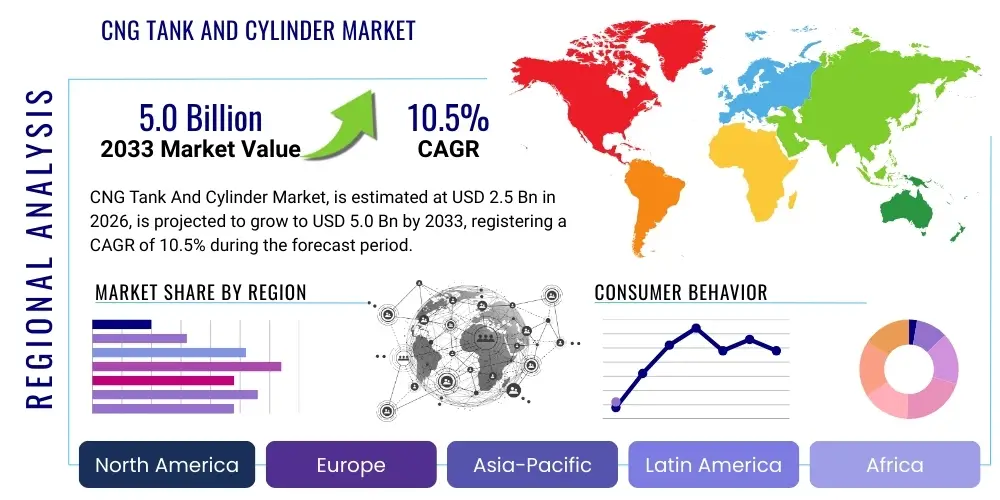

CNG Tank And Cylinder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438370 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

CNG Tank And Cylinder Market Size

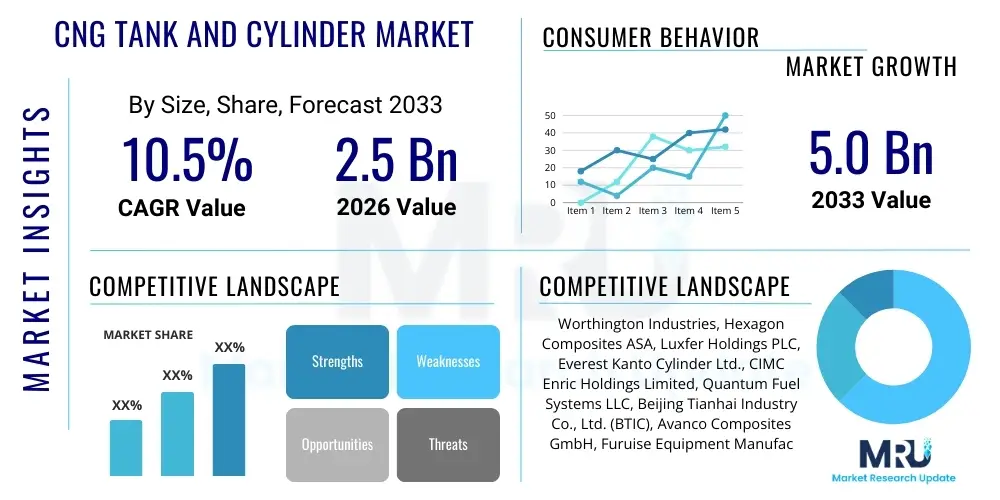

The CNG Tank And Cylinder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 5.0 Billion by the end of the forecast period in 2033.

CNG Tank And Cylinder Market introduction

The CNG Tank and Cylinder Market encompasses the manufacturing, distribution, and utilization of high-pressure storage vessels specifically designed for holding Compressed Natural Gas (CNG). These tanks are critical components in natural gas vehicles (NGVs) and various static storage applications, serving as the core infrastructure enabling the use of natural gas as a cleaner alternative fuel source. The primary function of these cylinders is to safely store CNG at pressures up to 3,600 psi (250 bar), ensuring efficient energy density and operational range for vehicles or reliable supply for industrial applications. Product descriptions range from traditional Type 1 steel tanks to advanced, lightweight Type 4 carbon fiber composite cylinders, each catering to specific performance and weight requirements in different vehicle classes.

Major applications of CNG tanks and cylinders span the automotive sector, including passenger cars, light commercial vehicles (LCVs), and heavy-duty vehicles (HDVs) such as buses and trucks, where CNG offers significant cost savings and reduced particulate emissions compared to diesel or gasoline. Beyond transportation, these cylinders are extensively utilized in bulk gas transportation (cascades), static storage for refueling stations, and industrial backup systems. The benefits derived from utilizing CNG fuel systems are multifaceted, primarily centered on economic viability—natural gas is often significantly cheaper than petroleum products—and environmental advantages, including lower CO2, NOx, and sulfur oxide emissions, which align with global regulatory mandates aimed at combating climate change.

Driving factors propelling the robust growth of this market include increasingly stringent governmental emission regulations worldwide, particularly in rapidly urbanizing economies like India and China, which are incentivizing the adoption of natural gas vehicles. Furthermore, the stable and relatively lower pricing of natural gas compared to volatile oil prices enhances the long-term operational cost-effectiveness for fleet operators. Continuous advancements in cylinder technology, particularly the shift towards lighter and safer composite tanks (Type 3 and Type 4), are expanding NGV acceptability by addressing historical concerns related to weight penalty and limited driving range, thereby sustaining market momentum across diverse geographic regions.

CNG Tank And Cylinder Market Executive Summary

The CNG Tank and Cylinder Market is poised for substantial expansion, driven primarily by favorable environmental policies and the accelerating global transition towards cleaner vehicular fuels. Key business trends indicate a strong competitive focus on technological innovation, specifically the mass production of Type 4 composite cylinders, which offer superior weight reduction and corrosion resistance, essential for maximizing payload capacity in commercial trucking. Strategic collaborations and mergers between material suppliers and tank manufacturers are increasing, aimed at securing supply chains and optimizing production processes to meet escalating demand from OEM automotive manufacturers integrating CNG systems directly into new vehicle lines. The market is also experiencing vertical integration as major players seek greater control over composite material inputs, thus enhancing cost efficiency and maintaining quality control across production stages.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, largely due to governmental mandates supporting NGVs, extensive infrastructure development in countries like India, Pakistan, and Thailand, and a high volume of new vehicle registrations. Europe is focused on replacing older diesel fleets with cleaner alternatives, driving demand for CNG buses and utility vehicles, bolstered by robust regulatory frameworks like the Euro VI standards. North America is witnessing sustained, albeit less rapid, growth, particularly in the heavy-duty fleet sector where long-haul operators are increasingly valuing the economic stability offered by natural gas pricing. Latin America, especially Brazil and Argentina, remains a mature market, consistently demanding durable Type 1 and Type 2 cylinders for well-established conversion markets.

In terms of segment trends, the Type 4 cylinder segment is projected to exhibit the highest CAGR due to its lightweight properties making it ideal for range extension and overall vehicle efficiency, despite its higher initial cost. Within applications, the Commercial Vehicle segment (buses and trucks) is dominating the market share, recognizing the significant fuel cost savings afforded by CNG over large operational lifecycles. Furthermore, the after-market installation segment, driven by conversion kits, continues to hold substantial relevance, particularly in price-sensitive developing economies where vehicle owners seek economical retrofitting solutions to comply with local emission norms or reduce daily running costs. These dynamics collectively shape a market characterized by high investment in composite manufacturing and strong reliance on supportive government policies.

AI Impact Analysis on CNG Tank And Cylinder Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the CNG Tank and Cylinder market frequently revolve around how AI can enhance safety, optimize manufacturing efficiency, and predict product lifespan. Users are highly interested in AI’s role in non-destructive testing (NDT), identifying micro-fractures in composite materials, and automating quality control during the complex winding processes of Type 4 cylinders. Furthermore, there is significant inquiry into predictive maintenance schedules for NGV fleets, utilizing AI to analyze usage patterns, pressure cycles, and temperature data to forecast tank inspection or replacement needs, thereby minimizing downtime and maximizing the safe operational life of the high-pressure vessels. The consensus expectation is that AI integration will lead to higher production standards, reduced waste, and a significant improvement in the overall safety and reliability of CNG storage solutions.

- AI-driven Predictive Maintenance: Optimizing replacement cycles for CNG tanks in fleets by analyzing real-time usage and pressure data, enhancing operational safety and reducing unplanned downtime.

- Automated Quality Control (QC): Using machine vision and deep learning algorithms to inspect composite winding patterns and detect microscopic material flaws or inconsistencies in Type 3 and Type 4 cylinders during manufacturing.

- Supply Chain Optimization: Leveraging AI for demand forecasting and inventory management of raw materials (carbon fiber, resin, steel), mitigating risks associated with supply volatility and reducing lead times.

- Design and Simulation: Employing generative AI tools to rapidly prototype and test new cylinder geometries and material compositions, improving stress resistance and weight reduction efficiency.

- Enhanced Safety Monitoring: Integrating AI analytics into CNG fueling stations and vehicle systems to continuously monitor pressure, temperature, and leak detection systems, generating immediate alerts for anomalous conditions.

DRO & Impact Forces Of CNG Tank And Cylinder Market

The dynamics of the CNG Tank and Cylinder market are governed by a robust interplay of Drivers, Restraints, and Opportunities, which collectively constitute the core Impact Forces shaping its trajectory. Key drivers include aggressive regulatory pushes by governments worldwide to curb vehicular pollution, particularly the imposition of stricter Euro and Bharat Stage equivalent standards, making CNG adoption mandatory or highly preferential. The inherent cost advantage of natural gas over traditional liquid fuels provides strong economic incentive for fleet operators, directly stimulating demand for high-capacity cylinders. Simultaneously, the market is restrained by the high initial capital cost associated with Type 4 composite cylinders, which, despite their technological superiority, present an economic barrier for budget-conscious buyers and conversion markets. Additionally, the relatively slow pace of CNG refueling infrastructure development in certain geographies limits the perceived feasibility and range of NGVs, impacting adoption rates outside established corridors.

Opportunities within the market center on rapid technological evolution, particularly the refinement of composite cylinder manufacturing processes to reduce costs, making lightweight solutions more accessible for passenger vehicle segments. The emergence of Renewable Natural Gas (RNG) or bio-CNG is presenting a compelling opportunity, positioning the fuel source as a fully sustainable option, thereby insulating the market from long-term fossil fuel divestment pressures. Furthermore, significant untapped potential exists in cascade storage systems for virtual pipelines and localized industrial gas distribution, which requires large volumes of highly durable storage tanks. The impact forces are thus dominated by the 'Push' factor of environmental legislation and the 'Pull' factor of technological innovation in lightweight materials.

The overall impact forces driving market growth are intensely positive, propelled by the global commitment to decarbonization and the necessity for stable, affordable transportation energy. While safety concerns inherent to high-pressure storage and infrastructure limitations act as frictional restraints, the compelling economic and environmental advantages of CNG ensure sustained, high-CAGR growth. Regulatory support, exemplified by subsidies for NGV procurement and tax breaks for CNG infrastructure investment, remains the most powerful external force stimulating demand for both vehicular and static storage cylinders. The strategic shift towards Type 4 tanks reflects a market responding proactively to the core constraint of weight, guaranteeing long-term viability and expanded acceptance across diverse automotive platforms.

Segmentation Analysis

The CNG Tank and Cylinder Market is comprehensively segmented based on three critical factors: Type, which delineates the material and construction methodology; Application, determining the end-use sector; and Material Type, focusing on the primary raw components used in manufacturing. Understanding these segments is crucial for strategic market planning, as each segment responds differently to shifts in technology, regulation, and pricing. The Type segmentation, ranging from Type 1 (all-metal) to Type 4 (all-composite), is the most influential differentiator, dictating weight, lifespan, and cost, directly affecting adoption rates across light and heavy vehicle categories. Geographic factors also play a critical role, as certain regions, particularly developed economies, show a preference for advanced, lightweight Type 3 and Type 4 cylinders, whereas price-sensitive, high-volume markets often rely on reliable Type 1 and Type 2 steel tanks.

Segmentation by Application reveals that the commercial vehicle segment—comprising municipal buses, logistics trucks, and delivery vans—commands the largest market share due to the intensive operational hours and high mileage accumulated, maximizing the return on investment from lower CNG fuel costs. Conversely, the passenger car segment is expanding rapidly, fueled by the introduction of factory-fitted CNG variants by major automotive OEMs and supportive governmental rebates. Static storage and cascade systems represent a niche yet crucial segment, supporting the necessary infrastructure backbone (refueling stations and industrial supply) essential for the broader growth of NGV usage. Analysis of Material Type confirms the increasing shift away from pure steel towards composite materials like carbon fiber and fiberglass, reflecting the industry's commitment to vehicle performance enhancement through weight reduction.

The interconnected nature of these segments means that innovation in one area often catalyzes growth in another. For instance, the successful reduction of Type 4 cylinder manufacturing costs directly accelerates adoption in the passenger car application segment. Similarly, stricter global safety standards inherently bolster the demand for highly regulated, certified tanks across all segments, favoring manufacturers with robust quality control and advanced testing capabilities. Therefore, successful market penetration requires tailored strategies addressing the specific needs and regulatory landscape pertinent to each distinct segment, ensuring the delivered product aligns with the required performance metrics, be it durability for heavy transport or minimal weight for personal mobility.

- By Type:

- Type 1 (All-Metal/Steel or Aluminum)

- Type 2 (Hoop-Wrapped Composite over Metal Liner)

- Type 3 (Fully Wrapped Composite over Metal Liner)

- Type 4 (Fully Wrapped Composite over Non-Metallic Liner)

- By Application:

- Passenger Cars

- Commercial Vehicles (Buses, Trucks, LCVs)

- Storage/Stationary Applications (Cascade Systems, Refueling Stations)

- By Material Type:

- Steel

- Carbon Fiber Composite

- Glass Fiber Composite

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For CNG Tank And Cylinder Market

The value chain for the CNG Tank and Cylinder Market is complex, beginning with upstream analysis focused on the procurement of critical raw materials, extending through sophisticated manufacturing processes, and concluding with downstream activities involving distribution and end-user installation. Upstream activities are dominated by the acquisition of high-strength steel, aluminum, and, increasingly, advanced composite materials such as carbon fiber and high-grade resins. The quality and availability of carbon fiber specifically influence the cost structure and production volume of high-end Type 3 and Type 4 cylinders. Manufacturers often engage in long-term supply agreements with specialized fiber producers to secure supply stability and maintain competitive pricing, underscoring the critical dependence on specialized material suppliers for market differentiation and technological leadership.

Midstream activities involve the core manufacturing processes, including forging, stamping, welding (for Type 1 and 2 tanks), and filament winding (for composite tanks). The technological sophistication required for filament winding, especially maintaining fiber tension and resin cure profiles for Type 4 tanks, represents a significant barrier to entry and is a key value-adding step. Following manufacturing, mandatory testing and certification processes, governed by international standards (e.g., ISO, UN/ECE R110), are integrated into the value chain to ensure product safety and regulatory compliance. Direct distribution channels are predominantly used for Original Equipment Manufacturers (OEMs) where tanks are integrated into new vehicle production lines, requiring just-in-time delivery and stringent quality checks directly linking the tank manufacturer to the vehicle assembly plant.

Downstream activities include distribution channels that cater to two primary markets: the OEM market (direct) and the aftermarket (indirect). The indirect channel involves distributors, authorized dealers, and professional retrofitters who sell and install tanks in vehicles already in operation, a prominent model in Asian and Latin American markets. The after-sales service component, including mandatory periodic tank inspection and re-certification services, forms a crucial part of the downstream value delivery, ensuring the continued safe operation of NGVs throughout their lifespan. Efficient logistics and robust localized service networks are essential for maintaining market trust and facilitating smooth end-user adoption, thereby completing the full cycle of value creation and delivery in this highly specialized segment.

CNG Tank And Cylinder Market Potential Customers

Potential customers for the CNG Tank and Cylinder Market primarily encompass entities involved in vehicle manufacturing, fleet operation, and energy infrastructure development, reflecting a diverse end-user base driven by operational economics and environmental compliance. Original Equipment Manufacturers (OEMs) of passenger cars, light commercial vehicles, and heavy-duty trucks constitute a core segment of potential buyers, integrating tanks directly into new vehicle platforms to offer factory-fitted CNG variants. These customers prioritize high quality, reliable supply, and compliance with specific dimensional and safety requirements dictated by modern vehicle design and rigorous automotive safety standards, often leading to preference for lightweight Type 3 and Type 4 composite tanks to optimize performance.

Another major category of buyers includes large fleet operators, encompassing municipal transportation authorities, long-haul logistics companies, and regional distribution services. These end-users are characterized by their bulk purchasing power and intense focus on Total Cost of Ownership (TCO). For them, the significant reduction in fuel expenses afforded by CNG outweighs the initial tank investment, driving demand for high-capacity, durable cylinders that can withstand rigorous, continuous duty cycles. Fleet customers often prioritize long-term durability, favoring robust Type 1 or Type 2 tanks for heavy transport, while increasingly adopting Type 4 tanks to reduce curb weight and improve fuel efficiency over long distances.

The third substantial segment includes entities responsible for CNG infrastructure and gas distribution, such as owners and operators of CNG refueling stations, industrial gas suppliers, and companies specializing in virtual gas pipelines (cascade transport). These customers require high-volume, static storage solutions, often involving large banks of cylinders bundled together in cascade systems for buffering or transport. For static applications, while safety remains paramount, the primary purchasing drivers include capacity maximization, long service life, and cost-effectiveness per unit volume of stored gas, leading to diverse requirements ranging from Type 1 heavy-duty storage tanks to specialized transport modules.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 5.0 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Worthington Industries, Hexagon Composites ASA, Luxfer Holdings PLC, Everest Kanto Cylinder Ltd., CIMC Enric Holdings Limited, Quantum Fuel Systems LLC, Beijing Tianhai Industry Co., Ltd. (BTIC), Avanco Composites GmbH, Furuise Equipment Manufacturing Co., Ltd., Rama Cylinders, Zhejiang Jindun Pressure Vessel Co., Ltd., Lianyungang Zhongfu Lianzhong Composites Group, Calyos Containers, Faber Industrie S.p.A., NPROXX GmbH, Zibo Baotong Mechanical and Electrical Equipment Co., Ltd., Gardner Denver, Inc., Xuzhou Haimo Tank Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

CNG Tank And Cylinder Market Key Technology Landscape

The technology landscape of the CNG Tank and Cylinder market is defined by a continuous drive towards lightweighting, enhanced safety features, and optimized manufacturing efficiency, particularly through advancements in composite material science. The transition from heavy, corrosion-prone Type 1 (steel) cylinders to advanced Type 4 (all-composite with a polymer liner) cylinders represents the most significant technological leap. Key technologies used include advanced filament winding techniques, where continuous carbon or glass fibers are precisely wound around a non-metallic liner (typically HDPE or polyamide). This process allows manufacturers to reduce the tank weight by up to 70% compared to equivalent steel tanks, thereby significantly improving vehicle fuel economy and carrying capacity—a critical factor for commercial fleets.

Material innovation is central to this landscape, with research focusing on optimizing the resin matrices used to bind the composite fibers, enhancing fatigue life, and increasing resistance to chemical degradation and impact damage. Furthermore, integrated sensor technology is becoming crucial, enabling cylinders to be designated as "smart tanks." These integrated sensors monitor internal pressure, temperature fluctuations, and acoustic emissions, providing real-time data on the tank's structural integrity and usage history. This data is essential for accurate predictive maintenance and compliance with stringent safety regulations, utilizing telematics integration to communicate the tank’s status to the vehicle management system and fleet operators.

Manufacturing process technology has also seen substantial investment, particularly in automation and non-destructive testing (NDT). Automated winding machines ensure precision and repeatability, which is vital for the safety of high-pressure composite vessels. Techniques such as ultrasonic testing and advanced X-ray imaging are employed to detect micro-voids, unbonded areas, or fiber breaks within the composite layers that are invisible to the naked eye. This commitment to robust quality control, supported by sophisticated data analytics and AI, ensures that the complex structural design of Type 3 and Type 4 tanks meets the exacting standards required for long-term safe operation under extreme pressure conditions, positioning technology as the core competitive differentiator in the market.

Regional Highlights

The global CNG Tank and Cylinder market exhibits distinct growth patterns influenced by regional regulatory environments, natural gas availability, and the maturity of automotive industries. Asia Pacific (APAC) dominates the market share and is projected to maintain the highest growth trajectory throughout the forecast period. This is largely driven by mass adoption in India and China, where environmental mandates (such as BS-VI in India) actively promote CNG as a primary substitute for gasoline and diesel, supported by massive government investments in refueling infrastructure and vehicle subsidies. The high density of vehicles and severe pollution levels in major urban centers within APAC make the transition to cleaner fuels an immediate priority, translating into consistently high demand for cost-effective CNG storage solutions, particularly Type 1 and Type 2 cylinders for conversion kits and Type 4 for new municipal bus fleets.

Europe represents a highly mature yet innovative market segment, characterized by a preference for advanced Type 3 and Type 4 composite cylinders, driven by strict EU directives on vehicle weight and emissions. Western European countries, including Italy and Germany, have established NGV corridors and strong incentives for heavy-duty vehicles running on CNG/LNG (Liquefied Natural Gas), stimulating consistent demand, particularly in the logistics and urban transport sectors. The region’s focus is not only on reducing emissions but also on integrating bio-CNG (RNG), which further enhances the market's sustainability profile and guarantees future demand for high-specification storage units capable of meeting rigorous European safety standards.

North America, while possessing vast natural gas reserves, exhibits growth primarily in the fleet sector, driven by commercial advantages for return-to-base operations, rather than mass passenger vehicle adoption. The focus here is on heavy-duty trucking and refuse fleets where the economic benefits of CNG fuel stability are maximized. Demand is strong for high-volume, lightweight Type 4 cylinders to extend the range of long-haul trucks without compromising payload. The Latin American market, particularly Brazil and Argentina, remains robust, heavily reliant on established conversion industries requiring durable Type 1 and Type 2 cylinders, supported by a long history of utilizing natural gas as a vehicular fuel. The Middle East and Africa (MEA) are emerging regions, where government initiatives to diversify domestic energy consumption and reduce reliance on liquid fuels are spurring initial investments in CNG infrastructure and NGV pilot programs, creating future growth opportunities.

- Asia Pacific (APAC): Leading market volume driven by India, China, and Pakistan due to stringent emission norms and governmental subsidy schemes promoting factory-fitted and conversion CNG vehicles.

- Europe: High-value market focused on advanced Type 4 composite tanks, driven by EU emissions standards and strong incentives for sustainable transport and bio-CNG usage across logistics and municipal fleets.

- North America: Stable demand concentrated in commercial fleets (heavy-duty trucking, refuse vehicles) where economic viability and availability of natural gas are key drivers for Type 4 cylinder adoption.

- Latin America: Mature market, especially in Brazil and Argentina, characterized by widespread reliance on aftermarket conversions and continuous demand for robust Type 1 and Type 2 storage solutions.

- Middle East and Africa (MEA): Emerging growth area stimulated by government programs in countries like Iran and Egypt seeking to leverage domestic gas resources for transport fuel diversification and air quality improvement.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the CNG Tank And Cylinder Market.- Worthington Industries

- Hexagon Composites ASA

- Luxfer Holdings PLC

- Everest Kanto Cylinder Ltd.

- CIMC Enric Holdings Limited

- Quantum Fuel Systems LLC

- Beijing Tianhai Industry Co., Ltd. (BTIC)

- Avanco Composites GmbH

- Furuise Equipment Manufacturing Co., Ltd.

- Rama Cylinders

- Zhejiang Jindun Pressure Vessel Co., Ltd.

- Lianyungang Zhongfu Lianzhong Composites Group

- Calyos Containers

- Faber Industrie S.p.A.

- NPROXX GmbH

- Zibo Baotong Mechanical and Electrical Equipment Co., Ltd.

- Gardner Denver, Inc.

- Xuzhou Haimo Tank Co., Ltd.

- Lincoln Composites

- Steelhead Composites

Frequently Asked Questions

Analyze common user questions about the CNG Tank And Cylinder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Type 1, Type 3, and Type 4 CNG cylinders?

The primary difference lies in construction material and weight. Type 1 is all-metal (steel or aluminum). Type 3 uses a metal liner wrapped in composite fiber, offering moderate weight savings. Type 4 is the lightest, using a non-metallic (polymer) liner fully wrapped in high-strength composite fibers (e.g., carbon fiber), significantly improving vehicle efficiency and range.

How do global emission regulations affect the demand for CNG tanks?

Stricter global emission standards (like Euro VI or equivalent regional norms) mandate lower levels of nitrogen oxides and particulates, making CNG a highly favorable, cleaner alternative to diesel and gasoline. This regulatory pressure directly drives OEM adoption and fleet conversion, thereby increasing the demand for certified CNG storage tanks.

Which segment of the CNG Tank market is expected to grow the fastest?

The Type 4 (all-composite) cylinder segment is projected to experience the highest growth rate due to its superior lightweight properties, which are crucial for electric vehicle integration, range maximization in heavy-duty commercial transport, and overall efficiency improvements in the passenger car sector.

What are the key safety standards governing the manufacturing of CNG cylinders?

Key international standards include ISO 11439, governing high-pressure cylinders for natural gas vehicles, and UN/ECE Regulation No. 110, which specifies requirements for CNG components. Compliance with these standards ensures cylinder integrity, burst pressure resistance, and thermal safety under extreme operating conditions.

What is the typical lifespan or inspection requirement for an NGV CNG tank?

The typical mandated service life for CNG tanks is 15 to 20 years, depending on the regulatory region and tank type. They require mandatory periodic visual inspection and sometimes hydrotesting, typically every 3 to 5 years, to ensure structural integrity and continued safe operation throughout their service life.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager