Clothianidin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433740 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Clothianidin Market Size

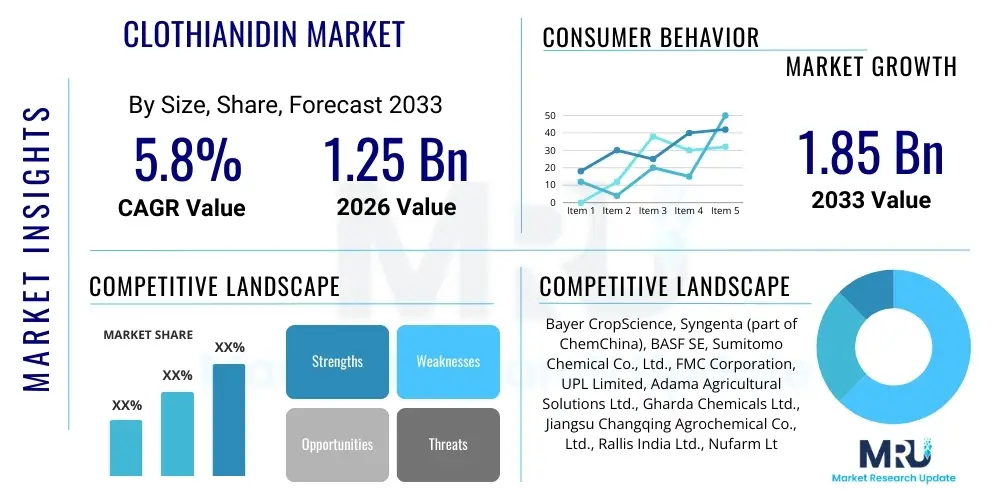

The Clothianidin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2033.

Clothianidin Market introduction

The Clothianidin market encompasses the production, distribution, and application of a synthetic, broad-spectrum neonicotinoid insecticide highly effective against sucking and chewing insects. As a systemic insecticide, Clothianidin is absorbed by the plant and translocated throughout the vascular system, providing protection to new growth and ensuring consistent pest management across diverse agricultural settings. Its high efficacy at low dosage rates, coupled with its relatively favorable environmental profile compared to older chemistries, has established it as a critical tool in modern Integrated Pest Management (IPM) strategies globally.

Major applications of Clothianidin span across critical agricultural sectors, including row crops such as corn, soybean, and cotton, as well as fruits, vegetables, and rice. The primary method of application includes seed treatment, which offers protection during the vulnerable initial germination and seedling stages, leading to robust plant establishment and reduced reliance on subsequent foliar sprays. Additionally, it is used in granular and suspension concentrate formulations for soil and foliar treatments, targeting pests such as aphids, leafhoppers, whiteflies, and certain beetles that pose significant threats to crop yield and quality.

The market is primarily driven by the escalating global demand for food security, which necessitates maximizing crop yields under increasing pressure from aggressive insect pests developing resistance to conventional treatments. Furthermore, the efficiency and ease of application provided by seed treatments are driving adoption, particularly in emerging economies where large-scale mechanized farming practices are expanding. The benefits of Clothianidin, including residual activity, broad target spectrum, and systemic action, cement its importance despite ongoing regulatory scrutiny related to non-target organism impacts, particularly pollinators.

Clothianidin Market Executive Summary

The Clothianidin market is undergoing a period of dynamic transformation characterized by intense regional segmentation based on regulatory environments and rapid adoption of specialized application methods. Business trends show a strategic shift toward formulation innovation, particularly focusing on microencapsulation and flowable concentrates that enhance efficacy, reduce environmental exposure, and meet stricter safety standards. Key market players are investing heavily in synergistic product development, combining Clothianidin with fungicides or bio-stimulants to create comprehensive seed treatment packages that offer superior early-season crop protection and drive premium pricing.

Regionally, the Asia Pacific (APAC) market maintains dominance, fueled by large-scale agricultural operations in countries like China, India, and Southeast Asia, where pest pressures are high and regulatory frameworks are often less restrictive than in Western nations. Conversely, North America faces heightened scrutiny, prompting manufacturers to focus on highly targeted applications and robust stewardship programs to maintain market access. Europe, having implemented strict restrictions or outright bans on outdoor use, represents a highly constrained market, forcing innovation towards protected cultivation and specialized low-volume, high-concentration applications.

Segment trends reveal that the seed treatment application method commands the largest market share due to its precision, environmental advantages (minimizing runoff and drift), and effectiveness during critical planting periods. In terms of crop type, cereals and grains, especially corn and soybean, are the primary consumers of Clothianidin, reflecting the large acreage dedicated to these commodity crops globally. However, the fastest growth is anticipated in high-value specialty crops, such as fruits and vegetables, as growers seek reliable systemic solutions to protect sensitive yields from complex pest complexes.

AI Impact Analysis on Clothianidin Market

User queries regarding AI in the agrochemical space frequently revolve around predictive modeling for pest outbreaks, optimizing treatment timing, and improving the efficiency of product discovery. Users are highly interested in how AI can help mitigate the regulatory risks associated with neonicotinoids by enabling precision application, thus reducing overall chemical load. Key themes center on achieving higher efficacy with less environmental impact, utilizing machine learning to analyze satellite imagery and drone data to identify localized infestation hotspots, and using sophisticated algorithms to recommend the exact dosage of Clothianidin required based on real-time environmental and phenological data, moving away from blanket treatments.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) platforms is revolutionizing the application and research phases of the Clothianidin lifecycle, directly addressing the core market constraint of regulatory scrutiny concerning non-target species. AI-powered algorithms analyze vast datasets encompassing weather patterns, soil conditions, historical pest migration routes, and crop health metrics to forecast pest pressure with unprecedented accuracy. This predictive capability allows agricultural professionals to utilize Clothianidin proactively only when necessary, moving application methods from reactive control to predictive and preventive management, thereby minimizing unnecessary environmental exposure and optimizing the economic return for the farmer.

Furthermore, AI is accelerating R&D processes related to formulation science and resistance management. Deep learning models are being utilized to simulate the interaction of Clothianidin formulations within diverse plant matrices and soil types, optimizing the delivery system to ensure maximum pest mortality while minimizing leaching or runoff. In the context of resistance, AI analyzes genetic sequencing data of targeted pests to predict the evolution of resistance mechanisms, enabling timely adjustments in dosage, rotation strategies, or the co-application of synergistic chemistries. This technological uplift ensures the longevity and sustained efficacy of Clothianidin as a vital insecticide.

- AI-Driven Precision Application: Machine learning models optimize the spatial and temporal deployment of Clothianidin, ensuring targeted use only on affected areas, significantly reducing chemical overuse.

- Predictive Pest Forecasting: Utilizing advanced algorithms to analyze environmental data (weather, climate, soil) to predict specific pest outbreaks (e.g., specific aphid or whitefly populations) requiring Clothianidin treatment.

- Dosage Optimization: Real-time analysis of plant health and infestation levels via remote sensing technologies (drones, satellites) to recommend minimum effective dosages, enhancing sustainability.

- Accelerated Formulation R&D: AI simulation used to design safer, encapsulated, or slow-release formulations of Clothianidin that reduce volatility and enhance targeted action.

- Regulatory Compliance Monitoring: AI platforms assist in tracking local regulatory changes and ensuring field practices adhere to stringent geographic restrictions on neonicotinoid application.

DRO & Impact Forces Of Clothianidin Market

The Clothianidin market is shaped by a powerful interplay of drivers supporting its use (D), strict restraints limiting its application (R), and strategic opportunities guiding future growth (O). Key drivers include the persistent global threat of crop destruction from sap-sucking insects, the need for effective seed treatments that minimize early-season losses, and the development of pest resistance to older, less effective chemical classes. The systemic and high-efficacy profile of Clothianidin makes it a preferred choice for ensuring high yields, particularly in crops like corn and soybeans where early-season protection is crucial for final harvest success.

Conversely, the primary restraints center heavily on the intense global regulatory backlash against neonicotinoids due to documented impacts on non-target organisms, specifically honeybees and other pollinators. These concerns have led to outright bans or severe restrictions on outdoor applications in major markets like the European Union and specific states in North America, substantially capping market potential and forcing manufacturers into costly research for alternatives and complex stewardship programs. This regulatory uncertainty creates a high barrier to entry for new applications and demands continuous scientific defense of existing product registrations.

Opportunities for market expansion are found in the strategic integration of Clothianidin within Integrated Pest Management (IPM) systems, positioning it as a tool of last resort or a highly precise preventative measure rather than a general application product. Furthermore, technological innovation in delivery systems, such as advanced polymer coatings for seed treatment that minimize dust-off and enhance soil adhesion, presents a significant avenue for growth that directly addresses environmental concerns. The sustained demand from high-growth markets in APAC and Latin America, where population growth drives increased demand for high-quality food, continues to offer a strong economic impetus for the product.

The impact forces influencing the market trajectory are multifaceted. Regulatory influence (Political/Legal) exerts the most significant downward pressure, requiring continuous adaptation. Environmental impact assessment (Environmental/Social) dictates public perception and consumer acceptance, pushing for bio-based alternatives. Economic forces, driven by increasing global commodity prices, reinforce the need for reliable yield protection, supporting the driver side. Technological advances in formulation science and delivery mechanisms act as a powerful mitigating force, offsetting some of the regulatory headwinds by promising safer application methods.

Segmentation Analysis

The Clothianidin market segmentation provides a critical view of product adoption across different application modalities, formulations, and targeted crop groups, reflecting specialized grower requirements and regional regulatory nuances. The segmentation by Type, Application, and Crop Type demonstrates the diversified commercial strategy employed by agrochemical companies to maximize market penetration while adhering to varying usage restrictions worldwide. Understanding these segments is crucial for predicting growth trajectories, as technological advancements often focus on optimizing specific formulation types for specialized applications, such as enhanced flowability for seed treatment or increased persistence for soil application.

The segmentation by application method highlights the market's preference for systemic delivery over broad-spectrum spraying. Seed treatment is the dominant segment, valued for its efficiency, environmental safety, and concentrated protective benefits early in the crop cycle. This method ensures that the active ingredient is available to the plant roots and emerging shoots when they are most susceptible to early-season pests. Meanwhile, the segmentation by crop type reveals the highest market consumption in high-acreage field crops, particularly cereals and grains, underscoring the product's role in global staple food production, though the highest potential for value growth is observed in high-margin specialty crops.

Geographically, market segmentation is fundamentally driven by regulatory compliance. Regions with permissive regulations allow for the full spectrum of applications (foliar, soil, seed), whereas highly restricted regions focus almost exclusively on seed treatments or highly specialized industrial applications, such as greenhouse use. This regulatory bifurcation necessitates segmented product portfolios, with manufacturers offering advanced, low-dust, highly targeted formulations in environmentally sensitive markets, and more conventional, cost-effective formulations in markets focused primarily on maximizing productivity per dollar spent.

- By Type:

- Wettable Powder (WP)

- Granule (GR)

- Suspension Concentrate (SC)

- Flowable Concentrate for Seed Treatment (FS)

- By Application:

- Seed Treatment

- Foliar Spray

- Soil Treatment (In-furrow or Broadcast)

- Turf and Ornamental Use

- By Crop Type:

- Cereals & Grains (Corn, Rice, Wheat, Barley)

- Oilseeds & Pulses (Soybean, Canola, Cotton)

- Fruits & Vegetables (Citrus, Potatoes, Tomatoes, Leafy Vegetables)

- Others (Sugar Beet, Turfgrass, Ornamentals)

Value Chain Analysis For Clothianidin Market

The value chain for the Clothianidin market begins with complex upstream activities, including the sourcing of proprietary chemical intermediates, such as chloronicotinyl compounds, which require high purity and specialized synthesis processes. Manufacturing involves high capital expenditure due to the complexity of synthesizing the active ingredient (AI) under stringent quality control standards. Key manufacturers often maintain integrated production facilities, controlling the process from basic chemical synthesis to the formulation of end-use products. This upstream segment is characterized by high technological barriers and patent-protected processes, providing significant competitive advantages to the leading global agrochemical companies.

Midstream activities involve the formulation and packaging of the AI into commercially viable products (WP, SC, FS). This stage is critical for market success as performance heavily depends on the final formulation's stability, handling characteristics, and effectiveness in the field. Companies prioritize advanced formulation technologies, such as microencapsulation, to improve safety profiles and application precision, particularly for seed treatments where minimizing dust-off is essential for compliance and environmental safety. The formulation process tailors the product specifically for regional application norms, whether for high-volume foliar spray in developing markets or specialized coatings for seeds in regulated markets.

The downstream distribution channel is highly decentralized and relies heavily on established networks. Direct sales channels are often used for large seed treatment companies and major plantation owners, ensuring bulk delivery and technical support. Indirect channels, which dominate small- to medium-sized farming segments, include national and regional distributors, agricultural cooperatives, and local agro-dealer networks. These indirect channels are crucial for providing technical advice, inventory management, and ensuring timely availability to farmers. The final step involves the end-user application, where comprehensive stewardship programs and adherence to Good Agricultural Practices (GAPs) become paramount to maximize efficacy and ensure regulatory compliance, closing the loop on responsible usage.

Clothianidin Market Potential Customers

The primary customers for Clothianidin products are agricultural producers across the globe, ranging from large-scale corporate farming operations to smallholder farmers, all seeking robust protection against yield-threatening insect pests. Large commercial farms, particularly those specializing in commodity crops like corn, soybean, and canola, are the most significant volume consumers, primarily utilizing pre-treated seeds that integrate Clothianidin as a preventative measure against soil-borne and early-season pests. These customers demand highly reliable, effective, and environmentally compliant seed treatment formulations that integrate seamlessly into mechanized planting systems.

Another crucial customer segment comprises seed companies (e.g., multinational seed giants) and professional seed treaters who purchase Clothianidin formulations in bulk to apply to proprietary seed varieties before sale. For these customers, the stability, low-dust characteristics, and compatibility of the insecticide with fungicides and polymer coatings are critical purchasing criteria. By integrating the insecticide directly into the seed package, they offer a value-added product that simplifies the farmer's planting process and guarantees optimized early-season protection.

Beyond traditional agriculture, potential customers include professional pest management operators, specialized greenhouse and nursery managers, and turfgrass professionals. In these non-crop segments, Clothianidin is utilized for controlling pests in highly sensitive environments, such as golf courses, public landscapes, and high-value ornamental plant production. These users prioritize highly targeted, low-risk formulations, often applied via soil drench or controlled release mechanisms, demonstrating the product’s utility beyond staple food crops and highlighting its versatility across diverse horticultural and commercial sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.85 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bayer CropScience, Syngenta (part of ChemChina), BASF SE, Sumitomo Chemical Co., Ltd., FMC Corporation, UPL Limited, Adama Agricultural Solutions Ltd., Gharda Chemicals Ltd., Jiangsu Changqing Agrochemical Co., Ltd., Rallis India Ltd., Nufarm Ltd., Corteva Agriscience, Nippon Soda Co., Ltd., Shandong Hailir Chemical Co., Ltd., Arysta LifeScience (now part of UPL), Sinon Corporation, Rotam CropSciences, Hubei Sanonda Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Clothianidin Market Key Technology Landscape

The technological landscape of the Clothianidin market is primarily focused on overcoming environmental challenges and enhancing the safety profile of the active ingredient, driven heavily by regulatory pressures. The most critical technological advancement lies in advanced formulation chemistry, specifically the development of high-quality Flowable Concentrates for Seed Treatment (FS) and sophisticated microencapsulation techniques. FS formulations are designed to ensure consistent, uniform application onto seeds while minimizing "dust-off," which is the release of insecticide particulates into the air during handling and planting, a major pathway for environmental exposure. Modern polymer coatings are used alongside these formulations to seal the active ingredient onto the seed surface, improving adhesion and reducing unintended runoff into the soil profile.

Furthermore, technology is centered on optimizing the systemic movement and longevity of Clothianidin within the target plant. Research focuses on developing formulations that modulate the release rate, ensuring the insecticide remains bioavailable throughout the critical seedling stage without accumulating excessively in non-target parts of the plant or the surrounding environment. This targeted delivery mechanism is often integrated with precision agriculture technologies, including Variable Rate Technology (VRT) in soil application systems. VRT utilizes GPS and soil maps to adjust the dosage of granular or liquid formulations based on known pest pressure zones within a field, significantly reducing the total volume of chemical applied while maintaining efficacy in high-risk areas.

Finally, resistance management technology forms a crucial part of the innovation strategy. The continuous use of any single chemical class leads to pest resistance, threatening the viability of Clothianidin. Manufacturers are actively developing and promoting pre-mixed formulations that combine Clothianidin with active ingredients from different chemical classes (e.g., pyrethroids or organophosphates) to provide multi-site action. This technological approach mitigates the development of resistance in target pests, such as whiteflies and aphids, thereby extending the effective lifecycle of the product and ensuring its long-term utility within comprehensive Integrated Pest Management protocols adopted globally by responsible agricultural organizations.

Regional Highlights

The Asia Pacific (APAC) region dominates the Clothianidin market, both in terms of consumption volume and future growth potential. Countries such as China, India, Indonesia, and Australia feature large-scale agriculture, high pest infestation rates requiring robust control, and generally less restrictive regulatory environments compared to Western counterparts. The rapid mechanization of farming and the increasing adoption of high-yield crop varieties in these countries necessitate reliable and cost-effective seed treatments and foliar sprays, making Clothianidin an essential component of pest management strategies for major crops like rice, cotton, and various vegetables. Government focus on self-sufficiency and food security further drives continuous high demand.

North America represents a mature but highly volatile market, characterized by significant usage in corn, soybean, and canola production, primarily via seed treatment applications. However, this region is subjected to intense public scrutiny and state-level regulatory divergence, particularly regarding pollinator safety. While the Federal level maintains some registrations, state bans or restrictions on certain neonicotinoid applications (especially foliar sprays) significantly constrain market potential. Companies operating in the U.S. and Canada must invest heavily in stewardship, farmer education, and data collection (AI-driven application mapping) to demonstrate responsible use and maintain product licenses amidst ongoing political and environmental pressures.

Europe presents the most challenging regional environment due to the near-total ban on neonicotinoids, including Clothianidin, for outdoor agricultural use across most of the European Union. This regulatory barrier has shifted the focus entirely to non-agricultural uses (e.g., protected cultivation, greenhouses, ornamental applications) or has pushed the market toward alternative, often less effective, or more expensive chemistries. Latin America, particularly Brazil and Argentina, offers robust growth opportunities similar to APAC. Driven by massive soybean, corn, and cotton production, combined with emerging insect resistance issues, the demand for effective systemic solutions like Clothianidin remains high, supported by favorable climatic conditions and less stringent regulatory control compared to North America.

- APAC (Asia Pacific): Largest and fastest-growing market; high consumption in rice, cotton, and horticulture; driven by large farm acreage and relatively favorable regulations. Key countries: China, India, Indonesia.

- North America: Significant market for corn and soybean seed treatment; highly regulated environment; focus on stewardship and localized restrictions to mitigate pollinator impact. Key countries: U.S., Canada.

- Europe: Highly constrained market due to strict bans on outdoor applications; limited use primarily to greenhouses and specific non-agricultural sectors; innovation focused on finding suitable alternatives. Key countries: Germany, France (minimal use).

- Latin America (LATAM): Strong growth potential driven by large-scale commodity farming (soybean, corn); increasing pest pressure and reliance on systemic protection; favorable regulatory outlook compared to North America. Key countries: Brazil, Argentina.

- Middle East and Africa (MEA): Emerging market with localized high demand for specialized crops; growth dependent on agricultural infrastructure development and technology transfer; primarily focused on improving overall food production efficiency.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Clothianidin Market.- Bayer CropScience

- Syngenta (part of ChemChina)

- BASF SE

- Sumitomo Chemical Co., Ltd.

- FMC Corporation

- UPL Limited

- Adama Agricultural Solutions Ltd.

- Gharda Chemicals Ltd.

- Jiangsu Changqing Agrochemical Co., Ltd.

- Rallis India Ltd.

- Nufarm Ltd.

- Corteva Agriscience

- Nippon Soda Co., Ltd.

- Shandong Hailir Chemical Co., Ltd.

- Sinon Corporation

- Rotam CropSciences

- Hubei Sanonda Co., Ltd.

- Arysta LifeScience (now part of UPL)

- Chemtura (now part of FMC)

- Dalian Lvyuan Biological Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Clothianidin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Clothianidin and how does it function as an insecticide?

Clothianidin is a second-generation neonicotinoid insecticide. It acts systemically, meaning it is absorbed by the plant and protects all parts, including new growth. Its mode of action targets the insect central nervous system by interfering with nicotinic acetylcholine receptors, resulting in paralysis and subsequent death of the pest, making it highly effective against sucking insects like aphids and whiteflies.

What is the primary application method for Clothianidin in the global market?

The primary and fastest-growing application method is seed treatment. Applying Clothianidin directly to the seed provides early-season, localized protection to the young seedling, minimizing overall chemical usage in the environment compared to broadcast foliar sprays and ensuring rapid, uniform establishment of the crop stand.

How do regulatory restrictions, particularly in Europe, affect the Clothianidin market?

Regulatory restrictions, driven by concerns over pollinator health (bee toxicity), have severely constrained the market, leading to bans on outdoor agricultural use in the EU. This forces manufacturers to focus R&D on non-agricultural uses (greenhouses) and advanced formulations (microencapsulation) that can demonstrate minimal environmental risk for specific, non-banned applications in other regions.

What key technological innovations are shaping the future of Clothianidin use?

The future is shaped by precision application technologies, particularly the integration of AI for predictive pest modeling and variable rate application. Additionally, advanced formulation science, including low-dust flowable concentrates and polymer seed coatings, is crucial for improving safety, reducing environmental exposure, and ensuring regulatory compliance globally.

Which region currently leads the consumption of Clothianidin and why?

The Asia Pacific (APAC) region leads consumption. This dominance is attributed to extensive agricultural acreage, high endemic pest pressures in staple crops like rice and cotton, favorable climatic conditions supporting multiple pest cycles, and generally less restrictive regulatory frameworks compared to North America and Europe, allowing for diverse application methods.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager