often suffer from interference and lower precision, toward definitive methods like mass spectrometry is a fundamental market dynamic. Furthermore, substantial investment in research and development aimed at creating standardized, pre-validated mass spectrometry workflows for high-volume clinical applications is expected to accelerate adoption significantly throughout the forecast period.

Clinical Mass Spectrometry Sales Market Executive Summary

The Clinical Mass Spectrometry Sales Market is experiencing robust expansion, characterized by a fundamental shift in diagnostic preferences across developed and rapidly developing economies. Business trends highlight strategic collaborations between instrument manufacturers and clinical reference laboratories to standardize protocols and ensure regulatory compliance, particularly with the transition towards IVD (In Vitro Diagnostic) registered devices. Key strategic acquisitions are consolidating the market landscape, allowing major players to integrate complementary technologies, such as advanced separation techniques (UPLC) and sophisticated bioinformatics tools necessary for handling the vast datasets generated by high-resolution instruments. Investment focus remains heavily concentrated on developing integrated systems that offer high-throughput capabilities without compromising analytical performance, directly addressing the pressure on clinical laboratories to reduce turnaround times (TAT) and operational costs while expanding testing menus.

Regionally, North America maintains its dominance due to established reimbursement policies, high laboratory infrastructure maturity, and early adoption of novel diagnostic technologies, specifically in precision medicine and complex toxicology testing. However, the Asia Pacific (APAC) region is poised for the fastest growth, fueled by increasing healthcare expenditure, rapid expansion of hospital laboratories seeking international accreditation, and growing governmental initiatives focused on improving public health screening programs, notably newborn screening and infectious disease diagnostics. European market growth is steady, driven primarily by standardization efforts under updated IVD regulations and significant investments in liquid chromatography-tandem mass spectrometry (LC-MS/MS) systems for therapeutic drug monitoring (TDM) and endocrinology applications, reflecting a maturity in adopting high-precision methods.

Segmentation trends indicate that the tandem mass spectrometry (LC-MS/MS) segment remains the largest revenue contributor due to its established utility in high-volume clinical testing requiring superior sensitivity and multiplexing capabilities. Within the application segment, newborn screening and TDM are critical drivers, offering significant market stability. However, the fastest-growing application segment is expected to be endocrinology, spurred by the need for accurate quantification of complex steroid profiles and hormones, where traditional immunoassays often yield unreliable results due to structural similarities. Furthermore, the consumables and reagents segment is projected to grow proportionally higher than instrument sales, reflecting the expanding installed base and the continuous need for standardized assay kits and internal standards required for daily clinical operations, thus generating predictable recurring revenue streams for manufacturers.

AI Impact Analysis on Clinical Mass Spectrometry Sales Market

User queries regarding the impact of Artificial Intelligence (AI) on the Clinical Mass Spectrometry Sales Market predominantly revolve around three key areas: how AI can accelerate data interpretation, whether AI integration will simplify operational complexity for non-expert users, and the potential of machine learning to discover novel clinical biomarkers from complex MS spectra. Users are highly concerned about the bottleneck presented by data analysis—mass spectrometry generates massive, complex datasets, and manual interpretation is time-consuming and prone to variability. Expectations center on AI applications automating peak integration, improving spectral library matching accuracy, and providing immediate quality control feedback. Furthermore, there is significant interest in AI's role in translating metabolomic and proteomic data derived from clinical MS into actionable diagnostic insights, effectively bridging the gap between raw analytical data and clinical relevance, thereby enhancing the overall utility and efficiency of high-resolution mass spectrometry systems in routine clinical practice.

- AI-driven automation of data processing reduces turnaround time (TAT) for high-volume tests.

- Machine learning algorithms enhance spectral library matching accuracy and reduce false positives in toxicology screening.

- Predictive maintenance schedules for MS instruments are optimized using AI analysis of performance data.

- AI facilitates the identification of complex clinical biomarkers in large-scale proteomics and metabolomics studies.

- Integration of AI tools simplifies complex method validation and quality control procedures in clinical laboratories.

- Enhanced pattern recognition capabilities aid in classifying disease states from clinical mass spectral fingerprints.

- AI optimizes instrument parameters in real-time, improving overall data quality and consistency.

DRO & Impact Forces Of Clinical Mass Spectrometry Sales Market

The market dynamics are defined by powerful drivers, necessitating widespread adoption, countered by significant operational restraints, while technological innovation opens lucrative opportunities, all governed by critical impact forces. The primary drivers include the escalating global prevalence of chronic diseases requiring TDM, the superior analytical specificity offered by MS compared to immunoassays, and the rising global demand for comprehensive newborn screening programs utilizing multiplexed MS assays. Restraints primarily involve the substantial initial capital investment required for high-end MS systems, the complexity of method development and validation unique to mass spectrometry, and the scarcity of highly trained technical personnel capable of operating and maintaining these specialized instruments in smaller clinical settings. Opportunities are centered on the expansion of personalized medicine, the development of miniaturized and simplified benchtop systems, and the increased implementation of MS in infectious disease diagnostics and therapeutic antibody monitoring, offering significant growth potential.

The core driving force remains the clinical necessity for accurate, interference-free quantification, particularly for small molecules and hormones, where the limitations of legacy technologies are evident. This clinical pull, combined with manufacturer efforts to standardize IVD-compliant workflows, strongly promotes market growth. Conversely, regulatory hurdles surrounding the approval of new assays and the challenging reimbursement environment in certain regions act as primary dampeners on adoption speed. The impact forces are further shaped by the competitive landscape, where aggressive pricing strategies and rapid iteration of software usability define success. Technological innovation in ionization sources, such as ambient ionization techniques, is an enabling impact force, dramatically expanding the types of samples that can be analyzed rapidly and effectively.

Ultimately, the long-term positive impact force of increasing standardization and improved instrument automation is expected to overcome the short-term negative impact of high initial costs and training requirements. As manufacturers provide increasingly integrated 'sample-in, result-out' solutions and external reference labs offer specialized MS testing services, the access barrier is progressively lowered. This synergy of technological refinement and service integration ensures that the superior analytical performance of mass spectrometry systems will continue to displace conventional technologies, reinforcing its indispensable role in modern clinical diagnostics, thereby providing a sustained positive momentum to the global sales market throughout the forecast period.

Segmentation Analysis

The Clinical Mass Spectrometry Sales Market is highly segmented based on product type, application, end-user, and geography, reflecting the diverse clinical needs and technological complexity inherent in this field. Product segmentation differentiates between instruments and reagents/consumables, with instruments further categorized by technology (LC-MS/MS, GC-MS, MALDI-TOF). This structure helps market players tailor their offerings, recognizing that instrument sales represent high-value, intermittent revenue, while consumables and reagents generate stable, recurring income essential for long-term financial health. The analysis of these segments highlights the dominance of LC-MS/MS due to its versatility and high performance in toxicology and TDM, while high-resolution systems are gaining traction in research-heavy clinical areas like proteomics and metabolomics.

Application segmentation reveals the areas of highest clinical utility, including endocrinology, toxicology, newborn screening, therapeutic drug monitoring, and clinical microbiology. The increasing complexity of drug cocktails and the need for precision dosing underscore the importance of TDM, making it a consistently high-growth segment. Similarly, toxicology screening, driven by the opioid crisis and increased forensic testing, demands the high specificity of MS. End-user segmentation distinguishes between hospital laboratories, clinical reference laboratories, and academic/research institutions, with clinical reference laboratories representing the largest purchasers due to their centralized testing models, economies of scale, and high testing volume capabilities required to justify the capital investment in sophisticated MS platforms.

- Product Type:

- Instruments (LC-MS/MS, GC-MS, MALDI-TOF, ICP-MS)

- Reagents and Consumables (Assay Kits, Solvents, Standards, Columns)

- Application:

- Therapeutic Drug Monitoring (TDM)

- Endocrinology (Steroid and Hormone Testing)

- Toxicology and Forensics

- Newborn Screening

- Clinical Microbiology

- Others (Metabolomics, Proteomics)

- End-User:

- Clinical Reference Laboratories

- Hospital Laboratories

- Academic and Research Institutes

- Physician Office Laboratories (POLs)

- Technology:

- Single Quadrupole Mass Spectrometry

- Tandem Mass Spectrometry (Triple Quadrupole)

- Time-of-Flight Mass Spectrometry (TOF-MS)

- Hybrid Mass Spectrometry

Value Chain Analysis For Clinical Mass Spectrometry Sales Market

The value chain for the Clinical Mass Spectrometry Sales Market begins with upstream activities involving core technology research and development, particularly focusing on ionization techniques, mass analyzer design, and detector sensitivity enhancement. Key upstream suppliers include specialized manufacturers providing high-purity chemicals, specialized electronics, vacuum components, and precision mechanical parts necessary for instrument assembly. Intense proprietary knowledge protects the core component fabrication, creating high barriers to entry. Instrument manufacturers then integrate these components, developing sophisticated software and standardized clinical assay protocols, transforming raw components into integrated diagnostic solutions. The quality and performance of these upstream components directly dictate the final accuracy and reliability of the clinical system.

The midstream phase involves the manufacturing, assembly, rigorous quality control testing, and global sales/distribution of the finished mass spectrometry systems and associated consumables. Distribution channels are bifurcated into direct sales models, often employed for high-value instrument sales requiring extensive technical support and installation, and indirect channels (distributors and authorized resellers), which are common for reagent and consumable sales, especially in geographically fragmented markets like Asia Pacific. Effective distribution requires specialized logistics to handle sensitive instruments and ensure timely delivery of perishable reagents. Successful midstream operations depend heavily on regulatory navigation (FDA clearance, CE marking) and the provision of comprehensive post-sales service, training, and maintenance contracts.

Downstream activities focus on the clinical adoption, operational utilization, and ongoing support provided to end-users such as clinical reference laboratories and hospital pathology departments. Direct interactions involve technical applications specialists training laboratory personnel on method validation and routine use. The final value realization occurs when the clinical laboratory utilizes the instrument to generate accurate patient results, influencing treatment decisions. Potential customers highly value systems that minimize hands-on time and maximize regulatory compliance (IVD certification). The continuous need for standardized, high-quality consumables and preventative maintenance ensures a cyclical revenue stream in the downstream market, emphasizing the criticality of long-term customer relationships and sustained support infrastructure.

Clinical Mass Spectrometry Sales Market Potential Customers

Potential customers for Clinical Mass Spectrometry systems are primarily institutions requiring high analytical precision, high throughput, and the ability to perform complex, non-standardized testing beyond the scope of traditional immunoassay systems. The largest customer base resides in clinical reference laboratories, such as Quest Diagnostics or LabCorp analogs worldwide, which handle massive volumes of specialized esoteric testing, including complex toxicology panels, specialized endocrinology tests, and comprehensive TDM for critical care and psychiatry patients. These labs possess the centralized infrastructure, high operational scale, and specialized personnel necessary to justify and manage the advanced technology and methodological complexity of MS platforms. Their primary procurement criteria center on throughput, automation capabilities, and the availability of pre-validated, standardized clinical methods that reduce validation time.

Hospital laboratories, particularly those affiliated with major academic medical centers and large integrated healthcare networks, constitute the second major customer segment. While general hospital labs may not require MS for all routine tests, critical care hospitals utilize these systems for rapid toxicology screening in emergency settings and for timely TDM of narrow therapeutic index drugs, where rapid, accurate results directly impact patient survival. These customers prioritize ease of use, robustness, and connectivity with existing Laboratory Information Management Systems (LIMS). Furthermore, academic research institutions actively purchasing MS systems are considered indirect customers, as their research output often leads to the development and clinical translation of new MS-based biomarkers, eventually driving demand in routine clinical labs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.2 Billion |

| Market Forecast in 2033 | USD 11.1 Billion |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Agilent Technologies, Bio-Rad Laboratories, SCIEX (Danaher Corporation), Thermo Fisher Scientific, Waters Corporation, PerkinElmer, Shimadzu Corporation, Bruker Corporation, LGC Group, F. Hoffmann-La Roche Ltd, Randox Laboratories, JASCO Corporation, LECO Corporation, BMG LABTECH, AB Sciex, Gerstel GmbH & Co. KG, Analytik Jena AG, Cambridge Isotope Laboratories, Merck KGaA, Varian Medical Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Clinical Mass Spectrometry Sales Market Key Technology Landscape

The technological landscape of the Clinical Mass Spectrometry Sales Market is dominated by liquid chromatography-tandem mass spectrometry (LC-MS/MS), which has become the gold standard for clinical quantification due to its superior separation power (LC) combined with highly sensitive and selective detection (MS/MS, typically triple quadrupole). Innovations are focused on enhancing front-end separation, such as Ultra-Performance Liquid Chromatography (UPLC), which shortens analysis times dramatically, allowing labs to increase throughput without significant instrument fleet expansion. Furthermore, developments in ionization sources, specifically electrospray ionization (ESI) and atmospheric pressure chemical ionization (APCI), are being refined for greater robustness in clinical matrices, reducing the impact of complex sample components on assay performance and ensuring consistent, reproducible results essential for clinical certification.

A secondary, rapidly evolving area is the adoption of high-resolution mass spectrometry (HRMS), including technologies like Quadrupole-Time-of-Flight (Q-TOF) and Orbitrap systems. While traditionally confined to research, HRMS is increasingly moving into complex clinical applications, particularly untargeted metabolomics and comprehensive toxicology screening. HRMS offers the advantage of retrospective analysis; all molecular data is captured during the initial run, allowing analysts to search for unexpected compounds later without re-running the sample. This capability is highly valuable in toxicology and newborn screening, where novel drug metabolites or unexpected endogenous compounds might need identification. The challenge remains simplifying HRMS data processing, a bottleneck that AI and advanced bioinformatics tools are actively addressing to facilitate routine clinical use.

The critical technological trends shaping future sales include miniaturization and democratization. Benchtop systems are becoming smaller, more robust, and easier to operate, enabling their placement in decentralized hospital labs rather than only centralized reference facilities. This simplification lowers the barrier to entry, expanding the potential customer base. Moreover, the integration of automation solutions, such as automated sample preparation modules directly linked to the MS system, minimizes manual handling and reduces the risk of human error, which is paramount in a regulated clinical environment. These technological advancements collectively drive down the total cost of ownership (TCO) and enhance the operational efficiency, paving the way for mass spectrometry to become a routine, rather than specialized, clinical diagnostic tool.

Specific technological advancements are also evident in the MALDI-TOF segment, primarily used in clinical microbiology for rapid microbial identification. Improvements in spectral database coverage, automation of plate handling, and regulatory approvals for IVD-registered assays are accelerating its penetration into clinical microbiology laboratories globally, displacing slower, traditional culture-based identification methods. Furthermore, specialized applications like Inductively Coupled Plasma Mass Spectrometry (ICP-MS) are seeing niche growth in elemental analysis for trace metals and toxicology within clinical contexts, requiring extremely low detection limits and high throughput. The emphasis across all technological platforms is increasingly on standardization through IVD-registered kits, minimizing the need for extensive laboratory-developed method validation, which traditionally slowed adoption.

Regional Highlights

Regional dynamics play a crucial role in shaping the Clinical Mass Spectrometry Sales Market, influenced by varying healthcare expenditures, regulatory frameworks, technological adoption rates, and disease prevalence across continents. North America, encompassing the United States and Canada, currently holds the largest market share, characterized by high investment in advanced diagnostic infrastructure, robust reimbursement pathways for specialized MS tests (e.g., TDM and toxicology), and the strong presence of major market players. The region's market maturity allows for quick adoption of high-resolution and fully automated systems, driven largely by centralized reference laboratories managing extensive test menus.

Europe represents the second-largest market, exhibiting steady growth propelled by stringent regulatory mandates (such as the IVDR) demanding highly accurate and reliable diagnostic methods, favorable governmental support for personalized medicine initiatives, and high R&D spending in pharmaceutical and biotech sectors that often rely on clinical MS data. Key European countries, including Germany, the UK, and France, are major consumers of LC-MS/MS systems for endocrinology and newborn screening. However, the market faces structural complexities related to diverse national healthcare systems and differing reimbursement policies across the European Union member states, which can impact standardization and adoption speed.

The Asia Pacific (APAC) region is forecasted to achieve the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth is primarily attributed to rapidly expanding healthcare infrastructure, significant government investment in diagnostic technology upgrades, and increasing awareness regarding the benefits of accurate screening for infectious and inherited diseases, particularly in high-population countries like China and India. While initial market focus in APAC centered on basic GC-MS and single quadrupole systems, the increasing clinical affluence and the push towards international accreditation standards (e.g., CAP, ISO 15189) are driving a rapid transition toward high-end LC-MS/MS platforms. Market penetration is significantly aided by localized manufacturing, strategic partnerships, and lower production costs for certain consumables.

Latin America (LATAM) and the Middle East and Africa (MEA) regions collectively represent emerging markets for clinical mass spectrometry. Growth in LATAM is driven by increasing investment in private healthcare facilities and centralized clinical laboratories in countries like Brazil and Mexico, focusing initially on essential applications such as basic toxicology and limited TDM. The MEA market, though smaller, is showing promise, particularly in the Gulf Cooperation Council (GCC) countries, where substantial oil wealth is fueling massive investments in state-of-the-art diagnostic facilities and specialized disease centers, often bypassing older diagnostic technologies and directly adopting high-end MS solutions for genetic screening and advanced health profiling. Infrastructure development and stability remain key factors influencing market maturation in these regions.

- North America: Market leader; strong reimbursement; high demand for complex toxicology and TDM; mature infrastructure and early adoption of AI tools.

- Europe: Stable growth driven by stringent IVDR compliance; high adoption in endocrinology and newborn screening; market fragmented by diverse national reimbursement policies.

- Asia Pacific (APAC): Highest growth rate; increasing healthcare expenditure; rising demand for standardized testing in China and India; significant opportunities in new laboratory setup and infrastructure upgrades.

- Latin America (LATAM): Emerging market; growing private healthcare sector; focus on centralized reference laboratories in Brazil and Mexico; adoption constrained by capital access.

- Middle East & Africa (MEA): Niche high-value market in GCC countries; substantial government investment in advanced diagnostics; slower adoption in developing African nations due to infrastructure limitations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Clinical Mass Spectrometry Sales Market.- Agilent Technologies

- Bio-Rad Laboratories

- SCIEX (Danaher Corporation)

- Thermo Fisher Scientific

- Waters Corporation

- PerkinElmer

- Shimadzu Corporation

- Bruker Corporation

- LGC Group

- F. Hoffmann-La Roche Ltd

- Randox Laboratories

- JASCO Corporation

- LECO Corporation

- BMG LABTECH

- Cambridge Isotope Laboratories

- Merck KGaA

- Restek Corporation

- Phenomenex (Danaher Corporation)

- CIL (Cambridge Isotope Laboratories)

- AB Sciex

Frequently Asked Questions

Analyze common user questions about the Clinical Mass Spectrometry Sales market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of Clinical Mass Spectrometry over traditional immunoassays?

The primary driver is the superior analytical specificity and sensitivity offered by Clinical Mass Spectrometry (CMS). Unlike immunoassays, CMS systems minimize interference from cross-reactivity and matrix effects, providing highly accurate and definitive quantification, especially critical for complex small molecules and therapeutic drug monitoring (TDM).

Which mass spectrometry technology holds the largest market share in clinical diagnostics?

Liquid Chromatography-Tandem Mass Spectrometry (LC-MS/MS), specifically the triple quadrupole system, holds the largest market share. This dominance is due to its established utility, robustness, high throughput capabilities, and regulatory acceptance for high-volume clinical applications like toxicology and TDM.

What are the main operational challenges faced by clinical laboratories adopting MS technology?

The main operational challenges include the high initial capital investment required for MS instruments, the complexity and time needed for developing and validating laboratory-developed tests (LDTs), and the critical shortage of skilled technical personnel trained in MS operation and maintenance.

How is Artificial Intelligence (AI) influencing the clinical mass spectrometry workflow?

AI significantly impacts the workflow by automating complex data interpretation, enhancing the speed and accuracy of spectral library matching, and streamlining quality control processes. This automation reduces analysis time, making high-resolution data manageable in routine clinical settings.

Which application segment is expected to exhibit the fastest growth in the CMS market?

The endocrinology segment, focusing on accurate steroid and complex hormone profiling, is expected to show the fastest growth. This is driven by the recognized limitations of traditional immunoassays in this field and the increasing clinical demand for interference-free measurement of structurally similar hormone metabolites.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager