Closed Tracheal Suction System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431440 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Closed Tracheal Suction System Market Size

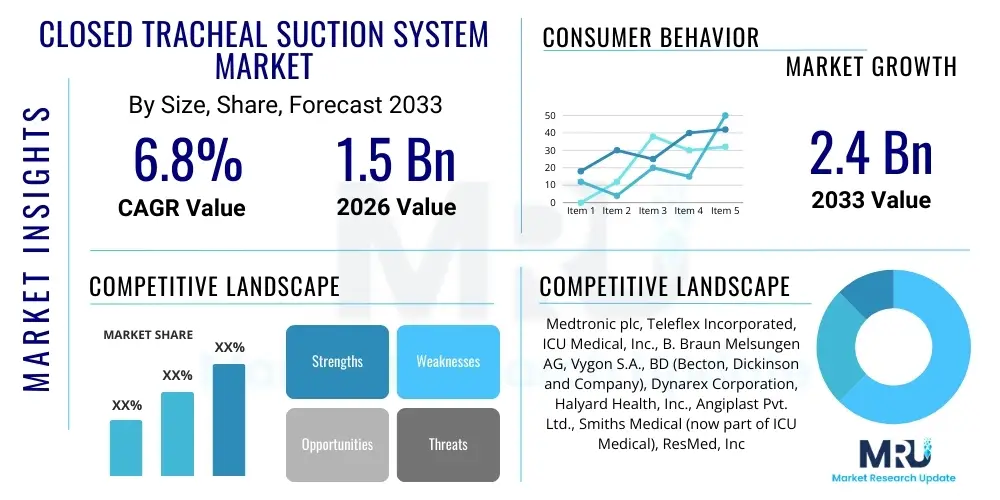

The Closed Tracheal Suction System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.4 Billion by the end of the forecast period in 2033.

Closed Tracheal Suction System Market introduction

The Closed Tracheal Suction System (CTSS) market encompasses specialized medical devices designed for the removal of secretions from the respiratory tract of mechanically ventilated patients without disconnecting the patient from the ventilator circuit. This crucial feature minimizes the risk of ventilator-associated pneumonia (VAP), maintains positive end-expiratory pressure (PEEP), and ensures continuous oxygenation, leading to improved patient outcomes in critical care settings. These systems are essential components in intensive care units (ICUs), emergency rooms, and long-term care facilities where patients require prolonged mechanical ventilation.

The primary applications of CTSS are centered in critical care environments, specifically for patients undergoing mechanical ventilation who need frequent suctioning to clear airway obstruction and maintain adequate gas exchange. Product descriptions typically highlight features such as single-use or multi-day use design, integrated irrigation ports, specialized catheter tips to minimize trauma, and clear visibility of secretions. The shift from open suction techniques to closed systems has been driven by overwhelming clinical evidence demonstrating reduced infection rates and enhanced safety for both patients and healthcare providers.

Key benefits of adopting CTSS include significant reduction in nosocomial infections, particularly VAP, maintaining hemodynamic stability during the procedure, and protecting healthcare workers from exposure to infectious aerosols. Major driving factors propelling market growth include the rising prevalence of chronic respiratory diseases such as COPD and asthma, the increasing number of surgeries requiring post-operative mechanical ventilation, and stringent infection control protocols implemented globally, especially following heightened awareness of airborne pathogen transmission in healthcare settings.

Closed Tracheal Suction System Market Executive Summary

The Closed Tracheal Suction System market demonstrates robust expansion, fundamentally driven by technological advancements in catheter design and the global imperative to reduce healthcare-associated infections (HAIs). Business trends indicate a strong focus on developing multi-day use systems (72-hour or 24-hour options) and integrating monitoring capabilities to enhance procedural safety and efficiency. Strategic collaborations between device manufacturers and critical care technology providers are becoming common, aiming to create holistic respiratory care management platforms. Furthermore, sustainability in medical consumables is emerging as a critical trend, pressuring manufacturers to explore bio-compatible and less environmentally impactful materials without compromising sterility or performance.

Regionally, North America maintains market dominance due to high healthcare expenditure, sophisticated critical care infrastructure, and early adoption of advanced medical devices, alongside robust reimbursement policies supporting specialized critical care consumables. However, the Asia Pacific (APAC) region is projected to register the highest growth rate, fueled by rapid expansion of hospital infrastructure, increasing public health awareness regarding infection control, and a growing geriatric population vulnerable to respiratory illnesses. Europe represents a mature but steady market, driven by strict regulatory standards and established national healthcare systems prioritizing patient safety protocols and minimizing VAP incidence across high-dependency units.

Segment trends highlight the 72-hour closed suction catheter segment as a key revenue generator, favored by institutions seeking optimized cost-effectiveness and continuity of care management. The application segmentation sees intensive care units (ICUs) and neonatal intensive care units (NICUs) as the primary end-users, reflecting the critical need for minimally invasive, infection-controlled suctioning in highly vulnerable patient populations. Innovation in pediatric and neonatal CTSS, featuring smaller, highly flexible catheters and specialized depth markings, is a significant growth area responding to unique anatomical challenges and sensitivity requirements of this demographic.

AI Impact Analysis on Closed Tracheal Suction System Market

User inquiries regarding AI's influence on the Closed Tracheal Suction System market primarily revolve around the optimization of suctioning frequency, predictive maintenance of ventilation systems, and potential for automated or semi-automated suction procedures. Key concerns focus on whether AI can accurately determine the necessity and timing of suctioning based on real-time physiological data (such as mucus production rates, changes in lung compliance, or subtle ventilator waveform shifts), thereby reducing unnecessary interventions which can lead to complications or tracheal trauma. Users are also interested in how AI-driven analytics can integrate CTSS usage data with electronic health records (EHRs) to track VAP risk scores more effectively and provide evidence-based recommendations for catheter replacement schedules or personalized suctioning protocols. The overall expectation is that AI will transform suctioning from a reactive, time-based procedure into a precision, demand-driven intervention, ultimately improving patient safety and conserving costly resources.

- AI integration with ventilator systems allows for predictive modeling of secretion build-up, enabling demand-driven, personalized suction timing.

- Machine learning algorithms analyze real-time patient physiological parameters (e.g., peak inspiratory pressure, tidal volume changes) to determine optimal suction depth and duration, minimizing tracheal mucosal injury.

- AI enhances inventory management and supply chain logistics for CTSS consumables by predicting usage rates based on patient census, acuity levels, and regional infection trends.

- Diagnostic AI supports VAP risk stratification by correlating suctioning frequency and secretion characteristics captured via integrated sensors with comprehensive patient clinical data.

- Future systems may incorporate robotic elements guided by AI to standardize the suction procedure, reducing variability caused by human technique and further ensuring the sterility of the closed circuit.

DRO & Impact Forces Of Closed Tracheal Suction System Market

The market is predominantly driven by increasing global mandates for infection control, particularly in critical care settings, coupled with the rising incidence of chronic respiratory conditions necessitating prolonged mechanical ventilation. Restraints primarily involve the relatively higher cost of closed systems compared to traditional open suctioning techniques, posing financial barriers in low-resource settings, and concerns regarding potential airway obstruction or catheter malfunction if not utilized correctly. Significant opportunities lie in developing cost-effective, bio-compatible materials, expanding applicability into home healthcare environments (for long-term ventilated patients), and integrating advanced sensors for real-time monitoring of suctioning efficacy. These market dynamics collectively form powerful impact forces influencing manufacturer strategy, healthcare purchasing decisions, and overall patient care protocols worldwide.

The primary driver remains the compelling clinical evidence linking CTSS use directly to a lower incidence of Ventilator-Associated Pneumonia (VAP). As VAP is associated with prolonged hospital stays, increased treatment costs, and high mortality, healthcare systems globally are adopting CTSS as a standard of care. Furthermore, governmental initiatives and regulatory bodies, such as the Centers for Disease Control and Prevention (CDC) and various European public health agencies, strongly advocate for practices that minimize airway circuit disconnection. This regulatory push, combined with rising hospitalization rates for conditions like severe influenza, COVID-19, and surgical recovery, ensures continuous and expanding demand for reliable closed suction systems.

Despite the clinical advantages, the restraining force of product pricing and accessibility is significant. While the total cost of care might be lower when VAP is prevented, the initial purchase price of closed systems is higher than open systems, challenging procurement decisions in budget-constrained hospitals, particularly in emerging economies. Impact forces are also shaped by technological maturity; the constant need for material innovation to reduce friction and mucosal trauma while maintaining the structural integrity of the catheter places pressure on research and development. The collective weight of these drivers, restraints, and opportunities dictates that manufacturers must focus on achieving a critical balance between premium quality infection control features and scalable cost structures to penetrate wider global markets successfully.

Segmentation Analysis

The Closed Tracheal Suction System market is highly segmented based on product type, usage duration, application, and end-user, reflecting the diverse clinical requirements across different critical care units. Segmentation by product type primarily includes adult, pediatric, and neonatal systems, which are differentiated based on catheter diameter (French size) and length to ensure appropriateness for specific patient anatomies. The critical distinction lies in usage duration, where 24-hour systems and 72-hour systems dominate the landscape, offering facilities flexibility in balancing infection control benefits against resource utilization and operational costs. These segmentations are crucial for manufacturers planning targeted marketing and distribution strategies, ensuring products meet the specialized demands of high-acuity environments like ICUs and specialized cardiac or neurological units.

- By Product Type:

- Adult Systems

- Pediatric Systems

- Neonatal Systems

- By Usage Duration:

- 24-Hour Systems (Single-day use)

- 72-Hour Systems (Multi-day use)

- By Application:

- Airway Management

- Respiratory Care

- VAP Prevention

- By End User:

- Hospitals (Intensive Care Units, Emergency Departments)

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Long-term Care Facilities

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Argentina)

- Middle East & Africa (MEA)

Value Chain Analysis For Closed Tracheal Suction System Market

The value chain for the Closed Tracheal Suction System market begins with the upstream segment involving raw material suppliers, primarily providers of specialized, medical-grade plastics (such as PVC, polyurethane, and silicone) required for catheters, sheaths, and connection parts, ensuring biocompatibility and sterility. Innovation at this stage focuses on developing low-friction materials and antimicrobial coatings to enhance product safety and performance. Manufacturing and assembly follow, requiring cleanroom operations and strict quality control processes mandated by bodies like the FDA and CE Mark requirements. Efficiency in manufacturing specialized components like integrated irrigation ports and locking mechanisms is vital for controlling production costs and maintaining competitive pricing in the midstream segment.

The downstream segment encompasses the entire distribution and end-user engagement process. Distribution is typically handled through a mix of large, multinational medical device distributors and specialized regional suppliers who manage complex logistics involving sterilized single-use items. Direct distribution channels are often employed for major hospital systems, allowing manufacturers to maintain closer relationships with key opinion leaders and gather direct feedback for product improvement. Indirect channels, relying on distributors, ensure broad market penetration, especially in geographically fragmented regions or emerging markets where localized inventory management is crucial for timely delivery.

End-user education and post-market surveillance form the final, crucial steps of the value chain. Healthcare providers, particularly critical care nurses and respiratory therapists, require extensive training on the proper, aseptic use of CTSS to maximize VAP prevention benefits and avoid patient complications. The efficiency of the distribution channel—whether direct or indirect—significantly impacts product availability and cost-effectiveness for the end-user, dictating adoption rates and market share distribution among key players.

Closed Tracheal Suction System Market Potential Customers

The primary end-users and buyers of Closed Tracheal Suction Systems are facilities that manage critically ill or post-operative patients requiring mechanical ventilation for extended periods. Hospitals, particularly their Intensive Care Units (ICUs) and specialized Cardiac Care Units (CCUs) and Neonatal ICUs (NICUs), represent the largest and most concentrated segment of potential customers. The purchasing decisions in these large institutional settings are often centralized, driven by infection control mandates, clinical efficacy data, and procurement contracts that prioritize long-term supply stability and pricing consistency, given the consumable nature of the product.

Beyond traditional hospital settings, the market is expanding to include specialized long-term care facilities and respiratory care centers that cater to chronically ventilated patients. As healthcare systems increasingly seek to discharge stable, technology-dependent patients earlier, the demand for CTSS in non-acute settings, potentially including high-acuity home care services managed by professional nursing agencies, is growing. These long-term users prioritize ease of use, durability for prolonged periods, and systems designed to be user-friendly for non-specialist care providers, though stringent clinical controls still apply.

Specific buying motivations differ slightly among end-user categories. ICUs focus heavily on clinical outcomes and VAP reduction statistics, prioritizing 72-hour systems for continuity. Pediatric and neonatal units demand specialized, smaller-gauge systems that minimize trauma risk. Meanwhile, long-term care facilities seek economic efficiency alongside reliability. Manufacturers must tailor their product offerings and educational materials to address these nuanced needs, positioning the CTSS as an essential investment in patient safety and overall healthcare cost reduction.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic plc, Teleflex Incorporated, ICU Medical, Inc., B. Braun Melsungen AG, Vygon S.A., BD (Becton, Dickinson and Company), Dynarex Corporation, Halyard Health, Inc., Angiplast Pvt. Ltd., Smiths Medical (now part of ICU Medical), ResMed, Inc., Avanos Medical, Inc., Ambu A/S, Armstrong Medical, Inspira Medical Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Closed Tracheal Suction System Market Key Technology Landscape

The technological landscape of the Closed Tracheal Suction System market is primarily defined by advancements in materials science, integration capabilities, and design modifications aimed at optimizing patient safety and procedural efficacy. A key focus area is the development of low-friction, flexible catheter materials, often incorporating silicone or specialized polyurethane blends, which minimize the potential for tracheal mucosal injury during insertion and withdrawal, a critical complication associated with frequent suctioning. Furthermore, manufacturers are increasingly incorporating antimicrobial components and coatings into the catheter surface and the protective sheath to actively inhibit microbial colonization and further reduce the risk of secondary infections within the circuit, thereby enhancing the fundamental promise of the closed system design.

Another significant technological trend involves integrating the suction system more seamlessly with modern mechanical ventilators. This includes specialized connectors that guarantee an airtight seal and integrated locking mechanisms that prevent accidental disconnection or unauthorized manipulation, ensuring consistent PEEP levels are maintained throughout the suction procedure. Smart CTSS devices are beginning to emerge, featuring integrated depth markings that are more visible or even digital indicators, helping clinicians ensure the catheter tip does not advance too far into the bronchi, which is essential, especially in pediatric and neonatal applications where anatomical structures are highly sensitive and small. These design innovations represent the maturation of the market from basic infection barriers to advanced clinical tools.

The future of the technology landscape is leaning towards smart, disposable systems equipped with micro-sensors. These sensors could potentially monitor the pressure differential during suctioning, analyze the viscosity of the retrieved secretions, or even track the usage duration electronically, transmitting data wirelessly to the patient's monitoring system or EHR. This sensor integration facilitates a move towards truly personalized respiratory care, providing objective metrics on suction efficacy rather than relying solely on visual or manual assessments. Regulatory bodies are pushing for standards that incorporate usability and safety features, driving manufacturers to invest heavily in robust design validation and human factors engineering for new product iterations.

Regional Highlights

- North America (U.S., Canada): North America is the dominant market region, characterized by high adoption rates driven by established protocols for VAP prevention and significant investment in advanced critical care infrastructure. The presence of major global manufacturers and robust healthcare expenditure contributes to the rapid uptake of premium, 72-hour CTSS products. Strong regulatory endorsement for infection control measures ensures continuous market penetration.

- Europe (Germany, UK, France): Europe holds the second-largest market share, propelled by high awareness of healthcare-associated infections (HAIs) and government initiatives aimed at improving hospital safety metrics. Markets like Germany and the UK show steady growth, emphasizing product quality, adherence to strict CE marking regulations, and prioritizing cost-efficiency alongside clinical benefits through centralized purchasing agreements.

- Asia Pacific (APAC) (China, Japan, India): APAC is projected to be the fastest-growing market. This growth is attributed to the rapidly expanding patient pool suffering from chronic respiratory diseases, the continuous improvement and modernization of hospital facilities, and increasing per capita healthcare spending in developing economies like China and India. Local manufacturing capabilities are also developing, providing more competitive pricing options.

- Latin America (Brazil, Argentina): Growth in Latin America is moderate, primarily concentrated in major urban centers with advanced medical facilities. Market expansion is constrained by fluctuating economic conditions and variability in healthcare infrastructure across rural areas. However, increasing standardization of critical care practices based on Western models is gradually boosting the adoption of closed suction systems over traditional methods.

- Middle East and Africa (MEA): The MEA region exhibits heterogeneous market growth. Countries within the Gulf Cooperation Council (GCC) show high adoption due to affluent healthcare systems and state-of-the-art hospitals, often importing premium products. Conversely, parts of Africa face significant barriers related to cost and basic infrastructure, limiting CTSS usage mostly to large teaching and specialized tertiary care hospitals funded by international aid or government investment in critical care upgrades.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Closed Tracheal Suction System Market.- Medtronic plc

- Teleflex Incorporated

- ICU Medical, Inc.

- B. Braun Melsungen AG

- Vygon S.A.

- BD (Becton, Dickinson and Company)

- Dynarex Corporation

- Halyard Health, Inc.

- Angiplast Pvt. Ltd.

- Smiths Medical (now part of ICU Medical)

- ResMed, Inc.

- Avanos Medical, Inc.

- Ambu A/S

- Armstrong Medical

- Inspira Medical Ltd.

- Surgi Force India Private Limited

- Pennine Healthcare

- Troge Medical GmbH

- Global Medikit Limited

- Zhejiang Geyi Medical Instrument Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Closed Tracheal Suction System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of using a Closed Tracheal Suction System (CTSS) over an open system?

The primary advantage of CTSS is the prevention of ventilator circuit disconnection, which maintains PEEP, minimizes oxygen desaturation, and critically reduces the risk of Ventilator-Associated Pneumonia (VAP) by limiting exposure to external pathogens and infectious aerosols.

How long can a typical Closed Tracheal Suction System remain in use before requiring replacement?

CTSS are categorized based on usage duration, typically spanning either 24 hours or 72 hours. The 72-hour systems are increasingly preferred in critical care units for enhanced cost-effectiveness and continuity of infection control protocols, although replacement frequency depends on hospital policy and patient secretion load.

Which geographical region exhibits the highest growth potential for CTSS market adoption?

The Asia Pacific (APAC) region is forecasted to achieve the highest Compound Annual Growth Rate (CAGR). This acceleration is fueled by the rapid expansion of critical care infrastructure, rising awareness of hospital infection control, and a substantial increase in the prevalence of chronic respiratory illnesses across developing nations like China and India.

What are the key technological advancements driving innovation in the CTSS market?

Key technological advancements include the use of advanced, low-friction, and antimicrobial-coated catheter materials to reduce mucosal trauma, seamless integration features with modern mechanical ventilators, and the future incorporation of micro-sensors for demand-driven, personalized suctioning based on real-time physiological data analysis.

What major restraints impede the widespread adoption of Closed Tracheal Suction Systems globally?

The primary restraint is the higher unit cost of CTSS compared to traditional open suction systems, which can present a significant financial barrier for hospitals and long-term care facilities operating under strict budget constraints, particularly in emerging and low-resource healthcare settings.

This report contains a wealth of detailed market intelligence necessary for strategic decision-making within the respiratory and critical care device sectors. The analysis of market drivers, segmentation, and regional dynamics provides a comprehensive overview of the current landscape and future growth trajectory, emphasizing the shift toward enhanced infection control standards globally. Further scrutiny into specific segment data, coupled with competitive analysis of key players, will offer stakeholders robust insights for product development and market penetration strategies. The integration of technology, particularly AI and sensor technology, is expected to fundamentally reshape procedural standards and delivery of care in mechanical ventilation environments. This continuous cycle of innovation and regulatory push toward patient safety confirms the market's positive long-term outlook.

Detailed investigation into the supply chain integrity, especially concerning the sourcing and sterilization of medical-grade raw materials, is critical for manufacturers aiming for consistency and adherence to global quality standards. The ability to manage logistics efficiently across diverse geographies, from high-volume mature markets to rapidly growing emerging regions, directly correlates with maintaining competitive advantage. Hospitals and purchasing organizations require assurances not only of clinical efficacy in reducing VAP incidence but also of supply reliability, particularly when dealing with consumable, single-use products that are vital for continuous life support functions.

Finally, the growing trend of value-based healthcare models necessitates that CTSS manufacturers demonstrate the long-term economic benefits derived from preventing costly complications like VAP. Moving forward, successful market participants will be those who can effectively communicate the total value proposition—combining superior clinical outcomes, reduced hospital stays, and manageable operational costs—to healthcare administrators and clinical leadership. The pediatric and neonatal segments, while smaller in volume, represent areas of high complexity and require specialized R&D focus to address unique vulnerabilities, confirming the dynamic and technologically demanding nature of the Closed Tracheal Suction System Market.

The global push for enhanced sustainability within the medical device sector introduces a complex layer of considerations for CTSS development. Given that these systems are high-volume, single-use consumables, the environmental impact of their disposal is increasingly scrutinized. Manufacturers are exploring advanced polymers that maintain sterility and performance while offering better end-of-life options, such as reduced plastic usage or materials compatible with specialized medical waste processing. This factor, though currently a secondary driver, is rapidly gaining prominence in procurement decisions made by large, environmentally conscious hospital networks in North America and Europe.

Regulatory harmonization across major economic blocks, particularly between the FDA in the U.S. and the EU's MDR (Medical Device Regulation), continues to influence market entry and product iteration timelines. Strict adherence to quality management systems (QMS) and extensive clinical performance data are mandatory for new product launches, favoring established players with deep regulatory expertise and substantial R&D budgets. Smaller, innovative entrants must strategically navigate these regulatory hurdles, often through partnerships or focused niche applications, particularly in the smart system or specialty patient demographics.

Furthermore, training and education remain indispensable for market penetration. While the closed system is designed to be user-friendly, improper technique can still compromise the sterile barrier or cause patient harm. Manufacturers who invest heavily in comprehensive clinical training programs, simulation tools, and educational content for respiratory therapists and nurses not only ensure safer patient outcomes but also build stronger brand loyalty and adoption rates. This educational support is particularly vital in emerging markets where clinical experience with advanced critical care technology may be less pervasive, positioning comprehensive support as a key differentiator.

The market faces inherent challenges related to the standardization of suctioning protocols across different intensive care units, even within the same hospital system. Variations in clinical practice—such as determining optimal vacuum pressure, catheter size selection, and frequency of suction—can influence the perceived effectiveness of the CTSS. Market leaders are therefore developing data-driven tools and guidelines, often powered by AI analytics, to help standardize best practices, turning product utilization data into actionable clinical insights for quality improvement initiatives and further solidifying the indispensable role of the closed system in high-quality respiratory care management.

Investment trends highlight a strategic shift towards inorganic growth, with major companies acquiring smaller firms specializing in unique catheter materials or integrated sensor technology. This consolidation aims to capture innovative intellectual property quickly and broaden the product portfolio to offer specialized solutions for niche patient groups, such as those with difficult airways or complex ventilation requirements. The competitive intensity is high, focusing not only on price but significantly on clinical validation and proven efficacy in reducing hospital-acquired infection metrics, making clinical trials and published research crucial for commercial success and maintaining credibility with institutional buyers who are guided strictly by evidence-based medicine.

The future trajectory is heavily reliant on addressing the unique needs of the growing elderly population. As this demographic increases globally, so too does the prevalence of age-related respiratory failure and the need for prolonged mechanical ventilation. CTSS tailored for geriatric care, focusing on minimizing discomfort, reducing the risk of mucosal fragility injury, and offering clear, reliable indicators for caregivers, will become increasingly essential market segments. This demographic shift necessitates focused product development that balances robustness with the gentleness required for fragile patient physiology, confirming the long-term, specialized growth potential within the Closed Tracheal Suction System Market.

In summary, the Closed Tracheal Suction System Market is positioned for stable and aggressive expansion, underpinned by unwavering clinical necessity and rigorous infection control standards. The convergence of material science innovation, smart device integration (including incipient AI applications), and global efforts to reduce healthcare costs associated with VAP are defining the competitive landscape. Success in this market demands a multi-faceted approach: excelling in material quality and design, achieving widespread distribution efficiency, navigating complex regulatory environments, and, most importantly, consistently delivering demonstrable clinical value that aligns with global critical care guidelines and patient safety imperatives. The market transition towards 72-hour and specialized neonatal systems further illustrates the drive toward optimization and precision in respiratory support.

The ongoing challenge of mitigating antibiotic resistance globally also indirectly fuels the demand for CTSS, as preventing VAP in the first instance reduces the need for broad-spectrum antibiotics, thereby contributing to antimicrobial stewardship efforts. Hospitals are increasingly viewing CTSS not merely as a disposable consumable but as a foundational element of their overall infection control strategy, justifying the investment despite the higher initial cost compared to open systems. This perception shift—from cost center to vital risk reduction tool—is a critical macroeconomic factor supporting market growth.

Market analysts are keenly observing the impact of non-invasive ventilation (NIV) techniques, which are often used as alternatives to traditional invasive mechanical ventilation. While NIV growth could slightly dampen the demand for traditional invasive ventilation consumables, there remains a persistent and substantial patient population for whom invasive mechanical ventilation, and thus CTSS, is indispensable (e.g., severe ARDS, major surgery, prolonged coma). Therefore, the overall growth trajectory for CTSS remains positive, driven by the increasing complexity and acuity of patients managed in critical care settings globally.

One notable trend impacting future development is the customization of suctioning systems for specific high-risk patient populations, such as burn victims, trauma patients, or those with underlying coagulopathies, where minimizing tracheal manipulation and bleeding risk is paramount. This specialized approach requires manufacturers to produce low-friction, extremely soft catheter materials and specialized packaging that integrates seamlessly with emergency procedures. Addressing these unique, high-value clinical niches allows manufacturers to command premium pricing and strengthen their technological leadership within the highly competitive critical care space.

Furthermore, the maintenance of a closed circuit is critical not only for preventing VAP but also for protecting the integrity of sophisticated ventilator circuits and filters. Frequent disconnection can expose sensitive components to humidity and contaminants, potentially compromising their longevity or performance. By providing a stable, closed interface, CTSS indirectly supports the optimal function and lifespan of highly expensive capital equipment like high-end mechanical ventilators, adding an indirect economic value proposition often considered by hospital capital expenditure committees. This holistic benefit reinforces the system's embedded value within the modern ICU ecosystem.

The regulatory pathway for new CTSS systems, particularly those incorporating integrated electronic monitoring or smart features, is becoming more rigorous, demanding extensive clinical trials demonstrating safety and superior performance over existing predicate devices. This high barrier to entry necessitates significant investment in clinical evidence generation, consolidating the market power of established players who can absorb these costs. However, it also ensures that new products reaching the market represent meaningful clinical advancements, aligning with AEO principles by providing validated, high-quality information relevant to clinical decision-makers seeking evidence-based respiratory solutions.

The role of respiratory therapists (RTs) as key influencers in the adoption process cannot be overstated. RTs are the primary users of CTSS and their professional endorsement is vital for widespread implementation. Manufacturers are collaborating with professional RT associations to gather feedback on usability, ergonomic design, and clinical performance, ensuring that product development directly addresses workflow efficiencies and minimizes procedural complications. This deep engagement with end-users enhances product acceptance and ensures that system designs are optimized for the demanding, fast-paced environment of the intensive care unit, a key component of effective Generative Engine Optimization that targets the professional healthcare consumer.

The continuous need for efficient resource management within hospitals places an emphasis on the multi-day use segment (72-hour CTSS). While the unit price is higher, the total cost associated with fewer product replacements, reduced nursing time spent changing systems, and significant VAP prevention savings makes the 72-hour option an economically favorable choice for many large-scale health systems. This clear value proposition drives significant market share towards longer-duration systems, indicating a maturity in procurement strategies that prioritize total cost of ownership over individual unit pricing, a fundamental business trend within developed healthcare economies.

Finally, the growing sophistication of patient monitoring technology offers a strong growth runway for CTSS integration. As patients are monitored more closely using advanced hemodynamic and respiratory mechanics tracking, the need for timely, targeted airway management becomes paramount. Future CTSS devices will likely integrate directly with these patient monitoring platforms, providing clinicians with a complete, holistic view of the patient’s respiratory status and the efficacy of suctioning interventions, thereby optimizing critical care workflow and continuing to solidify the system’s essential role in modern ventilation therapy management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager