Cocamine Oxide Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435784 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Cocamine Oxide Market Size

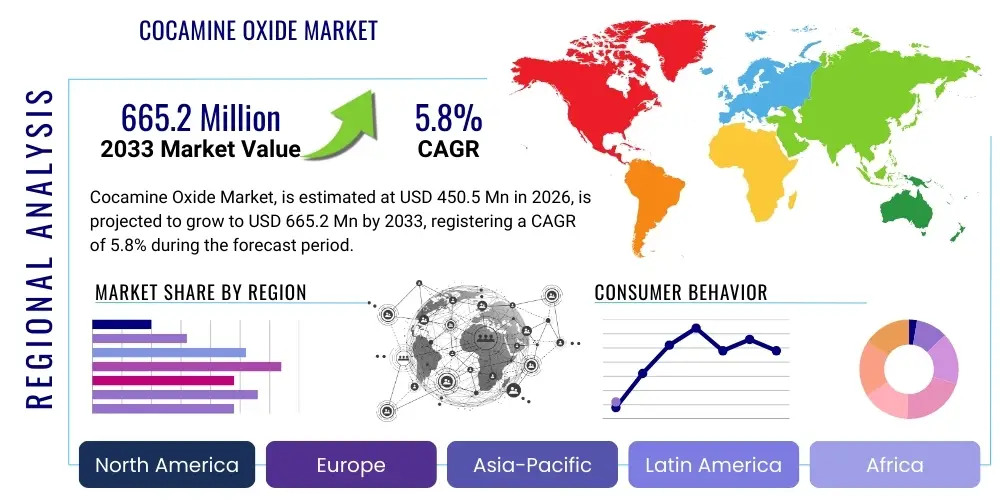

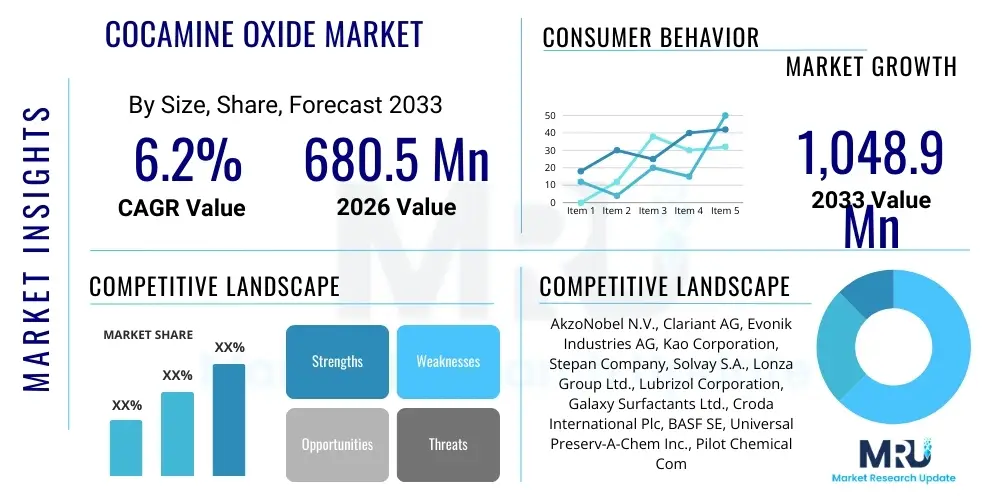

The Cocamine Oxide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 665.2 Million by the end of the forecast period in 2033.

Cocamine Oxide Market introduction

The Cocamine Oxide Market encompasses the production and distribution of cocamidopropylamine oxide (CAPO), a specialized, mild non-ionic/amphoteric surfactant derived from coconut oil fatty acids. This chemical compound is essential in formulating personal care products and household cleaning agents due to its outstanding foaming properties, mildness, and ability to act as a viscosity builder and foam stabilizer. It offers superior performance compared to traditional sulfates, aligning with the increasing consumer demand for gentle, skin-friendly ingredients.

Cocamine Oxide serves dual roles in various formulations. In shampoos and body washes, it enhances lather quality and provides conditioning effects, mitigating the harshness of anionic surfactants. In household detergents and dishwashing liquids, it significantly improves grease cutting efficiency and stabilizes the foam structure under various water hardness conditions. The increasing shift toward sulfate-free and naturally derived ingredients, especially across North America and Europe, acts as a primary driving factor, positioning Cocamine Oxide as a crucial component for manufacturers seeking green and effective alternatives.

Major applications of Cocamine Oxide span across multiple sectors, including cosmetics, textile processing, oilfield chemicals, and industrial cleaning. Its high tolerance to electrolytes and pH variations makes it a versatile chemical intermediate. Furthermore, the inherent biodegradability of Cocamine Oxide, stemming from its natural coconut oil base, meets stringent global environmental regulations, thereby supporting market expansion, particularly in regions prioritizing sustainable chemical practices and biosurfactant adoption.

Cocamine Oxide Market Executive Summary

The global Cocamine Oxide market is currently characterized by robust growth, primarily fueled by significant business trends such as the increasing demand for high-performance, mild surfactants in the Fast-Moving Consumer Goods (FMCG) sector, coupled with heightened regulatory pressure favoring biodegradable ingredients. Key manufacturers are focusing heavily on vertical integration, securing stable coconut oil sources to mitigate raw material price volatility, and innovating formulations to improve the active matter concentration and reduce production costs. Strategic mergers and acquisitions are observed among medium-sized players aiming to consolidate regional market presence and expand technological capabilities in mild surfactant synthesis.

Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market, driven by rapid urbanization, increasing disposable incomes, and the corresponding expansion of the personal care and household cleaning industries in countries like China and India. North America and Europe, while mature, exhibit high growth in premium and specialized segments, particularly those focusing on 'natural' or 'clean label' products, dictating the trend towards high-purity, bio-based Cocamine Oxide. Conversely, Latin America and the Middle East & Africa (MEA) are emerging markets, showing consistent uptake as international personal care brands expand their footprint.

Segmentation trends indicate that the Personal Care application segment holds the largest market share, emphasizing its use in specialized baby care products and sensitive skin formulations where mildness is paramount. By type, the higher active matter concentration (e.g., 35% Active Cocamine Oxide) segment is gaining traction due to operational efficiencies it provides to end-use manufacturers. Furthermore, within the function segment, its role as a key foam booster and viscosity modifier remains critical, driving product development focused on optimizing rheological properties in liquid formulations.

AI Impact Analysis on Cocamine Oxide Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Cocamine Oxide market commonly revolve around supply chain optimization, sustainable sourcing, predictive formulation development, and enhanced quality control. Consumers and industry stakeholders are concerned with how AI can mitigate the volatility associated with coconut oil pricing and availability, a persistent challenge in this market. Furthermore, there is significant interest in utilizing machine learning algorithms to predict the optimal blend ratios of Cocamine Oxide with other surfactants to achieve specific performance metrics (e.g., foam height, stability, and mildness) for targeted consumer applications, thereby accelerating the R&D cycle and reducing material waste during scale-up phases. The integration of AI-driven analytical tools is also expected to revolutionize real-time monitoring of synthesis parameters, ensuring high purity and regulatory compliance in production processes.

The implementation of AI systems promises to bring radical efficiency improvements across the entire value chain. In the sourcing phase, predictive analytics can forecast weather patterns and harvest yields in key coconut-producing regions, enabling manufacturers to negotiate better procurement contracts and maintain buffer stocks. Within manufacturing, AI-powered systems facilitate advanced process control, analyzing vast datasets from reactors to optimize reaction kinetics for cocamine oxide synthesis, leading to higher conversion rates and reduced energy consumption. This capability ensures that high-quality, consistent batches are produced, which is crucial for sensitive end-use applications like ophthalmic and baby care products.

Looking ahead, AI will fundamentally reshape competitive dynamics. Companies adopting generative AI for novel surfactant design might identify entirely new chemical structures that surpass Cocamine Oxide’s performance while maintaining similar biodegradability profiles. For Cocamine Oxide producers specifically, AI enhances their ability to offer highly customized solutions, tailoring surfactant concentrations and purity levels to meet the precise specifications of major FMCG clients. This shift from mass production to personalized chemical manufacturing is essential for maintaining market relevance in a rapidly evolving, consumer-driven chemical landscape.

- AI-driven Predictive Sourcing: Optimizing coconut oil procurement based on supply chain risk prediction and climate models.

- Automated Formulation Design: Machine learning algorithms predicting optimal surfactant blends for specific mildness and foam characteristics.

- Process Optimization: Real-time monitoring and control of amination and oxidation reactions to maximize yield and purity.

- Enhanced Quality Assurance (QA): Computer vision and sensor data analysis for identifying and isolating off-spec batches instantly.

- Sustainability Modeling: Using AI to simulate the environmental impact of various synthesis routes and ingredient combinations.

DRO & Impact Forces Of Cocamine Oxide Market

The Cocamine Oxide market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the Impact Forces that shape its trajectory. A primary driver is the accelerating consumer preference for naturally derived and mild ingredients, especially in the high-growth personal care segment, where Cocamine Oxide’s non-irritating nature makes it a crucial substitute for harsh sulfate-based surfactants. Simultaneously, the global regulatory environment, particularly in the European Union and North America, increasingly mandates the use of readily biodegradable and low-toxicity chemicals, strongly favoring Cocamine Oxide over petrochemical derivatives.

However, the market faces significant Restraints, most notably the high volatility and unpredictable pricing of key raw materials, primarily coconut oil. Geopolitical factors, climate change impacts on coconut harvests, and complex extraction processes contribute to supply chain instability, pressuring profit margins for manufacturers. Furthermore, the availability of alternative amphoteric and non-ionic surfactants, such as lauramine oxide and various alkyl polyglucosides (APGs), poses a competitive threat, forcing continuous innovation in synthesis efficiency and product purity to maintain market differentiation and cost-effectiveness.

Opportunities for growth are abundant, centered on product innovation and geographic expansion. The development of high-concentration, cold-processable Cocamine Oxide products reduces the energy consumption for end-users and simplifies formulation processes. Furthermore, there is a substantial untapped potential in industrial applications, particularly in enhanced oil recovery (EOR) and specialized metal cleaning where its unique emulsifying and wetting properties offer performance advantages. Penetration into emerging markets in Southeast Asia and Africa, where the household cleaning sector is rapidly formalizing, presents significant avenues for future expansion and market share capture, leveraging localized supply chains where feasible.

Segmentation Analysis

The Cocamine Oxide market is segmented comprehensively based on Active Matter Concentration (Type), End-Use Application, and Functional Role within the formulation. Analyzing these segments provides strategic insights into key demand vectors and areas of high growth potential. The Type segmentation reveals that while the standard 30% active concentration remains popular due to cost-effectiveness, the trend is moving towards higher active content (35% and above), driven by manufacturers seeking reduced transportation costs and simplified formulation procedures. These concentrated forms allow for more efficient use of warehouse space and reduced packaging waste, appealing to sustainability targets.

Application analysis highlights the dominance of the Personal Care sector, encompassing shampoos, body washes, liquid soaps, and baby products, which prioritize the surfactant's mildness and conditioning properties. The Household Detergent segment, including dishwashing liquids and laundry formulations, represents a stable and high-volume demand stream, relying on Cocamine Oxide for its foam stability and detergency synergy. The specialized Industrial & Institutional (I&I) Cleaning segment, though smaller in volume, demands highly technical specifications, often requiring customized Cocamine Oxide variants for specialized sanitizers and heavy-duty degreasers, offering higher profit margins.

Functionally, Cocamine Oxide excels as a versatile ingredient. Its primary roles as a Foaming Agent and Foam Stabilizer are critical for consumer acceptance across all segments, as foam quality is often correlated with perceived cleaning power. Simultaneously, its properties as a Viscosity Builder are essential for achieving the desired rheology and luxurious feel in cosmetic products. Lastly, its Emulsifier function is key in agrochemicals and certain I&I applications, helping to blend water-insoluble ingredients effectively, showcasing its broad spectrum of chemical utility beyond simple cleaning.

- By Active Matter Concentration (Type)

- 30% Active Cocamine Oxide

- 35% Active Cocamine Oxide

- Other Concentrations (e.g., 40% and custom dilutions)

- By Application

- Personal Care (Shampoos, Body Washes, Conditioners, Baby Care)

- Household Detergents (Dishwashing Liquids, Laundry Detergents, Surface Cleaners)

- Industrial & Institutional (I&I) Cleaning

- Agrochemicals

- Oilfield Chemicals

- By Function

- Foaming Agent

- Foam Stabilizer

- Viscosity Builder

- Emulsifier and Solubilizer

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Cocamine Oxide Market

The value chain for the Cocamine Oxide market begins with the Upstream Analysis, which focuses primarily on the sourcing and processing of raw materials. The foundation is lauric acid, derived overwhelmingly from coconut oil or, less commonly, palm kernel oil. Given the reliance on agricultural commodities, raw material procurement is the most vulnerable point in the chain, subject to climate and geopolitical risks. Coconut oil processing involves crushing and refining to isolate the fatty acid fractions, which are then converted into cocamines via amination with dimethylamine. Strategic manufacturers often maintain long-term contracts or invest in plantations to stabilize input costs and ensure quality control from the source.

The Midstream component involves the chemical synthesis stage where cocamines are oxidized (typically using hydrogen peroxide) to produce the final Cocamine Oxide product. This stage requires significant capital investment in specialized reaction vessels, precise temperature control, and purification techniques to meet the strict purity standards demanded by the personal care sector. Efficiency in this stage, particularly in managing the oxidation reaction to achieve high yields and low residual unreacted materials, is key to competitive advantage. Specialized producers often focus on proprietary catalyst systems or reaction conditions to offer differentiated products, such as those with extremely low free amine content.

Downstream Analysis covers the distribution channels and end-user consumption. Cocamine Oxide is typically sold in bulk liquid form or concentrated pastes. Distribution primarily utilizes specialty chemical distributors who manage warehousing, regulatory documentation, and regional delivery, providing logistical support to FMCG manufacturers. Direct sales channels are maintained for large-volume customers like multinational personal care corporations (e.g., Procter & Gamble, Unilever), ensuring technical support and tailored supply agreements. The final step involves the incorporation of Cocamine Oxide into consumer products (shampoos, detergents), where marketing strategies heavily emphasize its mildness and natural origins to appeal directly to the consumer, completing the value cycle.

Cocamine Oxide Market Potential Customers

The primary End-Users and Buyers of Cocamine Oxide are large-scale manufacturers operating within the Fast-Moving Consumer Goods (FMCG) sector, particularly those specializing in surface-active formulations. The largest segment of buyers comprises multinational and regional personal care product companies that require high-purity, mild surfactants for premium and sensitive product lines, including baby shampoos, tear-free formulations, and sulfate-free body washes. These customers prioritize consistent quality, supply reliability, and compliance with stringent cosmetic ingredient standards, often demanding certifications related to natural origin and sustainability.

A secondary, high-volume customer base exists in the Household and Laundry Care manufacturing industries. These buyers integrate Cocamine Oxide into formulations such as manual dishwashing liquids, heavy-duty liquid detergents, and specialized cleaning sprays where its foam stabilization and grease-cutting synergy with anionic surfactants are essential. This segment is highly price-sensitive but demands large, continuous supply volumes. Furthermore, industrial purchasers, including specialized chemical blenders for I&I cleaning and companies involved in niche applications such as textile auxiliary chemicals, mining flotation, and oilfield demulsification, represent valuable, albeit smaller, segments requiring highly technical product grades.

Beyond traditional cleaning sectors, emerging potential customers include formulators in the agricultural industry, utilizing Cocamine Oxide as an inert ingredient in pesticide formulations for improved wetting and spreading properties, thereby enhancing the efficacy of crop protection products. Pharmaceutical and nutraceutical companies also represent a niche market, requiring extremely high-purity grades for use as excipients or solubilizers in specific topical or oral drug formulations, demanding the highest level of regulatory documentation and batch traceability from the Cocamine Oxide suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 665.2 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AkzoNobel (Nouryon), Clariant, Evonik Industries, Kao Corporation, Stepan Company, Solvay, BASF SE, Croda International, Galaxy Surfactants, Huntsman Corporation, Pilot Chemical, Kemin Industries, Sino-Japan Chemical, Enaspol, Shanghai Fine Chemical, Zhejiang Xinhu Chem, Newroad Chemical, Colonial Chemical, Lubrizol, Innospec |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cocamine Oxide Market Key Technology Landscape

The production of Cocamine Oxide involves highly specialized chemical processing centered around the amination and subsequent oxidation of fatty acids derived from coconut oil. The primary technology utilized is the modified etherification process, where lauric acid, or a blend of fatty acids, is reacted with dimethylamine to form tertiary cocamines. Following this, the tertiary amine is subjected to an oxidation reaction, typically using hydrogen peroxide as the oxidizing agent, under controlled temperature and pressure to ensure maximum conversion and minimal impurity formation. Technological advancements in this area focus on developing continuous flow reactors as opposed to traditional batch processing, which enhances scalability, improves energy efficiency, and ensures tighter control over product consistency, particularly concerning free amine content.

A critical technological thrust in the modern Cocamine Oxide landscape is the development of bio-catalytic routes and solvent-free synthesis methods. While traditional methods rely on high temperatures and sometimes strong base catalysts, innovative green chemistry approaches are being explored to produce Cocamine Oxide with a significantly lower environmental footprint. This includes research into utilizing immobilized enzymes (lipases) for the initial esterification step or exploring novel, milder oxidizing agents that reduce waste byproducts. Such technologies not only align with global sustainability mandates but also result in a higher-purity end product, which commands a premium in the sensitive personal care market, minimizing the need for extensive post-reaction purification steps.

Furthermore, technology related to analytical quality control is becoming increasingly sophisticated. Leading manufacturers employ advanced spectroscopic techniques (such as Fourier-Transform Infrared Spectroscopy - FTIR) and high-performance liquid chromatography (HPLC) to monitor trace impurities, including residual hydrogen peroxide and unreacted amines, in real-time. This stringent quality assurance technology ensures compliance with global pharmacopeial standards and cosmetic directives. The implementation of IoT sensors and digital twin technology within the production facilities allows for predictive maintenance and real-time process adjustments, further optimizing yield and reducing downtime, thereby maintaining a competitive edge through operational excellence and unparalleled product safety profiles.

Regional Highlights

The geographical analysis of the Cocamine Oxide market reveals distinct growth patterns influenced by regulatory landscapes, consumer preferences, and industrial maturity across major regions. The Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate, driven by the massive scale of its population and the resulting expansion of the middle class in economies like China, India, and Southeast Asian nations. The region benefits from lower manufacturing costs and serves as a major hub for both raw material sourcing (coconut oil) and finished goods manufacturing for both domestic consumption and global export. Rapid modernization of household and personal hygiene standards ensures sustained high-volume demand.

North America and Europe represent mature markets characterized by high per-capita consumption of personal care products, but growth here is focused on value rather than volume. These regions lead the trend toward "clean beauty" and "natural ingredient" formulations. Strict European Union regulations regarding chemical safety and biodegradability have firmly entrenched Cocamine Oxide as a preferred, compliant mild surfactant. Market expansion in these regions is primarily achieved through premiumization, where specialty grades of Cocamine Oxide (e.g., COSMOS certified, RSPO certified) are utilized in high-end cosmetic lines, commanding higher prices and margins.

Latin America (LATAM) and the Middle East & Africa (MEA) are characterized by strong potential and dynamic local competition. In LATAM, growing industrialization and the influx of global FMCG brands are accelerating the transition from traditional, harsh cleaning agents to modern, milder surfactants like Cocamine Oxide, particularly in Brazil and Mexico. The MEA region, specifically the Gulf Cooperation Council (GCC) countries, shows increasing demand supported by high consumer spending on personal grooming products and the development of local manufacturing capabilities aiming to reduce reliance on imports, positioning these regions as critical long-term investment targets for global Cocamine Oxide suppliers.

- Asia Pacific (APAC): Dominates manufacturing and demand volume, fueled by expanding cosmetic and detergent industries in China, India, and Indonesia. High growth rate due to rising hygiene awareness and disposable income.

- North America: Market driver for premium, sulfate-free, and natural/bio-based Cocamine Oxide, heavily influenced by consumer wellness trends and strict regulatory compliance standards.

- Europe: Characterized by high environmental standards (REACH) and strong preference for biodegradable surfactants; focus on certified sustainable sourcing (RSPO) and high-quality specialty grades.

- Latin America: Emerging market with strong adoption in household cleaning and personal care sectors, driven by rapid urbanization and the formalization of consumer goods markets.

- Middle East and Africa (MEA): Growth stimulated by local industrial development, increased consumption of branded personal care products, and expanding I&I cleaning applications, particularly in the healthcare and hospitality sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cocamine Oxide Market.- AkzoNobel (Nouryon)

- Clariant

- Evonik Industries

- Kao Corporation

- Stepan Company

- Solvay

- BASF SE

- Croda International

- Galaxy Surfactants

- Huntsman Corporation

- Pilot Chemical

- Kemin Industries

- Sino-Japan Chemical

- Enaspol

- Shanghai Fine Chemical

- Zhejiang Xinhu Chem

- Newroad Chemical

- Colonial Chemical

- Lubrizol

- Innospec

Frequently Asked Questions

Analyze common user questions about the Cocamine Oxide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Cocamine Oxide primarily used for?

Cocamine Oxide is predominantly used as a mild surfactant in the personal care industry, serving as a secondary cleansing agent, foam booster, and viscosity builder in products such as shampoos, body washes, and gentle cleansers, valued for its non-irritating properties.

How is the Cocamine Oxide market affected by raw material price fluctuations?

The market is highly sensitive to fluctuations in coconut oil prices, which is the primary raw material source. Volatility stemming from climate change impacts on harvests and geopolitical trade issues significantly affects the manufacturing cost structure and profit margins of Cocamine Oxide producers.

Which geographical region exhibits the fastest growth rate for Cocamine Oxide adoption?

The Asia Pacific (APAC) region is anticipated to record the fastest market growth, driven by rapid industrial expansion in cosmetics and household detergents, increasing consumer awareness of mild ingredients, and the region's strong local manufacturing capacity.

Is Cocamine Oxide considered a sustainable or green ingredient?

Yes, Cocamine Oxide is generally considered sustainable because it is derived from renewable vegetable sources (coconut oil) and is readily biodegradable. Its inclusion in 'clean label' products is driven by its mild profile and favorable environmental fate compared to petrochemical alternatives.

What are the key technological trends influencing the production of Cocamine Oxide?

Key technological trends include the shift towards continuous flow manufacturing for increased efficiency, the implementation of green chemistry methods like bio-catalysis, and the adoption of advanced analytical instrumentation for real-time monitoring of product purity and compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager