Coffee Syrup Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436227 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Coffee Syrup Market Size

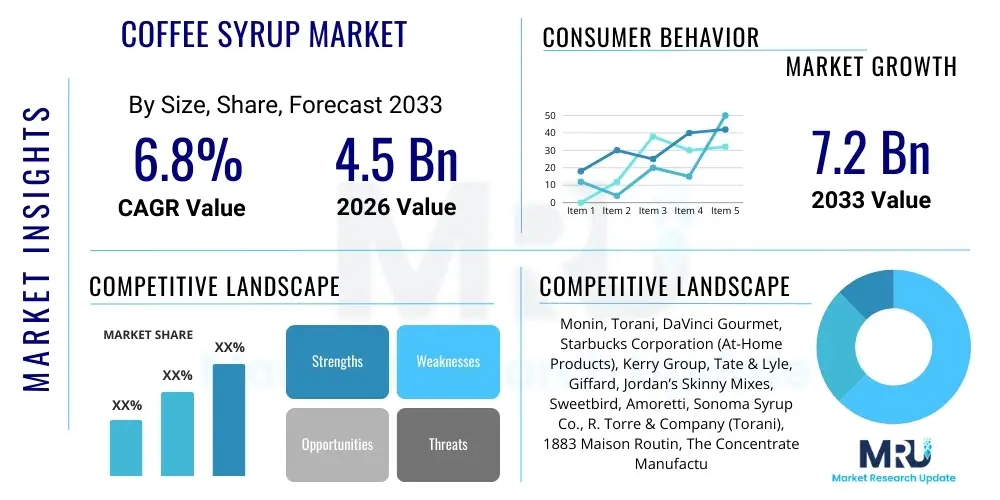

The Coffee Syrup Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $7.2 Billion by the end of the forecast period in 2033.

Coffee Syrup Market introduction

The Coffee Syrup Market encompasses the production, distribution, and consumption of flavored liquid sweeteners used primarily to enhance the taste profile of coffee, espresso drinks, and various non-alcoholic beverages. These products typically consist of a concentrated solution of sugar, water, natural or artificial flavorings, and sometimes colorings and preservatives. The increasing global appreciation for gourmet coffee experiences, driven by the expansion of specialty coffee houses and the growing consumer demand for customization, serves as a fundamental catalyst for market growth. Coffee syrups enable consumers and commercial establishments to replicate complex cafe-style beverages at home or in quick-service settings, offering versatility beyond traditional sweeteners.

Coffee syrups are broadly applied across the HORECA (Hotel, Restaurant, and Catering) sector, including large chain coffee shops, independent cafes, and institutional foodservice providers. Key applications extend to flavoring lattes, cappuccinos, iced coffee, cold brews, milkshakes, and cocktails. Beyond commercial uses, the residential segment represents a significant consumption base, as modern consumers prioritize convenience and the ability to experiment with diverse flavor profiles, ranging from classic staples like vanilla and caramel to seasonal and exotic blends. The core benefit of coffee syrups lies in their consistent flavor delivery, ease of mixing, and long shelf life, making them essential ingredients in the contemporary beverage industry landscape.

Driving factors for the market include the rising disposable income in developing regions, leading to increased expenditure on discretionary and premium food items. Furthermore, the proliferation of digital engagement and social media platforms, where aesthetic and innovative coffee creations gain traction, significantly fuels consumer interest in varied syrup offerings. Product innovation, particularly the development of natural, organic, and sugar-free alternatives to cater to health-conscious populations, is a critical element supporting sustained market expansion. The synergy between globalization of coffee culture and the localized demand for unique taste experiences solidifies the market's robust trajectory.

Coffee Syrup Market Executive Summary

The Coffee Syrup Market demonstrates dynamic shifts, characterized by strong product diversification and aggressive expansion in the Asia Pacific region. Business trends heavily favor brands that successfully integrate sustainable sourcing of ingredients and offer transparent labeling regarding sugar content and artificial additives. Major corporations are investing significantly in automated flavor blending and bottling technologies to ensure consistency and meet surging global demand, particularly for large volume accounts in the quick-service restaurant (QSR) and coffee chain segments. Mergers and acquisitions remain a common strategy, allowing established players to absorb niche flavor houses or gain deeper market penetration in high-growth geographies, aiming to control key segments such as natural flavors and diet-friendly formulations.

Regionally, North America and Europe retain market leadership owing to established coffee cultures and high consumer expenditure on specialty beverages. However, the Asia Pacific region, notably China, India, and Southeast Asia, exhibits the highest growth velocity. This exponential rise is attributed to the rapid Westernization of diets, the burgeoning middle class, and the widespread establishment of international coffee chains. Regional trends also show a distinct preference for locally inspired flavors, compelling global manufacturers to adapt their product portfolios to include indigenous fruit extracts and spice combinations. Latin America is also emerging, leveraging its status as a major coffee producer to integrate higher quality, often single-origin, coffee flavor profiles into its syrup offerings.

Segmentation trends highlight a pronounced shift towards the Sugar-Free and Natural Sweeteners segments. Driven by global campaigns against excessive sugar consumption, consumers are actively seeking products formulated with stevia, monk fruit, or erythritol, without compromising on taste complexity. The Flavor segment remains dominated by perennial favorites—Vanilla, Caramel, and Hazelnut—but seasonal and limited-edition flavors are crucial for driving consumer excitement and repeat purchases in both retail and commercial channels. Distribution channels show robust growth in the e-commerce sector, enabling smaller craft syrup producers to reach a broader consumer base directly, challenging the traditional dominance of institutional distribution networks serving the HORECA segment.

AI Impact Analysis on Coffee Syrup Market

User queries regarding AI's influence in the Coffee Syrup Market predominantly revolve around three key themes: how AI can personalize flavor creation, optimize complex supply chains involving global raw materials (like cocoa, vanilla beans, and specific fruits), and enhance the efficiency of marketing and inventory management for highly diverse product portfolios. Users express high expectations that AI could predict emerging taste trends before they become mainstream, thereby significantly reducing the time-to-market for novel syrup formulations. Concerns often focus on data privacy related to consumer purchase patterns used for personalization and the potential reduction in the need for human flavorists as AI-driven synthesis tools become more sophisticated, though this is also viewed as an opportunity for accelerated innovation.

The adoption of Artificial Intelligence is fundamentally reshaping the operational and innovative aspects of the Coffee Syrup industry, transitioning from reactive production to predictive modeling. AI algorithms are increasingly employed in analyzing vast datasets related to consumer demographics, seasonal purchase history, social media trends, and regional dietary preferences. This deep analysis enables manufacturers to accurately forecast demand for specific flavors, minimize overstocking of slow-moving inventory, and dynamically adjust production schedules, optimizing capital expenditure. Moreover, AI aids in quality control by continuously monitoring ingredient inputs and identifying deviations in flavor concentration or color consistency during the manufacturing process, ensuring unparalleled product uniformity across batches and production sites globally.

Furthermore, AI-powered predictive analytics are instrumental in sourcing and risk management within the supply chain. For natural ingredient-based syrups, AI models process real-time climate data, geopolitical stability indicators, and agricultural yields in sourcing regions. This proactive approach helps manufacturers secure optimal contracts, anticipate shortages (especially for volatile commodities like vanilla), and identify alternative suppliers, safeguarding the continuity of flavor formulation. In marketing, machine learning facilitates hyper-segmentation, allowing brands to tailor promotional content and recommend specific syrup flavors to individual consumers based on their historical purchase patterns and digital engagement, maximizing the effectiveness of digital campaigns and enhancing customer lifetime value.

- AI drives precision formulation by analyzing flavor compatibility and stability under various conditions.

- Predictive modeling optimizes inventory levels for seasonal and limited-edition flavor releases.

- Machine learning enhances supply chain resilience by forecasting raw material scarcity and price volatility.

- AI analyzes consumer sentiment and social media trends to identify emerging flavor preferences globally.

- Automation via AI-driven systems improves quality control and ensures batch-to-batch consistency in flavor concentration.

- Personalized marketing engines leverage AI to recommend specific syrup flavors to individual consumers, boosting e-commerce sales.

DRO & Impact Forces Of Coffee Syrup Market

The dynamics of the Coffee Syrup Market are dictated by a compelling balance between strong consumer desire for flavor variety (Drivers) and increasing regulatory and health scrutiny (Restraints), opening avenues for innovation (Opportunities). Driving factors include the globalization of cafe culture, the rise of the ready-to-drink (RTD) coffee segment which often uses syrup bases, and the massive consumer preference for customization in both professional and home settings. Conversely, the market faces significant headwinds from governmental efforts to curb sugar consumption through taxes or stringent labeling requirements, alongside the volatility in the prices of key agricultural inputs such as sugar, cocoa, and specialized flavor extracts. The underlying Impact Forces reflect intense competition based on product innovation, quality perception, and distribution reach, compelling market players to continuously refine their offerings to capture transient consumer interest while managing complex supply logistics.

Key drivers include the dramatic rise in home coffee consumption, catalyzed by the proliferation of sophisticated home brewing equipment (e.g., espresso machines and cold brew systems) that necessitate commercial-grade flavoring solutions to replicate cafe experiences. The younger demographic (Millennials and Gen Z) actively seeks out novel, often aesthetically appealing, beverages, contributing significantly to the demand for diverse and vibrant flavor syrups. Furthermore, the extensive marketing campaigns by leading coffee chains that routinely introduce seasonal syrup flavors effectively introduce new taste concepts to a mass audience, subsequently boosting retail purchases. The demand for clean label products, including natural flavors and organic certifications, also drives premiumization within the market segment.

Restraints primarily center on public health initiatives targeting caloric intake. The increasing popularity of intermittent fasting and ketogenic diets poses a challenge to traditional high-sugar syrup formulas, forcing rapid innovation into low-calorie and non-nutritive sweetener alternatives, which sometimes face consumer skepticism regarding taste parity. Additionally, the complex international supply chains required for sourcing high-quality, authentic ingredients (e.g., specific botanicals or fair-trade cocoa) are susceptible to climate change impacts and logistical disruptions, leading to fluctuating production costs and potential supply inconsistencies. Opportunities, however, abound in developing functional syrups infused with vitamins, adaptogens, or proteins, aligning the product with the burgeoning health and wellness trend. Furthermore, strategic expansion into underdeveloped markets in APAC and Africa presents significant long-term growth potential, provided localized flavor preferences are successfully integrated into the product line.

Segmentation Analysis

The Coffee Syrup Market is comprehensively segmented based on Type, Flavor, Distribution Channel, and Application, providing a multi-dimensional view of consumer preferences and market structure. This segmentation is crucial for understanding specific growth pockets, allowing manufacturers to tailor production and marketing efforts effectively. The Type segmentation distinguishes between Regular Syrups (containing high-fructose corn syrup or sucrose) and Diet/Sugar-Free Syrups (utilizing artificial or natural zero-calorie sweeteners), reflecting the ongoing tension between traditional indulgence and health consciousness. Flavor segmentation, while broad, is vital for identifying dominant consumer choices (e.g., Vanilla, Caramel) versus emerging specialty flavors (e.g., Lavender, Cardamom), which command higher price points and cater to experimental consumers.

Distribution Channel analysis divides the market based on how products reach the end-user, differentiating between Institutional/Commercial sales (HORECA segment, which demands large, bulk packaging) and Retail Sales (supermarkets, convenience stores, and online platforms, focusing on consumer-friendly sizes). Application segmentation clearly separates the usage context, primarily distinguishing between Coffee & Hot Beverages and Other Applications, such as desserts, cocktails, and culinary uses. Analyzing these segments together reveals that while institutional sales drive volume, the retail and e-commerce segments are instrumental in accelerating innovation and speed-to-market for new flavor profiles.

The pronounced growth trajectory observed within the Diet/Sugar-Free segment underscores a fundamental shift in consumer priorities, forcing even legacy brands to reformulate their core offerings to maintain relevance. This trend is coupled with increasing consumer scrutiny regarding the source and processing of flavors, favoring syrups made with natural extracts over artificial compounds. Geographically, segmentation helps in identifying specific regional flavor requirements; for example, North America shows high demand for Pumpkin Spice during autumn, while Asian markets might show preference for Matcha or Lychee flavors, demonstrating the need for highly localized inventory and marketing strategies.

- Type:

- Regular

- Sugar-Free/Diet

- Flavor:

- Vanilla

- Caramel

- Hazelnut

- Chocolate/Mocha

- Fruit

- Seasonal & Specialty

- Distribution Channel:

- Off-Trade (Retail, Supermarkets, Convenience Stores)

- On-Trade (HORECA, Food Service, Institutional)

- E-Commerce/Online

- Application:

- Coffee & Espresso Beverages

- Non-Coffee Beverages (Tea, Soda, Lemonade)

- Culinary & Dessert

Value Chain Analysis For Coffee Syrup Market

The Value Chain for the Coffee Syrup Market begins with Upstream Activities, primarily involving the sourcing and procurement of core raw materials, which include sweeteners (sugar, corn syrup, or alternative sweeteners like stevia), water, flavor compounds (natural extracts or synthetic aromatic chemicals), and packaging materials (glass or plastic bottles). The quality and reliability of these upstream suppliers directly dictate the final product quality and manufacturing cost. Due to the global nature of flavor sourcing—for instance, vanilla from Madagascar or cocoa from West Africa—managing geopolitical risk, ensuring ethical sourcing standards (fair trade), and stabilizing commodity pricing volatility are critical components at this stage. Effective vertical integration or long-term contractual agreements with reliable suppliers mitigate supply chain disruption risks.

The midstream process, or Manufacturing and Processing, involves complex blending, heating, stabilization, and bottling processes. This stage requires sophisticated equipment to ensure homogeneous mixing of viscous ingredients, pasteurization for extended shelf life, and high-speed, accurate filling and capping lines. Quality control is paramount here, focused on maintaining precise Brix levels (sugar concentration) and consistent flavor profiles batch over batch. Manufacturers often deploy proprietary flavor encapsulation technologies to ensure flavor stability over time and resistance to heat during beverage preparation. Efficient production planning and minimizing waste are key performance indicators in the manufacturing stage.

Downstream Activities encompass distribution, marketing, and sales, reaching both commercial and retail end-users. Distribution channels are segmented into direct sales to large coffee chains (requiring centralized warehousing and dedicated logistics) and indirect sales through distributors, wholesalers, and retailers (supermarkets, specialty food stores). The E-commerce channel represents a rapidly growing distribution method, offering direct-to-consumer engagement and requiring sophisticated digital logistics. Marketing efforts focus on branding, recipe innovation, and educating consumers on usage versatility. Successful market penetration relies heavily on robust cold chain logistics where required, rapid responsiveness to regional flavor demands, and strong relationships with institutional buyers (HORECA).

Coffee Syrup Market Potential Customers

The primary customer base for the Coffee Syrup Market is highly diversified, spanning from large-scale commercial entities that drive volume demand to individual consumers seeking customization for at-home consumption. Potential customers are fundamentally categorized into the HORECA (Hospitality, Restaurant, and Catering) segment, the Retail/Consumer segment, and specialized institutional users. The HORECA sector represents the largest consumer of bulk syrup, utilizing these products consistently across high-volume environments such as international coffee shop chains (e.g., Starbucks, Costa Coffee), quick-service restaurants, casual dining establishments, and independent artisanal cafes. These professional buyers prioritize consistency, bulk pricing, specialized formulation (e.g., heat-stable syrups), and reliable supply chains, as flavor consistency is crucial for brand integrity.

The Retail/Consumer segment includes household users who purchase syrups through supermarkets, specialty stores, or online platforms. These end-users are driven by ease of use, product variety, and the ability to replicate cafe-quality drinks affordably in their kitchens. They often show a higher propensity to purchase seasonal or novelty flavors and are highly responsive to marketing based on visual appeal and recipe ideas. Within this segment, there is a specialized subset of health-conscious buyers who exclusively seek sugar-free, organic, or naturally sweetened variants, driving demand for premium, clean-label products sold at higher price points.

Institutional buyers represent the third significant customer group, including corporate offices, hospitals, educational institutions, and airline catering services that offer coffee and specialty beverages as part of their foodservice operations. These clients typically require standardized, cost-effective solutions and often purchase through large food distributors. Furthermore, the bakery and confectionery industries serve as potential secondary customers, utilizing coffee syrups as flavor components in icings, glazes, and dessert fillings. Targeting these diverse segments requires tailored packaging, pricing strategies, and distribution methods, ensuring that the product meets the stringent quality and regulatory requirements pertinent to each end-use application.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Monin, Torani, DaVinci Gourmet, Starbucks Corporation (At-Home Products), Kerry Group, Tate & Lyle, Giffard, Jordan’s Skinny Mixes, Sweetbird, Amoretti, Sonoma Syrup Co., R. Torre & Company (Torani), 1883 Maison Routin, The Concentrate Manufacturing Company, Toschi Vignola s.r.l., Bristol Syrup Company, Stirling Syrups, Dr. Pepper Snapple Group (Snapple Syrups), C. C. Clarke & Co., Teisseire. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Coffee Syrup Market Key Technology Landscape

The technology landscape in the Coffee Syrup Market is focused on ensuring flavor authenticity, shelf stability, and scalable production efficiency. Key technological advancements involve precision blending and batching systems, crucial for maintaining consistency across high-volume production lines, particularly when handling complex flavor matrices and high viscosity liquid bases. Advanced computerized dosing systems regulate the exact ratio of flavor concentrates, sweeteners, and water, minimizing human error and allowing for rapid switching between different product formulations (e.g., moving from a sugar-based caramel to a stevia-based vanilla). Furthermore, ultra-high temperature (UHT) processing and aseptic filling technologies are vital for extending the product’s shelf life without relying excessively on preservatives, meeting the increasing consumer demand for "clean label" formulations.

In flavor creation, the use of proprietary extraction and distillation technologies is becoming standard practice, enabling manufacturers to isolate and concentrate natural essences from fruits, botanicals, and spices without thermal degradation. Micro-encapsulation technology is particularly relevant for volatile flavors like citrus or mint, which helps protect the aromatic compounds from oxidation or interaction with other ingredients, ensuring that the flavor profile remains vibrant even when mixed with hot coffee. This innovation is critical for maintaining the intended sensory experience from bottle to cup. Research and Development (R&D) efforts are increasingly leveraging sensory analysis software and predictive modeling (often AI-driven, as discussed earlier) to simulate how new flavor compounds will interact in a coffee matrix before expensive physical prototypes are created.

Packaging technology is also rapidly evolving, driven by sustainability goals and logistical efficiency. Manufacturers are adopting lighter, recyclable PET plastics for institutional sizes and focusing on barrier technologies to prevent flavor leaching or contamination. Smart packaging incorporating QR codes and near-field communication (NFC) tags is emerging, providing consumers with detailed information regarding sourcing, ingredients, and recipe suggestions. Automation remains central, with robotic palletizing, automated case packing, and integrated inventory management systems streamlining the downstream supply chain, ensuring fast and accurate order fulfillment for both large commercial accounts and diverse retail distribution networks.

Regional Highlights

North America currently holds the largest share of the Coffee Syrup Market, driven by an entrenched culture of specialized coffee consumption, exemplified by the pervasive presence of major chain cafes that heavily rely on syrup formulations for their menus. The region demonstrates high levels of innovation, particularly in the rapid adoption of sugar-free and premium organic lines, catering to sophisticated and health-conscious consumer preferences. The United States market is characterized by strong seasonality, with huge spikes in demand for specific flavors like Pumpkin Spice in the fall. Canada also contributes significantly, showing a steady demand for high-quality, sustainably sourced syrup products. Competition is fierce, focusing intensely on brand loyalty and expansive flavor portfolios marketed through both institutional and massive retail channels.

Europe represents a mature yet dynamic market, with distinct consumption patterns influenced by localized coffee traditions. Western European nations, such as the UK, Germany, and France, exhibit robust demand for syrups in both cafe environments and home use. However, European consumers tend to favor authentic, less intensely sweet flavor profiles compared to North America. The market growth here is strongly supported by stringent food safety and labeling standards, pushing manufacturers toward natural colors and flavors. The expansion of Nordic-style coffee shops, emphasizing high-quality, ethical sourcing, further drives the niche market for premium, small-batch, and organic certified syrups across the continent.

The Asia Pacific (APAC) region is poised to record the highest Compound Annual Growth Rate during the forecast period. This rapid expansion is primarily fueled by accelerated urbanization, increasing Western influence on dietary habits, and a significant rise in disposable incomes, enabling greater expenditure on luxury food and beverage items. Key markets like China and India are seeing the explosive growth of domestic and international coffee shop chains. Manufacturers are proactively adapting to regional tastes, introducing localized flavors such as green tea (Matcha), taro, lychee, and specific spice blends, making product localization a crucial element of market strategy in this diverse region. The convenience factor of syrups strongly appeals to the fast-paced urban lifestyles emerging across Southeast Asia.

Latin America (LATAM) shows promising growth, leveraging its strong heritage in coffee production. The regional market is characterized by a growing appetite for experimenting with flavor additions to locally grown coffee, moving beyond traditional methods. Manufacturers operating in LATAM often focus on integrating regional fruit essences and catering to a price-sensitive consumer base while balancing the demand for global standard flavors. Furthermore, the Middle East and Africa (MEA) region presents untapped potential. The Gulf Cooperation Council (GCC) countries, in particular, exhibit high per capita spending on specialty coffee and luxury consumables, favoring high-end, premium imported syrup brands. The challenge in MEA lies in navigating complex regulatory environments and ensuring product stability under high temperature and humidity conditions.

- North America: Market leader, driven by customization culture and high adoption of sugar-free alternatives.

- Europe: Mature market, focused on natural ingredients, and stringent quality control, with distinct national flavor preferences.

- Asia Pacific (APAC): Fastest-growing region, characterized by rapid expansion of coffee chains and strong demand for localized, unique flavors.

- Latin America (LATAM): Emerging market, growth driven by strong local coffee culture and increasing consumer experimentation.

- Middle East and Africa (MEA): High potential in GCC countries for premium and luxury imported syrup brands.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Coffee Syrup Market.- Monin

- Torani (R. Torre & Company)

- DaVinci Gourmet (Kerry Group)

- Starbucks Corporation (At-Home Products)

- 1883 Maison Routin

- Giffard

- Jordan’s Skinny Mixes

- Sweetbird

- Tate & Lyle

- Amoretti

- Sonoma Syrup Co.

- The Concentrate Manufacturing Company

- Toschi Vignola s.r.l.

- Bristol Syrup Company

- Stirling Syrups

- Dr. Pepper Snapple Group (Snapple Syrups)

- C. C. Clarke & Co.

- Teisseire

- Island Oasis

- Flavor Right

Frequently Asked Questions

Analyze common user questions about the Coffee Syrup market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Coffee Syrup Market globally?

The market growth is fundamentally driven by the expanding global specialty coffee culture, increasing consumer preference for beverage customization and premiumization, and the rapid expansion of coffee house chains worldwide. Furthermore, the rising demand for convenient at-home preparation of gourmet coffee beverages and continuous innovation in sugar-free and natural flavor options are key accelerators.

How is the rising demand for health and wellness impacting the Coffee Syrup industry?

The health and wellness trend significantly impacts the industry by shifting consumer preferences away from traditional sugar-heavy products. This has led to rapid innovation, with manufacturers investing heavily in developing and marketing sugar-free syrups utilizing natural alternative sweeteners like stevia and monk fruit, alongside functional syrups fortified with vitamins or botanical extracts, directly addressing consumer desire for lower caloric intake.

Which distribution channel holds the largest market share for coffee syrups?

The On-Trade channel, encompassing the HORECA segment (Hotels, Restaurants, and Cafes), traditionally holds the largest volume share due to high bulk purchasing by major coffee chains and foodservice providers. However, the E-commerce and Off-Trade (retail) channels are demonstrating the fastest growth rates, driven by increased individual consumer usage for home beverage preparation and broader product availability.

What is the key technological challenge facing coffee syrup manufacturers?

A key technological challenge involves maintaining flavor consistency and stability across diverse formulations (especially between sugar and sugar-free bases) and ensuring the shelf life of highly complex, natural flavor extracts. Manufacturers rely on precision blending, UHT processing, and advanced flavor encapsulation technologies to mitigate degradation and ensure uniformity in the final product delivered globally.

Which region is expected to exhibit the fastest growth rate in the forecast period?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is attributed to rapidly increasing disposable income, widespread urbanization, growing adoption of Western coffee consumption habits, and the concentrated market penetration strategies employed by leading global and regional coffee chain operators.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager