Cloud Native SIEM Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437706 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Cloud Native SIEM Market Size

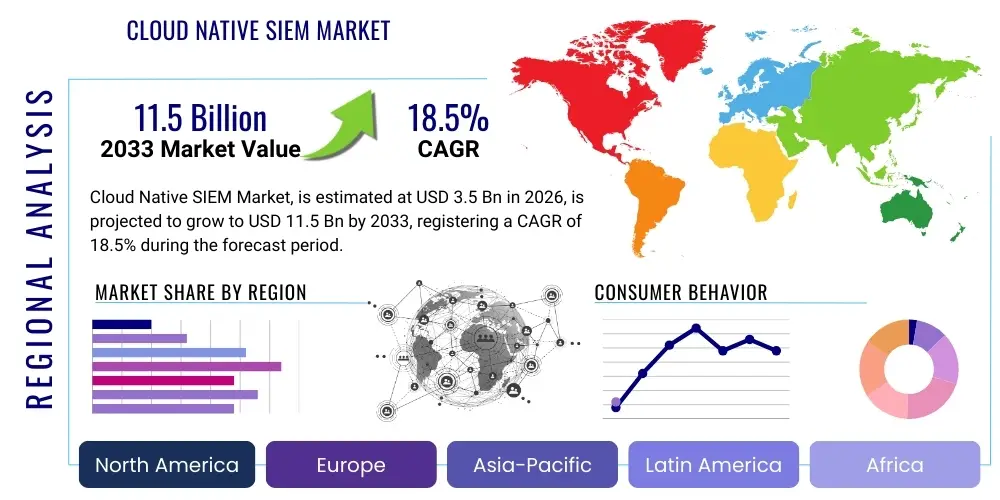

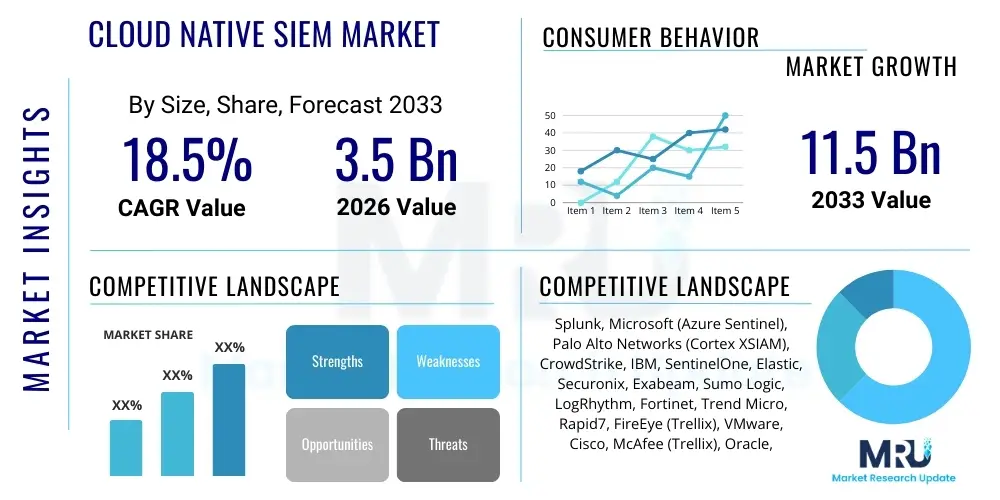

The Cloud Native SIEM Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 11.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the accelerated migration of enterprise workloads to hyperscale cloud environments, necessitating security solutions that are inherently scalable, elastic, and tailored for cloud infrastructure, unlike traditional, on-premise SIEM systems.

The transition to cloud-native architectures—leveraging microservices, serverless computing, and containers—renders legacy SIEM platforms inefficient and cost-prohibitive. Cloud native SIEM solutions, built on modern data lake technologies and cloud service provider frameworks, offer real-time analytics, automated threat detection, and integrated response capabilities directly within the cloud ecosystem. The high projected CAGR reflects the critical need for unified visibility and streamlined security operations (SecOps) across increasingly complex multi-cloud and hybrid environments.

Cloud Native SIEM Market introduction

The Cloud Native Security Information and Event Management (SIEM) Market encompasses advanced security analytics platforms designed specifically to operate within cloud infrastructure, leveraging cloud-native services for massive scalability, data ingestion, processing, and storage. These solutions move beyond simple log aggregation, offering sophisticated threat detection, security orchestration, automation, and response (SOAR) capabilities integrated directly into public cloud environments such as AWS, Azure, and Google Cloud. Products are characterized by their elastic scaling, pay-as-you-go pricing models, and ability to handle petabytes of data from diverse sources including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS) applications, significantly reducing the operational overhead associated with managing traditional SIEM infrastructure.

Major applications of Cloud Native SIEM include real-time threat detection, compliance monitoring (such as HIPAA, GDPR, and PCI DSS), security posture management, and centralized security operations across hybrid and multi-cloud deployments. Key benefits driving adoption include superior total cost of ownership (TCO) compared to traditional SIEMs, enhanced correlation capabilities utilizing machine learning and behavioral analytics, and accelerated mean time to detect (MTTD) and mean time to respond (MTTR) to security incidents. The primary driving factors are the rapid proliferation of cloud services, the increasing sophistication of cloud-based cyber threats, and stringent regulatory requirements compelling organizations to maintain comprehensive visibility and control over their cloud data and applications.

Cloud Native SIEM Market Executive Summary

The Cloud Native SIEM market is undergoing a period of intense innovation, largely dominated by major cybersecurity vendors and hyperscale cloud providers who are embedding advanced AI and automation features directly into their platforms. Business trends indicate a strong move toward unified security platforms (often termed XDR or Next-Gen SIEM) that consolidate data silos, offering a cohesive view of security events across the entire digital estate, including endpoints, networks, and cloud infrastructure. Consolidation activities and strategic partnerships focused on deep integration with specific cloud ecosystems are defining competitive strategies. Pricing models are shifting away from volume-based licenses toward consumption-based models, aligning vendor costs more closely with user value and facilitating easier adoption for organizations of all sizes.

Regional trends show North America maintaining market dominance due to high cloud adoption rates, stringent compliance mandates, and the presence of leading technology innovators. However, Asia Pacific (APAC) is emerging as the fastest-growing region, fueled by digital transformation initiatives, particularly in the BFSI and IT & Telecom sectors, and increased regulatory enforcement regarding data sovereignty and security. Segment trends reveal that Large Enterprises remain the primary revenue generators due to their complex multi-cloud environments and substantial data volumes, yet Small and Medium Enterprises (SMEs) are increasingly adopting these solutions, driven by the accessibility and lower operational burden of cloud-native platforms. Furthermore, the IT & Telecom and BFSI sectors continue to lead adoption based on their heightened exposure to sophisticated cyber risks and critical data assets.

AI Impact Analysis on Cloud Native SIEM Market

User queries regarding AI in the Cloud Native SIEM market primarily revolve around three critical areas: effectiveness in reducing alert fatigue, the viability of autonomous security operations, and the role of generative AI in threat hunting and incident response documentation. Users seek assurance that AI-driven analytics can accurately differentiate between malicious activity and benign anomalies, minimizing the constant stream of false positives that plague traditional SIEM deployments. There is a strong expectation that AI will move beyond basic correlation, providing prescriptive insights and accelerating the remediation process through highly optimized playbooks and automated workflows. The integration of advanced machine learning models, particularly deep learning and unsupervised learning, is viewed as essential for detecting zero-day attacks and subtle lateral movement often hidden within massive cloud data streams.

The incorporation of Artificial Intelligence and Machine Learning (AI/ML) is transformative for Cloud Native SIEM solutions, enhancing capabilities across the threat lifecycle. AI algorithms are crucial for normalizing and enriching data from disparate sources, establishing baseline behavioral models for users and entities (UEBA), and automating the classification and prioritization of threats. This shifts the function of the SIEM from a passive logging tool to an active threat intelligence and risk management platform. Generative AI, specifically large language models (LLMs), is now being explored to assist security analysts by summarizing complex incident timelines, suggesting targeted queries for threat hunting, and automatically generating formal investigation reports, thereby drastically improving analyst efficiency and democratizing access to complex security analysis.

- AI-Driven Behavioral Analytics: Utilizing User and Entity Behavior Analytics (UEBA) to identify anomalous activities and insider threats that evade signature-based detection.

- Real-Time Threat Prioritization: Employing machine learning to score and prioritize security alerts, significantly reducing alert fatigue for SecOps teams.

- Automated Incident Response (AIR): Integrating AI with SOAR capabilities to execute automated containment and remediation actions based on defined security playbooks.

- Generative AI for Documentation: Leveraging LLMs to summarize incident reports, translate technical findings, and draft communication summaries, speeding up compliance reporting.

- Predictive Security Modeling: Using deep learning models to forecast potential attack paths and identify system vulnerabilities before exploitation occurs.

- Intelligent Data Normalization: Automatically parsing, enriching, and standardizing diverse cloud telemetry data formats for consistent analysis.

DRO & Impact Forces Of Cloud Native SIEM Market

The Cloud Native SIEM market is propelled by the imperative for centralized visibility across complex multi-cloud environments and the escalating severity of cloud-based breaches, requiring solutions built for speed and scale. Key drivers include mandated compliance requirements, rapid digital transformation, and the inherent scalability advantages of cloud-native platforms over aging legacy systems. However, market growth faces restraints primarily related to the specialized skills required to manage these platforms, concerns over data localization and egress costs when centralizing data across geographical boundaries, and the high initial investment required for migration and integration. Opportunities lie in integrating advanced security orchestration, automation, and response (SOAR) capabilities, leveraging AI for predictive threat hunting, and expanding into vertical-specific solutions tailored for industries like healthcare and finance that handle sensitive regulated data.

Impact forces are heavily weighted toward technological innovation and regulatory pressure. The transition toward consumption-based pricing models makes these solutions more accessible, acting as a strong mitigating force against the restraint of high initial costs. The continuous development of unified security data lakes allows organizations to break down security silos, enhancing the value proposition. The most significant impact force remains the ever-increasing volume and velocity of cloud data, necessitating SIEM platforms that can elastically scale without performance degradation. Regulatory bodies, especially those focused on critical infrastructure protection, are continually tightening security mandates, forcing rapid adoption of best-in-class, cloud-aware security monitoring tools.

Segmentation Analysis

The Cloud Native SIEM market is fundamentally segmented by deployment type, organization size, and the end-user industry, reflecting the diverse operational needs and regulatory landscapes of various customers. Deployment segmentation is critical, addressing the architectural choices of enterprises, ranging from fully public cloud SIEM instances managed entirely by the vendor to hybrid deployments that bridge on-premise infrastructure with multiple public cloud environments. Organization size distinguishes the feature set and pricing structure adopted, with solutions tailored for large enterprises emphasizing multi-tenancy and extensive API integration, while offerings for SMEs prioritize ease of deployment and managed services. Analyzing these segments provides strategic insights into investment priorities and regional market maturity, revealing distinct needs for scalability versus simplicity across different user groups.

The End-User segmentation highlights where the highest demand and most critical requirements originate. Industries such as Banking, Financial Services, and Insurance (BFSI) and IT & Telecom are primary adopters due to their significant digital footprint and the critical nature of the data they handle, leading to intense regulatory scrutiny and constant exposure to highly sophisticated cyber threats. Government and defense organizations, while slower to adopt pure public cloud solutions, are increasingly utilizing hybrid models, driving demand for specialized compliance features and strict data sovereignty controls within cloud-native architectures. Retail and healthcare sectors are also rapidly implementing these systems to protect consumer data and ensure regulatory adherence, particularly concerning privacy laws.

- Deployment Type:

- Public Cloud SIEM

- Private Cloud SIEM

- Hybrid Cloud SIEM

- Organization Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- End-User Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and Life Sciences

- IT & Telecom

- Retail and E-commerce

- Government and Defense

- Manufacturing

- Others (Education, Media)

Value Chain Analysis For Cloud Native SIEM Market

The Cloud Native SIEM value chain begins with the upstream component, dominated by technology providers offering core infrastructure elements such as cloud data warehousing solutions, proprietary analytical engines (often leveraging Apache Flink or Spark), and machine learning frameworks. This foundational stage involves innovation in data ingestion pipelines capable of handling high-velocity, high-volume telemetry data from diverse sources like server logs, container activity, and network flow logs. Key activities at this stage focus on optimizing storage efficiency and ensuring computational power is elastically scalable to minimize costs for the downstream security platform providers. The differentiation at the upstream level is heavily based on platform robustness and seamless integration capabilities with hyperscalers (AWS, Azure, GCP).

In the middle and downstream segments, the focus shifts to solution development and distribution. The platform providers (e.g., Microsoft Sentinel, Splunk Cloud, Cortex XSIAM) integrate these upstream components to build the final SIEM application, adding layers of proprietary intellectual property such as curated threat intelligence feeds, pre-built correlation rules, and automated response playbooks. Distribution channels are predominantly indirect, relying heavily on Managed Security Service Providers (MSSPs), Value-Added Resellers (VARs), and system integrators who customize and manage the deployment for end-users, especially for complex multi-cloud environments. Direct distribution is common for large enterprise customers or platform providers who offer their solution directly via cloud marketplaces, utilizing the cloud provider’s billing and procurement mechanism, which significantly streamlines the purchasing process and accelerates time-to-value for the end consumer.

Cloud Native SIEM Market Potential Customers

Potential customers for Cloud Native SIEM solutions are organizations undergoing significant digital transformation, those with a substantial commitment to public or hybrid cloud infrastructure, and entities facing stringent regulatory requirements for data visibility and incident reporting. The primary buyers are Chief Information Security Officers (CISOs), Security Operations Center (SOC) managers, and IT Directors responsible for security compliance and incident response across distributed IT landscapes. Large enterprises across all major verticals represent critical end-users due to their need to aggregate petabytes of security telemetry from global operations and diverse cloud tenancy. These organizations often require advanced features such as centralized data governance, custom compliance reporting, and sophisticated integration with existing identity and access management (IAM) systems.

Mid-market organizations also constitute a rapidly growing segment of potential customers, particularly those that lack the internal resources or budget to maintain traditional, complex SIEM infrastructure. For these SMEs, the appeal of Cloud Native SIEM lies in its reduced management burden, rapid deployment capabilities, and subscription-based, consumption-aligned pricing models. Specific heavy consumption sectors include financial services, where real-time fraud detection and regulatory reporting (e.g., anti-money laundering compliance) are mission-critical; and the IT and technology sectors, which require robust security monitoring for their core product development and intellectual property protection, particularly where CI/CD pipelines and DevOps workflows are deeply integrated with cloud services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 11.5 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Splunk, Microsoft (Azure Sentinel), Palo Alto Networks (Cortex XSIAM), CrowdStrike, IBM, SentinelOne, Elastic, Securonix, Exabeam, Sumo Logic, LogRhythm, Fortinet, Trend Micro, Rapid7, FireEye (Trellix), VMware, Cisco, McAfee (Trellix), Oracle, RSA. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cloud Native SIEM Market Key Technology Landscape

The technology underpinning the Cloud Native SIEM market is defined by several foundational innovations, primarily centered around big data analytics and scalable, distributed architecture. Core to these systems is the use of cloud-native data lakes or security data fabric architectures, often built upon distributed storage systems like Amazon S3, Azure Data Lake Storage, or Google Cloud Storage, allowing for cost-effective storage and retrieval of massive volumes of security telemetry. These platforms eschew traditional relational databases in favor of scalable NoSQL or time-series databases, enabling extremely rapid data ingestion and real-time querying. The data processing layer heavily relies on cloud-optimized technologies such as Kubernetes for orchestration, serverless functions (Lambda, Azure Functions) for processing spikes, and highly optimized streaming data pipelines (e.g., Kafka, Kinesis) to ensure low latency event correlation and detection.

Machine Learning (ML) and Artificial Intelligence (AI) constitute the crucial analytical layer, moving beyond simple rule-based detection. Key technologies include User and Entity Behavior Analytics (UEBA), which uses unsupervised learning to model normal behavior and identify deviations indicative of compromised accounts or insider threats. Advanced correlation engines leverage statistical analysis and deep learning to contextualize alerts from various cloud services, network infrastructure, and endpoint detection and response (EDR) agents, effectively reducing noise. Furthermore, the modern Cloud Native SIEM integrates tightly with Security Orchestration, Automation, and Response (SOAR) platforms, utilizing APIs and workflow automation tools (e.g., serverless automation runbooks) to provide immediate, context-aware responses, such as isolating compromised cloud resources or revoking credentials automatically upon threat confirmation.

Interoperability and integration are paramount in this technology landscape. Modern SIEMs must be able to ingest proprietary logs and metrics from diverse IaaS, PaaS, and SaaS environments via secure, high-throughput APIs rather than relying solely on traditional Syslog forwarding. This necessitates standardized data models, such as the Open Cybersecurity Schema Framework (OCSF), to ensure uniform processing and analysis across multi-vendor environments. The development emphasis is currently placed on enhancing 'data ownership' and 'data sovereignty' features, utilizing technologies like homomorphic encryption or confidential computing when processing sensitive data, addressing critical compliance concerns, and assuring customers that their data remains localized and protected throughout the security analytics lifecycle, bolstering trust in the highly distributed cloud operating model.

Regional Highlights

Regional variations in the adoption, maturity, and regulatory environment significantly shape the Cloud Native SIEM market dynamics. Analyzing these highlights reveals where current spending is concentrated and where future growth opportunities are strongest, providing essential context for market players regarding strategic localization and investment prioritization. Discrepancies in cloud infrastructure maturity, regulatory complexity, and the prevalence of skilled security talent contribute to the distinct market characteristics observed across major geopolitical areas.

- North America: Market Dominance and Innovation Hub

North America, led by the United States, commands the largest share of the Cloud Native SIEM market. This dominance stems from the region's early and extensive adoption of public cloud infrastructure across key industries like BFSI, IT, and healthcare. The presence of major hyperscale cloud providers (AWS, Microsoft, Google) and numerous market-leading cybersecurity vendors fosters an ecosystem of rapid innovation and competitive pricing. Regulatory pressures, such as strict requirements from the SEC and HIPAA, compel organizations to invest heavily in advanced, scalable security monitoring solutions. The high concentration of large enterprises with complex, hybrid environments drives demand for advanced threat detection and centralized security governance, maintaining the region's strong growth trajectory.

- Europe: Focus on Data Sovereignty and Compliance

The European market is characterized by robust regulatory scrutiny, primarily driven by the General Data Protection Regulation (GDPR) and national data localization mandates. This regulatory environment mandates that Cloud Native SIEM solutions offer superior controls over where data resides and how it is processed, favoring solutions that can deploy within specific European regions or offer highly granular data sovereignty features. The adoption rate is accelerating, especially in Western European countries like the UK, Germany, and France, driven by cross-border data flow challenges and the necessity to replace legacy infrastructure with flexible, compliant cloud-based systems. The emphasis here is less on sheer volume and more on tailored compliance capabilities.

- Asia Pacific (APAC): Fastest Growth Trajectory

APAC is projected to be the fastest-growing region, fueled by massive digital transformation efforts, especially in emerging economies like India, China, and Southeast Asia. Countries in this region are rapidly building out public cloud infrastructure and migrating critical services online, leading to a sudden and high demand for cloud-aware security platforms. Government initiatives promoting digital economies, coupled with increasing cyber espionage activities, push organizations toward adopting advanced SIEM technology. However, the market is highly fragmented, with diverse local regulations and varying levels of cybersecurity maturity, requiring vendors to be flexible in their product offerings and localization strategy.

- Latin America (LATAM): Increasing Security Awareness

The LATAM market is experiencing steady growth, driven by regional economic recovery and increasing awareness of sophisticated cyber threats targeting financial institutions and critical infrastructure. Cloud adoption is rising, though often trailing North America and Europe. Key drivers include the need for cost-efficient security solutions that bypass the capital expenditure of traditional SIEMs, making the subscription-based Cloud Native model highly attractive. Regulatory harmonization efforts, though nascent, are beginning to spur investment, especially in major economies like Brazil and Mexico. The market is primarily focused on practical threat detection and compliance assurance rather than bleeding-edge innovation.

- Middle East and Africa (MEA): Strategic Infrastructure Investment

In the Middle East, particularly the GCC nations (Saudi Arabia, UAE), investment in Cloud Native SIEM is heavily influenced by strategic national digitalization agendas and massive spending on smart city and critical infrastructure projects. High investment in cloud infrastructure by government entities and major oil and gas corporations drives demand for high-security, scalable solutions. The African market is nascent but expanding, particularly in South Africa, driven by mobile connectivity and the need for affordable, managed security services. Vendor success in MEA is often predicated on strong local partnerships and adherence to national data protection and security mandates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cloud Native SIEM Market, characterized by their strategic positioning, investment in AI/ML analytics, and deep integration capabilities with major cloud ecosystems. These players are driving innovation through the development of unified security data lakes and advanced response automation features.- Splunk

- Microsoft (Azure Sentinel)

- Palo Alto Networks (Cortex XSIAM)

- CrowdStrike

- IBM

- SentinelOne

- Elastic

- Securonix

- Exabeam

- Sumo Logic

- LogRhythm

- Fortinet

- Trend Micro

- Rapid7

- FireEye (Trellix)

- VMware

- Cisco

- McAfee (Trellix)

- Oracle

- RSA

Frequently Asked Questions

Analyze common user questions about the Cloud Native SIEM market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between traditional and Cloud Native SIEM?

Traditional SIEMs rely on proprietary, expensive infrastructure and struggle with the scale and elasticity of cloud data, often requiring manual maintenance. Cloud Native SIEMs utilize the scalable architecture, storage, and processing power of public cloud providers, offering consumption-based pricing and seamless integration with cloud services, drastically improving TCO and scalability for modern environments.

How does Cloud Native SIEM address the challenges of multi-cloud environments?

Cloud Native SIEM platforms are designed to ingest, normalize, and correlate security data from multiple independent cloud environments (AWS, Azure, GCP) into a single, centralized data lake. This provides security teams with unified visibility, standardized threat detection rules, and centralized incident response capabilities across the entire hybrid and multi-cloud infrastructure.

Is Cloud Native SIEM more cost-effective than legacy SIEM solutions?

Yes, typically. Cloud Native SIEM eliminates significant capital expenditures (CAPEX) associated with hardware and licensing limits. By adopting consumption-based pricing and leveraging the inherent efficiency of cloud storage (like S3), organizations only pay for the data ingested and processed, leading to a significantly lower Total Cost of Ownership (TCO) and better alignment with operational expenses (OPEX).

What role does Security Orchestration, Automation, and Response (SOAR) play in Cloud Native SIEM?

SOAR is critically integrated into Cloud Native SIEM, automating repetitive security tasks, orchestrating complex workflows, and enabling rapid, automated response actions directly within the cloud infrastructure (e.g., isolating a compromised virtual machine or disabling a cloud function) based on the threat intelligence generated by the SIEM analytics engine.

Which compliance regulations are best supported by Cloud Native SIEM features?

Cloud Native SIEMs offer strong support for major global regulations including GDPR, HIPAA, PCI DSS, and ISO 27001. Their ability to maintain comprehensive, immutable audit logs, provide pre-built regulatory reporting templates, and offer granular data residency controls makes compliance documentation and enforcement significantly easier in a cloud context.

The market analysis indicates a pivotal shift from infrastructure-centric security monitoring to data-centric, analytical threat detection, positioning Cloud Native SIEM as an essential component of modern enterprise security architecture. The ongoing convergence of SIEM, UEBA, and SOAR capabilities underscores the competitive drive toward holistic security operations platforms.

The imperative for agility and scalability in security operations, coupled with the relentless pressure of sophisticated cloud-targeted attacks, guarantees sustained high growth rates within this market segment. Vendors who can successfully deliver seamless, low-friction deployment, coupled with superior AI-driven threat intelligence and consumption-optimized pricing, are poised to capture maximum market share over the forecast period.

Furthermore, the future growth narrative is heavily tied to the adoption acceleration within highly regulated sectors such as financial services and government, where the necessity for comprehensive data governance and resilience against advanced persistent threats (APTs) outweighs initial deployment complexities. The strategic focus on integrating cloud-native security posture management (CSPM) and cloud workload protection platforms (CWPP) directly into the SIEM dashboard will solidify the Cloud Native SIEM as the centralized hub for all cloud security needs.

Detailed analysis of regional spending patterns confirms that while North America leads in overall expenditure, the APAC region's accelerated digital transformation will necessitate aggressive investment in cloud security tools, offering the largest percentage increase in spending. Strategic planning for market expansion must account for localized compliance requirements, particularly data residency laws prevalent in Europe and parts of APAC, which demand regionally tailored solution deployment options.

The technological advancement in data processing, especially the transition to serverless and containerized deployment options for the SIEM itself, is key to managing cost volatility and maximizing operational efficiency. The next wave of innovation is expected to focus heavily on utilizing quantum-resistant encryption methods for log storage and leveraging federated learning models to enhance threat detection without compromising data privacy across multiple customer instances.

Finally, skilled labor shortages in cybersecurity continue to drive demand for highly automated solutions. The success of Cloud Native SIEM is intrinsically linked to its ability to offload routine analysis and incident response tasks via embedded AI and SOAR capabilities, thereby augmenting human analysts and allowing SecOps teams to focus on complex, high-impact threats rather than triage and false positive management.

The competitive landscape remains fluid, marked by platform integration battles between pure-play security vendors and cloud hyperscalers. The latter possess an inherent advantage due to their deep access to underlying cloud telemetry and native control plane data. However, independent vendors continue to differentiate themselves through superior cross-cloud visibility and vendor-agnostic analytical prowess, maintaining a vigorous competitive tension within the market.

Investment patterns reflect a move away from traditional infrastructure SIEMs, with significant capital flowing into security data lakes and unified analytics engines. This reallocation of resources indicates a clear consensus among security leaders that future monitoring capabilities must be built from the ground up to exploit the elasticity and distributed nature of modern cloud computing paradigms, ensuring that security scales linearly with business growth.

The sustained evolution of zero-trust architectures further reinforces the necessity of Cloud Native SIEM. As organizations minimize trust boundaries and enforce micro-segmentation, the SIEM becomes crucial for continuous monitoring and verification of user and workload behavior across distributed cloud services. This continuous verification model mandates real-time ingestion and advanced behavioral analytics capabilities that only cloud-native solutions can reliably provide at scale, thus strengthening the long-term demand curve.

Overall, the market trajectory is overwhelmingly positive, driven by macroeconomic forces pushing digital transformation and the non-negotiable requirement for robust, compliant cloud security. Companies prioritizing ease of use, sophisticated threat detection via machine learning, and flexible, pay-for-what-you-use models are set to lead the Cloud Native SIEM market evolution.

The shift towards Cloud Native SIEM also reflects a fundamental change in how security teams operate, moving from reactive defense to proactive threat hunting and preventative measures. The inherent ability of these platforms to store long-term, low-cost data enables historical analysis and effective forensic investigation, which is critical for complex regulatory compliance and understanding the complete kill chain of sophisticated cyber incidents. This long-term retention capability, economically unfeasible with legacy systems, provides significant security value.

Furthermore, the open-source community plays an accelerating, albeit indirect, role. Technologies derived from projects like Elastic Search, Kafka, and various logging agents are often integrated and optimized within proprietary Cloud Native SIEM offerings. This integration allows vendors to benefit from community-driven innovation while focusing their proprietary efforts on the specialized AI/ML algorithms and compliance reporting layers that differentiate their commercial products. The open ecosystem contributes to faster feature deployment and broader compatibility.

The Manufacturing sector, previously slower to adopt cloud services, is now rapidly deploying Industrial IoT (IIoT) solutions and migrating operational technology (OT) data to the cloud for analysis. This introduces a new critical requirement for Cloud Native SIEM: the ability to ingest and analyze specialized OT security protocols and data formats. Vendors are responding by developing specific connectors and threat models tailored to identify risks within converged IT/OT cloud environments, opening up a specialized vertical sub-segment with high growth potential.

Finally, the growing trend of cyber insurance providers requiring demonstrably effective security measures is acting as a powerful external driver. Organizations often find that adopting a robust, audited Cloud Native SIEM platform helps lower insurance premiums or meet coverage eligibility criteria, turning the security investment into a tangible risk mitigation and financial management tool. This market influence adds a financial incentive layer to the technology drivers already pushing adoption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager