Cloud Infrastructure Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432546 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Cloud Infrastructure Market Size

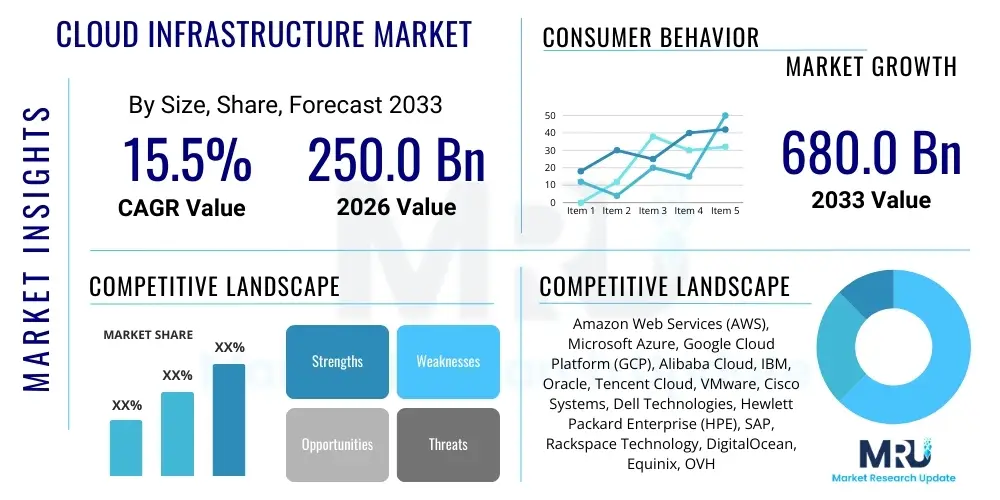

The Cloud Infrastructure Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at $250.0 Billion in 2026 and is projected to reach $680.0 Billion by the end of the forecast period in 2033.

Cloud Infrastructure Market introduction

Cloud infrastructure fundamentally refers to the composite architecture required to deliver cloud computing services, encompassing hardware components like servers, storage, and networking devices, alongside virtualized software layers, operating systems, and managed service applications. This architecture forms the backbone for Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS) offerings, enabling organizations to access scalable, on-demand computing resources without significant upfront capital investment. Key products within this ecosystem include server racks, data center interconnects, specialized accelerators (GPUs, TPUs), and comprehensive virtualization platforms that manage resource allocation and multi-tenancy environments. The inherent scalability, elasticity, and cost-efficiency provided by modern cloud infrastructure are primary factors fueling its widespread adoption across virtually all industries, from financial services to healthcare and media.

Major applications of cloud infrastructure span critical business operations, including hosting mission-critical enterprise applications, facilitating high-performance computing (HPC) workloads, enabling large-scale data analytics, and supporting disaster recovery and business continuity strategies. Furthermore, the rapid expansion of digital transformation initiatives, coupled with the necessity for distributed workforce enablement and remote operations, has cemented cloud infrastructure as a mandatory component of modern enterprise IT strategy. The benefits derived from robust cloud infrastructure are multifaceted, encompassing enhanced operational agility, reduced total cost of ownership (TCO) through the shift from CAPEX to OPEX models, improved security posture through centralized management tools, and accelerated time-to-market for new digital services.

Driving factors contributing significantly to the sustained market growth include the escalating volume of enterprise data requiring flexible storage solutions, the pervasive migration of on-premises workloads to hybrid and multi-cloud environments, and the increasing global demand for high-speed network connectivity and low-latency computing, particularly driven by edge computing initiatives. Regulatory reforms, while sometimes posing compliance challenges, often spur the adoption of specialized cloud solutions designed for data sovereignty and secure handling of sensitive information. Moreover, continuous technological advancements in hardware virtualization, serverless computing architectures, and the deployment of hyperscale data centers in emerging regions are perpetually expanding the addressable market for cloud infrastructure services.

Cloud Infrastructure Market Executive Summary

The Cloud Infrastructure Market is characterized by intense competition among hyperscale providers, sustained high growth rates driven by enterprise digital acceleration, and a critical pivot towards specialized infrastructure optimized for emerging technologies like Artificial Intelligence (AI) and edge computing. Current business trends indicate a significant shift in enterprise purchasing patterns, moving away from purely public cloud deployments toward sophisticated hybrid and multi-cloud strategies that allow for optimized workload placement, balancing factors such as cost, performance, and regulatory compliance. Furthermore, the increasing focus on sustainable IT practices and green data center operations is influencing infrastructure design, compelling vendors to invest heavily in energy-efficient hardware and advanced cooling technologies. The market is also witnessing rapid consolidation among mid-tier providers seeking specialized niches, particularly in areas like sovereign cloud and industry-specific PaaS offerings.

Regionally, North America maintains its dominance due to the presence of major technology hubs, high early adoption rates of cutting-edge technologies, and significant capital expenditure by hyperscale vendors. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth, fueled by massive digital population growth, governmental initiatives promoting digital transformation, and rapid establishment of new data center facilities in countries like India, Japan, and Australia. European trends are heavily influenced by stringent data privacy regulations, notably GDPR, which drives demand for local and regional cloud providers offering assured data residency, thereby favoring the adoption of hybrid cloud models managed through localized infrastructure solutions.

Segment trends reveal that the Infrastructure-as-a-Service (IaaS) component remains the largest segment by revenue, attributed to the foundational necessity of compute, storage, and networking resources for all cloud deployments. Within the deployment model segmentation, hybrid cloud solutions are gaining substantial traction as enterprises seek flexibility and control over sensitive data, bridging the gap between proprietary on-premises systems and expansive public cloud platforms. Technological segmentation shows accelerated growth in markets for specialized infrastructure, particularly those optimized for high-performance databases, machine learning model training, and low-latency edge deployments. The end-user analysis highlights substantial investment from the Banking, Financial Services, and Insurance (BFSI) sector, alongside robust adoption in the telecommunications and healthcare industries, driven by requirements for massive data handling and secure compliance frameworks.

AI Impact Analysis on Cloud Infrastructure Market

User inquiries regarding the impact of Artificial Intelligence on the Cloud Infrastructure Market predominantly revolve around three critical themes: necessary hardware acceleration, required network bandwidth, and the future cost implications. Users frequently ask, "How much specialized infrastructure, like GPUs and TPUs, is needed to run large language models?" and "Will AI training workloads overwhelm current data center networks?" A central concern focuses on resource contention—specifically, whether the surge in AI deployment will lead to prohibitive pricing or resource scarcity for standard enterprise workloads. Another key area of interest is how cloud providers are adapting their infrastructure design—specifically, the integration of dedicated AI chips, advanced storage solutions optimized for rapid data ingress/egress, and highly specialized, low-latency interconnects (e.g., InfiniBand alternatives) to handle complex, distributed AI training and inference processes efficiently. The collective user sentiment suggests a strong expectation that AI will act as the single largest long-term demand driver for cloud infrastructure innovation and capacity expansion.

The rise of generative AI, deep learning, and large model ecosystems (LLMs) necessitates an entirely new class of cloud infrastructure focused on high-density computing and massively parallel processing. This shift requires vendors to move beyond standard CPU-centric architectures and deploy purpose-built, highly expensive hardware accelerators, creating a substantial barrier to entry for smaller infrastructure providers and concentrating power among the hyper-scalers who can afford these massive investments. The specialized requirements extend beyond processing power to include high-throughput, low-latency storage systems (such as high-speed NVMe flash arrays) capable of feeding vast datasets to the training models without creating bottlenecks. Furthermore, the networking layer must evolve rapidly, transitioning to 400G and 800G Ethernet interconnects within the data center spine to manage the colossal data transfers inherent in multi-node AI training clusters, ensuring synchronization and efficiency across thousands of distributed accelerators.

The impact is also evident in the commercialization and delivery models of cloud infrastructure. AI drives the accelerated development of Platform-as-a-Service (PaaS) offerings dedicated solely to machine learning operations (MLOps) and model serving, making specialized infrastructure accessible to a wider developer base. This integration blurs the line between traditional IaaS and specialized AI services, forcing infrastructure providers to prioritize stack optimization from the silicon up to the API layer. Consequently, the demand for specialized, dedicated, or reserved AI infrastructure resources is expanding rapidly, often requiring custom procurement and unique pricing structures, fundamentally reshaping how cloud capacity is planned, deployed, and monetized across the global market. This infrastructural transformation underpins the entire AI economy.

- AI accelerates demand for high-performance computing (HPC) infrastructure, requiring massive deployments of GPUs, TPUs, and specialized neural processing units (NPUs).

- Drives significant capital expenditure (CAPEX) in next-generation data center networking (400G/800G) and extremely high-speed, low-latency interconnects to support distributed training clusters.

- Increases the market viability and necessity of dedicated storage solutions optimized for AI workloads, such as parallel file systems and high-throughput NVMe storage.

- Promotes the rapid commercialization and adoption of serverless infrastructure models tailored for AI inference and lightweight model serving at the edge.

- Leads to the specialization of cloud regions and zones dedicated solely to AI training, utilizing distinct hardware and power specifications unavailable in standard cloud offerings.

- Exacerbates resource planning complexity and potential resource contention between general enterprise workloads and intensive AI computation tasks.

DRO & Impact Forces Of Cloud Infrastructure Market

The Cloud Infrastructure Market is propelled by powerful market dynamics, constrained by significant operational and regulatory hurdles, and continually exposed to lucrative expansion opportunities. Primary drivers include the global imperative for digital transformation, which necessitates scalable and flexible IT resources, alongside the relentless growth of data volumes generated by connected devices and consumer interactions. The shift toward hybrid work models and the increasing reliance on complex enterprise applications requiring low-latency access further sustain demand. However, the market faces strong restraints, primarily concerning persistent data security and compliance concerns, particularly for highly regulated industries (BFSI, Healthcare), leading to caution in full-scale public cloud migration. The substantial initial capital investment required for building and maintaining hyperscale data centers also acts as a financial barrier to entry for new competitors. Opportunities are emerging through the expansion into edge computing environments, the integration of sovereign cloud solutions to meet geopolitical demands for data residency, and the monetization of specialized AI infrastructure services, offering differentiated, high-margin revenue streams. These forces collectively dictate the market's velocity and directional strategy.

Drivers are specifically evident in the telecommunications sector's migration toward 5G infrastructure, which inherently relies on localized cloud infrastructure (edge computing) to deliver necessary low latency, thereby generating massive demand for distributed compute resources. Additionally, the economic attractiveness of cloud models—allowing businesses to reduce their legacy IT operational overhead and redirect capital toward innovation—serves as a compelling, macro-economic driver. The impact force of virtualization and containerization technologies (like Kubernetes) continually improves infrastructure utilization and management efficiency, making cloud services more appealing and cost-effective, thus further accelerating adoption. However, navigating the complex licensing structures and vendor lock-in risks associated with proprietary cloud platforms remains a significant drag on adoption for enterprises seeking true flexibility and multi-cloud portability.

The overarching impact forces shaping the competitive landscape are technological disruption and geopolitical fragmentation. Technological advances, particularly in silicon efficiency and network performance, constantly redefine the baseline expectations for infrastructure capabilities, forcing rapid upgrade cycles among providers. Geopolitical fragmentation, expressed through data localization laws and varying standards of cyber resilience, creates robust opportunities for regional players to offer specialized, compliant infrastructure while simultaneously restraining the seamless global deployment capabilities of international hyperscalers. Consequently, investment flows are being directed toward resilient, geo-specific infrastructure deployments and tools that simplify multi-cloud governance and regulatory adherence across diverse jurisdictions.

- Drivers:

- Accelerated enterprise digital transformation initiatives across all vertical markets.

- Rapid proliferation of big data, IoT devices, and associated storage requirements.

- Increasing adoption of hybrid and multi-cloud strategies for workload optimization.

- Growing demand for high-performance computing (HPC) and specialized AI processing.

- Restraints:

- Persistent concerns regarding data security, privacy breaches, and complex regulatory compliance (e.g., GDPR, CCPA).

- High initial capital expenditure required for hyperscale data center construction and maintenance.

- Risks associated with vendor lock-in and challenges in achieving seamless cloud migration and data portability.

- Shortage of skilled cloud architecture and security professionals.

- Opportunities:

- Expansion of edge computing and micro data centers to support low-latency applications (5G, autonomous vehicles).

- Development and commercialization of sovereign cloud solutions addressing data localization mandates.

- Monetization of specialized infrastructure services tailored for AI/ML and quantum computing readiness.

- Adoption of sustainability and green IT principles driving demand for energy-efficient infrastructure.

- Impact Forces:

- Technological advancements in processor architecture (e.g., ARM-based servers) enhancing performance per watt.

- Intense competitive pressure among hyperscale providers driving aggressive pricing and service innovation.

- Regulatory scrutiny forcing higher standards of security, transparency, and data governance in cloud deployments.

- Macroeconomic conditions influencing enterprise IT budget allocations and pace of cloud migration.

Segmentation Analysis

The Cloud Infrastructure Market is meticulously segmented across several critical dimensions, including service model, deployment model, organization size, and end-user industry, enabling precise analysis of demand patterns and competitive positioning. The service model segmentation differentiates IaaS, PaaS, and Content Delivery Networks (CDN) services, with IaaS forming the foundational core and PaaS demonstrating accelerated growth due to increased developer reliance on managed platforms. The deployment model segmentation—Public, Private, and Hybrid—reflects the evolution of enterprise cloud strategy, emphasizing the customized flexibility offered by hybrid solutions that leverage both on-premises control and public cloud scalability. Understanding these segmentations is vital for vendors aiming to tailor their infrastructure offerings and go-to-market strategies to specific industry needs and regulatory environments.

Analysis by organization size clearly indicates that large enterprises remain the primary consumers of hyperscale infrastructure capacity, driving significant recurring revenue for major cloud providers through complex, multi-year contracts involving sophisticated hybrid setups and specialized infrastructure demands (e.g., SAP hosting, HPC clusters). However, the Small and Medium-sized Enterprises (SMEs) segment is rapidly increasing its contribution, driven by the accessibility and lower barrier to entry offered by public cloud IaaS and SaaS components, enabling them to achieve enterprise-level agility without heavy capital outlay. The focus for SMEs is often on simplified management, robust security baked into the platform, and pay-as-you-go consumption models, which heavily influence the design of cloud infrastructure products targeting this demographic.

Furthermore, segmentation by end-user industry reveals distinct infrastructure utilization profiles. The BFSI sector demands extreme levels of security, resilience, and compliance-specific infrastructure, often favoring private or hybrid deployments. Conversely, the Media and Entertainment sector requires massive bandwidth and high-throughput storage capacity for content delivery and streaming, heavily utilizing CDN and scalable storage infrastructure components. The Healthcare industry is characterized by the need for regulatory compliant data handling (e.g., HIPAA) and increasing adoption of AI for diagnostics, necessitating specialized infrastructure for secure patient data management and high-performance computing for medical image analysis. These vertical-specific requirements drive innovation in specialized cloud hardware and service integration.

- By Component:

- Hardware (Servers, Storage, Networking, Other Specialized Hardware)

- Software (Operating Systems, Virtualization Software, Cloud Management Platforms)

- By Service Model:

- Infrastructure-as-a-Service (IaaS)

- Platform-as-a-Service (PaaS)

- Content Delivery Networks (CDN)

- By Deployment Model:

- Public Cloud

- Private Cloud

- Hybrid Cloud

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By End-User Industry:

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and Life Sciences

- Telecommunications and IT

- Retail and E-commerce

- Government and Public Sector

- Manufacturing and Automotive

- Media and Entertainment

Value Chain Analysis For Cloud Infrastructure Market

The value chain for the Cloud Infrastructure Market is intricate and highly consolidated at the top, beginning with upstream raw material suppliers and silicon manufacturers, moving through infrastructure providers (hyperscalers), and culminating at downstream solution integrators and end-users. The initial stage involves core technology providers, such as semiconductor companies (e.g., Intel, AMD, NVIDIA) that design and manufacture the critical processors, memory modules, and specialized accelerators fundamental to cloud servers. Original Equipment Manufacturers (OEMs) then assemble these components into customized server racks and networking equipment optimized for hyperscale data center environments. Control over this upstream component supply, particularly specialized silicon for AI, grants significant leverage and dictates cost structures for the entire industry.

The central stage of the value chain is dominated by the major Cloud Service Providers (CSPs)—the hyperscalers—who acquire, deploy, and manage this massive hardware infrastructure across global data center networks. These CSPs invest heavily in virtualization software, proprietary cloud management platforms, and network infrastructure to deliver the core IaaS and PaaS services. Their role involves managing enormous energy consumption, ensuring physical security, and developing the proprietary software stack that optimizes hardware performance and resource allocation for multi-tenancy. This stage adds the highest value by transforming raw hardware capacity into scalable, consumable computing services, which are then sold directly to enterprises or through partner channels.

Downstream analysis focuses on the distribution channels and the final consumption layers. Distribution primarily occurs through direct sales channels for large enterprises and highly specialized cloud resellers, managed service providers (MSPs), and system integrators (SIs) for SMEs and tailored industry solutions. MSPs play a crucial role in enhancing the value chain by offering crucial services such as migration strategy, hybrid cloud management, security monitoring, and cost optimization, bridging the gap between complex cloud architecture and end-user business needs. Direct sales channels are frequently employed by hyperscalers for their largest enterprise clients, ensuring deep integration and customized service level agreements (SLAs), while indirect channels are essential for market penetration into diverse regional and SME markets, requiring partners to handle localization and ongoing support.

Cloud Infrastructure Market Potential Customers

Potential customers for cloud infrastructure are defined as any organization or entity requiring flexible, scalable, and reliable computing resources to execute their digital operations, ranging from startups needing rapid scaling to global corporations requiring global network redundancy. The end-user spectrum is incredibly broad but heavily concentrated in sectors characterized by high data processing needs, stringent security requirements, and fluctuating computational demands. The Financial Services sector, including global banks and insurance firms, represents a cornerstone clientele, driven by the need for secure transaction processing, algorithmic trading platforms, and massive regulatory reporting systems, often favoring private and hybrid cloud models for control over sensitive financial data.

Another rapidly expanding segment consists of technology-intensive enterprises, including Software-as-a-Service (SaaS) providers, gaming companies, and technology start-ups, who rely entirely on public cloud infrastructure to host and scale their core products rapidly and cost-effectively. These customers prioritize elasticity, developer tools (PaaS), and global reach, making them primary consumers of standard IaaS offerings. Furthermore, the Government and Public Sector entities, motivated by mandates for modernization and improved citizen service delivery, are increasingly adopting secure cloud infrastructure solutions, often requiring specialized compliance certifications and segregated data environments (e.g., FedRAMP in the U.S.), presenting a large, high-value customer segment.

In addition to these core segments, emerging customer groups include industrial organizations engaged in Manufacturing and Automotive, utilizing cloud infrastructure for IoT data processing, supply chain optimization, and running complex simulations (Digital Twins). The sheer volume of sensor data generated by smart factories and autonomous vehicles necessitates edge-based cloud infrastructure integrated seamlessly with central public cloud platforms. Finally, educational institutions and scientific research bodies represent critical consumers of HPC-optimized cloud infrastructure for complex computational research, genomic sequencing, and large-scale academic collaboration platforms, typically demanding burst capacity and specialized accelerator access.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $250.0 Billion |

| Market Forecast in 2033 | $680.0 Billion |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), Alibaba Cloud, IBM, Oracle, Tencent Cloud, VMware, Cisco Systems, Dell Technologies, Hewlett Packard Enterprise (HPE), SAP, Rackspace Technology, DigitalOcean, Equinix, OVHcloud, Baidu AI Cloud, Huawei Cloud, Salesforce, ServiceNow |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cloud Infrastructure Market Key Technology Landscape

The technological landscape of the Cloud Infrastructure Market is characterized by a rapid evolution toward highly optimized, software-defined environments and specialized silicon designed for specific workloads. Core technologies include advanced server virtualization platforms (e.g., KVM, Xen, VMware vSphere) that underpin IaaS delivery, alongside the foundational transition to bare metal servers supporting container orchestration tools like Kubernetes, which ensure portability and agility across multi-cloud environments. Networking infrastructure is fundamentally changing with the deployment of Software-Defined Networking (SDN) and Network Function Virtualization (NFV), allowing cloud providers to manage massive traffic volumes and deliver personalized bandwidth requirements with greater programmatic efficiency. Furthermore, the integration of high-speed interconnects (like NVLink or proprietary fabrics) is becoming essential for creating tightly coupled clusters required by modern HPC and AI applications, moving beyond traditional networking limitations.

Storage technology represents another major area of innovation, moving increasingly toward software-defined storage (SDS) solutions that offer flexible scaling and unified management across block, file, and object storage types. The adoption of high-performance NVMe flash storage and persistent memory technologies is critical for minimizing latency and maximizing throughput for demanding database and analytics workloads. Simultaneously, serverless computing architectures (Function-as-a-Service or FaaS) are transforming how applications are deployed, requiring underlying infrastructure that can rapidly provision and de-provision resources at a granular level, leading to highly optimized utilization rates and influencing data center hardware procurement strategies toward microservices support.

Looking ahead, the market is heavily investing in technologies supporting environmental sustainability and enhanced security. This includes the development and deployment of energy-efficient server hardware (often utilizing ARM-based processors), advanced liquid cooling techniques to manage the heat generated by high-density AI racks, and specialized cryptographic hardware (Hardware Security Modules or HSMs) embedded directly into the infrastructure. Hybrid cloud management platforms utilizing artificial intelligence operations (AIOps) are also becoming standard, offering automated monitoring, predictive maintenance, and optimized resource allocation across complex hybrid and multi-cloud footprints, ensuring operational excellence and reducing human intervention in critical infrastructure management tasks.

Regional Highlights

Regional analysis reveals stark differences in market maturity, regulatory influence, and growth trajectories across the globe. North America, encompassing the United States and Canada, remains the largest and most mature market, serving as the epicenter for technological innovation and housing the headquarters of the dominant hyperscale providers (AWS, Azure, GCP). Market saturation, while high, is offset by persistent high demand from the large enterprise sector for complex hybrid architectures and specialized AI/ML infrastructure. Investment in cutting-edge data center technologies, driven by fierce competitive pressures and the necessity to support ultra-low latency services, ensures its continued leadership in terms of capital expenditure and revenue generation.

Europe represents a highly fragmented yet rapidly expanding market, characterized by significant regulatory constraints, particularly concerning data sovereignty and privacy (GDPR). This regulatory environment strongly favors the deployment of sovereign clouds and localized infrastructure managed by European providers, or by hyperscalers who adhere strictly to data residency requirements. The adoption rate is robust across the BFSI and government sectors, driven by modernization efforts, but often leans towards private and hybrid models to maintain control. Western Europe is mature, while Eastern Europe is experiencing explosive growth due to digital infrastructure catch-up and increasing foreign direct investment.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally, buoyed by the rapid digitization of economies in China, India, Southeast Asia, and Australia. Factors driving this growth include massive population sizes, increasing internet penetration, governmental support for cloud adoption, and a burgeoning ecosystem of cloud-native start-ups. While China's market is largely dominated by domestic providers (Alibaba, Tencent, Huawei), the rest of APAC presents significant opportunities for global hyperscalers focusing on localized data centers, robust network connectivity, and scalable capacity to meet the demands of e-commerce, mobile applications, and large-scale manufacturing operations.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets exhibiting high potential. In LATAM, infrastructure deployment is accelerating, particularly in Brazil and Mexico, driven by the expansion of financial technology (FinTech) and the demand for improved regional network access. The MEA region is seeing substantial government-led investment, especially in the Gulf Cooperation Council (GCC) countries, focusing on diversifying economies away from oil dependency and establishing regional technology hubs, leading to significant build-out of modern data centers and robust cloud infrastructure services tailored for government and smart city projects.

- North America: Market leader; characterized by high maturity, dominance of hyperscale providers, and major investment in AI-optimized and HPC infrastructure.

- Europe: High growth driven by digital transformation; significantly influenced by GDPR and data sovereignty rules, leading to strong demand for hybrid and sovereign cloud infrastructure.

- Asia Pacific (APAC): Fastest-growing region; powered by rapid digitization, massive enterprise workload migration, and localized infrastructure build-outs in key markets like India and Southeast Asia.

- Latin America: Emerging high-growth region; increasing demand from FinTech and e-commerce sectors, focused on enhancing regional connectivity and data center redundancy.

- Middle East & Africa (MEA): Growth driven by government initiatives (Vision 2030 in Saudi Arabia, UAE); high capital investment in developing smart city infrastructure and localized cloud services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cloud Infrastructure Market.- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud Platform (GCP)

- Alibaba Cloud

- IBM Corporation

- Oracle Corporation

- Tencent Cloud

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- Cisco Systems Inc.

- VMware Inc. (A Broadcom Company)

- SAP SE

- Rackspace Technology

- DigitalOcean Holdings, Inc.

- Equinix, Inc.

- Huawei Technologies Co., Ltd.

- Baidu AI Cloud

- Lenovo Group Ltd.

- NetApp, Inc.

- Pure Storage, Inc.

Frequently Asked Questions

Analyze common user questions about the Cloud Infrastructure market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between IaaS, PaaS, and SaaS in the context of cloud infrastructure?

IaaS (Infrastructure-as-a-Service) provides the fundamental compute, storage, and networking components, giving the user maximum control over operating systems and middleware. PaaS (Platform-as-a-Service) offers a ready-to-use development environment, including operating systems and databases, abstracting away underlying infrastructure management. SaaS (Software-as-a-Service) delivers fully managed applications over the internet, requiring minimal user management beyond configuration, thus utilizing cloud infrastructure as a utility layer.

How is the rise of edge computing reshaping cloud infrastructure deployment strategies?

Edge computing is shifting cloud infrastructure from centralized hyperscale data centers towards distributed, smaller footprint micro data centers located closer to the point of data generation (e.g., factories, retail stores, 5G towers). This deployment minimizes latency for mission-critical applications like autonomous vehicles and industrial IoT, requiring cloud providers to develop specialized, ruggedized infrastructure hardware and highly efficient orchestration platforms capable of managing vast distributed resources.

What are the most significant security concerns affecting the adoption of public cloud infrastructure?

The most significant security concerns revolve around data governance, compliance with specific regulatory mandates (e.g., data residency), and the shared responsibility model. Users worry about misconfigurations, ensuring adequate identity and access management (IAM), and preventing unauthorized access to sensitive data stored within a multi-tenant environment. Hyperscalers address this through robust security tools, strict certifications, and comprehensive encryption standards to maintain data integrity and confidentiality across the infrastructure stack.

Which geographical region exhibits the highest expected growth rate in the Cloud Infrastructure Market and why?

The Asia Pacific (APAC) region is forecasted to have the highest Compound Annual Growth Rate (CAGR) due to rapid industrial digitization, massive population growth driving mobile and e-commerce adoption, and increasing government investments in digital infrastructure modernization. Countries like India, China, and Southeast Asian nations are undergoing rapid technological transformation, demanding scalable cloud resources to support their expanding digital economies and domestic tech ecosystems, leading to substantial new data center capacity build-out.

What role does vendor lock-in play as a restraint in multi-cloud and hybrid infrastructure adoption?

Vendor lock-in is a key restraint, referring to the difficulty and cost associated with migrating data and complex applications from one cloud provider's proprietary infrastructure and platform services to another. It inhibits multi-cloud flexibility by making it technically challenging or financially prohibitive for enterprises to switch providers or distribute workloads optimally. Organizations mitigate this by prioritizing open-source technologies, containerization (like Kubernetes), and multi-cloud management tools to maintain portability and negotiate favorable contractual terms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Mea Cloud Infrastructure Services Market Size Report By Type (Public Cloud, Private Cloud, Hybrid Cloud), By Application (.), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Cloud Infrastructure Market Size Report By Type (Hardware, Services), By Application (BFSI, Telecommunications and ITES, Healthcare, Government, Media and Entertainment, Manufacturing, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Penetration Testing Market Size Report By Type (Network Penetration Testing, Web & Wireless Penetration Testing, Cloud Infrastructure Penetration Testing), By Application (Small and Medium Enterprises, Large Enterprises), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Cloud Infrastructure Testing Market Size Report By Type (Server, Storage, Operating System), By Application (Banking, Financial Services, and Insurance, Telecom and IT, Government, Hospitality, Education, Public Sector and Utilities, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Pen-testing Market Statistics 2025 Analysis By Application (Small and Medium Enterprises, Large Enterprises), By Type (Network Penetration Testing, Web & Wireless Penetration Testing, Social Engineering Penetration Testing, Cloud Infrastructure Penetration Testing), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager