CNC Machine Tools Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433248 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

CNC Machine Tools Market Size

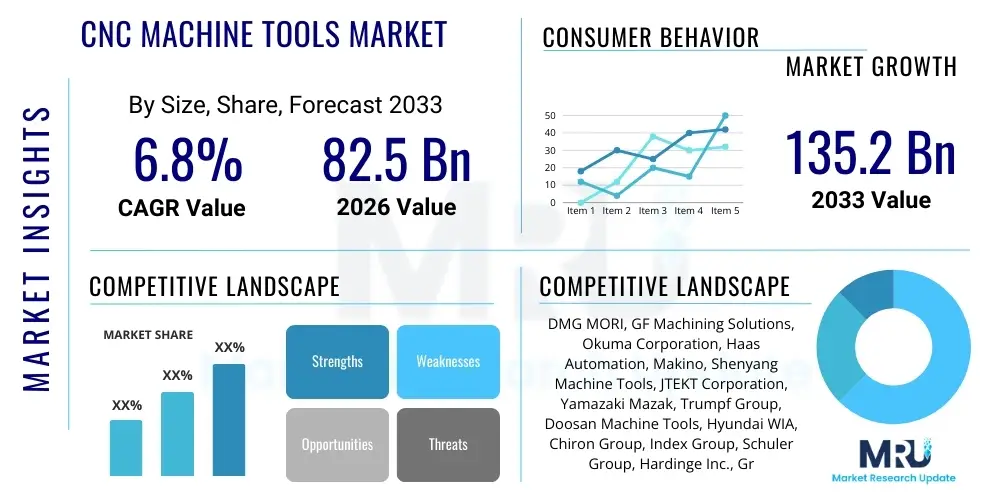

The CNC Machine Tools Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 82.5 Billion in 2026 and is projected to reach USD 135.2 Billion by the end of the forecast period in 2033.

CNC Machine Tools Market introduction

The CNC Machine Tools Market encompasses the technology and equipment utilized for highly precise, automated manufacturing processes. Computer Numerical Control (CNC) tools are electromechanical devices that manipulate raw materials based on programmed instructions, offering unparalleled accuracy, repeatability, and efficiency compared to traditional manual machining methods. These systems are foundational to modern industrial production, transforming design specifications into physical components across various scales and complexities. The core product offering includes CNC milling machines, lathes, grinding machines, and multi-axis machining centers, all integrated with sophisticated software and control systems that dictate their operational performance and complexity. The escalating demand for high-precision components in critical industries like aerospace and medical devices is a primary catalyst for market expansion.

Major applications for CNC machine tools span across automotive manufacturing, where they produce engine blocks, transmission components, and specialized parts; aerospace and defense, necessitating lightweight, high-tolerance components from exotic materials; and the general industrial machinery sector, including power generation and heavy equipment manufacturing. The versatility of these tools allows for rapid prototyping and mass production, making them indispensable in environments requiring both flexibility and high volume. Furthermore, the electronics and semiconductor industries rely heavily on CNC precision for mold making and micro-component fabrication, underscoring their critical role in the global supply chain.

Key benefits driving the adoption of CNC machine tools include drastically reduced cycle times, minimal human error, enhanced operational safety, and the ability to handle complex geometries with ease. The integration of advanced automation features, such as robotic loading/unloading and real-time monitoring, further optimizes production lines, leading to lower operating costs and improved material utilization. The driving factors behind current market growth are predominantly the global push towards Industry 4.0, emphasizing smart factories, the necessity for high-tolerance parts in emerging technologies (e.g., electric vehicles, 5G infrastructure), and increased government investment in defense and infrastructure projects worldwide, particularly in developing economies rapidly industrializing their manufacturing bases.

CNC Machine Tools Market Executive Summary

The global CNC Machine Tools Market is characterized by robust technological innovation, driven predominantly by the integration of digital technologies and advanced materials processing capabilities. Business trends highlight a strong shift toward 5-axis and multi-axis machines, which offer superior flexibility and reduced setup times, catering to complex component manufacturing required in aerospace and advanced automotive sectors. Key market players are increasingly focusing on mergers and acquisitions to expand their geographical footprint and technological portfolio, particularly in areas related to software-defined manufacturing and predictive maintenance solutions. Furthermore, the rising adoption of subscription-based models for machine tool software and maintenance services represents a significant commercial shift, providing manufacturers with predictable operational expenditure and continuous technological updates. Sustainability goals are also influencing business strategies, pushing companies to develop more energy-efficient machines and processes.

Regional trends indicate that the Asia Pacific (APAC) region, spearheaded by China, Japan, and South Korea, maintains the largest market share, fueled by massive government investments in infrastructure, rapid industrialization, and the presence of a vast consumer electronics and automotive manufacturing base. Europe follows, distinguishing itself through early adoption of high-end, precision machining centers, particularly within Germany's highly specialized engineering sector, focusing on digitalization and automation (Industry 4.0). North America is witnessing significant growth driven by reshoring initiatives and substantial demand from the aerospace and defense sectors, which require the highest levels of accuracy and material compatibility. Latin America and the Middle East and Africa (MEA) are emerging markets, primarily driven by increasing investments in energy, construction, and localized manufacturing capabilities, albeit starting from a lower base compared to established regions.

Segment trends reveal that milling machines dominate the market in terms of revenue due to their versatility across numerous applications, followed closely by CNC lathes which are essential for high-volume cylindrical component production. In terms of axis type, 5-axis and multi-axis machines are the fastest-growing segment, reflecting the industrial requirement for manufacturing increasingly intricate components in a single setup, minimizing tolerance stack-up errors. The end-user analysis confirms that the Automotive sector remains the primary consumer, although the Aerospace & Defense segment demands the most advanced and highest-cost machinery. Moreover, the demand for integrated solutions, encompassing both hardware and advanced control software, is outpacing the demand for standalone machines, signaling a trend toward complete, digitally managed manufacturing cells.

AI Impact Analysis on CNC Machine Tools Market

User inquiries regarding AI's influence on the CNC Machine Tools Market commonly revolve around themes of predictive maintenance capabilities, optimization of cutting parameters, autonomous operation, and the role of machine learning in quality control. Users are keen to understand how AI can transition CNC operations from reactive and rule-based systems to proactive, self-optimizing manufacturing environments. Key concerns often include the complexity of integrating AI algorithms with legacy systems, the cybersecurity implications of connected smart tools, and the required skillset shift for machine operators and maintenance personnel. Expectations are high regarding the ability of AI to drastically reduce downtime, minimize scrap material through real-time compensation, and enable true lights-out manufacturing by automating decision-making processes on the factory floor, thereby driving operational efficiency and cost savings.

The primary transformative impact of Artificial Intelligence in this sector is its ability to process vast amounts of sensor data generated by machine components, spindle motors, and tool wear sensors. This data, when analyzed by machine learning models, allows for the precise prediction of component failure well before it occurs, facilitating optimal scheduling of maintenance interventions. This transition from scheduled maintenance to condition-based and predictive maintenance fundamentally maximizes machine uptime and significantly reduces unexpected breakdowns, which are extremely costly in high-volume production environments. Furthermore, AI-driven algorithms are being deployed to dynamically adjust feed rates, spindle speeds, and coolant flow based on material properties, ambient conditions, and tool condition, achieving superior surface finishes and extending tool life beyond conventional parameter settings.

Moreover, AI contributes heavily to enhanced process optimization and quality assurance. Deep learning models can analyze vision system data and compare manufactured parts against CAD specifications in real-time, instantly flagging subtle deviations that might be missed by human inspection or traditional measurement tools. This immediate feedback loop allows the CNC controller to adapt the machining strategy proactively to maintain tight tolerances throughout the entire batch. The integration of Generative Design tools, often powered by AI, also influences the types of complex geometries that CNC machines are tasked to produce, pushing the boundaries of machine capability and necessitating even more advanced, AI-controlled operating systems to execute these intricate toolpaths efficiently and accurately, securing the future of autonomous precision manufacturing.

- AI enhances predictive maintenance by analyzing sensor data to forecast equipment failure, dramatically improving machine utilization rates.

- Machine learning optimizes cutting parameters (speed, feed, depth of cut) in real-time based on material conditions and tool wear, extending tool life and improving surface quality.

- AI-driven software enables adaptive control, allowing CNC machines to compensate for thermal drift or vibration dynamically during the machining process.

- Generative Engine Optimization (GEO) leverages AI to design highly efficient toolpaths, minimizing cycle time and energy consumption.

- Computer vision systems powered by AI automate high-speed quality inspection and dimensional verification, reducing reliance on manual gauging.

- AI facilitates complex scheduling and resource allocation in smart factories, orchestrating multiple CNC machines and robotic systems for maximum throughput.

- The rise of digital twins, heavily reliant on AI simulation, allows virtual testing and optimization of machining processes before execution on physical machines.

DRO & Impact Forces Of CNC Machine Tools Market

The dynamics of the CNC Machine Tools Market are shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and external Impact Forces. The primary drivers include the escalating global demand for precision engineering, particularly from the automotive (transition to electric vehicles requiring new components) and aerospace sectors, coupled with the pervasive trend of industrial automation (Industry 4.0) that mandates high-efficiency, interconnected manufacturing equipment. Restraints primarily encompass the high initial capital investment required for advanced CNC machinery, which poses a barrier to entry for small and medium enterprises (SMEs), and the critical shortage of skilled labor capable of programming, operating, and maintaining complex multi-axis systems, particularly in emerging markets. These high costs and skill gaps slow down the adoption rate, despite the obvious long-term benefits in efficiency.

Opportunities are abundant, centered around the rapid adoption of hybrid manufacturing technologies, such as integrating additive manufacturing (3D printing) capabilities directly into CNC platforms, offering manufacturers unprecedented design freedom and reducing material waste. Furthermore, the development of affordable, cloud-based monitoring and maintenance solutions presents a lucrative opportunity to serve the large base of SMEs by lowering operational overheads and facilitating easier adoption of smart factory features. The increasing utilization of lightweight and difficult-to-machine materials (e.g., composites, titanium alloys) in end-user industries creates a continuous demand for technologically superior CNC tools equipped with specialized tooling and high-stiffness structures, driving innovation in machine design and control systems. Cybersecurity protection for networked manufacturing environments also presents a growth opportunity for vendors offering integrated security solutions.

The overall impact forces are significant and multifaceted. Economic globalization necessitates competitive pricing and high-speed production, pressuring manufacturers to adopt the most efficient CNC technologies. Geopolitical instability, including trade wars and supply chain fragmentation, forces companies to localize manufacturing, which in turn boosts regional demand for new CNC machine installations in areas like Southeast Asia and Eastern Europe. Technological impact forces, driven by IIoT and 5G deployment, enable unprecedented machine connectivity and data analysis capabilities, transforming machine tools from standalone units into fully integrated nodes within a digital ecosystem. Regulatory impact, particularly strict quality and safety standards in the medical and aerospace fields, continuously pushes the envelope for machine accuracy and reliability, ensuring sustained investment in cutting-edge CNC technology that adheres to the strictest global manufacturing protocols.

Segmentation Analysis

The CNC Machine Tools Market segmentation provides a detailed structural view of the industry, based primarily on product type, axis configuration, and the dominant end-user applications. This analysis is critical for understanding market dynamics, technological specialization, and regional consumption patterns. Product differentiation, ranging from basic 3-axis mills to sophisticated multi-tasking machines, determines their suitability for specific manufacturing tasks and material processing. The market’s continuous evolution is evidenced by the increasing share of multi-axis machines, which represent the technological pinnacle, driven by demands for complex part geometry and reduced setup times across all major industrial sectors.

The primary segments reveal concentrated demand clusters. By product type, the market is dominated by general-purpose milling and turning centers, essential for standard industrial component manufacturing. However, high-precision, specialized segments like grinding and electrical discharge machining (EDM) are growing rapidly due to the rising demand for micro-machining and highly accurate mold production. Furthermore, the segmentation by end-user illustrates the strong correlation between industrial capital expenditure and machine tool procurement, with sectors like automotive and general industrial machinery being volume drivers, while aerospace and medical devices set the benchmark for technological specifications and accuracy requirements, often dictating the pace of innovation within the market.

Understanding the interplay between these segments is crucial for strategic market positioning. For instance, the convergence of 5-axis machines (axis segmentation) being adopted heavily by the aerospace sector (end-user segmentation) highlights a lucrative niche focused on high-performance materials and complex, monolithic components. Similarly, the growing demand for CNC routers (product type) in the construction and fabrication industries points towards emerging, high-volume, lower-cost application areas. This detailed segmentation allows manufacturers to tailor their R&D efforts and sales strategies, focusing on specific machine capabilities and regional industry needs to maximize market penetration and profitability in this highly competitive industrial landscape.

- By Product Type:

- CNC Milling Machines

- CNC Lathe Machines (Turning Centers)

- CNC Grinding Machines

- CNC Routing Machines

- Electrical Discharge Machines (EDM)

- Laser Machines

- Multi-Tasking Machines (MTMs)

- By Axis Type:

- 3-Axis CNC Machines

- 4-Axis CNC Machines

- 5-Axis CNC Machines

- Multi-Axis (6-axis and above) Machines

- By End-User Industry:

- Automotive

- Aerospace and Defense

- Industrial Machinery

- Electronics and Consumer Goods

- Medical Devices and Healthcare

- Energy and Power Generation

- Die and Mold

- By Component:

- Hardware (Machine Structure, Drives, Spindles)

- Software (CAD/CAM, Simulation, Monitoring)

- Services (Maintenance, Training, Retrofitting)

Value Chain Analysis For CNC Machine Tools Market

The value chain for the CNC Machine Tools Market is extensive and highly specialized, beginning with the upstream segment involving the sourcing of high-quality raw materials and critical components. This upstream analysis focuses on key suppliers providing specialized steel, castings for machine bases, high-precision bearings, ball screws, linear guides, and, crucially, advanced control systems and servo drives from specialized electronics manufacturers. The performance and reliability of the final machine are heavily dependent on the quality and synchronization of these upstream inputs. Therefore, suppliers capable of delivering components with extremely high geometric tolerances and reliability, such as those providing specialized numerical control (NC) units and high-torque spindle motors, hold significant leverage in the value chain. Global sourcing and strategic partnerships with component manufacturers are essential for competitive machine tool builders to maintain production quality and manage cost volatility, particularly concerning microprocessors and specialized electronic parts.

The central manufacturing stage involves the design, assembly, and testing of the machine tools. This phase requires substantial intellectual property in machine geometry optimization, thermal stability, vibration damping, and software development (CAD/CAM integration). Large, established machine tool builders invest heavily in R&D to enhance speed, accuracy, and digitalization features, often customizing machines for specific high-demand applications like titanium machining or micro-milling. Post-manufacturing, the downstream segment focuses on distribution, installation, commissioning, and post-sales support. Given the complexity and cost of CNC tools, efficient distribution channels are paramount. These channels include direct sales forces, which handle large strategic accounts, and a network of specialized distributors and agents, who provide localized sales, technical support, and critical application engineering services tailored to regional needs and language requirements.

Distribution channels in this market are critical, operating across both direct and indirect models. Direct sales are common for high-volume orders or highly customized, capital-intensive machines sold directly to major Tier 1 automotive suppliers or aerospace integrators, ensuring closer manufacturer-customer relationship management and tailored technical support. Indirect channels, through authorized dealers and value-added resellers (VARs), provide essential market reach, particularly to SMEs and in geographically dispersed regions. These indirect partners often provide financing options, basic maintenance, and operator training, adding significant value. The service component, including long-term maintenance contracts, retrofitting services to upgrade older machines with new CNC controllers, and continuous software updates, forms a highly profitable, recurring revenue stream in the downstream segment, often becoming a competitive differentiator among leading machine tool manufacturers, crucial for ensuring high customer lifetime value and maximizing machine uptime.

CNC Machine Tools Market Potential Customers

Potential customers for CNC Machine Tools are predominantly organizations engaged in discrete manufacturing across various vertical industries that require high precision and repeatability in component fabrication. The primary end-users, or buyers of these products, are typically categorized by the scale and complexity of their production needs. Large multinational manufacturers in the automotive sector, including OEM (Original Equipment Manufacturers) vehicle producers and their extensive network of Tier 1 and Tier 2 component suppliers, represent the single largest consumer base globally. These customers require high-speed, high-volume production centers (like CNC lathes and high-speed milling machines) designed for reliability in 24/7 operational environments, driven by the global transition towards electric and autonomous vehicle technologies demanding new tooling and component geometries.

Another crucial customer segment is the Aerospace and Defense industry, which demands the highest level of accuracy, often utilizing 5-axis and specialized multi-axis machines to process expensive, difficult-to-machine materials such as titanium, inconel, and advanced composites. These customers prioritize machine rigidity, thermal stability, and advanced process monitoring capabilities to ensure compliance with stringent regulatory requirements and safety standards for flight-critical components. The purchasing decision in this sector is heavily influenced by machine certification, reliability track records, and the ability of the machine tool builder to provide comprehensive application support for complex material removal strategies, often resulting in sales cycles that are longer but yielding high-value machine unit sales.

The third major segment includes general industrial machinery and heavy equipment manufacturers, alongside the electronics and medical device industries. Industrial machinery producers use CNC tools for producing gears, shafts, and large structural components, valuing durability and high material removal rates. The medical device sector, however, focuses on micro-machining and ultra-precision, using small, high-speed CNC tools for implants, surgical instruments, and prosthetic devices where surface finish and dimensional accuracy are non-negotiable ethical and regulatory requirements. Finally, independent job shops and small tooling manufacturers constitute a significant volume of customers, often preferring flexible, affordable 3-axis and 4-axis machines that can handle diverse, low-volume, high-mix production runs, necessitating easy programming and fast setup times.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 82.5 Billion |

| Market Forecast in 2033 | USD 135.2 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DMG MORI, GF Machining Solutions, Okuma Corporation, Haas Automation, Makino, Shenyang Machine Tools, JTEKT Corporation, Yamazaki Mazak, Trumpf Group, Doosan Machine Tools, Hyundai WIA, Chiron Group, Index Group, Schuler Group, Hardinge Inc., Grob Werke, Mitsubishi Heavy Industries, Toyoda Machinery, Fives Group, Heller GmbH, Komatsu Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

CNC Machine Tools Market Key Technology Landscape

The technological landscape of the CNC Machine Tools Market is rapidly evolving, driven by the integration of cyber-physical systems and the demand for higher machining precision and speed. A fundamental technological advancement involves the shift toward enhanced structural rigidity and thermal stability in machine design. Manufacturers are increasingly utilizing advanced composite materials, sophisticated finite element analysis (FEA), and integrated cooling systems to mitigate thermal expansion and vibration, which are primary factors affecting machining accuracy, especially during high-speed and long-duration operations. Furthermore, the development of high-speed direct-drive motors for spindles and axes is reducing mechanical complexity, enhancing acceleration, and enabling extremely fine motion control, crucial for micro-machining and achieving superior surface finishes required in optical and medical component manufacturing.

The digitalization of the machine shop floor, largely facilitated by the Industrial Internet of Things (IIoT), represents the most significant technological paradigm shift. Modern CNC machines are equipped with extensive sensor packages that monitor machine status, power consumption, tool condition, and process variables in real-time. This sensor data is transmitted via secure industrial protocols (like OPC UA or MTConnect) to cloud-based platforms for analysis. This connectivity enables advanced functionalities such as real-time performance dashboards, remote diagnostics, and condition monitoring, forming the backbone of smart factory operations. This integration is moving machine tools beyond simple execution devices into intelligent, networked production assets capable of self-diagnosis and communication with the wider enterprise resource planning (ERP) systems, thus optimizing the entire manufacturing workflow.

Advanced control software and human-machine interface (HMI) enhancements are also key areas of focus. Control systems are becoming more intuitive, integrating advanced features like simulation, collision avoidance, and adaptive control algorithms directly into the CNC unit. Modern CAD/CAM software is leveraging AI and machine learning to automatically generate optimized toolpaths, compensating for material variations and machine dynamics. A key emerging technology is the hybrid manufacturing machine, which combines subtractive CNC processes (milling/turning) with additive manufacturing technologies (laser deposition, wire arc additive manufacturing). This innovation allows for the creation of complex parts with internal features and rapid repair of high-value components, drastically reducing material waste and lead times, positioning these machines as the future standard for advanced, flexible production facilities globally.

Regional Highlights

Geographically, the CNC Machine Tools Market is dominated by the Asia Pacific (APAC) region, which accounts for the largest share in terms of both production and consumption. This dominance is primarily attributed to the robust manufacturing base in countries like China, Japan, and South Korea, which serve as global hubs for automotive, electronics, and general industrial production. China, in particular, exhibits rapid market growth driven by massive government investment in domestic manufacturing modernization (Made in China 2025 initiative) and increasing labor costs, necessitating higher levels of automation. Japanese manufacturers continue to be global leaders in high-precision, multi-axis, and specialized machine tools, providing technologically advanced solutions primarily for their domestic automotive and robotics industries, while simultaneously maintaining a strong export market, capitalizing on their reputation for reliability and quality. The APAC region’s high rate of industrialization and expanding middle class underpin continuous demand for manufactured goods, ensuring sustained market expansion.

Europe holds the second-largest share, distinguished by its concentration of high-value manufacturing and early adoption of Industry 4.0 standards, particularly in Germany (machine tools, automotive), Italy (metalworking), and Switzerland (high-precision engineering). European manufacturers, while facing high operating costs, maintain global competitiveness by specializing in highly complex, customized, and software-integrated machines, often focusing on niche, high-tolerance markets such as luxury automotive, aerospace, and advanced tooling. The emphasis here is not solely on volume but on technological sophistication, connectivity, and energy efficiency. Regulatory pressures regarding environmental impact also drive technological advancements in power consumption and material utilization, influencing regional machine design trends and creating demand for advanced retrofitting services for existing machine bases.

North America, characterized by the US market, is experiencing significant growth fueled by revitalization efforts in domestic manufacturing, often termed reshoring, particularly in the defense, aerospace, and medical device sectors. These sectors require cutting-edge 5-axis and multi-axis machines for complex part geometries and strict compliance. The US market is highly receptive to automation and digitalization solutions, including IIoT integration and advanced software interfaces, driven by the necessity to offset high domestic labor costs. Latin America and the Middle East and Africa (MEA) represent high-potential emerging markets. Growth in Latin America is tied to automotive expansion in Mexico and Brazil, while MEA growth is primarily linked to diversification initiatives away from oil dependency, leading to increased investments in infrastructure, localized defense manufacturing, and general industrial capacity building, necessitating the procurement of versatile, reliable CNC equipment, often sourced from Asian or European suppliers.

- Asia Pacific (APAC): Dominates the market due to high production capacity in China and technological leadership in Japan; driven by automotive, electronics, and mass industrialization efforts, requiring large volumes of diverse machine types.

- Europe: Characterized by demand for high-end, technologically sophisticated 5-axis and automation solutions; led by Germany and Italy, focusing on aerospace, high-precision tooling, and deep Industry 4.0 integration.

- North America: Growth stimulated by reshoring initiatives and substantial investment in aerospace and defense programs; strong adoption of advanced software, connectivity, and multi-tasking machines to maximize labor productivity.

- Latin America (LATAM): Market expansion driven by automotive production (Mexico, Brazil) and resource processing industries, focusing on general-purpose and durable CNC equipment for foundational industrial growth.

- Middle East and Africa (MEA): Emerging market growth primarily driven by infrastructure spending and industrial diversification efforts in key economies like Saudi Arabia and the UAE, gradually increasing demand for reliable manufacturing technology.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the CNC Machine Tools Market.- DMG MORI

- GF Machining Solutions

- Okuma Corporation

- Haas Automation

- Makino

- Shenyang Machine Tools Co., Ltd.

- JTEKT Corporation

- Yamazaki Mazak Corporation

- Trumpf Group

- Doosan Machine Tools (now DN Solutions)

- Hyundai WIA

- Chiron Group

- Index Group

- Schuler Group

- Hardinge Inc.

- Grob Werke

- Mitsubishi Heavy Industries, Ltd.

- Toyoda Machinery

- Fives Group

- Heller GmbH

- Komatsu Ltd.

Frequently Asked Questions

Analyze common user questions about the CNC Machine Tools market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the CNC Machine Tools Market?

Market growth is predominantly driven by the accelerating global adoption of smart manufacturing (Industry 4.0), the high demand for precision components across aerospace and medical sectors, and significant capital expenditure related to the electrification of the automotive industry (EV component manufacturing).

How is Artificial Intelligence (AI) being utilized in modern CNC machining centers?

AI is primarily used for enabling predictive maintenance, optimizing toolpath generation and cutting parameters in real-time to maximize efficiency, and conducting automated, high-speed quality control and inspection using integrated vision systems.

Which segmentation, based on axis type, is expected to exhibit the highest growth rate?

The 5-axis and Multi-Axis CNC Machine segment is projected to show the highest growth, driven by the necessity for complex, single-setup machining of intricate components, particularly in the aerospace, defense, and high-end mold and die industries.

What major challenges currently restrain the global adoption of advanced CNC machine tools?

The main restraints include the substantial initial capital investment required for high-tech machinery, which affects SME adoption, and a persistent global shortage of highly skilled operators and programmers trained to manage complex multi-axis systems and integrated software.

Which geographic region dominates the CNC Machine Tools Market, and why?

The Asia Pacific (APAC) region dominates the market due to extensive manufacturing scale, rapid industrialization, high volume production for automotive and consumer electronics, and strong government support for factory automation, particularly in China and Japan.

What is the significance of the term 'Multi-Tasking Machines' (MTMs) in the CNC market?

Multi-Tasking Machines integrate multiple machining processes (e.g., turning, milling, and grinding) into a single machine, drastically reducing part handling, minimizing setup errors, and achieving complete component processing in one operation, which is critical for reducing manufacturing lead times.

How does the aerospace sector influence technological advancements in CNC machine tools?

The aerospace sector necessitates the highest levels of machine rigidity, thermal stability, and 5-axis contouring capabilities to precisely machine exotic, hard materials like titanium and nickel alloys, thereby continually forcing machine tool manufacturers to push the boundaries of accuracy and specialized material compatibility.

What role does the Industrial Internet of Things (IIoT) play in the future of CNC machining?

IIoT enables seamless connectivity, allowing CNC machines to communicate real-time operational data, facilitating centralized monitoring, remote diagnostics, predictive analytics, and integration into broader smart factory ecosystems (MES/ERP systems) for optimized production planning.

Are refurbished or retrofitted CNC machines a significant factor in the market?

Yes, retrofitting is a significant factor, especially for SMEs, allowing them to upgrade older, structurally sound machines with modern CNC controls, drives, and software, extending their lifespan and integrating them into digital factory environments at a lower cost than purchasing entirely new equipment.

How are energy efficiency requirements impacting the design of new CNC machines?

Growing environmental awareness and regulatory pressures are driving manufacturers to design machines with energy-efficient components, such as optimized servo drives, hydraulic power units, and intelligent power management systems that reduce consumption during idle times, minimizing the total cost of ownership.

What are the key differences between a standard CNC mill and a CNC machining center?

While both perform milling operations, a CNC machining center is generally more complex, featuring an automatic tool changer (ATC), tool magazine, and often pallet changers, allowing it to execute multiple operations sequentially without human intervention, ideal for production environments.

In which end-user industry is the demand for micro-machining capabilities most pronounced?

The medical devices and electronics industries exhibit the highest demand for micro-machining CNC capabilities, required for producing highly accurate, miniature components such as surgical implants, micro-molds for lens manufacturing, and delicate electronic components.

How does the transition to electric vehicles (EVs) affect the CNC market?

The EV transition shifts demand away from complex internal combustion engine (ICE) machining (e.g., engine blocks, heads) towards new requirements for battery enclosures, motor housings, specialized cooling components, and lightweight structural parts, necessitating investments in large-scale, automated CNC systems and specialized tooling.

What is the role of CAD/CAM software in the CNC machine tools ecosystem?

CAD/CAM software is foundational, enabling designers to create digital models (CAD) and subsequently generating the machine-readable G-code toolpaths (CAM) required for the CNC machine to execute the physical machining process with precision and efficiency.

How do global supply chain vulnerabilities affect the CNC Machine Tools manufacturing sector?

Vulnerabilities in the global supply chain, particularly concerning high-end semiconductors, specialized controllers, and electronic components, can cause significant delays in machine tool delivery, impacting manufacturing timelines and forcing major players to diversify their component sourcing strategies.

What is adaptive control in the context of CNC machining?

Adaptive control refers to the ability of the CNC system to automatically adjust cutting parameters (like feed rate or speed) in real-time based on actual process conditions detected by sensors, such as spindle load or vibration, ensuring optimal material removal and preventing damage to the tool or workpiece.

What are the main advantages of direct-drive motors over traditional belt-driven systems in CNC machines?

Direct-drive motors offer higher rigidity, superior dynamic performance (faster acceleration/deceleration), eliminate backlash, and provide enhanced accuracy because they remove mechanical transmission elements (belts, gears) that introduce wear and compliance into the system.

In the value chain, where is the highest profit margin typically realized?

While capital equipment sales provide substantial revenue, the highest profit margins are often realized in the downstream segment, specifically through long-term service contracts, maintenance agreements, software subscriptions, and the sale of high-value replacement parts and specialized tooling.

What impact do trade policies and tariffs have on the regional CNC machine tools market dynamics?

Trade policies and tariffs can significantly shift market dynamics by increasing the import costs of machine tools, incentivizing localized production, influencing technology transfer, and altering the competitiveness of international manufacturers within specific high-tariff jurisdictions.

How are composites and lightweight materials affecting CNC machine design requirements?

Machining composites and lightweight alloys requires CNC machines with higher dynamic stiffness, faster spindle speeds, and specific dust/chip management systems, driving innovation towards specialized machine designs optimized for these challenging materials to maintain dimensional integrity and surface quality.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager