Coherent Doppler Wind Lidar Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437299 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Coherent Doppler Wind Lidar Market Size

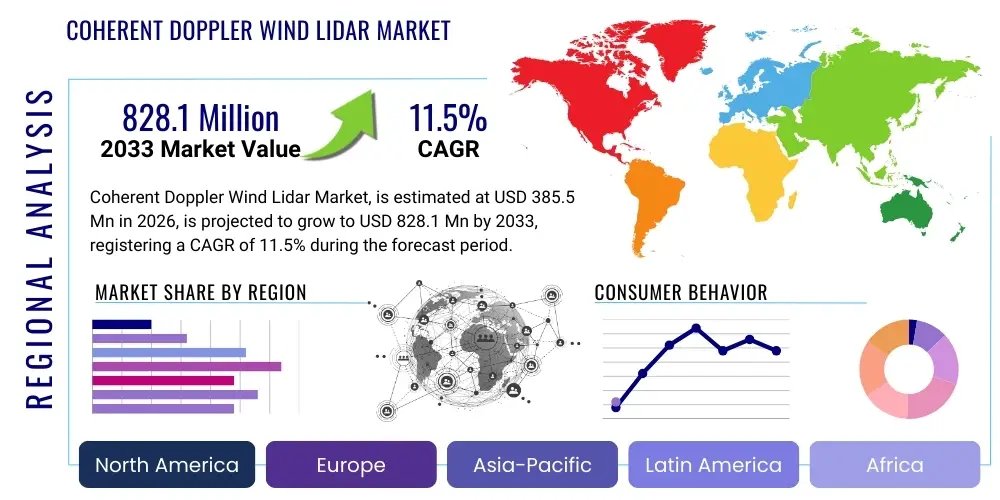

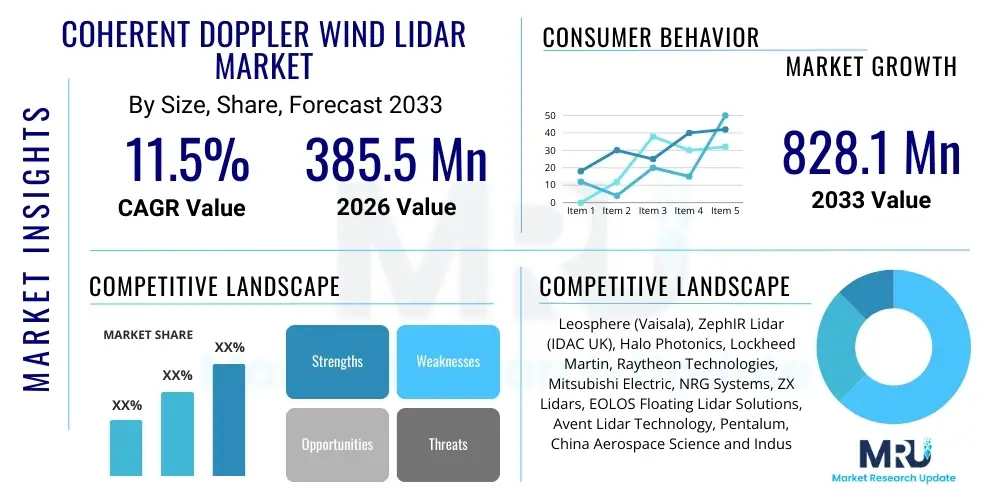

The Coherent Doppler Wind Lidar Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 385.5 million in 2026 and is projected to reach USD 828.1 million by the end of the forecast period in 2033.

Coherent Doppler Wind Lidar Market introduction

Coherent Doppler Wind Lidar systems represent sophisticated remote sensing technology utilized primarily for accurate, real-time measurement of atmospheric wind speed and direction, particularly at higher altitudes and over expansive geographical areas where conventional sensors are impractical or cost-prohibitive. These systems operate fundamentally based on the Doppler principle: a laser beam, typically operating in the eye-safe infrared spectrum (1.5–2.0 µm), is emitted into the atmosphere. This light interacts with naturally occurring atmospheric aerosols (microscopic particles) and is scattered back to a sensitive receiver. The Coherent detection technique measures the minute frequency shift (Doppler shift) in the backscattered light, which is directly proportional to the velocity of the aerosols, thereby providing a precise measurement of the three-dimensional wind vector in the sensing volume. This highly complex signal processing capability allows for the generation of comprehensive wind profiles, crucial for complex atmospheric modeling and operational decision-making across high-stakes industrial and governmental applications globally. The inherent precision, superior spatial coverage, and non-intrusiveness of this technology set it fundamentally apart from traditional mechanical instruments, particularly for projects requiring verifiable, high-fidelity data over extended vertical ranges.

The core utility of Coherent Doppler Wind Lidar spans numerous mission-critical applications across various sectors. In the rapidly expanding global renewable energy sector, Lidar is considered an indispensable tool for offshore wind farm development, where it provides validated, bankable wind resource assessments (WRA) necessary for critical project financing and optimized turbine layout design. Accurate wind profiling minimizes turbulence-related losses and maximizes Annual Energy Production (AEP) projections, ensuring investors receive reliable data. For governmental meteorological services, Lidar systems are pivotal in improving the granularity and accuracy of Numerical Weather Prediction (NWP) models by providing high-resolution vertical wind profiles, which are particularly vital for tracking the evolution of severe weather events, understanding planetary boundary layer dynamics, and improving atmospheric transport modeling critical for air quality forecasts. The necessity of these sophisticated inputs continues to fuel governmental procurement cycles worldwide.

Furthermore, in the aviation domain, Lidar enhances operational safety and efficiency by detecting hazardous phenomena such as wind shear, microbursts, and wake vortices around high-traffic airports, allowing air traffic control (ATC) to issue timely warnings and optimize flight trajectories, thereby reducing aircraft delays, minimizing fuel consumption, and enhancing overall airspace throughput. Key driving factors accelerating market expansion are strongly tied to the global commitment to meeting ambitious sustainable energy targets, which necessitates highly reliable wind data for increasingly complex offshore project implementation. Moreover, increasing investments by national security agencies and defense organizations for comprehensive, real-time atmospheric surveillance and target trajectory modeling, coupled with the rapid decline in size, weight, and power (SWaP) consumption of modern Lidar units due to continuous advancements in fiber laser technology and solid-state scanning mechanisms, are broadening their commercial viability and facilitating deployment on highly mobile and aerial platforms, further stimulating pervasive market growth across emerging and established industrial economies.

Coherent Doppler Wind Lidar Market Executive Summary

The Coherent Doppler Wind Lidar market is exhibiting substantial and consistent growth, largely propelled by fundamental shifts in global energy policy toward offshore renewables and an increased reliance on high-fidelity atmospheric data for critical safety systems. Key business trends underscore a strategic movement toward providing comprehensive integrated solutions rather than isolated hardware. Manufacturers are increasingly offering Lidar systems bundled with advanced data processing software, specialized calibration services, and long-term maintenance contracts, exemplified by the growing adoption of Lidar as a Service (LaaS). This business model evolution significantly lowers the financial entry barrier for new renewable energy project developers and ensures consistent, optimized performance across the operational lifetime of the system. Another critical trend involves the standardization and certification of Lidar data, with industry players actively collaborating to meet stringent international standards (like IEC 61400-12-1) to ensure the data is readily accepted by financial institutions for project validation.

Geographically, market expansion is characterized by a rapid concentration of growth within the Asia Pacific (APAC) region. This area is distinguished by large-scale, state-backed infrastructure development, particularly in offshore wind energy in key nations such as China, Japan, South Korea, and Taiwan. These large-scale deployments require significant volume procurement of marine-based Lidar systems, making APAC the primary driver of demand volume and the highest CAGR projected through 2033. Conversely, established markets in North America and Europe retain leadership in technological sophistication and application diversity. European growth is sustained by long-term, legally binding environmental policies and high penetration of nacelle-mounted Lidar for operational wind farm control. North America continues to dominate niche, high-value segments, particularly aerospace, defense, and advanced meteorological research, often utilizing custom-built, research-grade Lidar systems with superior range and accuracy specifications.

Analysis of market segmentation reveals distinct spending patterns. The Marine-Based Deployment segment, including Floating Lidar Solutions (FLiDAR), is expanding at an accelerated pace, mirroring the shift of wind farm development into deeper, more remote offshore areas, where traditional measurements are infeasible. The End-User analysis confirms that the Renewable Energy sector remains the dominant revenue source, though there is a perceptible strengthening in demand from governmental and defense organizations. Technological innovation within the Component segment, specifically advancements in solid-state fiber laser technology and sophisticated digital signal processing units, is critical, as improvements here directly enhance the Lidar system's durability, reduce its power consumption, and enable its integration into smaller, more autonomous platforms like Unmanned Aerial Vehicles (UAVs), thereby continuously opening up new commercial and specialized application markets globally.

AI Impact Analysis on Coherent Doppler Wind Lidar Market

User inquiries frequently highlight concerns regarding the scalability of Lidar data analysis, specifically asking how AI can efficiently process terabytes of raw velocity-azimuth-display (VAD) data into meaningful wind profiles and turbulence metrics. A common theme is the expectation that AI should eliminate subjectivity and errors inherent in manual atmospheric interpretation. Furthermore, users often question the capability of machine learning models to effectively integrate heterogeneous data sources—Lidar data combined with satellite imagery, radar, and in-situ sensor readings—to generate significantly more accurate, localized, and short-term (nowcasting) weather forecasts than traditional numerical models. The desire is for AI to provide a layer of intelligent automation, minimizing the expertise needed to operate and maintain these complex systems, and unlocking new applications such as autonomous environmental monitoring and dynamic drone routing.

Artificial Intelligence, particularly deep learning and sophisticated machine learning algorithms, is fundamentally necessary for handling the high temporal and spatial data density produced by modern Coherent Doppler Wind Lidar systems. Without AI, manually processing and quality-checking this data volume becomes resource-intensive and prone to human error. AI facilitates automatic noise reduction, filtering out undesirable signal artifacts caused by insects, precipitation, or hard targets. Crucially, ML models are trained to classify atmospheric conditions in real-time—distinguishing aerosols, fog layers, clouds, and boundary layer height—providing valuable contextual metadata that enhances the reliability of the calculated wind vectors, especially in complex atmospheric scenarios or rapidly changing weather conditions. This immediate, intelligent processing capability maximizes the actionable value of the raw measurements.

The influence of AI extends significantly into the operational phase, moving beyond mere data processing to optimization and predictive capabilities. AI is increasingly used for advanced diagnostic monitoring, analyzing the Lidar system’s internal operational parameters (laser stability, temperature, alignment) to predict potential component degradation before failure occurs, enabling proactive, scheduled maintenance. This is paramount for remote deployments, such as offshore buoys or mountaintop observatories, where accessibility is limited and system downtime is extremely costly. Moreover, AI models are now integrating Lidar-derived turbulence kinetic energy (TKE) measurements directly into sophisticated forecasting models, providing critical inputs that enhance the accuracy of short-term forecasts for aviation turbulence warnings and more efficient grid energy management, thereby elevating the Lidar technology into a core component of the smart atmosphere surveillance network.

- AI-Driven Data Quality Control: Automation of anomaly detection, calibration drift correction, and noise filtering in raw Lidar measurements using deep neural networks for superior data fidelity.

- Enhanced Predictive Modeling: Machine learning integration to assimilate Lidar-derived vertical wind profiles into high-resolution Numerical Weather Prediction (NWP) models, significantly improving localized wind speed and turbulence forecasts for grid optimization.

- Real-Time Atmospheric Classification: Algorithms utilized for automatic, real-time classification of atmospheric features, including cloud base height, boundary layer thickness, aerosol type, and identification of dangerous wind shear events.

- Automated System Calibration and Diagnostics: Use of AI for continuous internal monitoring of laser stability and optical alignment, enabling remote, intelligent adjustment and predictive maintenance scheduling to maximize operational uptime.

- Optimized Wind Energy Yield: AI assimilation of Lidar data, particularly for nacelle-mounted systems, to dynamically adjust turbine yaw and pitch controls in turbulent conditions, resulting in increased energy capture and reduced structural fatigue.

DRO & Impact Forces Of Coherent Doppler Wind Lidar Market

The market trajectory for Coherent Doppler Wind Lidar is fundamentally shaped by the necessity of precise atmospheric data to support massive global infrastructure projects and safety protocols. Key Drivers include the unprecedented growth in offshore wind development, which relies heavily on Lidar for preliminary site assessment and operational validation, far exceeding the practical limits of meteorological masts. Secondly, regulatory pressure from aviation safety bodies, requiring sophisticated real-time systems to mitigate wind shear hazards, sustains demand from major global airports. These driving forces are strongly counterbalanced by Restraints, notably the high initial capital outlay required for purchasing and installing Lidar systems, which acts as a deterrent for smaller entities, and the technical limitation regarding Lidar signal attenuation in dense fog or heavy rain, which can temporarily reduce data availability and accuracy.

Opportunities in the market are centered around technological refinement and expanded deployment modalities. The primary opportunity lies in the miniaturization and cost reduction of Lidar units, facilitating their integration onto Unmanned Aerial Vehicles (UAVs) and drones. This integration drastically reduces deployment time and cost for rapid, short-duration measurement campaigns, opening new revenue streams in urban atmospheric monitoring and logistical applications. A secondary but crucial opportunity is the development of next-generation Frequency-Modulated Continuous-Wave (FMCW) Lidar technology, which promises enhanced spatial resolution and higher data density with potentially lower component costs, potentially addressing current performance gaps related to short-range accuracy. Furthermore, business model innovation, such as the increasing acceptance of Lidar as a Service (LaaS), mitigates the initial investment barrier for prospective customers.

The Impact Forces exert significant external pressure on market development and adoption patterns. Stringent government regulations and ambitious national targets for decarbonization, particularly within the European Union and parts of Asia, act as a continuous force compelling utility companies and developers to invest in proven, high-accuracy measurement tools like Lidar for project validation and compliance. Conversely, intellectual property protection and the complex, proprietary nature of core Lidar technology components—such as specialized fiber lasers and complex optical designs—limit the number of viable manufacturers and impact overall market pricing, creating a high barrier to entry and fostering competitive intensity among existing key players. The necessity of adhering to global standardization protocols (e.g., IEC 61400-12-1) for wind measurement validation also dictates product development cycles and investment in calibration facilities.

Segmentation Analysis

Segmentation analysis of the Coherent Doppler Wind Lidar market reveals a complex ecosystem categorized by how and where the Lidar systems are deployed, the critical technological components that drive performance, the specific problems they solve, and the final purchasing entities. Analyzing these segments is essential for understanding current revenue streams and predicting future growth areas. The deployment categories demonstrate a market evolving from foundational ground-based assessments to highly mobile, sophisticated operational systems, reflecting the increasing maturity of user applications in highly dynamic environments. The components segment underscores the heavy reliance on advanced photonics and high-speed electronics, highlighting areas where continued technological breakthroughs will lead to performance improvements and cost reductions across the entire industry value chain. This structured view is critical for manufacturers tailoring product lines and investors seeking targeted market entry points.

Focusing on the application segments confirms the market's strong correlation with global energy policy. Wind resource assessment (WRA) remains the foundational application, generating steady demand from new project development, particularly in offshore settings where the system's extended range is non-negotiable. However, applications in advanced meteorology—specifically high-resolution boundary layer studies and wind profile inputs for atmospheric chemistry models—are seeing accelerated research and government funding. Similarly, the safety-critical domain of aviation continues to require highly reliable systems for turbulence and wind shear monitoring, presenting a persistent, albeit specialized, revenue stream. The evolution of Lidar towards multi-purpose use—serving both energy assessment and environmental monitoring from a single deployment—is a key trend within application segmentation.

The End-User categorization clarifies purchasing power distribution. Renewable Energy Companies, including independent power producers (IPPs) and large utility firms, hold the largest wallet share, utilizing Lidar for project validation and operational control. Government agencies, encompassing meteorological offices (e.g., NOAA, ECMWF) and defense departments, represent a stable, mission-critical customer base, often prioritizing system longevity and accuracy over initial cost. The segmentation analysis thus confirms the market's resilience, supported by both commercial infrastructure demands and essential public safety and defense requirements, insulating it somewhat from pure commodity market fluctuations. The strong coupling between the Marine Deployment segment and the Renewable Energy End-User segment illustrates the most significant area of current and forecast growth.

- By Deployment Type:

- Ground-Based Lidar Systems: Used primarily for long-term site assessment, meteorological research, and calibration verification.

- Nacelle-Mounted Lidar Systems: Integrated directly onto wind turbine nacelles for optimizing individual turbine performance, feed-forward control, and power curve verification.

- Marine-Based (Floating or Vessel-Mounted) Lidar Systems (FLiDAR): Critical for offshore wind resource assessment, providing mobile, validated data without the need for fixed met masts.

- Airborne/UAV-Integrated Lidar Systems: Utilized for rapid atmospheric mapping and specialized defense applications, focusing on low SWaP requirements.

- By Component:

- Transmitter (Fiber Lasers, Optics, Modulators): The most technically complex and expensive part, determining system range and data quality.

- Receiver and Signal Processing Units: Responsible for detecting the weak backscattered signal and converting Doppler shift information into wind velocity vectors.

- Data Acquisition and Analysis Software: Essential for complex data assimilation, quality control, visualization, and integration with meteorological models or SCADA systems.

- Scanners and Beam Steering Devices: Optical assemblies that allow the laser beam to rapidly sample the atmosphere at different azimuth and elevation angles.

- By Application:

- Wind Resource Assessment and Power Curve Verification: Core commercial application for project financing and operational auditing.

- Meteorology and Weather Forecasting: Providing high-resolution inputs for NWP models, boundary layer studies, and climate research.

- Aviation Safety and Air Traffic Control: Real-time detection of wind shear, wake vortices, and turbulence for airport safety systems.

- Environmental Monitoring and Pollution Tracking: Tracking the transport and dispersion of aerosols, smoke plumes, and volcanic ash.

- Defense and Security Surveillance: Atmospheric intelligence gathering for ballistics and remote sensing operations.

- By End-User:

- Renewable Energy Companies (Wind Farm Developers, IPPs, Operators): The largest consumer group, utilizing all deployment types.

- National Meteorological Services and Research Institutions: Focused on ground-based and research-grade systems for atmospheric studies and forecasting improvement.

- Aviation Authorities and Airports (e.g., FAA, Eurocontrol): Purchasing specialized, high-reliability systems for safety monitoring.

- Government and Defense Organizations: Acquiring custom-built, ruggedized Lidar for strategic atmospheric sensing.

Value Chain Analysis For Coherent Doppler Wind Lidar Market

The Coherent Doppler Wind Lidar value chain commences with a highly specialized upstream segment focused on the manufacturing of core photonic components. This stage is dominated by a relatively small group of specialized suppliers who produce the proprietary high-power, narrow-linewidth fiber lasers, low-noise detectors, high-quality optical circulators, and sensitive interferometers. These components require exceptionally high precision engineering and proprietary manufacturing processes, leading to high production costs and strong negotiation power for these suppliers. Upstream market dynamics are characterized by high barriers to entry due to stringent quality control requirements related to laser stability and thermal management, which are critical determinants of the final Lidar system's accuracy and longevity, especially in demanding temperature and vibration environments.

The midstream segment involves the system integrators—the Lidar manufacturers themselves. They focus on acquiring the complex components, designing robust and often modular mechanical enclosures, integrating the electronic control units, and developing the sophisticated proprietary signal processing software necessary to translate raw optical signals into meaningful wind vector data. This stage includes intensive research and development, stringent factory calibration against standardized references, and specialized packaging tailored for specific deployment conditions (e.g., corrosion resistance for marine systems). Successful midstream operations hinge on intellectual property protection concerning algorithm efficiency and the ability to maintain robust supply chain relationships for critical, single-source components like specialized optical fibers.

The downstream flow encompasses marketing, distribution, installation, and essential post-sales support, culminating in the value delivered to the end-user. Distribution channels are typically short: major Lidar players often engage in direct sales to large renewable energy developers and government bodies due to the complexity and customization required for integration. Indirect channels utilize specialized regional value-added resellers (VARs) who provide local installation, maintenance, and regional language support, particularly important in fast-growing APAC markets. The final stage involves the provision of Lidar data analysis services (LaaS) and long-term maintenance contracts, representing a growing, high-margin revenue stream that ensures continuous operational support and mitigates the risk associated with complex technology for the end-user. Effective downstream success relies on providing integrated software solutions that seamlessly merge Lidar data into client-specific platforms like SCADA systems or meteorological databases.

Coherent Doppler Wind Lidar Market Potential Customers

The primary customer base for Coherent Doppler Wind Lidar is diversified yet centered around entities requiring quantified, highly accurate atmospheric dynamics for economic or safety reasons. Independent Power Producers (IPPs) and large multinational utility companies operating in the renewable energy sector are the most significant volume buyers. They procure Lidar systems across all deployment types—ground-based for resource assessment, nacelle-mounted for power curve optimization, and floating systems for complex offshore pre-feasibility studies. These customers rely on Lidar data to achieve "bankable" accuracy, ensuring that the financial models used to secure project funding accurately predict the Annual Energy Production (AEP) of their wind assets, directly impacting profitability and investment viability.

Governmental customers form a stable, high-reliability segment. National Meteorological and Hydrological Services (NMHS) are continuous consumers, utilizing Lidar to augment their ground observation networks, providing crucial vertical wind shear and turbulence data that improves the skill scores of their operational forecasts, particularly for localized severe weather warnings. Furthermore, international agencies involved in climate change research, such as university consortiums and national laboratories, acquire Lidar for fundamental atmospheric science studies, often requiring the most advanced, research-grade instruments capable of extreme range or highly rapid scanning. Their purchasing decisions are driven less by immediate ROI and more by long-term research capability and instrument precision.

A burgeoning segment consists of airports and Air Navigation Service Providers (ANSPs). Faced with increasing air traffic density and complex terminal area operations, they deploy specialized Lidar systems designed to detect transient hazards like microbursts and wake vortices, which pose significant threats to aircraft safety and airport throughput. Finally, defense contractors and military organizations are essential customers, often commissioning ruggedized, mobile, or specialized airborne Lidar systems for applications ranging from atmospheric corrections for radar systems to tactical wind profile measurements used in drone and missile trajectory calculations. The growing demand for advanced atmospheric situational awareness across military domains ensures consistent, high-specification demand from this customer cluster.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 385.5 Million |

| Market Forecast in 2033 | USD 828.1 Million |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Leosphere (Vaisala), ZephIR Lidar (IDAC UK), Halo Photonics, Lockheed Martin, Raytheon Technologies, Mitsubishi Electric, NRG Systems, ZX Lidars, EOLOS Floating Lidar Solutions, Avent Lidar Technology, Pentalum, China Aerospace Science and Industry Corporation (CASIC), SgurrEnergy, Windar Photonics, Observator Instruments, Advalue Photonics, Streamline Scientific, GWU-Lasertechnik, Sigma Space Corporation, Meteodyn, Pure Photonics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Coherent Doppler Wind Lidar Market Key Technology Landscape

The technological core of Coherent Doppler Wind Lidar relies on precise fiber optics and extremely high-speed digital signal processing. The fundamental design choice centers on the operational wavelength, typically around 1.55 microns, selected meticulously because it ensures high levels of eye safety for ground personnel and concurrently maximizes the efficiency of backscatter from naturally occurring atmospheric aerosols, which are universally abundant at this specific wavelength. Modern high-performance Lidar systems are intrinsically dependent on highly specialized optical components, including robust Erbium-Doped Fiber Amplifiers (EDFAs), ultra-stable, narrow-linewidth seed lasers, and low-noise photodetectors capable of resolving minute frequency shifts with exceptional fidelity. The crucial industrial transition from complex, alignment-sensitive bulk optics configurations to fully integrated, fusion-spliced fiber optic assemblies has marked a significant technological maturity point, substantially increasing system reliability, dramatically reducing the physical footprint, and simplifying the necessary thermal management required to maintain the ultra-stable coherence necessary for accurate long-range Doppler velocity measurement in highly variable environmental conditions.

Significant and aggressive innovation efforts are currently concentrated in two major technological spheres: the perfection and commercial scaling of Frequency-Modulated Continuous-Wave (FMCW) Lidar technology and the widespread development of highly cost-effective, genuinely solid-state scanning mechanisms. FMCW Lidar utilizes a continuous, frequency-swept laser beam rather than short pulses, which provides an inherently superior spatial resolution, particularly effective in the near-field environment—a critical requirement for nacelle-mounted wind turbine optimization and highly detailed boundary layer studies. This advanced technological pathway promises to deliver higher data quality, reduced system complexity, and fewer interference issues compared to traditional pulsed systems. Simultaneously, the market is urgently moving away from legacy mechanical scanners, which utilize bulky, rotating mirrors, and is investing heavily in next-generation solid-state beam steering technologies, such as micro-electro-mechanical systems (MEMS) mirrors or advanced optical phased arrays (OPAs). These solid-state alternatives offer dramatically faster scanning rates, significantly increased reliability due to the absence of moving parts subject to wear, and are substantially more compact and power-efficient, ultimately paving the way for the pervasive integration of Lidar into demanding autonomous systems like fixed-wing UAVs, rotary-wing drones, and permanent distributed monitoring networks.

The software and data processing layer represents an equally critical frontier where continuous advancements are essential for maximizing the utility of the hardware. Given the exponential increase in raw data volume generated by high-resolution, high-frequency systems, the operational efficiency and speed of the dedicated Signal Processing Unit (SPU) are paramount to maintaining real-time data output. Advanced Lidar systems are increasingly incorporating dedicated, high-speed computational resources, such as Field-Programmable Gate Arrays (FPGAs) and high-performance Graphics Processing Units (GPUs), to execute extremely complex algorithms, including Fast Fourier Transforms (FFTs) and complex velocity-azimuth display (VAD) processing, in sub-second timelines. Furthermore, ongoing software development is intensely focused on seamless interoperability, ensuring that Lidar-derived wind data can be effortlessly integrated with standard operational platforms, including SCADA, Numerical Weather Prediction (NWP) models, and various energy management systems utilizing standardized communication protocols. The industry-wide push toward cloud-based data storage, sophisticated virtualization, and AI-powered analytical platforms is collectively enhancing the accessibility, utility, and actionable business intelligence derived from these highly advanced atmospheric measurement systems for end-users ranging from energy traders to national climate modelers.

Regional Highlights

Understanding the regional distribution of the Coherent Doppler Wind Lidar market is vital for strategic market entry and resource allocation, as growth drivers and application focus vary significantly by geography.

- North America: Leading the market in technological maturity and high-value applications, particularly in aviation safety and defense R&D. The US Federal Aviation Administration (FAA) and military branches are primary consumers. Strong growth is anticipated in offshore wind development, especially along the East Coast, driving demand for high-resolution marine-based systems.

- Europe: A dominant force, primarily due to ambitious offshore wind energy targets (Net Zero goals) established by the European Union and member states like the UK, Germany, and Denmark. Europe pioneered nacelle-mounted Lidar for turbine control and is characterized by robust regulatory frameworks (e.g., MEASNET standards) that mandate accurate measurement tools.

- Asia Pacific (APAC): Expected to exhibit the highest Compound Annual Growth Rate (CAGR). This growth is fueled by massive infrastructure projects in China and India, the rapid expansion of offshore wind in Taiwan, South Korea, and Japan, and significant governmental investment in weather and disaster management modernization programs across the region.

- Latin America (LATAM): Growth is primarily concentrated in onshore wind farm development in countries like Brazil and Mexico. The market is highly price-sensitive, presenting an opportunity for cost-effective, ground-based Lidar systems for preliminary site prospecting.

- Middle East and Africa (MEA): Emerging market driven by strategic renewable energy projects (e.g., Saudi Arabia’s NEOM city initiatives) and the need for sophisticated weather monitoring in volatile climate regions, often coupled with defense surveillance requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Coherent Doppler Wind Lidar Market.- Leosphere (Vaisala)

- ZephIR Lidar (IDAC UK)

- Halo Photonics

- Lockheed Martin

- Raytheon Technologies

- Mitsubishi Electric

- NRG Systems

- ZX Lidars

- EOLOS Floating Lidar Solutions

- Avent Lidar Technology

- Pentalum

- China Aerospace Science and Industry Corporation (CASIC)

- SgurrEnergy

- Windar Photonics

- Observator Instruments

- Advalue Photonics

- Streamline Scientific

- GWU-Lasertechnik

- Sigma Space Corporation

- Meteodyn

- Pure Photonics

- Fibertek, Inc.

- Cubic Corporation

Frequently Asked Questions

Analyze common user questions about the Coherent Doppler Wind Lidar market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of Coherent Doppler Wind Lidar over traditional cup or sonic anemometers?

Coherent Doppler Wind Lidar systems remotely measure highly accurate three-dimensional wind profiles (speed and direction) up to several kilometers altitude, eliminating the need for physically erected tall masts, which is critical for cost-effective, non-intrusive wind resource assessment (WRA) in offshore and complex terrain environments.

How does the Coherent Lidar market directly support the expansion of global offshore wind energy?

Lidar, especially Floating Lidar Solutions (FLiDAR), provides bankable, high-resolution wind data required for securing project financing, accurately validating wind resource availability for optimized turbine site selection, and performing essential power curve verification in compliance with stringent international standards (e.g., IEC).

What are the main technological constraints impacting the widespread adoption of Coherent Doppler Wind Lidar?

Key constraints include the substantial initial capital investment required for purchasing high-precision fiber laser components, the specialized expertise needed for calibration and data integration, and potential performance degradation (signal attenuation) during periods of dense fog or heavy rainfall, which limits data availability.

Which geographical region is expected to experience the fastest market growth and why?

The Asia Pacific (APAC) region is projected to show the fastest growth, driven by unprecedented national investment in large-scale offshore wind energy projects (particularly in East Asia) and significant governmental efforts to modernize weather forecasting capabilities and disaster mitigation infrastructure in populous nations.

How is Artificial Intelligence (AI) enhancing the functionality and value of Lidar systems?

AI integrates with Lidar to manage massive data volumes, automating quality control and noise filtering, classifying atmospheric conditions in real-time, and significantly enhancing the accuracy of short-term (nowcasting) weather predictions by efficiently assimilating Lidar inputs into advanced machine learning models for operational decision support.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager