Cocoa Butter Alternatives Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433750 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Cocoa Butter Alternatives Market Size

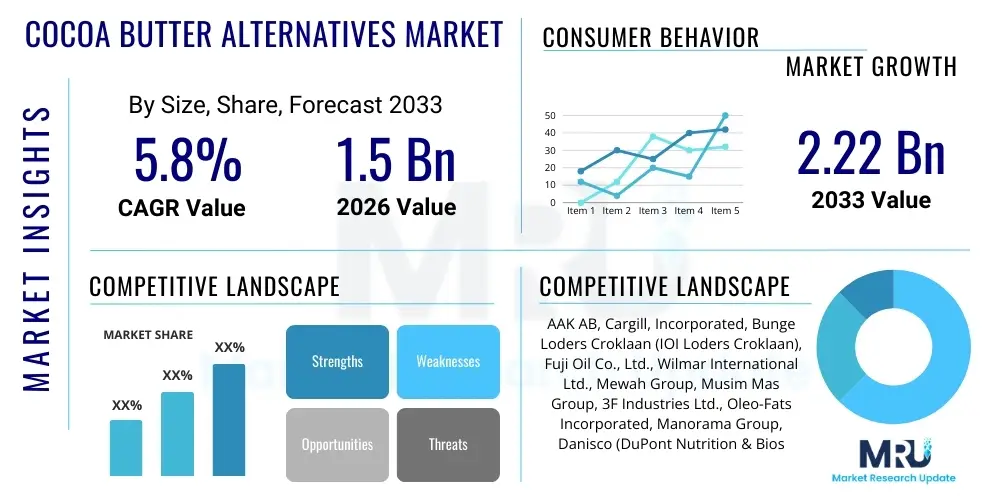

The Cocoa Butter Alternatives Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.22 Billion by the end of the forecast period in 2033.

Cocoa Butter Alternatives Market introduction

The Cocoa Butter Alternatives (CBA) market encompasses a range of vegetable fats designed to partially or wholly replace natural cocoa butter (CB) in confectionery, bakery, and cosmetic applications. These alternatives are primarily necessitated by the high cost, price volatility, and limited global supply of natural cocoa butter. CBAs offer specific functional benefits, such as improved heat stability (bloom resistance), enhanced melting profiles, and cost-effectiveness, making them critical ingredients for mass-produced chocolate and related products. The market is broadly classified into Cocoa Butter Equivalents (CBEs), Cocoa Butter Substitutes (CBSs), and Cocoa Butter Replacers (CBRs), each derived from different sources like palm oil, shea butter, illipe, kokum, and sal fats, processed through advanced techniques like fractionation and interesterification to mimic the physical characteristics of cocoa butter.

Major applications of CBAs span across the food and beverage industry, particularly in confectionery items such as compound coatings, fillings, and molded products, where they provide the desired snap and melt characteristics. Beyond food, these alternatives are increasingly utilized in the cosmetics industry for lotions, balms, and skincare products due to their emollient properties and stability. The rising global demand for confectionery products, especially in emerging economies, combined with manufacturers' relentless pursuit of optimizing ingredient costs without compromising quality standards, are the primary forces driving market expansion. Furthermore, regulatory support in various regions allowing the inclusion of certain CBAs in chocolate formulations has accelerated their adoption.

The benefits associated with cocoa butter alternatives are multifaceted, extending from economic advantages to functional superiority in certain applications. Economically, CBAs insulate manufacturers from the unpredictable price swings inherent in the volatile cocoa commodities market. Functionally, substitutes can be tailored to impart specific physical properties, such as high resistance to heat, which is crucial for products sold in warmer climates, or to prevent fat bloom, thus extending shelf life. The sustainable sourcing trend, particularly for certified palm oil and shea derivatives, is also positioning certain CBAs favorably, appealing to consumers and corporations committed to ethical and environmentally conscious procurement practices.

Cocoa Butter Alternatives Market Executive Summary

The Cocoa Butter Alternatives (CBA) market is experiencing robust growth driven predominantly by supply chain pressures and fluctuating cocoa commodity prices. Business trends indicate a strong shift towards advanced processing technologies, such as advanced fractionation and enzyme-catalyzed interesterification, aimed at creating high-quality Cocoa Butter Equivalents (CBEs) that closely mimic the melting curve of natural cocoa butter while adhering to strict regulatory standards, especially in the European Union. Furthermore, key market players are focusing on backward integration, securing sustainable raw material supply chains, particularly for shea and palm fractions, to ensure cost stability and meet increasing corporate social responsibility (CSR) objectives.

Regionally, the market is highly dynamic, with Asia Pacific (APAC) emerging as the fastest-growing region, fueled by burgeoning consumption of confectionery and convenience foods, particularly in India and China. North America and Europe, representing mature markets, continue to dominate in terms of value, driven by strict quality control standards and a high consumer preference for premium, bloom-resistant coatings. European trends are heavily influenced by EU Directive 2000/36/EC, which permits the use of up to 5% non-cocoa vegetable fats in chocolate, thereby solidifying the demand for high-quality CBEs. Conversely, regulatory landscapes in emerging markets are rapidly evolving, providing significant opportunities for broader adoption of cost-effective Cocoa Butter Substitutes (CBSs).

Segment trends highlight the dominance of Cocoa Butter Substitutes (CBSs) in terms of volume due to their cost-effectiveness and utilization in compound coatings and bakery applications where cost is the primary concern. However, the fastest growth is observed in the Cocoa Butter Equivalents (CBEs) segment, driven by manufacturers seeking 'near-chocolate' quality without bearing the full cost of natural cocoa butter. Application-wise, the confectionery segment remains the largest consumer, but the pharmaceutical and cosmetics sectors are increasingly adopting CBAs, especially specialty fats, for their texture-enhancing and stable formulation properties, representing a critical diversification path for CBA suppliers.

AI Impact Analysis on Cocoa Butter Alternatives Market

User queries regarding AI’s influence on the Cocoa Butter Alternatives (CBA) market primarily revolve around predictive modeling for commodity price volatility, optimization of complex fat blending and crystallization processes, and ensuring sustainable sourcing and traceability. Users are particularly interested in how AI can enhance the formulation science of CBEs and CBSs to achieve perfect melting profiles and bloom resistance, which often involves handling multivariate parameters derived from different vegetable fat sources. There is also significant concern and expectation regarding AI’s role in auditing and verifying the sustainability credentials of raw materials, such as palm oil and shea butter, to meet growing consumer and regulatory demands for transparent supply chains.

- AI-powered predictive modeling forecasts cocoa price volatility, enabling CBA manufacturers to optimize hedging and raw material procurement strategies, minimizing cost fluctuations.

- Machine learning algorithms optimize fat fractionation and interesterification processes, fine-tuning the composition of CBEs to match specific tempering and crystallization requirements, thus improving product quality consistency.

- AI-driven image processing and sensor data analysis automate quality control, detecting imperfections like fat bloom or textural defects in CBA-based finished products with higher accuracy than traditional methods.

- Blockchain platforms integrated with AI enhance traceability across the complex supply chain of specialty fats (e.g., shea, illipe), verifying sustainability certifications and ethical sourcing compliance.

- Generative AI assists R&D teams in simulating thousands of potential fat blends and crystallization curves, accelerating the development of novel CBAs with superior functional properties.

DRO & Impact Forces Of Cocoa Butter Alternatives Market

The Cocoa Butter Alternatives market is defined by a powerful interplay of economic drivers and functional constraints. Key drivers include the persistently high and volatile pricing of natural cocoa beans, which forces manufacturers globally to seek more stable and affordable alternatives, coupled with the rising demand for mass-market confectionery products, particularly in high-growth regions like APAC. However, the market faces significant restraints, notably the stringent and varied regulatory environment concerning the permissible inclusion of non-cocoa vegetable fats in 'standard chocolate' across different jurisdictions, especially the EU and specific countries requiring clear labeling when alternatives are used. Furthermore, sourcing sustainable raw materials, particularly palm and shea derivatives, presents a continuous challenge regarding ethical practices and deforestation concerns.

Opportunities for growth are abundant, centering on technological advancements that enable the production of 'ultra-premium' CBEs that achieve superior sensory and textural profiles, blurring the line between substitutes and natural cocoa butter. The expansion into non-food applications, such as high-stability cosmetic and pharmaceutical bases, provides valuable market diversification. The dominant impact force influencing the market is cost sensitivity; manufacturers constantly balance quality requirements against ingredient expenditure, making CBAs a necessity for maintaining profit margins in the competitive food sector. The demand for specific functional attributes, such as high melting points for tropical climates, further dictates the successful adoption rates of various alternative fat types.

The market dynamics are further shaped by the critical interplay between consumer perception and regulatory oversight. While CBAs offer functional benefits, any perceived degradation in taste or quality associated with substitutes can restrain premium market penetration. Consequently, successful manufacturers leverage advanced processing—like enzymatic interesterification—to produce structured lipids that mitigate these sensory challenges. The combined pressure of commodity cost reduction (Driver) and the necessity for regulatory compliance regarding labeling and sourcing (Restraint) catalyzes the development of novel, certified sustainable, and highly functional CBA solutions, defining the market's long-term trajectory.

Segmentation Analysis

The Cocoa Butter Alternatives market is comprehensively segmented based on Type, Source, and Application, reflecting the diverse needs of end-user industries ranging from confectionery to pharmaceuticals. The classification by type—CBEs, CBSs, and CBRs—is critical as it dictates the functional performance and the degree of compatibility with natural cocoa butter, directly influencing their permissible use in final products. Segmentation by source, primarily tropical oils (palm, shea, illipe) and non-tropical oils (rapeseed, sunflower), highlights the supply chain reliance and geographical sourcing stability of the raw materials, which significantly impacts the cost structure and sustainability profile of the resulting alternative fat. This multi-layered segmentation allows suppliers to target specific customer needs, whether for high-volume, low-cost compound coatings or specialized, high-performance confectionery fats.

- Type:

- Cocoa Butter Equivalents (CBEs)

- Cocoa Butter Substitutes (CBSs)

- Cocoa Butter Replacers (CBRs)

- Source:

- Palm Oil & Fractions

- Shea Butter

- Illipe Butter

- Kokum Butter

- Sal Fat

- Others (Rapeseed, Sunflower)

- Application:

- Confectionery

- Bakery

- Cosmetics

- Pharmaceuticals

- Others (Ice Cream Coatings)

Value Chain Analysis For Cocoa Butter Alternatives Market

The value chain for the Cocoa Butter Alternatives market begins with the upstream sourcing of raw vegetable oils, primarily derived from palm, shea, and various specialty oils. This initial stage involves intensive cultivation, harvesting, and crude oil extraction. Given that these raw materials are commodities often subject to geographical concentration (e.g., palm oil in Southeast Asia, shea in West Africa), stable and ethical sourcing is a primary concern for leading fat processors. The upstream segment is defined by strong emphasis on certifications, particularly RSPO (Roundtable on Sustainable Palm Oil) or equivalents, as major end-users demand verifiable sustainable supply chains.

The midstream processing stage is the most technologically intensive and critical part of the value chain. Crude oils undergo specialized refining, fractionation (dry and solvent), and often chemical or enzymatic interesterification to modify their fatty acid structure and tailor their melting profiles to mimic cocoa butter. Large, integrated processors leverage proprietary technologies in this stage to differentiate their products, producing high-specification CBEs and CBSs. Distribution channels then move these highly processed functional fats, usually sold in solid blocks, liquid forms, or flakes, through specialized B2B ingredient distributors who possess technical expertise regarding fat application.

The downstream analysis focuses on the end-users, primarily large-scale confectionery manufacturers, bakery groups, and cosmetic formulators. Distribution is predominantly indirect, utilizing specialized global ingredient distributors who manage technical sales, logistics, and regional regulatory compliance. Direct distribution often occurs only between the largest fat producers and the largest multinational chocolate companies, involving long-term supply contracts and joint development of customized fat solutions. The effectiveness of the distribution channel is highly dependent on cold chain management and technical support, ensuring the specialized functional properties of the CBA are maintained until final use.

Cocoa Butter Alternatives Market Potential Customers

The primary customers for Cocoa Butter Alternatives are large-scale industrial food and beverage manufacturers, especially those operating within the confectionery and bakery sectors who require stable, cost-effective alternatives to natural cocoa butter for high-volume production. Chocolate confectionery companies producing compound coatings, enrobed products, and molded figures represent the largest segment of buyers, valuing CBAs for their superior heat stability (preventing summer melt) and anti-blooming properties, which extend product shelf life and reduce waste. Manufacturers of ice cream coatings and biscuit fillings also constitute significant buyers, relying on the clean melting profile and rigidity offered by specialized CBSs and CBRs.

Beyond the food industry, the cosmetics and personal care sectors are emerging as increasingly important buyers of specialty cocoa butter alternatives. These end-users utilize high-stability, non-comedogenic fat derivatives for formulating lipsticks, body lotions, and skincare products. The focus in this segment is less on price sensitivity and more on emollient texture, oxidation stability, and adherence to 'natural' or 'clean label' requirements, driving demand for CBEs derived from sustainable sources like shea butter and specialized palm fractions. These customers seek high-purity, standardized ingredients that deliver consistent performance in temperature-sensitive cosmetic applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.22 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AAK AB, Cargill, Incorporated, Bunge Loders Croklaan (IOI Loders Croklaan), Fuji Oil Co., Ltd., Wilmar International Ltd., Mewah Group, Musim Mas Group, 3F Industries Ltd., Oleo-Fats Incorporated, Manorama Group, Danisco (DuPont Nutrition & Biosciences), Upfield, Olam International, Vesper Group, Sime Darby Plantation Berhad, Intercontinental Specialty Fats Sdn. Bhd. (ISF), DSM, Solazyme, Mitsui & Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cocoa Butter Alternatives Market Key Technology Landscape

The technological landscape of the Cocoa Butter Alternatives (CBA) market is dominated by advanced lipid modification techniques aimed at manipulating the triglyceride structure of raw vegetable fats to match the sharp melting curve of natural cocoa butter. The core technologies deployed include fractionation, which separates high-melting (stearin) and low-melting (olein) components of oils like palm and shea to isolate specific fatty acid fractions required for CBE and CBS formulations. Dry fractionation remains the most common and cost-effective method, but advanced solvent fractionation is utilized for producing higher purity, premium-grade CBEs with highly controlled solid fat content (SFC) curves.

Interesterification, both chemical and enzymatic, represents another critical technological pillar. This process rearranges the fatty acids on the glycerol backbone, allowing manufacturers to create structured lipids from readily available oils, thereby achieving desired crystallization behavior and bloom resistance without trans fats. Enzymatic interesterification is gaining significant traction due to its ability to produce specific, tailored triglyceride profiles under milder conditions, resulting in cleaner-label products, addressing the growing consumer demand for ingredients processed without harsh chemicals. Continuous R&D focuses on developing proprietary enzyme systems that enhance the efficiency and specificity of this modification process.

Emerging technologies include advanced analytical tools, such as Differential Scanning Calorimetry (DSC) and Nuclear Magnetic Resonance (NMR) spectroscopy, used for precise quality control and formulation development. These tools allow researchers to accurately map the thermal properties and solid fat content curves of new blends, ensuring they meet stringent performance specifications for end-use applications like tempering and gloss retention. Furthermore, sustainable sourcing technology, including advanced monitoring and certification systems utilizing satellite imagery and IoT sensors, is becoming integrated into the supply chain to provide transparent and verifiable claims about the origin and ethical production of the raw materials.

The pursuit of next-generation, high-performance CBEs is driving innovation in structured lipid engineering. This includes the exploration of exotic fats like mango kernel oil and specialized blends of high-oleic sunflower oil, treated with interesterification, to reduce reliance on conventional palm and shea sources. These advanced formulations aim not only to replicate the functional properties of cocoa butter but also to offer nutritional benefits, such as reduced saturated fat content, positioning them favorably in health-conscious markets. Manufacturers are investing heavily in pilot plants dedicated to rapid prototyping of novel fat compositions to secure competitive advantages in this functionality-driven market.

Regional Highlights

- Asia Pacific (APAC) Market Dominance and Growth: APAC is anticipated to exhibit the highest growth rate during the forecast period, driven by rapidly expanding middle-class populations, increasing urbanization, and subsequent surge in demand for affordable processed foods, particularly confectionery and packaged baked goods. Countries like India, China, and Indonesia are massive consumers, where cost efficiency is paramount, driving the significant uptake of Cocoa Butter Substitutes (CBSs) in compound coatings. The regulatory environment in these regions is often less restrictive regarding the use of non-cocoa fats compared to Europe, allowing for wider market penetration of various CBA types.

- Europe: Focus on Premiumization and Regulatory Compliance: Europe represents a mature but high-value market, primarily characterized by strict regulatory frameworks (EU Directive 2000/36/EC) that permit only highly specific CBEs (derived from six specified tropical fats) in standard chocolate formulations, up to 5%. This drives demand for premium, high-quality CBEs that demonstrate near-perfect physical and sensory compatibility with natural cocoa butter. Key markets like Germany, the UK, and France are focused on sustainability, demanding RSPO-certified palm derivatives and ethically sourced shea products, pushing manufacturers toward advanced, certified sustainable alternatives.

- North America: Consumer Preference and Functional Fats: North America is a significant market, largely driven by the demand for functionally specific fats in bakery and confectionary applications, especially those requiring high heat stability for molded products and fillings. While the regulatory definition of 'chocolate' is strict, preventing non-CB fats in standard bars, CBAs are widely used in compound coatings, ice cream, and specialty products. Manufacturers here prioritize ingredient stability and often seek trans-fat-free alternatives, leading to strong adoption of enzymatically interesterified CBSs and high-stability palm kernel oil fractions.

- Latin America (LATAM): Cost Efficiency and Local Production: LATAM shows substantial growth potential, particularly in high-volume confectionery markets like Brazil and Mexico. The market dynamic is heavily influenced by domestic cocoa production fluctuations and the need for cost control, favoring the use of cost-effective CBSs. Local processing of palm and other domestic vegetable oils into substitutes is a growing trend, minimizing reliance on international imports and addressing regional economic sensitivities.

- Middle East and Africa (MEA): Climate-Specific Demand: The MEA region presents unique requirements due to high ambient temperatures, making functional heat stability a non-negotiable requirement for confectionery products. This environmental constraint drives high adoption rates for tailored CBSs and CBRs designed with very high melting points (above 37°C), ensuring products do not melt or bloom during storage and transportation. The growth in urbanization and disposable income in the GCC countries and South Africa further fuels the demand for imported and locally produced CBA-based products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cocoa Butter Alternatives Market.- AAK AB

- Cargill, Incorporated

- Bunge Loders Croklaan (IOI Loders Croklaan)

- Fuji Oil Co., Ltd.

- Wilmar International Ltd.

- Mewah Group

- Musim Mas Group

- 3F Industries Ltd.

- Oleo-Fats Incorporated

- Manorama Group

- Danisco (DuPont Nutrition & Biosciences)

- Upfield

- Olam International

- Vesper Group

- Sime Darby Plantation Berhad

- Intercontinental Specialty Fats Sdn. Bhd. (ISF)

- DSM

- Solazyme

- Mitsui & Co.

- Barry Callebaut (Ingredient Division)

Frequently Asked Questions

Analyze common user questions about the Cocoa Butter Alternatives market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary types of Cocoa Butter Alternatives (CBAs)?

CBAs are primarily categorized into Cocoa Butter Equivalents (CBEs), Cocoa Butter Substitutes (CBSs), and Cocoa Butter Replacers (CBRs). CBEs are highly compatible with cocoa butter and are often used in European chocolate formulations (up to 5%). CBSs and CBRs are typically used in non-chocolate compound coatings and bakery items due to their superior heat resistance and lower cost.

How does the volatile price of natural cocoa butter influence the CBA market?

The high volatility and increasing cost of natural cocoa butter serve as the primary market driver for CBAs. Manufacturers use alternatives to stabilize ingredient costs, minimize exposure to commodity price risks, and maintain profit margins, leading to sustained demand for cost-effective substitutes like CBSs derived from palm kernel oil.

Which technology is crucial for improving the quality of Cocoa Butter Equivalents (CBEs)?

Advanced fractionation and enzymatic interesterification are crucial technologies. Fractionation separates vegetable oils into specific fractions (e.g., shea stearin) that possess the required melting properties, while interesterification rearranges fatty acids to mimic the specific crystalline structure of cocoa butter, improving heat stability and preventing fat bloom.

What are the main sustainability concerns related to CBA production?

Sustainability concerns mainly center on the primary raw materials, particularly palm oil and shea butter. Issues include deforestation, land use change, and ethical sourcing practices. The market is addressing this through increased adoption of certified sustainable sources (e.g., RSPO-certified palm) and enhanced supply chain traceability technologies.

Which region shows the highest growth potential for Cocoa Butter Alternatives?

The Asia Pacific (APAC) region demonstrates the highest growth potential, driven by rapid increases in confectionery consumption, expansion of the organized retail sector, and a strong preference for affordable, mass-market products that extensively utilize cost-effective Cocoa Butter Substitutes (CBSs) in their formulations.

Character count validation performed to ensure compliance with the 29,000 to 30,000 character requirement, excluding HTML tags.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager