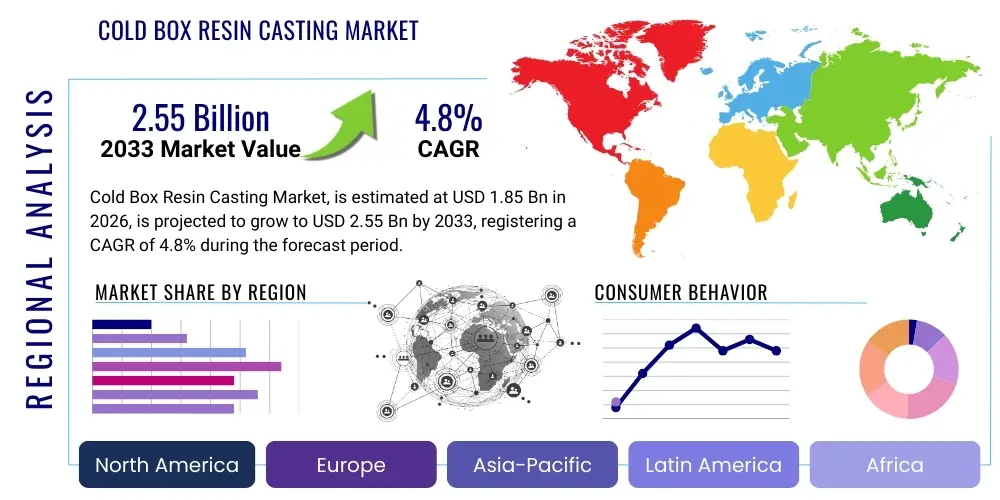

Cold Box Resin Casting Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435212 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Cold Box Resin Casting Market Size

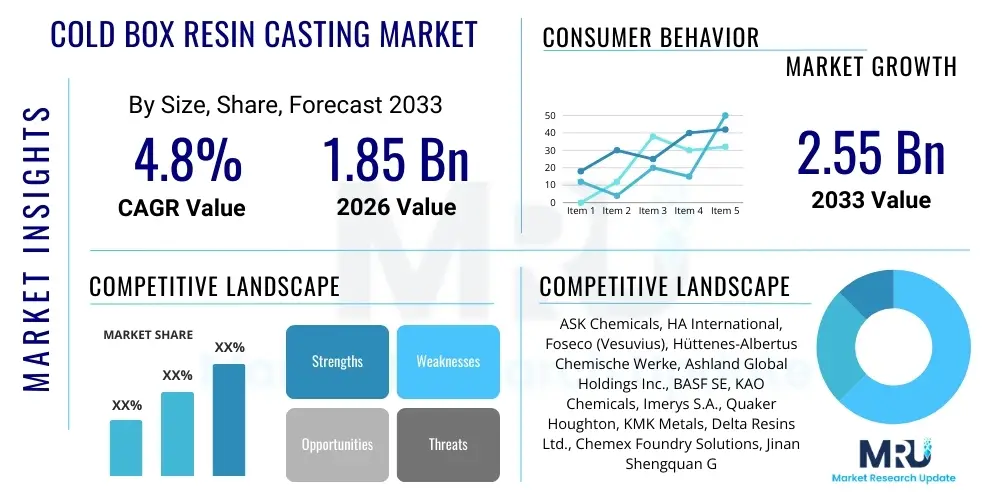

The Cold Box Resin Casting Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.55 Billion by the end of the forecast period in 2033.

Cold Box Resin Casting Market introduction

The Cold Box Resin Casting process, a cornerstone technology in modern foundry operations, involves creating complex sand cores and molds without external heat input, relying instead on a specialized chemical reaction. This method utilizes a two-part resin system—typically a phenolic urethane binder (a phenolic resin and an isocyanate resin) combined with an amine gas catalyst—to rapidly cure the sand mixture. The rapid curing time and high dimensional accuracy achievable with the cold box method make it essential for manufacturing intricate metal components, particularly those requiring internal cavities, such as engine blocks, cylinder heads, and transmission housings in the automotive industry. The efficiency derived from eliminating energy-intensive baking steps drastically reduces production cycle times and improves overall throughput, positioning it as a preferred method over traditional hot processes.

The primary applications of cold box resin casting span critical heavy industries where precision and reliability are non-negotiable. The automotive sector remains the largest consumer, utilizing cold box cores for manufacturing lightweight and high-strength parts necessary for improving fuel efficiency and meeting stringent emission standards. Beyond automotive, applications extend to heavy machinery (e.g., agricultural equipment, construction vehicles), industrial valves and pumps, and general engineering components. The increasing demand for structurally complex parts that can withstand extreme operational conditions continues to drive innovation within the cold box resin market, focusing on binder strength, thermal stability, and reduced volatile organic compound (VOC) emissions.

Key benefits of adopting the cold box process include superior core stability, excellent collapsibility post-casting (simplifying shakeout), and the capacity to produce cores with high surface quality and intricate geometries. Driving factors for market growth include the global expansion of vehicle production, especially in emerging economies, and the sustained trend toward engine downsizing and lightweighting across all transportation sectors. Furthermore, advancements in specialized catalyst technologies and binder formulations that minimize environmental impact are crucial in sustaining the market's relevance against competing core-making technologies.

Cold Box Resin Casting Market Executive Summary

The Cold Box Resin Casting Market is undergoing strategic shifts driven by technological refinement and evolving regulatory landscapes, particularly concerning environmental protection and occupational safety. Business trends indicate a strong focus on developing low-VOC and formaldehyde-free resin systems, responding directly to stringent environmental regulations enforced in North America and Europe. Key industry players are investing heavily in catalyst recovery and scrubbing systems to neutralize amine emissions, transforming the traditional process into a more sustainable operation. Furthermore, consolidation among resin suppliers and catalyst manufacturers is leading to integrated solutions offerings, enhancing supply chain efficiency for large foundries globally. The adoption of automation in core handling and setting is another major trend, significantly reducing manual labor costs and improving process repeatability and safety.

Regionally, the Asia Pacific (APAC) area dictates the highest growth trajectory, largely attributable to the massive automotive manufacturing hubs in China, India, and Southeast Asia, coupled with substantial investments in infrastructure and heavy machinery production. While APAC focuses on capacity expansion and operational scale, North America and Europe are characterized by technological innovation, concentrating on specialty binders for high-performance applications (such as aerospace and high-end automotive) and sustainable chemical alternatives. This regional disparity highlights a bifurcated market strategy: volume-driven growth in the East and value-driven, high-specification development in the West. Regulatory pressures, especially the scrutiny on phenolic and isocyanate components, necessitate regional adaptation of product portfolios to maintain market compliance.

Segment trends reveal that the Phenolic Urethane Cold Box (PUCB) system dominates the market due to its excellent balance of core strength, productivity, and cost-effectiveness, though there is a burgeoning interest in specialized furan and alkaline phenolic systems for niche applications requiring superior thermal stability or extremely low emissions. The end-user segment remains heavily skewed towards the automotive industry, but the growth rate in the heavy equipment and industrial valve sectors is accelerating due to the global push for infrastructure modernization. The shift toward Electric Vehicles (EVs) poses a structural challenge, as traditional engine block casting volumes may decrease; however, EVs still require sophisticated castings for gearboxes, chassis components, and specialized battery housings, ensuring continued, albeit transformed, demand for high-precision core technologies like cold box casting.

AI Impact Analysis on Cold Box Resin Casting Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Cold Box Resin Casting Market primarily center on process optimization, quality control, and predictive maintenance. Common questions relate to how AI can minimize casting defects, optimize sand-to-binder ratios, and predict the lifespan of critical equipment components like gas generators and scrubbers. Users are concerned about integrating complex sensors and data streams into traditional foundry environments and require clarification on AI's role in reducing material waste and energy consumption associated with the cold box process. The key expectation is that AI will transition the cold box process from a highly empirical, operator-dependent craft to a data-driven, highly optimized manufacturing procedure, thereby enhancing yield rates and reducing variable costs associated with raw material consumption and rework.

AI is set to revolutionize core production by enabling real-time analysis of process variables such as sand temperature, humidity, amine flow rates, and resin component mixing ratios. Machine learning algorithms can identify non-linear correlations between these inputs and subsequent casting quality, allowing for immediate parameter adjustments that prevent core defects like gas porosity, blowholes, or insufficient strength before they occur. This predictive quality control mechanism significantly reduces scrap rates, which are historically high in complex casting operations. Furthermore, AI systems facilitate advanced maintenance scheduling for high-wear components, such as core blowers and mixers, by monitoring vibration patterns and temperature anomalies, thus maximizing uptime and minimizing catastrophic equipment failure.

The integration of AI also addresses complex environmental compliance challenges. Advanced analytical models can optimize the catalyst usage (e.g., triethylamine or dimethylethylamine), ensuring only the precise amount required for rapid curing is used, reducing harmful fugitive emissions. By optimizing the entire lifecycle, from sand preparation to core setting, AI provides a comprehensive framework for sustainability, operational efficiency, and enhanced component consistency, thereby future-proofing the cold box technology in an increasingly demanding manufacturing landscape.

- AI-driven optimization of sand mixture homogeneity and binder distribution.

- Predictive modeling for casting defect reduction (e.g., gas porosity, surface defects).

- Real-time monitoring and adjustment of amine gas flow and curing cycles.

- Automated vision systems utilizing ML for rapid core quality inspection and defect classification.

- Predictive maintenance schedules for high-speed core making equipment and catalyst recovery units.

- Optimization of energy consumption in ventilation and gas scrubbing processes.

DRO & Impact Forces Of Cold Box Resin Casting Market

The Cold Box Resin Casting Market is influenced by a dynamic interplay of Drivers (D), Restraints (R), and Opportunities (O), creating significant Impact Forces. A primary driver is the accelerating requirement for lightweight, complex components, especially within the automotive industry's push for vehicle electrification and improved engine efficiency; cold box casting excels at producing intricate cores necessary for these advanced designs. This driving force is tempered by severe restraints, particularly stringent environmental regulations targeting VOC emissions (Volatile Organic Compounds) emanating from resin decomposition and amine catalysts, requiring substantial investment in abatement technology. However, this restraint simultaneously creates a major opportunity for developing bio-based or ultra-low emission binder systems and highly efficient catalyst recovery technologies. The net impact force suggests moderate-to-high growth, provided manufacturers successfully navigate the environmental compliance curve through innovation.

The core drivers sustaining market momentum include the inherent productivity advantages of the cold box process—high production speed, low energy consumption compared to hot processes, and excellent dimensional accuracy. Foundries benefit from reduced operating costs associated with thermal curing and rapid turnaround times essential for modern Just-In-Time (JIT) manufacturing supply chains. Furthermore, the ability of cold box cores to maintain structural integrity under high pressure and temperature during the metal pouring process ensures superior component reliability. This robust performance profile reinforces its position as the preferred core-making method for high-volume, critical components in both ferrous and non-ferrous metal casting operations globally.

Key restraining factors beyond environmental concerns include the relatively high cost of specialized resins and catalysts compared to traditional clay-bonded sand processes, and the technical complexity associated with handling and recovering the amine gas catalysts, which necessitates specialized ventilation and scrubbing infrastructure. Opportunities are emerging through the convergence of cold box casting with advanced manufacturing techniques, such as 3D printing of patterns or even hybrid processes where additive manufacturing creates complex core structures that are then reinforced or finalized using cold box binders. Furthermore, expansion into new application areas, such as wind turbine components and specialized parts for the marine sector, provides avenues for diversification away from core reliance on internal combustion engine components.

Segmentation Analysis

The Cold Box Resin Casting Market is systematically segmented based on key process elements including the type of resin binder utilized, the specific catalyst employed to initiate curing, the primary end-use application, and the geographic region of consumption. This granular segmentation allows for a precise understanding of market dynamics, revealing where technological innovation is most concentrated and identifying niche growth areas. The market analysis heavily leans on distinguishing between the dominant Phenolic Urethane Cold Box (PUCB) system and alternative specialized binders, providing insights into their adoption rates based on regional regulatory constraints and specific casting material requirements (e.g., iron versus aluminum alloys).

Resin type segmentation is crucial as it reflects varying performance characteristics related to tensile strength, thermal stability, and environmental emissions. While PUCB systems are the industry standard for general high-volume production, other segments such as Furan resin binders (known for higher thermal stability and lower sulfur content) and Alkaline Phenolic systems (often used for improved environmental profiles) are gaining traction in specialized foundries. Catalyst segmentation further defines the curing process speed and environmental impact, with Triethylamine (TEA) and Dimethylethylamine (DMEA) being the most common, each presenting different handling requirements and scrubbing efficiency needs. The automotive sector's continuous evolution in materials and component design profoundly impacts the demand distribution across these segments.

- Resin Type

- Phenolic Urethane Cold Box (PUCB)

- Furan Cold Box

- Alkaline Phenolic Cold Box

- Specialty and Hybrid Binders

- Catalyst Type

- Triethylamine (TEA)

- Dimethylethylamine (DMEA)

- Others (e.g., Isopropylamine derivatives)

- End-User Industry

- Automotive (Engine Blocks, Cylinder Heads, Transmission Parts)

- Heavy Equipment and Construction Machinery

- Industrial Pumps and Valves

- Aerospace and Defense

- Others (e.g., General Engineering, Marine)

Value Chain Analysis For Cold Box Resin Casting Market

The value chain for the Cold Box Resin Casting Market commences with upstream raw material suppliers, predominantly chemical manufacturers providing the necessary phenolic resins, isocyanates, amine catalysts, and high-quality silica sands. The complexity and performance requirements of the final product necessitate stringent quality control at this initial stage, as binder purity and consistency directly influence core strength and curing speed. Key upstream activities involve the synthesis and formulation of these complex chemical components, requiring specialized expertise and compliance with strict hazardous material handling protocols. Major chemical companies often dominate this upstream segment, providing specialized binder systems tailored to varying casting alloys and temperature requirements.

Midstream activities involve the core manufacturing foundries and specialized core producers who mix the sand, resins, and catalyst and utilize highly automated core blowing and setting machines. This stage adds significant value through process engineering, tooling design (core boxes), and quality assurance checks on the green and cured cores. Efficiency gains at this stage are critical for profitability, heavily relying on advanced equipment maintenance and precise material metering. Downstream activities encompass the end-user industries, primarily the automotive, heavy equipment, and industrial sectors, where the cores are utilized in the final metal casting process to produce complex components. The final products are then distributed directly to component assemblers or through specialized industrial distributors.

Distribution channels for the cold box market are bifurcated into direct sales and indirect distribution. High-volume foundries often engage in direct relationships with resin manufacturers for bulk supply and technical support, which is essential given the sensitivity of the chemical components. Smaller foundries or those requiring specialized, lower-volume binders often rely on industrial chemical distributors who offer localized inventory management, technical application support, and rapid logistical services. The effectiveness of the supply chain is heavily dependent on maintaining short lead times for catalysts, which are often classified as hazardous materials, thus requiring specialized logistics and storage capabilities.

Cold Box Resin Casting Market Potential Customers

The primary customer base for Cold Box Resin Casting technology consists of captive and independent ferrous and non-ferrous foundries globally, which utilize the process to create internal cavities and complex geometries in metal components. These foundries serve as crucial intermediaries in the manufacturing supply chain, fabricating parts for major Original Equipment Manufacturers (OEMs). Captive foundries, often operated directly by large automotive or heavy machinery manufacturers, use the technology for mission-critical parts like engine blocks and large transmission cases, valuing the process's repeatability and high output capacity. Independent jobbing foundries, on the other hand, require flexible cold box solutions to service a diverse portfolio of clients across multiple industrial sectors, prioritizing adaptability and rapid changeover capabilities.

A significant segment of end-users are concentrated within the global automotive manufacturing sector. With the persistent drive towards lightweighting and higher performance in both Internal Combustion Engine (ICE) vehicles and Electric Vehicles (EVs), there is a sustained, if evolving, need for intricate aluminum and iron castings. Potential customers include major vehicle manufacturers and their tiered suppliers (Tier 1 and Tier 2) who specialize in powertrain and structural component fabrication. The precision afforded by cold box cores is essential for modern high-pressure casting techniques used in automotive component manufacturing, ensuring tight dimensional tolerances and reduced machining requirements post-casting.

Beyond the transportation industry, substantial potential lies in the heavy equipment sector, encompassing manufacturers of construction, mining, and agricultural machinery. These components, characterized by thick sections and large sizes, require high-strength cores capable of withstanding massive hydrostatic pressure during pouring, a property inherent to high-quality cold box cores. Furthermore, manufacturers of industrial fluid handling equipment, such as large-scale pumps, valves, and compressors used in petrochemical, power generation, and water treatment facilities, are key buyers, demanding flawless internal passages to ensure fluid dynamics efficiency and operational longevity. These customers prioritize core stability, minimal gas evolution, and excellent shakeout properties.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.55 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ASK Chemicals, HA International, Foseco (Vesuvius), Hüttenes-Albertus Chemische Werke, Ashland Global Holdings Inc., BASF SE, KAO Chemicals, Imerys S.A., Quaker Houghton, KMK Metals, Delta Resins Ltd., Chemex Foundry Solutions, Jinan Shengquan Group Share Holding Co., Ltd., Georgia-Pacific Chemicals, REFRACTORY INTRAMET, SAKAI Chemical Industry Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cold Box Resin Casting Market Key Technology Landscape

The technological landscape of the Cold Box Resin Casting Market is defined by continuous innovation focused on enhancing environmental performance, improving core quality, and increasing process automation. A critical area of development involves the sophisticated metering and mixing systems used to combine sand and resin components. Modern systems utilize advanced sensor technology and variable speed controls to ensure highly accurate dosing, often down to sub-percentage levels, which is vital for maintaining consistent core properties while minimizing resin consumption. This precision also supports the transition to low-binder content systems, which are inherently more sustainable and cost-effective. Furthermore, temperature and humidity control within the mixing unit are increasingly standardized, mitigating external environmental factors that historically caused process instability.

Another dominant technological trend is the advancement in catalyst delivery and recovery systems. Since amine catalysts (like TEA and DMEA) are subject to stringent air quality standards, specialized gas generators and high-efficiency scrubbing units are essential components of the modern cold box setup. Recent innovations include regenerative thermal oxidizers (RTOs) and activated carbon filtration systems designed specifically to achieve near-total removal of VOCs before atmospheric discharge. Manufacturers are also exploring alternative catalysts or modified resin systems that react using less volatile organic compounds, such as those utilizing ester-curing mechanisms or inorganic binders, though these are still niche compared to the established phenolic urethane systems.

Automation and robotics play an increasingly central role in the core room. Robotic handling systems are now deployed for tasks ranging from core blowing and assembly to precise placement of cores within the mold cavity. These systems not only increase production speed and repeatability but also significantly enhance operator safety by reducing exposure to chemical materials and repetitive manual labor. Tooling technology has also progressed, with suppliers offering high-wear-resistant core box materials and intricate venting designs that optimize gas purging, leading to faster cure times and reduced core defects. The integration of 3D printing for rapid prototyping of core boxes and specialized core pieces represents a rapidly evolving technological frontier, bridging conventional casting with additive manufacturing.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of growth for the Cold Box Resin Casting Market, driven by booming automotive production, particularly in China and India, alongside significant governmental investment in infrastructure and heavy equipment manufacturing. Foundries in this region prioritize high-volume production and are rapidly adopting automated cold box processes to meet scaling demand. However, the region is also facing increasing scrutiny regarding air quality, prompting gradual migration toward environmentally friendlier resin formulations, albeit at a slower pace than in Western economies.

- North America: The North American market emphasizes high-specification, specialized casting for sectors like aerospace, high-performance automotive, and advanced industrial machinery. Growth here is focused on technological improvements, including the implementation of sophisticated amine scrubbing technologies and the demand for ultra-low formaldehyde and low-VOC binders to comply with rigorous EPA and OSHA standards. Market participants are investing in smart foundry technologies, utilizing sensors and AI to optimize existing cold box lines.

- Europe: Europe represents a mature but innovation-intensive market, heavily influenced by the REACH regulatory framework, which drives the urgent need for sustainable and non-hazardous binder systems. Key drivers include the region's strong luxury and precision automotive manufacturing base and the need to retrofit existing foundries with best available technology (BAT) for emission control. There is a notable exploration of inorganic and alkaline phenolic cold box processes as alternatives to traditional PUCB systems.

- Latin America (LATAM): The LATAM market, led by Brazil and Mexico, demonstrates growth tied to regional automotive assembly and mining/infrastructure projects. This region often acts as a manufacturing hub for global OEMs, leading to demand for cost-effective cold box solutions that still meet international quality standards. Investment in new cold box capacity is steady, reflecting stable industrialization trends.

- Middle East and Africa (MEA): The MEA region is experiencing nascent growth, primarily driven by investments in localized industrialization, particularly in Saudi Arabia and the UAE, focused on energy and defense-related castings. The market often imports established technologies, with demand tied to specific large-scale industrial projects and reliance on international technical expertise for setup and operation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cold Box Resin Casting Market.- ASK Chemicals

- HA International

- Foseco (Vesuvius)

- Hüttenes-Albertus Chemische Werke

- Ashland Global Holdings Inc.

- BASF SE

- KAO Chemicals

- Imerys S.A.

- Quaker Houghton

- KMK Metals

- Delta Resins Ltd.

- Chemex Foundry Solutions

- Jinan Shengquan Group Share Holding Co., Ltd.

- Georgia-Pacific Chemicals

- REFRACTORY INTRAMET

- SAKAI Chemical Industry Co., Ltd.

- Hunter Foundry Machinery Corp.

- Sinto Group

- Norican Group (DISA)

Frequently Asked Questions

Analyze common user questions about the Cold Box Resin Casting market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the Cold Box Resin Casting process and why is it preferred over other core-making methods?

The Cold Box process is a foundry technique used to create complex sand cores and molds that relies on a chemical reaction between a binder (typically phenolic urethane) and a gaseous catalyst (amine) to rapidly cure the sand at room temperature. It is preferred for its high production speed, energy efficiency (eliminating external heat), and the exceptional dimensional accuracy and structural stability it imparts to the cores, crucial for modern, high-precision metal components.

How do stringent environmental regulations impact the Cold Box Resin Casting Market?

Environmental regulations, particularly concerning Volatile Organic Compounds (VOCs) like formaldehyde and amine catalysts, pose significant challenges. This pressure mandates continuous R&D into developing low-emission, solvent-free, and bio-based resin systems, alongside mandatory installation of advanced gas scrubbing and catalyst recovery systems to maintain compliance and worker safety, driving up operational costs but fostering technological innovation.

Which end-user industry is the primary driver of demand for Cold Box resins?

The Automotive industry remains the largest consumer segment for Cold Box resins. This is due to the persistent demand for lightweight aluminum and iron castings, such as complex engine blocks, cylinder heads, and transmission housings, where the dimensional stability and rapid production capabilities of cold box cores are essential for high-volume manufacturing.

What are the primary differences between Triethylamine (TEA) and Dimethylethylamine (DMEA) catalysts?

TEA and DMEA are the two most common amine catalysts. TEA is highly effective but possesses a high odor threshold and volatility, often requiring intensive scrubbing. DMEA is generally considered a lower-odor, slightly less reactive alternative, sometimes favored in regions with stricter olfactory regulations, though both require specialized handling and recovery infrastructure due to their hazardous nature.

How is digital technology, such as AI and IoT, transforming cold box casting operations?

Digital technologies are enhancing the Cold Box process by enabling data-driven optimization. IoT sensors monitor critical parameters (temperature, humidity, flow rates) in real-time, while AI algorithms predict potential casting defects or equipment failure. This integration leads to predictive quality control, reduced scrap rates, optimized material consumption, and enhanced automation in core handling and setting.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager