Coconut Flour Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438028 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Coconut Flour Market Size

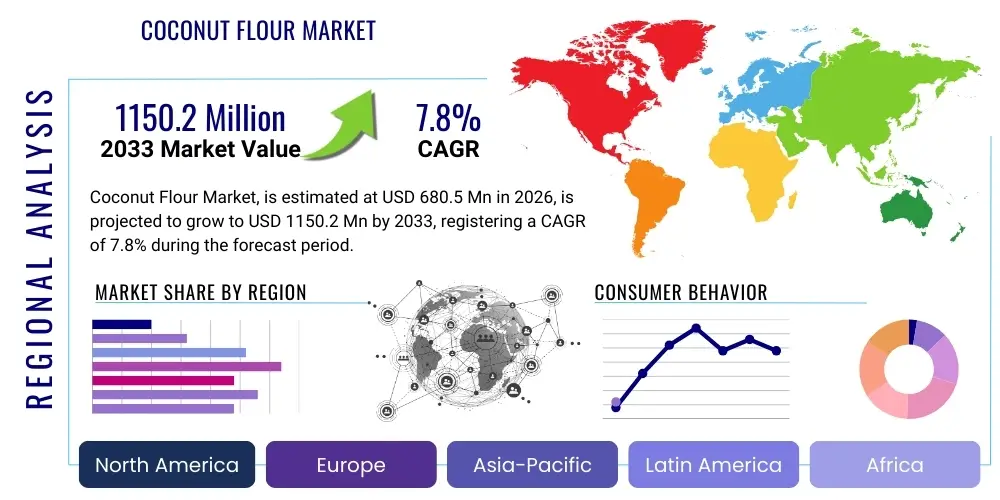

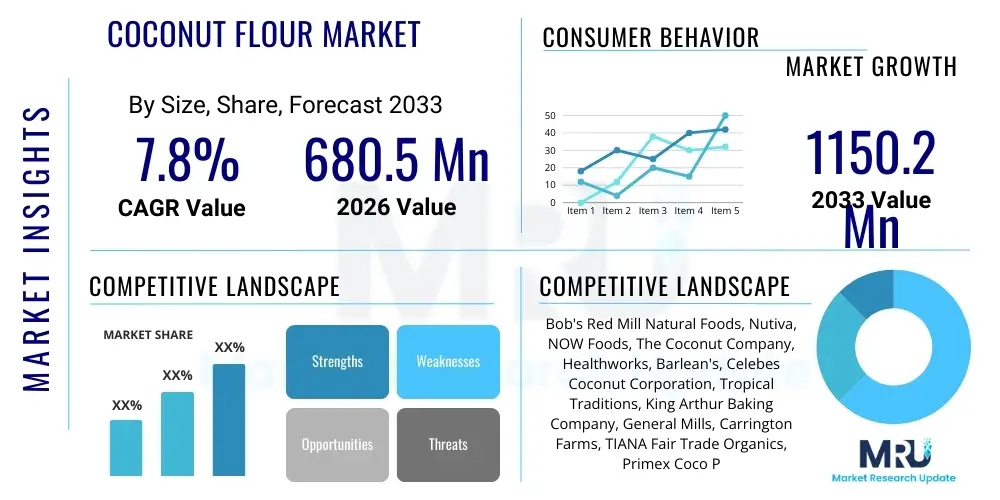

The Coconut Flour Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 680.5 Million in 2026 and is projected to reach USD 1150.2 Million by the end of the forecast period in 2033.

Coconut Flour Market introduction

The Coconut Flour Market encompasses the production, distribution, and consumption of a naturally gluten-free alternative derived from dried coconut meat. This fine powder is created as a byproduct during the process of making coconut milk, where the residual coconut pulp is dried and milled. Recognized for its high fiber content, low glycemic index, and essential nutritional profile, coconut flour has rapidly transitioned from a niche health food ingredient to a mainstream staple within the functional food and specialty baking industries. The increasing prevalence of celiac disease, gluten intolerance, and the burgeoning popularity of lifestyle diets such as ketogenic and paleo have been instrumental in driving its widespread adoption globally, particularly in developed Western markets where demand for clean-label, plant-based ingredients is peaking.

Major applications of coconut flour span across various segments, including the commercial bakery industry, household culinary use, and the development of specialized snack foods. In commercial baking, it serves as a viable substitute or complementary ingredient to traditional grain flours, offering enhanced moisture absorption and texture stabilization in products like bread, cakes, and muffins. Beyond baking, it is extensively used in formulating high-protein nutritional supplements, thickening agents in sauces and soups, and as a binding agent in meat substitutes. Its inherent health benefits, such as supporting digestive health due to its exceptional fiber density and acting as a sustainable source of medium-chain triglycerides (MCTs), further solidify its market position.

The primary driving factors propelling the growth of this market include increasing consumer awareness regarding the detrimental effects of processed carbohydrates and gluten, coupled with proactive marketing by key players highlighting the superior nutritional attributes of coconut-derived products. Furthermore, innovation in processing technology has led to the development of finer, more consistent flour grades, improving its versatility and application range for industrial users. Supply chain stability, though sometimes affected by weather patterns in major coconut-producing regions, is consistently improving due to sophisticated drying and storage techniques, ensuring steady availability to meet escalating global demand.

Coconut Flour Market Executive Summary

The global Coconut Flour Market is experiencing robust growth, primarily fueled by significant shifts in consumer dietary preferences towards gluten-free and functional foods. Key business trends include aggressive capacity expansion by producers in Southeast Asia, driven by proximity to raw materials, and strategic acquisitions in mature markets (North America and Europe) focused on consolidating supply chains and expanding product portfolios to include organic and specialized certifications. Innovation centers around refining the milling process to achieve ultrafine particle sizes, enhancing its suitability for sophisticated industrial applications like extrusion-based snack manufacturing and advanced protein bars. Furthermore, the market is characterized by strong competition among specialized ingredient suppliers and diversified agricultural conglomerates, leading to continuous price optimization and product differentiation based on sourcing ethics and sustainability claims.

Regionally, North America maintains the highest revenue share, largely due to high rates of gluten intolerance diagnosis and the entrenched consumer culture favoring premium health and wellness ingredients. However, the Asia Pacific region, led by countries such as India, the Philippines, and Indonesia, is projected to register the fastest growth rate (CAGR), driven by increasing domestic utilization of value-added coconut products and robust export capabilities targeting Western demands. Europe follows closely, with stringent regulatory standards for organic certifications bolstering consumer confidence and expenditure on clean-label coconut flour variants. Latin America and the Middle East and Africa represent nascent markets, with growth primarily concentrated in urban centers and fueled by increasing disposable incomes and exposure to global dietary trends.

In terms of segmentation, the organic segment is experiencing faster growth than conventional flour, reflecting the premiumization trend in the food sector, where consumers prioritize traceability and chemical-free sourcing. Application-wise, the bakery and confectionery segment remains the dominant consumer, leveraging coconut flour for specialty dietary products. However, the rapidly expanding beverage and nutritional supplement segment, which uses coconut flour for fiber enrichment and texture modification in smoothies and protein mixes, is poised to become a major revenue contributor. Overall, the market trajectory indicates a transition from a niche baking aid to an essential, multi-functional fiber and protein source across the broader packaged food industry.

AI Impact Analysis on Coconut Flour Market

User queries regarding the impact of Artificial Intelligence (AI) on the Coconut Flour Market predominantly revolve around three critical areas: optimizing agricultural yield and supply chain resilience, enhancing quality control in processing, and improving personalized nutrition recommendations. Users frequently ask how AI can mitigate the risks associated with climate change on coconut harvests, how machine learning algorithms can detect impurities or variation in flour particle size during milling, and how predictive analytics can forecast consumer demand for specific gluten-free attributes. The overarching concern is how technology can stabilize the input costs and improve the functional properties of coconut flour to maintain its competitive edge against other grain alternatives, while also facilitating direct-to-consumer personalized diet planning.

AI's role is transformative, offering solutions that range from primary production optimization to advanced consumer engagement. Utilizing satellite imagery and machine learning, AI models can predict pest outbreaks, analyze soil nutrient levels, and optimize irrigation schedules in coconut plantations, thereby ensuring higher, more consistent yields and stable raw material supply, which is critical given the long growth cycle of coconut trees. Furthermore, in the processing stage, Computer Vision systems are being integrated into drying and milling lines. These systems monitor color, moisture content, and particle size in real-time, allowing for instant adjustments to machinery parameters, significantly reducing batch inconsistencies and waste, thus improving the overall quality and uniformity of the final product to meet stringent industrial specifications.

On the demand side, AI-driven data analytics and generative models are enabling smarter market segmentation and product development. By analyzing vast amounts of social media data, recipe search trends, and e-commerce purchasing behavior, AI can identify emerging dietary trends (e.g., highly specific fiber goals, low-carb baking needs) and rapidly prototype new coconut flour-based mixes or end-products. This allows manufacturers to drastically shorten the time-to-market for targeted products, ensuring inventory alignment with hyper-localized demand peaks. AI also contributes to sustainability efforts by optimizing logistics routes, minimizing carbon emissions in the supply chain, and providing verifiable data for ethical sourcing and traceability claims, which are major purchasing criteria for modern consumers.

- AI optimizes coconut crop yield through predictive climate modeling and resource management (irrigation and fertilization).

- Machine learning algorithms enhance quality control by performing real-time analysis of moisture, color, and particle distribution during milling.

- Predictive analytics stabilize supply chain costs by forecasting raw material availability and pricing volatility.

- Computer Vision systems detect and prevent foreign material contamination and ensure product consistency compliant with high-standard industrial needs.

- AI-driven consumer insights facilitate personalized product development and targeted marketing strategies for specific dietary niches (Keto, Paleo, High-Fiber).

- Blockchain integration, often supported by AI monitoring, provides enhanced traceability and verifies sustainable sourcing practices.

DRO & Impact Forces Of Coconut Flour Market

The Coconut Flour Market is shaped by a strong interplay of positive drivers, structural restraints, and significant long-term opportunities, all influenced by powerful external impact forces. The dominant driver is the accelerating consumer shift towards functional, plant-based, and free-from food alternatives, particularly the demand for certified gluten-free products, which provides a foundational growth trajectory for coconut flour. This is significantly restrained by the high inherent cost of processing compared to traditional grain flours, fluctuating raw material prices driven by climatic vulnerability in major producing regions, and the technical challenge of baking solely with coconut flour due to its lack of gluten structure, requiring specialized formulations and binding agents. The primary opportunity lies in expanding its use beyond baking into diverse industrial applications such as pet food, high-fiber supplements, and fortified beverages, capitalizing on its nutritional density and clean-label appeal. These factors collectively determine market scalability and adoption rates globally.

The most significant impact force on this market is the dramatic change in global public health and dietary recommendations. As governments and health organizations increasingly advocate for lower carbohydrate intake, higher fiber consumption, and the reduction of inflammatory ingredients like refined wheat, coconut flour naturally benefits. However, substitution risk poses a constant threat; competition from other functional flours, such as almond flour, cassava flour, and specialized ancient grain flours, necessitates continuous innovation in texture and flavor profiles. Furthermore, regulatory alignment concerning health claims and labeling standards across different geographies acts as an influential force, determining market access and consumer trust. Supply chain disruptions, often geopolitical or climate-driven, exert a strong negative force, highlighting the need for diversification in sourcing and robust inventory management strategies among key market players.

Market sustainability is intrinsically linked to the ethical sourcing and processing standards applied in coconut-producing nations. Consumer demand for organic, Fair Trade, and sustainably sourced ingredients is creating a positive reinforcement loop, driving investment into certified plantations and transparent processing facilities. However, the high capital expenditure required for advanced processing equipment (such as specialized jet mills for ultrafine particle size) and the energy intensity of the extensive drying process present financial constraints for small and medium enterprises (SMEs), thereby concentrating market power among larger, vertically integrated corporations. Successfully navigating these drivers and restraints, especially the need to achieve price parity with competitive alternatives while maintaining quality, will define the market leaders over the forecast period, leveraging the inherent opportunities in health and wellness trends.

Segmentation Analysis

The Coconut Flour Market is comprehensively segmented based on its Type, Application, and Distribution Channel, allowing for detailed analysis of consumption patterns and growth drivers across different sectors. This segmentation highlights the critical distinction between conventional and organic offerings, reflecting the consumer prioritization of sourcing transparency and production methods. The application segmentation reveals the dominant end-use industries, particularly the reliance on commercial baking, while the distribution channel structure illustrates the shift towards e-commerce platforms and specialized health food retail stores, underscoring modern consumer access points and purchasing behavior.

A granular approach to segmentation aids market players in formulating targeted strategies, focusing resources on high-growth segments such as organic sourcing and the burgeoning nutritional supplement application. The functional properties of coconut flour, including its capacity for high liquid absorption and fiber contribution, make it uniquely valuable in specific application segments like pet food formulations and gluten-free industrial texturization. Understanding the interrelationship between these segments—for instance, how organic certification drives demand specifically through specialty distribution channels—is paramount for strategic market positioning and achieving maximum revenue potential.

- By Type:

- Organic Coconut Flour

- Conventional Coconut Flour

- By Application:

- Bakery and Confectionery

- Beverages and Smoothies

- Nutritional Supplements and Functional Foods

- Household/Retail

- Feed (Animal and Pet Food)

- By Distribution Channel:

- Online Retail

- Supermarkets and Hypermarkets

- Specialty Stores (Health Food Stores)

- B2B (Direct Supply to Food Manufacturers)

Value Chain Analysis For Coconut Flour Market

The value chain for the Coconut Flour Market begins with the highly dispersed upstream segment, involving coconut cultivation and harvesting, predominantly centered in tropical regions like Southeast Asia. Raw material procurement is critical, relying on stable yields of mature coconuts. The midstream processing phase is complex and capital-intensive, starting with the mechanical de-shelling, meat extraction, milk processing, and culminating in the critical steps of pulp drying and fine milling. Efficiency at the drying stage, which requires significant energy, and achieving a uniform, fine particle size through milling are key value-addition points in this segment. Quality control measures, including moisture and microbiological testing, are also applied rigorously here before packaging.

The downstream activities involve distribution and sales. The market features both direct and indirect distribution channels. Direct channels (B2B) involve large-volume sales to industrial food manufacturers (bakeries, functional food producers) who require specific quality standards and consistent supply contracts. Indirect channels cater to the retail market through importers, distributors, supermarkets, hypermarkets, and increasingly, specialized online retail platforms. The high shelf-stability of packaged coconut flour supports complex international logistics, but transparency and certified traceability are increasingly demanded by B2B buyers. Specialty stores and online platforms capture premium pricing due to their focus on organic, niche, and health-conscious consumers.

Profit margins generally increase downstream, with the highest realization achieved by branded manufacturers selling directly to end-consumers through premium retail channels. However, the greatest risk and variability lie upstream, driven by weather-related crop failures and fluctuating commodity prices. Optimization of the value chain is focused on vertical integration, where major players control both raw material processing and industrial distribution, mitigating price volatility and ensuring consistent quality. This integration allows for robust quality assurances (such as ISO or HACCP certification) and faster adaptation to market demands, streamlining the journey from the coconut farm to the end-use product manufacturer or consumer.

Coconut Flour Market Potential Customers

Potential customers for the Coconut Flour Market are highly diverse, spanning both industrial manufacturers and individual consumers driven by specific dietary requirements and health consciousness. Industrially, the largest buyers are commercial bakeries specializing in 'free-from' products, particularly gluten-free bread, pastries, and mixes. These manufacturers value coconut flour for its unique binding properties, high fiber content that improves satiety, and its natural slightly sweet flavor profile, which can reduce the need for added sugar in formulations. Furthermore, manufacturers of functional food and nutritional supplements represent a rapidly growing customer base, utilizing coconut flour as a clean-label fiber enhancer and bulking agent in protein powders, meal replacement shakes, and nutritional bars, capitalizing on its low glycemic index benefits.

The retail customer segment includes households with individuals diagnosed with celiac disease or gluten sensitivity, and consumers actively pursuing specific lifestyle diets such as Paleo, Keto, or low-carb regimes. These consumers purchase smaller, branded packages primarily through supermarkets, specialized health stores, and e-commerce platforms, often seeking organic or non-GMO certifications. The demand from the pet food industry is also emerging significantly; coconut flour is being incorporated into high-quality pet snacks and specialized veterinary diets as a source of digestible fiber and a hypoallergenic grain substitute, appealing to the growing trend of humanizing pet nutrition and avoiding common pet allergens.

Institutional customers, such as schools, hospitals, and corporate catering services, are also becoming significant buyers as they adapt menus to accommodate prevalent dietary restrictions and prioritize healthier ingredient sourcing. These large-scale institutional buyers prioritize bulk packaging, stringent quality control documentation, and stable contractual pricing. The underlying characteristic uniting all these potential customers is the proactive search for functional ingredients that deliver tangible health benefits without compromising on texture or taste, positioning coconut flour as a premium solution over conventional grain alternatives in an increasingly health-aware global marketplace.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 680.5 Million |

| Market Forecast in 2033 | USD 1150.2 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bob's Red Mill Natural Foods, Nutiva, NOW Foods, The Coconut Company, Healthworks, Barlean's, Celebes Coconut Corporation, Tropical Traditions, King Arthur Baking Company, General Mills, Carrington Farms, TIANA Fair Trade Organics, Primex Coco Products, Van Houtven Foods, Tradin Organic, Madhava Natural Sweeteners, Anthony's Goods, Blue Diamond Growers, Sunopta, Inc., Viva Naturals |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Coconut Flour Market Key Technology Landscape

The core technology driving quality improvement and efficiency in the Coconut Flour Market centers around sophisticated drying and ultrafine milling techniques. Achieving consistent, low-moisture content (typically below 5%) is crucial for extending shelf life and preventing microbial growth; this is primarily managed through advanced commercial dryers, including flash dryers, spray dryers, and sometimes vacuum drying systems, optimized to handle the fibrous nature of coconut pulp without scorching. Precision control over temperature and air flow is essential to maintain the white color and nutritional integrity of the product. These technologies significantly reduce energy consumption per unit volume compared to older, traditional sun-drying methods, thereby enhancing production scalability.

The second critical area is milling technology, specifically the use of advanced jet mills or pin mills. Industrial buyers, particularly high-end bakery and nutritional supplement manufacturers, require an extremely fine particle size (often measured in microns) to ensure smooth texture, high blend consistency, and optimal performance in complex industrial formulations. Ultrafine milling enhances the functionality of the flour by improving its ability to absorb liquids and blend seamlessly without leaving a gritty mouthfeel. Investment in these specialized mills represents a significant barrier to entry but is vital for producers aiming for the premium segment of the market, enabling them to meet the stringent quality demands of industrial B2B clients.

Furthermore, technology is impacting quality assurance and traceability. Near-infrared (NIR) spectroscopy is increasingly utilized for rapid, non-destructive analysis of moisture content, protein, and fat profiles, ensuring consistent batch quality before packaging. Coupled with the rising adoption of blockchain technology, this allows for immutable records tracing the coconut flour back to its origin farm. This technological push for transparency and verifiable quality assurance is crucial for meeting the stringent regulatory requirements in North America and Europe, differentiating high-quality, ethically sourced coconut flour brands in a crowded market and commanding higher price points from conscious consumers.

Regional Highlights

Regional dynamics heavily influence the supply and demand equilibrium of the Coconut Flour Market. Asia Pacific serves as the dominant global supplier due to its natural abundance of coconut cultivation, benefiting from proximity to raw material and lower processing costs. Conversely, North America and Europe act as the principal consuming regions, characterized by high disposable incomes, deeply ingrained health and wellness trends, and a mature market for specialty dietary ingredients. This inherent geographical separation necessitates robust international trade and complex logistics networks, linking the large-scale producers in the East with the premium demand centers in the West.

The regulatory environment also shapes regional highlights; for example, European markets prioritize Non-GMO and certified organic status, often requiring expensive certifications that restrict market access to smaller producers. North America, driven by consumer enthusiasm for Keto and Paleo diets, focuses heavily on macronutrient labeling and certified gluten-free status. These stringent requirements often lead to differentiated product portfolios tailored specifically for these high-value consumer regions, commanding superior pricing compared to flour sold in developing domestic markets in Asia Pacific.

- North America (Dominant Consumer): High adoption rates driven by strong consumer awareness of gluten intolerance, coupled with popular low-carb and paleo dietary trends.

- Europe (Premium Growth): Focus on certified organic and ethically sourced coconut flour, fueled by strict EU standards and a preference for clean-label products.

- Asia Pacific (Largest Producer and Fastest Growth): Home to major exporting nations (Philippines, Indonesia, India); rapidly increasing domestic consumption due to rising middle-class disposable income and urbanization.

- Latin America (Emerging Market): Growth driven by increased health awareness in urban centers, although import dependence can elevate product costs.

- Middle East & Africa (Niche Market): Slow but steady growth centered around expatriate communities and specialized health food stores catering to high-income consumers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Coconut Flour Market.- Bob's Red Mill Natural Foods

- Nutiva

- NOW Foods

- The Coconut Company

- Healthworks

- Barlean's

- Celebes Coconut Corporation

- Tropical Traditions

- King Arthur Baking Company

- General Mills

- Carrington Farms

- TIANA Fair Trade Organics

- Primex Coco Products

- Van Houtven Foods

- Tradin Organic

- Madhava Natural Sweeteners

- Anthony's Goods

- Blue Diamond Growers

- Sunopta, Inc.

- Viva Naturals

Frequently Asked Questions

Analyze common user questions about the Coconut Flour market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Coconut Flour Market?

The primary factor driving market growth is the widespread consumer shift toward gluten-free, low-carbohydrate, and high-fiber diets, significantly accelerated by the increased diagnosis of celiac disease and the popularity of keto and paleo lifestyle regimes.

How does the cost of coconut flour compare to traditional wheat flour?

Coconut flour is typically more expensive than traditional wheat flour due to higher processing complexity, specialized drying and milling requirements, and vulnerability to fluctuations in raw coconut commodity prices in tropical producing regions.

Which application segment holds the largest share in the Coconut Flour Market?

The Bakery and Confectionery segment currently holds the largest market share, driven by its intensive use in manufacturing gluten-free bread, specialized cakes, and low-carb baking mixes for retail and industrial distribution.

What are the main technical challenges in using coconut flour for baking?

The main technical challenge is the absence of gluten, which requires specialized formulation adjustments and the inclusion of binding agents (like eggs or gums) to achieve desired texture and structural integrity in baked goods, due to its high liquid absorption capacity.

Which geographical region is projected to exhibit the fastest growth rate?

The Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR), fueled by increasing regional industrial utilization, favorable export policies, and growing domestic consumption in countries like India and Indonesia.

Regional Market Analysis and Growth Outlook

North America Coconut Flour Market

The North American market, comprising the United States and Canada, represents the most mature and dominant consumer base for coconut flour globally. This region benefits from high consumer awareness regarding health issues associated with gluten and high carbohydrate intake, contributing to a robust demand for alternative flours. The market structure here is highly organized, characterized by strong brand loyalty and extensive distribution networks that efficiently move products from large importers and processors to major supermarkets, specialty health food stores, and leading e-commerce platforms. The trend of clean eating and the popularity of specific restrictive diets like the ketogenic (Keto) and Paleo diets are primary consumption drivers. Coconut flour is viewed not just as a substitute but as a premium, functional ingredient offering enhanced nutritional benefits, including superior fiber content.

Industrial demand in North America is significant, driven by food manufacturers specializing in high-value convenience foods such as protein bars, gluten-free snack mixes, and specialized breakfast cereals. These industrial buyers prioritize consistency in particle size and moisture content, demanding suppliers adhere to strict quality and traceability standards, including Non-GMO Project verification and Certified Gluten-Free labeling. Regulatory standards set by the FDA play a pivotal role, requiring transparent labeling and accurate representation of nutritional claims, reinforcing consumer confidence in the premium price point of coconut flour products. Innovation often focuses on developing pre-mixed baking blends that simplify the use of coconut flour for the average consumer, mitigating the technical challenges associated with its high absorption properties.

The competitive landscape is fragmented but highly dynamic, featuring both large multinational food corporations (who integrate coconut flour into their broader product lines) and specialized organic ingredient suppliers. Strategic marketing emphasizes the sustainability and ethical sourcing of the product, with consumers increasingly willing to pay a premium for Fair Trade and sustainably harvested varieties. Future growth is anticipated from the expansion of coconut flour utilization into the rapidly growing plant-based meat alternative and functional beverage sectors, further diversifying its application base beyond traditional baking and confectionery.

- Key Drivers: High incidence of celiac disease, pervasive popularity of Keto/Paleo diets, and sophisticated e-commerce penetration.

- Dominant Application: Specialty gluten-free baking and nutritional supplement manufacturing.

- Regulatory Focus: Strict adherence to FDA and CFIA labeling requirements, focusing on gluten-free and allergy claims.

- Growth Strategy: Product innovation targeting convenience (pre-mixed blends) and functional food fortification.

Europe Coconut Flour Market

The European market for coconut flour exhibits strong growth, underpinned by a consumer base highly attuned to sustainability, organic certification, and ethical sourcing. Countries such as Germany, the United Kingdom, and France are the largest consumers, where consumer health consciousness is consistently high and expenditure on premium, functional ingredients is robust. The regulatory framework within the European Union (EU) is particularly stringent regarding organic standards and traceability, leading European consumers to favor imported coconut flour that meets comprehensive quality controls, including strict maximum residue limits (MRLs) for pesticides and compliance with Novel Food regulations, where applicable.

Market expansion is also driven by the widespread acceptance of plant-based diets and vegetarianism/veganism across Western Europe. Coconut flour serves as a versatile, hypoallergenic component in formulating a wide array of vegetarian and vegan products, ranging from specialized bakery items to dairy-free desserts. The distribution channel is heavily reliant on established retail chains and a highly active specialty health food store sector, although online retail is rapidly gaining prominence, allowing smaller, certified organic brands to achieve significant market reach without extensive physical infrastructure.

A key trend in Europe is the focus on minimizing the supply chain's environmental footprint. Manufacturers often face pressure to provide detailed information on carbon footprint and sourcing methodologies, prompting investment in sustainable packaging and reduced-emission transport logistics. Although Europe is a net importer, its industrial sector leverages coconut flour for high-end applications, often in conjunction with other superfoods, to create premium, health-positioned end-products. The challenge remains maintaining stable supply volumes and competitive pricing against domestically produced grain alternatives while absorbing high import duties and complex logistical overheads.

- Key Drivers: High prioritization of Organic and Fair Trade certifications, and the mature market for plant-based and vegan diets.

- Dominant Application: Clean-label food formulation, particularly in organic bakery and health food stores.

- Regulatory Focus: Stringent EU Organic regulations, Novel Food compliance, and comprehensive traceability requirements.

- Growth Strategy: Differentiation based on ethical sourcing, sustainability claims, and premium branding.

Asia Pacific (APAC) Coconut Flour Market

The Asia Pacific region holds a unique position, acting simultaneously as the world's primary producer and a rapidly emerging consumer market for coconut flour. Key producing nations—the Philippines, Indonesia, India, and Sri Lanka—dominate the global supply chain, leveraging abundant raw material access and established processing infrastructure, often built around traditional coconut milk and oil production. Export revenue from high-quality coconut flour to North America and Europe remains a significant economic driver for these countries, requiring them to meet international quality and safety standards rigorously, including HACCP and ISO certifications.

Domestically, the consumption pattern is undergoing a transformation. Historically, most coconut pulp was used locally for animal feed or discarded. However, rising urbanization, increasing disposable incomes, and greater exposure to Western dietary trends (like fitness and wellness movements) are spurring domestic demand for high-value coconut-derived products. Urban centers in China, India, and Southeast Asia are witnessing rapid growth in specialized retail outlets and local manufacturing of gluten-free products tailored for the local market, including traditional snacks with a modern, healthy twist utilizing coconut flour.

The market in APAC is characterized by a strong competitive environment among large, integrated processors focusing on cost efficiency and volume. Investment is concentrated on optimizing the drying and milling process to reduce energy consumption and improve flour fineness for export purposes. The growth rate is projected to be the highest globally, driven by infrastructure improvements, favorable government policies promoting value-added agricultural exports, and the transition of local manufacturers from basic commodity production to sophisticated ingredient supply. Challenges include climate vulnerability affecting coconut crop yields and the need for standardized quality control measures across numerous small and medium-sized processing units.

- Key Drivers: Abundant raw material supply, strong export orientation, and rapid growth in domestic health consciousness among the urban middle class.

- Dominant Application: Export to international industrial manufacturers; emerging local use in healthy snack foods.

- Regulatory Focus: Meeting international export standards (EU and US requirements) while improving local food safety adherence.

- Growth Strategy: Vertical integration to control quality from farm to export and significant expansion of processing capacity.

Latin America Coconut Flour Market

The Latin America market for coconut flour is in a nascent to growth phase, with demand concentrated in economically developed urban areas such as Brazil, Mexico, and Chile. Although the region has indigenous coconut production, much of the coconut flour consumed is imported, particularly the certified organic and high-grade varieties required by specialty food manufacturers and health-conscious retail consumers. Consumer demand is driven by increasing health literacy and the adoption of global dietary trends, including the popularity of natural, whole-food ingredients and functional foods aimed at weight management and digestive health.

Market penetration is significantly influenced by macro-economic stability and fluctuating currency exchange rates, which can impact the cost of imported raw materials and specialty ingredients. Local manufacturers and processors are beginning to explore opportunities for domestic coconut flour production to reduce reliance on imports and stabilize costs. This regional market offers substantial growth potential, particularly if local agricultural policies encourage the shift from basic coconut products (like oil and water) to higher-value processed ingredients like flour. The retail distribution landscape is dominated by large supermarket chains, which are increasingly dedicating shelf space to specialized gluten-free and organic sections to capture affluent consumer segments.

The primary opportunity for market players lies in educating local food manufacturers about the functional benefits of coconut flour as a cost-effective, high-fiber replacement for other imported, specialty flours. Strategic partnerships with local retail distributors and direct marketing emphasizing the natural and tropical origin of the ingredient are key to successful market entry and expansion. Regulatory frameworks are evolving, with increasing standardization efforts to harmonize food safety and labeling requirements across major Latin American economies, which will facilitate trade and consumer trust in imported and locally processed goods.

- Key Drivers: Growing middle-class expenditure on health products, increasing prevalence of global nutritional trends (e.g., functional fibers).

- Dominant Application: Household consumption for dietary restrictions and use in high-end specialty desserts and confectionery.

- Regulatory Focus: Improvement in national food safety and import standardization across major economies.

- Growth Strategy: Localizing production to counter import volatility and strategic retail placement in major urban centers.

Middle East and Africa (MEA) Coconut Flour Market

The Middle East and Africa (MEA) market remains relatively small but shows promising growth, particularly within the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia, Qatar) and South Africa. Demand in the Middle East is almost exclusively driven by high-income expatriate populations and affluent local consumers who adopt global wellness trends. The retail environment is sophisticated, featuring specialized organic stores, large international hypermarkets, and robust cold-chain logistics capable of handling imported specialty foods. Coconut flour is positioned as a premium, imported product, often utilized in luxurious bakery items and health supplements tailored for the fitness-conscious urban demographic.

Import reliance is high across the GCC, leading to elevated retail prices, which limits mass-market adoption. However, governmental health initiatives aimed at combating rising rates of diabetes and obesity are subtly shifting consumer preferences toward low-carb and high-fiber ingredients, potentially broadening the customer base over the forecast period. Supply chain stability, involving long-distance shipping from APAC producers, is a major logistical consideration, demanding efficient inventory management to prevent stock-outs.

In Africa, the market is highly fragmented. While some localized coconut production exists, large-scale processing for industrial-grade coconut flour is limited. South Africa is the largest consumer market due to its developed retail sector and higher health awareness. The future expansion in MEA will depend heavily on sustained economic growth in key nations, leading to increased discretionary spending on premium health ingredients, and the successful navigation of complex import duties and differing religious certification requirements, such as Halal, which can add layers of processing complexity for international suppliers.

- Key Drivers: High disposable income in GCC states, strong influence of Western dietary trends among expatriates, and government focus on combating lifestyle diseases.

- Dominant Application: Niche high-end baking, specialty health food retail, and nutritional supplementation.

- Regulatory Focus: Compliance with Halal certification standards and stringent import quality checks.

- Growth Strategy: Focusing distribution efforts on urban centers and high-end retail channels catering to affluent consumer segments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager