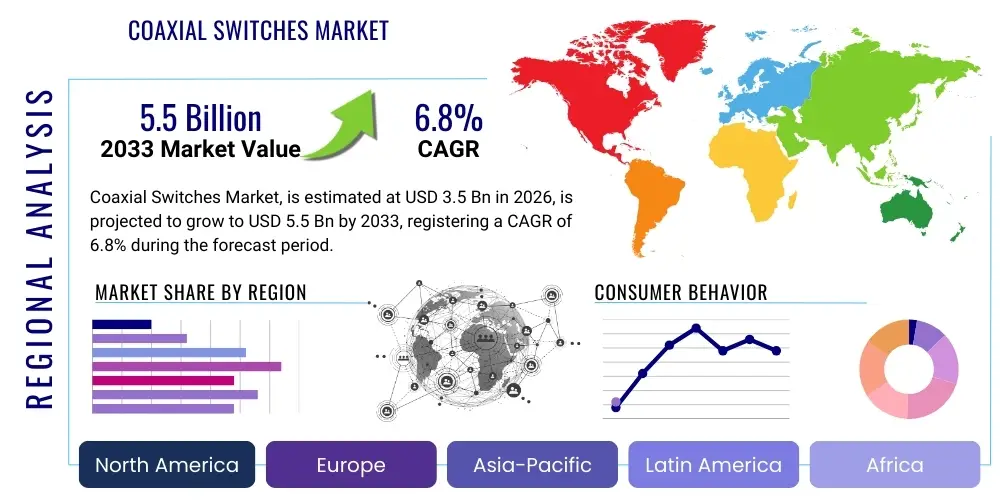

Coaxial Switches Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437835 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Coaxial Switches Market Size

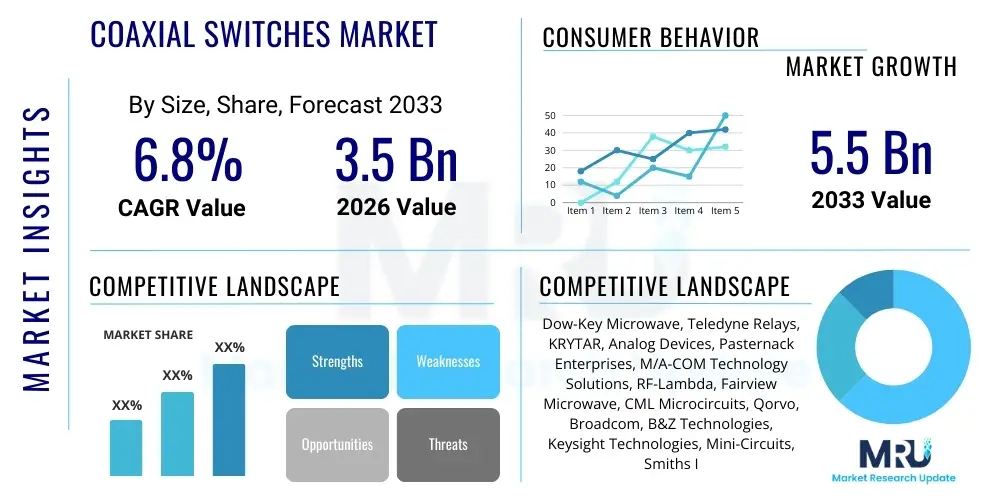

The Coaxial Switches Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.5 Billion by the end of the forecast period in 2033.

Coaxial Switches Market introduction

The Coaxial Switches Market encompasses devices crucial for directing high-frequency signals within electronic systems, primarily operating in the Radio Frequency (RF) and microwave spectra. These switches are fundamental components used for signal routing, testing, and system redundancy across various high-reliability sectors. The core product definition covers electromechanical, solid-state, and hybrid switches designed to maintain signal integrity and minimal insertion loss while handling frequencies often exceeding 50 GHz. Key attributes include high isolation, low Voltage Standing Wave Ratio (VSWR), and rapid switching speed, making them indispensable in complex communication architectures and critical defense systems where performance reliability is non-negotiable.

Major applications of coaxial switches span telecommunications infrastructure, including 5G network deployment and satellite communication systems, military and aerospace radar and electronic warfare (EW) equipment, and sophisticated automated test equipment (ATE). The inherent benefit of these devices lies in their ability to manage complex signal paths efficiently, reducing system complexity while maximizing operational flexibility. For instance, in ATE environments, they allow a single test port to connect to multiple devices under test (DUTs) or instruments, significantly accelerating throughput and reducing overall testing costs. The demand is intrinsically linked to the increasing complexity of RF systems and the continuous expansion of high-speed data transmission technologies globally.

Driving factors for sustained market growth include the global rollout of 5G and subsequent 6G research and development, which necessitate robust and high-frequency switching solutions. Furthermore, increasing defense spending on advanced radar and electronic warfare systems, especially in North America and Asia Pacific, fuels the demand for high-reliability, ruggedized switches. The continuous miniaturization of electronic devices also pushes manufacturers toward developing smaller, surface-mount, and highly integrated switch solutions that maintain superior electrical performance, adapting to the stringent requirements of modern communications and defense industries.

Coaxial Switches Market Executive Summary

The Coaxial Switches Market is experiencing robust expansion driven by significant investment in advanced communication infrastructure and defense capabilities worldwide. Business trends indicate a strong shift towards solid-state switches, favored for their rapid switching speeds and extended lifecycles, particularly in high-volume production test environments and phased array radar systems. Strategic mergers, acquisitions, and technological collaborations among market participants are common strategies employed to enhance product portfolios, especially in the millimeter-wave (mmWave) frequency range necessary for 5G backhaul and advanced sensing applications. Companies are focusing on optimizing switch design for lower power consumption and enhanced ruggedness to meet stringent operational demands across military and space applications, establishing clear competitive advantages through component reliability and specialized frequency coverage.

Regionally, North America remains the dominant market, propelled by heavy investment in defense modernization programs, advanced aerospace projects, and a well-established ecosystem of telecommunication equipment manufacturers and R&D centers. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, primarily fueled by the rapid expansion of 5G networks in China, Japan, and South Korea, coupled with significant increases in indigenous satellite communication programs and commercial electronics manufacturing. European markets maintain steady growth, driven by stringent regulatory environments mandating high-reliability components for automotive radar and air traffic control systems, emphasizing reliability and certification standards for critical infrastructure components. These regional dynamics underscore a global commitment to enhanced connectivity and security technologies, requiring high-performance signal routing components.

Segment-wise, the electromechanical switches segment, despite facing competition from solid-state alternatives, continues to hold a substantial market share, particularly for high-power, low-insertion-loss applications where mechanical integrity is necessary for optimal performance. Within the application segment, the test and measurement sector holds the largest revenue share, reflecting the escalating need for precision instruments to validate complex RF circuitry utilized in new generation wireless devices. Simultaneously, the frequency band segment covering 18 GHz to 40 GHz is witnessing accelerating growth, directly correlated with the deployment of mid-band and C-band 5G spectrum and the development of next-generation satellite payloads. Manufacturers are continually innovating to bridge performance gaps between electromechanical and solid-state technologies, aiming for the 'best of both worlds' in terms of speed, power handling, and longevity across all primary frequency bands.

AI Impact Analysis on Coaxial Switches Market

User queries regarding the impact of Artificial Intelligence (AI) on the Coaxial Switches Market frequently center on automation, predictive maintenance, and the role of AI in optimizing complex RF system architectures. Key themes revolve around how AI can enhance the performance verification process in Automated Test Equipment (ATE), reducing testing cycles and improving diagnostic capabilities for switch failures. Users are also concerned about whether AI-driven software-defined radios (SDRs) might partially replace traditional hardware switching by intelligently managing signal flow dynamically. The general expectation is that AI will not fundamentally replace the hardware components but rather become an indispensable layer for system management, configuration optimization, and ensuring long-term operational reliability through predictive diagnostics and adaptive signal routing algorithms in extremely dense and high-frequency environments.

The direct impact of AI implementation is most evident in sophisticated automated testing environments, where AI algorithms are utilized to optimize test sequencing and rapidly identify anomalous behavior in coaxial switches, thereby increasing the efficiency of quality assurance processes. Furthermore, the integration of AI in cognitive radio systems and adaptive beamforming technologies, especially in defense and advanced satellite communications, requires extremely fast and intelligent reconfiguration of signal paths, often leveraging high-speed solid-state switches. AI facilitates the decision-making process for when and how to switch signals based on real-time environmental factors, spectral congestion, or communication priority, demanding higher performance specifications and guaranteed reliability from the underlying coaxial switch hardware, thus driving innovation in switch controller interfaces and response times.

Ultimately, AI adoption contributes significantly to the demand for higher-performance coaxial switches by increasing the overall complexity and responsiveness required of the RF front-end. Systems utilizing AI must be able to adapt instantaneously, requiring switches with extremely high reliability, minimal latency, and consistent performance across wide bandwidths. This translates into stringent design requirements for manufacturers, focusing on embedded monitoring capabilities and interfaces that can seamlessly communicate status and diagnostic data to the overarching AI control system. Therefore, AI acts as a performance accelerator, pushing the limits of current coaxial switch technology rather than serving as a disruptive replacement for the physical hardware components themselves.

- AI optimizes automated test equipment (ATE) sequences involving multiple coaxial switches, reducing test time by up to 30%.

- Predictive maintenance algorithms use operational data from switches to forecast potential failures, maximizing system uptime, especially in critical aerospace applications.

- AI-driven cognitive radio systems require ultra-fast, high-isolation coaxial switches for instantaneous frequency hopping and dynamic spectrum allocation.

- Complex system health monitoring in defense platforms integrates AI to manage and optimize signal routing through redundant coaxial switch matrices.

- AI enhances the characterization and calibration processes of new switch designs, ensuring optimal performance across varying environmental conditions.

DRO & Impact Forces Of Coaxial Switches Market

The Coaxial Switches Market is significantly influenced by a confluence of accelerating market drivers and intrinsic structural restraints, balanced by emergent technological opportunities, all contributing to the overall market impact forces. A primary driver is the pervasive global deployment of 5G and ongoing development of 6G communication standards, which mandates high-performance switches capable of operating reliably at millimeter-wave frequencies. Restraints include the inherent limitations of mechanical switches, specifically their finite lifecycle and slower switching speeds compared to solid-state alternatives, alongside intense price competition, particularly for lower-frequency, standard-performance components used in consumer electronics testing. Opportunities are abundant in the form of developing micro-electromechanical systems (MEMS) switches, which promise to combine the low insertion loss of mechanical switches with the speed and miniaturization of solid-state devices, potentially revolutionizing the market structure and application scope. These opposing forces—technology acceleration versus cost and physical limits—define the competitive landscape and guide strategic investment decisions across the value chain, focusing heavily on enhancing longevity and frequency handling capabilities.

Impact forces on the market stem heavily from the stringent regulatory requirements and long design cycles associated with high-reliability sectors such as defense, aerospace, and medical devices. The necessity for switches to withstand extreme temperatures, vibrations, and radiation environments in space or military applications significantly increases R&D costs and time to market, acting as a natural barrier to entry for smaller players. Conversely, the massive volume and standardization required by the telecommunications industry, particularly for massive Multiple-Input Multiple-Output (MIMO) antenna systems and base station testing, exert downward pressure on unit costs while demanding consistent quality and swift supply chain responsiveness. This dual pressure—high specialization for niche markets and high volume for commercial markets—forces manufacturers to maintain diverse product lines and manufacturing capabilities, optimizing for either ruggedization or cost efficiency depending on the target end-user application.

The market also faces an opportunity driven by the continuous advancement in automated testing and measurement (ATE) systems, where the increasing complexity of devices under test (DUTs)—incorporating Wi-Fi 6/7, UWB, and advanced cellular standards—requires highly integrated and scalable switch matrices. This application area provides continuous growth and high-margin opportunities, as ATE components must lead the performance curve to validate emerging technologies. However, the reliance on specialized semiconductor materials for solid-state switches, such as Gallium Arsenide (GaAs) and Gallium Nitride (GaN), introduces supply chain vulnerabilities and pricing volatility, posing a critical restraint. Overall, the dominant impact force remains technological evolution; manufacturers who successfully innovate in material science, packaging, and integration—particularly in the mmWave spectrum—will secure long-term leadership positions, mitigating the impact of mechanical limitations and capitalizing on the burgeoning demand for high-speed connectivity components.

Segmentation Analysis

The Coaxial Switches Market is highly diversified and segmented primarily based on the actuation mechanism, frequency band, application area, and end-user industry. The fundamental segmentation lies in the technology employed, distinguishing between electromechanical switches, which offer superior power handling and low insertion loss but have limited lifecycles, and solid-state switches, which provide infinite mechanical life, rapid switching speeds, and are ideal for high-volume, repetitive switching tasks. Further differentiation is achieved by classifying products based on their operational frequency, ranging from DC to extremely high frequencies (EHF, over 40 GHz), reflecting their suitability for diverse communication and radar systems. The granularity of these segments allows both manufacturers and consumers to precisely match component specifications to demanding system requirements, ensuring optimal signal integrity across the entire RF chain.

Application segmentation is crucial, with the Test & Measurement (T&M) sector being the largest consumer, utilizing switches for high-precision validation of electronic devices and components. Defense & Aerospace requires extremely ruggedized, high-reliability switches compliant with military standards (MIL-SPEC) for radar, electronic warfare, and mission-critical communications. Telecommunications drives volume demand, particularly for infrastructure components in base stations and network monitoring systems. The end-user analysis further refines this view, separating government agencies, commercial organizations, and research institutions, each possessing unique purchasing dynamics, volume needs, and performance expectations. The interplay between these segments determines pricing strategies, production volumes, and the necessity for specialized certifications, making a comprehensive segmentation analysis vital for market penetration and strategic planning.

- Technology Type:

- Electromechanical Coaxial Switches (Latching, Non-Latching, Failsafe)

- Solid-State Coaxial Switches (PIN Diode, FET/HEMT, MMIC)

- Micro-Electromechanical Systems (MEMS) Switches

- Frequency Band:

- DC to 6 GHz (Lower Frequency Applications)

- 6 GHz to 18 GHz (C-Band, Ku-Band)

- 18 GHz to 40 GHz (K-Band, Ka-Band, Q-Band)

- Above 40 GHz (Millimeter Wave/EHF)

- Switch Configuration:

- Single-Pole Single-Throw (SPST)

- Single-Pole Double-Throw (SPDT)

- Single-Pole Multi-Throw (SPnT)

- Transfer Switches (DPDT)

- Switch Matrices

- Application:

- Test and Measurement (ATE, Benchtop Instruments)

- Telecommunications Infrastructure (Base Stations, 5G/6G)

- Defense and Aerospace (Radar, EW, Satellite Communications)

- Industrial and Medical

- End-User:

- Commercial Entities

- Government and Military

- Academic and Research Institutions

Value Chain Analysis For Coaxial Switches Market

The value chain for the Coaxial Switches Market begins with upstream activities focused on the procurement and preparation of specialized raw materials, primarily including high-quality metals (such as beryllium copper and brass for contacts and housings), low-loss dielectric materials (like PTFE and ceramics), and specialized semiconductor substrates (such as GaAs and GaN for solid-state components). Upstream suppliers are crucial as the electrical performance of the final product is highly dependent on the precision and quality of these foundational materials. The manufacturing phase involves complex high-precision machining for electromechanical switches and advanced semiconductor fabrication (wafer processing, packaging) for solid-state devices. Expertise in RF modeling, simulation, and high-frequency soldering techniques is required during assembly, calibration, and rigorous testing, ensuring that the switches meet stringent insertion loss and isolation specifications, often requiring highly skilled labor and proprietary processes.

Downstream activities center on distribution, integration, and final deployment. The distribution channel is bifurcated into direct sales for large volume or highly specialized military contracts and indirect channels involving authorized distributors, value-added resellers (VARs), and dedicated online component marketplaces. Direct distribution is favored when complex technical consultations or customized product integration support is required, particularly for aerospace and large-scale ATE systems where direct technical collaboration between the switch manufacturer and the system integrator is essential for system optimization. Indirect channels, typically through broad-line electronic component distributors, are primarily used for standard, high-volume products sold to smaller OEMs or for maintenance, repair, and overhaul (MRO) purposes, capitalizing on the distributors' established logistics networks and extensive customer bases.

The flow within the value chain is increasingly influenced by the requirement for rapid prototyping and shorter lead times, especially in the competitive telecommunications sector. System integrators, who are the immediate downstream consumers, leverage coaxial switches to build large RF switch matrices for network optimization or high-throughput test systems. The interaction between manufacturers and end-users often includes extensive post-sales technical support and calibration services, particularly for mission-critical applications. This emphasis on service and technical partnership highlights the shift from merely component sales to integrated solution provisioning, solidifying the importance of strong relationships across the distribution and integration phases of the value chain to maintain system longevity and reliable operation.

Coaxial Switches Market Potential Customers

The primary end-users and potential customers of coaxial switches are categorized based on their technical complexity and criticality of application, spanning multiple high-technology sectors. Major customers include aerospace and defense contractors, such as Lockheed Martin, Raytheon Technologies, and Northrop Grumman, who require ruggedized, MIL-SPEC compliant switches for integration into advanced radar systems, electronic warfare platforms, and satellite communication payloads where failure is not an option. These entities demand switches capable of operating reliably in harsh environments and often require custom designs with specialized certifications, leading to high-value, long-term contracts for niche suppliers focused on resilience and performance consistency under extreme conditions.

Another significant customer segment is composed of manufacturers of Automated Test Equipment (ATE), including companies like Keysight Technologies, Rohde & Schwarz, and National Instruments. These customers purchase coaxial switches in high volumes, integrating them into complex switch matrices used for rapidly testing consumer electronics (smartphones, Wi-Fi modules, IoT devices) and automotive radar sensors during manufacturing. For this segment, the emphasis is placed on switching speed, high cycle life (often favoring solid-state technology), and seamless integration with complex software control systems, as efficiency and throughput directly translate into cost savings for the mass production lines relying on their equipment.

Finally, global telecommunication service providers and equipment manufacturers, such as Ericsson, Nokia, Huawei, and various internet satellite operators, represent a continually growing customer base. They utilize coaxial switches extensively in base station architectures, network monitoring systems, and ground stations for satellite communication links. The transition to 5G and the rollout of large constellations of low earth orbit (LEO) satellites have massively increased the demand for high-frequency, reliable switching components to manage complex signal routing and redundancy. These end-users prioritize high isolation, low insertion loss at critical 5G frequency bands, and scalable solutions that can be deployed rapidly across vast geographical areas to maintain network performance and uptime.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dow-Key Microwave, Teledyne Relays, KRYTAR, Analog Devices, Pasternack Enterprises, M/A-COM Technology Solutions, RF-Lambda, Fairview Microwave, CML Microcircuits, Qorvo, Broadcom, B&Z Technologies, Keysight Technologies, Mini-Circuits, Smiths Interconnect, ATM Microwave, JFW Industries, Ducommun, Menlo Micro, Planar Monolithics Industries (PMI) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Coaxial Switches Market Key Technology Landscape

The Coaxial Switches Market technology landscape is characterized by a mature foundation in electromechanical actuation being rapidly challenged by emerging solid-state and Micro-Electromechanical Systems (MEMS) technologies. Electromechanical switches rely on physical movement of contacts to establish or break RF connections, offering high linearity and superior power handling, typically utilizing materials optimized for minimal signal loss, such as gold-plated contacts and high-precision ceramic insulators. Recent innovations in electromechanical designs focus on enhancing longevity by employing advanced magnetic actuation mechanisms and utilizing non-contact switching approaches (e.g., magnetically levitated contacts) to achieve millions of cycles, thereby extending their viability in demanding ATE applications while retaining their inherent advantages in minimizing insertion loss at high frequencies, which remains a key performance metric for RF system architects.

Solid-state switches, predominantly based on semiconductor technologies like Gallium Arsenide (GaAs), Gallium Nitride (GaN), and Silicon-on-Insulator (SOI), represent the fastest-growing segment due to their microsecond switching speeds and virtually infinite operational lifespan. GaN-based switches are particularly disruptive, offering significantly higher power handling capabilities compared to traditional GaAs PIN diode switches, making them increasingly suitable for high-power radar and transmit/receive module applications that previously required large mechanical devices. The integration of solid-state switches into Monolithic Microwave Integrated Circuits (MMICs) allows for highly miniaturized, low-cost switching matrices, crucial for phased array antennas and high-density, multi-channel ATE systems. This integration minimizes the physical footprint and reduces parasitic effects, which is essential for maintaining signal integrity in millimeter-wave systems.

The most promising breakthrough lies in MEMS switch technology, which aims to combine the best features of both domains: the extremely low insertion loss and high linearity of mechanical switches with the miniaturization and long cycle life (though not infinite) of solid-state devices. MEMS switches utilize micro-scale mechanical elements fabricated using semiconductor processing techniques, resulting in switches orders of magnitude smaller than traditional electromechanical counterparts. While currently facing challenges regarding power handling capacity and packaging robustness, ongoing research focuses on improving these limitations through specialized hermetic sealing and advanced actuation methods (electrostatic, thermal). Successful commercialization and scaling of robust MEMS switches are expected to fundamentally reshape the market, potentially displacing both traditional mechanical and certain solid-state applications, especially in portable, low-power, and high-frequency communication modules where space and power efficiency are critical constraints.

Regional Highlights

Regional dynamics heavily influence the demand, technology adoption, and competitive landscape of the Coaxial Switches Market, reflecting geopolitical spending priorities and technological infrastructure maturity.

- North America: Dominates the global market share due to substantial and sustained defense spending on advanced radar, electronic warfare systems, and aerospace platforms, particularly driven by U.S. government contracts. The region also hosts the world's leading ATE manufacturers and major telecom innovators, creating consistent demand for high-end, high-frequency, and military-grade components. Investment in space-based systems and the early adoption of 5G/6G research further solidify its leading position, emphasizing high-reliability, low-latency, and customized switch solutions.

- Asia Pacific (APAC): Exhibits the highest CAGR, primarily fueled by massive infrastructure investment in 5G network rollout across China, South Korea, and Japan, driving demand for high-volume, cost-effective switches for base stations and related testing. Rapid growth in indigenous defense modernization programs (especially in India and China) and the booming commercial electronics manufacturing sector contribute significantly. APAC manufacturers are increasingly focused on mastering MMIC and solid-state switch fabrication to secure competitive advantages in the high-volume telecom component segment, though they often rely on imported technology for specialized, extreme-frequency defense applications.

- Europe: Represents a mature market characterized by stringent industry standards, particularly in the automotive (radar systems), industrial automation, and air traffic control sectors. Demand is steady, focusing on certified, high-quality switches for critical infrastructure and defense cooperation programs (e.g., NATO). Key drivers include collaborative defense projects and established European telecommunications research, though the volume growth is generally slower compared to the accelerated pace observed in APAC.

- Middle East and Africa (MEA): Growth is primarily concentrated in the defense sector, driven by geopolitical instability and significant military modernization efforts in countries like Saudi Arabia and the UAE, necessitating high-performance radar and communication systems. The telecommunications segment is also expanding with increasing mobile penetration and fiber optic network expansion, although the overall market size remains comparatively smaller, with demand focused on high-reliability, long-lifecycle equipment suitable for challenging climatic conditions.

- Latin America: This region maintains nascent growth, mostly driven by necessary upgrades to existing telecommunication infrastructure and modest defense expenditures. Market activity is generally characterized by reliance on imported finished products and systems, with limited indigenous manufacturing or R&D capability in high-frequency switch technology, making cost-effectiveness a key purchasing criterion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Coaxial Switches Market.- Dow-Key Microwave

- Teledyne Relays (A Teledyne Technologies Company)

- Smiths Interconnect

- KRYTAR

- Analog Devices, Inc. (ADI)

- Qorvo, Inc.

- M/A-COM Technology Solutions (A part of MACOM)

- Mini-Circuits

- Pasternack Enterprises (A brand of Infinite Electronics)

- Fairview Microwave (A brand of Infinite Electronics)

- Keysight Technologies

- Rohde & Schwarz GmbH & Co. KG

- JFW Industries

- Ducommun Incorporated

- ATM Microwave

- B&Z Technologies

- CML Microcircuits

- Planar Monolithics Industries (PMI)

- Broadcom Inc.

- Menlo Micro

Frequently Asked Questions

Analyze common user questions about the Coaxial Switches market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between electromechanical and solid-state coaxial switches?

Electromechanical switches physically move contacts to route signals, offering superior linearity and power handling but limited operational lifespan. Solid-state switches use semiconductor materials (like PIN diodes or FETs) to achieve signal routing, providing virtually infinite life and microsecond switching speeds, ideal for high-volume ATE applications, though they typically handle lower power than mechanical switches.

How is 5G technology influencing the demand for coaxial switches?

5G necessitates coaxial switches capable of operating reliably at much higher frequencies, particularly in the 6 GHz to 40 GHz range (mmWave). This transition drives the demand for high-performance, low-loss solid-state switches and ruggedized electromechanical components essential for base station infrastructure, active antenna systems (AAS), and high-precision testing of 5G components and devices.

Which application segment holds the largest market share in the Coaxial Switches Market?

The Test and Measurement (T&M) application segment currently holds the largest revenue share. This is due to the increasing complexity of modern electronic devices (Wi-Fi 7, UWB, advanced cellular) requiring sophisticated, automated test setups and large switch matrices to validate performance and ensure compliance during high-volume manufacturing processes.

What are the key technical specifications critical for aerospace and defense coaxial switches?

Switches for aerospace and defense must meet stringent MIL-SPEC standards. Key requirements include high isolation, low insertion loss, exceptional reliability across extreme temperature and vibration ranges, high radiation tolerance (for space applications), and resistance to harsh environmental conditions to ensure mission-critical communications and radar functionality.

What is the anticipated impact of MEMS technology on the Coaxial Switches Market?

MEMS technology is anticipated to be highly disruptive, offering switches with the low insertion loss of mechanical components combined with the miniaturization and faster switching speed typical of solid-state devices. Once manufacturing robustness and high-power handling limitations are overcome, MEMS switches are expected to capture significant market share in portable, low-power, and high-frequency applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager