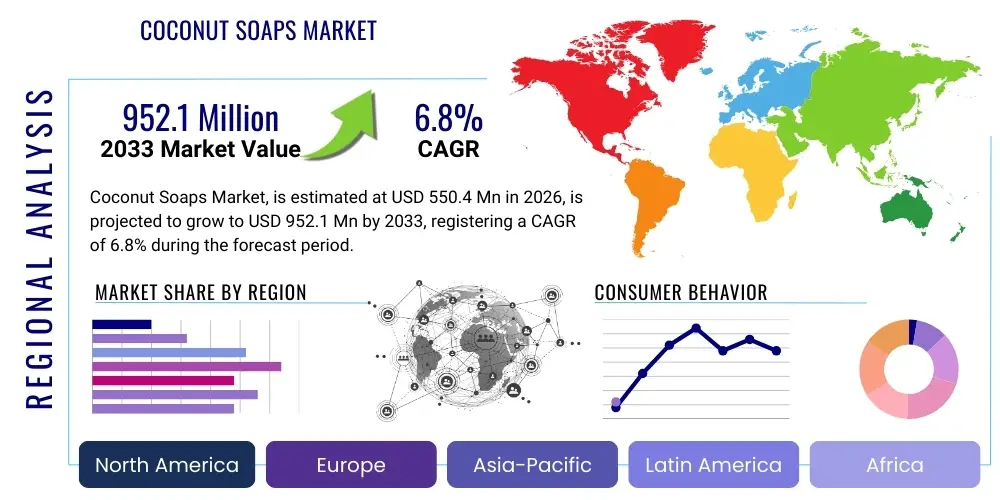

Coconut Soaps Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437403 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Coconut Soaps Market Size

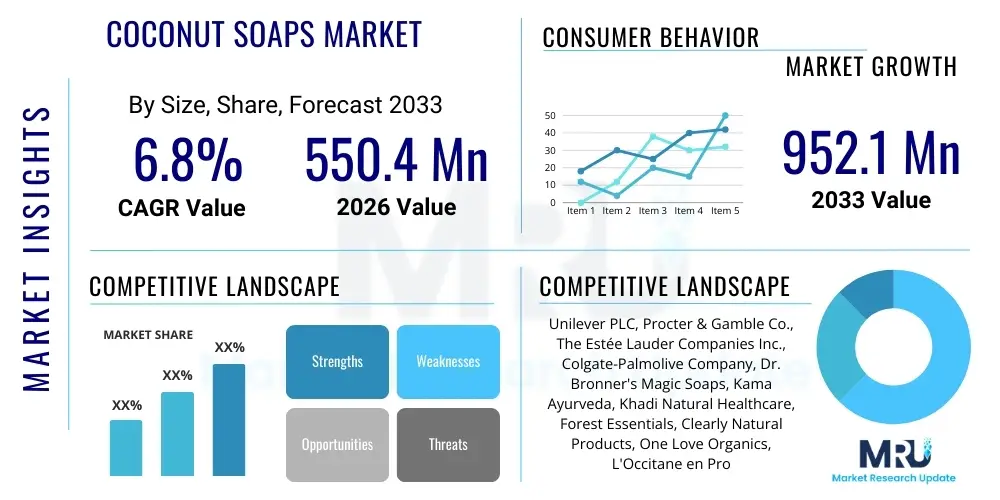

The Coconut Soaps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 550.4 Million in 2026 and is projected to reach USD 952.1 Million by the end of the forecast period in 2033.

Coconut Soaps Market introduction

The Coconut Soaps Market encompasses the production, distribution, and consumption of various cleaning and personal hygiene products derived primarily from coconut oil or its fatty acids. These soaps are highly valued for their natural cleansing properties, rich lathering capabilities, and inherent moisturizing benefits, making them a preferred alternative to synthetic chemical-based soaps. The core product utilizes the saponification of coconut oil, resulting in soaps rich in lauric acid, which possesses recognized antimicrobial and anti-inflammatory characteristics. The market includes bar soaps, liquid soaps, and specialized formulations tailored for sensitive skin or specific dermatological needs.

Major applications of coconut soaps span across household cleaning, personal care, and industrial uses. In the personal care segment, they are utilized extensively in face wash, body wash, and hand hygiene products due to growing consumer preference for natural ingredients and transparency in labeling. The market growth is fundamentally driven by a global shift towards sustainable, eco-friendly, and naturally sourced products. Consumers are increasingly aware of the potential hazards associated with parabens, sulfates, and artificial fragrances often found in conventional soaps, thereby fueling demand for benign, plant-based alternatives like coconut soap. Furthermore, the robust marketing efforts promoting the natural origin and skin benefits of coconut oil are pivotal in expanding the market base.

The primary benefits driving adoption include superior hydration, gentle cleansing action suitable for all skin types—including sensitive and acne-prone skin—and their biodegradable nature, which appeals to environmentally conscious consumers. Key driving factors accelerating market expansion include rapid urbanization in developing regions, increased disposable income allocated to wellness products, and the rising prevalence of skin allergies demanding mild, hypoallergenic cleansing solutions. Regulatory support encouraging the use of natural ingredients in cosmetic and hygiene products also provides significant momentum to the market structure, encouraging innovation in formulation and packaging design.

Coconut Soaps Market Executive Summary

The global Coconut Soaps Market exhibits strong resilience, underpinned by persistent consumer demand for natural and sustainable personal care products. Current business trends indicate a significant shift towards specialized product offerings, such as vegan, cruelty-free, and artisanal coconut soaps, which command premium pricing and cater to niche segments focused on ethical sourcing. E-commerce platforms are playing an increasingly dominant role in distribution, allowing smaller, independent brands to compete effectively against established multinational corporations. Furthermore, manufacturers are focusing on innovative processing techniques, such as cold-pressed soap making, to preserve the maximum nutritional integrity of the coconut oil, enhancing product quality and market differentiation.

Regional trends reveal Asia Pacific (APAC) as the largest and fastest-growing market, largely due to high domestic production of raw coconut oil, widespread traditional usage of natural ingredients in hygiene, and the massive consumer base in countries like India, Indonesia, and the Philippines. North America and Europe, while mature, demonstrate high adoption rates for premium, organic, and certified fair-trade coconut soap variants, driven by strict regulatory standards regarding ingredient safety and high consumer awareness regarding sustainability. Investment in supply chain optimization, particularly in traceable sourcing of certified organic coconut oil, remains a critical factor for maintaining competitive advantage across all major regions.

Segment trends highlight the dominance of the Bar Soap segment in terms of volume, primarily due to cost-effectiveness and longer shelf life, particularly popular in developing economies. Conversely, the Liquid Soap segment is showing accelerated growth, fueled by increased hygiene standards, convenience, and sophisticated dispensing mechanisms, especially in commercial and institutional settings. The Organic segment, though smaller, is expanding rapidly, reflecting a premiumization trend where consumers are willing to pay more for third-party certified natural ingredients. Key strategies deployed by market players involve strategic mergers and acquisitions to secure raw material supply chains and extensive R&D focused on combining coconut oil benefits with other complementary natural extracts, such as shea butter or essential oils, to broaden product appeal and application scope.

AI Impact Analysis on Coconut Soaps Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Coconut Soaps Market frequently center on optimizing the supply chain, enhancing personalized product development, and improving consumer engagement through data analytics. Key concerns revolve around how AI can guarantee ethical sourcing traceability, predict fluctuating commodity prices (like coconut oil), and automate quality control processes to ensure consistency in natural formulations. Users are particularly interested in AI's role in analyzing complex consumer feedback from social media and e-commerce platforms to quickly identify emerging demand patterns for specific ingredients (e.g., fragrance-free or specific essential oil combinations) or sustainable packaging preferences. The expectation is that AI will drive efficiency gains in manufacturing and distribution, while simultaneously enabling hyper-personalization in marketing strategies targeted at environmentally conscious demographics.

- AI optimizes raw material sourcing by predicting commodity price volatility and ensuring traceability of certified organic coconut oil.

- Generative AI models accelerate new product formulation by simulating ingredient interactions and predicting stability and efficacy.

- Machine learning algorithms personalize marketing efforts by analyzing purchasing history and demographic data to recommend specific soap variants.

- AI-powered automated quality control systems monitor viscosity, pH levels, and ingredient ratios in real-time during the saponification process, minimizing batch deviations.

- Predictive maintenance schedules for manufacturing equipment are enhanced using AI, reducing downtime and improving overall production yield.

- Automated customer service chatbots handle common queries regarding ingredient transparency, sustainability certifications, and usage instructions, improving consumer satisfaction.

DRO & Impact Forces Of Coconut Soaps Market

The Coconut Soaps Market is influenced by a dynamic interplay of factors encompassing strong consumer health consciousness and macroeconomic vulnerabilities related to raw material procurement. The primary driver is the burgeoning demand for natural and organic hygiene products, fueled by increasing global awareness regarding the detrimental effects of synthetic chemicals on skin health and the environment. This driver is powerfully complemented by robust endorsements from dermatologists and wellness advocates emphasizing the inherent moisturizing and antibacterial properties of coconut oil. However, market expansion is significantly restrained by the inherent volatility in the price and supply of raw coconut oil, which is heavily reliant on climatic conditions and geopolitical stability in major producing regions, leading to unpredictable operational costs for manufacturers.

Opportunities for growth are vast, primarily through geographical expansion into untapped emerging markets in Africa and Latin America, where basic hygiene awareness and disposable incomes are steadily rising. Furthermore, technological innovation presents a significant opportunity, allowing for the creation of hybrid products, such as soap-infused shampoos or specialized industrial cleaning agents derived from coconut fatty acids, broadening the market application scope beyond traditional personal care. Impact forces, which include external factors that fundamentally shape market trajectory, are dominated by stringent regulatory standards governing the labeling and claims of natural cosmetic products, requiring manufacturers to invest heavily in certifications (e.g., USDA Organic, Ecocert). Social influence, particularly through influencer marketing and digital health trends promoting minimalist and natural skincare routines, further amplifies product adoption and sets high standards for ethical sourcing and sustainable packaging practices across the competitive landscape.

Segmentation Analysis

The Coconut Soaps Market is systematically segmented based on formulation type (Bar, Liquid), end-user application (Household, Commercial), and distribution channel (Online, Offline), providing a granular view of market dynamics and consumer preferences. Analyzing these segments allows market participants to tailor their product offerings, marketing strategies, and distribution networks to maximize reach and profitability. The segmentation based on formulation is critical, as Bar Soaps maintain dominance in cost-sensitive regions, while Liquid Soaps capture significant value share in developed markets due to perceived convenience and enhanced hygiene features. The increasing specialization within the Household segment, demanding certified organic and hypoallergenic variants, necessitates continuous innovation and investment in high-quality raw materials.

The distribution segmentation is undergoing a rapid transformation, with the E-commerce channel registering the highest growth rate. This accelerated growth is attributed to the direct-to-consumer (D2C) model adopted by many niche organic coconut soap brands, leveraging digital marketing to bypass traditional retail barriers. Conversely, the Offline segment, encompassing supermarkets and specialized pharmacies, still accounts for the majority of sales volume, particularly for established household brands. Understanding the intersectionality of these segments—for instance, high-end organic liquid coconut soap sold primarily through specialty online retailers—is crucial for effective strategic planning and resource allocation in competitive market environments.

- By Product Type:

- Bar Soap

- Liquid Soap

- Others (e.g., Flakes, Wipes)

- By Application/End User:

- Household

- Commercial (Hotels, Hospitals, Corporate Offices)

- By Nature:

- Organic

- Conventional

- By Distribution Channel:

- Offline Retail (Supermarkets, Hypermarkets, Drug Stores)

- Online Retail (E-commerce Platforms, D2C Websites)

Value Chain Analysis For Coconut Soaps Market

The value chain for the Coconut Soaps Market commences with the upstream analysis, focusing on the cultivation and harvesting of coconuts, primarily in tropical regions such as Southeast Asia and the Pacific Islands. This stage involves securing sustainable and high-quality coconut supply, often requiring complex certification processes (e.g., fair trade, organic) to meet sophisticated consumer demands in developed markets. The next critical step is the extraction and refinement of coconut oil, where techniques such as cold-pressing or fractional distillation are employed to produce the specific fatty acid profile required for superior saponification. Efficiency and cost control at this upstream level are vital, as raw material cost constitutes a significant portion of the final product price, heavily influencing competitive positioning.

The central phase involves manufacturing and processing, where crude coconut oil is saponified with lye (sodium or potassium hydroxide) to create the soap base. Differentiation occurs through the addition of secondary ingredients, such as essential oils, botanical extracts, colors, and specialized conditioners, enhancing product efficacy and sensorial appeal. Quality control and packaging design, ensuring both aesthetic appeal and product integrity, are paramount before distribution. The downstream analysis involves the intricate logistics network, encompassing storage and movement through various distribution channels—Direct and Indirect. Indirect distribution, leveraging major retailers, wholesalers, and e-commerce aggregators, provides broad market coverage. Direct distribution, often favored by premium or artisanal brands, utilizes proprietary online stores and specialty shops, allowing for higher margin retention and closer customer relationship management. The choice of channel profoundly impacts marketing requirements and inventory management complexity.

The distribution channel structure highlights the growing importance of online platforms which offer unparalleled reach and lower entry barriers for new market entrants. Large manufacturers utilize comprehensive indirect channels, relying on established agreements with hypermarkets and large drug store chains for mass distribution. Conversely, niche, organic brands increasingly prioritize the direct channel to communicate their sustainability narratives effectively and control the customer experience end-to-end. Supply chain optimization, particularly the integration of cold storage and specialized transportation for liquid soap formulations, ensures product stability and shelf-life, culminating in the final delivery to end-users such as households or commercial institutions.

Coconut Soaps Market Potential Customers

Potential customers for the Coconut Soaps Market are highly diverse, spanning both B2C and B2B segments, fundamentally unified by a preference for gentle, effective, and naturally derived cleaning agents. The primary end-user segment is the Household consumer, which includes individuals and families prioritizing natural personal care, focusing particularly on mitigating skin sensitivities and seeking eco-friendly alternatives to conventional synthetic soaps. This demographic often seeks out specific product attributes such as hypoallergenic certification, cruelty-free labels, and biodegradable packaging, translating into a strong preference for premium, organic coconut soap variants available through specialized retail or online D2C channels.

The B2B segment, categorized under Commercial and Institutional buyers, represents another significant customer base. This includes hotels, resorts, and the hospitality sector which utilize coconut soaps as part of their commitment to sustainability and luxury guest amenities. Healthcare facilities, including hospitals and clinics, are increasingly adopting coconut oil-based sanitizers and soaps due to their proven mildness and natural antimicrobial properties, especially for staff requiring frequent handwashing. Furthermore, manufacturers of other consumer goods, such as specialized laundry detergents or industrial cleaning solutions, often act as indirect buyers, sourcing refined coconut oil fatty acids as foundational ingredients, highlighting a crucial industrial application for derivatives of the primary product.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550.4 Million |

| Market Forecast in 2033 | USD 952.1 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Unilever PLC, Procter & Gamble Co., The Estée Lauder Companies Inc., Colgate-Palmolive Company, Dr. Bronner's Magic Soaps, Kama Ayurveda, Khadi Natural Healthcare, Forest Essentials, Clearly Natural Products, One Love Organics, L'Occitane en Provence, Chagrin Valley Soap & Salve, Neal's Yard Remedies, Osmia Organics, Tropical Traditions, South of France Natural Body Care, Sappo Hill Soapworks, Sunaroma Inc., Botanie Soap, Kirk's Natural LLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Coconut Soaps Market Key Technology Landscape

The technology landscape in the Coconut Soaps Market primarily revolves around optimizing the saponification process and enhancing the preservation and delivery systems of the final product. Traditional soap making involves batch processing, but modern facilities increasingly adopt Continuous Saponification Processes (CSP), which utilize automated control systems to ensure precise measurement of lye and oil ratios, resulting in highly consistent product quality and reduced manufacturing cycle times. Furthermore, manufacturers are employing advanced techniques, such as vacuum drying and chilling tunnels, to rapidly cure and stabilize bar soaps, improving their longevity and minimizing the risk of rancidity, a common challenge with natural oil-based products. These technological advancements not only boost production efficiency but also allow for greater scalability to meet burgeoning global demand.

Another significant technological focus is on enhancing the bio-efficacy of the natural ingredients. Micellar technology, originally popular in skincare, is being adapted for liquid coconut soaps to create highly effective cleansing solutions that maintain skin hydration by encapsulating dirt and oil without stripping natural moisture. Ingredient technology also includes the use of highly fractionated coconut oil derivatives (such as caprylic/capric triglycerides) which offer superior stability and texture compared to crude oil, allowing for more sophisticated and specialized product formulations targeted at sensitive skin types. This sophisticated processing requires investment in specialized refining equipment and analytical laboratories to ensure the purity and concentration of active coconut-derived compounds, upholding the premium positioning of organic and natural soap lines.

Furthermore, packaging technology plays a crucial supportive role, especially concerning the sustainability mandate of the market. Innovations include biodegradable and compostable packaging materials, recycled content plastics, and lightweight designs to minimize environmental footprint and transportation costs. Smart packaging integration, though nascent, is being explored to offer consumers traceability information (QR codes linking to sourcing data) and tamper-proof sealing. Overall, the technological evolution is characterized by a push towards automation for efficiency, precise ingredient refinement for enhanced quality, and sustainable solutions that align with the core values driving consumer adoption of coconut-based hygiene products.

Regional Highlights

The global Coconut Soaps Market displays diverse growth trajectories across major geographical segments, influenced by local consumer preferences, raw material availability, and regulatory frameworks governing natural ingredients.

Asia Pacific (APAC) is recognized as the dominant regional market, holding the largest share and simultaneously exhibiting the highest growth rate. This dominance is intrinsically linked to the region’s status as the primary global hub for coconut cultivation and processing (notably in the Philippines, Indonesia, India, and Sri Lanka), ensuring abundant and cost-effective access to raw materials. Traditional wisdom surrounding the use of coconut oil in hygiene and wellness is deeply embedded in local culture, supporting high indigenous consumption rates. Furthermore, the burgeoning middle-class population, coupled with increasing disposable incomes and rapid urbanization, drives the transition from basic hygiene products to premium, branded coconut soaps. Investment in manufacturing infrastructure and favorable government policies supporting the export of coconut-derived products further cement APAC’s leading role in the global market. Manufacturers in this region often focus on competitive pricing and leveraging local supply chain efficiencies.

North America represents a mature yet high-value market, characterized by strong consumer emphasis on sustainability, organic certifications, and ingredient transparency. Consumers in the US and Canada are highly discerning and willing to pay premium prices for specialized products, such as vegan, gluten-free, and ethically sourced coconut soaps. The market is driven by sophisticated wellness trends and strong retail presence of natural product stores and dedicated e-commerce platforms. Regulatory requirements, particularly those enforced by the FDA concerning cosmetic labeling and safety, guide product development and marketing efforts. Growth in this region is primarily fueled by continuous innovation in luxury and specialized segment offerings, rather than overall volume expansion.

Europe closely mirrors North America in terms of quality demands but is distinguished by particularly strict environmental and ethical standards, such as REACH regulations. Western European countries, including Germany, the UK, and France, show high adoption rates for certified natural and biodegradable coconut soaps. The market benefits from strong institutional buyers (hotels, public services) adhering to stringent procurement policies favoring sustainable suppliers. European manufacturers often collaborate with international certification bodies (e.g., Ecocert, COSMOS) to assure consumers of ingredient purity and ecological impact. The challenge here remains the relatively high cost of importing raw coconut oil, which is mitigated by focusing on high-margin, value-added products.

Latin America (LATAM) shows substantial potential for future growth. Countries like Brazil and Mexico possess large, young populations with increasing awareness of natural personal care benefits. While traditional soap consumption remains high, there is a visible trend towards natural, locally sourced ingredients. Market development is primarily dependent on improving economic stability and expanding modern retail infrastructure. Local manufacturers often focus on combining coconut oil with other regional botanical extracts to create unique product lines that appeal to national preferences.

Middle East and Africa (MEA) is the smallest market but offers significant untapped opportunities, particularly in the Gulf Cooperation Council (GCC) countries where high disposable incomes support the luxury and premium segment. In parts of Africa, local coconut production sustains domestic consumption. Market growth across MEA is highly diversified, driven by rising hygiene standards and exposure to global brands through trade. Key challenges include logistical complexities and varied regulatory landscapes across the continent. Investment in regional distribution networks is crucial for effective market penetration.

- Asia Pacific (APAC): Dominant market share due to proximity to raw material sources (Indonesia, Philippines) and high indigenous consumption; fastest growth driven by urbanization and rising disposable income.

- North America: High-value market focused on organic, certified, and premium formulations; driven by sophisticated wellness trends and strong e-commerce penetration.

- Europe: Strong regulatory environment (REACH, COSMOS) demanding ecological sustainability and transparency; high demand for biodegradable and cruelty-free coconut soaps.

- Latin America (LATAM): Emerging market characterized by increasing health awareness and growth in modern retail channels; focus on value-for-money and natural local ingredient blends.

- Middle East and Africa (MEA): Growing market potential fueled by increased hygiene standards, particularly in the GCC region focusing on premium imported brands.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Coconut Soaps Market.- Unilever PLC

- Procter & Gamble Co.

- The Estée Lauder Companies Inc.

- Colgate-Palmolive Company

- Dr. Bronner's Magic Soaps

- Kama Ayurveda

- Khadi Natural Healthcare

- Forest Essentials

- Clearly Natural Products

- One Love Organics

- L'Occitane en Provence

- Chagrin Valley Soap & Salve

- Neal's Yard Remedies

- Osmia Organics

- Tropical Traditions

- South of France Natural Body Care

- Sappo Hill Soapworks

- Sunaroma Inc.

- Botanie Soap

- Kirk's Natural LLC

- Vermont Soap Organics

- Mountain Rose Herbs

Frequently Asked Questions

Analyze common user questions about the Coconut Soaps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Coconut Soaps Market?

The market growth is fundamentally driven by the escalating global demand for natural, organic, and chemical-free personal care products, combined with heightened consumer awareness regarding the moisturizing, antibacterial, and hypoallergenic benefits inherent to coconut oil.

How does the segmentation by product type influence market dynamics?

Bar soap dominates the market volume due to cost-efficiency and traditional usage, particularly in developing regions. Conversely, liquid soap leads in value growth, driven by consumer preference for convenience and enhanced hygiene features in commercial and institutional settings across developed economies.

Which region currently holds the largest share in the Coconut Soaps Market?

Asia Pacific (APAC) holds the largest market share, benefiting from its massive raw coconut oil production capabilities (Indonesia, Philippines) and strong historical and cultural affinity for natural, coconut-based personal hygiene products.

What major restraints challenge market expansion and profitability?

Key restraints include the significant volatility and fluctuations in the global price and supply of raw coconut oil, which is vulnerable to climatic changes and agricultural instability, directly impacting manufacturing costs and profitability margins.

What role does sustainability play in product development for coconut soaps?

Sustainability is central, influencing product innovation toward eco-friendly sourcing (fair trade, organic certifications), water-efficient manufacturing, and the adoption of biodegradable or zero-waste packaging materials to appeal to environmentally conscious consumers.

Are coconut soaps suitable for all skin types, including sensitive skin?

Yes, pure coconut soaps are generally highly suitable for sensitive skin. They are typically formulated without harsh detergents, synthetic fragrances, or sulfates, making them hypoallergenic and gentle, though specific sensitivities should be monitored due to high cleansing power.

What is the difference between conventional and organic coconut soap segments?

The Organic segment uses coconut oil derived from certified organic farms, processed without harsh chemicals, commanding a premium price and appealing to consumers seeking maximum ingredient purity and environmental assurance, unlike the Conventional segment which focuses on mass-market accessibility and standard processing.

How is technology impacting the production of coconut soaps?

Technology enhances production through Continuous Saponification Processes (CSP) for consistent quality, micellar technology for superior gentle cleansing, and advanced quality control systems to ensure product stability and ingredient precision throughout the manufacturing cycle.

What are the key distribution channels utilized in this market?

Distribution is split between Offline Retail (major supermarkets, hypermarkets, and drug stores), which drives bulk volume, and Online Retail (e-commerce, D2C websites), which is experiencing rapid growth due to targeted marketing and direct consumer engagement for niche and premium brands.

Why is supply chain traceability important for coconut soap manufacturers?

Traceability is crucial for meeting ethical consumer demands, ensuring raw coconut oil is ethically sourced, supporting fair trade practices, and verifying organic certifications, which are vital components of the premium branding strategy in the competitive market.

What opportunities exist for market expansion into new product applications?

Expansion opportunities lie in formulating specialized industrial cleaning agents using coconut fatty acid derivatives, developing hybrid products like soap-infused shampoos, and focusing on specialized dermatological applications for anti-acne or eczema management.

How do price fluctuations of crude oil affect the Coconut Soaps Market?

While coconut oil is plant-based, the energy costs associated with processing, manufacturing, and distribution, which heavily rely on crude oil prices, indirectly increase the operational expenditure, leading to higher final product pricing, particularly for globally distributed brands.

Is the commercial segment a significant driver for coconut soap demand?

Yes, the commercial segment, including the hospitality sector (hotels, resorts) and healthcare facilities, is a major driver, utilizing coconut soaps to meet institutional sustainability commitments and provide high-quality, gentle hygiene products to guests and patients.

What role does the 'Cold Process' method play in the market?

The Cold Process method is highly valued, particularly by artisanal and organic brands, as it utilizes low heat, preserving more of the natural glycerin and therapeutic properties of the coconut oil, resulting in a superior moisturizing and higher-priced final product sought after by premium consumers.

How does the introduction of AI enhance product personalization in this sector?

AI utilizes machine learning to analyze vast amounts of consumer data, social media sentiment, and purchase histories, enabling manufacturers to rapidly customize product offerings, recommend specific fragrance or ingredient combinations, and tailor marketing communications for hyper-personalized consumer experiences.

What competitive advantage do brands with direct-to-consumer (D2C) channels hold?

D2C channels provide enhanced control over brand narrative, allow for higher profit margins by eliminating intermediaries, and facilitate direct feedback loops, enabling agile product adjustments and fostering stronger customer loyalty and advocacy for sustainable practices.

How significant is the influence of dermatologists in driving consumer adoption?

Dermatological recommendations are highly influential, particularly for sensitive skin consumers. Endorsements emphasizing the mildness, non-comedogenic nature, and natural anti-inflammatory properties of coconut soaps significantly boost credibility and consumer trust, driving demand in specialty segments.

What defines the upstream segment of the coconut soap value chain?

The upstream segment covers the cultivation, harvesting, and initial processing of coconuts, including the crucial steps of extraction, refining, and fractionating of the crude coconut oil into specific fatty acids suitable for saponification, demanding strict quality control.

How do varying regulations across regions affect market penetration?

Varied regional regulations (e.g., EU's REACH vs. FDA standards) necessitate significant adaptation in labeling, ingredient disclosure, and safety testing, raising compliance costs and complexity for manufacturers attempting global market penetration, favoring localized production strategies.

What impact do fair trade certifications have on market positioning?

Fair trade certifications significantly enhance brand reputation and premium positioning, assuring consumers that farmers receive equitable wages and promoting ethical sourcing, which is a major purchasing criterion for the affluent and socially conscious consumer base in North America and Europe.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager