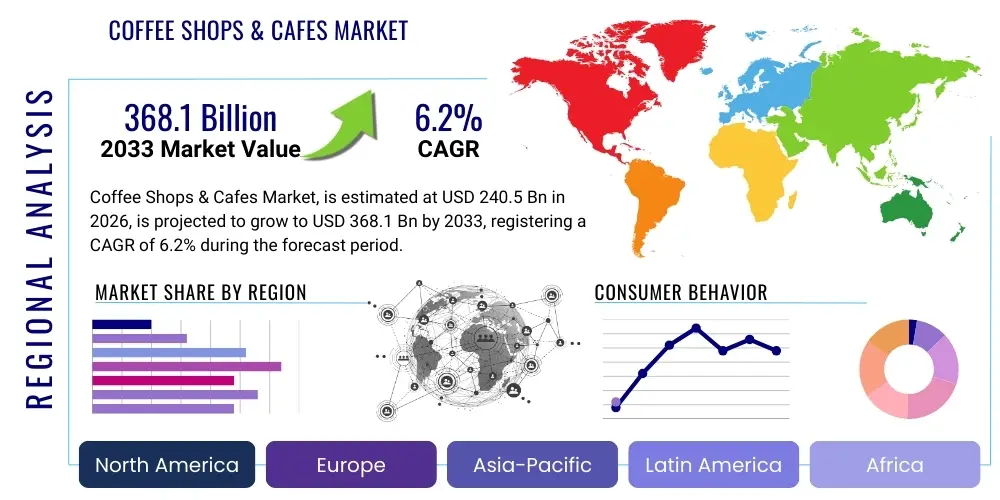

Coffee Shops & Cafes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436431 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Coffee Shops & Cafes Market Size

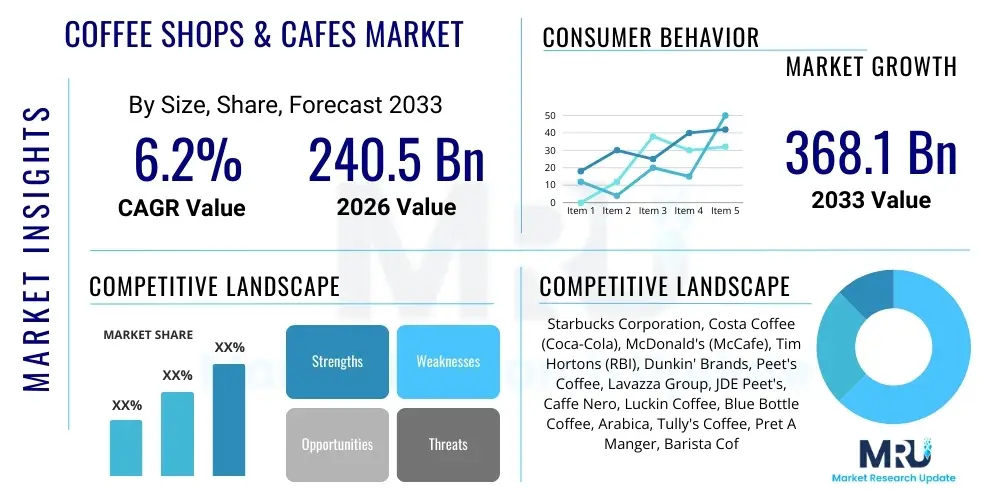

The Coffee Shops & Cafes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at USD 240.5 Billion in 2026 and is projected to reach USD 368.1 Billion by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the evolving consumer preferences toward premium and specialty coffee, increased urbanization globally, and the cultural integration of coffee consumption into daily social and professional routines. The expansion of established global chains into emerging economies, coupled with the proliferation of independent, artisanal cafes offering unique, localized experiences, significantly contributes to this upward trajectory, solidifying the market's robust future outlook.

Coffee Shops & Cafes Market introduction

The Coffee Shops & Cafes Market encompasses establishments primarily engaged in preparing and serving nonalcoholic beverages, principally coffee and tea, alongside light snacks, pastries, and sometimes full meals. This market segment is characterized by its high degree of consumer interaction and its pivotal role as a 'third place'—a crucial environment distinct from home and work. The primary product offering has diversified significantly beyond traditional brewed coffee to include complex espresso-based drinks, cold brews, functional beverages, and ready-to-drink (RTD) options integrated within the cafe setting. Major applications of these establishments range from casual meetings and remote working hubs to dedicated social spaces and quick service points for commuters seeking convenience and quality.

The key benefits derived from this market include providing high-quality, specialized coffee products, fostering community engagement, and offering convenient access to prepared beverages and food items. Furthermore, cafes serve as crucial innovators in the food and beverage industry, driving trends related to ethical sourcing (Fair Trade, direct trade), sustainable practices (compostable materials, waste reduction), and nutritional transparency. The market's resilience is often attributed to the non-discretionary nature of daily coffee consumption for many global consumers, turning a luxury item into a daily necessity. This inherent demand structure provides a stable foundation for continuous operational expansion and service diversification, particularly in high-density urban areas and rapidly developing economic zones where lifestyle integration is most pronounced.

Driving factors propelling market expansion are manifold, including rising disposable incomes in emerging markets, especially across Asia Pacific and Latin America, leading to greater affordability and adoption of premium coffee culture. Technological advancements, such as mobile ordering platforms and personalized loyalty programs, enhance customer convenience and drive repeat business, lowering transaction friction. Moreover, the increasing demand for high-quality, single-origin coffee, driven by informed consumers who value provenance and ethical production methods, pushes operators to premiumize their menus and sourcing strategies, ultimately elevating average transaction value and market revenue potential. These dynamics ensure that the coffee shop remains a vital and expanding component of the global food service landscape, adapting continuously to demographic shifts and evolving aesthetic and functional demands.

Coffee Shops & Cafes Market Executive Summary

The Coffee Shops & Cafes market demonstrates powerful resilience characterized by simultaneous premiumization and operational streamlining. Current business trends indicate a significant pivot towards digital integration, where mobile applications facilitate ordering, payment, and loyalty management, critically enhancing operational efficiency and customer experience, particularly in high-volume settings. The competition landscape is bifurcated, featuring intense rivalry between global, standardized chains focused on speed and consistency, and hyper-local, independent cafes emphasizing unique ambiance, highly specialized artisanal products, and strong local community ties. Sustainability and ethical sourcing remain central strategic pillars, directly impacting brand perception and procurement decisions, with consumers increasingly favoring brands that demonstrate transparent and responsible supply chain management practices throughout the coffee bean journey.

Regionally, North America and Europe maintain maturity, focusing on technological optimization, drive-thru models, and specialty product innovation, with consumer demand increasingly favoring convenience and diverse cold-brew formats. The Asia Pacific region, particularly China and Southeast Asia, represents the most dynamic growth area, driven by rapid Westernization of diets, expanding middle-class consumption, and large-scale entry by international and domestic cafe operators establishing extensive retail footprints. Latin America, while a major producer, is seeing an internal shift towards higher domestic consumption of quality coffee, moving beyond its traditional role as a primary exporter. These regional trends necessitate localized menu strategies and operational flexibility to cater effectively to diverse cultural palates and market entry barriers, including regulatory and infrastructure differences.

In terms of segmentation, the primary growth drivers are evident within the chain segment (due to scale and standardization) and the specialty coffee category (due to high margin potential). Product segmentation shows robust growth in espresso-based drinks and cold beverages, reflecting demographic preferences among younger consumers for customization and chilled formats. Furthermore, the segmentation by ownership type reveals that franchises are critical for rapid expansion, leveraging standardized brand recognition and established supply chains, while non-franchise establishments drive innovation and unique market positioning. These segmental trends collectively illustrate a market actively balancing scale requirements with the consumer desire for authenticity, personalization, and experiential retail environments.

AI Impact Analysis on Coffee Shops & Cafes Market

Common user questions regarding AI's impact on coffee shops typically center around automation of routine tasks, improvement of personalized customer experiences, efficiency gains in inventory and staffing, and the potential displacement of human baristas. Users frequently inquire about the feasibility of robotic baristas for consistent quality, the use of predictive analytics for sales forecasting and minimizing food waste, and how AI-powered loyalty programs can offer tailored recommendations and incentives. The key themes revolve around whether AI will augment or replace human service, the cost-benefit analysis of implementing complex AI systems in smaller operations, and how these technologies ensure data privacy while maximizing operational profitability. Analysis reveals that users anticipate AI primarily as a tool for sophisticated efficiency and personalization, rather than a total replacement for the human element central to the café experience.

- AI-driven Predictive Maintenance: Utilizing sensor data from brewing and grinding equipment to predict failures, minimizing costly downtime.

- Automated Inventory Management: AI algorithms optimize stock levels based on sales history, seasonality, and delivery lead times, drastically reducing spoilage and stockouts.

- Personalized Customer Journeys: Implementation of AI-powered CRM systems to analyze purchase history and preferences, enabling tailored marketing communications and beverage recommendations.

- Robotic Barista Integration: Deployment of sophisticated robotic arms for precise, consistent preparation of standard espresso drinks, increasing speed during peak hours.

- Optimized Labor Scheduling: AI systems analyze foot traffic and sales patterns to create optimized staffing schedules, reducing unnecessary labor costs and improving service flow.

- Dynamic Menu Pricing: Using machine learning to adjust prices based on real-time demand, inventory levels, and competitor pricing, maximizing profit margins.

- Advanced Quality Control: Employing computer vision systems to monitor beverage preparation quality and consistency against established brand standards.

DRO & Impact Forces Of Coffee Shops & Cafes Market

The operational landscape of the Coffee Shops & Cafes Market is governed by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), collectively constituting the market's impact forces. A primary driver is the accelerating trend of coffee premiumization, where consumers are willing to pay higher prices for specialty beans, complex preparation methods, and ethical sourcing certifications, substantially boosting revenue per customer. This is coupled with the growing global urban workforce which relies heavily on quick-service food and beverage options for daily routines. However, the market faces significant restraints, chiefly high volatility in green coffee bean prices due to climate change and geopolitical factors, which compresses operating margins. Additionally, escalating labor costs and intense competition in saturated urban centers pose structural challenges to smaller and independent operators, demanding constant differentiation and operational excellence. Opportunities emerge prominently through technological integration, particularly in utilizing data analytics for hyper-personalization and expanding non-traditional sales channels like drive-thrus, mobile ordering, and delivery partnerships, which cater to convenience-driven modern lifestyles. These forces necessitate continuous adaptation in sourcing, technology adoption, and consumer engagement strategies to maintain profitability and market share.

Segmentation Analysis

The Coffee Shops & Cafes Market is broadly segmented based on several critical dimensions including ownership type, product type, application, and distribution channel, providing a granular view of market structure and growth potential. Segmentation by ownership, encompassing both chain outlets (national and international brands) and independent shops, reveals distinct market strategies, with chains leveraging scale and branding consistency, and independents relying on localized appeal and artisanal quality. Product segmentation is vital, separating traditional brewed coffee from espresso-based drinks, cold beverages, and food items, with specialty drinks exhibiting the fastest growth trajectory globally due to shifting consumer preferences for customized and complex flavor profiles. Analyzing these segments helps stakeholders strategically allocate resources, develop targeted marketing campaigns, and optimize menu engineering to capitalize on specific consumer demands within localized geographic areas, ensuring comprehensive market coverage and maximizing revenue streams across diverse consumption occasions, from morning commuters to afternoon social gatherings. This detailed segmentation supports evidence-based decision-making in product innovation and expansion planning.

- By Ownership Type:

- Chain Outlets (e.g., Starbucks, Costa Coffee)

- Independent Outlets

- Franchise Outlets

- By Product Type:

- Brewed Coffee

- Espresso-based Drinks (Latte, Cappuccino, Americano)

- Cold Beverages (Cold Brew, Iced Coffee, Frappes)

- Food & Snacks (Pastries, Sandwiches)

- Tea & Other Beverages

- By Application/Service Type:

- Dine-in/In-store Consumption

- Takeaway/To-go Services

- Delivery Services

- Drive-Thru Services

- By Distribution Channel:

- In-House Sales (Direct)

- Online Ordering Platforms (Third-party aggregators)

- Retail Sales (Packaged coffee beans/grounds)

Value Chain Analysis For Coffee Shops & Cafes Market

The value chain of the Coffee Shops & Cafes Market is complex, beginning with upstream activities focused on raw material procurement and processing. Upstream analysis involves the critical processes of coffee bean cultivation, harvesting, processing (wet or dry), and green bean trading. Key stakeholders in this phase include farmers, cooperatives, exporters, and large commodity traders, often based in origin countries across Latin America, Africa, and Asia. Ethical sourcing standards, such as Fair Trade and Direct Trade certifications, have fundamentally reshaped this segment, emphasizing transparency and sustainability. High volatility in commodity prices and the increasing impact of climate change on yield variability remain persistent challenges in the upstream segment, forcing major cafe operators to enter into long-term sourcing contracts to ensure supply stability and consistent quality, which is crucial for brand integrity. Roasting, often categorized as midstream, transforms the green bean into the final product sold to the cafe, requiring significant investment in specialized machinery and expertise in flavor profile development and quality assurance.

The downstream analysis focuses on the retail execution and consumer interaction phase. This involves the operations within the cafe establishment, including equipment investment (espresso machines, grinders), highly skilled labor (baristas), and service provision (order taking, preparation, and seating). Distribution channels are highly diversified, encompassing direct physical sales (in-house consumption and takeaway) and increasingly robust indirect channels via third-party delivery aggregators (Uber Eats, DoorDash) and proprietary mobile applications. The efficiency of the downstream segment is highly dependent on effective retail location strategy, brand experience delivery, and seamless integration of technology for order fulfillment and customer relationship management. Successful cafe chains prioritize speed of service, consistency of product quality across multiple locations, and cultivating a distinct, attractive atmosphere that encourages repeat visits and builds customer loyalty within a highly competitive retail environment.

The flow from raw material to end-user involves direct and indirect channels. The direct channel typically involves the cafe sourcing roasted beans or roasting in-house, selling the final brewed product directly to the consumer for immediate consumption, which is the traditional model emphasizing the in-store experience. The indirect channels utilize third-party logistics or platforms for delivery, expanding the cafe's reach beyond its physical proximity but introducing additional costs and complexity in maintaining product quality during transit. Furthermore, many major chains also utilize indirect retail distribution for packaged products (e.g., selling branded coffee pods or grounds in supermarkets), diversifying their revenue streams beyond the physical store front. Effective management of this integrated value chain requires robust supply chain oversight, technological investment in point-of-sale (POS) and inventory systems, and meticulous attention to labor training and operational consistency, especially as businesses scale regionally or globally.

Coffee Shops & Cafes Market Potential Customers

The primary end-users or buyers of the Coffee Shops & Cafes Market are exceptionally diverse, spanning several demographic and behavioral segments. These include daily commuters seeking quick, caffeinated sustenance and convenience on their way to work, office workers utilizing cafes as temporary remote working spaces or locations for informal business meetings, and students who frequent cafes for study sessions and social interaction. A significant segment comprises lifestyle consumers, typically younger demographics (Millennials and Gen Z) who prioritize premium, specialty, and ethically sourced coffee, viewing the cafe visit as an integral part of their social identity and leisure time. Furthermore, tourists and occasional drinkers constitute a vital segment, seeking a break or unique local culinary experiences while traveling, contributing substantially to revenue, particularly in high-traffic commercial and urban centers where footfall is consistently high. This diverse customer base demands a flexible service model capable of catering simultaneously to speed (for commuters), comfort (for remote workers), and quality/specialization (for connoisseurs).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 240.5 Billion |

| Market Forecast in 2033 | USD 368.1 Billion |

| Growth Rate | CAGR 6.2% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Starbucks Corporation, Costa Coffee (Coca-Cola), McDonald's (McCafe), Tim Hortons (RBI), Dunkin' Brands, Peet's Coffee, Lavazza Group, JDE Peet's, Caffe Nero, Luckin Coffee, Blue Bottle Coffee, Arabica, Tully's Coffee, Pret A Manger, Barista Coffee, Caribou Coffee, The Coffee Bean & Tea Leaf, Seattle's Best Coffee, Gloria Jean's Coffees, and Muffin Break. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Coffee Shops & Cafes Market Key Technology Landscape

The technological landscape within the Coffee Shops & Cafes market is characterized by focused investments aimed at improving operational efficiency, enhancing customer interaction, and ensuring product consistency. Central to this transformation are advanced Point-of-Sale (POS) systems that integrate order management, inventory tracking, and sales analytics, providing operators with real-time data crucial for dynamic decision-making on staffing and procurement. Furthermore, the rapid expansion of contactless and mobile payment technologies (e.g., NFC, QR codes, proprietary mobile wallets) has accelerated transaction speed and reduced operational friction, which is vital during peak hours. Digital loyalty programs and Customer Relationship Management (CRM) tools, often integrated into branded mobile apps, utilize data analytics to segment customers and deliver highly personalized offers, significantly boosting repeat visits and overall customer lifetime value in a competitive environment. These digital infrastructures are essential for managing the high demands of modern urban consumerism where speed and personalization are key differentiators.

Beyond customer-facing technology, significant innovation is occurring within the preparation and operational back-end. Internet of Things (IoT) sensors embedded in commercial espresso machines and grinders allow for remote diagnostics and precise monitoring of brewing parameters (temperature, pressure, extraction time), ensuring unparalleled consistency across multiple store locations, a necessity for large chains maintaining brand standards. Automated brewing equipment, ranging from sophisticated self-cleaning pour-over systems to fully automated robotic barista kiosks, addresses labor constraints and ensures precision, particularly for high-volume, standardized drinks. Supply chain management technology, including blockchain traceability solutions, is gaining traction, particularly for specialty coffee providers who need to provide verified provenance data to consumers increasingly concerned with sustainability and ethical sourcing, bolstering brand trust and justifying premium pricing strategies in the global marketplace.

The convergence of physical retail with digital infrastructure is driving new concepts, such as "dark kitchens" or ghost cafes focusing exclusively on delivery and drive-thru fulfillment, optimizing space utilization and lowering overhead costs associated with extensive seating areas. Geo-location services integrated into mobile apps allow for precise order timing, ensuring beverages are ready upon customer arrival, minimizing waiting times and maximizing customer satisfaction. Cloud-based software solutions manage enterprise resource planning (ERP) across multiple global outlets, standardizing training materials, optimizing global supply logistics, and centralizing financial reporting, providing the necessary scalable backbone for international expansion. The continued successful deployment of these technologies is not merely an optional upgrade but a fundamental requirement for maintaining competitiveness and responding effectively to the rapidly evolving demands of the digitally native consumer base within the global coffee market ecosystem.

Regional Highlights

- North America (NA): Characterized by high market maturity, North America leads in digital transformation and operational innovation. The region shows strong demand for specialty and customized cold beverages (e.g., cold brew and nitro coffee) and convenience-focused formats like drive-thrus and mobile ordering. Competition is intensely concentrated among major national chains, focusing on loyalty programs and rapid fulfillment times. Sustainability and ethical sourcing are significant consumer drivers, forcing menu transparency and sustainable packaging initiatives. The US remains the largest single market globally, with continuous innovation in both product offerings and service delivery models.

- Europe: The market is segmented between Western Europe's traditional, high-quality cafe culture (particularly Italy, France, and Germany) and Eastern Europe's rapid adoption of global chain formats. Europe places a strong emphasis on ambiance, quality, and locally roasted beans. There is a robust preference for traditional espresso and filter coffee, though specialty formats are gaining ground among younger demographics. Regulatory pressures concerning food waste, sustainability, and high labor costs are key regional challenges. The UK serves as a major hub for large cafe chains, driven by busy urban commuter culture, making speed of service paramount.

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by the expanding middle class in China, India, and Southeast Asia, coupled with high rates of urbanization and Western cultural integration. Market dynamics are diverse, ranging from sophisticated established markets (Japan, South Korea) that prioritize aesthetic quality and high-tech service, to explosive growth markets (China, Vietnam) where rapid chain expansion and localization of menus are key strategies. Local players like Luckin Coffee compete fiercely with global brands by utilizing sophisticated technology and aggressive expansion strategies, highlighting the region's focus on tech-enabled convenience and localized flavors.

- Latin America (LATAM): While historically focused on coffee production and export, LATAM is experiencing increasing domestic consumption of specialty coffee. Markets like Brazil, Colombia, and Mexico are seeing growth in domestic cafe culture, driven by local chains and boutique cafes offering traceable, locally sourced high-quality beans. The region is focused on improving internal processing and retail infrastructure to retain higher value within the domestic market, moving away from being purely commodity exporters towards being consumer markets for premium end-products.

- Middle East and Africa (MEA): This region presents varied growth profiles. The Middle East, particularly the GCC countries, exhibits high spending power and strong preference for luxury and high-end cafe experiences, often integrated into large retail centers. Africa, with its strong coffee heritage (e.g., Ethiopia, Kenya), is gradually developing domestic retail consumption, though high operational costs and infrastructure challenges temper growth rates. The focus in the Middle East is on creating aesthetically pleasing, high-service environments that cater to socializing and luxury consumption patterns, often featuring elaborate interior design and fusion beverage options combining traditional flavors with modern preparation techniques.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Coffee Shops & Cafes Market.- Starbucks Corporation

- Costa Coffee (The Coca-Cola Company)

- McDonald's Corporation (McCafe)

- Tim Hortons (Restaurant Brands International)

- Dunkin' Brands (Inspire Brands)

- JDE Peet's

- Lavazza Group

- Caffe Nero

- Luckin Coffee

- Blue Bottle Coffee (Nestlé)

- Peet's Coffee

- The Coffee Bean & Tea Leaf (Jollibee Foods Corporation)

- Caribou Coffee

- Pret A Manger

- Tully's Coffee

- Gloria Jean's Coffees

- Arabica

- Seattle's Best Coffee

- Muffin Break

- Barista Coffee

Frequently Asked Questions

Analyze common user questions about the Coffee Shops & Cafes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the specialty coffee segment in the market?

Growth is primarily driven by rising consumer awareness regarding coffee provenance, preparation quality, and sustainability, coupled with increased disposable incomes allowing consumers to trade up from mass-market to premium, ethically sourced, and complex espresso-based beverages, enhancing the perceived value of the café experience.

How is technology reshaping the operational efficiency of coffee shops?

Technology, including sophisticated POS systems, AI-driven inventory management, mobile ordering apps, and IoT-enabled brewing equipment, is crucial for streamlining operations, reducing labor costs, ensuring product consistency, and providing a personalized, rapid service experience essential for urban consumers.

Which geographical region offers the most significant growth opportunities for new entrants?

The Asia Pacific (APAC) region, particularly emerging economies like China, India, and Southeast Asian nations, offers the most significant growth opportunities, characterized by rapid urbanization, expanding middle-class consumption, and increasing adoption of Western-style coffee culture, supporting aggressive expansion strategies.

What are the main sustainability challenges facing the coffee shops and cafes industry?

Key sustainability challenges include managing coffee bean price volatility due to climate change impacts on crop yield, reducing single-use plastic waste through material innovation (e.g., compostable cups), and ensuring transparent, ethical sourcing practices to combat forced labor and deforestation in supply chain management.

How does the rivalry between chain outlets and independent cafes affect market innovation?

The rivalry drives innovation on two fronts: global chains focus on efficiency, standardization, and technological scale (e.g., mobile apps, robotics), while independent cafes drive innovation in product experimentation, unique flavor profiles, high-touch customer service, and community-focused store concepts, catering to the demand for local authenticity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager