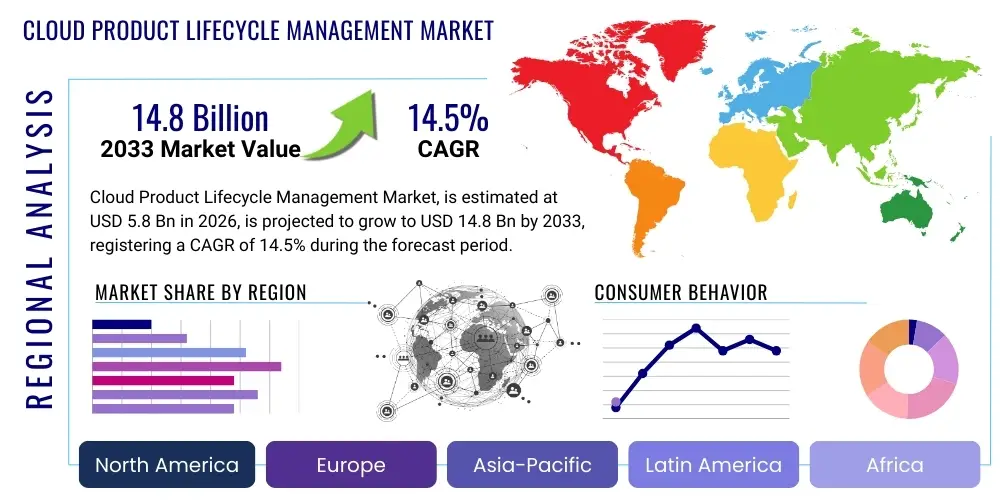

Cloud Product Lifecycle Management Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436604 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Cloud Product Lifecycle Management Market Size

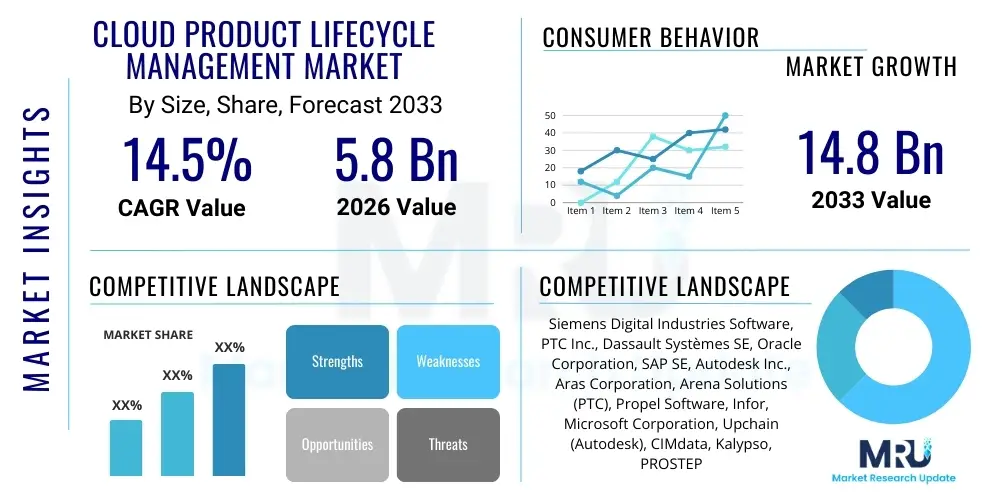

The Cloud Product Lifecycle Management Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 14.8 Billion by the end of the forecast period in 2033.

Cloud Product Lifecycle Management Market introduction

The Cloud Product Lifecycle Management (PLM) Market encompasses software solutions and services delivered via cloud infrastructure (SaaS, PaaS, IaaS) designed to manage a product's entire life cycle, from ideation and engineering design through manufacturing, service, and disposal. Cloud PLM offers critical capabilities for global, distributed organizations by providing a centralized, accessible, and scalable platform for data management, collaboration, and process control, thereby eliminating the high upfront investment and maintenance burden associated with traditional on-premise PLM systems. This transformative approach allows businesses, particularly Small and Medium-sized Enterprises (SMEs), to rapidly implement sophisticated PLM capabilities that were previously exclusive to large enterprises. The inherent flexibility and integration potential of cloud platforms enable seamless connectivity with Enterprise Resource Planning (ERP), Manufacturing Execution Systems (MES), and Supply Chain Management (SCM) tools, fostering a truly connected digital thread across the value chain.

Major applications of Cloud PLM span highly regulated and complex industries, including automotive, aerospace and defense, high-tech electronics, and medical devices, where stringent compliance requirements, rapid iteration cycles, and extensive supply chain coordination are mandatory. The core benefits delivered by these systems include enhanced product quality, accelerated time-to-market, reduced operational costs, and improved cross-functional visibility. By standardizing product data and workflows in the cloud, companies can facilitate better collaboration between engineering teams, suppliers, and customers, leading to more informed design decisions and fewer manufacturing errors. Furthermore, the subscription-based model of Cloud PLM allows companies to scale usage based on current business needs, providing essential agility in volatile market conditions.

Driving factors for the substantial growth in this market include the global push toward digital transformation, the increasing complexity of modern products requiring sophisticated cross-domain collaboration (e.g., IoT devices), and the rising adoption of subscription-based software models across all enterprise sectors. The market is also heavily influenced by the competitive pressure to innovate quickly, demanding tools that support concurrent engineering and virtual prototyping. The inherent security enhancements provided by major cloud service providers (CSPs) and the capability to integrate advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) for predictive insights are further solidifying Cloud PLM's position as a foundational element of the modern digital enterprise architecture.

Cloud Product Lifecycle Management Market Executive Summary

The Cloud Product Lifecycle Management (PLM) Market is experiencing robust expansion, fundamentally driven by pervasive digital transformation initiatives and the imperative for organizations to enhance global collaboration across increasingly complex supply chains. Key business trends indicate a strong migration from legacy on-premise solutions to sophisticated Software-as-a-Service (SaaS) PLM platforms, favored for their scalability, lower Total Cost of Ownership (TCO), and rapid deployment capabilities. The market sees major PLM vendors focusing intensely on developing industry-specific cloud solutions (e.g., specialized platforms for life sciences or automotive), utilizing microservices architectures to ensure flexible integration with adjacent enterprise systems like ERP and CRM. Competitive dynamics are defined by continuous innovation in user experience, the incorporation of advanced analytics, and the strategic acquisition of niche cloud providers to consolidate capabilities and expand market reach, positioning major players like Siemens, PTC, and Dassault Systèmes as dominant forces while fostering significant growth opportunities for specialized cloud-native startups.

Regionally, North America maintains its leadership position, attributed to the presence of large high-tech and aerospace companies, coupled with significant early investment in cloud technologies and digitalization. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period, fueled by rapid industrialization, burgeoning manufacturing sectors in countries like China and India, and increasing governmental support for digital manufacturing initiatives. European markets show stable growth, driven primarily by the stringent regulatory environments in sectors such as automotive (EV development) and pharmaceuticals, demanding cloud-based solutions that ensure compliance and traceability. Global trends confirm that investment in hybrid cloud deployment models is gaining traction among large multinational corporations seeking to balance data security requirements for proprietary intellectual property with the flexibility offered by public cloud environments for collaborative tasks.

Segmentation trends highlight that the adoption of Cloud PLM is accelerating notably among Small and Medium-sized Enterprises (SMEs), which benefit significantly from the subscription model eliminating capital expenditure barriers. While large enterprises remain the primary revenue contributors, the SME segment is the fastest-growing end-user category. Regarding components, the Services segment, which includes consulting, integration, and managed services, is experiencing rapid growth as organizations require expert assistance to transition effectively from legacy systems and customize cloud solutions to fit unique business processes. Furthermore, the application landscape is diversifying, with high-tech electronics and automotive remaining core applications, while the consumer goods and retail sectors increasingly utilize cloud PLM for rapid concept-to-market cycles and management of extensive product portfolios.

AI Impact Analysis on Cloud Product Lifecycle Management Market

User inquiries regarding the impact of Artificial Intelligence (AI) on Cloud Product Lifecycle Management overwhelmingly revolve around enhancing predictive capabilities, optimizing complex design processes, and automating data management. Users frequently ask how AI can specifically accelerate innovation timelines, how machine learning models improve demand forecasting for service and spares management, and what concrete steps vendors are taking to ensure data security and governance when AI processes sensitive product intellectual property (IP). Key themes identified include the expectation that AI should transform reactive PLM functions into proactive decision support systems, the desire for generative design capabilities integrated directly into the PLM workflow, and concerns regarding the necessity of training large AI models on proprietary company data. Ultimately, the market anticipates AI moving Cloud PLM beyond simple data storage and retrieval toward becoming an intelligent, self-optimizing system capable of handling the extreme complexity of modern interconnected products.

- Generative Design and Engineering Optimization: AI algorithms automate the creation and testing of thousands of design iterations based on specified constraints (material, cost, performance), significantly reducing development time and material usage.

- Predictive Maintenance and Service Planning: Machine Learning analyzes sensor data from operational products, feeding insights back into the PLM system to inform design improvements and predict component failure, optimizing service parts inventory.

- Automated Data Classification and Tagging: AI tools automatically categorize vast amounts of unstructured engineering data (CAD files, specifications, test reports), ensuring higher data quality, traceability, and easier retrieval within the cloud environment.

- Enhanced Requirement Management: Natural Language Processing (NLP) reviews and validates complex product requirements, flagging potential conflicts, ambiguities, or deviations from regulatory standards early in the design phase.

- Supply Chain Risk Mitigation: AI models analyze real-time external data (geopolitical events, weather, logistics disruptions) alongside internal BOM (Bill of Materials) data, providing predictive risk scores for components and suppliers managed within the PLM system.

- Intellectual Property Protection: Utilizing AI-driven anomaly detection to monitor access patterns and data usage within the cloud PLM environment, immediately flagging unusual activity that could indicate IP theft or misuse.

- Knowledge Management Facilitation: AI assists in structuring institutional knowledge captured throughout the product lifecycle, making lessons learned readily accessible to future product development teams.

DRO & Impact Forces Of Cloud Product Lifecycle Management Market

The Cloud Product Lifecycle Management Market is primarily driven by the fundamental shift toward digital transformation, which necessitates highly scalable and collaborative platforms, coupled with the rising complexity of smart and connected products (IoT), demanding seamless integration across disparate systems. The restraint landscape is dominated by persistent data security concerns, particularly among highly regulated industries hesitant to move sensitive intellectual property (IP) to public cloud environments, alongside the challenges associated with migrating decades of legacy PLM data and integrating heterogeneous systems. However, significant opportunities exist through the specialization of Cloud PLM solutions tailored for specific industrial needs (e.g., sustainability reporting and circular economy management), the explosive growth in emerging markets, and the continuous incorporation of advanced technologies like AI and Digital Twins, promising enhanced efficiency and predictive capabilities. These forces collectively propel the market forward, with drivers strongly outweighing restraints, leading to a consistent expansion trajectory.

Segmentation Analysis

The Cloud Product Lifecycle Management (PLM) market is extensively segmented based on key operational parameters that define vendor offerings and user adoption patterns. Segmentation by component is crucial, differentiating between the core software solutions (which include design collaboration, change management, and configuration management modules) and the highly critical services segment (comprising consulting, system integration, maintenance, and support services), where complex migration projects drive significant revenue. Deployment models categorize the market into Public Cloud, Private Cloud, and Hybrid Cloud, reflecting organizational preferences regarding data ownership, security, and scalability. Furthermore, organization size splits the market into Large Enterprises and Small and Medium-sized Enterprises (SMEs), with SMEs being the major impetus for cloud adoption due to the reduced capital expenditure requirements. Finally, application segmentation maps market demand across key verticals such as Automotive & Transportation, Aerospace & Defense, High-Tech Electronics, and Medical Devices, each demanding unique regulatory and technical functionalities from the PLM solution.

- By Component:

- Solutions (Software Platforms)

- Services (Consulting, Integration, Support, Managed Services)

- By Deployment Type:

- Public Cloud

- Private Cloud

- Hybrid Cloud

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Application (End-User Industry):

- Automotive and Transportation

- Aerospace and Defense (A&D)

- High-Tech Electronics and Semiconductors

- Industrial Machinery and Heavy Equipment

- Consumer Goods and Retail (CGR)

- Medical Devices and Pharmaceuticals

- Others (Energy, Construction)

Value Chain Analysis For Cloud Product Lifecycle Management Market

The value chain of the Cloud PLM market begins with upstream activities focused on foundational software development and infrastructure provision. This stage involves core PLM software developers creating robust modular applications and collaborating closely with major Cloud Service Providers (CSPs) like AWS, Microsoft Azure, and Google Cloud to ensure optimal hosting, security, and scalability. Upstream suppliers are focused on integrating modern architectures, such as microservices and containerization, to enhance system flexibility and facilitate seamless integration capabilities, a crucial requirement for successful cloud migration. Innovation at this stage centers on incorporating AI/ML functionalities directly into the PLM core to offer predictive analytics and generative design tools.

The midstream involves system integrators, value-added resellers (VARs), and implementation partners who specialize in customizing, deploying, and migrating client data to the Cloud PLM platforms. These channels are responsible for configuring the software to meet specific industry compliance requirements (e.g., FDA regulations, ISO standards) and integrating the new cloud system with the client’s existing enterprise landscape, including legacy ERP and MES systems. The efficiency of the distribution channel is increasingly shifting towards subscription-based, direct sales models (SaaS), although indirect channels involving specialized consultants remain vital for handling complex, large-scale deployments, especially in highly regulated sectors.

Downstream activities focus on post-implementation support, training, and ongoing managed services, ensuring high user adoption and continuous performance optimization. Direct sales provide vendors with proprietary insights into customer usage and pain points, driving continuous product updates and feature development. Indirect distribution channels, particularly local IT consulting firms, play a pivotal role in reaching SMEs and regional manufacturers who require localized language support and customized integration strategies. The effectiveness of the value chain is measured by the rapid deployment capability and the TCO reduction achieved for the end-user, emphasizing the criticality of strong partnerships between software developers, CSPs, and system integrators.

Cloud Product Lifecycle Management Market Potential Customers

The primary customer base for Cloud Product Lifecycle Management solutions encompasses a broad range of enterprises characterized by complex product portfolios, distributed global operations, and stringent regulatory requirements. Potential customers are fundamentally entities seeking to accelerate innovation cycles, reduce manufacturing errors, and establish a single source of truth for all product-related data. This includes large multinational corporations in the Aerospace & Defense sector, which need secure, global collaboration tools for highly proprietary designs, and Automotive manufacturers transitioning rapidly towards electric vehicles (EVs) and autonomous driving systems, requiring fast iteration and stringent traceability. These buyers prioritize robust configuration management, integrated requirements management, and verifiable compliance reporting features that are readily available in a cloud environment.

A rapidly growing segment of potential customers includes Small and Medium-sized Enterprises (SMEs) in the high-tech electronics and consumer goods sectors. These organizations often lack the capital and IT infrastructure to deploy and maintain traditional on-premise PLM systems. Cloud PLM offers them an affordable entry point to sophisticated capabilities, enabling them to compete effectively with larger players by streamlining collaboration with offshore manufacturers and improving product quality controls. The key drivers for SME adoption are the subscription-based pricing, which converts capital expenditure into operational expenditure, and the reduced demand on internal IT resources for system maintenance and upgrades.

Furthermore, the Life Sciences sector (Medical Devices and Pharmaceuticals) represents a high-value customer segment due to the paramount importance of regulatory compliance (e.g., FDA 21 CFR Part 11). These customers seek Cloud PLM solutions that offer validated environments, robust audit trails, and integrated quality management systems (QMS), ensuring traceability from initial design specifications through clinical trials and post-market surveillance. Ultimately, any organization involved in the creation, engineering, or manufacturing of tangible products, and facing pressure to enhance speed, quality, and regulatory adherence, represents a crucial potential buyer for Cloud PLM solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 14.8 Billion |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens Digital Industries Software, PTC Inc., Dassault Systèmes SE, Oracle Corporation, SAP SE, Autodesk Inc., Aras Corporation, Arena Solutions (PTC), Propel Software, Infor, Microsoft Corporation, Upchain (Autodesk), CIMdata, Kalypso, PROSTEP, IBM Corporation, Wipro Limited, HCL Technologies, ENOVIA, EPLAN Software & Service. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cloud Product Lifecycle Management Market Key Technology Landscape

The Cloud Product Lifecycle Management market is defined by several converging technologies focused on enhancing connectivity, intelligence, and operational efficiency across the product value stream. Central to the landscape is the utilization of Software-as-a-Service (SaaS) architecture, which facilitates rapid deployment, automatic updates, and subscription-based payment models. This is inherently linked to foundational cloud computing platforms (AWS, Azure, GCP), which provide the necessary robust infrastructure, scalability, and globally distributed data centers required to manage enormous volumes of product data securely. Modern Cloud PLM solutions are increasingly built on microservices architecture, allowing organizations to adopt or update specific modules (e.g., document control, quality management) independently, offering superior flexibility compared to monolithic legacy systems.

The integration of the Digital Twin concept is a paramount technological advancement within Cloud PLM. Digital Twins involve creating a virtual replica of a physical product or system, allowing for real-time monitoring, simulation, and predictive maintenance analysis. The cloud provides the essential processing power and connectivity to handle the constant streams of IoT data necessary to keep the twin synchronized with its physical counterpart, enabling engineers to refine products based on actual performance feedback. Furthermore, Application Programming Interfaces (APIs) and standard connectors are vital, promoting open integration between the PLM system and other critical enterprise tools like ERP, CRM, and Supply Chain Management platforms, creating the necessary digital thread that connects information across functions.

The increasing prevalence of Artificial Intelligence (AI) and Machine Learning (ML) technologies is fundamentally transforming the system's intelligence layer. AI is being utilized for advanced analytics, predictive quality control, automated compliance checking, and generative design processes, significantly reducing the manual effort required in development. Blockchain technology is also emerging as a specialized tool within Cloud PLM, particularly in highly regulated industries, offering immutable records for intellectual property (IP) management, tracking supply chain provenance, and ensuring verifiable audit trails for regulatory submissions, adding an unparalleled layer of security and transparency to the product history stored in the cloud.

Regional Highlights

- North America: This region dominates the global Cloud PLM market, driven by the presence of major technology innovators, the early and widespread adoption of cloud infrastructure, and substantial investment in the aerospace, defense, and high-tech sectors. High IP sensitivity and strong regulatory frameworks necessitate advanced, secure hybrid Cloud PLM solutions. The U.S. remains the largest market, focusing on integrating AI/ML capabilities for complex product development and maintaining global supply chain visibility, setting technology trends for the rest of the world.

- Europe: Characterized by stringent regulations (e.g., GDPR, environmental directives) and a strong manufacturing tradition, European adoption is fueled by the need for compliance and sustainability reporting capabilities integrated into PLM. Germany, the UK, and France are key contributors, with manufacturers in the automotive and industrial machinery segments heavily migrating to cloud solutions to support Industry 4.0 initiatives and maintain competitive advantage through streamlined pan-European collaboration.

- Asia Pacific (APAC): APAC is anticipated to exhibit the fastest growth rate, propelled by rapid urbanization, massive government investment in digital manufacturing (e.g., "Made in China 2025"), and the proliferation of SMEs seeking affordable PLM solutions. Countries like China, India, Japan, and South Korea represent huge untapped markets, where increased production complexity and the globalization of regional supply chains necessitate robust, scalable Cloud PLM infrastructure to manage rapid product scaling and quality control.

- Latin America: Market growth here is steady, albeit slower than APAC, driven primarily by resource-intensive industries such as mining, oil and gas, and automotive assembly. Adoption is concentrated in major economies like Brazil and Mexico, where companies are increasingly moving to cloud platforms to improve operational efficiency, manage geographically dispersed sites, and reduce dependence on costly legacy IT infrastructure.

- Middle East and Africa (MEA): While currently a smaller market share, MEA shows promising growth, particularly in the Gulf Cooperation Council (GCC) countries. Investment in large-scale infrastructure projects, diversification away from oil dependence, and growing defense sectors are creating demand for advanced Cloud PLM capabilities, especially for managing complex engineering projects and ensuring national security in product development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cloud Product Lifecycle Management Market.- Siemens Digital Industries Software

- PTC Inc.

- Dassault Systèmes SE

- Oracle Corporation

- SAP SE

- Autodesk Inc.

- Aras Corporation

- Arena Solutions (PTC)

- Propel Software

- Infor

- Microsoft Corporation

- Upchain (Autodesk)

- CIMdata

- Kalypso

- PROSTEP

- IBM Corporation

- Wipro Limited

- HCL Technologies

- Capgemini (Altran)

- OpenText

Frequently Asked Questions

Analyze common user questions about the Cloud Product Lifecycle Management market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between traditional PLM and Cloud PLM in terms of cost and deployment?

Traditional PLM requires significant upfront capital expenditure (CapEx) for hardware, software licensing, and specialized IT staff, involving lengthy deployment cycles. Cloud PLM (SaaS) operates on a subscription model (OpEx), significantly reducing initial costs, simplifying maintenance, and enabling rapid, scalable deployment via the internet.

How does Cloud PLM integration support the digital thread in manufacturing?

Cloud PLM acts as the central hub for product data, using open APIs and connectors to seamlessly link engineering data (CAD, specifications) with downstream systems like ERP, MES, and IoT platforms. This linkage creates a continuous, traceable digital thread, ensuring all departments work from the same validated product information, minimizing errors and accelerating change management.

What industries are driving the highest adoption rates for Hybrid Cloud PLM models?

Industries dealing with highly sensitive Intellectual Property (IP) or strict regulatory compliance, such as Aerospace and Defense, Financial Services (internal components), and large-scale Automotive OEMs, favor Hybrid Cloud PLM. This model allows them to store proprietary design files in a secure private cloud while utilizing the public cloud for broad collaboration and supply chain communication.

What are the key security concerns organizations should address before migrating PLM to the cloud?

The primary concerns include data residency and jurisdictional requirements, access control and authentication mechanisms (e.g., multi-factor authentication), and robust encryption protocols for data both in transit and at rest. Organizations must ensure the Cloud Service Provider (CSP) meets all relevant industry-specific compliance standards (e.g., ITAR, HIPAA, ISO 27001).

How is Artificial Intelligence (AI) enhancing collaboration within Cloud PLM environments?

AI enhances collaboration by automating non-value-added tasks like data tagging and classification, intelligently routing change requests to the appropriate team members based on project context, and providing predictive analytics on design feasibility and potential manufacturing issues before physical prototypes are created, streamlining decision-making across global teams.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager