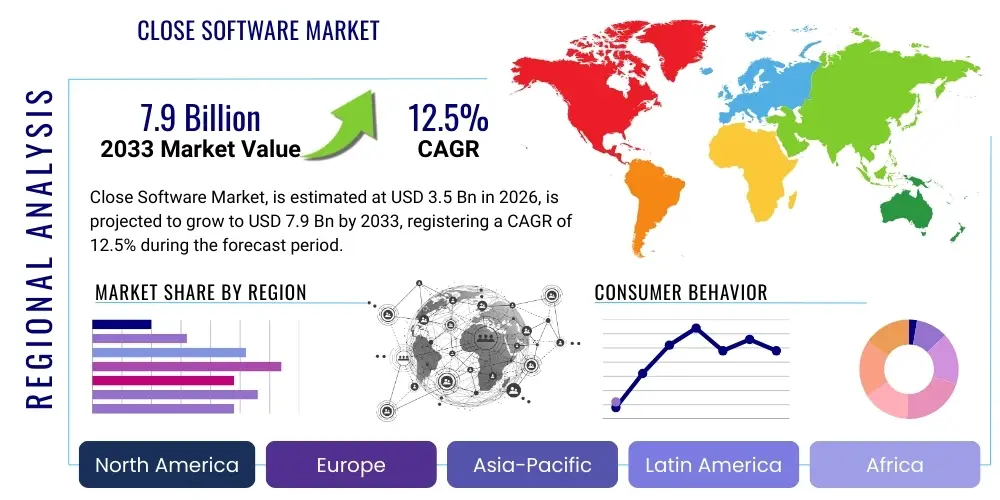

Close Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439038 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Close Software Market Size

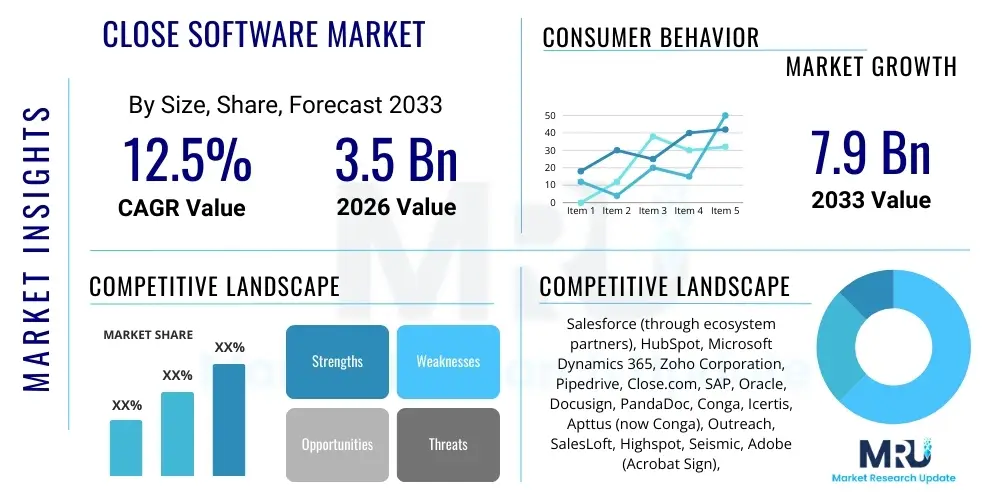

The Close Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $3.5 Billion in 2026 and is projected to reach $7.9 Billion by the end of the forecast period in 2033.

Close Software Market introduction

The Close Software Market encompasses specialized applications and platforms designed to optimize and automate the final stages of the sales cycle, specifically focusing on deal closure, contract management, and post-sale follow-up. This segment of the broader Customer Relationship Management (CRM) ecosystem is critical for businesses aiming to enhance sales efficiency, improve forecasting accuracy, and accelerate revenue realization. These solutions move beyond standard CRM features by integrating tools for proposal generation, negotiation tracking, e-signature, and seamless transition of a finalized deal into the operational pipeline, such as invoicing or service delivery.

Products within this domain typically offer robust features such as intelligent workflow automation, pipeline visualization optimized for closure metrics, and deep integration with existing enterprise resource planning (ERP) systems and financial software. The primary applications include automated task management for sales representatives, real-time analytics concerning deal velocity and conversion rates, and compliance checks related to contract execution. These tools are fundamental for sales leadership seeking granular control and predictive capabilities over quarterly results, ensuring that bottlenecks in the final stages are promptly identified and resolved.

The market is primarily driven by the global imperative for digital transformation across sales organizations, seeking to minimize manual data entry, reduce human error in contract drafting, and ensure a streamlined customer experience during the critical closing phase. The increasing complexity of regulatory environments and the global shift towards subscription-based or outcome-based pricing models necessitate sophisticated software that can handle nuanced contractual terms and recurring revenue management, further bolstering the demand for dedicated close software solutions that guarantee efficiency and compliance.

Close Software Market Executive Summary

The Close Software market is experiencing accelerated adoption driven by macro-level business trends emphasizing hyper-automation and predictive analytics in sales operations. A significant trend involves the incorporation of advanced machine learning algorithms to assess deal health and predict the probability of closure, enabling sales teams to prioritize high-potential opportunities efficiently. Furthermore, the shift towards remote and hybrid work models has solidified the necessity for cloud-native closing tools that offer secure, collaborative environments for dispersed teams to manage contracts and final negotiations seamlessly, driving robust growth in the Software-as-a-Service (SaaS) deployment segment globally.

Regionally, North America maintains its dominance due to the high concentration of technology innovators and early adoption of sophisticated sales technologies within major corporations, particularly in the tech and financial services sectors. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), fueled by aggressive digital investment by small and medium-sized enterprises (SMEs) and expanding economic activity in emerging markets like India and Southeast Asia. European markets are characterized by strong regulatory compliance requirements, leading to high demand for close software solutions that emphasize stringent data governance and contractual security features.

Segmentation trends indicate a strong preference for integration capabilities, where solutions that seamlessly embed into existing CRM ecosystems (such as Salesforce or Microsoft Dynamics) are highly favored. Verticalization is also a key segment trend, with specialized close software emerging to cater specifically to regulated industries like healthcare and banking, which require unique compliance workflows and documentation standards. The small and medium enterprise (SME) segment is becoming increasingly crucial, utilizing simplified, subscription-based closing platforms that offer essential automation features without the high upfront investment required by large enterprise suites.

AI Impact Analysis on Close Software Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Close Software Market primarily revolve around the automation of critical, high-value tasks, the ethical use of predictive scoring, and the potential displacement of sales support roles. Users frequently inquire about the reliability of AI in generating complex contract language, its ability to assess counterparty risk accurately, and how AI-driven insights can genuinely enhance, rather than obstruct, the human element of complex negotiations. There is also a significant concern regarding data privacy and the proprietary nature of deal information when processed through external AI models, alongside a high expectation for AI to significantly reduce the time-to-close metric.

Based on this analysis, the key thematic summary is that AI is fundamentally reshaping the closure process by transforming it from a reactive, effort-based activity into a proactive, data-driven science. Users anticipate AI will provide unprecedented predictive accuracy for sales forecasting, automate mundane administrative tasks associated with contract finalization, and furnish sales professionals with real-time negotiation intelligence. However, this transformation must be managed carefully, ensuring ethical guidelines govern the use of predictive scoring to prevent biased outcomes and maintaining robust security frameworks to protect sensitive deal documentation throughout the automated workflow.

The integration of deep learning and Natural Language Processing (NLP) into close software is leading to the development of "Cognitive Closure Platforms." These platforms leverage AI to analyze communication patterns during negotiations, identify potential deal derailers based on sentiment analysis of email exchanges, and automatically generate optimal contract redlines based on predefined legal parameters. This high degree of automation necessitates that vendors focus intensely on explainable AI (XAI) to ensure that users understand the rationale behind suggested actions, building trust and accelerating the adoption of these sophisticated tools.

- AI automates contract generation and verification against compliance templates, drastically reducing legal review cycles.

- Predictive analytics algorithms calculate deal probability scores using historical data and real-time activity metrics.

- Machine learning enhances negotiation strategies by analyzing competitor positioning and suggesting optimal concession points.

- Natural Language Processing (NLP) reviews client communication (emails, transcripts) for sentiment and risk indicators.

- AI-powered tools automate the transition of deal data into financial systems (invoicing, revenue recognition), eliminating manual handover errors.

DRO & Impact Forces Of Close Software Market

The Close Software Market is significantly driven by the accelerating demand for sales process efficiency and the subsequent need for accurate, real-time revenue forecasting, which is critical for corporate financial health and investor relations. Restraints largely center on the challenges associated with complex legacy system integration and profound data security and compliance requirements, especially across heavily regulated global industries. Opportunities are abundant, specifically through the leveraging of AI and predictive intelligence to deliver hyper-personalized closing experiences, coupled with the expansion into niche industry verticals requiring specialized contractual workflows, collectively exerting strong positive impact forces on market expansion despite inherent operational hurdles.

Key drivers include the pervasive trend of digital transformation efforts that mandate end-to-end automation of the sales process, ensuring that the last mile—the closure—is as optimized as the lead generation phase. The rise of sophisticated Enterprise Resource Planning (ERP) and advanced CRM systems creates a technological environment conducive to the adoption of specialized close software that can provide critical integration bridges. Furthermore, the global proliferation of complex, multi-layered contract structures, especially in technology and services agreements, mandates dedicated software to manage version control, approval workflows, and legal adherence efficiently.

Restraints primarily involve the substantial costs and time associated with migrating sales and contract data from outdated, disparate systems into a unified close software platform, often requiring extensive customization to match specific organizational policies. Data sovereignty concerns and stringent regional compliance mandates (such as GDPR or CCPA) present significant challenges, as vendors must guarantee that sensitive financial and contractual data is handled securely and legally across various jurisdictions. The final crucial restraint is user adoption resistance, particularly among long-tenured sales professionals who rely on established, manual negotiation processes and may view new automated tools with skepticism.

Segmentation Analysis

The Close Software market is strategically segmented based on factors including deployment model, organization size, component type, and vertical application, reflecting the diverse needs of the global business landscape. The dominance of the cloud-based deployment model highlights the demand for agility, scalability, and accessibility for remote sales teams, particularly beneficial for SMEs. Segmentation by component is crucial, differentiating between core software functionality and the surrounding ecosystem services, such as managed integrations and consulting, which often represent substantial revenue streams for vendors. Analyzing the market across various enterprise sizes provides clarity on pricing strategies, feature complexity, and implementation requirements, with large enterprises demanding highly customizable, robust platforms and SMEs seeking simpler, out-of-the-box solutions.

- By Component:

- Software (Platform and Applications)

- Services (Consulting, Integration, Support, and Maintenance)

- By Deployment Model:

- Cloud-Based (SaaS)

- On-Premise (Legacy and Hybrid Deployments)

- By Organization Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By Application/End-User Vertical:

- BFSI (Banking, Financial Services, and Insurance)

- IT and Telecommunications

- Retail and E-commerce

- Manufacturing

- Healthcare and Pharmaceuticals

- Media and Entertainment

- Other Verticals (Real Estate, Education, Government)

Value Chain Analysis For Close Software Market

The value chain of the Close Software market begins with upstream activities focused on foundational technology development, including providers of cloud infrastructure, specialized AI/ML libraries, and core database management systems necessary for handling vast amounts of deal data. These technology enablers provide the essential components upon which close software platforms are built. Midstream activities involve the core competencies of software development companies, which focus on designing, coding, testing, and continuously updating the application layer, ensuring integration compatibility with popular CRM, ERP, and legal technology stacks, optimizing user experience, and developing proprietary algorithms for predictive closure analytics.

Downstream activities concentrate heavily on distribution, implementation, and post-sale support. Distribution channels are bifurcated into direct sales models, often utilized for complex enterprise deployments requiring extensive customization and dedicated account management, and indirect channels, which utilize value-added resellers (VARs), system integrators, and strategic partnerships, particularly vital for penetrating global and SME markets. Implementation services, integration consulting, and continuous customer success management form the crucial final links, ensuring that the software is effectively deployed, adopted by the sales force, and delivers the promised return on investment (ROI) through ongoing optimization and technical support.

The dominance of the SaaS model dictates that recurring revenue streams are prioritized, making the service component (downstream) critically important for vendor profitability. Effective distribution relies heavily on channel partners that possess deep vertical expertise, enabling them to tailor the close software solution to the specific regulatory and operational needs of specialized industries like BFSI or healthcare. Successful companies in this market segment often differentiate themselves not just through superior product features, but through the quality of their professional services and the efficiency of their indirect distribution networks in delivering rapid time-to-value for their diverse client base.

Close Software Market Potential Customers

The primary customer base for Close Software encompasses enterprises of all sizes across virtually every industry vertical that maintains a structured sales organization and handles formalized contracts or proposals. Key buyers are typically located within the Sales Operations, Finance, and Legal departments, as the software intersects with revenue recognition, compliance, and frontline sales effectiveness. The primary function of these solutions is to serve Sales Vice Presidents and Directors, providing them with granular pipeline visibility, accurate forecasting tools, and performance metrics crucial for strategic planning and resource allocation.

Within large corporations, the most influential buyers often reside in Sales Enablement and Revenue Operations (RevOps) teams, tasked with implementing technology that optimizes the entire revenue lifecycle, ensuring tight alignment between sales, marketing, and customer success functions. These technical buyers seek platforms that offer open APIs, robust security protocols, and seamless integration with existing enterprise architecture. Finance teams, specifically controllers and revenue accountants, are critical stakeholders due to the software’s role in ensuring compliance with accounting standards (e.g., ASC 606/IFRS 15) concerning contract management and recognition timelines.

In the Small and Medium Enterprise (SME) segment, the potential customer often presents as the CEO, Founder, or dedicated Sales Manager who prioritizes ease of use, rapid deployment, and immediate ROI visibility. Industries with high transaction volumes, complex regulatory oversight, or long sales cycles—such as technology vendors, insurance carriers, capital equipment manufacturers, and professional services firms—represent the highest concentration of potential customers, relying heavily on automated close software to mitigate risk and accelerate cash flow.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3.5 Billion |

| Market Forecast in 2033 | $7.9 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Salesforce (through ecosystem partners), HubSpot, Microsoft Dynamics 365, Zoho Corporation, Pipedrive, Close.com, SAP, Oracle, Docusign, PandaDoc, Conga, Icertis, Apttus (now Conga), Outreach, SalesLoft, Highspot, Seismic, Adobe (Acrobat Sign), Ironclad, Contract Logix |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Close Software Market Key Technology Landscape

The technological backbone of the Close Software market is fundamentally rooted in scalable, multi-tenant cloud computing infrastructure, primarily utilizing public cloud providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP). This foundation ensures the high availability, security, and scalability necessary to process large volumes of sensitive deal and contract data globally. Crucially, modern close platforms heavily rely on advanced Application Programming Interfaces (APIs) and webhooks to facilitate deep, real-time bidirectional integration with mission-critical enterprise systems, including primary CRM platforms, CPQ (Configure, Price, Quote) solutions, and core accounting software, enabling a seamless data flow across the revenue cycle.

A secondary, yet rapidly expanding, technological area involves the widespread integration of Artificial Intelligence (AI) and Machine Learning (ML). This includes NLP for contract analysis, identifying key terms and potential risks; predictive modeling for forecasting closure rates based on activity metrics and deal size; and automated workflow engines that trigger necessary actions (e.g., legal review requests or compliance checks) based on predefined criteria. These intelligent features are essential for moving the close process from manual management to autonomous orchestration, driving efficiency gains unattainable through traditional software architectures alone.

Furthermore, digital signature technology and immutable ledger systems, such as blockchain in highly regulated industries, are becoming standard components to ensure the legal veracity and auditability of finalized contracts. Low-code/no-code platforms are also gaining traction, enabling sales operations teams to rapidly customize workflow rules and approval hierarchies without extensive IT involvement. This agility in customization is a significant differentiator, allowing software vendors to meet the unique contractual and regulatory demands of varied vertical markets effectively and rapidly.

Regional Highlights

The global Close Software Market exhibits distinct regional characteristics concerning adoption rates, technological maturity, and compliance focus. North America holds the largest market share, predominantly driven by the early adoption of advanced sales technology, the presence of major technology hubs, and a highly competitive corporate environment that places a premium on sales efficiency and forecasting accuracy. U.S. and Canadian companies, particularly in the tech, finance, and professional services sectors, are aggressive investors in integrated RevOps solutions, ensuring high penetration of specialized closing platforms designed for rapid, compliant deal execution. The regulatory landscape, while complex, fosters innovation in data security and seamless integration with existing CRM ecosystems.

Europe represents the second-largest market, characterized by strong demand for compliance-centric software due to rigorous data protection mandates, most notably the General Data Protection Regulation (GDPR). European enterprises, particularly in Germany, the UK, and France, prioritize solutions that offer robust audit trails, localized contract templates, and data residency options. The market growth here is steady, fueled by the modernization of legacy systems across established industrial and banking sectors, emphasizing risk mitigation and contractual standardization as primary purchasing criteria for close software implementations.

The Asia Pacific (APAC) region is poised for the highest growth trajectory, benefiting from widespread digital transformation initiatives across emerging economies like India, China, and Southeast Asia. Rapid industrialization, coupled with a surging number of SMEs entering global markets, is accelerating the demand for scalable, cloud-based close software. While fragmented regulatory environments present implementation challenges, the sheer size of the potential customer base and the focus on mobile-first sales solutions make APAC a critical expansion target for global vendors. Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions, exhibiting growth primarily in sectors such as telecommunications and oil & gas, prioritizing solutions that can handle complex multi-currency transactions and diverse legal frameworks efficiently.

- North America: Market leader; characterized by high maturity, early adoption of AI in sales forecasting, and demand for deep CRM integration.

- Europe: Strong focus on GDPR compliance and data sovereignty; steady growth driven by modernization in manufacturing and financial services.

- Asia Pacific (APAC): Highest projected CAGR; rapid adoption across SMEs, strong growth in e-commerce and IT sectors, high demand for cloud-native platforms.

- Latin America (LATAM): Emerging market; growing demand in banking and natural resources, emphasis on multi-language and multi-currency support.

- Middle East & Africa (MEA): Niche adoption; significant growth in telecommunications and government sectors driven by digital government initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Close Software Market.- Salesforce (focusing on ecosystem integration)

- HubSpot

- Microsoft Dynamics 365

- Zoho Corporation

- Pipedrive

- Close.com

- SAP

- Oracle

- Docusign

- PandaDoc

- Conga

- Icertis

- Outreach

- SalesLoft

- Highspot

- Seismic

- Adobe (Acrobat Sign and associated workflow tools)

- Ironclad

- Contract Logix

- Coupa Software (focus on Business Spend Management integration)

Frequently Asked Questions

Analyze common user questions about the Close Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Close Software and traditional CRM?

Close Software focuses specifically on the final, critical stages of the sales cycle, automating tasks like contract generation, legal review workflows, e-signature, and accurate revenue recognition. While CRM manages the entire customer relationship (from lead to post-sale), Close Software optimizes the transition from "opportunity" to "closed won," ensuring compliance and accelerating cash flow.

How does AI improve forecasting accuracy in close software platforms?

AI utilizes machine learning algorithms to analyze historical deal closure data, sales representative activity metrics, and conversational sentiment data. It provides predictive scoring that objectively assesses the probability of each deal closing within the required timeframe, offering a more accurate and objective forecast compared to traditional subjective sales representative estimates.

Which deployment model is dominating the Close Software Market?

The Cloud-Based (SaaS) deployment model is dominating the market. SaaS solutions offer superior scalability, lower upfront costs, high accessibility necessary for remote sales teams, and continuous feature updates, making them the preferred choice for both Small and Medium Enterprises (SMEs) and large global organizations seeking agile deployment.

What are the main security concerns associated with adopting close software?

The main security concerns revolve around data sovereignty, protecting highly sensitive contractual and financial data from breaches, and ensuring compliance with regional data protection regulations (like GDPR and CCPA). Vendors address this through robust encryption, secure access controls, and adherence to international security standards (e.g., ISO 27001).

Which industry vertical is showing the strongest demand for customized close software?

The BFSI (Banking, Financial Services, and Insurance) vertical exhibits strong demand for customized close software. This sector requires highly specialized compliance workflows, immutable audit trails, and strict regulatory adherence for every financial contract, necessitating solutions that offer deep customization and secure digital signature integration.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager