CNC Tool Grinders Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436920 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

CNC Tool Grinders Market Size

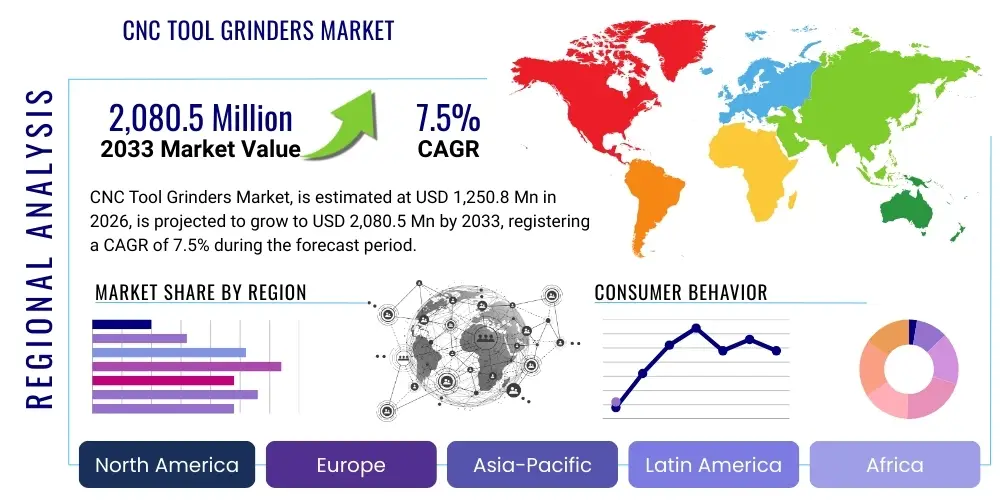

The CNC Tool Grinders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $1,250.8 Million in 2026 and is projected to reach $2,080.5 Million by the end of the forecast period in 2033.

CNC Tool Grinders Market introduction

The CNC Tool Grinders Market encompasses sophisticated machine tools designed for the precise manufacturing, sharpening, and reconditioning of various cutting tools used across industrial applications. These grinders utilize Computer Numerical Control (CNC) systems to automate complex grinding operations, ensuring high precision, repeatability, and consistency, crucial for modern manufacturing standards. Key products include 5-axis, 6-axis, and multi-axis machines capable of handling diverse tool geometries, such as end mills, drills, hobs, and specialized inserts. The core functionality of CNC tool grinders lies in their ability to maintain tight tolerances and superior surface finishes, which directly impacts the performance and lifespan of the cutting tools employed in high-speed machining centers.

Product descriptions typically highlight features like high-speed spindles, linear motor technology, integrated automation (e.g., robotic loaders), and advanced software for simulation and collision avoidance. These systems cater to the stringent demands of industries where machining quality is paramount. Major applications span high-volume production environments, custom tool shops, and re-grinding service centers. The technological evolution in this space focuses on achieving micron-level accuracy and integrating smart monitoring capabilities to optimize grinding processes and reduce operational downtime. The growing adoption of hard materials in aerospace and automotive industries necessitates robust and precise tool preparation, making CNC tool grinders indispensable assets.

The primary benefits of utilizing these advanced grinding systems include significant improvements in productivity, reduced manual intervention, enhanced tool longevity, and the capability to produce intricate, customized tool profiles that older manual systems cannot achieve. Driving factors propelling market growth include the robust expansion of the global manufacturing sector, particularly in emerging economies, the continuous demand for higher performance cutting tools, and the industry's shift towards automation and lights-out manufacturing. Furthermore, the emphasis on tool reconditioning and recycling, driven by sustainability goals and cost reduction initiatives, further stimulates the demand for high-quality CNC tool grinding machinery.

CNC Tool Grinders Market Executive Summary

The global CNC Tool Grinders market is experiencing robust growth driven by accelerating industrial automation and the necessity for precision tooling in advanced manufacturing sectors like aerospace, automotive, and medical devices. Business trends show a strong shift towards highly automated, multi-axis machines (5-axis and 6-axis) capable of handling complex geometries and facilitating unmanned operations. Key market players are concentrating on integrating proprietary software that enhances tool design capabilities, optimizes grinding paths, and incorporates machine learning for predictive maintenance, thereby providing a significant competitive advantage. The focus on reducing cycle times and minimizing material waste is pushing manufacturers to invest in high-efficiency grinding machines equipped with sophisticated cooling and filtration systems.

Regionally, the Asia Pacific (APAC) stands as the largest and fastest-growing market, propelled by rapid industrialization, massive investments in automotive and electronics manufacturing in China, India, and Southeast Asian nations, and the expansion of local tool manufacturing capabilities. North America and Europe, while mature, exhibit sustained demand, particularly for premium, high-automation, and specialized application grinders, driven by stringent quality standards in aerospace and defense sectors. These established regions are focused less on volume expansion and more on technological upgrades and integrating Industry 4.0 principles, including cloud-based monitoring and advanced analytics for operational excellence.

Segment trends indicate that the application segment is dominated by the demand for end mills and drills, although the fastest growth is observed in specialized tools such as hobs and broaches, driven by the gear manufacturing sector. In terms of end-users, the automotive industry remains a core consumer due to continuous production volume and the need for precision engine components, followed closely by the aerospace sector, where demand for advanced composite and hard material machining tools necessitates continuous investment in high-precision grinding solutions. The rise of Electric Vehicles (EVs) also necessitates new tooling geometries for battery and motor component manufacturing, presenting a nascent yet powerful segment driver.

AI Impact Analysis on CNC Tool Grinders Market

User queries regarding AI in the CNC Tool Grinders market frequently center on how Artificial Intelligence can enhance process stability, improve surface finish predictability, and reduce the dependence on highly skilled human operators. Common questions include the feasibility of autonomous tool quality inspection, the role of machine learning in optimizing grinding parameters based on tool wear history, and the integration of AI-powered diagnostics for preventative maintenance. Users are keenly interested in understanding if AI can truly achieve 'first part right' performance by compensating for thermal drift, wheel wear, and material inconsistencies in real-time, thereby minimizing scrap rates and maximizing production efficiency. The collective expectation is that AI will move these machines beyond mere automation toward true cognitive optimization.

AI's influence is transforming CNC tool grinding by shifting the focus from reactive control to proactive intelligence. Machine learning algorithms are being trained on vast datasets encompassing grinding noise, vibration signatures, power consumption, and thermal images. This data analysis enables the system to detect subtle anomalies indicative of wheel loading or excessive wear far sooner than traditional monitoring systems. Consequently, AI allows for dynamic adjustments to feed rates, spindle speeds, and coolant flow during the grinding process, ensuring consistent quality even when faced with minor material or environmental variations, thus significantly tightening tolerance achievable in production environments.

Furthermore, AI facilitates the development of intelligent grinding software capable of automatically generating optimal grinding strategies for novel tool geometries based on stored knowledge of hundreds of previous successful jobs. This capability reduces the required setup time and the expertise level needed for programming complex tools, democratizing high-precision grinding capabilities. In the immediate future, the primary impact will be seen in predictive maintenance schedules, automated process optimization, and enhanced quality control through computer vision systems, leading to lower operating costs and unprecedented levels of operational efficiency across tool manufacturing and re-sharpening facilities globally.

- Real-time Process Optimization: AI algorithms dynamically adjust grinding parameters (speed, feed, angle) to compensate for environmental and mechanical variables, ensuring optimal surface finish and profile accuracy.

- Predictive Maintenance (PdM): Machine learning monitors vibration, temperature, and current signatures to predict component failure (spindle, axis motors), dramatically reducing unplanned downtime.

- Automated Quality Control: Integration of AI-driven computer vision systems for rapid, non-contact inspection of tool geometry and edge integrity against CAD specifications.

- Autonomous Programming: AI assists in generating optimized grinding routines for complex or specialized tools, minimizing setup time and reliance on expert programmers.

- Enhanced Thermal Management: AI models predict and mitigate thermal deformation effects on the machine structure, improving long-term precision and repeatability.

DRO & Impact Forces Of CNC Tool Grinders Market

The CNC Tool Grinders Market dynamics are primarily shaped by four critical forces: continuous technological demands for high-performance cutting tools (Driver); the significant initial capital expenditure required for purchasing advanced machinery (Restraint); the expanding utilization of hard-to-machine materials like ceramics and nickel alloys (Opportunity); and the pervasive influence of global industrial capacity utilization (Impact Force). The persistent drive toward leaner manufacturing and the increasing adoption of multi-axis machining centers necessitate cutting tools with complex geometries and tighter tolerances, fueling demand for sophisticated grinding solutions. Conversely, the high cost of acquiring and maintaining these precision machines, coupled with the necessity for specialized training, poses a significant barrier, particularly for small to medium-sized enterprises (SMEs).

Key drivers include the global resurgence in automotive production and the sustained growth in aerospace manufacturing, both requiring large volumes of custom tools made from advanced materials. The movement towards re-shoring manufacturing activities in North America and Europe also stimulates investment in state-of-the-art grinding technology to maintain competitive costs. Furthermore, the market benefits from the sustained trend of tool reconditioning, where precision grinders extend the life cycle of expensive cutting tools, offering significant cost savings over replacement. This focus on lifecycle management supports both new machine sales (for advanced grinding processes) and service contracts.

Restraints are dominated by economic volatility, which can delay major capital equipment investments, and the global shortage of highly skilled CNC operators and programmers capable of maximizing the potential of multi-axis grinders. Opportunities are plentiful, rooted in the rapid expansion of additive manufacturing (AM), which requires specialized post-processing and finishing tools, and the medical device sector's need for micro-tooling with exceptionally high precision. The most significant impact force remains the global push for Industry 4.0 integration, compelling manufacturers to upgrade legacy equipment with connectivity features, real-time monitoring, and automation capabilities to ensure seamless integration into digital factory ecosystems, fundamentally reshaping purchasing criteria and market competition.

Segmentation Analysis

The CNC Tool Grinders Market is broadly segmented based on machine type, application, and end-user industry, reflecting the diverse requirements of the global manufacturing landscape. Segmentation provides critical insights into purchasing trends, regional dominance, and technological preferences. The core of the market is defined by the capabilities of the machine, where multi-axis configuration is the leading differentiator, determining the complexity of tool geometries that can be accurately produced. The segmentation by application highlights the specific cutting tool markets that drive demand, with standard tools like end mills representing the volume base, while specialized tools such as hobs command premium pricing due to complexity.

Analysis of the machine type segment reveals a continuous migration from 5-axis standard machines towards 6-axis and multi-axis configurations, particularly in high-precision industries like die-mold and turbine component manufacturing. This shift is predicated on the need to grind complex features, such as relief angles and chip breakers, in a single setup, optimizing efficiency. The end-user segmentation clearly indicates the automotive and aerospace industries as the primary consumers, although the rapid expansion of the medical sector, fueled by demand for orthopedic implants and surgical instruments, is creating a high-growth niche for micro-grinding solutions requiring sub-micron accuracy.

- By Type:

- 5-Axis CNC Tool Grinders

- 6-Axis CNC Tool Grinders

- Multi-Axis (7-axis and above) CNC Tool Grinders

- By Application:

- End Mills and Ball Nose Cutters

- Drills and Taps

- Hobs and Broaches (Gear Tools)

- Inserts and Blades

- Other Specialized Tools

- By End-User Industry:

- Automotive

- Aerospace and Defense

- Medical Devices

- Electronics and Semiconductors

- General Manufacturing and Tool Shops

Value Chain Analysis For CNC Tool Grinders Market

The value chain for the CNC Tool Grinders Market begins with upstream activities involving raw material suppliers and core component manufacturers, including providers of high-precision castings, linear guides, ball screws, high-speed spindles, and advanced CNC control units (e.g., Siemens, Fanuc, Heidenhain). Precision in the upstream segment is paramount, as the final machine’s accuracy is fundamentally dependent on the quality and thermal stability of these foundational components. Strong relationships between grinder manufacturers and core technology providers ensure the timely integration of innovations such as direct-drive motors and high-resolution measurement systems, maintaining the competitiveness of the final product.

The manufacturing stage involves the assembly, integration, and meticulous testing of the grinding machines. This phase is highly capital and labor-intensive, requiring specialized expertise in machine kinematics and control system tuning. Manufacturers differentiate themselves through proprietary software (CIM systems) for tool design and simulation, thermal stabilization techniques, and the integration of automated loading and unloading systems (robotics). Downstream analysis focuses on distribution channels, which typically rely on a mix of direct sales forces for large, strategic accounts (like major automotive OEMs) and a network of specialized technical distributors or agents who provide local sales support, installation, and essential aftermarket service and application engineering support to SMEs.

Direct distribution channels allow manufacturers greater control over branding and service quality, particularly for high-end, customized machines. Indirect distribution, leveraging local agents, is crucial for market penetration in geographically diverse regions like APAC, where localized technical support and cultural understanding are essential for sales success. Post-sales services, including software updates, re-calibration, and application training, form a significant part of the value proposition, ensuring customer satisfaction and generating recurring revenue streams, thereby completing the value chain loop.

CNC Tool Grinders Market Potential Customers

Potential customers (End-Users/Buyers) for CNC Tool Grinders are predominantly found within industrial sectors requiring high volumes of precision cutting tools for subtractive manufacturing processes. These end-users range from multinational corporations operating captive tool manufacturing departments to independent, specialized cutting tool service providers and re-sharpening workshops. The common denominator among all potential customers is the stringent requirement for achieving tight geometrical tolerances, superior surface finishes, and repeatable output, which only advanced CNC grinding technology can reliably deliver.

The largest volume of demand originates from the automotive powertrain and chassis component manufacturers, who require constant supplies of precision tools for milling, boring, and gear cutting operations. The second major group comprises aerospace and defense contractors and their tier suppliers. These entities demand highly specialized tools, often fabricated from difficult-to-machine superalloys (e.g., Inconel, Titanium), necessitating high-rigidity grinders equipped with advanced thermal compensation features. The complexity and high cost of these tools mandate comprehensive reconditioning services, further driving machine purchases.

Emerging key customer segments include medical device manufacturers focusing on intricate surgical tools and implants, where micro-tooling and biocompatible material processing are critical, driving demand for ultra-precision machines. Additionally, large-scale general manufacturing and contract machining shops consistently seek versatile, automated 5-axis grinders that can handle a wide variety of tools efficiently, balancing flexibility with high throughput. Investing in in-house grinding capabilities allows these customers to reduce lead times, control costs, and maintain proprietary tool designs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1,250.8 Million |

| Market Forecast in 2033 | $2,080.5 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ANCA, Rollomatic, Walter Maschinenbau GmbH (UNITED GRINDING Group), Saacke, Schneeberger, EWAG (UNITED GRINDING Group), Star Cutter Company, Vollmer, Makino, DMG MORI, Schütte, Tormach, Kellenberger (Hardinge Group), JTEKT, Gleason Corporation, Haas Automation, Okuma Corporation, Fives Group, Zayer, Tornos. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

CNC Tool Grinders Market Key Technology Landscape

The technological landscape of the CNC Tool Grinders market is characterized by a relentless pursuit of higher precision, faster cycle times, and greater automation, all underpinned by advancements in control systems and machine design. One of the paramount technologies is the integration of linear motor drives, which offer superior acceleration, speed, and accuracy compared to traditional ball screw systems. Linear motors eliminate backlash and reduce mechanical wear, making them ideal for ultra-precise grinding operations required for micro-tooling and specialized inserts. Concurrently, advanced direct-drive rotary axes improve rigidity and allow for simultaneous 5- or 6-axis interpolation with exceptional smoothness and thermal stability, crucial for complex helix and relief angle grinding.

Another fundamental technology involves high-frequency, liquid-cooled spindle systems, which provide the rotational speed and power necessary to efficiently grind challenging materials, such as tungsten carbide and advanced ceramics, while minimizing thermal expansion effects that compromise accuracy. Alongside hardware advancements, proprietary software and simulation tools (Computer-Aulated Manufacturing, or CAM, specifically tailored for tool grinding) are crucial differentiators. These software packages enable highly accurate 3D modeling of the tool before grinding, allowing operators to simulate material removal, check for collisions, and optimize wheel paths, drastically reducing setup time and the risk of costly errors during physical production.

Furthermore, the incorporation of on-machine measurement systems, such as non-contact laser measurement probes and integrated acoustic emission sensors, is becoming standard. These systems allow for in-process gauging and automatic compensation for wheel wear and tool runout, ensuring consistent quality without manual intervention. The broader trend of connectivity (IoT and Industry 4.0 standards) involves integrating these machines with centralized manufacturing execution systems (MES) for real-time performance monitoring, data logging, and remote diagnostics. This connectivity enables lights-out manufacturing and facilitates predictive maintenance strategies, maximizing machine utilization and aligning the market with digital factory standards globally.

Regional Highlights

Regional dynamics heavily influence the demand and technological adoption rates within the CNC Tool Grinders Market, reflecting varying levels of industrial maturity and manufacturing focus across key global economic centers.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market, primarily fueled by China, India, and South Korea. This region’s growth is driven by massive domestic automotive production, the burgeoning electronics and semiconductor industry, and significant government investments in upgrading manufacturing infrastructure. APAC manufacturers often prioritize cost-effectiveness alongside increasing precision, leading to high volume demand for 5-axis standard machines and strong growth in the reconditioning service sector. The competitive landscape here often includes both global market leaders and robust local manufacturers.

- North America: Characterized by a high demand for advanced, multi-axis (6-axis and above) systems, the North American market is driven by the stringent requirements of the aerospace, defense, and medical device sectors. Precision and automation are prioritized over sheer volume. Investments in CNC tool grinders here are often tied to initiatives aimed at reducing reliance on overseas tooling suppliers and enhancing domestic manufacturing capabilities, demanding machines with sophisticated software for complex material processing and integration into networked digital factories.

- Europe: Europe is a mature but highly innovative market, historically leading in CNC grinding technology, particularly Germany and Switzerland. The region focuses heavily on R&D, demanding machines capable of processing next-generation materials and supporting highly specialized applications (e.g., watchmaking, advanced die/mold). Environmental regulations and sustainability goals also drive demand for high-efficiency machines and those optimized for tool reconditioning and recycling, positioning quality, reliability, and precision as key purchasing criteria.

- Latin America (LATAM): The market in LATAM, concentrated largely in Brazil and Mexico, is closely tied to automotive manufacturing and resource extraction industries. Demand is typically for mid-range, reliable 5-axis grinders for standardized tool production and maintenance. Market growth is sensitive to global economic shifts and foreign direct investment into manufacturing facilities.

- Middle East and Africa (MEA): MEA remains a nascent market, with demand driven primarily by investments in oil & gas equipment manufacturing (requiring specialized threading and drilling tools) and emerging diversification efforts in the UAE and Saudi Arabia. Infrastructure and defense spending are also contributing factors, resulting in intermittent, high-value purchases of specialized, heavy-duty grinding equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the CNC Tool Grinders Market.- ANCA

- Rollomatic

- Walter Maschinenbau GmbH (UNITED GRINDING Group)

- Saacke

- Schneeberger

- EWAG (UNITED GRINDING Group)

- Star Cutter Company

- Vollmer

- Makino

- DMG MORI

- Schütte

- Tormach

- Kellenberger (Hardinge Group)

- JTEKT

- Gleason Corporation

- Haas Automation

- Okuma Corporation

- Fives Group

- Zayer

- Tornos

Frequently Asked Questions

Analyze common user questions about the CNC Tool Grinders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for 6-axis CNC tool grinders?

The primary driver is the increasing complexity of cutting tool geometries, particularly those required for multi-flute end mills, specialized dental tools, and turbine blade components. Six-axis capability allows for grinding these complex profiles and primary/secondary relief angles in a single clamping setup, maximizing throughput and geometric accuracy.

How does the shift towards Electric Vehicles (EVs) impact the CNC Tool Grinders market?

The EV transition necessitates new tooling for machining battery casings, motor stators, and lightweight structural components made from specialized aluminum alloys. This requires a demand shift towards precision tools for high-speed machining and specialized gear hobs, maintaining market stability but altering the profile of required tooling.

What are the typical operating costs associated with high-precision CNC tool grinding machines?

Operating costs are primarily driven by consumables, including grinding wheels, specialized coolants, and filtration systems. High-precision operation also requires substantial investment in routine maintenance, software licensing, and skilled operator salaries, which typically account for a larger share of the total cost of ownership than simple energy consumption.

Which application segment currently holds the largest market share in CNC tool grinding?

The End Mills and Ball Nose Cutters segment holds the largest market share due to their universal use across various manufacturing sectors, including general engineering, mold making, and die casting. High-volume demand and the need for frequent re-sharpening stabilize this segment’s leading position.

What role does Industry 4.0 play in the evolution of CNC tool grinders?

Industry 4.0 is crucial, enabling the integration of grinders into smart factory ecosystems through connectivity, IoT sensors, and cloud monitoring. This facilitates real-time performance analytics, remote diagnostics, and automated data exchange with MES/ERP systems, optimizing production scheduling and reducing human intervention.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager