CMOS Camera Lens Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434552 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

CMOS Camera Lens Market Size

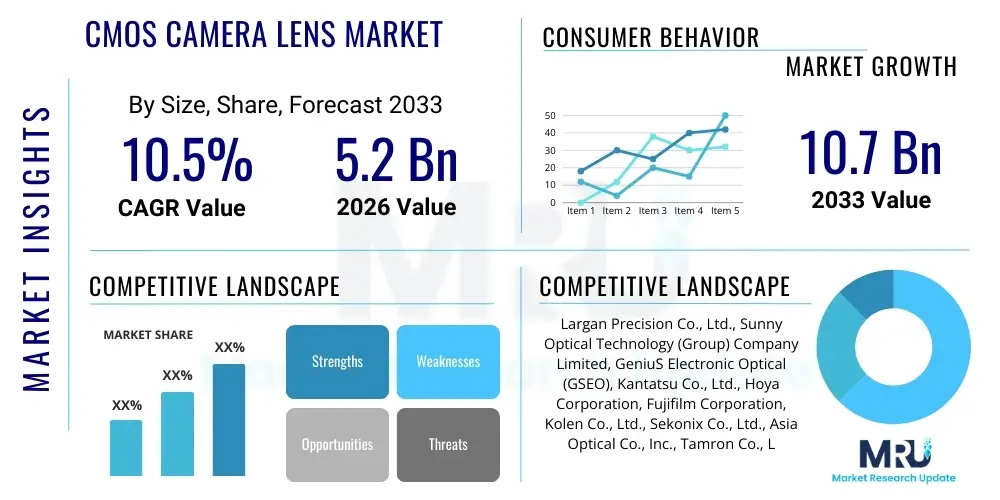

The CMOS Camera Lens Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 10.7 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by the pervasive integration of CMOS imaging sensors across a diverse range of consumer electronics, automotive safety systems, industrial automation processes, and advanced medical devices. The continuous demand for higher resolution, increased miniaturization, and improved optical performance in compact modules is the primary catalyst driving investments in advanced lens manufacturing technologies, such as wafer-level optics (WLO) and precision molding.

The acceleration of 5G infrastructure deployment and the proliferation of IoT devices further amplify the market expansion, as numerous connected systems require high-fidelity image capture capabilities for monitoring and data processing. Specifically, multi-camera arrays in smartphones and advanced driver-assistance systems (ADAS) in vehicles necessitate tailored lens solutions that offer exceptional image quality under varying operational conditions, including low-light environments and extreme temperatures. Furthermore, the push towards computational imaging, where software algorithms enhance image output, requires lenses optimized for specific sensor characteristics, shifting focus towards integrated optical and electronic solutions.

CMOS Camera Lens Market introduction

The CMOS Camera Lens Market encompasses the design, manufacture, and distribution of optical lens assemblies specifically engineered to work in conjunction with Complementary Metal-Oxide-Semiconductor (CMOS) image sensors. These lenses are crucial components responsible for focusing light onto the sensor plane, determining the field of view, clarity, depth of field, and overall image quality captured by the digital camera module. Market growth is fundamentally tied to the increasing global demand for imaging capabilities across virtually all technological sectors, moving beyond traditional photography into machine vision and embedded systems. Key applications span mobile devices, automotive vision systems, security and surveillance cameras, medical imaging, and industrial inspection equipment, each demanding specialized lens characteristics regarding size, aberration correction, and durability.

The core product description includes fixed-focus lenses, autofocus lenses, zoom lenses, and specialized wide-angle or telephoto lenses, often incorporating complex multi-element designs and specialized coatings to minimize reflections and chromatic aberrations. Major applications are concentrated in the consumer electronics sector, particularly high-end smartphones featuring complex multi-camera setups (wide, ultra-wide, telephoto, and depth sensors). Benefits of modern CMOS camera lenses include high optical resolution, compact form factors suitable for miniaturization, efficient light gathering (high aperture), and increasing robustness against environmental factors. Driving factors for this market include the global transition towards AI-powered vision systems, regulatory mandates promoting vehicle safety features (ADAS), and the persistent consumer desire for improved imaging experiences in mobile devices.

CMOS Camera Lens Market Executive Summary

The CMOS Camera Lens Market is characterized by intense technological innovation, driven predominantly by miniaturization requirements and the need for enhanced optical performance suitable for high-resolution sensors and computational photography. Business trends indicate a significant shift towards Wafer-Level Optics (WLO) manufacturing processes, enabling mass production of extremely compact and consistent lens modules, particularly favored in the high-volume smartphone segment. Furthermore, strategic collaborations between sensor manufacturers, lens designers, and module assemblers are becoming common to ensure optimal performance alignment. Regional trends highlight the Asia Pacific (APAC) region as the undisputed leader in both consumption and manufacturing capacity, primarily due to the concentration of major consumer electronics production hubs in countries like China, South Korea, and Taiwan. North America and Europe, while smaller in volume, exhibit strong demand for high-reliability, specialized lenses used in advanced applications such as autonomous driving and industrial machine vision.

Segment trends reveal that the application segment is heavily dominated by Mobile Devices, though the Automotive segment is experiencing the fastest proportional growth rate, fueled by the rapid deployment of ADAS Level 2 and above features, requiring multiple highly reliable cameras per vehicle. The material type segment shows increasing utilization of hybrid glass-plastic lens systems, balancing cost-effectiveness with superior thermal stability and optical correction capabilities, particularly essential for high-megapixel sensors. The competitive landscape remains consolidated at the high-end specialty lens level, but fragmented in the mass-produced plastic lens segment. Suppliers are constantly investing in advanced metrology and automated assembly processes to meet stringent quality requirements demanded by end-users, ensuring focus precision down to micrometer levels.

AI Impact Analysis on CMOS Camera Lens Market

Common user questions regarding AI's impact on the CMOS Camera Lens Market often revolve around whether AI processing will reduce the necessity for perfect optical quality, how AI influences lens design specifications, and which applications benefit most from AI-enabled vision systems. Users are concerned about the future role of traditional optical engineers versus software engineers in optimizing image quality. Based on this analysis, the key themes indicate that rather than replacing the need for high-quality lenses, Artificial Intelligence is elevating the requirements for consistency and calibration accuracy. AI algorithms rely on stable and predictable input data; poorly designed lenses introducing severe, unpredictable aberrations can hinder algorithmic performance. Users expect AI to correct minor imperfections (computational photography) but demand that the underlying lens structure provides a consistent, high-fidelity baseline. AI is also fundamentally driving the adoption of multi-camera arrays and specialized optics (e.g., depth sensing lenses) crucial for spatial and contextual awareness in autonomous systems and robotics.

The implementation of deep learning algorithms in computational photography fundamentally changes how lens systems are evaluated and designed. Traditionally, lens design focused purely on minimizing optical aberrations across the field of view. However, AI-driven pipelines introduce the concept of "AI-friendly optics," where specific, predictable lens characteristics (even slight distortions) can be leveraged by algorithms for enhanced final image output (e.g., enhanced depth mapping or optimized low-light performance). This synergistic relationship between hardware and software mandates closer integration during the product development cycle, requiring lens manufacturers to provide precise optical transfer function (OTF) and distortion mapping data for efficient calibration of AI models. This shift requires lens suppliers to invest heavily in advanced simulation tools that integrate optical modeling with AI processing capabilities.

- AI-driven computational photography reduces the physical size constraints of individual lens elements while increasing the demand for highly consistent optical quality across mass production batches.

- Enhanced depth perception and spatial mapping required for autonomous vehicles and robotics rely heavily on multi-lens arrays (stereoscopic or structured light) validated and processed by AI, driving demand for specialized optics.

- AI-powered inspection systems are being integrated into lens manufacturing (Metrology and Quality Control) to detect microscopic defects and ensure tighter tolerances, thereby improving overall module reliability.

- Machine learning optimizes lens calibration procedures, reducing manual adjustment time and improving yield rates in high-volume assembly lines, particularly for compact camera modules (CCMs).

- New lens designs are emerging specifically optimized for specific AI tasks, such as low-power, wide-field-of-view lenses for always-on visual sensing applications.

DRO & Impact Forces Of CMOS Camera Lens Market

The CMOS Camera Lens Market is influenced by a powerful combination of drivers stemming from technological advancements and application proliferation, countered by constraints related to manufacturing complexity and cost pressures, while new opportunities arise from emerging sectors like AR/VR and specialized medical imaging. Major drivers include the increasing adoption of multi-camera systems in smartphones and the regulatory push for enhanced safety features (ADAS/Autonomous Vehicles), which necessitate robust and high-resolution imaging optics. Restraints often center on the inherent difficulty in achieving micron-level precision during mass production of plastic lens elements, coupled with intense price competition, particularly in the consumer electronics space, squeezing profit margins. The primary opportunities lie in developing highly specialized, ruggedized lens solutions for high-growth sectors such as aerospace, industrial IoT, and advanced robotic vision systems that demand superior optical performance under harsh conditions. These forces collectively shape the market dynamics, favoring companies that can achieve significant scale, maintain stringent quality control, and innovate in materials science and manufacturing processes like Wafer-Level Optics.

One critical impact force is the relentless trajectory of sensor resolution improvement (measured in megapixels). As pixel sizes shrink, the tolerance for optical imperfections dramatically decreases, forcing lens manufacturers to utilize higher precision molding techniques and specialized materials to mitigate chromatic and spherical aberrations. This increases the complexity and cost of the lens stack, acting as a constraint while simultaneously driving innovation (Driver). Another significant impact force is the geopolitical tension affecting global supply chains; as lens manufacturing is concentrated heavily in East Asia, any disruption directly impacts global availability and pricing, highlighting the need for geographically diversified production capabilities. Furthermore, the convergence of imaging and sensing technologies (e.g., integrating LiDAR or ToF with traditional camera lenses) is opening substantial opportunities, requiring lens assemblies capable of handling multiple wavelengths and sensing modalities within a single compact module.

The continuous push towards device miniaturization remains a pervasive driver, requiring lens systems to achieve superior optical power within increasingly tighter z-height (thickness) constraints. This is particularly challenging in mobile devices where overall module thickness is a critical competitive metric. Consequently, lens designers must constantly innovate using hybrid glass-plastic elements and advanced material science to maintain performance while slimming down the lens stack. This miniaturization driver also fuels the shift towards advanced manufacturing techniques like WLO, which offers superior repeatability and smaller form factors compared to traditional assembly methods. The necessity for thermal stability, especially in automotive and industrial applications where operating temperatures fluctuate widely, dictates material choices and assembly methods, adding complexity and cost, which acts as a restraint against aggressive price reductions.

Segmentation Analysis

The CMOS Camera Lens market is segmented comprehensively based on lens type, material, application, and geographic region, reflecting the diverse requirements of end-user industries. This segmentation provides crucial insights into the varying technological demands and growth potential across different market verticals. Key lens types include fixed focus lenses, which dominate lower-cost and high-volume segments like surveillance, and autofocus/zoom lenses, which are critical for high-end mobile devices and specialized professional cameras. Material segmentation highlights the trade-offs between cost-effective plastic lenses (P), high-performance glass lenses (G), and increasingly popular hybrid lenses (G+P) that offer a balance of thermal stability and high optical correction in compact forms. Application segmentation clearly delineates the high-growth sectors, particularly Automotive and Industrial, away from the mature, yet largest, Mobile Devices segment.

Analyzing segmentation by material is vital as material science innovations often unlock new performance capabilities. Plastic lenses are favored for their low cost, light weight, and moldability, making them ideal for mass-produced consumer goods. However, their sensitivity to temperature fluctuations limits their use in high-reliability environments like vehicle exteriors. Glass lenses offer superior thermal stability, lower dispersion, and higher refractive indices, but they are more expensive to manufacture, leading to their concentration in high-precision, premium applications (e.g., medical endoscopy, professional photography). Hybrid lenses represent a strategic compromise, using glass elements for critical light-bending tasks near the sensor and plastic elements for the outer components, optimizing both performance and manufacturing feasibility under competitive cost pressures. The increasing adoption of 7P (seven plastic elements) or 1G6P (one glass, six plastic) hybrid configurations in flagship smartphones illustrates this trend.

- Lens Type:

- Fixed Focus Lenses

- Autofocus (AF) Lenses

- Zoom Lenses (Optical and Digital/Hybrid)

- Material Type:

- Plastic Lenses (P)

- Glass Lenses (G)

- Hybrid Lenses (G+P)

- Application:

- Mobile Devices (Smartphones, Tablets)

- Automotive (ADAS, Cabin Monitoring, Rearview)

- Security and Surveillance (CCTV, IP Cameras)

- Industrial (Machine Vision, Robotics, Drones)

- Medical and Healthcare (Endoscopy, Diagnostics)

- Consumer Electronics (Webcams, Gaming, AR/VR)

- Manufacturing Process:

- Traditional Polishing and Assembly

- Wafer-Level Optics (WLO)

Value Chain Analysis For CMOS Camera Lens Market

The value chain for the CMOS Camera Lens market is complex, spanning from raw material extraction and component fabrication to final camera module integration and distribution. Upstream analysis involves suppliers of specialized optical materials, including high-purity optical plastics (e.g., specific polycarbonates and acrylics) and optical glass blanks (often sourced from specialized glass companies). This stage also includes suppliers of molds and highly precise tooling required for injection molding plastic lenses or grinding and polishing glass elements. The quality of these raw materials directly impacts the final optical performance, necessitating stringent quality control at the foundational level. The midstream is dominated by independent lens manufacturers, who undertake optical design, precision molding, coating deposition (anti-reflection and hard coatings), and highly accurate active alignment and assembly of multiple lens elements into a barrel or housing. This stage is capital-intensive due to the requirement for cleanrooms and high-precision automation equipment.

Downstream analysis focuses on the integration and distribution channels. The assembled lens sets are delivered to Camera Module Assemblers (CCMs), who integrate the lens with the CMOS sensor and the voice coil motor (VCM) or piezoelectric actuator for focusing capabilities, creating the final camera module. These modules are then supplied directly to Original Equipment Manufacturers (OEMs), such as smartphone, automotive, or industrial system producers. Distribution channels are primarily direct, especially for high-volume or highly customized orders, maintaining close communication between the lens manufacturer and the OEM or the CCM assembler to ensure precise specifications are met. Indirect channels are utilized less frequently but may involve specialized distributors for smaller industrial or specialized niche markets. Efficiency and yield rates in the midstream and downstream assembly processes are crucial profitability determinants due to the sheer volume and high precision required.

The increasing prominence of Wafer-Level Optics (WLO) is fundamentally streamlining the value chain by merging molding, alignment, and packaging processes onto the wafer level, thereby reducing the dependency on complex traditional active alignment in the downstream process. This convergence is shifting value capture towards companies with expertise in semiconductor fabrication techniques adapted for optics. Companies that manage both the plastic molding and WLO processes gain significant competitive advantage. The automotive segment necessitates an exceptionally robust and traceable supply chain (often lasting 10+ years), demanding tier-one lens suppliers who can guarantee material reliability and extensive failure analysis capabilities, placing a premium on vertically integrated operations and strict adherence to automotive quality standards (e.g., IATF 16949).

CMOS Camera Lens Market Potential Customers

The potential customers for CMOS Camera Lenses are incredibly diverse, spanning high-volume consumer markets to highly regulated professional and industrial sectors. The largest customer segment, in terms of volume, remains the Mobile Device Manufacturers, including globally recognized smartphone and tablet brands, who purchase lens assemblies either directly or via large Camera Module Integrators. These customers prioritize miniaturization, high resolution, and cost-effectiveness. The fastest-growing customer base is the Automotive Industry, encompassing Tier 1 suppliers and major vehicle manufacturers demanding extremely reliable, thermally stable, and ruggedized lenses for ADAS, surround view, and in-cabin monitoring systems, where failure is unacceptable.

Industrial sector customers represent a highly specialized, medium-volume, high-margin segment, including manufacturers of robotics, factory automation equipment, quality control inspection systems, and specialized surveillance equipment. These users require lenses optimized for machine vision characteristics such as low distortion, precise telecentricity, and specific magnification factors. Furthermore, the Medical and Healthcare sector serves as a premium customer base, requiring highly specialized, miniature lenses for endoscopes and diagnostic imaging equipment, where biological compatibility and exceptional clarity are paramount. The future potential customer base is expanding significantly within the Extended Reality (XR) space (AR/VR headsets), requiring unique pancake lenses, catadioptric systems, and slim optics necessary for spatial computing and eye-tracking applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 10.7 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Largan Precision Co., Ltd., Sunny Optical Technology (Group) Company Limited, GeniuS Electronic Optical (GSEO), Kantatsu Co., Ltd., Hoya Corporation, Fujifilm Corporation, Kolen Co., Ltd., Sekonix Co., Ltd., Asia Optical Co., Inc., Tamron Co., Ltd., Carl Zeiss AG, Schott AG, Largan Glass, O-Film Group Co., Ltd., Cosina Co., Ltd., Kinko Optical, Corning Incorporated, AGC Inc., Ability Opto-Electronics Technology Co., Ltd., Vivotek Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

CMOS Camera Lens Market Key Technology Landscape

The technological landscape of the CMOS Camera Lens Market is characterized by a strong focus on precision manufacturing, advanced material science, and optical design optimization to meet the demands of shrinking pixel sizes and increasing sensor resolution. A major technological advancement is the maturation of Wafer-Level Optics (WLO), which transitions lens element fabrication and assembly from labor-intensive, element-by-element processes to scalable semiconductor-like batch processing. WLO enables the creation of highly compact, ultra-slim lens modules with exceptional repeatability and reduced component variation, which is critical for consistent performance in multi-camera setups where image parameters must be perfectly matched. This technology is instrumental in facilitating the aggressive miniaturization demanded by mobile devices and emerging wearables, pushing the limits of lens thickness.

Another crucial technological area involves advanced optical materials, specifically high-refractive-index (HRI) plastics and specialized optical glasses. The pursuit of thinner lens stacks requires materials that can bend light more efficiently, necessitating HRI materials that minimize spherical and chromatic aberrations while maintaining high transparency and thermal stability. In high-reliability sectors, advanced coating technologies are paramount, including multi-layer anti-reflection (AR) coatings, hydrophobic coatings (for automotive external cameras), and specialized filters (e.g., infrared cut-off filters integrated directly into the lens stack). Furthermore, the integration of liquid lenses (or liquid crystal lenses) is gaining traction, offering electrically controllable variable focus without mechanical movement, which is highly beneficial for industrial machine vision and specific medical applications requiring fast, silent, and robust autofocus capabilities.

Precision assembly techniques, particularly Active Alignment (AA), remain central to manufacturing high-performance camera modules, even with the rise of WLO. AA involves adjusting the position and tilt of lens elements relative to the image sensor while monitoring the resultant image quality in real-time, often achieving alignment tolerances below 0.5 micrometers. Sophisticated robotic systems and advanced metrology tools (like wavefront sensors and interferometers) are essential for achieving these levels of precision on a mass production scale, especially for complex lens stacks (6P, 7P, or more elements) used in flagship mobile and premium automotive cameras. The future technology landscape points towards increasing integration of sensing components directly onto or near the lens structure, leading to smart optical modules that perform localized image processing or spatial measurements, reducing latency and reliance on external processing units, thereby driving the embedded vision trend across industrial IoT applications.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market for CMOS camera lenses, accounting for the largest share in both production capacity and consumption volume. This dominance is driven by the presence of global manufacturing bases for consumer electronics (smartphones, PCs, surveillance equipment) in China, South Korea, Japan, and Taiwan. The region benefits from a highly developed ecosystem involving specialized component suppliers, advanced module assemblers (CCMs), and high-volume OEMs. China, in particular, drives immense demand due to its massive domestic smartphone market and its global leadership in surveillance technology deployment. Investment in advanced manufacturing, particularly WLO and automated precision assembly, is highest in this region to maintain cost competitiveness and meet the massive scale requirements. The increasing adoption of locally produced ADAS solutions in China is rapidly accelerating the demand for automotive-grade lenses, positioning APAC to maintain its leadership throughout the forecast period.

- North America: North America represents a technologically advanced, high-value market, focusing less on volume and more on high-performance, customized lens solutions. Demand is primarily generated by sectors requiring sophisticated imaging capabilities, such as high-end automotive systems (Level 3+ autonomy development), specialized defense and aerospace applications, advanced medical imaging devices, and the emerging AR/VR and mixed reality market leaders. The region acts as a hub for critical optical design and software integration, often setting the standards for lens requirements used in computational photography and cutting-edge sensor technologies. Strict regulatory standards, especially concerning automotive safety, compel OEMs to utilize premium, high-reliability lens modules, commanding higher average selling prices (ASPs).

- Europe: Europe is characterized by strong demand from the premium automotive industry (Germany, France, Italy) and the industrial machine vision sector. European vehicle manufacturers lead in the deployment of sophisticated ADAS features, requiring robust, temperature-resistant lens assemblies engineered for external vehicle mounting. Furthermore, the region has a mature industrial base that relies heavily on high-precision machine vision systems for quality control, automation, and robotics. This drives demand for specialized telecentric, low-distortion, and high-resolution lenses. The security and surveillance segment also contributes significantly, with a focus on high-fidelity, long-range optics for smart city and infrastructure monitoring applications, emphasizing optical zoom and superior low-light performance characteristics.

- Latin America, Middle East, and Africa (LAMEA): LAMEA represents an emerging market with moderate growth potential, primarily driven by the increasing penetration of smartphones and the expansion of modern surveillance infrastructure in urban centers and commercial establishments. While manufacturing capabilities are limited, the consumption market is growing steadily, particularly in large economies such as Brazil and the UAE. Investment in smart city projects and essential infrastructure development requires basic and mid-range surveillance lenses, ensuring a stable demand for cost-effective CMOS camera lens solutions, often imported from APAC manufacturers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the CMOS Camera Lens Market.- Largan Precision Co., Ltd.

- Sunny Optical Technology (Group) Company Limited

- GeniuS Electronic Optical (GSEO)

- Kantatsu Co., Ltd.

- Hoya Corporation

- Fujifilm Corporation

- Kolen Co., Ltd.

- Sekonix Co., Ltd.

- Asia Optical Co., Inc.

- Tamron Co., Ltd.

- Carl Zeiss AG

- Schott AG

- Largan Glass

- O-Film Group Co., Ltd.

- Cosina Co., Ltd.

- Kinko Optical

- Corning Incorporated

- AGC Inc.

- Ability Opto-Electronics Technology Co., Ltd.

- Vivotek Inc.

Frequently Asked Questions

Analyze common user questions about the CMOS Camera Lens market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Wafer-Level Optics (WLO) and how does it influence CMOS camera lens manufacturing?

Wafer-Level Optics (WLO) is an advanced manufacturing technology that fabricates and aligns multiple lens elements simultaneously on a large glass or polymer wafer, similar to semiconductor processing. This method drastically reduces the size of lens modules, lowers production costs through batch processing, and ensures exceptional consistency and repeatability, making it critical for high-volume, slim mobile camera modules and multi-sensor systems requiring minimal variation.

How does the shift towards autonomous vehicles impact the demand for CMOS camera lenses?

The autonomous vehicle trend significantly increases demand for highly reliable, specialized CMOS camera lenses. Each autonomous vehicle requires multiple cameras (up to 12 or more) for surround view and sensing, demanding automotive-grade lenses that are thermally stable, resistant to harsh weather, durable over a long lifespan, and optimized for high-resolution imaging to support advanced computer vision and sensor fusion algorithms.

What are the primary challenges associated with manufacturing high-performance CMOS camera lenses?

The primary challenges include achieving sub-micron level precision in lens alignment and assembly (Active Alignment), overcoming optical limitations while constantly reducing the lens stack height (miniaturization), managing chromatic and spherical aberrations in multi-element hybrid designs, and maintaining cost-efficiency while utilizing specialized, high-refractive-index materials necessary for high-megapixel sensors.

Which application segment holds the largest market share for CMOS camera lenses?

The Mobile Devices segment, primarily driven by smartphones and tablets, currently holds the largest market share in terms of volume and revenue for CMOS camera lenses. This dominance is due to the massive annual production volume of mobile devices and the increasing complexity of multi-camera setups (e.g., 4P, 5P, 6P, or 7P lens stacks) integrated into flagship and mid-range phones globally.

Is the use of plastic or glass lenses preferable for high-end optical systems?

For the highest-end optical systems, particularly those requiring superior thermal stability and minimal dispersion (like advanced medical imaging or professional machine vision), pure glass lenses are often preferred. However, high-end consumer optics, such as flagship smartphone cameras, frequently utilize hybrid glass-plastic (G+P) lens stacks. Hybrids leverage the cost and weight benefits of plastic while using one or two high-performance glass elements to correct critical aberrations, striking an optimal balance between performance and manufacturability for compact systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager