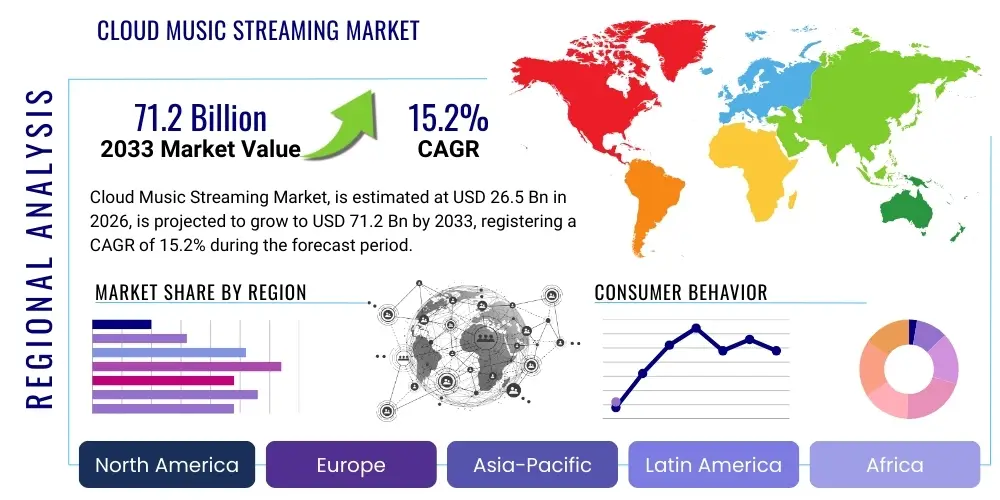

Cloud Music Streaming Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438898 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Cloud Music Streaming Market Size

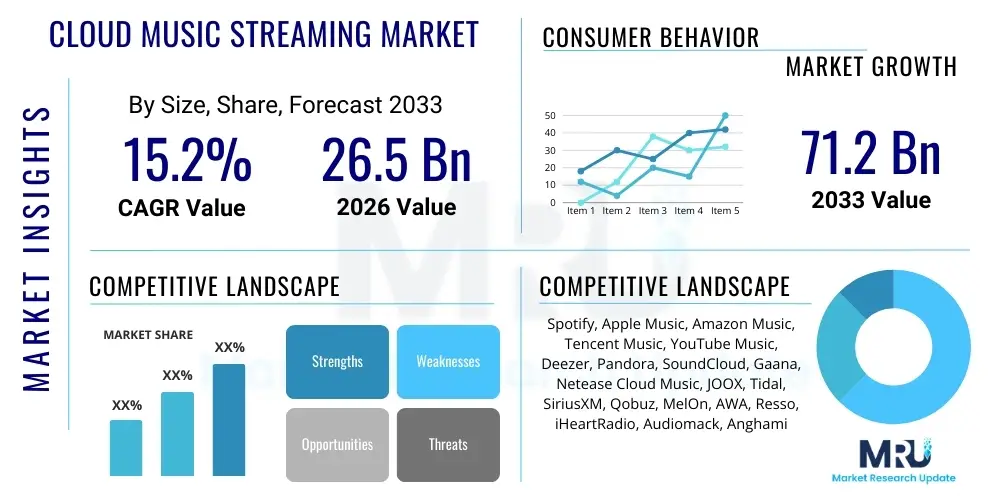

The Cloud Music Streaming Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.2% between 2026 and 2033. The market is estimated at USD 26.5 billion in 2026 and is projected to reach USD 71.2 billion by the end of the forecast period in 2033.

Cloud Music Streaming Market introduction

Cloud music streaming fundamentally represents the digital distribution model where audio content is delivered on-demand via the internet from centralized, scalable cloud servers, eliminating the need for local storage of media files by the end-user. This transformative approach has redefined consumer interaction with music, offering immense catalogs accessible across numerous interconnected devices using either cellular data or Wi-Fi networks. The core infrastructure relies heavily on robust Content Delivery Networks (CDNs) and advanced data compression techniques to ensure high-quality, low-latency playback regardless of the user's geographical location or device capabilities. The value proposition extends beyond mere accessibility, incorporating sophisticated features like personalized discovery, collaborative playlist creation, and seamless integration into pervasive digital ecosystems.

The widespread application of cloud music streaming spans individual consumer entertainment, where users utilize platforms for daily listening, discovery, and social sharing of music preferences. Major adjacent applications include integrated fitness ecosystems, where dynamic music tailored to workout intensity is streamed; specialized therapeutic soundscapes utilized in wellness and mental health applications; and commercial licensing for background music in public venues such as retail stores, restaurants, and corporate environments. The technological complexity involved includes managing vast amounts of proprietary and licensed metadata, ensuring instant synchronization across disparate user devices, and maintaining robust Digital Rights Management (DRM) systems to protect intellectual property against unauthorized distribution, which is central to maintaining stable relationships with copyright holders.

Market expansion is significantly driven by several key factors: the unrelenting global proliferation of smartphones and other connected consumer electronic devices, which serve as the primary access points; substantial improvements in global mobile network infrastructure, particularly the rollout of 5G technology enabling high-resolution audio streaming without buffering; and the growing consumer acceptance of recurring subscription models for media access over outright ownership. Furthermore, the effectiveness of AI-driven recommendation engines in enhancing user experience and surfacing culturally relevant content is crucial for reducing churn and boosting subscriber loyalty. The inherent flexibility of the cloud model allows platforms to rapidly adapt to new audio formats, such as spatial and lossless audio, continually offering consumers a technological incentive to migrate from older media formats and invest in premium tiers.

Cloud Music Streaming Market Executive Summary

The Cloud Music Streaming Market is positioned at the intersection of media consumption shifts, technological infrastructure advancements, and complex digital rights management, exhibiting dynamic growth characterized by strategic diversification and intense platform competition. Current business trends illustrate a move beyond pure music delivery, focusing heavily on adjacent audio content such as podcasts, audiobooks, and live radio features to increase platform stickiness and maximize the perceived value of subscription packages. Key operational shifts include heavy investment in proprietary content—either exclusive artist deals or original podcast production—to differentiate offerings from competitors that largely share the same foundational music catalogs. Furthermore, platforms are aggressively pursuing integration into non-traditional consumption environments, notably in connected cars and specialized B2B commercial settings, opening up significant, often overlooked, revenue streams that stabilize annual recurring revenue.

Regionally, the market presents a dichotomy: North America and Western Europe command the highest ARPU and subscription penetration rates, acting as profitability centers where the focus is on premium feature upselling, such as high-fidelity and spatial audio. Conversely, the Asia Pacific (APAC) region, driven by countries like India and Indonesia, represents the future volume growth engine. APAC dynamics are shaped by affordability constraints, resulting in a dominance of localized freemium models and specialized partnerships with mobile carriers to bundle data and access. Latin America mirrors this mobile-first, value-conscious growth trajectory, while the Middle East and Africa (MEA) are emerging, pending further investment in reliable broadband infrastructure and the development of secure local digital payment ecosystems necessary to foster subscription reliability.

Segmentation analysis clearly indicates the subscription tier as the financial backbone of the market, offering predictable, high-margin revenue crucial for covering escalating content acquisition costs and infrastructural scaling. However, the ad-supported segment remains strategically vital as a massive user funnel and a crucial revenue source in price-sensitive markets, often employing increasingly sophisticated targeting algorithms for advertisers. Device segmentation confirms the smartphone as the dominant consumption medium, yet smart speakers, driven by increased AI-driven voice interaction capabilities, and connected vehicle systems are rapidly acquiring dedicated listening hours. The long-term market trajectory points toward immersive audio experiences, powered by advancements in spatial audio technology and the integration of music discovery mechanisms directly into social media and gaming platforms, fundamentally blurring the lines between media consumption and interactive entertainment.

AI Impact Analysis on Cloud Music Streaming Market

User inquiries concerning AI's transformative role in cloud music streaming frequently center on three critical areas: the sophistication and potential bias of algorithmic recommendation engines, the legal and creative implications of generative music composition, and AI’s capacity to optimize the economic model for rights holders. Users are concerned about whether algorithmic curation leads to content filters, inadvertently excluding independent or niche artists in favor of mainstream, data-validated tracks. Simultaneously, there is significant interest in how AI can move beyond simple playlist creation to offer truly contextual, mood-based, and activity-driven soundscapes that feel uniquely human in their curation, raising the bar for hyper-personalization across all major platforms.

From an operational standpoint, AI integration drives substantial efficiencies, particularly in metadata management and server infrastructure optimization. Machine learning models automatically process billions of audio characteristics and user interactions, allowing platforms to accurately tag content (mood, genre, tempo, instrumentation) far beyond manual capability, which significantly enhances search functionality and the precision of recommendations. Furthermore, predictive AI models forecast peak usage times and geographical load patterns, allowing cloud infrastructure to dynamically allocate server resources. This optimization minimizes operational latency and reduces overall infrastructure costs, translating directly into improved profitability margins for large-scale Digital Service Providers (DSPs) while maintaining service reliability during high-demand periods globally.

The increasing prominence of generative AI presents a disruptive force within the content creation ecosystem, moving from simple assistance tools to sophisticated models capable of producing commercially viable, royalty-free background music tailored for gaming, advertising, and fitness applications. This content creation shift offers an opportunity for DSPs to supplement licensed music libraries with platform-owned content, thereby reducing reliance on major label negotiations and lowering effective content costs. However, this also introduces critical ethical and legal challenges regarding intellectual property rights—specifically, who owns the copyright to music generated by an algorithm trained on existing human-created works—a topic requiring urgent legislative clarity and industry consensus to avoid long-term market instability and disputes with established artists' rights organizations.

- Hyper-personalization: AI refines recommendation algorithms using deep learning, increasing playlist accuracy by correlating listening patterns with external data points like location and time, drastically boosting listener session length and reducing churn.

- Generative Music Production: Algorithms create bespoke, royalty-free functional music for integrated platform features, providing cost control and proprietary content differentiation.

- Optimized Search and Discovery: AI enhances semantic search capabilities, enabling natural language queries and improving the discovery of niche content through advanced metadata processing and contextual relevance ranking.

- Operational Cost Reduction: Predictive AI optimizes Content Delivery Network (CDN) usage and cloud resource allocation based on anticipated demand spikes, lowering bandwidth and storage expenditures.

- Sophisticated Royalty Tracking: Machine learning improves the precision of micro-payment distribution by accurately tracking and logging streams across complex user journeys and device switching.

- Audio Quality Enhancement: AI processes audio files to upscale quality or optimize compression for varying bandwidths in real-time, ensuring the best possible experience across low-end and high-end consumer devices.

DRO & Impact Forces Of Cloud Music Streaming Market

The Cloud Music Streaming Market is primarily propelled by powerful socio-economic and technological drivers, most notably the near-universal access to smartphones coupled with decreasing costs of mobile data across large parts of the globe. The rollout of high-speed 5G networks is critical, as it addresses previous streaming constraints by allowing users to access high-fidelity, bandwidth-intensive audio formats reliably on the move, transforming the listening experience from background entertainment to a premium, immersive media experience. Furthermore, the cultural shift among younger demographics away from physical or downloaded media towards subscription-based access models accelerates market maturation. The inherent convenience of cloud access, offering infinite libraries without storage constraints or manual file management, serves as a decisive competitive advantage over legacy consumption methods.

Despite robust growth, the market faces significant structural restraints, chiefly the immensely complex and escalating costs associated with global music licensing. Platforms must negotiate rights with thousands of artists, publishers, and record labels across different territories, a process that consumes significant operational capital and time, often leading to content gaps in specific regions. Additionally, in many emerging economies, the cost of mobile data relative to disposable income remains high, making prolonged streaming inaccessible to lower-income segments, thereby limiting the adoption of high-ARPU subscription tiers and necessitating reliance on low-margin ad-supported models. The persistent issue of music piracy, although declining, continues to divert potential revenue, demanding constant investment in sophisticated DRM and anti-piracy countermeasures that add to operational overhead.

Opportunities for future expansion are manifold and focus heavily on technological integration and geographical diversification. The rising popularity of spatial audio and virtual reality ecosystems, particularly the metaverse, offers platforms a chance to redefine music consumption into shared, interactive experiences, commanding premium pricing. Expanding into commercial B2B segments, such as providing bespoke sound solutions for retail and corporate wellness environments, opens stable, recession-resistant revenue streams less susceptible to consumer churn. Strategic partnerships with telecommunication companies in high-growth regions like Southeast Asia and Africa, offering heavily subsidized or bundled access, represent a scalable mechanism for accelerating user acquisition and combating high data usage costs as a consumer barrier.

The market is impacted by several potent external forces. Pricing pressure represents a constant competitive force, compelling major players to maintain competitive, often introductory, pricing to attract new users, thereby sometimes suppressing overall ARPU growth. The bargaining power of major record labels remains extremely high due to their control over decades of essential catalog content, allowing them to continually demand higher royalty splits and guaranteed minimum payments, which squeezes platform profit margins. Furthermore, increasing regulatory scrutiny, particularly in the EU and US, regarding anti-competitive practices, data privacy (GDPR, CCPA compliance), and fair artist compensation, necessitates stringent operational compliance, influencing platform feature development and market entry strategies globally, adding a layer of legislative uncertainty to long-term forecasting.

Segmentation Analysis

The segmentation of the Cloud Music Streaming Market provides a crucial framework for understanding diverse user behavior and tailoring monetization strategies effectively across varying global socioeconomic landscapes. The segmentation by Offering Type—Subscription-based versus Ad-supported—is paramount, illustrating the market's revenue structure. Subscription models target high-value users willing to pay for an uninterrupted, feature-rich experience, offering higher margins and predictable cash flows essential for long-term investment in technology and content acquisition. The ad-supported tier serves a dual purpose: acting as a low-barrier entry point to convert users to paid tiers, and capturing revenue from the vast global population that cannot or will not pay for digital media, thereby maximizing reach and maintaining overall market volume.

Segmentation by Platform/Device further reveals consumption trends. While mobile devices (smartphones/tablets) account for the overwhelming majority of listening hours due to portability, the rapid adoption of integrated devices—such as smart speakers (e.g., Amazon Echo, Google Home) and in-car infotainment systems—signals a move towards ambient, hands-free listening environments. This shift mandates platform optimization for voice control and seamless session transfer across devices, indicating that future competitive advantage will depend heavily on robust ecosystem integration beyond the mobile app itself. The End-User segmentation separates the high-volume, low-margin individual market from the high-margin, stable commercial market, which requires specialized licensing and service delivery tailored for public performance environments.

Segmentation by Content Type highlights the strategic move toward media diversification, driven by platforms seeking unique identifiers beyond the core music library. The inclusion of podcasts, live audio, and exclusive narrative content (audiobooks) increases the time spent on the platform and reduces perceived substitutability, a critical factor in a market where music catalogs are largely standardized due to licensing agreements. Geographical segmentation is arguably the most dynamic layer, reflecting distinct market maturity levels. North America and Europe prioritize premium subscriptions, while APAC and LATAM prioritize volume through aggressive freemium or carrier-bundled models, necessitating localized content catalogs, language support, and regional payment gateway integration to facilitate transactional fluidity and accessibility for a mass-market audience.

- By Offering Type:

- Subscription-based (Premium Tier)

- Ad-supported (Freemium Tier)

- By End-User:

- Individual/Personal Consumption

- Commercial/Business Use

- By Content Type:

- Music Catalog

- Podcasts and Talk Shows

- Live Audio/Radio Streaming

- By Platform/Device:

- Smartphones and Tablets (iOS, Android)

- Smart Speakers and Home Hubs

- Computers and Laptops

- Connected Car Systems

- Wearables and Gaming Consoles

Value Chain Analysis For Cloud Music Streaming Market

The Cloud Music Streaming value chain is highly complex, starting with the crucial upstream phase of Content Creation and Acquisition. This phase involves artists, songwriters, producers, and the entities responsible for managing the Intellectual Property (IP), primarily major record labels (Universal, Sony, Warner) and large independent distributors. Content creation includes the recording, mixing, and mastering processes, while acquisition centers on licensing—securing the rights to publicly perform, reproduce, and distribute the audio files digitally. The efficiency of this phase depends heavily on accurate metadata embedding, which ensures proper royalty tracking later in the chain. Control over premium and exclusive content at this stage provides the DSPs with a critical competitive differentiation advantage.

The midstream phase encompasses the platform operations and infrastructure managed by the Digital Service Providers (DSPs). This involves vast cloud storage solutions, implementation of proprietary encoding and compression techniques to optimize file size for streaming quality, and the deployment of global Content Delivery Networks (CDNs) to minimize latency for users worldwide. Crucially, the DSPs develop and maintain the core proprietary technology, including the user interfaces, AI recommendation engines, and robust Digital Rights Management (DRM) systems necessary to enforce licensing restrictions and prevent unauthorized content sharing. The successful execution of this phase determines service reliability, scalability, and the overall quality of the user experience.

The downstream segment focuses entirely on distribution, monetization, and user interaction. Distribution occurs through both direct and indirect channels. Direct distribution involves the user downloading or accessing the platform’s application or website independently. Indirect distribution leverages strategic partnerships, such as bundling streaming subscriptions with mobile network operator contracts (Telco bundling), integration into OEM hardware (smart speakers, car manufacturers), and promotional deals via internet service providers. Monetization occurs through subscription fees and targeted advertising sales. The continuous flow of user data (listening habits, device usage, engagement metrics) forms a crucial feedback loop, feeding back into the midstream to refine recommendation algorithms and inform the upstream content acquisition strategy, thereby optimizing the entire value chain for future profitability and user satisfaction.

Cloud Music Streaming Market Potential Customers

The core customer segment remains the young, digitally integrated urban demographic, typically aged 18 to 34, who value convenience, high-quality audio, and personalized content discovery mechanisms. These individuals are comfortable with access-based economic models and are generally the first adopters of new features like spatial audio or high-resolution streaming tiers. This segment exhibits high mobile usage, frequent cross-device streaming, and a high likelihood of converting from ad-supported trials to premium family or individual subscription plans. Their willingness to pay for a superior, uninterrupted listening environment makes them the primary drivers of Average Revenue Per User (ARPU) growth across established Western markets.

A rapidly expanding segment involves the commercial End-User sector, which encompasses businesses that require ambient music for their operational environments but must comply with complex public performance licensing laws. This includes customers in the hospitality industry (cafés, hotels, bars), wellness and fitness centers that need integrated playlist management for group classes, and corporate offices seeking background audio solutions. These customers prioritize reliability, centralized control, and legal compliance, often subscribing to B2B-specific platforms or premium commercial tiers offered by major DSPs. This B2B segment is characterized by higher subscription volumes and lower churn rates, providing foundational stability to the market structure.

Emerging potential customer bases include older adults (55+) who are increasingly adopting smart speakers and simplified digital interfaces, providing a valuable niche for nostalgia-focused catalogs and user-friendly platforms. Additionally, consumers in emerging markets (APAC, LATAM) represent a massive volume opportunity, constrained primarily by disposable income and data costs. These users are heavy consumers of freemium and ad-supported services, making accessibility through carrier billing and localized pricing mechanisms essential for their conversion. The strategic focus on engaging these emerging market customers through culturally relevant content and lower-cost entry barriers is key to achieving global market saturation and long-term user count objectives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 26.5 billion |

| Market Forecast in 2033 | USD 71.2 billion |

| Growth Rate | 15.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Spotify, Apple Music, Amazon Music, Tencent Music, YouTube Music, Deezer, Pandora, SoundCloud, Gaana, Netease Cloud Music, JOOX, Tidal, SiriusXM, Qobuz, MelOn, AWA, Resso, iHeartRadio, Audiomack, Anghami |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cloud Music Streaming Market Key Technology Landscape

The foundational technology powering the cloud music streaming market is the scalable, globally distributed cloud infrastructure, typically utilizing major providers such as Amazon Web Services (AWS) and Google Cloud Platform (gCP) due to their extensive network reach and high availability. This infrastructure is essential for handling petabytes of audio files and accommodating millions of simultaneous user streams with minimal interruption. Optimization strategies heavily rely on sophisticated Content Delivery Networks (CDNs) that strategically cache frequently accessed content closer to end-users, drastically reducing geographic latency and ensuring that playback starts instantly, which is a key metric for user satisfaction and platform performance in AEO terms.

A major focus of technological differentiation lies in audio quality standards and transmission protocols. There is a decisive industry push towards high-resolution audio formats, including lossless (e.g., FLAC, ALAC) and truly immersive spatial audio technologies (such as Dolby Atmos and Sony 360 Reality Audio). Implementing these features requires proprietary encoding algorithms, greater storage capacity, and the development of custom software clients optimized to decode these complex audio streams efficiently across various device specifications, from high-end headphones to integrated home theater systems. These quality enhancements are primarily aimed at attracting and retaining high-ARPU subscribers willing to pay a premium for a superior sonic experience that leverages advancements in consumer hardware.

Furthermore, the integration of cutting-edge Artificial Intelligence (AI) and Machine Learning (ML) techniques is non-negotiable for competitive survival. AI governs the proprietary recommendation engines, processing user signals—explicit likes, skips, demographic data, and contextual environment—to create highly effective personalized content flows that drive engagement. Beyond user experience, NLP technology is crucial for optimizing voice-activated search and control, essential for interaction with smart speakers and automotive systems. Finally, robust Digital Rights Management (DRM) technologies and advanced encryption protocols are continuously updated to secure content against digital theft, safeguarding the economic interests of rights holders and maintaining the integrity of the subscription model across fragmented global operating systems and hardware environments.

Regional Highlights

The North American market, encompassing the United States and Canada, remains the global benchmark in terms of revenue and maturity, characterized by high Average Revenue Per User (ARPU) figures driven by a consumer base that shows a strong propensity for premium tier subscriptions. This region leads in technological adoption, particularly concerning the seamless integration of streaming services into smart home ecosystems, wearable technology, and the advanced infotainment systems of connected vehicles. The competitive landscape is dominated by tech giants like Apple Music and Amazon Music, alongside the industry leader, Spotify, driving continuous innovation in high-fidelity audio options and exclusive content acquisitions, particularly in the rapidly growing podcast segment. Regulatory stability and mature digital payment infrastructure support this market dominance, focusing competition on feature parity and ecosystem lock-in strategies.

Europe presents a highly consolidated yet regionally diverse market. Western European countries—including Germany, the United Kingdom, and France—exhibit mature subscription economies mirroring North America, although linguistic and cultural fragmentation necessitates highly localized content and marketing efforts. The regulatory environment, particularly concerning data privacy (GDPR compliance) and potential anti-competitive behaviors, is exceptionally stringent, impacting operational strategies for global players. Eastern and Southern Europe represent important growth pockets, often requiring more flexibility in pricing and greater emphasis on carrier billing options to overcome lower credit card penetration. The competitive intensity often pits pan-European players like Deezer against the global behemoths, focusing on content exclusivity related to local artists and national language podcasts.

Asia Pacific (APAC) stands out as the primary engine for future volume growth, projected to achieve the highest CAGR during the forecast period. This growth is predominantly fueled by massive population bases in markets like India, China, and Indonesia, coupled with accelerating mobile internet penetration and increasingly affordable smartphone devices. However, this region is largely characterized by low ARPU due to high price sensitivity, resulting in the prevalence of ad-supported and freemium models. China operates as a largely insulated market dominated by powerful domestic players like Tencent Music and Netease Cloud Music, which integrate music streaming with social networking and live performance platforms. India’s market growth relies heavily on regional language music catalogs and strategic partnerships with telecom providers to bundle services and mitigate high data costs for consumers.

Latin America (LATAM) shows immense potential, driven by a youthful demographic and rapid urbanization leading to increased digital consumption. Key markets such as Brazil and Mexico are transitioning quickly from historically high piracy rates to legalized streaming platforms, facilitated by improved digital payment options and widespread mobile connectivity. Strategic pricing localization and partnerships with local artists and festivals are critical success factors here. Finally, the Middle East and Africa (MEA) remain emerging territories, where market expansion is heavily dependent on infrastructure development—specifically, reliable, high-speed internet access—and the establishment of secure digital payment gateways. The GCC countries (e.g., UAE, Saudi Arabia) lead adoption rates in MEA due to higher disposable incomes, while regional players like Anghami focus on Arabic content exclusivity to secure early market dominance across North Africa and the Levant, capitalizing on cultural relevance.

- North America: Market leader by revenue; high ARPU, advanced technological integration (smart speakers, automotive systems), focus on premium Hi-Fi and spatial audio upgrades.

- Europe: Mature, fragmented market; stringent regulatory environment (GDPR), strong focus on localized content and language support; steady, sustainable subscriber growth.

- Asia Pacific (APAC): Highest user volume and growth rate; dominated by freemium models and mobile-first strategies; high competition from powerful domestic players (Tencent, Netease).

- Latin America (LATAM): High potential market; driven by youth demographics and conversion from piracy; success hinges on carrier bundling and localized competitive pricing structures.

- Middle East and Africa (MEA): Emerging market; growth constrained by infrastructure but promising in high-income urban centers; driven by localized content acquisition strategies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cloud Music Streaming Market.- Spotify Technology S.A.

- Apple Inc. (Apple Music)

- Amazon.com, Inc. (Amazon Music)

- Tencent Music Entertainment Group

- YouTube Music (Google LLC)

- Deezer S.A.

- Pandora Media (Sirius XM Holdings Inc.)

- SoundCloud Limited

- Gaana (Times Internet)

- Netease Cloud Music

- JOOX (Tencent)

- Tidal (Block, Inc.)

- SiriusXM

- Qobuz

- MelOn (Kakao Entertainment)

- AWA (Avex Group)

- Resso (ByteDance)

- iHeartMedia, Inc. (iHeartRadio)

- Audiomack

- Anghami

Frequently Asked Questions

What is the projected Compound Annual Growth Rate (CAGR) for the Cloud Music Streaming Market?

The Cloud Music Streaming Market is projected to exhibit a robust CAGR of 15.2% during the forecast period of 2026 to 2033, driven by increasing digital penetration and the expansion of mobile broadband infrastructure globally.

Which segmentation model currently generates the highest revenue in cloud music streaming?

The Subscription-based (Premium) offering type currently generates the highest revenue, characterized by stable recurring income and higher Average Revenue Per User (ARPU) compared to the volume-driven, Ad-supported model.

How is Artificial Intelligence (AI) primarily impacting content discovery?

AI utilizes sophisticated machine learning algorithms to analyze extensive user behavioral data, creating hyper-personalized playlists and recommendations that significantly improve user engagement, retention rates, and content consumption diversity.

Which geographical region is anticipated to demonstrate the fastest growth in this market?

The Asia Pacific (APAC) region is expected to demonstrate the fastest market growth, primarily fueled by vast, young populations in countries like China and India, coupled with rapid smartphone adoption and the widespread use of freemium services.

What are the primary restraints affecting the expansion of cloud music streaming?

Key restraints include the high operational costs associated with obtaining complex global music licensing rights, persistent challenges related to piracy in certain regions, and high mobile data costs for consumers in developing economies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager