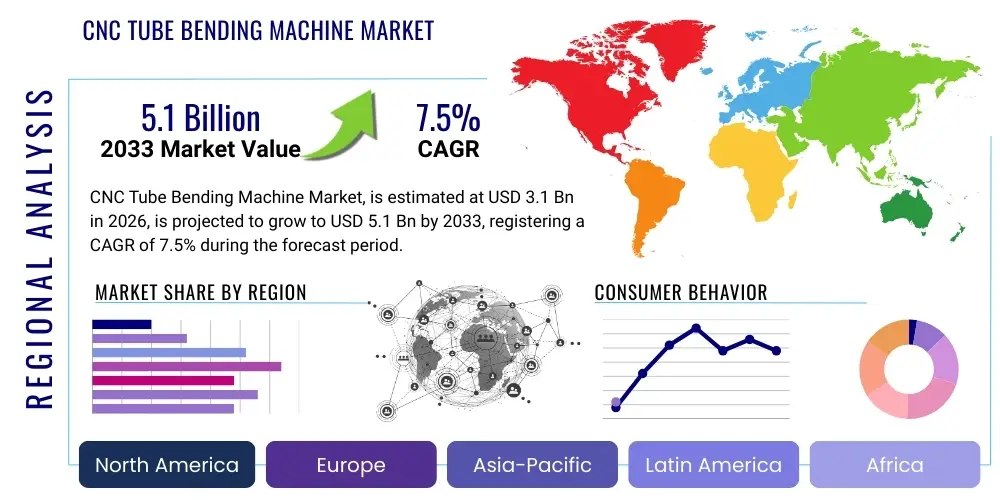

CNC Tube Bending Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438974 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

CNC Tube Bending Machine Market Size

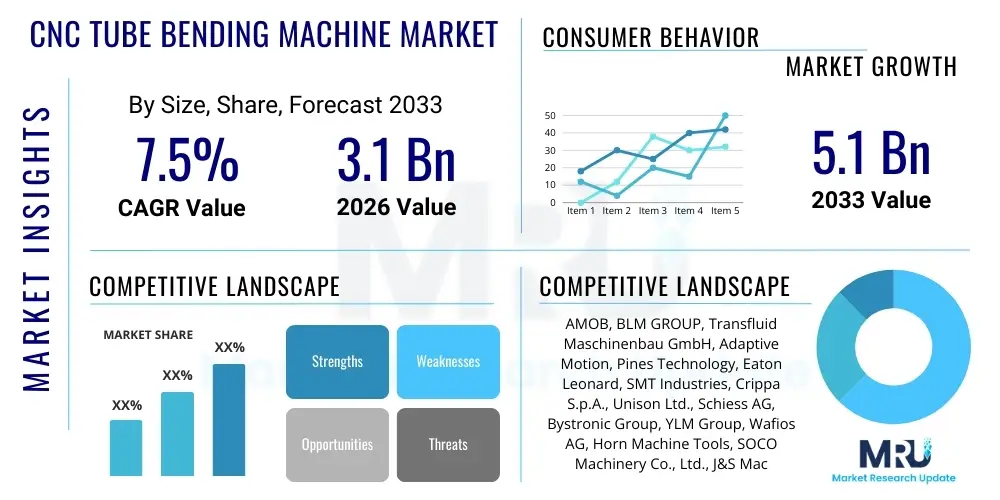

The CNC Tube Bending Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 3.1 Billion in 2026 and is projected to reach USD 5.1 Billion by the end of the forecast period in 2033.

CNC Tube Bending Machine Market introduction

The CNC Tube Bending Machine Market encompasses specialized equipment designed for the precise and automated shaping of metallic tubes and pipes used across various industrial sectors. These computer numerically controlled systems offer superior accuracy, repeatability, and speed compared to traditional hydraulic or manual bending methods, making them indispensable in modern manufacturing environments requiring complex geometries and high throughput. The core function of these machines involves feeding tubes, clamping them securely, and then utilizing rotary draw bending, compression bending, or roll bending techniques, all managed through sophisticated software interfaces that minimize material waste and setup time.

The primary product categories within this market include all-electric (servo-driven), hybrid, and hydraulic CNC bending machines, differentiated primarily by their power source, energy efficiency, and operational speed. Major applications span high-precision industries such as automotive manufacturing, particularly in exhaust systems and chassis components; aerospace and defense, where stringent quality standards demand perfect tube bends for fluid lines; and HVAC and construction, utilizing bent tubing for infrastructure and climate control systems. The ongoing global emphasis on lightweighting materials, especially in electric vehicle production, necessitates advanced bending technologies capable of handling stainless steel, aluminum alloys, and high-strength low-alloy (HSLA) steels with exceptional precision.

Key benefits driving the adoption of CNC tube bending machines include enhanced dimensional accuracy, significantly reduced cycle times, and the ability to store and recall complex bending programs, facilitating mass customization and flexible production runs. Furthermore, these automated systems minimize reliance on highly skilled manual labor, thereby reducing operational variability and improving overall process efficiency. Driving factors contributing to market expansion include the sustained growth in automotive production, increasing defense spending globally leading to higher demand for specialized components, and the integration of advanced automation features such as robotic loading and unloading, transforming bending operations into fully integrated manufacturing cells.

CNC Tube Bending Machine Market Executive Summary

The CNC Tube Bending Machine Market is poised for substantial growth, driven primarily by accelerating industrial automation trends, the proliferation of electric vehicle manufacturing, and the stringent quality demands of the aerospace sector. Business trends indicate a clear shift towards all-electric and hybrid machine architectures, which offer enhanced energy efficiency, lower maintenance requirements, and superior control over bending parameters, crucial for handling complex and thin-walled materials. Manufacturers are increasingly focusing on integrating smart features, including IoT connectivity and predictive maintenance modules, to improve machine uptime and optimize production planning for end-users. The market competitive landscape is characterized by intense technological innovation, with key players focusing on developing multi-stack bending heads and non-contact measuring systems to further improve operational precision.

Regionally, the Asia Pacific (APAC) market dominates the consumption landscape, primarily fueled by the massive automotive and rapidly expanding industrial machinery production base in China, India, and Southeast Asian nations. However, North America and Europe remain crucial hubs for technological advancement and demand for high-end, fully automated systems, particularly within the aerospace and medical device sectors where regulatory requirements for component traceability are extremely high. The demand in Latin America and the Middle East & Africa (MEA) is progressively increasing, spurred by infrastructure development projects and diversification away from traditional industries, creating opportunities for mid-range, versatile bending solutions.

Segment-wise, rotary draw bending remains the most prevalent technology due to its versatility and precision in producing tight radii bends, while end-users in the automotive and aerospace segments are the largest contributors to market revenue. There is a noticeable trend favoring larger diameter tube bending machines, reflecting increased demand from oil & gas, shipbuilding, and construction industries. Furthermore, the rising adoption of specialized software for simulation and collision avoidance is transforming the operational segment, enabling rapid prototyping and error reduction before physical production begins, thereby enhancing the overall efficiency and attractiveness of high-end CNC bending solutions across all major industry verticals.

AI Impact Analysis on CNC Tube Bending Machine Market

User inquiries regarding AI's influence on the CNC Tube Bending Machine Market frequently center on three critical areas: achieving zero-defect production, optimizing complex bending sequences for specialized alloys, and minimizing machine downtime through predictive analytics. Users express high expectations regarding AI's capability to compensate for material spring-back variations in real-time, a historically challenging factor in achieving precise bends, particularly with high-strength materials. There is significant interest in how AI-driven algorithms can automatically adjust machine settings based on sensor feedback and historical data, leading to adaptive manufacturing processes that reduce scrap rates and reliance on trial-and-error adjustments. Furthermore, concerns often revolve around the security and integration cost of implementing AI-powered industrial software alongside existing legacy CNC infrastructure.

The core theme summarizing user expectations is the transition from static, pre-programmed operations to dynamic, self-optimizing bending processes. AI is anticipated to revolutionize quality control by automating visual inspection using computer vision models, immediately identifying surface defects or deviations from tolerance. In terms of operational efficiency, machine learning (ML) models are being utilized to analyze massive datasets related to machine parameters, material properties, and environmental conditions (such as temperature fluctuations) to predict component wear, scheduling maintenance precisely before a failure occurs. This proactive approach significantly enhances overall equipment effectiveness (OEE) and ensures uninterrupted production flows, a major performance metric for high-volume manufacturers.

Ultimately, the impact of AI extends beyond simple optimization into strategic manufacturing decisions. AI algorithms can simulate millions of bending scenarios based on CAD models, determining the optimal tooling configuration, clamping pressures, and feed rates necessary to achieve the desired output, minimizing physical testing. This capability drastically accelerates the product development cycle for new parts, providing a significant competitive advantage to manufacturers adopting this technology. The integration of AI tools is transforming CNC bending from a deterministic operation into an intelligent, adaptive process capable of handling greater complexity and variability inherent in advanced materials and demanding design specifications.

- Real-time compensation for material spring-back variations using predictive ML models.

- Enhanced preventive maintenance scheduling through anomaly detection in spindle vibrations and power consumption.

- Automated visual inspection and quality control (QC) using computer vision to detect surface imperfections and geometric deviations.

- Optimization of tool paths and sequencing for complex, multi-bend components, reducing cycle time.

- Accelerated new product introduction (NPI) through AI-driven bending simulation and collision avoidance.

- Energy consumption optimization by learning ideal operational parameters based on material load and ambient temperature.

- Facilitation of digital twin creation for virtual machine commissioning and operator training.

DRO & Impact Forces Of CNC Tube Bending Machine Market

The dynamics of the CNC Tube Bending Machine Market are shaped by a complex interplay of internal and external forces, summarized by Drivers, Restraints, and Opportunities (DRO). A primary Driver is the increasing global demand for automation across manufacturing sectors, driven by the need for enhanced efficiency, precision, and reduced labor costs. The rapid expansion of industries such as automotive (especially electric vehicles requiring complex cooling lines and structural components) and aerospace mandates highly accurate, repeatable bending processes that only CNC technology can reliably provide. Concurrently, the rising adoption of high-strength, lightweight materials requires sophisticated machines capable of precise manipulation, further fueling market growth. However, this growth is partially Restrained by the high initial capital investment required for advanced, all-electric CNC bending machines, which can be prohibitive for small and medium-sized enterprises (SMEs). Furthermore, the operational complexity of these advanced systems necessitates specialized training for personnel, creating a potential skills gap in rapidly developing markets.

Opportunities for market expansion are significant, primarily stemming from the increasing integration of industry 4.0 concepts, including IoT, cloud computing, and advanced data analytics, allowing for remote monitoring, diagnostics, and optimized production scheduling. The growing trend of customization and small-batch production across various industries presents a strong opportunity for flexible, quick-changeover CNC bending solutions. Additionally, the replacement cycle of older, hydraulic-based machines with newer, energy-efficient all-electric models provides a continuous revenue stream for manufacturers. Impact forces, which modulate market growth, include stringent safety and environmental regulations (pushing manufacturers toward energy-efficient electric systems) and global supply chain volatility affecting the procurement of specialized components like servo motors and control systems, potentially influencing production costs and delivery timelines.

The impact of rapid technological advancements cannot be overstated; the continuous development of multi-radius bending capabilities and non-contact measuring systems (e.g., laser scanners) directly addresses market demands for zero-defect output and versatility. While economic downturns or geopolitical tensions can temporarily Restrain large capital expenditures on machinery, the long-term strategic necessity of automation to maintain global competitiveness ensures that the fundamental Driver for CNC bending technology remains robust. The overall market trajectory is highly positive, driven by technological evolution and sustained industrial requirements for precision metal fabrication, positioning the pursuit of high-efficiency, automated bending cells as a central focus for both machine vendors and end-users.

- Drivers: Growing adoption of lightweighting materials (aluminum, high-strength steels) in automotive and aerospace; increasing demand for automation and high precision manufacturing; rapid growth of the electric vehicle (EV) sector.

- Restraints: High initial capital expenditure and complexity of all-electric CNC systems; volatility in raw material costs for machine manufacturing; requirement for highly skilled technical labor for operation and maintenance.

- Opportunities: Integration with Industry 4.0 technologies (IoT, AI, digital twins); significant untapped potential in emerging markets (MEA, Latin America); replacement demand for outdated hydraulic machinery with energy-efficient electric models.

- Impact Forces: Strict safety and environmental regulations globally; advancements in sensor technology and control systems; fluctuating global economic conditions affecting capital expenditure cycles.

Segmentation Analysis

The CNC Tube Bending Machine Market is comprehensively segmented based on machine type, bending technology, tube diameter, and end-user application, enabling a granular understanding of market dynamics and targeted deployment strategies. The machine type segmentation distinguishes between hydraulic, electric (all-electric/servo), and hybrid systems, with the electric segment demonstrating the highest growth due to superior precision, energy efficiency, and reduced noise levels, aligning perfectly with modern sustainable manufacturing goals. Bending technology is primarily categorized into rotary draw bending (most versatile and popular for tight radii), roll bending (used for large radii and long tubes), and compression bending (suitable for less critical, high-volume bends). Each technology segment caters to specific requirements related to material thickness, tube diameter, and the required geometric accuracy of the final component.

Analysis by tube diameter reveals significant demand for small to medium diameter machines (under 50mm) driven overwhelmingly by the automotive, HVAC, and medical sectors, which require complex manipulation of smaller tubing for fluid transfer and heat exchange systems. Conversely, large diameter machines (over 100mm) find their niche applications primarily in heavy industries such as shipbuilding, oil & gas pipeline construction, and structural engineering, where robustness and high torque are essential. The end-user analysis provides the most critical insight, highlighting the automotive industry as the dominant consumer due to its continuous requirement for exhaust components, structural elements, and increasingly complex battery cooling lines in EVs. The aerospace and defense sector, while smaller in volume, demands the highest level of precision and material handling capability, driving the adoption of premium, multi-stack bending machines.

These segmentations collectively define the market landscape, indicating that future growth will be concentrated in segments that prioritize efficiency and intelligence. The trend toward customized production runs and intricate designs necessitates machines capable of seamless transitions between different bending parameters and materials. This continuous evolution pushes manufacturers to focus on highly versatile, software-driven electric machines, ensuring that market offerings remain aligned with the sophisticated demands arising from high-growth sectors adopting advanced engineering materials and complex geometric specifications.

- By Type:

- Hydraulic CNC Tube Benders

- All-Electric (Servo) CNC Tube Benders

- Hybrid CNC Tube Benders

- By Bending Technology:

- Rotary Draw Bending

- Roll Bending

- Compression Bending

- By Tube Diameter:

- Small Diameter (Under 50 mm)

- Medium Diameter (50 mm - 100 mm)

- Large Diameter (Above 100 mm)

- By End-User Application:

- Automotive (Exhaust, Chassis, Fluid Lines, EV Cooling)

- Aerospace & Defense

- HVAC & Refrigeration

- Oil & Gas and Shipbuilding

- Furniture & Architectural

- Industrial Machinery & Others

Value Chain Analysis For CNC Tube Bending Machine Market

The value chain for the CNC Tube Bending Machine Market initiates with the upstream analysis, focusing on the procurement of critical raw materials and specialized components. Key upstream activities involve securing high-grade steel, cast iron, and aluminum for the machine frame and tooling, alongside acquiring sophisticated electronic components such as high-performance servo motors, precision gearboxes, advanced sensors, and CNC controllers (often supplied by specialized firms like Siemens, Fanuc, or Mitsubishi). The quality and availability of these components directly impact the machine's precision, durability, and cost. Manufacturers must maintain robust relationships with component suppliers to mitigate risks associated with supply chain disruptions, especially concerning specialized high-tolerance bearings and hydraulic components (in the case of hybrid systems).

The core segment of the value chain is the Original Equipment Manufacturers (OEMs) who design, assemble, and test the CNC bending machines. This stage involves extensive R&D investment focused on developing proprietary software for bending simulation, collision detection, and automated setup routines (AEO/GEO optimization often applies to machine software interfaces). OEMs manage complex processes ranging from precision machining of critical parts (mandrels, die sets) to the final integration of electrical and software systems. The distribution channel analysis highlights a dual approach: Direct sales are common for large, customized, or highly complex systems sold to Tier 1 manufacturers in aerospace and automotive, allowing for specialized consultation and after-sales service. Indirect distribution utilizes regional distributors, sales agents, and value-added resellers (VARs) to penetrate SME markets and offer localized support and service, particularly in geographically diverse regions like APAC.

Downstream analysis centers on the utilization, service, and maintenance provided to the end-users. After-sales support, including training, spare parts availability, remote diagnostics, and software updates, constitutes a significant value addition and revenue stream for OEMs. The efficiency of this downstream network is crucial for maintaining customer satisfaction and minimizing machine downtime. The seamless interaction between machine output and subsequent manufacturing steps (e.g., robotic welding cells) emphasizes the need for connectivity standards and compatibility, driving continuous collaboration between bending machine manufacturers and automation providers.

CNC Tube Bending Machine Market Potential Customers

The primary potential customers and end-users of CNC tube bending machines are major fabrication and manufacturing entities requiring precise, repeatable bending of metallic tubing across various dimensions and materials. The automotive industry represents the largest buyer segment, utilizing these machines extensively for high-volume production of exhaust systems, catalytic converters, chassis components, and specialized fluid lines, particularly for modern vehicles emphasizing intricate and robust designs. The rapidly growing electric vehicle (EV) sector requires specialized bending for battery cooling structures and lightweight frame components, driving demand for all-electric, high-precision machines capable of handling exotic alloys.

Another major segment is the aerospace and defense sector, characterized by extremely strict quality control standards and the use of high-performance materials like titanium and specialized aluminum alloys. These customers demand advanced rotary draw bending machines with multi-stack capabilities and integrated non-contact measuring systems to ensure zero-defect components critical for hydraulic lines, engine supports, and structural integrity. Furthermore, infrastructure-related industries, including HVAC (heating, ventilation, and air conditioning), construction, and power generation, consistently invest in these machines for producing coils, heat exchangers, and structural piping, often favoring large diameter or roll bending capabilities for extensive tubing lengths.

The market also includes smaller, specialized fabrication shops and metal service centers that cater to custom orders and prototyping services for industries ranging from medical devices (requiring extremely small, precise bends for surgical tools) to furniture manufacturing (seeking aesthetic and structural component fabrication). These potential customers often prioritize machine versatility, rapid changeover times, and user-friendly control interfaces to handle a diverse array of small-to-medium batch jobs. Investment cycles in these sectors are heavily influenced by local economic growth and capital availability, making flexibility and competitive pricing key purchasing criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 5.1 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AMOB, BLM GROUP, Transfluid Maschinenbau GmbH, Adaptive Motion, Pines Technology, Eaton Leonard, SMT Industries, Crippa S.p.A., Unison Ltd., Schiess AG, Bystronic Group, YLM Group, Wafios AG, Horn Machine Tools, SOCO Machinery Co., Ltd., J&S Machine, Chiyoda Kogyo Co., Ltd., Baileigh Industrial, TRACTO-TECHNIK GmbH, Ercolina S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

CNC Tube Bending Machine Market Key Technology Landscape

The key technology landscape of the CNC Tube Bending Machine Market is rapidly evolving, moving away from purely hydraulic power systems toward sophisticated servo-electric actuation, which forms the basis of all-electric and hybrid machines. All-electric bending machines are gaining prominence due to their exceptional energy efficiency, lower operational noise, and superior control over multiple axes simultaneously, achieving accuracies down to fractions of a degree. These systems utilize advanced digital servo motors for controlling the feeding, rotating, and bending axes, allowing for immediate compensation for material inconsistencies like varying wall thickness or yield strength. This high level of control is crucial for bending challenging materials such as stainless steel and titanium used in critical applications like aircraft fuel lines and medical implants.

Another major technological advancement is the integration of advanced software features and measuring systems. Modern CNC benders utilize sophisticated Computer-Aided Manufacturing (CAM) software for simulating the entire bending process, including collision detection, which is vital when creating complex 3D tubular structures. Furthermore, non-contact measuring systems, primarily using laser scanning technology, are integrated directly into the work cell. These scanners rapidly measure the bent tube after fabrication, compare it against the CAD model, and automatically generate necessary corrections (feedback loop) to the bending program to eliminate the next piece of scrap. This Sell-Check-Adjust process drastically reduces setup time and enhances first-piece yield, aligning perfectly with lean manufacturing principles and high-mix, low-volume production strategies.

The rise of machine connectivity and automation solutions defines the cutting edge of the market. CNC bending machines are increasingly incorporated into fully automated cells using articulated robots for tube loading, handling, and transferring components to subsequent processes (e.g., welding or end-forming). This integration facilitates seamless lights-out manufacturing. Furthermore, the adoption of proprietary Human-Machine Interfaces (HMIs) designed for intuitive operation, along with cloud-based monitoring platforms, allows operators and managers to remotely track machine performance, diagnose issues, and schedule maintenance proactively. The convergence of precise mechanical engineering, powerful digital controls, and smart factory integration is defining the competitive advantage in the CNC tube bending machinery sector.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for CNC Tube Bending Machines, predominantly driven by the immense scale of manufacturing in China, which serves as a global hub for automotive, construction, and electronics manufacturing. The region benefits from lower manufacturing costs and substantial government investments in infrastructure and industrial modernization. South Korea, Japan, and India are also significant markets, with Japan focusing on high-precision, highly automated machinery for export and high-tech domestic industries, while India's burgeoning automotive and industrial sectors demand versatile, mid-range bending solutions. The focus in APAC is on high volume, efficiency, and increasing adoption of automation to counteract rising local labor costs.

- North America: North America is characterized by high demand for advanced, high-precision bending equipment, particularly from the aerospace, defense, and oil & gas sectors. The stringent quality requirements in these industries necessitate the use of premium, all-electric CNC machines with integrated quality control features. The rapid expansion of the Electric Vehicle (EV) manufacturing ecosystem across the US and Canada is a major driver, demanding specialized bending processes for complex thermal management and structural components. Furthermore, the region shows a strong propensity for adopting Industry 4.0 solutions, integrating AI and IoT connectivity for optimized factory performance and traceability.

- Europe: Europe holds a mature and technologically sophisticated market, with Germany, Italy, and France leading in both production (OEMs) and consumption of high-end CNC bending technology. This region emphasizes precision, energy efficiency, and compliance with strict environmental regulations, favoring the adoption of advanced hybrid and all-electric systems. The market is supported by strong automotive supply chains (Tier 1 and 2 suppliers), specialized machinery manufacturing, and a robust medical device industry. European users prioritize flexibility and rapid prototyping capabilities to serve diverse, small-batch, high-value contracts.

- Latin America: The market in Latin America, particularly Brazil and Mexico, is experiencing steady growth, largely tied to automotive production (serving local and export markets) and expanding industrial infrastructure. Demand here tends to favor cost-effective, reliable hydraulic and hybrid machines, though there is a gradual shift towards higher-efficiency electric models driven by multinational corporations establishing manufacturing bases. Economic stability remains a crucial factor influencing capital expenditure decisions in this region, often resulting in phased automation strategies.

- Middle East and Africa (MEA): The MEA market is largely driven by large-scale infrastructure projects, expansion in the oil & gas sector (requiring large-diameter pipe bending), and diversification efforts in countries like Saudi Arabia and the UAE. Demand is project-based and highly specialized, focusing on heavy-duty, robust machinery for handling complex pipeline geometries and construction materials. While smaller in overall size, the region offers high growth potential due to ongoing national industrialization programs and military procurement contracts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the CNC Tube Bending Machine Market.- AMOB (Adelino Monteiro & Brito, S.A.)

- BLM GROUP

- Transfluid Maschinenbau GmbH

- Adaptive Motion

- Pines Technology

- Eaton Leonard

- SMT Industries

- Crippa S.p.A.

- Unison Ltd.

- Schiess AG

- Bystronic Group

- YLM Group

- Wafios AG

- Horn Machine Tools

- SOCO Machinery Co., Ltd.

- J&S Machine

- Chiyoda Kogyo Co., Ltd.

- Baileigh Industrial

- TRACTO-TECHNIK GmbH

- Ercolina S.p.A.

Frequently Asked Questions

Analyze common user questions about the CNC Tube Bending Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of all-electric CNC tube bending machines?

The primary driver for the adoption of all-electric (servo-driven) CNC tube bending machines is the need for superior bending precision, high repeatability, and enhanced energy efficiency compared to traditional hydraulic models. These machines offer better control over spring-back compensation and are essential for handling high-strength, lightweight materials utilized extensively in the electric vehicle (EV) and aerospace industries, meeting stringent quality requirements while reducing operational costs and environmental impact.

How does AI technology specifically improve the performance of CNC bending processes?

AI technology enhances CNC bending performance primarily through real-time process optimization and predictive quality control. Machine learning algorithms analyze sensor data to predict and compensate for material inconsistencies (like spring-back) instantly, minimizing scrap rates. Furthermore, AI enables predictive maintenance, accurately forecasting component failure, thereby maximizing machine uptime and overall equipment effectiveness (OEE) through proactive scheduling.

Which end-user segment dominates the CNC Tube Bending Machine Market globally?

The automotive industry currently dominates the global CNC Tube Bending Machine Market in terms of volume and revenue share. This segment utilizes bending machines extensively for manufacturing exhaust systems, fuel lines, chassis components, and specialized fluid management systems necessary for both conventional and electric vehicles. The ongoing transition to electric mobility is fueling continuous demand for high-precision bending solutions.

What are the main constraints impacting the growth of the high-end CNC bending machine market?

The main constraints impacting the high-end market growth include the substantial initial capital investment required for purchasing sophisticated all-electric and hybrid CNC systems. Additionally, the complexity of these machines necessitates highly skilled labor for programming, operation, and maintenance, creating a potential skills gap challenge, especially in developing industrial economies, which can deter adoption by smaller fabrication shops.

What distinguishes rotary draw bending from roll bending technology in CNC machines?

Rotary draw bending is primarily used for achieving tight radius bends and complex geometries with high accuracy, making it ideal for industries like aerospace and automotive where high precision is critical. Conversely, roll bending (or three-roll bending) is typically employed for producing large radius curves or coils over long tube lengths, commonly utilized in heavy industries such as shipbuilding, construction, and oil & gas pipeline fabrication, focusing more on volume and structure than extremely tight radii.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager