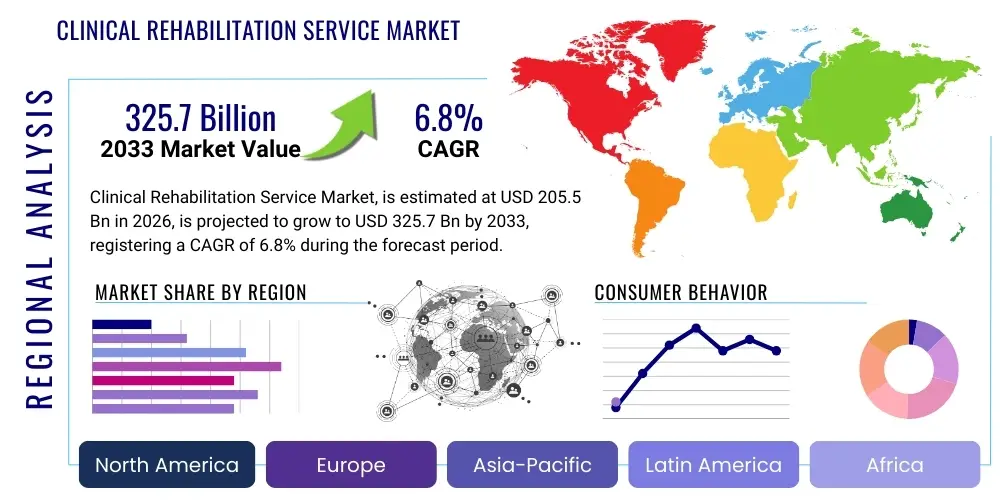

Clinical Rehabilitation Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435603 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Clinical Rehabilitation Service Market Size

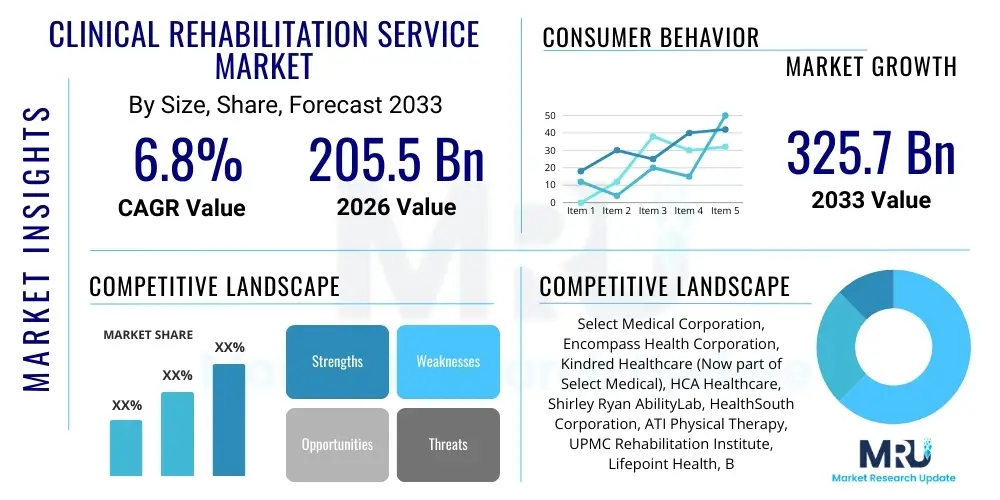

The Clinical Rehabilitation Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $205.5 Billion in 2026 and is projected to reach $325.7 Billion by the end of the forecast period in 2033.

Clinical Rehabilitation Service Market introduction

The Clinical Rehabilitation Service Market encompasses a broad spectrum of medical services designed to help patients recover, maintain, or improve functional abilities lost due to injury, illness, or chronic conditions. These services are crucial for enhancing the quality of life and promoting independence across diverse patient populations, ranging from those recovering from orthopedic surgery or stroke to individuals managing chronic obstructive pulmonary disease (COPD) or neurological disorders. Core offerings typically include physical therapy (PT), occupational therapy (OT), and speech-language pathology (SLP), delivered across various settings such as hospitals, specialized rehabilitation centers, outpatient clinics, and increasingly, in the patient's home through telerehabilitation platforms.

The primary applications of clinical rehabilitation services are extensive, covering musculoskeletal disorders, cardiovascular and pulmonary conditions, neurological impairments (including traumatic brain injury and spinal cord injury), and developmental delays in pediatric populations. These services aim not just for physical restoration but also focus on cognitive and psychological well-being, utilizing customized treatment plans that often integrate sophisticated equipment like robotics, virtual reality systems, and advanced diagnostic tools. The benefits realized by patients include reduced pain, improved mobility and balance, enhanced communication skills, and the capacity to perform daily living activities, leading to lower rates of readmission and reduced long-term care costs.

Major driving factors fueling the expansion of this market include the global demographic shift toward an aging population, which is inherently more susceptible to chronic degenerative conditions requiring ongoing rehabilitative care. Furthermore, advancements in surgical techniques mean more individuals survive acute events (like strokes or major traumas) but require intensive post-acute care to regain full function. Regulatory support emphasizing preventative care and early intervention, alongside increasing consumer awareness regarding the efficacy of rehabilitation in achieving optimal recovery outcomes, solidifies the sustained growth trajectory of the clinical rehabilitation service sector globally, pushing providers towards specialized and outcome-based care models.

Clinical Rehabilitation Service Market Executive Summary

The Clinical Rehabilitation Service Market is experiencing robust expansion driven by structural shifts in global healthcare delivery and patient demographics. Key business trends include a major pivot towards outpatient and community-based rehabilitation centers, fueled by cost-effectiveness and patient preference for receiving care closer to home. There is also a significant merger and acquisition activity among private equity firms and large health systems aiming to consolidate fragmented service providers and integrate rehabilitation into the full continuum of care, ensuring seamless transitions from acute to post-acute settings. Innovation in service delivery, particularly the scaling of hybrid models combining in-person sessions with digitally-enabled remote monitoring and therapy, is redefining competitive dynamics and provider performance metrics.

Segment trends highlight the accelerated growth of specialized rehabilitation services, particularly cardiac rehabilitation, pulmonary rehabilitation, and neuro-rehabilitation, driven by the rising prevalence of non-communicable diseases (NCDs) globally. Technology adoption is creating distinct segment differentiation; for instance, rehabilitation utilizing advanced robotics and exoskeletons commands a premium and attracts sophisticated patient populations seeking faster, data-driven recovery paths. Moreover, the shift from fee-for-service to value-based care models is profoundly influencing segment growth, compelling providers to prioritize demonstrable patient outcomes (e.g., lower readmission rates, improved functional independence) to secure favorable reimbursement contracts and strategic partnerships with major payers.

Regionally, North America maintains market leadership due to high healthcare expenditure, sophisticated infrastructure, and early adoption of advanced rehabilitation technologies, alongside robust government and private payer reimbursement mechanisms. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by improving healthcare access, massive population bases requiring chronic and geriatric care, and increasing governmental investments in healthcare infrastructure across major economies like China and India. European markets, characterized by established universal healthcare systems, focus heavily on integrating rehabilitation services into preventative health programs, ensuring stable demand supported by comprehensive social security frameworks, though growth rates are generally moderated compared to the rapidly evolving APAC landscape.

AI Impact Analysis on Clinical Rehabilitation Service Market

User inquiries regarding Artificial Intelligence (AI) in clinical rehabilitation services frequently center on efficiency gains, personalization of therapy, and the potential displacement of clinical roles. A predominant concern involves understanding how AI can synthesize complex patient data—including wearables data, electronic health records (EHRs), and biomechanical assessments—to develop dynamically adjusting and personalized treatment protocols that surpass human capability. Users are keen to identify AI applications in diagnostic accuracy, particularly in gait analysis and movement pattern recognition, and how predictive analytics can determine optimal intervention timing and anticipate potential complications. There is also significant interest in AI's role in facilitating telerehabilitation, specifically through virtual coaching and objective outcome measurement, mitigating access barriers in remote or underserved areas. The overall expectation is that AI will enhance clinical decision support, standardize treatment quality, and allow therapists to focus more intently on direct patient interaction requiring empathy and complex problem-solving, rather than administrative tasks.

The introduction of AI is fundamentally transforming the assessment phase of clinical rehabilitation. AI algorithms can process visual and sensor data captured during patient movement, providing instantaneous, highly objective feedback on performance metrics that are difficult to quantify manually. This data drives predictive modeling, allowing clinicians to forecast recovery trajectories with greater accuracy and adjust intensity or modality of therapy in real-time. For instance, in neurological rehabilitation, machine learning can identify subtle functional improvements or declines far earlier than traditional methods, optimizing the critical recovery window post-stroke or injury. Furthermore, AI-powered systems are crucial for managing the immense data generated by connected devices and remote monitoring programs, ensuring that therapists receive actionable insights rather than data overload, thereby significantly improving clinical workflow efficiency.

Despite the immense potential, user concerns remain focused on the ethical implications of data privacy, algorithmic bias potentially leading to disparities in care, and the necessity for extensive training of clinical staff to effectively utilize AI tools. The market is trending toward integrated AI solutions that function as sophisticated clinical assistants, not replacements for human judgment. Providers adopting AI are strategically positioning themselves as leaders in outcome-based care, using AI-driven insights to negotiate better reimbursement rates and attract patients seeking cutting-edge treatment. This strategic integration is pivotal for scaling personalized therapy across large patient populations while maintaining high standards of care consistency and maximizing resource utilization.

- AI-driven personalized treatment protocol generation based on real-time biometric feedback.

- Enhanced diagnostic capabilities via machine learning for objective gait and movement analysis.

- Predictive modeling of patient recovery outcomes, optimizing resource allocation and intervention timing.

- Automation of administrative and documentation tasks, freeing up therapist time for direct patient care.

- Development of intelligent virtual coaches and chatbots for remote patient motivation and monitoring in telerehabilitation.

- Improved risk assessment and prevention of secondary complications through continuous data analysis.

- Standardization of care quality across large networks through algorithmically guided clinical pathways.

- Utilization of computer vision for posture correction and exercise adherence monitoring during remote sessions.

DRO & Impact Forces Of Clinical Rehabilitation Service Market

The Clinical Rehabilitation Service Market operates under a complex interplay of Dynamics, Restraints, and Opportunities, collectively defined by significant Impact Forces. A primary driver is the accelerating global prevalence of chronic diseases, including diabetes, heart disease, and neurological conditions, all of which necessitate long-term rehabilitative support to manage symptoms and maintain function. Concurrently, increasing road traffic accidents, sports injuries, and workplace injuries contribute substantially to the demand for acute and sub-acute physical rehabilitation. These demographic and epidemiological factors create a foundational, non-cyclical demand for services, particularly within geriatric care settings, where multi-morbidity often requires coordinated, interdisciplinary rehabilitation interventions focused on maintaining functional independence and delaying institutionalization.

Significant restraints on market growth primarily revolve around challenges in healthcare financing and infrastructure. Variable reimbursement policies across different geographies, particularly regarding coverage for advanced or technology-driven therapies (like robotics or VR), can limit patient access and provider investment. Furthermore, the global shortage of qualified rehabilitation professionals (physical therapists, occupational therapists, and speech pathologists) represents a severe bottleneck, particularly in rural and low-income regions, hindering capacity expansion necessary to meet rising demand. Regulatory hurdles related to licensing and data security in cross-border telerehabilitation also pose limitations, requiring providers to navigate fragmented and complex compliance landscapes, especially when scaling digital solutions.

Opportunities for growth are abundant, spearheaded by the rapid adoption of telerehabilitation and remote monitoring technologies, which address both the access and workforce constraints by enabling services to be delivered efficiently outside traditional facility walls. Investment in specialized rehabilitation centers focusing on niche areas such as sports medicine, vestibular disorders, or pediatric development offers high-margin growth avenues. The shift towards value-based care incentivizes providers to invest in technologies and protocols that demonstrate measurable positive outcomes, fostering a competitive environment focused on clinical excellence and patient satisfaction. These factors, combined with the increasing integration of consumer-grade wearables data into clinical decision-making, are creating a potent force driving market innovation and penetration into previously underserved populations, fundamentally reshaping service delivery models towards integrated, predictive, and accessible care.

Segmentation Analysis

The Clinical Rehabilitation Service Market is extensively segmented based on service type, application/condition, setting, and end-user, providing a granular view of demand patterns and provider specialization. The segmentation by service type, primarily comprising Physical Therapy (PT), Occupational Therapy (OT), Speech-Language Pathology (SLP), and Respiratory/Cardiac Rehabilitation, reflects the distinct clinical needs of different patient populations. The growing emphasis on preventative rehabilitation and wellness programs is broadening the scope of PT and OT beyond post-acute recovery into chronic condition management and performance enhancement. Furthermore, the application segmentation reveals critical growth sectors such as neurological rehabilitation, driven by the increasing incidence of strokes and Parkinson's disease, and musculoskeletal rehabilitation, consistently buoyed by aging populations and orthopedic procedures.

Segmentation by setting—Inpatient Rehabilitation Facilities (IRFs), Skilled Nursing Facilities (SNFs), Outpatient Clinics, and Home Healthcare—is pivotal as it dictates the intensity and duration of care, as well as the cost structure and reimbursement models. Outpatient clinics are expected to demonstrate the fastest growth due to lower operational costs and the convenience they offer, alongside the exponential expansion of home-based rehabilitation facilitated by digital health technologies. This shift towards lower-acuity, community-based settings is driven by payer mandates seeking cost-effective alternatives to prolonged institutional stays, placing pressure on providers to ensure quality and integration across the care continuum.

- Service Type:

- Physical Therapy (PT)

- Occupational Therapy (OT)

- Speech-Language Pathology (SLP)

- Respiratory Therapy

- Cardiac Rehabilitation

- Cognitive Rehabilitation

- Application/Condition:

- Neurological Rehabilitation (Stroke, TBI, Spinal Cord Injury)

- Musculoskeletal Rehabilitation (Orthopedic Injuries, Arthritis)

- Cardiovascular and Pulmonary Rehabilitation

- Pediatric Rehabilitation

- Pain Management Rehabilitation

- Sports Injury Rehabilitation

- Setting:

- Inpatient Rehabilitation Facilities (IRFs)

- Skilled Nursing Facilities (SNFs)

- Outpatient Rehabilitation Centers

- Home Healthcare (Home-based Rehabilitation)

- Hospitals

- End-User:

- Hospitals and Clinics

- Specialized Rehabilitation Centers

- Academic and Research Institutes

- Insurance Providers/Payers

Value Chain Analysis For Clinical Rehabilitation Service Market

The value chain for clinical rehabilitation services begins with upstream activities dominated by equipment manufacturers and technology providers. This includes developers of highly specialized robotic systems (exoskeletons, gait trainers), manufacturers of traditional physical therapy equipment, and, increasingly, software companies offering Electronic Health Records (EHRs) specifically tailored for rehabilitation documentation, and developers of telerehabilitation platforms and wearable sensors. The efficiency and quality of rehabilitation delivery are heavily dependent on the innovation and reliability provided by these upstream suppliers. Trends show a growing integration of hardware and software, where equipment vendors partner with AI developers to offer comprehensive, data-driven solutions that enhance both therapist efficiency and patient outcomes. Access to high-quality, specialized equipment is a key differentiator for providers aiming to attract patients seeking cutting-edge care.

Midstream activities involve the core service delivery providers: hospitals, dedicated inpatient facilities, large outpatient clinic chains, and independent private practices. This segment focuses on staffing, infrastructure management, clinical protocol development, and patient acquisition. Distribution channels are highly fragmented, categorized broadly into direct and indirect methods. Direct distribution involves services delivered within a healthcare organization's integrated network, such as hospital-owned rehabilitation units or large healthcare system outpatient centers. These channels benefit from streamlined patient referrals and centralized management. Indirect distribution involves standalone private clinics or third-party providers who contract with health systems or insurance payers, relying heavily on community reputation and payer network inclusion for patient volume. The effectiveness of distribution is heavily influenced by local payer-provider dynamics and referral relationships.

Downstream activities center on the end-users—the patients—and the payers (government entities, private insurance companies, and self-pay individuals). Payers exert significant control over the value chain by setting reimbursement rates, defining covered services, and increasingly scrutinizing outcome data to determine payment. This downstream pressure for demonstrable value drives providers to invest in measurable technologies and standardized clinical pathways. Furthermore, the rise of consumer empowerment means patients are more involved in choosing providers, making quality of care, specialized expertise, and positive patient experience critical for market success. Optimization throughout the value chain relies on efficient data exchange between upstream technology providers, midstream service deliverers, and downstream payers for streamlined billing and continuous quality improvement.

Clinical Rehabilitation Service Market Potential Customers

The primary purchasers of clinical rehabilitation services are multifaceted, encompassing organizational entities, direct consumer payments, and governmental bodies. Hospitals and integrated health systems are major buyers, seeking to provide a continuum of care that includes both acute and post-acute rehabilitation services. These institutions invest in or contract with rehabilitation facilities to ensure optimal patient discharge planning, reduce readmission rates, and maintain quality scores, especially for high-volume procedures like joint replacements or cardiac events. Specialized rehabilitation centers, which focus intensely on complex conditions such as spinal cord injury or traumatic brain injury, also represent significant internal end-users, requiring continuous investment in specialized staffing, technology, and facility upkeep to maintain their market positioning and clinical expertise.

A second crucial group comprises third-party payers, including large commercial insurance companies, Medicare, Medicaid, and various national health services globally. While they do not directly consume the service, they dictate demand and access by determining coverage limits, co-pays, and reimbursement rates for providers. Their evolving focus on value-based models means they are increasingly sophisticated buyers, relying on data analytics to partner with providers who can deliver cost-effective care with superior clinical outcomes. Their purchasing decisions heavily influence provider behavior, driving consolidation and technological adoption in favor of measurable, evidence-based interventions. This necessitates providers viewing payers not just as revenue sources but as sophisticated customers demanding specific performance metrics.

Individual patients, particularly those seeking elective rehabilitation (such as sports performance enhancement or wellness therapy not fully covered by insurance) or those managing chronic conditions with limited governmental support, represent the direct consumers of these services. This segment is highly sensitive to service convenience, geographical proximity, and reputation. Furthermore, employer groups and worker compensation schemes act as indirect customers, purchasing rehabilitation services to facilitate the rapid and safe return of injured employees to the workforce, prioritizing providers known for efficient case management and effective injury recovery protocols. The diversity of these potential customers requires market players to develop highly flexible and specialized offerings tailored to varying financial models and clinical needs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $205.5 Billion |

| Market Forecast in 2033 | $325.7 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Select Medical Corporation, Encompass Health Corporation, Kindred Healthcare (Now part of Select Medical), HCA Healthcare, Shirley Ryan AbilityLab, HealthSouth Corporation, ATI Physical Therapy, UPMC Rehabilitation Institute, Lifepoint Health, Brooks Rehabilitation, Össur Corporate, DJO Global, Bionik Laboratories Corp., Ekso Bionics, ReWalk Robotics Ltd., Zimmer Biomet, Fresenius Medical Care (FMC), RehabCare (A Kindred Company), Providence St. Joseph Health, Mednax. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Clinical Rehabilitation Service Market Key Technology Landscape

The technological landscape of the Clinical Rehabilitation Service Market is rapidly evolving, moving beyond traditional manual techniques to embrace sophisticated digital and mechanical assistance tools. Robotics is a transformative element, introducing exoskeletons for gait training, robotic arms for upper extremity rehabilitation, and intelligent movement sensors that provide quantifiable data on patient performance. These devices enable high-intensity, repetitive, and precise training, which is crucial for neurological recovery (e.g., post-stroke). The clinical utility of robotics lies in its ability to offer standardized, tireless therapeutic interventions, enhancing neuroplasticity and ensuring consistent application of force or movement patterns far exceeding human capacity, thus accelerating recovery timelines and improving long-term functional outcomes.

Virtual Reality (VR) and Augmented Reality (AR) systems are gaining traction, providing immersive and engaging environments for therapeutic exercises. VR rehabilitation often involves gamified platforms that motivate patients to perform repetitive tasks, improving motor skills, balance, and cognitive function in a safe, controlled setting. These systems generate comprehensive performance data, allowing therapists to track progress objectively and adjust difficulty levels dynamically. Furthermore, the rise of advanced wearable technology, including smart sensors and biometric trackers, allows continuous monitoring of patient activity, physiological responses, and adherence outside the clinical setting. This influx of data is critical for refining treatment plans and ensuring the continuity of care between in-person sessions, a crucial component in the success of chronic condition management.

The integration of Tele-rehabilitation platforms represents another cornerstone of the modern technological landscape, facilitating remote consultation, supervision, and delivery of therapy. These platforms utilize high-definition video conferencing, specialized software, and connected peripherals to bridge geographical gaps, making specialized care accessible to remote populations and reducing patient travel burden. Crucially, these platforms are increasingly being powered by AI algorithms that analyze patient movement captured via standard cameras or depth sensors, providing real-time feedback and adherence scores. This shift towards digitally-enabled, distributed care models is optimizing facility capacity, lowering operational costs, and positioning technology as essential infrastructure, rather than merely an optional enhancement, for competitive clinical rehabilitation providers.

Regional Highlights

- North America: North America, particularly the United States, commands the largest share of the Clinical Rehabilitation Service Market, driven by high per-capita healthcare spending, robust infrastructure, and favorable reimbursement policies through Medicare and private payers for specialized services. The region is characterized by early and aggressive adoption of cutting-edge technologies, including robotics and advanced VR systems, often facilitated by competitive private healthcare systems and a strong focus on specialized rehabilitation centers (e.g., IRFs). The presence of numerous large, well-established national and regional rehabilitation chain providers, coupled with high awareness regarding the benefits of post-acute care, ensures sustained demand. Regulatory initiatives focusing on outcome-based care, such as the implementation of the Patient-Driven Payment Model (PDPM) in SNFs, continually push providers toward maximizing efficiency and demonstrable patient recovery, fueling investment in advanced diagnostic and therapeutic tools.

- Europe: Europe represents a mature and stable market, characterized by comprehensive, often state-funded, universal healthcare systems that prioritize integrated and accessible rehabilitation services. Western European nations, notably Germany, the UK, and France, exhibit high utilization rates driven by an exceptionally large and aging population requiring rehabilitation for cardiovascular diseases, stroke, and orthopedic conditions. Market growth, while steady, is constrained by rigorous regulatory approval processes for new medical devices and technologies compared to the US, and national budgeting cycles that can influence capital expenditure on advanced equipment. However, strong emphasis on patient rehabilitation within the European Union's public health strategies ensures predictable, high demand. Eastern European markets are showing accelerated growth due to increasing private sector investment bridging gaps in previously underserved public healthcare infrastructure.

- Asia Pacific (APAC): The APAC region is forecast to be the fastest-growing market globally, presenting immense untapped potential. This rapid expansion is primarily attributed to rapidly increasing healthcare expenditure, massive population density, rising disposable incomes in key economies (China, India, Japan, South Korea), and increasing awareness about therapeutic efficacy. Governments across the region are actively investing in healthcare infrastructure development, establishing new rehabilitation centers, and training specialized personnel to address the burgeoning burden of chronic diseases and age-related ailments. While infrastructure sophistication varies, countries like Japan and South Korea are leaders in adopting high-tech rehabilitation solutions, including robotics and AI, often driven by the urgent need to manage rapidly aging societies and mitigate workforce shortages. Market players focus on partnerships and localized service models to navigate diverse regulatory and cultural landscapes, capitalizing on the massive shift from traditional medicine toward evidence-based clinical interventions.

- Latin America, Middle East, and Africa (MEA): These regions are emerging markets with varied growth trajectories. Latin America is driven by increased public and private investment in health services, particularly in countries like Brazil and Mexico, though economic instability and fragmented payer systems pose challenges. The Middle East demonstrates focused growth, particularly in the UAE and Saudi Arabia, characterized by high spending on premium rehabilitation facilities aimed at medical tourism and specialized care, often featuring state-of-the-art technology. Africa remains largely constrained by limited infrastructure and low per-capita spending, with services concentrated in major urban centers, though governmental and NGO initiatives are starting to improve basic access and training for core rehabilitation services, focusing initially on community-based care models.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Clinical Rehabilitation Service Market.- Select Medical Corporation

- Encompass Health Corporation

- Kindred Healthcare (Now part of Select Medical)

- HCA Healthcare

- Shirley Ryan AbilityLab

- HealthSouth Corporation

- ATI Physical Therapy

- UPMC Rehabilitation Institute

- Lifepoint Health

- Brooks Rehabilitation

- Össur Corporate

- DJO Global

- Bionik Laboratories Corp.

- Ekso Bionics

- ReWalk Robotics Ltd.

- Zimmer Biomet

- Fresenius Medical Care (FMC)

- RehabCare (A Kindred Company)

- Providence St. Joseph Health

- Mednax

- Hospital for Special Surgery (HSS)

- Mary Free Bed Rehabilitation Hospital

- Kessler Institute for Rehabilitation

Frequently Asked Questions

Analyze common user questions about the Clinical Rehabilitation Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are primarily driving the growth of the Clinical Rehabilitation Service Market?

Market growth is predominantly driven by the accelerating global aging population, leading to a higher prevalence of chronic and degenerative conditions (like cardiovascular disease and stroke) requiring extensive rehabilitative support. Additionally, advancements in medical technology improving patient survival rates after acute events, coupled with increasing governmental and private investment in value-based care emphasizing measurable recovery outcomes, strongly contribute to sustained market expansion.

How is technology, specifically Artificial Intelligence (AI), impacting service delivery in rehabilitation?

AI is transforming service delivery by enabling highly personalized and objective therapeutic interventions. AI is used in gait and movement analysis for precise diagnostics, developing adaptive treatment plans based on real-time biometric data, and powering sophisticated telerehabilitation platforms for remote monitoring and virtual coaching, ultimately enhancing efficiency and standardizing the quality of care.

Which segmentation setting is expected to witness the fastest growth?

The Outpatient Rehabilitation Centers and Home Healthcare segments are projected to exhibit the fastest growth. This trend is fueled by their cost-effectiveness compared to inpatient facilities, increasing patient preference for community-based or home care, and the scalability offered by digital health and telerehabilitation platforms that facilitate high-quality care delivery outside traditional institutional walls.

What are the primary restraints limiting market potential in developing regions?

In developing regions, market potential is primarily restrained by insufficient healthcare infrastructure, particularly the lack of specialized rehabilitation centers and advanced equipment. Furthermore, severe shortages of trained rehabilitation professionals (physical therapists, occupational therapists), coupled with limited public and private insurance coverage for long-term care, significantly restrict service accessibility and market penetration.

Which geographic region currently holds the largest market share for clinical rehabilitation services?

North America, led by the United States, currently holds the largest market share. This dominance is attributed to high healthcare expenditure, established and sophisticated reimbursement structures that support specialized rehabilitation, a high volume of orthopedic and neurological procedures, and the early adoption and integration of advanced robotic and digital therapeutic technologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager