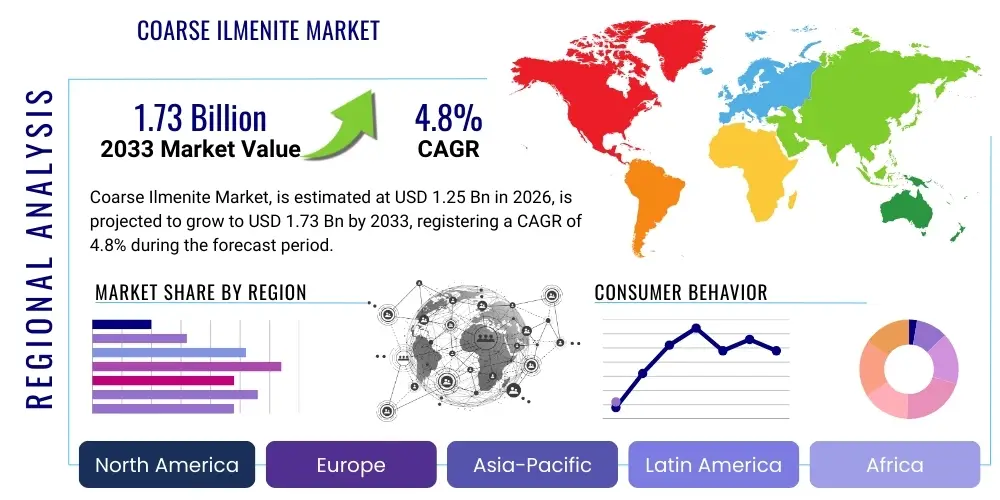

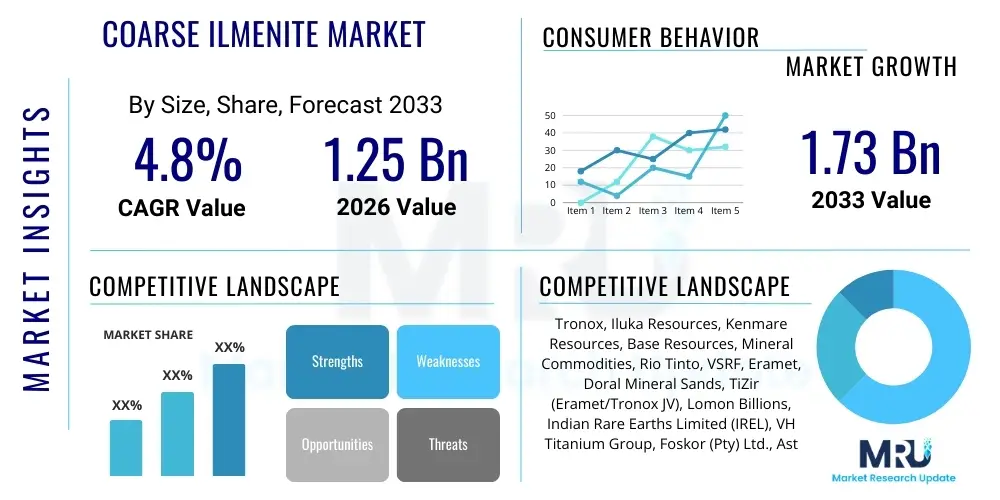

Coarse Ilmenite Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437030 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Coarse Ilmenite Market Size

The Coarse Ilmenite Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.73 Billion by the end of the forecast period in 2033.

Coarse Ilmenite Market introduction

Coarse ilmenite, primarily iron titanate (FeTiO3), serves as the foundational feedstock for producing titanium dioxide (TiO2) pigment, which accounts for the vast majority of its commercial consumption. This specific grade of ilmenite, characterized by a larger particle size distribution compared to fines, is often preferred in processes requiring higher permeability or specific metallurgical applications. Its inherent chemical stability and high titanium content make it indispensable in sectors demanding opacity, durability, and resistance to chemical degradation. The global market is fundamentally driven by the robust demand from the coatings, plastics, and paper industries, which rely on TiO2 for crucial aesthetic and functional properties. The economic viability of new ilmenite projects is intricately linked to the co-product credits generated from associated heavy minerals, such as rutile and zircon, which are extracted concurrently, providing a crucial buffer against fluctuations in the standalone ilmenite price.

The product’s versatility extends beyond pigment production into specialized applications, including the manufacturing of welding rod fluxes, where it stabilizes the arc and slag, and in the production of high-performance titanium metal and titanium sponge. The quality and concentration of coarse ilmenite, often derived from mineral sands deposits, directly impact the efficiency and cost structure of downstream processing, particularly in the production of synthetic rutile or high-titanium slag. Geopolitical stability in key mining regions and the sustainability of extraction practices are emerging as critical variables influencing market stability and long-term supply dynamics. The preferred feedstock for the energy-intensive chloride process for TiO2 production often dictates the demand for upgraded coarse ilmenite products, emphasizing the technological nexus between mining and chemical processing efficiency.

Major market acceleration factors include rapid urbanization, particularly across emerging economies in Asia Pacific, leading to increased construction activities and heightened demand for paints and coatings. Furthermore, the growing use of titanium metal in aerospace, automotive, and medical industries, driven by its exceptional strength-to-weight ratio and corrosion resistance, indirectly fuels the demand for high-grade ilmenite feedstock. Investment in advanced processing technologies aimed at increasing titanium recovery rates from lower-grade ores is also contributing significantly to expanding the market's operational capacity and profitability margins. The long-term contracted supply relationships that characterize this market provide a layer of stability but also introduce inertia, making rapid supply adjustments challenging in response to sudden shifts in global industrial demand cycles.

The distinction between coarse and fine ilmenite is crucial for end-users; coarse material is generally easier to handle and separate, often leading to lower operational losses during magnetic and gravity separation stages, which ultimately results in a more efficient path to synthetic rutile conversion. This preference for coarse material ensures that mineral sands operations capable of producing high-quality, coarse-grained ilmenite maintain a premium market position. Environmental considerations are also playing an increasingly pivotal role, pushing the industry toward sustainable sourcing practices and minimizing the environmental footprint associated with dredging and processing activities, affecting investment decisions in new projects globally. The stability of long-term supply agreements is paramount, given the cyclical nature of TiO2 demand and the necessity for continuous operation of capital-intensive processing plants.

Coarse Ilmenite Market Executive Summary

The Coarse Ilmenite Market is characterized by moderate growth, primarily underpinned by persistent global demand for titanium dioxide pigment and strategic resource consolidation among major producers. Business trends indicate a strong focus on vertical integration, with key mining companies increasingly investing in processing capabilities (synthetic rutile, slag production) to capture higher value throughout the supply chain and mitigate volatility in raw material pricing. Supply chain resilience and adherence to stringent environmental, social, and governance (ESG) standards are becoming critical competitive differentiators, influencing procurement decisions in major consumer markets like North America and Europe. Innovation in beneficiation techniques to process lower-grade or fine-grained deposits more economically is also reshaping the competitive landscape, pushing the industry towards advanced sensor-based sorting and process control automation to maintain quality consistency and reduce energy consumption across the mining lifecycle.

Regional trends highlight the Asia Pacific (APAC) region as the dominant force, serving as both the largest consumer market, due to expansive infrastructure development and a burgeoning middle class driving coatings demand, and a critical processing hub, particularly in China and India. Conversely, established markets like North America and Europe demonstrate mature, stable demand focusing on specialty applications and premium-grade pigment production, emphasizing supply security and environmental compliance. The regulatory landscape in Europe, specifically concerning waste management and energy usage, heavily influences feedstock preferences, often favoring upgraded ilmenite products suitable for the chloride process. The Middle East and Africa (MEA), notably South Africa and Mozambique, remain crucial primary sources of high-quality mineral sands and coarse ilmenite, positioning these regions at the nexus of global supply logistics, though political and operational risks present constant challenges to stable output.

Segment trends underscore the enduring dominance of the pigment application segment, driven by global architectural and industrial coatings consumption, which remains highly correlated with GDP growth. However, the metallurgical segment, though smaller in volume, exhibits higher growth potential owing to the increasing adoption of titanium alloys in advanced manufacturing sectors like additive manufacturing and specialized aerospace components. The premium nature of demand in the metallurgical segment drives specific requirements for ultra-low impurity levels, impacting the viability of various ilmenite sourcing and processing routes. The market structure is moving towards a tiered system where high-purity, environmentally compliant ilmenite commands a significant premium over standard industrial grades, reflecting the strong differentiation strategy employed by major market leaders.

Furthermore, the executive outlook indicates that capital investment will increasingly flow into regions possessing large, unexploited mineral sand resources, provided the regulatory framework is supportive and infrastructure is adequate to handle large-scale bulk commodities. Long-term strategic planning for market participants involves navigating the cyclical nature of the TiO2 pigment market while securing long-duration permits for mining operations, often extending decades into the future. The integration of digital technologies, including Artificial Intelligence for process optimization, is recognized as essential for maintaining cost competitiveness against global peers and ensuring rapid response to evolving quality specifications from downstream users, particularly concerning trace element contamination that affects pigment quality.

AI Impact Analysis on Coarse Ilmenite Market

Common user questions regarding AI's impact on the Coarse Ilmenite Market revolve around operational efficiency, geological resource modeling, and predictive maintenance in large-scale mining operations. Users frequently inquire about how machine learning can optimize separation processes, minimizing energy consumption and maximizing titanium recovery from complex ores. A primary concern is the potential for AI to de-risk exploration through advanced data analytics, accurately locating viable new coarse ilmenite deposits and predicting future resource depletion rates. The consensus expectation is that AI integration will fundamentally shift the cost curve for ilmenite extraction, making previously marginal operations economically viable and enhancing the overall sustainability profile of the industry, particularly by optimizing the use of scarce resources such as water and processing chemicals critical for beneficiation.

AI technologies, including computer vision and advanced robotics, are increasingly being deployed in mineral processing plants to enhance quality control and automate tedious separation tasks. These systems analyze particle size distribution, mineralogical composition, and color attributes in real-time, allowing for dynamic, micro-level adjustments to flotation, magnetic separation, or electrostatic separation circuits, thereby drastically reducing the misplacement of valuable material and improving the final product grade consistency necessary for high-specification downstream applications. The precise control offered by AI algorithms minimizes the reliance on manual sampling and laboratory testing, accelerating the feedback loop and enhancing throughput stability, a major advantage in continuous, high-volume operations where even marginal gains in efficiency translate to substantial savings.

The application of predictive analytics to complex geological data sets—integrating seismic, drilling, and historical production data—enables miners to create highly accurate 3D models of orebodies. This capability is pivotal for strategic mine planning, allowing for optimized path selection for dredges or dry mining machinery, thereby maximizing ore recovery per unit of energy expended and reducing environmental disturbance. Furthermore, predictive maintenance systems utilize sensor data (vibration, temperature, current draw) from critical equipment like heavy mineral concentrators and electric arc furnaces to forecast failure points, drastically reducing unscheduled downtime—a primary operational constraint in remote mineral sands operations—and extending the operational life of highly capitalized assets.

Moreover, AI-driven solutions are crucial in managing complex supply chain logistics, particularly for bulk commodities like coarse ilmenite that traverse vast distances from mine site to processing plant and end-user. Machine learning algorithms optimize shipping routes, predict demand fluctuations based on real-time macroeconomic indicators across construction and manufacturing sectors, and ensure timely delivery, reducing inventory holding costs and improving cash flow management for producers. The ability of AI to model complex regulatory and environmental compliance scenarios also aids producers in anticipating future operational challenges related to tailings management and site rehabilitation, ensuring long-term operational license continuity and mitigating reputation risk associated with environmental incidents. This digital transformation is setting new benchmarks for operational excellence within the coarse ilmenite mining sector.

- Optimization of mineral separation processes using real-time machine learning algorithms, leading to higher titanium recovery rates and consistent product quality.

- Enhanced geological modeling and exploration success rates through predictive data analytics, de-risking new project investments and resource estimation.

- Implementation of predictive maintenance protocols for heavy mining and processing equipment, minimizing costly unscheduled downtime and improving asset utilization.

- Automation of quality control and grading processes using computer vision systems, ensuring strict adherence to customer-specific coarse ilmenite specifications.

- Improved supply chain efficiency and logistics optimization for bulk shipment of ores and derived products (slag, synthetic rutile) across global routes.

- AI-assisted environmental monitoring, compliance reporting, and resource usage optimization (water and energy intensity reduction).

- Dynamic pricing and demand forecasting based on sophisticated global industrial indicators and downstream consumer market trends.

- Development of digital twins for processing plants to simulate process adjustments and maximize yield before physical implementation, enhancing process safety.

DRO & Impact Forces Of Coarse Ilmenite Market

The Coarse Ilmenite Market's trajectory is primarily dictated by the sustained high demand for titanium dioxide pigment, which acts as the principal driver, counterbalanced by increasing environmental compliance costs and geopolitical risks associated with key sourcing regions. Market growth is propelled by global infrastructure spending and the burgeoning paints and coatings sectors, offering continuous opportunities for suppliers who can guarantee stable, high-quality material supply. However, the market faces significant restraints related to capital intensity in establishing new mining operations, variability in ore grades, and the rising global scrutiny on carbon footprints associated with mineral processing and waste disposal. These forces collectively create a dynamic, yet constrained, environment where operational efficiency, strategic long-term contracting, and technological adaptation determine competitive success and profitability margins across the value chain, necessitating continuous process optimization.

Drivers: The dominant driver remains the irreversible global trend toward urbanization and expanding construction activity, particularly in APAC and parts of the Middle East, necessitating massive quantities of high-quality coatings and plastics utilizing TiO2. Furthermore, the increasing adoption of lightweight materials, including titanium metal derived from ilmenite, in critical high-performance sectors like aerospace, defense, and specialized chemical processing provides a steady, albeit smaller, premium demand stream for high-grade ilmenite intermediates. The cost-effectiveness of coarse ilmenite as a feedstock compared to pure rutile in specific processing routes, coupled with continuous technological improvements in synthetic rutile conversion, ensures its vital role in meeting the global demand for titanium feedstocks economically. Global economic recovery post-pandemic also stimulated deferred infrastructure projects, adding immediate pressure on ilmenite supply volumes and securing forward contracts.

Restraints: Significant limitations include the high capital expenditure and long lead times (often 5-10 years) required for mineral sand projects, making the supply side relatively inelastic to short-term demand spikes, leading to cyclical price volatility. Environmental regulations, especially concerning water usage, management of radio-active byproducts (like monazite), and land rehabilitation, are becoming increasingly stringent globally, elevating operational costs and posing severe challenges to securing and maintaining mining licenses in politically sensitive areas. Price volatility in energy and key reagents, critical inputs for mineral processing and slag production, introduces substantial cost uncertainty. Additionally, the increasing focus on the circular economy and potential substitution, such as certain calcined clays in low-end TiO2 applications, presents a long-term risk to traditional ilmenite mining economics, although titanium's functional superiority in high-performance applications remains largely unchallenged.

Opportunity: Key opportunities lie in the development and commercial deployment of advanced beneficiation technologies that allow for the efficient, low-cost extraction of ilmenite from lower-grade or complex deposits previously deemed uneconomical, thereby expanding the exploitable resource base and securing future supply in new geographies. Strategic diversification into downstream processing (synthetic rutile, titanium slag) enables miners to capture greater value and mitigate raw material price fluctuations by offering value-added products that feed directly into the chloride process. Furthermore, meeting the rising global demand for sustainable sourcing and low-carbon TiO2 production provides a significant competitive edge for companies investing in environmentally sound extraction practices and carbon capture technologies, opening access to premium, ESG-focused market segments in mature industrialized economies.

Impact Forces: The interplay of these forces exerts significant pressure on the market structure and competitive dynamics. The dominant driver (TiO2 demand) ensures long-term market expansion, while restraints (regulatory burden, capital intensity) constrain the rapid introduction of new supply, often leading to periods of tight market conditions and favorable pricing for established producers with existing permits and low-cost operations. The increasing influence of ESG mandates acts as a crucial filtering mechanism, disproportionately affecting smaller, less technologically advanced players, leading to consolidation among larger, integrated corporations. Opportunities, particularly in technological upgrading and geographical diversification of deposits, favor vertically integrated companies, reinforcing their market power and ensuring superior profitability compared to pure miners of raw ore commodities.

Segmentation Analysis

The Coarse Ilmenite Market is primarily segmented based on its application, reflecting the two main end-use routes: the production of titanium dioxide pigments and metallurgical applications, including the manufacturing of titanium metal and specialized alloys. A secondary, yet crucial, segmentation is based on the source type, differentiating between ilmenite derived from mineral sands deposits, which typically yields a high-purity product after wet separation, and that extracted from hard rock formations, which often requires more complex and energy-intensive comminution and magnetic separation processes. This distinction is critical as it significantly impacts the physical characteristics (purity, particle size, iron content) and the required processing intensity, thereby influencing the suitability for specific downstream processes, such as the sulfate versus the chloride route for TiO2 pigment production.

The application segmentation clearly indicates the strong correlation between global construction, automotive, and consumer goods sectors and market performance. Pigment production is the massive volume driver, where coarse ilmenite is either processed directly via the sulfate route (historically dominant but facing environmental pressures) or upgraded into synthetic rutile or titanium slag for the more efficient chloride route (the modern standard). The robust demand in coatings is particularly sensitive to cyclical economic stability. Conversely, the metallurgical segment, though accounting for a smaller volume share, focuses on ultra-high-purity ilmenite intermediates required for titanium sponge production. These customers, due to the critical nature of aerospace and defense end-uses, demand extremely stringent quality control and command significantly premium pricing, showcasing the market’s quality sensitivity.

The segmentation by grade is increasingly important, with high-grade coarse ilmenite (typically >58% TiO2) being highly sought after as it requires less intense pre-treatment before conversion, yielding significant cost savings downstream, especially for synthetic rutile producers. Lower-grade ilmenite requires more complex upgrading, often through the Becher process, increasing the overall production cost but broadening the usable resource base. Analyzing these segmentation dynamics is essential for producers to strategically align their product offering and capacity expansion plans with the specific quality requirements of their diverse end-user base, enabling effective inventory management and hedging against market volatility by offering flexibility in feedstock options.

Geographic segmentation is also highly relevant, as supply is heavily concentrated in specific resource-rich regions (Australia, South Africa, Canada) while processing and demand centers are widespread, particularly in industrialized nations and rapidly developing economies. Understanding these regional segmentation dynamics allows market players to accurately forecast regional demand shifts, manage supply chain risks associated with lengthy ocean freight and potential political instability in sourcing countries, and optimize their pricing strategies based on the delivered cost and the specific quality scarcity of coarse ilmenite grades required by localized processing facilities. The increasing shift of TiO2 processing capacity to Asia demands closer scrutiny of intra-regional supply chains.

- By Application:

- Titanium Dioxide Pigment Production (Paints, Coatings, Plastics, Paper, Inks) - Dominant volume segment, driving bulk demand.

- Titanium Metal and Alloys Manufacturing (Aerospace components, Defense equipment, Medical implants, Chemical Processing equipment) - High-value, purity-driven segment with specific feedstock requirements.

- Welding Rod Fluxes and Other Metallurgical Uses (Flux cored wire, abrasives, refractories) - Niche specialty segment requiring consistent particle size distribution.

- By Source Type:

- Mineral Sands Deposits (Characterized by high recovery and relative ease of primary separation).

- Hard Rock Deposits (Requires significant comminution and potentially complex hydrometallurgical processing).

- By Grade:

- High-Grade Coarse Ilmenite (Typically >58% TiO2, preferred for upgrading to synthetic rutile).

- Standard-Grade Coarse Ilmenite (45%-58% TiO2, generally suitable for sulfate route or basic slagging).

- By Processing Route Suitability:

- Chloride Process Feedstock (High Purity / Synthetic Rutile Grade, demanding low iron and chromium).

- Sulfate Process Feedstock (Lower Purity / Direct Feed Grade, less sensitive to minor impurities).

Value Chain Analysis For Coarse Ilmenite Market

The Coarse Ilmenite value chain commences with extensive geological exploration, often utilizing sophisticated aerial survey and remote sensing technologies to identify heavy mineral anomalies, followed by upstream activities involving large-scale mining operations, typically dredging or high-volume dry mining of extensive mineral sands resources. This upstream segment is highly capital-intensive, requiring substantial initial investment in infrastructure, and is characterized by oligopolistic concentration, dominated by a few global diversified mining entities holding significant, high-grade reserve bases, primarily located in Australia, South Africa, and Mozambique. The primary output from the initial mining stage is a heavy mineral concentrate, which is then subjected to multi-stage beneficiation—gravity separation, high-intensity magnetic separation, and electrostatic separation—to isolate the coarse ilmenite from other valuable heavy minerals like rutile, zircon, and garnet. Efficient beneficiation at the mine site is critical to reducing transportation costs of non-value-added material and meeting pre-transport impurity specifications.

The midstream segment involves the critical processing of the refined ilmenite into higher-value intermediates, such as high-titania slag (via pyrometallurgical reduction in electric arc furnaces, concentrating TiO2 up to 85%) or synthetic rutile (via complex chemical processing like the Becher or chloride acid leach processes, achieving over 90% TiO2). This conversion step adds substantial value, and is typically carried out by vertically integrated miners or specialized chemical processors situated strategically near cheap energy sources or major ports to minimize logistical hurdles. The choice of processing route is highly dependent on the quality (TiO2 content and impurity profile) of the feedstock and the desired end product purity. Technological advancements in this midstream stage are focused on lowering energy consumption and efficiently managing high volumes of waste materials, particularly iron-rich byproducts and acid regeneration systems, to comply with evolving environmental mandates.

Downstream activities include the manufacturing of final products, predominantly TiO2 pigment via the sulfate or chloride process, or the manufacturing of titanium sponge for metallurgical uses, where the material undergoes further reduction reactions. The major global TiO2 producers represent the final bulk consumer of upgraded ilmenite feedstock. Distribution channels are varied, involving direct long-term contractual agreements between major miners/processors and large pigment manufacturers (e.g., contracts between Iluka and major pigment houses) to ensure supply security and stable pricing over multi-year periods. Indirect sales occur through specialized global commodity traders who provide liquidity and spot market access, catering to smaller manufacturers or reacting to short-term supply deficits. Market pricing is often influenced by global economic cycles, particularly housing and automotive production, and the sustained regulatory pressure for high-quality, traceable raw materials.

The dominant flow of value is geographically unbalanced, moving from resource-rich MEA and APAC regions (mining and basic beneficiation) to industrialized regions (Europe, North America, and specific Asian industrial zones) for advanced chemical processing and final product manufacturing. The value chain is inherently exposed to global shipping costs and geopolitical risks, making supply chain optimization, often using digital tools and predictive analytics, a key competitive battleground. Strategic backward integration by pigment producers into synthetic rutile or slag facilities provides greater cost control and feedstock quality assurance, while pure ilmenite producers seek to forward-integrate to capture the higher margins associated with processed titanium feedstocks, minimizing reliance on selling raw commodity ore.

Coarse Ilmenite Market Potential Customers

The primary and largest volume consumers of coarse ilmenite are multinational chemical manufacturers and pigment producers, such as Tronox, Lomon Billions, and Venator, who require massive quantities of bulk feedstock for their titanium dioxide plants globally. These entities represent the heart of the downstream market and are highly sensitive to both the purity (specifically the critical tramp elements like FeO, V, Cr, and U/Th content) and the consistency of the ilmenite supply, as variations can severely disrupt their high-temperature and acid-based conversion processes. Major players in the protective coatings, automotive finishes, high-end plastics, and specialty paper industries rely indirectly on stable ilmenite supply, as disruptions affect the cost, availability, and crucial functional properties (opacity, whiteness) of their essential whitening and opacifying agent, TiO2.

A secondary, yet crucial, customer group comprises specialized metallurgical companies focusing on the reduction of titanium tetrachloride to produce titanium sponge, which is the precursor to titanium metal and its advanced alloys. These customers, heavily concentrated in regions supporting robust aerospace and defense manufacturing (US, Russia, China, Japan), require extremely high-grade titanium slag or synthetic rutile derived from coarse ilmenite feedstock. Their procurement prioritizes stringent purity standards (particularly low levels of radioactive elements and heavy metals) and long-term security of supply, often resulting in direct, decade-long off-take agreements with integrated ilmenite processors. Furthermore, manufacturers of welding electrodes, specialized fluxes, and refractories also constitute a niche, stable customer base, valuing the mineral’s low thermal expansion, high density, and efficient slag-forming characteristics for demanding industrial welding and casting applications.

Geographically, potential customers are concentrated in major industrial hubs where capital and infrastructure support large chemical processing plants. China remains the single largest consuming nation due to its immense manufacturing base and infrastructure build-out, possessing both sulfate and rapidly growing chloride route capacity. Western Europe and the United States maintain pivotal roles as centers for high-quality pigment and premium titanium metal production. Procurement decisions are heavily influenced by environmental standards, corporate social responsibility policies (ESG), and the demonstrated traceability of the sourced ilmenite, pushing customers towards suppliers with certified sustainable mining practices and lower carbon footprints. The high energy costs associated with processing feedstock mean that customers seek suppliers who offer the most energy-efficient raw material, typically high-grade synthetic rutile derived from optimized coarse ilmenite.

Strategic customers often engage in joint ventures or off-take agreements with miners to secure feedstock quality and price stability, illustrating the criticality of ilmenite in their operational viability and long-term capital planning. For TiO2 pigment producers, managing feedstock cost is typically the single largest variable component of their total production cost, making efficient and reliable coarse ilmenite supply a non-negotiable factor in maintaining global competitive pricing and profitability. The potential for customers to shift between suppliers is constrained due to the high volumes required, the substantial capital needed for feedstock inventory, and the technical difficulty of adapting existing plant chemistry to new, varied feedstock types without compromising final product quality.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.73 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tronox, Iluka Resources, Kenmare Resources, Base Resources, Mineral Commodities, Rio Tinto, VSRF, Eramet, Doral Mineral Sands, TiZir (Eramet/Tronox JV), Lomon Billions, Indian Rare Earths Limited (IREL), VH Titanium Group, Foskor (Pty) Ltd., Astron Corporation, China National Nuclear Corporation (CNNC), Richards Bay Minerals (RBM - Rio Tinto), Exxaro Resources, CRH plc, P&J Resources. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Coarse Ilmenite Market Key Technology Landscape

The technological landscape for the Coarse Ilmenite Market is defined by the necessity for highly efficient, cost-effective, and environmentally sound beneficiation and processing methods designed to handle varying ore qualities while maximizing titanium recovery. Key technologies focus on maximizing the recovery of ilmenite from complex mineral sand deposits and subsequently upgrading the feedstock to achieve the high TiO2 content required for the chloride process. Advanced gravity separation techniques, utilizing highly engineered spirals, cones, and hydrocyclones, remain foundational, optimized through continuous, real-time sensor-based monitoring systems that adjust operational parameters to handle subtle variations in ore density, particle shape, and size distribution, ensuring material separation efficiency and minimizing loss to tailings and improving concentrate grade.

Magnetic separation technology, particularly high-intensity rare earth wet and dry magnetic separators, is crucial for effectively isolating ilmenite (which is weakly magnetic) from non-magnetic heavy minerals like zircon and rutile, as well as highly magnetic iron minerals. Technological advancements here include the use of superconducting magnets in research to achieve superior separation efficacy at lower energy consumption, although adoption remains limited. Furthermore, the development and refinement of sophisticated processes for converting standard ilmenite into high-value titanium intermediates, such as synthetic rutile (typically 90%+ TiO2) or high-titania slag (80-85% TiO2), are critical competitive differentiators. These conversion processes, including the Becher process (involving reduction roasting and acid leaching) and the high-temperature pyrometallurgical routes for slagging, are continually optimized to lower energy intensity, increase throughput, and improve acid regeneration, minimizing costly waste disposal impact.

A major technological trend reshaping operational dynamics is the pervasive adoption of automation and digitalization. Advanced Process Control Systems (APCS), often leveraging AI and machine learning algorithms, are integrated across the mining and processing stages. These systems enable highly precise control over reagent dosage, magnetic separation current, and slurry density, leading to superior product consistency and significant reductions in operational variance, which is crucial for downstream chemical purity. In the context of sustainable mining, technology advancements include dry mining techniques that minimize water consumption compared to traditional dredging, particularly vital in arid regions, alongside innovative methods for managing and reprocessing mining residue and tailings to recover trace minerals or neutralize acid components, driven by stringent global regulatory pressure and ESG investment criteria.

The industry is also witnessing significant investment in reducing the dependence on high-cost, environmentally challenging reagents. New catalytic processes and physical separation methods are being explored to upgrade lower-grade ilmenite without the need for intense chemical leaching, thereby reducing overall environmental liability. The continuous quest for cleaner, more efficient, and cost-effective conversion technologies is essential for maintaining the competitive viability of ilmenite as the dominant feedstock against increasingly scarce natural rutile and for securing a long-term, sustainable supply for the burgeoning global TiO2 pigment industry, focusing heavily on maximizing the purity of the coarse fraction required for modern pigment production.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of both coarse ilmenite demand and processing, largely driven by the explosive growth in infrastructure, automotive manufacturing, and real estate sectors in China, India, and Southeast Asia. The region hosts the world’s largest and fastest-growing TiO2 pigment producers (e.g., Lomon Billions), creating massive, sustained demand for upgraded feedstock. Australia and India are significant ilmenite mining nations, providing essential primary supply. This region’s dominance is expected to continue, fueled by ongoing urbanization and industrial expansion, although environmental regulations in key processing hubs like China are becoming stricter, accelerating the shift towards cleaner chloride-route feedstock.

- North America: The North American market is characterized by mature, high-value demand, focusing on specialty coatings, high-performance plastics, and premium titanium metal applications, particularly for aerospace and defense. Demand is stable and highly quality-sensitive, prioritizing ultra-low impurity levels. While domestic production of mineral sands is limited compared to global giants, the region maintains substantial processing capacity for synthetic rutile and TiO2, relying heavily on reliable imports from Africa and Australia, prioritizing long-term contractual agreements and adherence to strict traceability and ESG standards for imported minerals.

- Europe: Europe represents a sophisticated, highly regulated consumer market with stringent regulatory standards (e.g., REACH), driving demand towards suppliers that comply with high environmental and social governance (ESG) criteria and lower carbon footprints. The region hosts significant TiO2 production facilities, catering primarily to the automotive, industrial coatings, and specialized packaging sectors. Focus is predominantly on the adoption of chloride-route processing where high-grade feedstock (or synthetic rutile derived from coarse ilmenite) is essential, maintaining stable, quality-driven demand and driving market preference for technologically advanced suppliers.

- Middle East and Africa (MEA): MEA is critically important as a major global sourcing hub for coarse ilmenite, accounting for a large portion of the world's mineral sands reserves. Countries like South Africa, Mozambique, and Kenya possess vast, high-quality deposits, making them essential upstream contributors to the global supply chain. The region's market dynamics are fundamentally supply-driven, with significant foreign direct investment focused on developing large-scale, efficient mining and beneficiation infrastructure. Geopolitical stability, infrastructure quality, and labor relations are key factors influencing the reliability and consistency of global supply originating from this region.

- Latin America (LATAM): LATAM remains a smaller, yet growing, demand center, tied closely to regional economic cycles, particularly in construction and automotive manufacturing (Brazil, Mexico). While the region has some mineral sand reserves, it is primarily a net importer of processed titanium feedstocks and finished TiO2 pigment. Future market growth depends on increased industrialization, stabilization of regional economies, and foreign investment in regional manufacturing capabilities, which would subsequently increase localized demand for ilmenite and its derivatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Coarse Ilmenite Market.- Tronox Holdings plc

- Iluka Resources Limited

- Kenmare Resources plc

- Base Resources Limited

- Mineral Commodities Ltd

- Rio Tinto Group

- VSRF (Vietnamese State-Owned Enterprise)

- Eramet SA

- Doral Mineral Sands Pty Ltd

- TiZir (Eramet/Tronox Joint Venture)

- Lomon Billions Group Co., Ltd.

- Indian Rare Earths Limited (IREL)

- VH Titanium Group

- Foskor (Pty) Ltd.

- Astron Corporation Limited

- China National Nuclear Corporation (CNNC)

- Richards Bay Minerals (RBM - Rio Tinto subsidiary)

- Exxaro Resources Limited

- CRH plc (indirect influence through building materials)

- P&J Resources Inc.

Frequently Asked Questions

Analyze common user questions about the Coarse Ilmenite market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for Coarse Ilmenite?

The primary driver is the robust, global demand for titanium dioxide (TiO2) pigment, which utilizes approximately 90% of mined ilmenite. Growth is directly tied to the expansion of the architectural coatings, plastics, and paper industries, particularly in rapidly urbanizing regions like Asia Pacific, where infrastructure development is accelerating.

How does Coarse Ilmenite differ from Rutile in the market?

Coarse Ilmenite (45-60% TiO2) is lower in titanium content than natural Rutile (>90% TiO2). Ilmenite requires significant, capital-intensive processing (synthetic rutile or titanium slag production) before use in the preferred chloride pigment route, whereas rutile can be used directly. Ilmenite is the primary feedstock due to its greater abundance and lower cost.

Which regions are the largest producers of Coarse Ilmenite globally?

Australia and the African continent, specifically South Africa (Richards Bay Minerals) and Mozambique (Kenmare Resources), are the dominant global sources for coarse ilmenite derived from high-quality mineral sands deposits. These regions account for the majority of globally traded raw ilmenite ore.

What is the role of environmental regulations in shaping the Ilmenite market?

Stricter environmental regulations, particularly concerning tailings management, water use, and carbon emissions from mineral processing, significantly increase operational costs. This pressure favors producers who invest in sustainable, low-impact extraction technologies and advanced waste neutralization systems, driving preference for ESG-compliant suppliers.

How is AI being utilized to optimize Coarse Ilmenite mining operations?

AI is primarily used for optimizing mineral separation circuits in real-time to maximize titanium recovery and maintain consistent product purity, thereby reducing energy consumption and waste. It is also critical in predictive maintenance systems to minimize unscheduled downtime for expensive, remote mining and processing equipment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager