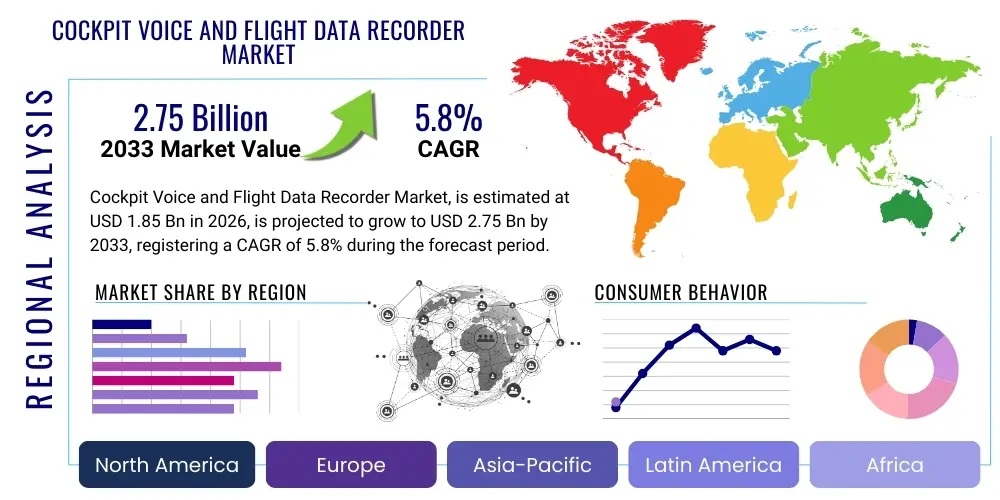

Cockpit Voice and Flight Data Recorder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437430 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Cockpit Voice and Flight Data Recorder Market Size

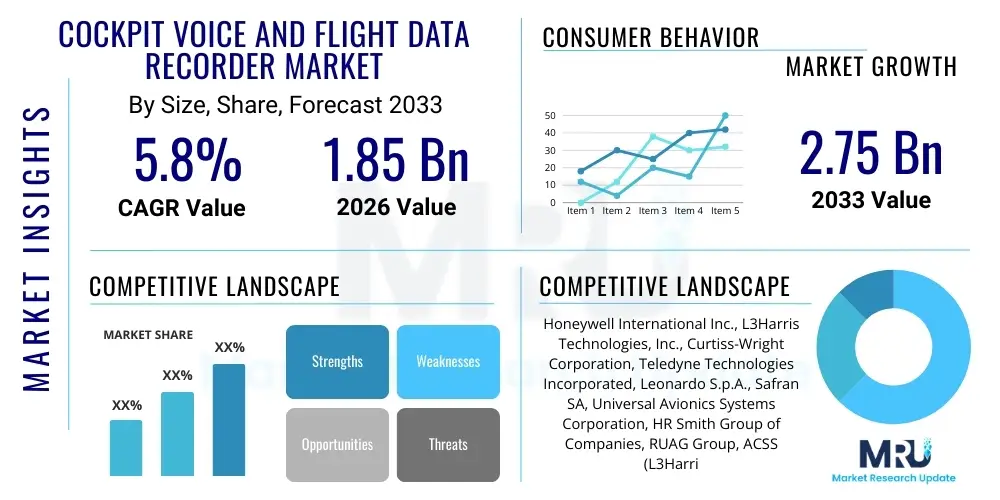

The Cockpit Voice and Flight Data Recorder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.75 Billion by the end of the forecast period in 2033.

This growth trajectory is underpinned by stringent regulatory mandates issued globally by aviation authorities such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA). These regulations necessitate the adoption of modern recording systems, particularly those compliant with ED-112A standards, which demand enhanced recording duration and improved crash survivability features. The continuous replacement cycles of aging commercial aircraft fleets and the expansion of air travel, especially in emerging economies, further fuel the demand for advanced Cockpit Voice Recorders (CVR) and Flight Data Recorders (FDR) that integrate high-fidelity audio, video recording, and parametric data capabilities. Furthermore, advancements in solid-state memory technology are driving the obsolescence of older magnetic tape recorders, pushing operators toward digital solutions that offer greater data integrity and easier retrieval post-incident.

Cockpit Voice and Flight Data Recorder Market introduction

The Cockpit Voice and Flight Data Recorder Market centers on essential aviation safety devices designed to capture and store critical information relating to an aircraft's operations and the flight crew’s communications. CVRs record ambient sound in the cockpit, including conversations, radio transmissions, and audible warnings, providing vital context for accident investigations. FDRs, conversely, record specific performance parameters, such as altitude, airspeed, heading, and control surface positions, offering a comprehensive snapshot of the aircraft's state leading up to and during an incident. These devices, often consolidated into a single unit known as a Combined Recorder or requiring mandated underwater locator beacons (ULBs), are fundamental components of modern airworthiness standards, acting as the primary evidentiary tools for accident prevention and forensic analysis.

Product sophistication is rapidly increasing, moving beyond simple data capture toward systems that offer enhanced resilience, longer recording capacities (up to 25 hours for CVRs under new regulations), and the integration of advanced sensors capable of monitoring thousands of flight parameters. Major applications span commercial aviation, military aircraft, and business jets, with commercial airlines representing the largest end-user segment due to mandatory compliance requirements and high fleet turnover rates. The latest generation of recorders incorporates deployable components and streaming capabilities, addressing historical challenges related to locating recorders in catastrophic loss events over large bodies of water or remote terrain. These technological leaps are crucial for reducing the time taken for accident investigation boards to recover critical data.

The core benefits derived from these recorders include significantly improving aviation safety standards worldwide by providing actionable insights into human factors, mechanical failures, and operational deficiencies. Driving factors for market growth involve stricter global regulatory enforcement concerning recording fidelity and duration, the global increase in air traffic demanding larger and more modern fleets, and the imperative for aviation insurers and regulatory bodies to minimize accident recurrence. The transition towards solid-state memory and the integration of cockpit image recording (CIR) further define the market landscape, pushing manufacturers to continuously innovate compliant, highly survivable recording solutions that meet the evolving demands of air transport safety and monitoring protocols across different operational environments.

Cockpit Voice and Flight Data Recorder Market Executive Summary

The Cockpit Voice and Flight Data Recorder Market is characterized by robust demand driven primarily by mandatory regulatory compliance and technological modernization cycles across global aviation fleets. Key business trends include the increasing adoption of combined CVR/FDR units (COMBI recorders) for simplified installation and maintenance, and a strong focus on developing highly survivable data modules resistant to extreme heat, impact, and deep-sea pressure. Furthermore, a shift toward subscription-based data recovery and analysis services is emerging, providing airlines with preventative maintenance insights derived from recorded flight data, thereby transforming the devices from mere forensic tools into proactive safety management systems. The competitive landscape is consolidated, dominated by a few established aerospace technology providers specializing in certified avionics systems and long-term support contracts.

Regionally, North America and Europe maintain dominance due to the presence of major aircraft manufacturers and historically stringent safety regulations, driving significant retrofit and procurement activities compliant with new ED-112A standards. However, the Asia Pacific region is demonstrating the highest growth potential, fueled by massive infrastructure investment in air travel, rapid expansion of low-cost carriers, and substantial new aircraft deliveries, particularly in China and India. These emerging markets require immediate installation of the latest recording technologies in their rapidly expanding fleets. Restraints include high initial investment costs associated with certified avionics hardware and the long product lifecycles of existing fleet recorders, which temporarily dampen immediate replacement demand outside of regulatory deadlines. Opportunities are abundant in the integration of streaming data technology, allowing real-time parameter monitoring and remote diagnostics.

Segment trends highlight the shift from legacy separate units to integrated COMBI recorders for efficiency. The end-user segment is dominated by Commercial Airlines, although the Military Aircraft segment remains critical due to demand for specialized, hardened recorders tailored for high-performance and tactical platforms. By component, the hardware segment (memory units, chassis, power supplies) commands the largest share, but the software and service segment, covering data analysis tools and maintenance contracts, is poised for faster growth as carriers increasingly rely on Flight Operations Quality Assurance (FOQA) programs utilizing recorded data. The focus on improved data security and encryption within the storage mechanism is also a critical technological segment trend observed across the market.

AI Impact Analysis on Cockpit Voice and Flight Data Recorder Market

User inquiries regarding AI's influence on the Cockpit Voice and Flight Data Recorder market frequently center on whether AI will eventually replace traditional physical recorders, how AI can expedite accident investigation, and the role of machine learning (ML) in predictive maintenance using captured flight data. Users are keen to understand how AI algorithms process the vast amounts of parametric data generated by FDRs—often thousands of data points per second—to identify anomalies that precede potential system failures. A primary concern is the ethical and privacy implications of using AI to analyze CVR audio, particularly relating to crew performance assessment and potential legal liability. The consensus expectation is that while AI will not replace the certified, crash-survivable physical recorder, it will fundamentally transform the utility of the recorded data, shifting the focus from post-mortem forensics to real-time predictive safety management and operational efficiency improvements.

AI’s most immediate impact is transforming the downstream data analysis segment. Machine learning algorithms are now being employed within Flight Operations Quality Assurance (FOQA) and Flight Data Monitoring (FDM) systems to sift through routine flight data, identifying subtle deviations or recurring trends (e.g., hard landings, unstable approaches) that human analysts might miss. This proactive identification allows airlines to address pilot training deficiencies or maintenance issues before they escalate into safety incidents. Furthermore, AI tools are accelerating accident investigation processes by rapidly correlating flight parameters with cockpit audio transcripts, automating the initial analysis phase, and significantly reducing the time required to establish potential causes or contributing factors, thereby improving the efficiency of global safety boards.

Looking ahead, AI integration is expected to influence the design of next-generation recorders. Future systems may include embedded AI capabilities for preprocessing data before storage, potentially compressing redundant data or prioritizing the recording of parameters deemed critical based on real-time operational context. This advanced processing ensures that the most relevant data is preserved under survivability limits. Moreover, the integration of AI with data streaming solutions allows for sophisticated predictive analytics, wherein deviations detected in real-time can trigger automated warnings or maintenance alerts, further solidifying the recorder's role as a key component in an aircraft's interconnected safety ecosystem rather than a standalone black box.

- AI enhances Flight Data Monitoring (FDM) programs by automating anomaly detection and trend analysis in parametric data.

- Machine learning accelerates accident investigation by rapidly correlating thousands of data points with audio and environmental conditions.

- Predictive maintenance applications utilize recorded data processed by AI to forecast component failures and optimize service schedules.

- AI algorithms assist in reducing data volume transmitted in streaming recorders by prioritizing critical, non-redundant information.

- Integration of Natural Language Processing (NLP) aids in transcribing and analyzing Cockpit Voice Recorder (CVR) audio for safety insights.

- AI-driven tools improve the efficiency and accuracy of safety audits and operational compliance checks based on recorded flight parameters.

DRO & Impact Forces Of Cockpit Voice and Flight Data Recorder Market

The dynamics of the Cockpit Voice and Flight Data Recorder Market are strongly shaped by a unique combination of regulatory drivers and technological imperatives, balanced against specific financial and logistical restraints. Key drivers include mandatory global regulatory upgrades, such as the requirement for 25-hour recording duration for CVRs and the push for Cockpit Image Recording (CIR), which necessitate fleet-wide retrofitting and new aircraft compliance. Opportunities are substantial in integrating data link capabilities, such as real-time data streaming and deployable recorder systems, which address the primary industry challenge of locating recorders after severe incidents, particularly those occurring over water. These technological advances attract investment and partnerships between avionics firms and satellite communication providers, expanding the market’s scope beyond traditional hardware sales.

However, the market faces significant restraints. The long operational lifespan of existing commercial aircraft means replacement cycles for core avionics systems are lengthy and often only driven by mandated regulatory deadlines, not spontaneous technology upgrades, leading to periodic market spikes followed by stabilization. Furthermore, the high cost associated with developing, certifying, and manufacturing crash-survivable electronic components, which must meet stringent FAA/EASA TSO standards for fire, impact, and immersion resistance, acts as a barrier to entry for smaller manufacturers. The complex intellectual property landscape surrounding patented data compression and storage technologies also limits competitive dynamism, favoring established players with deep regulatory expertise and existing supply chain relationships.

The impact forces driving the market are primarily regulatory pressure, technological obsolescence of legacy magnetic recorders, and the continuous desire for improved aviation safety standards. Competitive forces manifest through differentiation in survivability features, recording capacity, and the sophistication of the associated ground support equipment (GSE) and data analysis software. The bargaining power of buyers, especially large commercial carriers and aircraft OEMs (Original Equipment Manufacturers), is moderate to high, as they procure these units in large volumes under long-term contracts. Supplier power is also significant due to the limited number of certified providers capable of meeting the stringent quality and reliability requirements essential for flight safety hardware. Overall, the market remains highly inelastic to price changes but highly sensitive to regulatory changes that dictate immediate hardware upgrades.

Segmentation Analysis

The Cockpit Voice and Flight Data Recorder Market is primarily segmented based on the component type, the product type of the recorder, the end-user application, and the technology deployed. This segmentation provides clarity on the varying technological requirements and purchasing patterns across different sectors of the aviation industry. Product segmentation, differentiating between CVRs, FDRs, and combined units, reflects the ongoing industry trend toward consolidation and efficiency in hardware installation. End-user segmentation highlights the dominance of commercial carriers but also underscores the specialized, high-specification needs of the military aviation sector. The underlying technology split, particularly between solid-state and legacy magnetic tape systems, showcases the crucial transition fueling modern market demand for digital and high-capacity storage solutions globally.

The component segment further breaks down the market into hardware (comprising the survivable memory unit, chassis, and interface control units) and associated software and services. While hardware procurement drives immediate revenue, the long-term growth is increasingly anchored in the software and service segment, which includes data analysis, flight data monitoring tools (FDM), maintenance, repair, and overhaul (MRO), and data retrieval services. These services are becoming indispensable for leveraging the vast amounts of data captured by modern recorders, moving the value proposition beyond mere recording to actionable safety insights. The increasing complexity of the data retrieved necessitates specialized software tools and trained analysts, creating a robust, high-margin service ecosystem around the core physical product.

Technology-wise, the market is overwhelmingly shifting towards solid-state recorders (SSR), which offer superior reliability, larger storage capacity, and enhanced resistance to shock and temperature extremes compared to outdated magnetic tape recorders. The adoption rate of SSRs is nearly universal in new aircraft deliveries and is a primary focus for retrofitting campaigns. Furthermore, emerging technology segmentation includes deployable flight recorders (DFRs), which automatically eject upon detection of catastrophic impact, significantly improving recoverability, especially over water. These advanced systems represent the premium segment of the market, driven by regulations requiring enhanced data recovery mechanisms for long-haul commercial flights over remote oceanic areas, further diversifying the market offerings and pricing structures.

- By Product Type:

- Cockpit Voice Recorder (CVR)

- Flight Data Recorder (FDR)

- Combined Recorder (COMBI)

- Quick Access Recorder (QAR)

- Deployable Flight Recorder (DFR)

- By Component:

- Hardware (Survivable Memory Unit, Interface Unit, Chassis)

- Software and Services (Data Analysis Tools, MRO, FDM Programs)

- By Technology:

- Solid State Recorders (SSR)

- Magnetic Tape Recorders (Legacy)

- By End User:

- Commercial Airlines

- Business Jets and General Aviation

- Military Aircraft

Value Chain Analysis For Cockpit Voice and Flight Data Recorder Market

The value chain for Cockpit Voice and Flight Data Recorders is complex and highly specialized, beginning with the manufacturing of highly durable, certified electronic components. Upstream activities involve sourcing specialized materials for the survivable memory unit casing (often titanium or high-grade stainless steel) and acquiring certified solid-state memory chips and power management modules that meet extreme operating conditions and crash survivability standards. Research and development are intensely focused on meeting regulatory specifications (e.g., ED-112A, TSO-C124b/C176a), requiring significant investment in testing and certification processes. Key suppliers often operate within a stringent regulatory framework, leading to long-term relationships with avionics manufacturers who demand consistently high quality and traceability for safety-critical parts.

Midstream activities involve the assembly, integration, and stringent testing of the final recorder unit. Leading manufacturers design proprietary hardware and develop the certified operating software necessary for data capture, compression, and storage. Integration into the aircraft is performed either by Original Equipment Manufacturers (OEMs) during new aircraft assembly or by third-party Maintenance, Repair, and Overhaul (MRO) facilities during retrofit cycles. The distribution channel is predominantly indirect for new installations, where recorders are sold directly to major aircraft manufacturers (Boeing, Airbus) as Tier 1 suppliers. For the aftermarket (replacements and retrofits), distribution is handled through certified avionics dealers and authorized MRO networks globally, ensuring localized support and compliant installation services.

Downstream activities focus on the operational deployment and post-flight data management. Direct engagement occurs between manufacturers and airlines through long-term service contracts for ground support equipment (GSE), data retrieval tools, and critical analysis software used in Flight Data Monitoring (FDM) programs. The ultimate downstream function involves the highly sensitive data retrieval process post-incident, handled by safety investigation authorities (e.g., NTSB, BEA). The value chain emphasizes reliability and certification at every stage, where indirect channels dominate initial sales to OEMs, and a combination of direct service provision and specialized MRO channels manages the extensive lifecycle support and data analysis requirements of the operators.

Cockpit Voice and Flight Data Recorder Market Potential Customers

The primary customer base for Cockpit Voice and Flight Data Recorders consists of entities involved in the operation and manufacturing of aircraft, driven by legal mandates rather than optional procurement. Commercial airlines constitute the largest segment of potential customers, spanning major international carriers, regional operators, and rapidly growing low-cost airlines across all geographies. These customers require compliant, reliable recording solutions for their entire fleet, encompassing narrow-body, wide-body, and regional jet platforms. Their purchasing decisions are heavily influenced by Total Cost of Ownership (TCO), ease of integration into existing avionics architecture, and the sophistication of the associated Flight Data Monitoring (FDM) software suite provided by the vendor, which is crucial for their operational efficiency and safety management systems.

A second crucial customer segment is represented by Military and Defense organizations globally. These entities require highly specialized, hardened recorders for tactical fighters, heavy lift transport aircraft, and surveillance platforms. Military recorders often demand enhanced security features, greater environmental resilience (e.g., higher G-force survivability), and integration into classified data networks, diverging significantly from commercial specifications. Additionally, General Aviation (GA) and Business Jet operators form a substantial, though dispersed, customer group, increasingly adopting simplified, sometimes portable, recording solutions due to evolving regulations that are now beginning to mandate recording equipment even for smaller turbine-powered aircraft used for charter operations, driving a growing demand for cost-effective, compact COMBI units.

Aircraft Original Equipment Manufacturers (OEMs) like Boeing, Airbus, Embraer, and Bombardier are pivotal indirect customers, as they integrate these recorders into new aircraft production lines. The recorder manufacturer’s ability to secure OEM contracts guarantees high-volume sales for the duration of the aircraft program. Beyond manufacturers and operators, Maintenance, Repair, and Overhaul (MRO) facilities and aircraft leasing companies also act as key buyers, purchasing recorders for fleet retrofits, replacement of failed units, and ensuring aircraft returning from lease or undergoing major overhaul meet the latest regulatory requirements. These customers focus intensively on rapid availability of certified replacement units and ease of installation certification.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.75 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., L3Harris Technologies, Inc., Curtiss-Wright Corporation, Teledyne Technologies Incorporated, Leonardo S.p.A., Safran SA, Universal Avionics Systems Corporation, HR Smith Group of Companies, RUAG Group, ACSS (L3Harris & Thales Joint Venture), Garmin Ltd., Meggitt PLC, GE Aviation, Phoenix International, Fairchild Recording Equipment Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cockpit Voice and Flight Data Recorder Market Key Technology Landscape

The technological landscape of the Cockpit Voice and Flight Data Recorder market is defined by a continuous push toward enhanced survivability, increased data capacity, and advanced retrieval mechanisms. The foundational technology involves Solid-State Memory Units (SSMUs), which have replaced magnetic tape, providing higher storage density (enabling the mandated 25 hours of CVR recording) and significantly improving resilience to crash forces, fire, and immersion. Key technological advancements include sophisticated data compression algorithms designed to maximize the storage of thousands of flight parameters without compromising data integrity or traceability. Furthermore, manufacturers are focusing heavily on developing robust power systems to ensure recording continues until the final impact and to power the Underwater Locator Beacons (ULBs) for extended periods post-crash.

A critical emerging technology is Data Streaming and Connectivity. Modern recorders are increasingly integrated with data link systems (often utilizing satellite communication) to stream essential flight parameters in near real-time back to ground stations. This capability provides a redundancy layer, minimizing the risk of total data loss if the physical recorder is unrecoverable. Related to this is the development of Deployable Flight Recorders (DFRs), which employ internal sensors to detect catastrophic events and automatically eject a floating, resilient data module, improving recovery odds significantly in remote or oceanic crash scenarios. These systems integrate complex sensor inputs and automated mechanical ejection mechanisms that must meet stringent reliability standards to prevent accidental deployment during normal operations.

Furthermore, the market is undergoing transformation through the mandated adoption of Cockpit Image Recorders (CIR). While not fully standardized globally, the technology integrates high-resolution video capture within the cockpit environment alongside audio and parametric data. This requires advanced image processing capabilities and secure, high-capacity storage. Associated ground support equipment (GSE) technology is also evolving, featuring rapid download capabilities and advanced forensic software tools capable of harmonizing CVR audio, FDR parameters, and CIR video feeds into a unified timeline for accident investigators. Encryption and cyber security protocols are also becoming vital components of the technology landscape, ensuring that sensitive flight data remains protected from unauthorized access both during operation and storage.

Regional Highlights

- North America: This region holds a dominant market share, driven primarily by the presence of major aircraft manufacturers (Boeing) and the strong regulatory influence of the FAA. The FAA frequently issues Airworthiness Directives (ADs) that necessitate immediate upgrades or modifications, ensuring a steady retrofit market. High levels of R&D investment in advanced avionics, particularly relating to cyber security standards for data streaming and the implementation of deployable recorders, keep the region at the forefront of technology adoption. The large existing fleet size and high operational standards contribute significantly to consistent demand for high-end recording solutions and associated data analysis services, making it a critical hub for market innovation and procurement.

- Europe: Europe represents a significant market segment, primarily influenced by EASA regulations, which have been pivotal in mandating the new 25-hour CVR recording duration and promoting the deployment of deployable recorders, particularly for long-haul flights over water. The region benefits from key aerospace manufacturers (Airbus, Leonardo) and specialized avionics firms (Safran, Thales), fostering a strong ecosystem for supply and innovation. The focus here is often on standardization across European air traffic and ensuring compliance through strict MRO procedures, driving demand for certified maintenance services and sophisticated ground support equipment. Fleet modernization efforts targeting noise reduction and fuel efficiency often coincide with recorder upgrades.

- Asia Pacific (APAC): APAC is the fastest-growing market region globally, characterized by rapid expansion of commercial fleets, driven by burgeoning middle classes and increased air travel demand, particularly in China, India, and Southeast Asia. Regulatory environments in these countries are quickly aligning with international standards (FAA/EASA), necessitating the immediate installation of the latest generation of solid-state recorders in new aircraft deliveries. Market growth is fueled by substantial government investment in aviation infrastructure and the rise of local low-cost carriers, creating a high-volume demand environment for both new equipment and MRO support, although price sensitivity remains a factor compared to Western markets.

- Latin America (LATAM): The LATAM market is defined by steady but cautious growth, largely driven by the operational needs of major regional airlines and adherence to global safety protocols adopted from ICAO standards. Market activity is often tied to the cyclical acquisition of used or leased aircraft from North American and European carriers, generating demand for retrofit activities to ensure regional compliance. Economic stability issues in some countries can introduce volatility in capital expenditure, often favoring extended maintenance cycles over proactive technology replacement, but the underlying regulatory pressure for certified flight safety equipment ensures ongoing, essential procurement.

- Middle East and Africa (MEA): This region is notable for the significant capital expenditure by Gulf carriers (e.g., Emirates, Qatar Airways) on technologically advanced wide-body aircraft, requiring state-of-the-art recording systems, including deployable units and extensive data streaming capabilities. The MEA market segment is characterized by a strong demand for premium products and robust service contracts. In contrast, the African segment faces challenges related to aging fleets and lower overall spending power, leading to a focus on essential compliance upgrades rather than leading-edge technology adoption, though growth is emerging in regions focusing on infrastructure development and fleet rejuvenation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cockpit Voice and Flight Data Recorder Market.- Honeywell International Inc.

- L3Harris Technologies, Inc.

- Curtiss-Wright Corporation

- Teledyne Technologies Incorporated

- Leonardo S.p.A.

- Safran SA

- Universal Avionics Systems Corporation

- HR Smith Group of Companies

- RUAG Group

- ACSS (L3Harris & Thales Joint Venture)

- Garmin Ltd.

- Meggitt PLC

- GE Aviation

- Phoenix International

- Fairchild Recording Equipment Corporation

- Aviation Devices & Electronic Components (ADEC)

- Thales Group

- BAE Systems plc

- Kongsberg Gruppen

- Astronautics Corporation of America

Frequently Asked Questions

Analyze common user questions about the Cockpit Voice and Flight Data Recorder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a CVR and an FDR?

The CVR (Cockpit Voice Recorder) captures audio data, including crew conversations and ambient cockpit sounds, necessary for understanding human factors. The FDR (Flight Data Recorder) captures hundreds of technical flight parameters (e.g., speed, altitude, engine performance) essential for analyzing the aircraft's physical state. Modern aircraft increasingly use COMBI recorders, combining both functions into one survivable unit.

What new regulations are significantly driving the market growth?

The most significant regulations are those mandating extended recording duration for CVRs, specifically requiring 25 hours of recording time (e.g., EASA/FAA mandates based on ED-112A standards). Additionally, rules promoting the adoption of Deployable Flight Recorders (DFRs) for enhanced data recoverability, especially on long overwater flights, are accelerating hardware replacement cycles across global fleets.

How does AI impact the utility of recorded flight data?

AI transforms recorded flight data by shifting its primary use from post-incident forensic analysis to proactive safety management. Machine learning algorithms process FDR data within Flight Data Monitoring (FDM) programs to automatically identify subtle anomalies, trends, or safety events that require immediate corrective action, improving predictive maintenance and pilot training effectiveness.

Why are Solid State Recorders (SSR) replacing older technology?

Solid State Recorders (SSRs) offer superior performance in several critical areas compared to legacy magnetic tape recorders. SSRs provide significantly higher data storage capacity (meeting new regulatory demands), greater reliability due to fewer moving parts, and enhanced crash survivability against impact, fire, and immersion, ensuring better data preservation after a severe accident.

What are Deployable Flight Recorders (DFRs) and where are they most relevant?

DFRs are advanced safety devices that automatically detach and float away from the aircraft in the event of a catastrophic water impact or structural failure. They are particularly relevant and often mandated for long-haul commercial flights operating over remote oceanic areas, where the conventional retrieval of fixed recorders is extremely difficult, costly, and time-consuming, thereby drastically improving data recovery rates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager