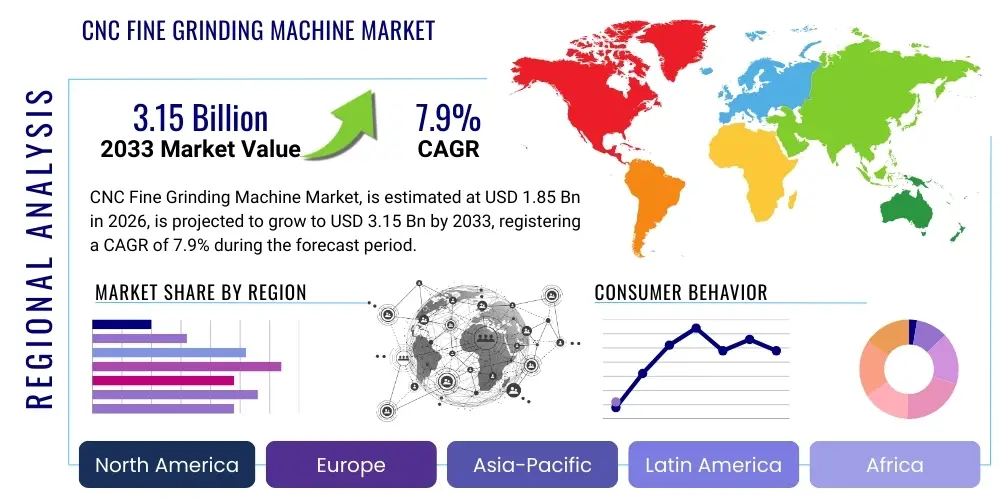

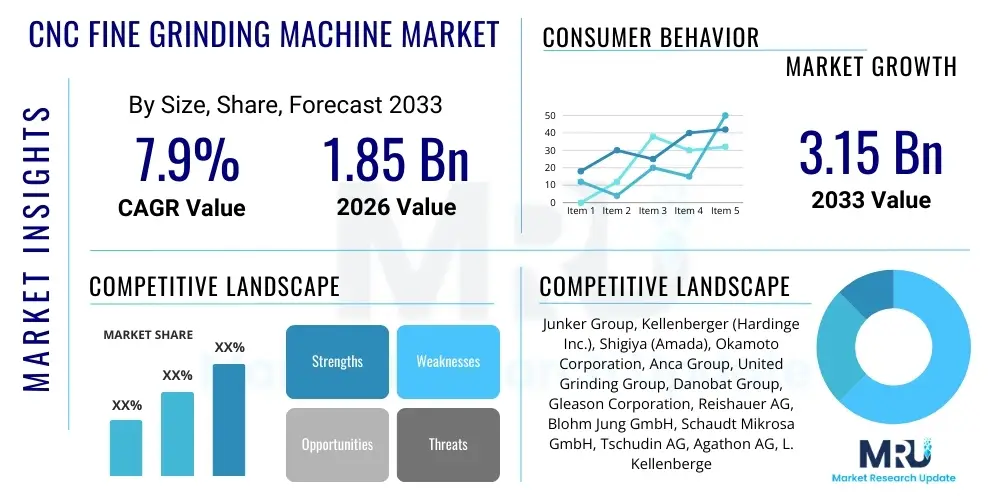

CNC Fine Grinding Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437094 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

CNC Fine Grinding Machine Market Size

The CNC Fine Grinding Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.9% between 2026 and 2033. The market is estimated at $1.85 Billion USD in 2026 and is projected to reach $3.15 Billion USD by the end of the forecast period in 2033.

CNC Fine Grinding Machine Market introduction

The CNC Fine Grinding Machine Market encompasses advanced precision machinery designed for achieving extremely tight tolerances and superior surface finishes on various difficult-to-machine materials, including high-strength steels, technical ceramics, specialized alloys, and carbon composites. These sophisticated machines utilize Computer Numerical Control (CNC) systems to automate complex grinding operations, ensuring exceptional repeatability, reducing reliance on manual skill, and minimizing geometric errors, which is paramount in sectors demanding ultra-precise component dimensions. Fine grinding differentiates itself from conventional abrasive processes by its focus on material removal within the micron or sub-micron range, necessary for producing critical components such as internal combustion engine fuel injection systems, high-speed bearing races, semiconductor silicon and sapphire wafers, and complex orthopedic surgical implants. The technological advancements driving this market include integrating high-frequency direct-drive spindles, advanced thermal management systems, and proprietary in-process laser measurement probes to maintain thermal stability and dimensional accuracy throughout continuous, high-volume production cycles. The expanding global requirement for component miniaturization coupled with enhanced operational performance dictates that surfaces must minimize friction and maximize energy efficiency, securing the ongoing necessity for highly advanced fine grinding technology.

Major applications of CNC fine grinding machines span across critical industrial sectors where component reliability and surface integrity are non-negotiable prerequisites for operational success. The modern automotive industry, particularly the rapidly expanding electric vehicle (EV) manufacturing segment, utilizes these machines extensively for high-precision components, including hardened gear wheels, specialized motor shafts, and robust transmission parts that must operate quietly and efficiently. Aerospace manufacturing is another cornerstone of demand, relying on fine grinding for critical safety-related parts such as turbine engine components, actuator rods, landing gear elements, and structural assemblies that require high fatigue life and stringent material integrity checks. Furthermore, the medical device and surgical manufacturing sectors depend entirely on the capabilities of fine grinding technology to produce perfectly polished orthopedic joint replacements, dental implants, and precision surgical instruments with biocompatible and meticulously controlled surface roughness specifications. The core benefits realized by end-users include the achievement of superior component form accuracy, enhanced surface integrity free from sub-surface thermal damage, elevated production throughput due to automation, and the inherent flexibility to handle challenging materials and highly diversified production batches, all contributing directly to improved product quality and longevity.

The market driving factors are diverse and internationally intertwined, stemming fundamentally from the worldwide acceleration in demand for high-performance, precision manufacturing capabilities across key economic regions such such as Asia Pacific, Western Europe, and North America. The pervasive transformation in the transportation sector, specifically the pivot towards electric mobility, necessitates a new class of components that are both harder and more precise than traditional internal combustion engine parts, thereby fueling the immediate need for advanced fine grinding machinery capable of handling new materials like specialty ceramics and extremely hard steels. Additionally, ongoing technological convergence in the semiconductor fabrication industry, involving the continuous reduction of node sizes and the requirement for increasingly flat and parallel wafers, demands ultra-precise grinding and polishing equipment. Legislative and market pressures related to improving energy efficiency, reducing operational noise, and minimizing harmful emissions further incentivize manufacturers across all sectors to invest in precision-ground components that drastically reduce friction, wear, and power loss. This convergence of demanding technical requirements, regulatory compliance, and market-driven miniaturization strategies solidifies the future expansion trajectory for the CNC fine grinding machine market.

CNC Fine Grinding Machine Market Executive Summary

The CNC Fine Grinding Machine Market is characterized by vigorous expansion, fueled significantly by the rapid industrial uptake of electric vehicle manufacturing and the sustained, stringent precision requirements within the aerospace and medical industries globally. A critical current business trend is the widespread integration of Industry 4.0 paradigms, leading to the deployment of fully automated, multi-axis grinding centers equipped with advanced in-line metrology systems and robotic material handling, which collectively enable completely unmanned, single-setup manufacturing processes and significantly improve overall equipment effectiveness (OEE). Leading global manufacturers are increasingly investing in research and development focused on creating hybrid machine solutions that combine fine grinding with other secondary operations, such as micro-honing or specialized lapping, aiming to deliver comprehensive, finished component solutions directly from a single platform. Concurrently, successful market penetration increasingly relies on forging deep strategic alliances between core machine tool manufacturers and specialized suppliers of advanced abrasive materials, which is crucial for optimizing the complex process interactions required when machining next-generation, high-performance alloys. Environmental consciousness is also a major operational consideration, spurring innovations in dry grinding techniques and Minimum Quantity Lubrication (MQL) systems, which aim to substantially diminish dependence on traditional coolants, thereby lowering waste management costs, enhancing sustainability profiles, and achieving compliance with stricter international environmental regulations.

From a geographical perspective, the Asia Pacific (APAC) region continues to dominate the global CNC Fine Grinding Machine Market in terms of volume consumption and production output, primarily due to the vast, industrialized economies of China, Japan, and South Korea, which benefit from extensive manufacturing infrastructure and robust government support aimed at accelerating advanced production capabilities. This region's dominance is heavily underpinned by the vigorous automotive supply chain activity and the massive scale of consumer electronics component production. Europe maintains its traditional leadership in the high-precision and specialized segment of the market, driven by the demanding engineering standards and expertise concentrated in nations like Germany and Switzerland, which cater meticulously to high-reliability sectors such as European aerospace and the highly regulated medical device manufacturing sector. North America continues to exhibit strong and consistent market growth, characterized by its high propensity for adopting cutting-edge automation technologies, including advanced robotics and sophisticated software integration within grinding cells, strategically addressing regional skilled labor constraints and simultaneously maximizing productivity across high-value defense and critical infrastructure manufacturing segments.

Analysis of market segmentation reveals that cylindrical grinding machines are experiencing the most rapid adoption rate, spurred directly by the increasing geometric complexity and stringent quality demands placed upon powertrain components within the burgeoning EV sector and the demanding requirements for precision rollers in heavy machinery applications. Simultaneously, surface and profile grinding segments remain essential, particularly for the tool and die industry and for manufacturing high-precision flat components in electronics. Regarding technology, while conventional aluminum oxide abrasives maintain a stable foundational presence, there is a pronounced and accelerating market shift towards the utilization of superabrasives, specifically Cubic Boron Nitride (CBN) and diamond wheels, which are indispensable for achieving efficient material removal and extended tool longevity when processing new generations of exceptionally hard and brittle workpiece materials. End-user analysis confirms that the automotive industry remains the largest consumer by unit volume, yet the aerospace and medical sectors consistently generate the highest revenue per machine, reflecting the extreme specialization and custom engineering required for these mission-critical applications. The prevailing trend across all segments is the mandated move towards seamless Industry 4.0 integration, where comprehensive data analytics and digital connectivity solutions are now viewed as fundamental competitive differentiators, enabling true closed-loop process optimization and remote operational management.

AI Impact Analysis on CNC Fine Grinding Machine Market

User inquiries frequently focus on the potential for artificial intelligence (AI) and machine learning (ML) to transcend the traditional limitations inherent in fine grinding processes, particularly in achieving and sustaining extreme precision under real-world, dynamic manufacturing conditions. Common questions analyze the feasibility of utilizing sophisticated ML models for predictive process optimization, allowing the system to automatically compensate for minor material inconsistencies, spindle vibrations, and thermal expansion in real-time without human intervention. End-users show keen interest in how AI can be leveraged to minimize the high costs associated with premature abrasive wheel wear and unplanned machine downtime, particularly through the implementation of highly accurate predictive maintenance schedules derived from complex sensor data fusion. Furthermore, there is significant exploration into AI's capability in revolutionizing closed-loop quality assurance, such as employing deep learning algorithms combined with in-situ high-speed imaging to instantly detect and correct minute surface imperfections, ensuring that quality yield rates approach 100%. Overall market sentiment is highly optimistic, anticipating that AI integration will fundamentally transform CNC fine grinding operations from being heavily reliant on static programming and expert knowledge to becoming fully adaptive, self-learning manufacturing cells capable of achieving unparalleled accuracy and efficiency, thereby addressing the long-standing industry challenge of maintaining consistent sub-micron precision under prolonged, high-throughput operating conditions.

- AI-driven Predictive Maintenance Systems: Utilizing complex machine learning algorithms to analyze multivariate sensor data streams—including vibration, motor current, acoustic emission, and thermal flux—to accurately predict potential failures in critical components such as high-speed spindles and linear drives, thus minimizing catastrophic breakdowns and scheduling maintenance exclusively when required.

- Dynamic Adaptive Control (DAC): Employing neural networks to continuously adjust crucial grinding parameters—including feed rate, grinding wheel velocity, and cooling lubricant flow—in microseconds based on immediate feedback loops from the grinding contact zone, ensuring optimal material removal without inducing thermal damage or micro-cracking, particularly when processing highly variable exotic alloys.

- Enhanced Process Simulation and Optimization: Leveraging AI to execute sophisticated virtual simulations of the grinding process, optimizing complex multi-axis toolpaths and compensating strategies prior to physical execution, dramatically reducing set-up time, minimizing material waste during process validation, and maximizing overall cycle time efficiency.

- Autonomous Quality Verification: Integrating deep learning and computer vision systems with ultra-high-resolution cameras and tactile sensors for comprehensive in-process quality inspection, allowing the machine to automatically identify and classify subtle surface defects, chatter marks, or geometrical errors that are undetectable by conventional statistical process control (SPC) methods.

- Automated Knowledge Management and Recipe Generation: Utilizing AI to catalogue and retrieve optimal grinding recipes based on historical performance data, material type, and geometry, thereby rapidly facilitating the efficient setup of new components and drastically shortening the overall time-to-production for small-batch, high-mix manufacturing orders.

DRO & Impact Forces Of CNC Fine Grinding Machine Market

The CNC Fine Grinding Machine Market is fundamentally propelled by the vigorous Drivers associated with the global technological shift toward high-efficiency systems across various critical industries, mandating components with ultra-low friction and maximal geometric precision. Key drivers include the exponential increase in electric vehicle production worldwide, which demands extremely accurate grinding for silent, efficient transmission components; the continuous innovation in the medical sector requiring complex, high-surface-quality orthopedic and surgical implants; and the persistent needs of the aerospace industry for zero-defect, highly durable turbine and structural parts. These industry-specific pressures ensure sustained investment in cutting-edge fine grinding capability. However, the market faces significant Restraints, principally the exceptionally high initial capital expenditure required for acquiring advanced CNC fine grinding centers, which often involves customized integration and specialized ancillary equipment. This investment hurdle, coupled with the critical reliance on a highly specialized technical workforce capable of programming, operating, and maintaining these complex machines, limits adoption among smaller enterprises and developing economies, necessitating long-term strategic workforce planning by manufacturers.

Opportunities for market expansion are abundant, particularly in the realm of technological convergence and service diversification. There is a burgeoning Opportunity in developing highly flexible, hybrid machines that seamlessly integrate fine grinding with other precision finishing operations like superfinishing or micro-milling, offering end-users a compact, high-efficiency, single-platform solution for complete component manufacturing. The expansion of the global installed base also generates substantial long-term opportunities in the high-margin areas of service contracts, software upgrades, and the precision refurbishment market for older, high-quality grinding equipment. Furthermore, geographical diversification, specifically targeting new industrial clusters in Southeast Asia and Latin America that are receiving increased foreign direct investment for automotive and electronics manufacturing, represents untapped potential for vendors offering modular and scalable fine grinding solutions. The successful monetization of AI and data analytics services attached to the machine sales also constitutes a major future revenue stream, shifting the value proposition from hardware sales to performance-based service offerings.

The primary Impact Forces shaping the competitive dynamics of this market stem from two major sources: rapid technological change in abrasive materials and the intense globalization of manufacturing supply chains. The continuous development of superior superabrasive wheel technology (e.g., tailored CBN wheel chemistries and advanced diamond formulations) allows for significantly faster material removal rates and superior surface finish quality, creating a powerful competitive pressure for machine manufacturers to constantly update their platform designs to harness these new capabilities. Simultaneously, the globalization of Tier 1 supplier networks increases the volume demand for standard precision components while simultaneously intensifying global price competition, pushing machine builders to optimize their manufacturing processes and supply chains to offer competitive pricing without sacrificing the required precision. This dual pressure of required innovation and cost management forces market participants to maintain extremely high R&D intensity and operational efficiency to remain viable and competitive on the global stage.

Segmentation Analysis

The CNC Fine Grinding Machine Market is meticulously segmented across multiple dimensions to accurately reflect the complexity and diversity of end-user needs, encompassing machine architecture, required level of technological sophistication, the specific industry served, and the nature of the application. Segmentation based on machine type is critical, distinguishing between surface grinders (used for achieving parallelism and flatness on broad components), cylindrical grinders (essential for external and internal diameters and complex contours on rotational parts like shafts and bearings), and highly specialized profile grinders (used for intricate forms like gear teeth and complex thread profiles). This categorization allows market participants to tailor their offerings precisely to the geometric requirements of the target components. The granularity of the market is further detailed by assessing the technology used, which provides insight into the increasing penetration of advanced materials and high-speed processes necessary for modern manufacturing demands.

The segmentation by technology differentiates between machines optimized for traditional abrasives (e.g., aluminum oxide wheels) and those built specifically to leverage the performance advantages of superabrasives, notably Cubic Boron Nitride (CBN) and synthetic diamonds. CBN technology, which offers superior hardness and thermal resistance, is mandatory for efficiently grinding case-hardened steels and superalloys, representing the premium growth segment. Complementary to this is the categorization by end-user industry, which delineates the market consumption patterns across major vertical sectors. The automotive industry, representing high volume and consistent demand, stands distinct from sectors like aerospace and medical, which, while lower in volume, demand the highest levels of customization, certification, and process validation, commanding significantly higher average selling prices for specialized equipment due to the criticality of the components manufactured for these demanding applications.

The final layer of segmentation addresses the specific application and the level of automation utilized in the machine deployment. Application-based segmentation includes highly technical niches such as high-precision gear tooth grinding (critical for noise reduction in EVs), intricate medical component polishing, and ultra-flat wafer thinning in semiconductor fabrication, each requiring unique machine characteristics and specific software controls. Furthermore, the increasing differentiation between semi-automatic machines (requiring manual loading/unloading) and fully automated systems (featuring integrated robotics, automated gauging, and unmanned operation capabilities) reflects the global trend towards minimizing human intervention and maximizing production reliability. These detailed segmentation insights are indispensable for strategic marketing, product development roadmapping, and precise identification of high-potential growth pockets across the diverse global market landscape, ensuring vendor offerings remain acutely relevant to evolving industrial specifications.

- By Machine Type:

- Surface Grinding Machines (Reciprocating and Rotary Table)

- Cylindrical Grinding Machines (External Diameter Grinding)

- Cylindrical Grinding Machines (Internal Diameter Grinding)

- Centerless Grinding Machines

- Profile Grinding Machines (CNC Optical and CNC Form Grinding)

- Special Purpose Grinding Machines (e.g., Gear Grinding, Cam Grinding, Thread Grinding)

- By Technology:

- Conventional Abrasive Grinding (Aluminum Oxide, Silicon Carbide)

- Superabrasive Grinding (Cubic Boron Nitride – CBN)

- Superabrasive Grinding (Diamond Wheels)

- Creep Feed Grinding Technology

- Electrochemical Grinding (ECG)

- By End User:

- Automotive Industry (Engine, Transmission, Chassis Components, EV Parts)

- Aerospace and Defense (Turbine Blades, Structural Components, Hydraulics)

- Medical Devices and Implants (Orthopedics, Surgical Tools, Dental)

- Electronics and Semiconductors (Wafer Processing, Hard Drive Components)

- Tool & Die Making and Mold Manufacturing

- General Precision Machinery and Heavy Equipment Manufacturing

- By Application:

- High Precision Component Finishing (Tolerances < 5 µm)

- Bearing Race and Roller Grinding

- Fuel Injection System Components (Common Rail Parts)

- Wafer Thinning and Planarization

- Turbine Blade Root and Airfoil Grinding

- By Automation Level:

- Semi-Automatic/Manual Load Machines

- Fully Automated Cells (Integrated with Robotics and Pallet Systems)

Value Chain Analysis For CNC Fine Grinding Machine Market

The value chain for the CNC Fine Grinding Machine Market commences with the crucial Upstream segment, dominated by highly specialized component suppliers and raw material providers. This stage involves the procurement of extremely high-quality materials, including proprietary grades of cast iron or high-polymer granite composites essential for constructing vibration-dampening machine bases, guaranteeing the requisite static and dynamic rigidity. The procurement of key mechanical and electronic subsystems is paramount, specifically precision linear motion components (high-accuracy linear guides and temperature-compensated ball screws), high-speed, high-power direct-drive spindle units, and sophisticated CNC controllers from global leaders such as Fanuc, Siemens, or Heidenhain. A critical upstream dependency is the supply of advanced abrasive materials, including the synthesis of industrial diamond and Cubic Boron Nitride (CBN) grit, followed by the manufacturing of high-performance grinding wheels using proprietary ceramic, resin, or metal bonding technologies. Efficiency and cost optimization at this stage are heavily influenced by long-term strategic relationships with component suppliers, given the specialized nature and often long lead times for high-precision components, which directly dictates the final cost structure and technological superiority of the assembled grinding machine.

The core of the value chain is occupied by the CNC Machine Tool Builders, who leverage their proprietary intellectual property in machine kinematics, thermal stabilization, and process control software to design, assemble, and rigorously test the final grinding centers. This manufacturing stage involves highly precise assembly processes conducted in climate-controlled environments to ensure geometrical accuracy during alignment. Downstream activities encompass the distribution, sales, intricate installation, and long-term after-sales support necessary for sustained operation. Distribution channels operate via a dual approach: large, direct sales teams manage high-value, complex projects requiring extensive application engineering consultation, such as installing a custom gear grinding cell for an aerospace Tier 1 supplier. In parallel, a network of specialized, technically proficient industrial distributors and localized agents handles the sale of more standardized surface and cylindrical grinders, offering broader market reach and essential local presence for immediate technical assistance and spare parts supply, which is critical for machine utilization rates.

The successful execution of the downstream channel is intrinsically linked to the provision of comprehensive, value-added services. Since fine grinding is a highly complex process, the profitability and long-term customer retention rely heavily on post-sale services, including extensive operator training programs, continuous process optimization consultancy (e.g., defining optimal coolant strategies and dressing parameters), and proactive, predictive maintenance contracts enabled by remote diagnostics capabilities. Direct channels are absolutely necessary for market penetration in highly regulated or technologically complex sectors like medical or defense, where regulatory compliance and comprehensive process validation must be directly handled by the original equipment manufacturer (OEM). The efficiency of this overall value chain, from raw material precision to localized after-sales support, determines not only the initial machine sale but also the long-term total cost of ownership (TCO) for the end-user, emphasizing the importance of robust, responsive technical backing to maintain continuous high-precision output on the customer's shop floor.

CNC Fine Grinding Machine Market Potential Customers

The target demographic for CNC Fine Grinding Machines comprises large-scale industrial manufacturers and specialized component contractors who require parts characterized by uncompromising geometrical accuracy, parallelism, and surface finishes measured in the sub-micron range. The most significant buying segment resides within the global transportation sector, encompassing major automotive OEMs and their primary Tier 1 suppliers engaged in producing high-performance internal combustion engine components (e.g., camshafts, crankshafts, valve bodies) and, critically, the increasingly complex and hardened components for electric vehicle (EV) drivetrains, including high-precision planetary and helical gears, motor shafts, and bearing assemblies, where acoustic performance and efficiency are key selling points. These customers prioritize high throughput and repeatable accuracy to meet demanding production schedules while adhering strictly to industry standards for component longevity and operational noise reduction, driving their preference towards fully automated, high-speed grinding centers integrated into production lines.

Another high-value customer group includes the aerospace and defense industries, which require components made from highly specialized, difficult-to-machine materials such as nickel-based superalloys and titanium. Manufacturers in this sector are purchasers of specialized five-axis and creep-feed grinding machines used for critical parts like turbine blade roots, structural components, and high-pressure hydraulic control parts. For these customers, the purchasing criteria are dominated by zero-defect manufacturing requirements, rigorous material integrity checks, compliance with strict governmental certifications (e.g., FAA, EASA), and the ability of the machine to handle specialized material removal techniques that minimize thermal stress, making them buyers of the most technologically advanced and often custom-engineered grinding solutions available on the market, thereby securing the highest average selling prices for vendors.

Furthermore, the medical device and surgical implant manufacturing industry represents a rapidly expanding and highly profitable customer segment. This includes companies producing complex orthopedic components (femoral heads, tibial trays), surgical tools, and delicate precision components for diagnostics. Surface finish requirements in this sector are driven by biocompatibility and minimizing wear inside the human body, necessitating machines capable of achieving mirror-like finishes and complex contouring on materials like cobalt-chrome and titanium alloys. The electronics and semiconductor fabrication sector is also a core customer base, relying on specialized fine grinding (back-grinding and edge grinding) and polishing equipment to prepare silicon, sapphire, and SiC wafers to nanometer-scale thickness and flatness specifications, which are essential for producing advanced microprocessors and memory chips. These diverse end-users collectively emphasize not just the machine's innate accuracy, but the vendor's application expertise, post-sales technical validation, and continuous process support.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion USD |

| Market Forecast in 2033 | $3.15 Billion USD |

| Growth Rate | 7.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Junker Group, Kellenberger (Hardinge Inc.), Shigiya (Amada), Okamoto Corporation, Anca Group, United Grinding Group, Danobat Group, Gleason Corporation, Reishauer AG, Blohm Jung GmbH, Schaudt Mikrosa GmbH, Tschudin AG, Agathon AG, L. Kellenberger & Co. AG, Lapmaster Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

CNC Fine Grinding Machine Market Key Technology Landscape

The key technology landscape defining the CNC Fine Grinding Machine Market is characterized by a relentless pursuit of enhanced precision, superior thermal stability, and increased operational speed, often simultaneously. A cornerstone of modern fine grinding machine design is the widespread adoption of friction-free motion systems, particularly hydrostatic bearing technology for machine axes and spindles. Hydrostatic guides utilize a pressurized oil film to completely separate the moving machine components, eliminating stick-slip effects and mechanical wear, thereby offering maximum dampening capability and high stiffness. This superior rigidity is paramount for absorbing grinding forces without inducing vibrations, which directly translates into achieving ultra-fine surface finishes and maintaining sub-micron geometrical tolerances over extended, heavy-duty operational periods. Furthermore, high-performance linear motors are replacing traditional ball screws in high-axis count machines, providing exceptional dynamic response, extremely rapid acceleration, and zero backlash, making them ideal for complex, rapid contouring operations common in precision profile grinding applications.

Parallel to machine architecture advancements is the continuous evolution in abrasive technology and in-process control. The use of advanced superabrasives, specifically vitrified-bond Cubic Boron Nitride (CBN) wheels, is gaining traction due to their ability to process extremely hard materials with superior thermal stability and extended life. Manufacturers are investing heavily in research to optimize the wheel bond composition and porosity to improve coolant penetration, chip evacuation, and reduce heat generation at the grinding point. This is intrinsically linked to sophisticated in-process measurement and dressing technologies. Modern machines integrate non-contact laser or capacitive measuring probes and acoustic emission sensors that monitor the sharpness of the grinding wheel in real-time, allowing the CNC system to automatically initiate and execute micro-dressing cycles, compensating for wheel wear dynamically. This capability ensures that the grinding process maintains peak efficiency and consistent surface quality throughout the batch, dramatically reducing the need for manual setup and quality checks.

Finally, the competitive edge is increasingly being defined by the software and connectivity layer, driven by Industry 4.0 principles. Advanced thermal compensation algorithms, utilizing dense arrays of embedded sensors throughout the machine structure, allow the control system to model and predict structural deformation caused by temperature fluctuations (both ambient and internally generated). The CNC then applies corresponding micro-corrections to the axes, nullifying thermal drift and maintaining peak accuracy regardless of operating hours or environmental changes. Additionally, robust digital connectivity supports machine-to-machine (M2M) communication, seamless integration with plant-wide Manufacturing Execution Systems (MES), and facilitates crucial vendor services such as remote diagnostics, software updates, and the implementation of AI-driven process optimization modules, ensuring the long-term operational excellence and adaptability of the fine grinding equipment in smart factory environments globally.

Regional Highlights

The CNC Fine Grinding Machine Market demonstrates significant regional variation in demand and technological adoption, largely reflecting the maturity and specialization of local manufacturing industries. Asia Pacific (APAC) holds the undeniable position as the largest and fastest-growing market globally. This dominance is intrinsically tied to the colossal manufacturing base in China, which serves as a global hub for automotive components (including rapidly growing EV parts), consumer electronics, and general machinery production. The demand profile in APAC is characterized by a requirement for high-volume production capabilities, leading to heavy investment in fully automated grinding cells and specialized machinery for semiconductor wafer processing in countries like South Korea and Taiwan. Governmental initiatives across the region, such as China's "Made in China 2025," strongly incentivize industrial upgrading and the adoption of advanced precision machining technologies, driving continuous market expansion, often targeting cost-effective automation solutions alongside high-end precision equipment.

Europe represents a mature and technologically sophisticated market, particularly concentrated within the DACH region (Germany, Austria, Switzerland), which is globally recognized for its excellence in precision engineering. Demand in Europe is primarily focused on the highest end of the precision spectrum, catering to complex, high-mix, low-volume requirements from the aerospace, luxury automotive (e.g., performance powertrain parts), and advanced medical device industries. European customers place an exceptional emphasis on long-term machine stability, energy efficiency, proprietary thermal management, and the flexibility to machine extremely difficult, high-value materials. This segment of the market is less sensitive to initial capital cost and more focused on lifetime precision performance, leading to strong sales of customized, ultra-high-accuracy cylindrical and profile grinding machines from local specialized vendors.

North America maintains a resilient market position, with demand largely fueled by substantial defense and aerospace sector expenditures and significant investment in restructuring the automotive industry to support electric vehicle production and battery component manufacturing. The key distinguishing factor in North America is the strong drive towards adopting highly integrated automation solutions, including robotics for loading and unloading, to offset persistent skilled labor shortages and maximize output per shift. North American buyers prioritize vendor relationships that include robust local support, comprehensive training, and adherence to stringent quality and compliance standards, particularly for components destined for defense and regulated medical applications, ensuring high reliability and rapid return on investment (ROI) through sophisticated software and automation integration.

The Latin America (LATAM) and Middle East & Africa (MEA) regions collectively represent smaller but emerging markets, demonstrating moderate growth driven by regional industrialization and foreign direct investment in key manufacturing sectors. LATAM demand, concentrated in Mexico and Brazil, is closely tied to the global automotive supply chain, requiring reliable CNC grinding solutions for local component production. In MEA, market uptake is more sporadic, often linked to large-scale infrastructural projects, nascent defense production, and industrial diversification efforts in oil-rich nations. As industrial capabilities in these regions mature, the demand for locally serviced, quality CNC grinding machines is expected to grow steadily, shifting from basic industrial grinding towards higher-precision capabilities as local manufacturing quality requirements intensify.

- Asia Pacific (APAC): Dominant market share and highest growth rate; characterized by high-volume production demand in Automotive (EV), Electronics, and General Machinery (China, South Korea). Focus on integrated automation and cost-efficiency.

- Europe: High-value market segment focusing on ultra-precision, specialization, and R&D-intensive applications in Aerospace, Medical, and High-Performance Automotive (Germany, Switzerland). Prioritizes machine stability and energy consumption.

- North America: Strong demand driven by Aerospace/Defense budgets and critical domestic investments in EV manufacturing. High propensity for adopting full robotic automation and advanced software integration to address labor constraints.

- Latin America (LATAM): Growth linked to regional automotive supply chain consolidation (Mexico, Brazil). Focus on reliable, medium-to-high precision cylindrical and surface grinding solutions for local production needs.

- Middle East & Africa (MEA): Emerging market growth tied to industrial diversification programs and infrastructure development, sourcing precision equipment primarily through international vendors and service partners.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the CNC Fine Grinding Machine Market.- United Grinding Group (Studer, Schaudt, Mikrosa, Blohm Jung)

- Junker Group

- Okamoto Corporation

- Hardinge Inc. (Kellenberger)

- Danobat Group

- Gleason Corporation

- Reishauer AG

- Anca Group

- Lapmaster Group

- Shigiya Machine Works Ltd.

- Toyoda Machine Works, Ltd.

- Fives Machining Systems Inc.

- Agathon AG

- Tsubaki Nakashima Co., Ltd.

- Makino Milling Machine Co., Ltd.

- Hauni Maschinenbau GmbH

- Kent Industrial Co., Ltd.

- ELB-Schliff Werkzeugmaschinen GmbH

- Vollmer Group

- Mitsui Seiki Kogyo Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the CNC Fine Grinding Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the CNC Fine Grinding Machine Market?

The primary driver is the accelerating global transition towards electric vehicles (EVs), which necessitates exceptionally precise grinding of complex components like hardened gears, shafts, and motor parts to ensure optimal efficiency, minimal noise, and maximum lifespan for EV powertrains. Simultaneously, demand from the aerospace and medical sectors for highly reliable, precision-finished parts also contributes significantly.

How is Industry 4.0 influencing the operation and design of new fine grinding machines?

Industry 4.0 is enabling the integration of IoT sensors, advanced cloud connectivity, and edge computing into CNC fine grinding machines. This facilitates predictive maintenance, real-time process monitoring, automated thermal compensation, and remote diagnostics, drastically increasing machine uptime and ensuring consistent quality output in automated manufacturing environments, minimizing reliance on manual intervention.

Which abrasive technology is experiencing the fastest growth in the fine grinding market?

Superabrasive grinding technology, utilizing Cubic Boron Nitride (CBN) and diamond wheels, is experiencing the fastest growth. CBN is essential for efficiently grinding hardened steel and exotic alloys prevalent in automotive and aerospace industries, offering superior material removal rates and tool life when processing high-strength, difficult-to-machine materials necessary for modern high-performance components.

What are the key technological challenges currently faced by CNC fine grinding machine manufacturers?

Key challenges include accurately managing the high thermal load generated during ultra-precision grinding to prevent thermal distortion and subsurface workpiece damage, achieving and maintaining sustained sub-micron accuracy over extended, high-throughput production runs, and overcoming the high initial capital expenditure required due to the inherent mechanical and software complexity of the equipment.

Which geographical region is projected to be the largest market for CNC fine grinding machines through 2033?

Asia Pacific (APAC) is projected to remain the largest market through 2033. This dominance is driven by the region's massive manufacturing capacity, particularly in China and Southeast Asia, coupled with substantial governmental and private sector investments in advanced automation and precision production infrastructure for global electronics and rapidly expanding automotive supply chains.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager