CMOS Smartphone Camera Lens Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438673 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

CMOS Smartphone Camera Lens Market Size

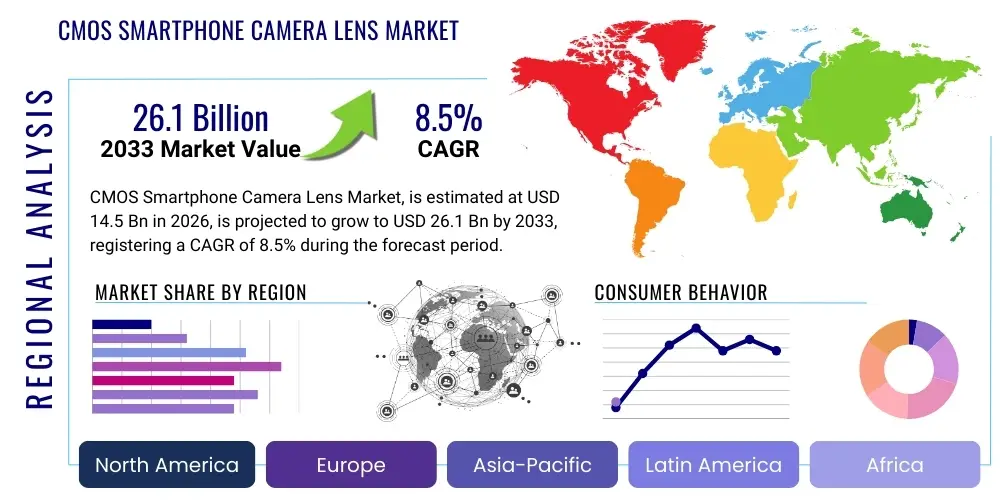

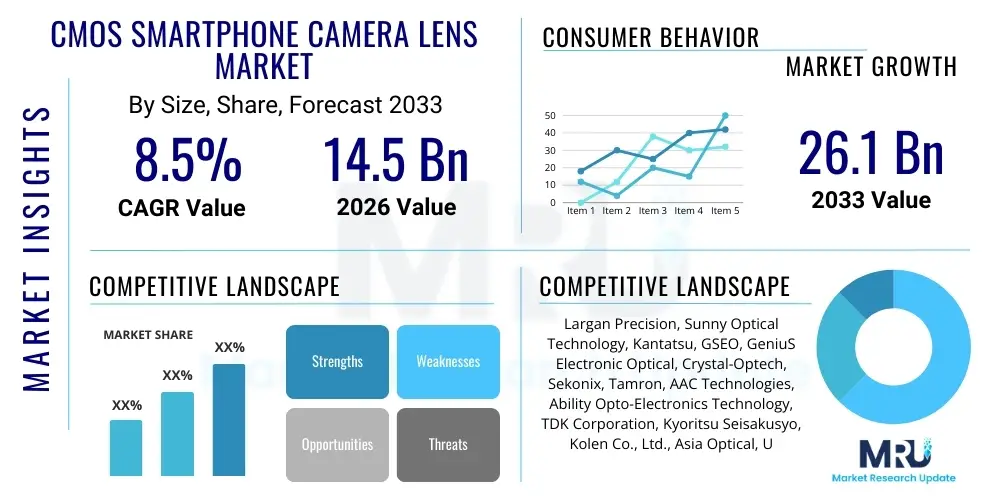

The CMOS Smartphone Camera Lens Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 14.5 Billion in 2026 and is projected to reach USD 26.1 Billion by the end of the forecast period in 2033. This substantial expansion is primarily fueled by the relentless consumer demand for enhanced mobile photography capabilities, including multi-lens systems, higher resolution sensors, and advanced computational photography features integrated within smartphones across all price tiers globally.

CMOS Smartphone Camera Lens Market introduction

The CMOS Smartphone Camera Lens Market encompasses the manufacturing, distribution, and integration of optical lens modules utilized in Complementary Metal-Oxide-Semiconductor (CMOS) image sensors within mobile communication devices. These lens modules, typically constructed from high-precision plastic and glass elements, are crucial components that focus light onto the sensor, dictating image quality, optical zoom capabilities, and overall camera performance. The market is fundamentally defined by rapid technological evolution, particularly the transition from single-camera setups to sophisticated multi-camera arrays (wide, ultrawide, telephoto, and macro) becoming standard across mainstream and flagship smartphone models. The ongoing pursuit of thinner smartphone designs necessitates increasingly compact, high-performance lens modules, driving continuous innovation in material science and optical design, such as hybrid glass-plastic lens structures and advanced anti-reflection coatings.

Major applications of these lenses extend beyond basic photography to include advanced functionalities essential for modern mobile computing. These applications include biometric authentication (facial recognition via 3D sensing), augmented reality (AR) experiences that require precise depth mapping, and integration with advanced video processing technologies such as 8K capture and high-frame-rate slow-motion recording. The inherent benefits of these advanced lens systems include superior image clarity, improved low-light performance, increased versatility for different photographic styles, and seamless integration with complex AI algorithms for computational enhancements. As mobile devices increasingly replace dedicated cameras for daily use, the quality and sophistication of the CMOS lens module become a critical differentiating factor for smartphone manufacturers globally, directly influencing consumer purchasing decisions.

Key driving factors accelerating market growth include the universal proliferation of smartphones, particularly in emerging economies like India and Southeast Asia, where first-time smartphone buyers prioritize robust camera specifications. Furthermore, the aggressive adoption of higher megapixel sensors (48MP, 108MP, and beyond) mandates corresponding improvements in lens resolution and manufacturing precision to prevent optical limitations from degrading image quality. The competitive landscape among top-tier smartphone OEMs necessitates yearly upgrades, often centered around new optical formats like periscope telephoto lenses and extremely fast apertures, ensuring a sustained high demand for cutting-edge, high-volume lens production capabilities.

CMOS Smartphone Camera Lens Market Executive Summary

The CMOS Smartphone Camera Lens Market is characterized by intense competition and rapid technological shifts, primarily driven by the transition toward multi-lens modules and the integration of sophisticated computational photography elements. Business trends indicate a consolidation among high-end suppliers capable of delivering precision modules with seven or more plastic elements (7P/8P), coupled with increased investment in automated manufacturing to meet stringent quality requirements and escalating volume demands. Key players are strategically expanding production capacity in Asia Pacific to serve major smartphone assembly hubs, simultaneously focusing on vertical integration to control the supply chain from raw materials (lens resin and glass) to final module assembly. The pressure on pricing remains constant, forcing suppliers to innovate continuously to maintain margins while delivering increasingly complex products.

Regionally, Asia Pacific (APAC) dominates the market, serving as both the largest manufacturing base and the most significant consumption market, attributed to the presence of global smartphone giants like Samsung, Xiaomi, and Apple’s primary supply chain partners. China, South Korea, and Taiwan are central to lens manufacturing expertise, controlling the bulk of high-precision lens output. North America and Europe, while smaller in volume, represent critical markets for premium, high-specification lens modules, particularly those supporting innovative 3D sensing and advanced AR applications. Emerging markets in Latin America and MEA are experiencing rapid growth, driven by the increasing affordability of mid-range smartphones equipped with triple and quad-camera setups, ensuring sustained demand for standard and mid-tier lens solutions.

Segment trends reveal that the high-resolution segment (48MP and above) is experiencing the fastest growth, propelled by flagship and high-midrange devices utilizing pixel-binning technology. The shift from Fixed Focus (FF) to Autofocus (AF) and Optical Image Stabilization (OIS) mechanisms is pervasive across all price points, increasing the complexity and average selling price (ASP) of lens modules. Furthermore, the adoption of specialized lenses, such as those optimized for time-of-flight (ToF) sensors and dedicated macro photography, signifies a maturing market where differentiation is achieved through functional specialization rather than merely increasing the number of lenses.

AI Impact Analysis on CMOS Smartphone Camera Lens Market

User queries regarding the impact of Artificial Intelligence (AI) on the CMOS Smartphone Camera Lens Market frequently center on themes such as how computational photography reduces the reliance on purely optical quality, the potential for AI to compensate for smaller lens size deficiencies, and the necessity of specialized lenses for 3D sensing and advanced AI functions like object recognition and real-time segmentation. Users are keenly interested in whether AI algorithms will render large, high-cost lens assemblies obsolete, or if AI instead acts as an amplifier, demanding even greater optical precision to feed clean data to sophisticated neural networks. Key concerns also revolve around the future specifications of lenses specifically optimized for AI-driven tasks, such as low distortion and enhanced spectral purity.

The core influence of AI is the shift from traditional photography being purely optical to being computational. While AI excels at enhancing images post-capture (e.g., noise reduction, dynamic range optimization, portrait mode bokeh), it cannot create data that was not captured by the lens. Therefore, AI drives demand for lenses with minimal defects, low chromatic aberration, and high resolving power to provide the cleanest possible input for algorithms. The push toward features like advanced video stabilization and real-time deep learning requires not just high-quality primary lenses, but also specialized auxiliary lenses (e.g., sensors for depth and motion tracking) that feed environmental data directly into the device’s Neural Processing Unit (NPU).

Moreover, AI is intrinsically linked to the growing importance of 3D sensing technologies, such as Structured Light and Time-of-Flight (ToF), which require highly specialized lens and diffuser arrays operating in the infrared spectrum. These specialized optical systems are integral components for enabling secure facial recognition (a key AI application), advanced augmented reality experiences, and precise subject tracking. As AI capabilities expand, requiring richer, multi-dimensional data inputs, the complexity and diversity of the required lens portfolio increase, ensuring that AI, far from replacing high-quality optics, actually raises the threshold for optical precision and system integration across the entire camera module.

- AI mandates higher optical purity and low noise input, sustaining demand for precision manufacturing.

- Computational photography increases demand for multi-lens arrays (wide, telephoto, depth) optimized for specific data collection.

- AI algorithms drive the necessity for specialized IR lenses used in 3D sensing (ToF/Structured Light).

- Machine learning models are used in R&D to optimize lens element placement and material selection for superior performance.

- Increased complexity due to AI integration raises the Average Selling Price (ASP) of complete camera modules.

DRO & Impact Forces Of CMOS Smartphone Camera Lens Market

The CMOS Smartphone Camera Lens Market is shaped by powerful Drivers (D), significant Restraints (R), and compelling Opportunities (O), creating distinct Impact Forces. The primary drivers include the pervasive trend of multi-camera adoption, the continuous increase in pixel count requiring higher optical resolution, and the rapid replacement cycle of smartphones fueled by consumer desire for superior camera performance. These forces collectively push manufacturers toward high-precision, high-element (7P/8P) lens designs. However, the market faces restraints such as intense price competition, leading to pressure on profit margins, and the inherent physical limitations imposed by device thinness, which challenges engineers attempting to incorporate advanced optics like true optical zoom without sacrificing form factor. Additionally, manufacturing yield rates for ultra-precision molded lenses remain a critical constraint impacting scalability and cost-efficiency.

Opportunities for growth are abundant, particularly in the emerging fields of 3D sensing for advanced augmented reality and biometric security applications, which require entirely new types of specialized lenses operating outside the visible spectrum. Furthermore, the proliferation of 5G connectivity enables higher quality video streaming and capture, necessitating lens systems capable of reliable 4K and 8K video resolution, thereby opening new high-value segments. The ongoing shift toward hybrid glass-plastic lenses (G+P) offers a path to mitigate thinness constraints while maintaining high optical performance, presenting a significant technological opportunity for lens material innovation and specialized coating development. Successful navigation of these forces requires significant R&D investment and operational scale.

The immediate impact forces are centered around supply chain resilience and technological leadership. Companies capable of rapidly prototyping and mass-producing innovative solutions, such as foldable optics for periscope systems or micro-molded glass elements, gain significant competitive advantage. The market is highly susceptible to the competitive strategies of major smartphone OEMs; large volume orders from companies like Apple and Samsung dictate production schedules and R&D focus for the lens suppliers. Geopolitical risks affecting supply chain concentration in Asia Pacific also exert a measurable impact on long-term investment planning and diversification efforts across the industry.

Segmentation Analysis

The CMOS Smartphone Camera Lens Market is comprehensively segmented based on fundamental operational characteristics, technological complexity, and targeted device application. Understanding these segments is crucial for strategic positioning, as volume markets often prioritize cost-efficiency (e.g., Fixed Focus), while premium markets are driven by technological superiority (e.g., OIS and high-element count lenses). The primary segmentation categories reflect the evolving demand landscape, moving from simple, low-cost optics to complex, electronically controlled modules necessary for advanced mobile photography and sensing functions. This matrix approach allows market participants to tailor R&D and manufacturing efforts to specific high-growth areas within the smartphone ecosystem.

- By Focus Type:

- Fixed Focus (FF)

- Autofocus (AF)

- By Resolution:

- Under 12 Megapixels (MP)

- 12MP to 48MP

- Above 48MP (Including 64MP, 108MP, and higher)

- By Lens Structure (Element Count):

- 5P (Five Plastic Elements)

- 6P (Six Plastic Elements)

- 7P and Above (High-End Multi-Element Systems, G+P Hybrids)

- By Application/Device Tier:

- Standard/Budget Smartphones

- Mid-Range Smartphones

- Premium/Flagship Smartphones

- Specialized Devices (e.g., Rugged Phones, Industrial Use Cases)

- By Technology:

- Standard Wide/Ultrawide Lenses

- Telephoto Lenses (Standard and Periscope)

- Depth/ToF Sensing Lenses (IR optimized)

- Macro Lenses

Value Chain Analysis For CMOS Smartphone Camera Lens Market

The value chain of the CMOS Smartphone Camera Lens Market is highly specialized and characterized by sequential dependency, starting from specialized raw material suppliers and culminating in integration by Original Equipment Manufacturers (OEMs). The upstream segment is dominated by highly specialized manufacturers of optical plastic resins (e.g., cyclic olefin copolymer/polymer, COC/COP) and precision glass molding companies. These materials must meet extremely rigorous specifications for refractive index, thermal stability, and clarity, essential for achieving micron-level lens precision. Further upstream involves the supply of sophisticated manufacturing equipment, including ultra-precision injection molding machines, automated inspection systems, and anti-reflection coating application equipment, where technological expertise is concentrated in regions like Japan and Germany.

The midstream is the core of the market, involving lens element fabrication and subsequent assembly into integrated modules. Specialized lens makers (like Largan Precision, Sunny Optical) mold individual lens elements (e.g., 5P, 7P), apply coatings, and then assemble them with spacers and housing components. Downstream activities involve the integration of these lens modules with the CMOS image sensor (provided by companies like Sony or Samsung) and the voice coil motor (VCM) actuator for focusing and stabilization. This integrated unit, the Camera Control Module (CCM), is then sold directly to smartphone OEMs for final assembly. The direct distribution channel involves high-volume, long-term contracts between Tier-1 lens makers and global smartphone giants, characterized by strict quality control and just-in-time delivery schedules.

Indirect channels primarily serve smaller or regional smartphone brands, where component sourcing often goes through specialized distributors or module integrators who package sensor, lens, and actuator components into a complete unit before supplying the OEM. Control over the value chain is critical; companies attempting vertical integration, particularly into module assembly (CCM), aim to capture higher margins and offer turnkey solutions to OEMs, shortening the design and manufacturing cycle. This highly competitive structure necessitates intense focus on proprietary optical design and cost management at every stage, from polymer compounding to final module calibration and testing.

CMOS Smartphone Camera Lens Market Potential Customers

The potential customers and end-users of CMOS Smartphone Camera Lenses are overwhelmingly the global Original Equipment Manufacturers (OEMs) specializing in mobile communication devices. These buyers are sophisticated entities with stringent technical specifications and massive volume requirements, purchasing components either directly from lens fabricators or through specialized camera module integrators. The customer base is segmented into flagship-tier OEMs, mid-tier volume producers, and regional brand specialists, each demanding tailored performance and pricing structures corresponding to their targeted consumer market segments.

Flagship customers, such as Apple, Samsung Electronics, and Huawei (in relevant regions), demand the most advanced lenses, characterized by high element counts (7P+), complex optical designs (periscope zoom), and integration with advanced stabilization (OIS) and specialized sensing components (ToF/3D). These buyers prioritize technological exclusivity, high yield rates, and confidentiality in their supply partnerships. Mid-tier and volume segment customers, including Xiaomi, Oppo, Vivo, and Transsion Holdings, focus on achieving the optimal balance between performance and cost-efficiency, driving demand for multi-lens setups (e.g., quad-camera arrays) where individual lenses meet competitive price points while delivering visually impressive results for mass-market consumers. These customers are crucial for high-volume revenue generation in the lens market.

A smaller, yet growing, customer segment includes manufacturers of industrial or specialized mobile devices, such as rugged smartphones for field workers, medical diagnostic handhelds, and security systems integrated into mobile platforms. These end-users require lenses optimized for durability, specific spectral ranges (e.g., enhanced UV or IR sensitivity), or unusual fields of view, presenting niche, high-margin opportunities for specialized lens providers. The purchasing decision for all customer segments is heavily influenced by prior qualification processes, component reliability, ability to scale production quickly, and the supplier's capacity for rapid iteration during critical product development cycles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 14.5 Billion |

| Market Forecast in 2033 | USD 26.1 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Largan Precision, Sunny Optical Technology, Kantatsu, GSEO, GeniuS Electronic Optical, Crystal-Optech, Sekonix, Tamron, AAC Technologies, Ability Opto-Electronics Technology, TDK Corporation, Kyoritsu Seisakusyo, Kolen Co., Ltd., Asia Optical, Union Optech, Fujinon (Fujifilm), Lite-On Technology, Cowell E Holdings Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

CMOS Smartphone Camera Lens Market Key Technology Landscape

The technological landscape of the CMOS Smartphone Camera Lens Market is defined by the relentless pursuit of superior optical performance within increasingly confined spaces, driving innovation in material science, manufacturing precision, and integration mechanics. A core technology is the advancement in high-precision plastic injection molding, particularly the shift toward molding lenses with six, seven, or even eight individual elements (6P, 7P, 8P). This increase in element count is necessary to correct sophisticated optical aberrations inherent in wide-angle and high-resolution systems, while maintaining a compact form factor. Parallel development in specialty optical resins, such as advanced polymers offering higher refractive indices and lower dispersion, enables lens designers to achieve equivalent performance with fewer or thinner elements, directly addressing the critical thinness constraint of modern smartphone design.

Another pivotal technology is the development and commercialization of hybrid glass-plastic (G+P) lenses. While plastic offers excellent moldability and cost-efficiency for mass production, glass elements provide superior thermal stability and higher refractive index, mitigating issues like thermal defocusing and maintaining peak performance under varying environmental conditions. Integrating a single glass element with multiple plastic elements allows manufacturers to create modules that are both slim and high-performing, especially crucial for high-end telephoto and wide-angle optics in flagship devices. Furthermore, advanced coating technologies, including multi-layer anti-reflection coatings and infrared (IR) cut filters, are essential for maximizing light transmission, minimizing flare and ghosting, and ensuring accurate color reproduction under diverse lighting conditions, forming a critical part of the overall optical stack.

Mechanism technology also plays a crucial role, specifically in the form of Voice Coil Motor (VCM) actuators, which are the standard technology for enabling Autofocus (AF) and Optical Image Stabilization (OIS). Innovations in VCM design focus on reducing power consumption, increasing response speed, and miniaturization. For telephoto segments, the development of periscope lens technology is transformative, utilizing prisms and horizontally stacked lens arrays to achieve legitimate optical zoom without the module protruding significantly from the phone body. This complex mechanical integration requires extremely tight tolerances and precise alignment capabilities, pushing the boundaries of micro-assembly automation and testing procedures used by Tier-1 lens and module manufacturers.

Regional Highlights

The global CMOS Smartphone Camera Lens market exhibits distinct regional dynamics, primarily shaped by manufacturing concentration, smartphone penetration rates, and consumer disposable income dictating device tier adoption. Asia Pacific (APAC) stands as the undeniable leader, dominating both production and consumption. The region hosts the world’s largest lens manufacturing powerhouses—located predominantly in China, Taiwan, and South Korea—which benefit from established supply chain ecosystems, economies of scale, and proximity to major smartphone assemblers like Foxconn, Samsung, and Huawei. Demand in APAC is consistently robust due to high unit volumes across all price segments, from budget devices adopting dual cameras to premium devices integrating complex 7P/8P optics and 3D sensing.

North America and Europe represent critical, high-value markets, although their production footprint is minimal compared to APAC. These regions are characterized by a high adoption rate of premium and flagship smartphones, driving demand for the most sophisticated and high-cost lens modules, particularly those supporting innovative features like cinematic video capture, advanced AI computational photography, and leading-edge AR applications. North American OEMs often set the global standard for feature integration, meaning suppliers must prioritize R&D to meet the rigorous specifications required for launches in these profitable segments. European consumers exhibit strong brand loyalty and often gravitate toward devices emphasizing photography quality, sustaining high ASPs for complex lens systems.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging growth territories defined by increasing smartphone penetration and the rapid transition from basic feature phones. While ASPs are generally lower than in developed regions, the sheer volume growth potential is significant. Consumer demand in these regions focuses heavily on visual metrics, making multi-camera setups (e.g., affordable triple-camera systems) a key differentiator for mid-range and budget devices. Suppliers targeting LATAM and MEA need scalable, cost-effective lens solutions that integrate well with high-volume, standardized sensor platforms, emphasizing durability and competitive pricing over the ultra-high complexity required by flagship models.

- Asia Pacific (APAC): Dominates manufacturing and consumption; home to major lens suppliers (Largan, Sunny Optical) and key smartphone OEMs. Focus on scale, high-resolution elements (48MP+), and component integration for mass market.

- North America (NA): High average selling prices (ASPs) driven by flagship phone dominance (Apple, Google). Primary demand for specialized optics, 3D sensing components, and G+P hybrid lens technology for high-end imaging.

- Europe: Strong market for premium Android and iOS devices, focused on devices that emphasize photo and video quality. Steady demand for OIS-enabled modules and sophisticated optical zoom solutions.

- Latin America (LATAM): Rapid growth in mid-range smartphone adoption; increasing preference for triple and quad-camera setups for marketing appeal. Focus on maximizing perceived value through feature count.

- Middle East & Africa (MEA): High growth potential fueled by first-time smartphone users and expanding network connectivity. Demand concentrated in the cost-sensitive, high-volume segment, requiring robust and affordable lens solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the CMOS Smartphone Camera Lens Market, spanning specialized lens manufacturers, comprehensive module assemblers, and technology innovators who collectively influence the direction of optical evolution in mobile devices.- Largan Precision

- Sunny Optical Technology

- Kantatsu Co., Ltd.

- Genius Electronic Optical (GSEO)

- Crystal-Optech Co., Ltd.

- Sekonix Co., Ltd.

- Tamron Co., Ltd.

- AAC Technologies Holdings Inc.

- Ability Opto-Electronics Technology Co., Ltd.

- TDK Corporation (Actuators/VCM)

- Kyoritsu Seisakusyo Co., Ltd.

- Kolen Co., Ltd.

- Asia Optical Co., Inc.

- Union Optech Co., Ltd.

- Fujinon (Fujifilm Corporation)

- Lite-On Technology Corporation

- Cowell E Holdings Inc.

- Ofilm Group Co., Ltd. (Module Integrator)

- Q-Tech International Holdings Limited (Module Integrator)

- Pixon Technologies Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the CMOS Smartphone Camera Lens market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the increasing complexity in smartphone camera lenses?

The complexity is driven primarily by the shift from single-camera systems to multi-lens arrays (wide, ultra-wide, telephoto, macro), coupled with consumer demand for high resolution (48MP+) and the integration of specialized functions like optical image stabilization (OIS) and 3D depth sensing, which require additional, high-precision elements (7P or more).

How does AI impact the requirements for CMOS smartphone lenses?

AI significantly impacts requirements by demanding higher optical purity and low distortion from the lens system, as algorithms perform better with cleaner input data. AI also increases the necessity for specialized lenses (e.g., IR optics for ToF sensors) used in computational photography and advanced biometric functions.

What is the primary constraint limiting lens size and performance in smartphones?

The primary constraint is the physical thinness requirement of modern smartphone designs. Achieving true optical zoom or superior aperture performance generally requires a thicker lens stack, forcing manufacturers to adopt space-saving technologies like hybrid glass-plastic (G+P) lenses and periscope optical structures.

Which regions lead the manufacturing of high-precision CMOS smartphone lenses?

Asia Pacific (APAC), particularly companies located in Taiwan (Largan), mainland China (Sunny Optical, Crystal-Optech), and South Korea, dominates the global manufacturing of high-precision CMOS smartphone camera lenses due to established expertise, massive scale, and proximity to major smartphone assembly hubs.

What role do hybrid glass-plastic (G+P) lenses play in the market?

G+P lenses combine the high optical performance and thermal stability of glass elements with the mass-producible and cost-effective properties of plastic elements. They are crucial for maintaining high image quality in premium devices while adhering to the strict dimensional constraints imposed by thin smartphone designs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager