CMP Polishing Pad Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435100 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

CMP Polishing Pad Market Size

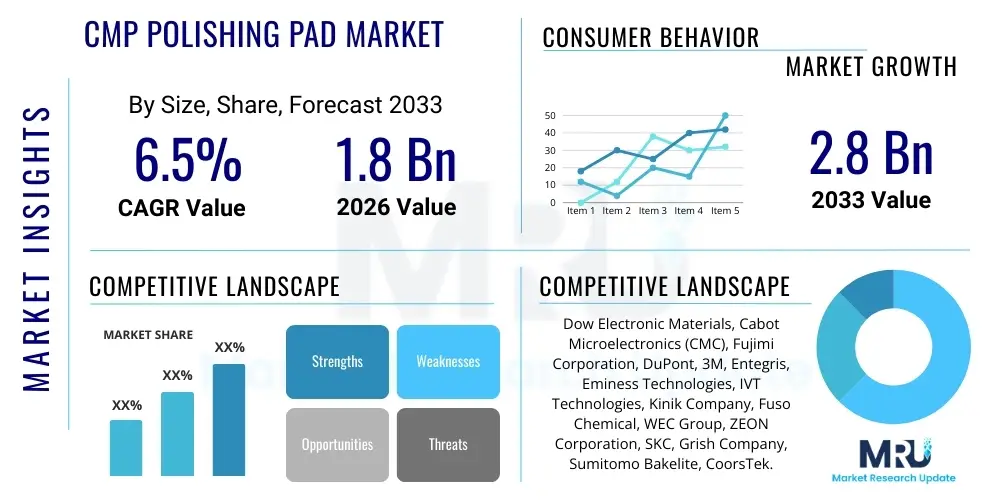

The CMP Polishing Pad Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033.

CMP Polishing Pad Market introduction

The Chemical Mechanical Planarization (CMP) Polishing Pad Market encompasses consumables critical for the semiconductor manufacturing process, specifically for achieving global planarization across silicon wafers. CMP is an essential step where the surface topography created by sequential deposition and etching processes is smoothed using a combination of chemical slurry and mechanical abrasion delivered via the polishing pad. The increasing complexity of integrated circuits, driven by demands for smaller feature sizes and three-dimensional stacking architectures (such as 3D NAND and advanced DRAM), necessitates extremely tight control over planarity and defectivity, directly influencing the demand and technological evolution of polishing pads.

These specialized pads, typically made from porous polyurethane materials or composite structures, serve as the interface between the wafer and the abrasive slurry. Their primary functions include holding the slurry, maintaining uniform pressure distribution across the wafer surface, and facilitating the removal of unwanted material layers (metals, dielectrics, or insulators) to achieve a near-perfect surface finish. The quality of the pad, including its hardness, groove pattern, compressibility, and conditioning response, critically determines the removal rate uniformity (RRU) and minimizes dishing and erosion, which are significant challenges in advanced manufacturing nodes.

Major applications driving this market include the fabrication of high-performance logic devices, memory chips (DRAM, NAND), and Micro-Electro-Mechanical Systems (MEMS). The benefits derived from high-quality CMP pads are profound, including enhanced device yield, improved circuit reliability, and enablement of sub-10nm technology scaling. Key driving factors are the rapid expansion of semiconductor fabrication capacity globally, particularly in Asia Pacific, the proliferation of Internet of Things (IoT) devices, the continuous advancement of computing power requiring more complex chip architectures, and the significant capital investment channeled into new fabrication plants (fabs) equipped for advanced CMP processes.

CMP Polishing Pad Market Executive Summary

The CMP Polishing Pad Market is characterized by intense technological competition and strong dependence on the cyclical yet structurally growing semiconductor industry. Current business trends indicate a shift toward high-performance, non-porous pads and fixed abrasive pads (FAPs) to address the stringent uniformity requirements of sub-7nm nodes. Key manufacturers are focusing on material innovation, particularly developing advanced polyurethane chemistries and optimized pad grooves to improve slurry flow dynamics and extend pad life. Furthermore, sustainability is becoming a minor but growing factor, encouraging the development of pads that minimize consumable waste and improve the efficiency of associated conditioning processes, thereby reducing overall cost of ownership for chip manufacturers.

Regionally, Asia Pacific (APAC) remains the undisputed epicenter of the market, driven by the massive concentration of semiconductor fabrication facilities in countries such as Taiwan, South Korea, China, and Japan. While established semiconductor powerhouses continue to drive demand for the most advanced nodes, China’s aggressive investment in domestic self-sufficiency is creating significant localized growth opportunities for both domestic and international pad suppliers. North America and Europe, while having lower fabrication volumes compared to APAC, maintain importance as centers for research, development, and high-end specialty applications, particularly in advanced material science and equipment manufacturing.

Segment trends highlight the dominance of the polyurethane pad segment due to its versatility and established performance benchmarks, although specialized composite pads are gaining traction for specific metal CMP steps. From an application standpoint, logic and memory manufacturing collectively account for the majority of the market share, with 3D NAND structure fabrication demanding pads with exceptionally high selectivity and minimal defectivity. The trend towards copper and advanced low-k dielectric integration necessitates specialized multi-layer pads tailored to manage complex material removal processes, driving higher average selling prices (ASPs) in these high-end segments compared to standard oxide CMP applications.

AI Impact Analysis on CMP Polishing Pad Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the CMP Polishing Pad Market typically revolve around how AI can enhance process control, predict pad wear, and optimize consumable usage, rather than directly impacting the core pad material itself. Key themes include the implementation of machine learning (ML) models for real-time fault detection, predictive maintenance of CMP equipment, and closed-loop feedback systems to adjust slurry flow or pad conditioning parameters instantly. Users are concerned with whether AI integration will lead to a reduction in the volume of pads consumed due to optimized lifecycles, and conversely, whether the massive computational demands of AI hardware (requiring next-generation chips) will accelerate overall semiconductor production, thereby boosting long-term pad demand.

The general expectation is that AI will be a positive disruptor for process efficiency. Advanced pattern recognition algorithms applied to in-situ metrology data (such as friction force, temperature, and current draw) enable precise monitoring of pad degradation, allowing fabs to utilize pads closer to their actual end-of-life without risking yield loss. This optimization reduces unscheduled downtime and maximizes resource utilization. Furthermore, AI-driven simulations are being employed in the design phase of new pad architectures and groove patterns, accelerating R&D cycles and enabling quicker deployment of pads suitable for emerging material stacks like those incorporating GaN or SiC for power electronics, although the direct procurement volume impact is balanced by increased process stability.

- AI-enhanced Predictive Maintenance: ML algorithms predict optimal pad replacement timing based on historical performance data and real-time sensor inputs, minimizing yield risk.

- Real-time Process Optimization: AI feedback loops adjust conditioning arm pressure and speed to maintain removal rate uniformity (RRU) as the pad wears.

- Automated Defect Classification (ADC): AI improves the accuracy and speed of identifying polishing-related defects, accelerating process tuning.

- Accelerated Material R&D: Machine learning models simulate the performance of novel polyurethane formulations or groove designs, shortening time-to-market for new pad products.

- Increased Semiconductor Demand: The proliferation of AI accelerators and advanced data center chips necessitates higher volumes of complex wafers, indirectly driving overall CMP pad procurement.

DRO & Impact Forces Of CMP Polishing Pad Market

The dynamics of the CMP Polishing Pad market are fundamentally governed by the interplay between the technological push for finer geometries and the inherent challenges associated with maintaining surface quality at the atomic scale. Drivers primarily stem from the rapid scale-up of advanced node manufacturing and massive investments in foundry capacity expansions, particularly for 5nm and below nodes where CMP requirements are most rigorous. Restraints include the high capital expenditure required for adopting advanced CMP processes, the technical difficulty and cost associated with disposal of used pads and slurry waste, and the persistent pressure from end-users (fabs) to extend pad lifetime to reduce the high operational expenditure associated with these consumables.

Opportunities are largely centered around niche markets such as advanced packaging (e.g., 2.5D/3D integration requiring through-silicon via (TSV) planarization), specialized substrates (like silicon carbide and gallium nitride utilized in power and RF electronics), and the development of next-generation fixed abrasive pads (FAPs) that integrate abrasive particles directly into the pad matrix, offering potential benefits in terms of slurry reduction and improved process consistency. Impact forces, which include external pressures such as geopolitical trade tensions affecting supply chain stability and the cyclical nature of the global semiconductor market (e.g., inventory corrections), introduce volatility into long-term demand forecasting for polishing pads.

The market faces significant technological hurdles, particularly related to achieving uniform material removal across increasingly large wafers (up to 300mm) while minimizing defectivity at critical interfaces. The push for chemical-free or reduced-chemical CMP processes is a growing opportunity that challenges traditional pad designs, requiring materials that can mechanically achieve high removal rates with minimal chemical assistance. Overall, the market remains highly sensitive to global semiconductor capital expenditure cycles and demands for higher levels of integration, ensuring that innovation in pad material science remains a high priority for both suppliers and equipment manufacturers.

Segmentation Analysis

The CMP Polishing Pad Market is comprehensively segmented based on material type, pad application, and end-user industry, reflecting the diverse requirements across the semiconductor manufacturing spectrum. Material segmentation is crucial as it defines the mechanical and chemical properties relevant for specific CMP steps. Polyurethane pads dominate due to their optimal blend of stiffness, compressibility, and chemical resistance, enabling their use in both oxide and metal CMP processes. However, specialized segments like fixed abrasive pads (FAPs) are emerging as critical for advanced applications requiring reduced slurry consumption and superior defect control. The application segmentation differentiates demand based on the layer being polished, such as oxide, copper, tungsten, or barrier films, each necessitating unique pad characteristics.

- By Material Type:

- Polyurethane Pads

- Non-Woven Pads

- Fixed Abrasive Pads (FAPs)

- Composite Pads

- By Pad Application:

- Oxide CMP (e.g., STI, ILD)

- Copper CMP

- Tungsten CMP

- Barrier/Liner CMP (e.g., Ta, TaN)

- Low-k Dielectric CMP

- Silicon (Si) CMP

- By End-Use Industry:

- IC Fabrication (Logic and Memory)

- Advanced Packaging (2.5D/3D TSV)

- MEMS

- Optoelectronics

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For CMP Polishing Pad Market

The value chain for CMP Polishing Pads begins with upstream activities, primarily involving the sourcing and processing of specialized raw materials, predominantly high-grade polyols, isocyanates, and various additives required for polyurethane synthesis. Key upstream players include chemical manufacturers specializing in polymer precursors. This stage is highly critical as the purity and consistency of these inputs directly affect the mechanical and chemical properties of the final pad, influencing factors like hardness, porosity, and wear resistance. Suppliers often collaborate closely with pad manufacturers to tailor the raw material specifications for specific CMP applications, ensuring optimal performance for advanced semiconductor nodes.

Midstream activities involve the core manufacturing process, where raw materials are polymerized, cast, and processed into large polyurethane sheets, followed by precision machining, grooving, and quality control checks. Pad manufacturers invest heavily in proprietary casting techniques to control the internal structure and uniformity of the pad material, which is vital for maintaining consistent removal rates. Distribution channels form the critical link to the end-users (fabs). Due to the technical nature of the product and the need for just-in-time delivery and technical support, direct sales channels dominate, where pad manufacturers employ dedicated technical sales teams to service major integrated device manufacturers (IDMs) and foundries. Indirect channels, involving specialized regional distributors, are typically used for smaller fabs or for distributing older technology pads.

Downstream analysis focuses on the end-users: the semiconductor fabrication plants. In this highly specialized environment, technical support, process qualification, and application engineering services are as important as the physical product itself. Pad suppliers must work interactively with the fabs to qualify new pads for specific processes and equipment (e.g., Applied Materials, Ebara, or Tokyo Electron tools). The lifecycle management of the pads, including conditioning and eventual disposal, also forms part of the downstream value chain. Continuous feedback from these high-volume manufacturing environments drives the R&D cycle upstream, focusing on developing pads that offer longer life, better consistency, and lower total cost of ownership.

CMP Polishing Pad Market Potential Customers

The primary customers for CMP Polishing Pads are organizations involved in the high-volume manufacturing and processing of semiconductor wafers, where planarization is a mandatory step for successful device integration. These customers are categorized into various segments based on their business model and the type of chips they produce. The largest segment includes Integrated Device Manufacturers (IDMs) like Intel and Samsung, which design and manufacture their own logic and memory chips. Foundries, such as TSMC and GlobalFoundries, represent the other major customer base, specializing in manufacturing chips designed by external fabless companies.

A significant portion of demand also originates from manufacturers of specialized components, including those producing advanced memory products (e.g., 3D NAND and HBM memory stacks), microprocessors, and sophisticated sensors. Furthermore, the emerging market of specialized substrate manufacturing, including Silicon Carbide (SiC) and Gallium Nitride (GaN) wafers used predominantly in power electronics and 5G infrastructure, represents a high-growth customer segment. These materials require ultra-smooth surfaces often achieved through highly customized CMP pad and slurry combinations, indicating a growing diversification in the end-user base beyond traditional silicon IC fabrication.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dow Electronic Materials, Cabot Microelectronics (CMC), Fujimi Corporation, DuPont, 3M, Entegris, Eminess Technologies, IVT Technologies, Kinik Company, Fuso Chemical, WEC Group, ZEON Corporation, SKC, Grish Company, Sumitomo Bakelite, CoorsTek. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

CMP Polishing Pad Market Key Technology Landscape

The CMP Polishing Pad technological landscape is continuously evolving, focusing on optimizing the pad's mechanical interface properties to meet sub-micron planarization demands. A major area of focus is the development of next-generation polyurethane materials, often utilizing techniques to create uniform micro-porosity structures within the pad. This micro-structure control is crucial for consistent slurry retention and distribution across the wafer surface, which directly impacts the achieved uniformity of material removal. Techniques include controlled foaming processes and specialized casting methods that ensure the pad maintains its mechanical integrity and compressibility throughout its operational life, counteracting the effects of glazing and conditioning.

Groove pattern design represents another critical technological differentiator. Manufacturers employ complex groove geometries (e.g., K-Grooves, X-Y Grooves, and Concentric Grooves) designed via computational fluid dynamics (CFD) simulations to optimize slurry transport, prevent hydroplaning, and ensure even distribution of shear forces. Advanced sensor integration into the polishing system, often referred to as "smart polishing," is gaining prominence, allowing for real-time monitoring of pad characteristics such as temperature and friction. This data feeds into the process control systems, optimizing the conditioning process—which involves using specialized abrasive discs to periodically refresh the pad surface—to maintain a stable removal rate and extend pad life efficiently.

Furthermore, the push towards Fixed Abrasive Pads (FAPs) represents a significant technological shift. FAPs embed the abrasive material directly into the pad matrix, potentially reducing reliance on traditional slurry systems, minimizing disposal costs, and offering higher control over the particle size and distribution. While FAPs currently hold a smaller market share, their technological promise in reducing process complexity and contamination risk, particularly for highly critical barrier and metal CMP steps, positions them as a key area of future technological growth and competitive differentiation within the CMP consumables market.

Regional Highlights

The global CMP Polishing Pad market exhibits significant regional disparities driven primarily by the geographical concentration of advanced semiconductor fabrication capabilities. Asia Pacific (APAC) dominates the market landscape, accounting for the largest share in both consumption volume and value. This supremacy is attributable to the region housing the world’s leading foundries and memory manufacturers (TSMC, Samsung, SK Hynix), which are aggressively expanding capacity, particularly for next-generation 3D NAND, advanced DRAM, and leading-edge logic processors (3nm and 2nm nodes). Countries like Taiwan, South Korea, and increasingly China, are the primary drivers of demand, where the need for high-performance, consistent polishing pads is paramount to maintaining high yields.

North America maintains a robust presence, driven less by sheer fabrication volume (compared to APAC) but more by R&D, advanced material development, and the fabrication of specialized high-end processors, often conducted by IDMs like Intel. North American demand is concentrated on ultra-premium pads designed for the most challenging processes, necessitating suppliers to innovate constantly in material science and process control. Europe, while smaller, supports specialized semiconductor sectors, including automotive electronics and industrial automation components, contributing stable demand for both standard and specialty polishing pads, particularly as European nations focus on securing local supply chains through initiatives like the European Chips Act.

Emerging markets in Latin America and the Middle East and Africa (MEA) currently represent marginal shares but are showing gradual growth, largely tied to the establishment of assembly, testing, and packaging (ATP) facilities, and minor fabrication plants focusing on older nodes or specialized applications. The APAC region's influence is expected to solidify further throughout the forecast period due to ongoing massive capital expenditure announcements for new mega-fabs, ensuring that regional market dynamics, supply chain logistics, and localized manufacturing strategies will remain crucial determinants of global market success for pad suppliers.

- Asia Pacific (APAC): Dominates the global market, driven by Taiwan, South Korea, and China, due to high concentration of advanced logic and memory manufacturing facilities (fabs).

- North America: Focuses on high-value, R&D-intensive applications and premium pads for leading-edge processes, supporting major IDMs and equipment manufacturers.

- Europe: Stable demand fueled by the automotive and industrial electronics sectors, with increasing strategic investment aimed at bolstering regional semiconductor supply resilience.

- China: Experiencing rapid growth in domestic CMP pad consumption driven by national initiatives to achieve semiconductor self-sufficiency and substantial investment in new fabrication capacity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the CMP Polishing Pad Market.- Dow Electronic Materials

- Cabot Microelectronics (CMC)

- Fujimi Corporation

- DuPont

- 3M

- Entegris

- Eminess Technologies

- IVT Technologies

- Kinik Company

- Fuso Chemical

- WEC Group

- ZEON Corporation

- SKC

- Grish Company

- Sumitomo Bakelite

- CoorsTek

- Nippon Pillar Packing

- Versum Materials (now part of Merck KGaA)

- Rohm and Haas (now part of Dow)

- Ashland Global Holdings

Frequently Asked Questions

Analyze common user questions about the CMP Polishing Pad market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary material used in CMP Polishing Pads?

The primary material used in high-performance CMP polishing pads is specialized porous or non-porous polyurethane, chosen for its chemical inertness, specific hardness, and controlled compressibility, which are vital for achieving uniform material removal across the silicon wafer surface.

How does the adoption of 3D IC structures impact CMP pad requirements?

The shift to 3D IC structures, such as 3D NAND and TSV for advanced packaging, dramatically increases the demand for pads capable of ultra-high selectivity, minimal dishing, and low defectivity, necessitating specialized multi-layer or composite pads for precise planarization of high-aspect-ratio features.

Which geographical region dominates the CMP Polishing Pad Market?

Asia Pacific (APAC) dominates the market, primarily driven by the massive concentration of leading-edge semiconductor fabrication facilities (fabs) in key manufacturing hubs like Taiwan, South Korea, and China, which generate the highest demand for CMP consumables.

What is the future outlook for Fixed Abrasive Pads (FAPs)?

The future outlook for Fixed Abrasive Pads (FAPs) is positive, especially in critical metal and barrier CMP steps, as they offer benefits like reduced slurry consumption, improved particle control, and lower cost of ownership, making them a significant area of research and potential market disruption.

How do pad conditioning technologies relate to CMP pad market growth?

Pad conditioning is intrinsically linked to market growth as advancements in conditioner design and AI-driven conditioning control systems extend the effective life of the polishing pad, ensuring consistent material removal rates and lower consumable operating costs for semiconductor manufacturers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager